Key Insights

The US electrical enclosures market is poised for significant expansion, projected to reach a substantial valuation and exhibiting robust growth. This upward trajectory is largely fueled by the escalating demand for reliable and safe electrical infrastructure across diverse sectors. The increasing adoption of smart grid technologies, coupled with the ongoing need for upgraded power distribution and transmission networks, presents a powerful impetus. Furthermore, the burgeoning renewable energy sector, particularly solar and wind power installations, necessitates extensive electrical enclosure solutions for protection and management. Growing industrial automation and the expansion of data centers, requiring sophisticated environmental controls for sensitive electronic equipment, are also key drivers. The commercial and residential construction booms, especially in urban and suburban areas, further contribute to the demand for robust and aesthetically integrated electrical enclosures.

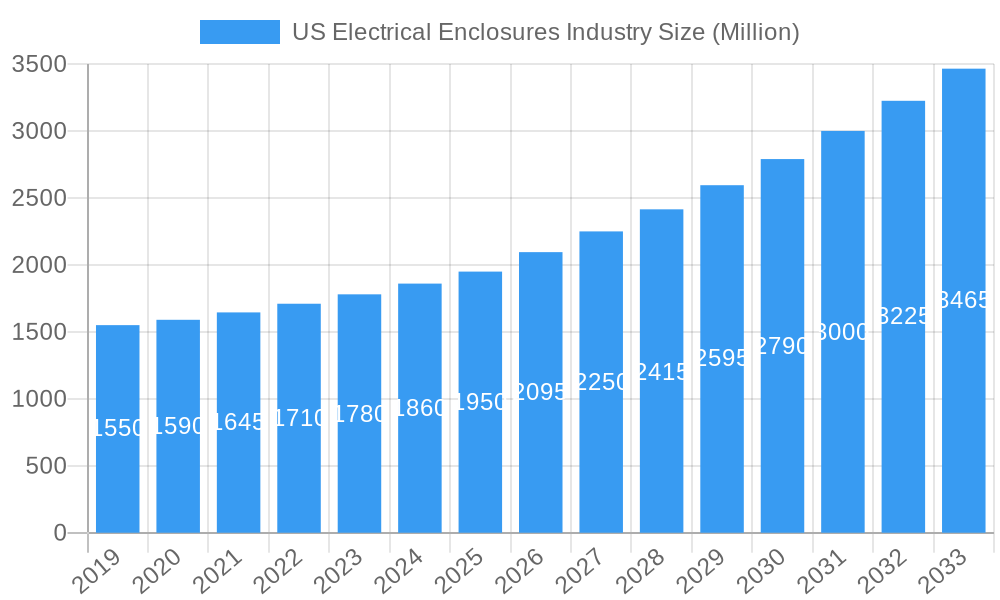

US Electrical Enclosures Industry Market Size (In Billion)

The market's growth is underpinned by technological advancements and a strong focus on safety and compliance. Innovations in materials science are leading to the development of more durable, lightweight, and corrosion-resistant enclosures, enhancing their suitability for harsh environments. The integration of IoT capabilities for remote monitoring and predictive maintenance within enclosures is also gaining traction. While the market is propelled by these strong drivers, potential restraints such as fluctuating raw material costs and stringent regulatory compliance requirements could influence its pace. However, the overarching trend points towards a dynamic and expanding market, with opportunities arising from infrastructure modernization, industrial growth, and the sustained development of commercial and residential properties, all demanding secure and efficient electrical housing solutions.

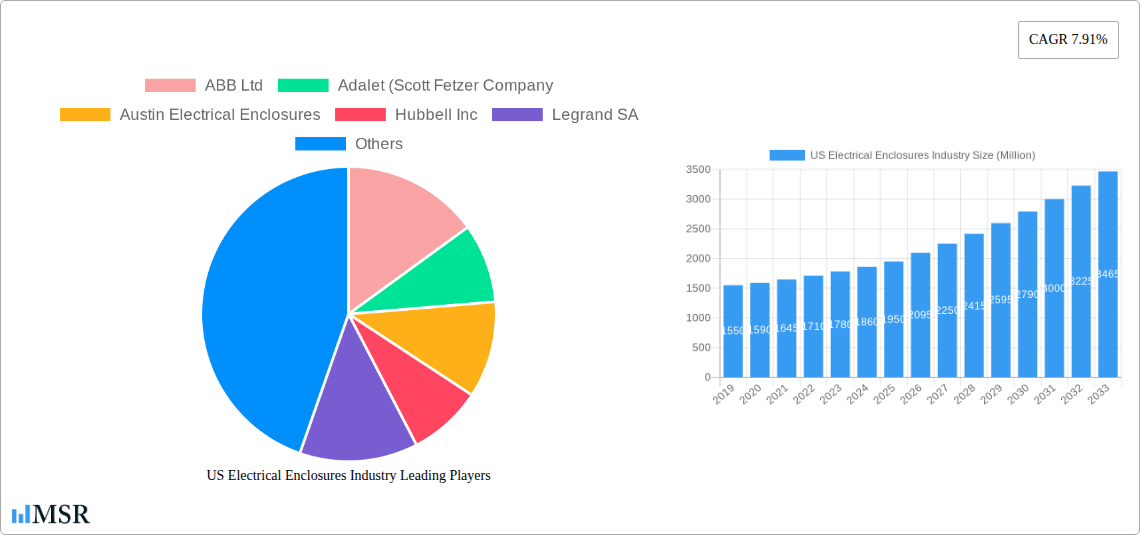

US Electrical Enclosures Industry Company Market Share

Unveiling the US Electrical Enclosures Industry: A Comprehensive Market Analysis (2019-2033)

This in-depth report provides an exhaustive analysis of the US electrical enclosures industry, offering critical insights into market dynamics, growth drivers, key players, and future opportunities. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this research is indispensable for stakeholders seeking to navigate the evolving landscape of electrical enclosures, industrial enclosures, commercial enclosures, and residential enclosures in the United States. Explore market concentration, technological innovations, regulatory impacts, and emerging trends shaping the US electrical enclosure market.

US Electrical Enclosures Industry Market Concentration & Dynamics

The US electrical enclosures market exhibits a moderate to high level of concentration, with key players like Siemens AG, Schneider Electric SE, ABB Ltd, Eaton Corporation, and Emerson Electric Co holding significant market share. The innovation ecosystem is characterized by continuous investment in R&D, focusing on enhanced durability, environmental protection (IP ratings), smart connectivity, and miniaturization of electrical enclosure solutions. Regulatory frameworks, such as those from UL and NEC, play a crucial role in dictating product standards and safety, influencing product development and market access. Substitute products, while present in niche applications, generally fall short of the comprehensive protection offered by dedicated electrical enclosures. End-user trends indicate a growing demand for customized and intelligent enclosures