Key Insights

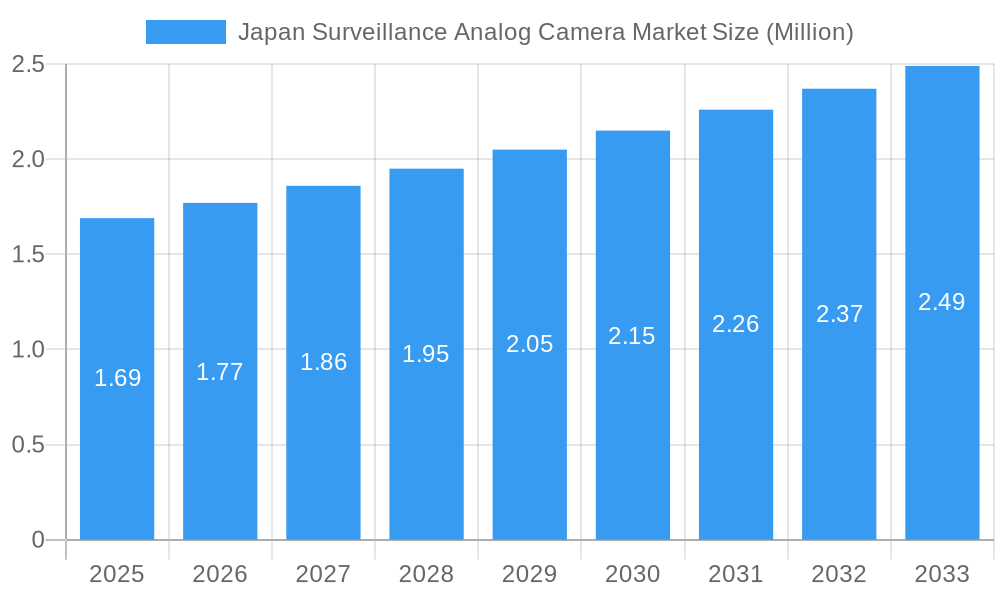

The Japan Surveillance Analog Camera Market is poised for significant growth, projected to reach approximately USD 1.69 million with a robust Compound Annual Growth Rate (CAGR) of 5.03% over the forecast period of 2025-2033. This expansion is fueled by a confluence of factors including the persistent need for enhanced security across diverse end-user industries, coupled with ongoing technological advancements within the analog camera segment. The government sector, a significant adopter of surveillance systems for public safety and infrastructure monitoring, is a primary driver. Similarly, the banking and financial services sector continues to invest in analog cameras for branch security and transaction monitoring, recognizing their cost-effectiveness and reliability. The healthcare industry is also increasingly incorporating analog surveillance for patient safety and facility protection, while the transportation and logistics sector leverages these systems for asset tracking and operational efficiency, particularly in ports, airports, and distribution centers. The industrial segment, encompassing manufacturing and heavy industries, relies on analog cameras for process monitoring and workplace safety.

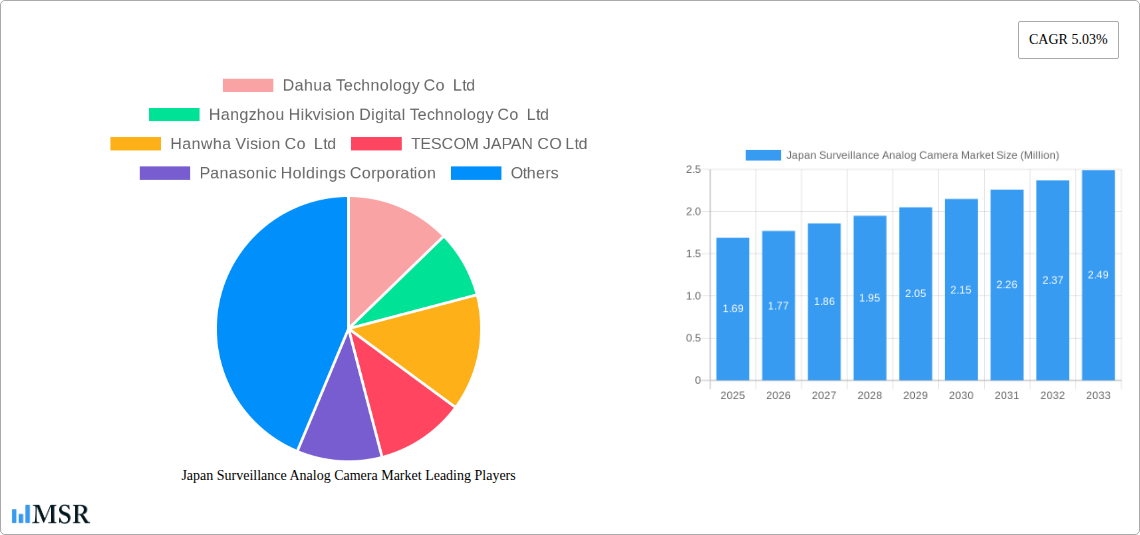

Japan Surveillance Analog Camera Market Market Size (In Million)

Despite the rise of digital solutions, analog surveillance cameras maintain their relevance in Japan due to several key trends. The inherent durability and established infrastructure of analog systems make them a preferred choice for straightforward, budget-conscious deployments. Furthermore, the ongoing development of higher resolution analog cameras and improved transmission technologies continues to enhance their performance capabilities, bridging the gap with digital counterparts in certain applications. The market also benefits from the presence of established global and domestic players, such as Dahua Technology, Hikvision, and Panasonic Holdings Corporation, who are continually innovating and offering competitive solutions. However, the market's growth trajectory might encounter some restraints, including the increasing adoption of IP-based surveillance systems offering advanced features and scalability, and potential initial high investment costs for complete overhauls of existing analog infrastructure. Nevertheless, the overall outlook for the Japan Surveillance Analog Camera Market remains positive, driven by continued demand for reliable and cost-effective security solutions across a broad spectrum of industries.

Japan Surveillance Analog Camera Market Company Market Share

Japan Surveillance Analog Camera Market: Comprehensive Market Research Report 2019–2033

This in-depth report delivers critical insights into the Japan surveillance analog camera market, offering a thorough analysis from 2019 to 2033. With a base year of 2025 and a detailed forecast period of 2025–2033, this research is essential for stakeholders seeking to understand current trends, future growth prospects, and competitive landscapes within Japan's burgeoning security sector. The report leverages extensive data and expert analysis to provide actionable intelligence for manufacturers, distributors, integrators, and end-users.

Japan Surveillance Analog Camera Market Market Concentration & Dynamics

The Japan surveillance analog camera market exhibits a moderate to high degree of concentration, with a few dominant players vying for market share. Innovation plays a crucial role, as companies continuously invest in Research & Development to enhance product features and maintain a competitive edge. Regulatory frameworks governing data privacy and security protocols significantly influence market entry and product deployment. The presence of substitute products, particularly IP-based surveillance systems, necessitates a focus on the cost-effectiveness and proven reliability of analog solutions. End-user trends, driven by increasing security concerns across various sectors, are shaping demand for robust and integrated surveillance solutions. Merger and acquisition (M&A) activities, though present, have been strategic, focusing on expanding product portfolios or geographical reach. The market share distribution sees key players like Dahua Technology Co Ltd and Hangzhou Hikvision Digital Technology Co Ltd holding significant portions, followed by Hanwha Vision Co Ltd and Panasonic Holdings Corporation. M&A deal counts are expected to remain stable, with a focus on technology acquisition and market consolidation.

- Key Market Dynamics:

- Technological innovation in analog camera capabilities (e.g., higher resolution, improved night vision).

- Evolving regulatory landscape impacting data security and privacy.

- Competition from advanced IP surveillance solutions.

- Demand for cost-effective and reliable security systems.

- Strategic partnerships and collaborations to enhance market presence.

Japan Surveillance Analog Camera Market Industry Insights & Trends

The Japan surveillance analog camera market is experiencing a steady growth trajectory, driven by an escalating demand for enhanced security across public and private sectors. The market size is projected to reach xx Million by 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is underpinned by several key factors, including increasing urbanization, a rise in petty and organized crime, and a growing awareness of the need for comprehensive surveillance systems in critical infrastructure. Technological disruptions are primarily focused on improving the resolution and clarity of analog footage, alongside advancements in digital transmission capabilities to bridge the gap with IP systems. For instance, the development of HD-over-coax technology allows analog cameras to deliver resolutions comparable to early IP systems, offering a compelling upgrade path for existing analog installations. Evolving consumer behaviors are also playing a significant role; businesses are increasingly prioritizing proactive security measures over reactive responses, leading to greater investment in continuous monitoring and recording solutions. The government's emphasis on public safety, coupled with private sector investments in asset protection, further fuels this demand. The Japan analog CCTV market is thus poised for sustained expansion.

Key Markets & Segments Leading Japan Surveillance Analog Camera Market

The Japan surveillance analog camera market is largely driven by the Government and Industrial sectors, which consistently demonstrate robust demand for reliable and cost-effective surveillance solutions. The government's mandate for public safety, evident in initiatives like the deployment of cameras in public spaces and transportation hubs, significantly contributes to market growth. For example, the February 2024 deployment of approximately 1,000 security cameras by the National Police Agency in Ishikawa Prefecture underscores the government's commitment to leveraging surveillance for crime prevention and disaster response. The Industrial sector's demand is fueled by the need to monitor vast facilities, secure sensitive equipment, and ensure worker safety, making analog cameras a practical choice due to their ease of installation and maintenance.

Government Sector Dominance:

- Drivers: Increased public safety initiatives, counter-terrorism measures, smart city development projects, and critical infrastructure protection.

- Analysis: The government's proactive approach to security, particularly in the wake of natural disasters and potential threats, necessitates widespread deployment of surveillance systems. The deployment in Ishikawa Prefecture, aimed at curbing crimes and providing reassurance to displaced residents, exemplifies this trend. Analog cameras, with their proven track record and interoperability with existing infrastructure, remain a preferred choice for large-scale public sector projects.

Industrial Sector Demand:

- Drivers: Manufacturing facility monitoring, supply chain security, remote asset management, and compliance requirements.

- Analysis: The robust Japanese industrial base, encompassing manufacturing, logistics, and energy, requires continuous monitoring and control. Analog cameras provide a scalable and economical solution for securing large operational areas, preventing theft, and improving operational efficiency. Their resilience in harsh industrial environments also makes them a preferred choice.

Banking Sector's Continued Reliance:

- Drivers: Prevention of internal and external fraud, ATM security, branch protection, and regulatory compliance.

- Analysis: While increasingly adopting IP solutions, the banking sector still relies on analog cameras for their cost-effectiveness in covering numerous branches and ATMs. The need for high-resolution footage for forensic analysis remains critical.

Transportation and Logistics Growth:

- Drivers: Port and airport security, railway surveillance, traffic management, and warehouse monitoring.

- Analysis: The continuous flow of goods and people necessitates advanced surveillance. Analog cameras play a role in monitoring large transit areas and logistics hubs, ensuring security and operational efficiency.

Healthcare Sector's Emerging Role:

- Drivers: Patient safety, asset protection within hospitals, and securing sensitive areas.

- Analysis: As healthcare facilities expand and face unique security challenges, analog surveillance offers a cost-effective way to enhance overall security and patient well-being.

Others: This segment encompasses retail, education, and residential applications, where analog cameras are chosen for their affordability and ease of deployment for basic security needs.

Japan Surveillance Analog Camera Market Product Developments

Recent product developments in the Japan surveillance analog camera market underscore a continued push for enhanced performance and user experience within the analog domain. Hikvision's April 2024 unveiling of its Turbo HD 8.0 line, featuring real-time communication, 180-degree video coverage, improved night vision, and Smart Hybrid Light functionality, exemplifies this trend. The integration of two-way audio and compact dual-lens cameras with stitching technology offers advanced functionalities. These innovations aim to elevate user security, providing more comprehensive and intelligent surveillance capabilities, and demonstrate the ongoing evolution of analog technology to meet modern security demands.

Challenges in the Japan Surveillance Analog Camera Market Market

Despite its strengths, the Japan surveillance analog camera market faces several challenges. The primary restraint is the rapidly advancing technology and increasing market penetration of IP (Internet Protocol) surveillance cameras, which offer higher resolutions, remote accessibility, and more advanced analytics. The ongoing global semiconductor shortage, though showing signs of easing, can still impact production and lead to price volatility for components. Furthermore, the digital transformation in various industries is pushing for integrated smart security solutions, where analog systems may require significant integration efforts to be compatible. The high cost of upgrading existing analog infrastructure to accommodate newer, higher-resolution analog standards can also be a barrier for some organizations.

- Key Challenges:

- Intensifying competition from IP surveillance solutions.

- Global supply chain disruptions affecting component availability and pricing.

- Perceived limitations in advanced features compared to IP cameras.

- Cost and complexity of integrating analog systems with modern IT infrastructure.

- The need for specialized technical expertise for installation and maintenance.

Forces Driving Japan Surveillance Analog Camera Market Growth

Several forces are propelling the Japan surveillance analog camera market forward. The persistent need for robust and cost-effective security solutions in a nation with a high population density and a diverse range of businesses is a primary driver. Government initiatives focused on public safety, such as the February 2024 deployment of cameras in Ishikawa Prefecture, directly stimulate demand. Furthermore, the legacy infrastructure in many Japanese organizations, especially in older industrial facilities and public institutions, makes upgrading to analog systems a more practical and economically viable option than a complete overhaul to IP. The reliability and proven track record of analog technology in various environmental conditions also contribute to its continued adoption.

- Key Growth Drivers:

- Continued demand for budget-friendly and dependable security systems.

- Government investment in public safety and critical infrastructure protection.

- The cost-effectiveness of upgrading existing analog setups.

- The inherent robustness and durability of analog cameras in diverse environments.

- Ongoing technological improvements enhancing analog camera performance.

Challenges in the Japan Surveillance Analog Camera Market Market

Looking beyond immediate obstacles, the long-term growth of the Japan surveillance analog camera market hinges on its ability to adapt and innovate. A significant challenge is the perceived technological gap compared to the rapid advancements in IP and AI-enabled surveillance. While analog technology is improving, the sheer pace of innovation in digital systems creates a constant need for analog manufacturers to demonstrate competitive value. The evolving landscape of cybersecurity threats also presents a challenge, as analog systems, while less vulnerable to direct network attacks, must be integrated securely into broader digital security frameworks. Furthermore, the shrinking pool of skilled technicians proficient in analog systems could pose a future constraint for installation and maintenance.

- Long-Term Growth Catalysts:

- Continued innovation in analog-to-digital transmission technologies.

- Development of hybrid analog-IP solutions for seamless integration.

- Focus on user-friendly interfaces and simplified installation.

- Strategic partnerships with IT security firms to address evolving cyber threats.

- Cost reduction through optimized manufacturing and supply chain management.

Emerging Opportunities in Japan Surveillance Analog Camera Market

Emerging opportunities within the Japan surveillance analog camera market lie in capitalizing on specific niche demands and leveraging technological advancements. The retrofitting and upgrading of existing analog infrastructure in sectors with significant legacy systems presents a substantial market. For instance, older industrial plants or public transportation networks can significantly enhance their surveillance capabilities by adopting higher-resolution analog cameras and digital recorders without the cost of a complete IP system replacement. The development of advanced analog HD technologies, offering improved image quality and longer transmission distances, opens doors for more sophisticated applications in areas like border security and large-scale event monitoring. The growing demand for economical surveillance solutions in the small and medium-sized business (SMB) sector also presents an opportunity, as analog systems provide an accessible entry point into comprehensive security.

- Key Emerging Opportunities:

- Targeting the SMB market with affordable and easy-to-install analog solutions.

- Developing hybrid systems that seamlessly integrate analog and IP technologies.

- Focusing on specific vertical markets with unique analog-friendly requirements.

- Offering robust analog solutions for harsh environmental conditions.

- Providing value-added services such as installation, maintenance, and remote monitoring for analog systems.

Leading Players in the Japan Surveillance Analog Camera Market Sector

- Dahua Technology Co Ltd

- Hangzhou Hikvision Digital Technology Co Ltd

- Hanwha Vision Co Ltd

- TESCOM JAPAN CO Ltd

- Panasonic Holdings Corporation

- CP PLUS

- Sony Corporation

- Pelco

- Tyco (Johnson Control Brand)

- SAMSUNG ELECTRONICS Co Ltd

Key Milestones in Japan Surveillance Analog Camera Market Industry

- April 2024: Hikvision unveiled its latest Turbo HD analog security line, Turbo HD 8.0, enhancing user security experiences with real-time communication, 180-degree video coverage, improved night vision, and an expanded product portfolio. Noteworthy features include two-way audio, compact dual-lens cameras with stitching technology, and Smart Hybrid Light functionality integrated into the entire Turbo HD camera range. The release also showcases a new cutting-edge pro-series DVR, highlighting AcuSense technology.

- February 2024: The National Police Agency in Ishikawa Prefecture was set to deploy approximately 1,000 security cameras across evacuation centers and critical locations. This move aims to curb crimes, notably sexual assaults and break-ins, particularly in unoccupied residences. The agency also initiated live webcasts of patrol car footage, reassuring displaced residents after the Noto Peninsula Earthquake.

Strategic Outlook for Japan Surveillance Analog Camera Market Market

The strategic outlook for the Japan surveillance analog camera market indicates a period of sustained relevance, particularly for vendors that focus on enhancing the core strengths of analog technology while strategically integrating with broader digital ecosystems. Continued investment in R&D to improve resolution, low-light performance, and transmission capabilities will be crucial for staying competitive. Emphasizing cost-effectiveness and ease of installation will remain key selling propositions for the SMB sector and for organizations with existing analog infrastructure. The development of hybrid solutions that allow seamless integration of analog cameras with modern IP-based security management systems will unlock significant growth potential. Furthermore, strategic partnerships with cybersecurity firms to ensure the secure deployment of analog systems within networked environments will be paramount. The market is expected to see a continued focus on meeting specific end-user requirements across government, industrial, and commercial sectors.

Japan Surveillance Analog Camera Market Segmentation

-

1. End-User Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation and Logistics

- 1.5. Industrial

- 1.6. Others (

Japan Surveillance Analog Camera Market Segmentation By Geography

- 1. Japan

Japan Surveillance Analog Camera Market Regional Market Share

Geographic Coverage of Japan Surveillance Analog Camera Market

Japan Surveillance Analog Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost-Effectiveness of Analog Cameras' Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Cost-Effectiveness of Analog Cameras' Drives the Market Growth

- 3.4. Market Trends

- 3.4.1. Cost-Effectiveness of Analog Cameras is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Surveillance Analog Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation and Logistics

- 5.1.5. Industrial

- 5.1.6. Others (

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dahua Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hanwha Vision Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TESCOM JAPAN CO Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic Holdings Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CP PLUS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sony Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pelco

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tyco (Johnson Control Brand)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SAMSUNG ELECTRONICS Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dahua Technology Co Ltd

List of Figures

- Figure 1: Japan Surveillance Analog Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Surveillance Analog Camera Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Surveillance Analog Camera Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 2: Japan Surveillance Analog Camera Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 3: Japan Surveillance Analog Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan Surveillance Analog Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Japan Surveillance Analog Camera Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Japan Surveillance Analog Camera Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: Japan Surveillance Analog Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Japan Surveillance Analog Camera Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Surveillance Analog Camera Market?

The projected CAGR is approximately 5.03%.

2. Which companies are prominent players in the Japan Surveillance Analog Camera Market?

Key companies in the market include Dahua Technology Co Ltd, Hangzhou Hikvision Digital Technology Co Ltd, Hanwha Vision Co Ltd, TESCOM JAPAN CO Ltd, Panasonic Holdings Corporation, CP PLUS, Sony Corporation, Pelco, Tyco (Johnson Control Brand), SAMSUNG ELECTRONICS Co Ltd.

3. What are the main segments of the Japan Surveillance Analog Camera Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost-Effectiveness of Analog Cameras' Drives the Market Growth.

6. What are the notable trends driving market growth?

Cost-Effectiveness of Analog Cameras is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Cost-Effectiveness of Analog Cameras' Drives the Market Growth.

8. Can you provide examples of recent developments in the market?

April 2024: Hikvision unveiled its latest Turbo HD analog security line, Turbo HD 8.0, to elevate user security experiences. The upgraded version boasts four notable enhancements: real-time communication, 180-degree video coverage, improved night vision, and an expanded product portfolio. Noteworthy features include two-way audio, compact dual-lens cameras with stitching technology, and Smart Hybrid Light functionality integrated into the entire Turbo HD camera range. The release also showcases a new cutting-edge pro-series DVR, highlighting AcuSense technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Surveillance Analog Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Surveillance Analog Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Surveillance Analog Camera Market?

To stay informed about further developments, trends, and reports in the Japan Surveillance Analog Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence