Key Insights

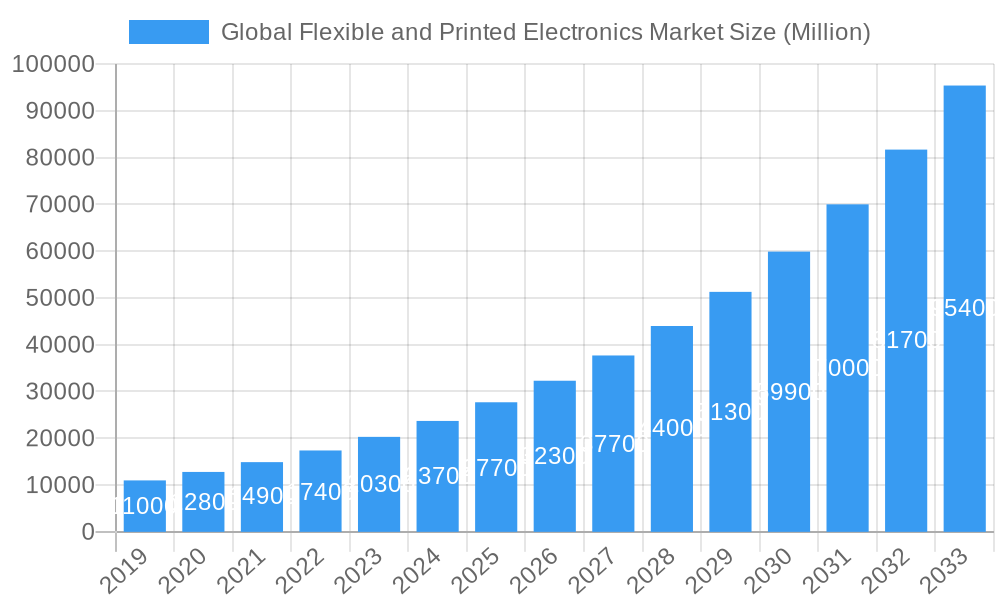

The Global Flexible and Printed Electronics Market is projected for significant expansion, reaching an estimated market size of $19.46 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 15.4% through 2033. This growth is largely attributed to the escalating demand for advanced consumer electronics and the expanding Internet of Things (IoT) ecosystem. Innovations in displays, conductive inks, in-mold electronics (IME), and printed/flexible sensors are accelerating adoption across diverse applications. The integration of these technologies into wearables, smart packaging, and healthcare solutions is opening new market avenues. The automotive, transportation, retail, and packaging sectors are increasingly utilizing flexible electronics for enhanced connectivity, smart features, and improved supply chain management via RFID tags.

Global Flexible and Printed Electronics Market Market Size (In Billion)

Key growth drivers include the miniaturization of electronic components, demand for lighter and more flexible device designs, and the cost-efficiency of printing techniques. Emerging trends encompass transparent and stretchable electronics, advanced material integration, and a focus on sustainable manufacturing. Potential challenges may arise from manufacturing complexities and the need for specialized infrastructure. However, continuous innovation by industry leaders and substantial potential across various applications are expected to fuel market growth. Asia Pacific is anticipated to lead, supported by its strong manufacturing capabilities and high consumer demand.

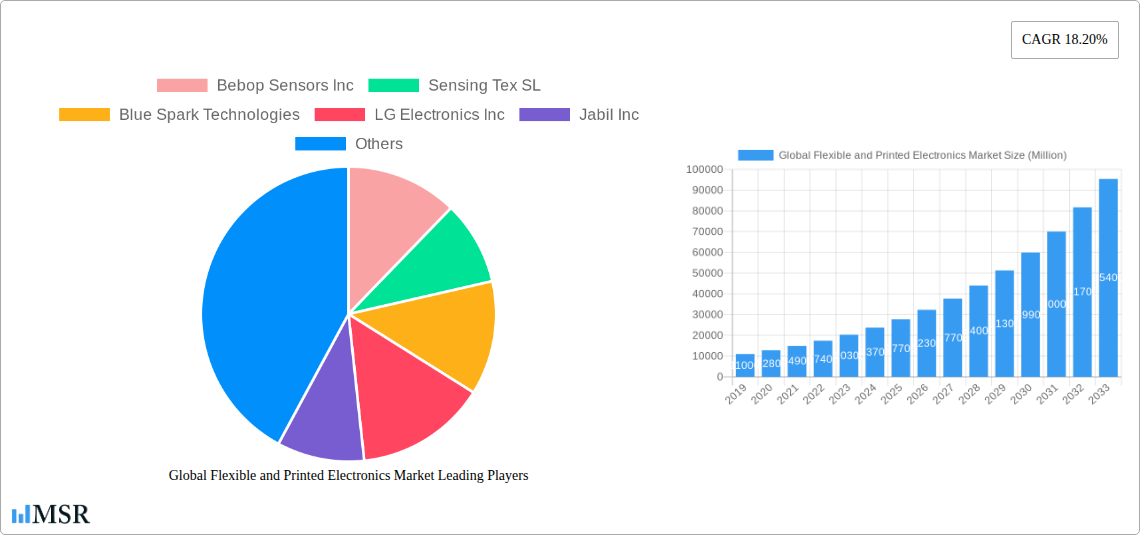

Global Flexible and Printed Electronics Market Company Market Share

Unlocking the Future: Global Flexible and Printed Electronics Market – A Comprehensive Analysis (2019-2033)

**Dive deep into the dynamic world of flexible and printed electronics with this authoritative report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this comprehensive analysis provides actionable insights into market concentration, industry trends, key segments, product developments, challenges, growth drivers, and emerging opportunities. Essential for stakeholders seeking to navigate and capitalize on the burgeoning *flexible electronics market*, *printed electronics market*, and **wearable technology market.

Global Flexible and Printed Electronics Market Market Concentration & Dynamics

The global flexible and printed electronics market exhibits a moderately concentrated landscape, with a few dominant players alongside a vibrant ecosystem of innovators and specialized component suppliers. Key industry participants actively engage in research and development to push the boundaries of material science and manufacturing processes, fostering a competitive environment. Innovation hubs are emerging in regions with strong R&D infrastructure and supportive government policies, driving the adoption of printed sensors, OLED displays, and RFID tags. Regulatory frameworks, while evolving, are largely focused on ensuring material safety and interoperability, influencing market entry strategies. The threat of substitute products, though present in some niche applications, is mitigated by the unique advantages offered by flexible and printed solutions, such as ultra-thin profiles, conformal designs, and lower manufacturing costs. End-user trends increasingly favor miniaturization, enhanced functionality, and seamless integration, directly fueling demand for advanced flexible and printed electronic components. Mergers and acquisitions (M&A) activities are moderately prevalent, with larger corporations acquiring innovative startups to gain access to proprietary technologies and expand their product portfolios. For instance, recent M&A deal counts suggest a strategic consolidation aimed at capturing market share in high-growth segments like wearable technology and IoT devices. This dynamic interplay between established giants and agile innovators defines the competitive arena.

Global Flexible and Printed Electronics Market Industry Insights & Trends

The global flexible and printed electronics market is experiencing robust expansion, driven by a confluence of technological advancements, evolving consumer preferences, and expanding application horizons. The market size is projected to reach $XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. Key market growth drivers include the relentless demand for thinner, lighter, and more versatile electronic components across various industries. The miniaturization trend in consumer electronics, coupled with the proliferation of the Internet of Things (IoT), necessitates solutions that can be seamlessly integrated into everyday objects and devices. Technological disruptions such as advancements in printable materials, including conductive inks and organic semiconductors, are enabling the cost-effective mass production of complex electronic circuits. Furthermore, the development of novel manufacturing techniques like roll-to-roll processing is significantly reducing production costs and lead times, making flexible and printed electronics more accessible for a wider range of applications. Evolving consumer behaviors, characterized by an increasing adoption of wearable technology, smart home devices, and connected vehicles, are creating unprecedented demand for personalized and context-aware electronic solutions. The ability of flexible and printed electronics to conform to irregular surfaces and integrate unobtrusively into products is a significant competitive advantage. Emerging applications in areas like smart packaging, electronic textiles, and advanced healthcare monitoring are further propelling market growth. The ongoing innovation in in-mold electronics (IME) is also opening new avenues for integrating electronics directly into plastic components, revolutionizing product design and functionality in the automotive and consumer goods sectors. The sustained investment in R&D by leading companies is expected to yield further breakthroughs, solidifying the position of flexible and printed electronics as a cornerstone of future technological innovation.

Key Markets & Segments Leading Global Flexible and Printed Electronics Market

The Consumer Electronics & IoT segment is currently the dominant force in the global flexible and printed electronics market, driven by the insatiable demand for smartphones, smartwatches, tablets, and an ever-expanding array of connected devices. Within this segment, Displays represent a significant sub-segment, with advancements in foldable and rollable OLED displays revolutionizing user experiences and enabling novel product designs. The Retail & Packaging segment is also demonstrating substantial growth, propelled by the adoption of smart labels and RFID tags for enhanced supply chain management, inventory tracking, and anti-counterfeiting measures. Wearable Technology continues to be a major growth engine, with flexible sensors integrated into clothing and accessories for health monitoring, fitness tracking, and augmented reality applications.

Product Type Dominance:

- Displays: Leading due to advancements in OLED and e-paper technologies for smartphones, wearables, and digital signage.

- Conductive Ink/In-Mold Electronics (IME): Experiencing rapid adoption in automotive interiors and consumer appliances, offering integrated functionalities.

- Printed & Flexible Sensors: Crucial for IoT devices, medical diagnostics, and environmental monitoring, offering miniaturization and conformal integration.

- RFID Tags: Vital for supply chain efficiency, retail inventory, and access control systems.

Application Dominance:

- Consumer Electronics & IoT: The primary driver, encompassing a vast range of smart devices and connected products.

- Wearable Technology: A high-growth area, fueled by increasing consumer interest in health and fitness monitoring.

- Automotive & Transportation: Emerging strong with applications in smart dashboards, interior lighting, and sensor integration.

- Healthcare: Significant potential for flexible biosensors, wearable diagnostic devices, and smart medical implants.

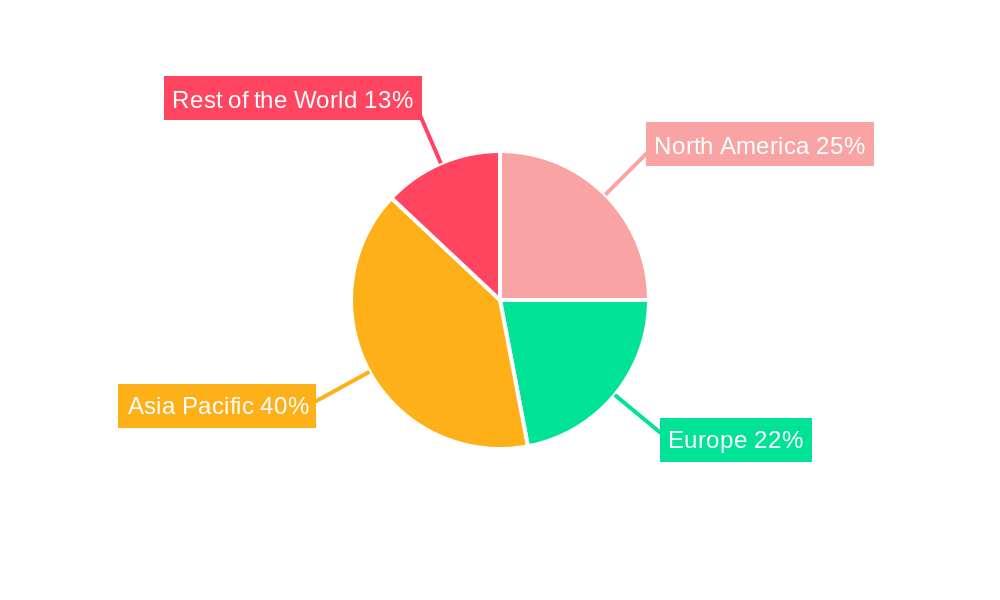

Geographically, Asia Pacific continues to lead the market, owing to its robust manufacturing capabilities, significant investments in R&D, and a large consumer base for electronic devices. Countries like China, South Korea, and Japan are at the forefront of innovation and production in this sector. North America and Europe are also crucial markets, driven by advanced technological adoption, particularly in the healthcare and automotive sectors. Economic growth, strong infrastructure for advanced manufacturing, and supportive government initiatives for technological development are key drivers for regional market expansion.

Global Flexible and Printed Electronics Market Product Developments

Recent product developments in the flexible and printed electronics market highlight a commitment to enhancing functionality, durability, and integration. Innovations in conductive inks are enabling higher conductivity and improved adhesion to diverse substrates, paving the way for more complex printed circuits. The continuous refinement of flexible displays, particularly in OLED and e-paper technologies, is leading to devices with unprecedented form factors, such as foldable and rollable screens, enhancing user portability and interaction. Advances in printed sensors are enabling the development of highly sensitive and selective sensors for applications ranging from medical diagnostics to environmental monitoring, often integrated into flexible substrates for wearable or disposable devices. The increasing sophistication of In-Mold Electronics (IME) is allowing for the seamless integration of electronic components directly into plastic parts, creating aesthetically pleasing and highly functional products in automotive and consumer goods.

Challenges in the Global Flexible and Printed Electronics Market Market

Despite its promising growth trajectory, the global flexible and printed electronics market faces several significant challenges. Scalability and manufacturing costs remain a hurdle for widespread adoption in certain high-volume applications, particularly when competing with established silicon-based technologies. Achieving consistent quality and reliability in mass production of printed electronics can be complex, leading to potential defects and performance variations. Material limitations in terms of durability, conductivity, and temperature resistance can restrict their use in demanding environments. Furthermore, the integration of flexible and printed components with existing electronic systems and the development of standardized interfaces require ongoing effort. Supply chain complexities for specialized inks and substrates can also pose challenges.

Forces Driving Global Flexible and Printed Electronics Market Growth

The global flexible and printed electronics market is propelled by several powerful forces. The relentless demand for miniaturization and portability in consumer electronics, coupled with the expansion of the Internet of Things (IoT), necessitates electronic solutions that are thin, lightweight, and conformable. Technological advancements in printable materials and manufacturing processes, such as roll-to-roll printing, are enabling cost-effective production and wider application adoption. The increasing consumer adoption of wearable technology and the growing interest in smart health monitoring are creating significant demand for flexible sensors and displays. Furthermore, government initiatives and funding for advanced manufacturing and R&D are fostering innovation and market growth.

Challenges in the Global Flexible and Printed Electronics Market Market

Long-term growth catalysts for the global flexible and printed electronics market are deeply rooted in continuous innovation and strategic market penetration. The development of novel materials with enhanced properties, such as improved conductivity, flexibility, and environmental robustness, will unlock new application possibilities. Strategic partnerships and collaborations between material suppliers, component manufacturers, and end-product developers are crucial for driving integrated solutions and accelerating market adoption. The expansion of flexible and printed electronics into emerging markets and applications, such as smart agriculture, advanced infrastructure monitoring, and disposable medical devices, will create significant new revenue streams. Continued investment in advanced manufacturing techniques that further reduce costs and improve yields will be essential for widespread commercial success.

Emerging Opportunities in Global Flexible and Printed Electronics Market

Emerging opportunities in the global flexible and printed electronics market are vast and diverse. The burgeoning field of electronic textiles presents a significant avenue, enabling the integration of sensors and displays into clothing for smart apparel, health monitoring, and interactive fashion. The healthcare sector continues to offer immense potential, with the development of disposable biosensors for rapid diagnostics, smart wound dressings, and flexible medical implants. The expansion of smart packaging solutions, incorporating embedded electronics for tracking, authentication, and enhanced consumer engagement, is another key growth area. Furthermore, advancements in flexible solar cells and energy harvesting devices are creating opportunities for self-powered flexible electronics, reducing reliance on traditional power sources. The integration of printed electronics into architectural elements and the development of smart building materials also represent a promising frontier.

Leading Players in the Global Flexible and Printed Electronics Market Sector

- Bebop Sensors Inc

- Sensing Tex SL

- Blue Spark Technologies

- LG Electronics Inc

- Jabil Inc

- Samsung Electronics Co Ltd

- Coatema Coating Machinery GmbH

- Ynvisible Interactive Inc

- Royole Corporation

- Agfa-Gevaert NV

- E Ink Holdings Inc

- Carre Technologies Inc

- Isorg SA

- Flex Ltd

- GSI Technologies

Key Milestones in Global Flexible and Printed Electronics Market Industry

- March 2022: E Ink Holdings, a leader in electronic ink technology, partnered with Avalue, an industrial PC solutions provider, to launch the next-generation Digital Paper Tablet Solution for Business, based on the Linfiny product developed with Sony Semiconductor Solutions.

- September 2021: LG Chemical developed new technology for foldable displays by combining novel material tools and advanced coating technologies, positioning itself for expansion in the next-generation materials industry.

Strategic Outlook for Global Flexible and Printed Electronics Market Market

The strategic outlook for the global flexible and printed electronics market is exceptionally bright, characterized by continuous innovation and expanding application frontiers. Growth accelerators will be driven by the increasing demand for personalized and integrated electronic functionalities across consumer, industrial, and healthcare sectors. Key opportunities lie in the advancement of novel materials, the optimization of manufacturing processes for cost-effectiveness and scalability, and the development of robust ecosystems for interoperability. Strategic collaborations and partnerships will be paramount in bringing complex integrated solutions to market. The focus on sustainability and the development of eco-friendly printable electronics will also become increasingly important. Market expansion into emerging applications like smart infrastructure, advanced robotics, and personalized medicine will further solidify its position as a transformative technology.

Global Flexible and Printed Electronics Market Segmentation

-

1. Product Type

- 1.1. Displays

- 1.2. Conductive Ink/In-Mold Electronics (IME)

- 1.3. Printed & Flexible Sensors

- 1.4. RFID Tags

- 1.5. Other Ap

-

2. Application

- 2.1. Consumer Electronics & IoT

- 2.2. Wearable Technology

- 2.3. Retail & Packaging

- 2.4. Healthcare

- 2.5. Automotive & Transportation

- 2.6. Other Applications

Global Flexible and Printed Electronics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Global Flexible and Printed Electronics Market Regional Market Share

Geographic Coverage of Global Flexible and Printed Electronics Market

Global Flexible and Printed Electronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Cost Advantages and Increased Integration into Numerous Applications; Emerging Need for Lightweight

- 3.2.2 Mechanically Flexible

- 3.2.3 and Cost-effective Products

- 3.3. Market Restrains

- 3.3.1. Regulations and Lack of Skilled Integrators

- 3.4. Market Trends

- 3.4.1. The explosive growth of smart wearable devices to augment market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flexible and Printed Electronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Displays

- 5.1.2. Conductive Ink/In-Mold Electronics (IME)

- 5.1.3. Printed & Flexible Sensors

- 5.1.4. RFID Tags

- 5.1.5. Other Ap

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Consumer Electronics & IoT

- 5.2.2. Wearable Technology

- 5.2.3. Retail & Packaging

- 5.2.4. Healthcare

- 5.2.5. Automotive & Transportation

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Global Flexible and Printed Electronics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Displays

- 6.1.2. Conductive Ink/In-Mold Electronics (IME)

- 6.1.3. Printed & Flexible Sensors

- 6.1.4. RFID Tags

- 6.1.5. Other Ap

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Consumer Electronics & IoT

- 6.2.2. Wearable Technology

- 6.2.3. Retail & Packaging

- 6.2.4. Healthcare

- 6.2.5. Automotive & Transportation

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Global Flexible and Printed Electronics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Displays

- 7.1.2. Conductive Ink/In-Mold Electronics (IME)

- 7.1.3. Printed & Flexible Sensors

- 7.1.4. RFID Tags

- 7.1.5. Other Ap

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Consumer Electronics & IoT

- 7.2.2. Wearable Technology

- 7.2.3. Retail & Packaging

- 7.2.4. Healthcare

- 7.2.5. Automotive & Transportation

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Global Flexible and Printed Electronics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Displays

- 8.1.2. Conductive Ink/In-Mold Electronics (IME)

- 8.1.3. Printed & Flexible Sensors

- 8.1.4. RFID Tags

- 8.1.5. Other Ap

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Consumer Electronics & IoT

- 8.2.2. Wearable Technology

- 8.2.3. Retail & Packaging

- 8.2.4. Healthcare

- 8.2.5. Automotive & Transportation

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Global Flexible and Printed Electronics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Displays

- 9.1.2. Conductive Ink/In-Mold Electronics (IME)

- 9.1.3. Printed & Flexible Sensors

- 9.1.4. RFID Tags

- 9.1.5. Other Ap

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Consumer Electronics & IoT

- 9.2.2. Wearable Technology

- 9.2.3. Retail & Packaging

- 9.2.4. Healthcare

- 9.2.5. Automotive & Transportation

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Bebop Sensors Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sensing Tex SL

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Blue Spark Technologies

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LG Electronics Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Jabil Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Samsung Electronics Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Coatema Coating Machinery GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Ynvisible Interactive Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Royole Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Agfa-Gevaert NV

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 E Ink Holdings Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Carre Technologies Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Isorg SA*List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Flex Ltd

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 GSI Technologies

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Bebop Sensors Inc

List of Figures

- Figure 1: Global Global Flexible and Printed Electronics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Global Flexible and Printed Electronics Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Global Flexible and Printed Electronics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Global Flexible and Printed Electronics Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Global Flexible and Printed Electronics Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Global Flexible and Printed Electronics Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Global Flexible and Printed Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Global Flexible and Printed Electronics Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Global Flexible and Printed Electronics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Global Flexible and Printed Electronics Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Global Flexible and Printed Electronics Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Global Flexible and Printed Electronics Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Global Flexible and Printed Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Global Flexible and Printed Electronics Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Global Flexible and Printed Electronics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Global Flexible and Printed Electronics Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Global Flexible and Printed Electronics Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Global Flexible and Printed Electronics Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Global Flexible and Printed Electronics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Global Flexible and Printed Electronics Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Rest of the World Global Flexible and Printed Electronics Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Rest of the World Global Flexible and Printed Electronics Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Rest of the World Global Flexible and Printed Electronics Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Global Flexible and Printed Electronics Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Global Flexible and Printed Electronics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Flexible and Printed Electronics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Flexible and Printed Electronics Market?

The projected CAGR is approximately 15.4%.

2. Which companies are prominent players in the Global Flexible and Printed Electronics Market?

Key companies in the market include Bebop Sensors Inc, Sensing Tex SL, Blue Spark Technologies, LG Electronics Inc, Jabil Inc, Samsung Electronics Co Ltd, Coatema Coating Machinery GmbH, Ynvisible Interactive Inc, Royole Corporation, Agfa-Gevaert NV, E Ink Holdings Inc, Carre Technologies Inc, Isorg SA*List Not Exhaustive, Flex Ltd, GSI Technologies.

3. What are the main segments of the Global Flexible and Printed Electronics Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.46 billion as of 2022.

5. What are some drivers contributing to market growth?

Cost Advantages and Increased Integration into Numerous Applications; Emerging Need for Lightweight. Mechanically Flexible. and Cost-effective Products.

6. What are the notable trends driving market growth?

The explosive growth of smart wearable devices to augment market growth.

7. Are there any restraints impacting market growth?

Regulations and Lack of Skilled Integrators.

8. Can you provide examples of recent developments in the market?

March 2022- E Ink Holdings, the leading innovator of electronic ink technology, and Avalue, a provider of industrial PC solutions, announced a collaboration to offer the next-generation Digital Paper Tablet Solution for Business. The Digital Paper Tablet is based on the Linfiny product, a collaboration between E Ink and Sony Semiconductor Solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Flexible and Printed Electronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Flexible and Printed Electronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Flexible and Printed Electronics Market?

To stay informed about further developments, trends, and reports in the Global Flexible and Printed Electronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence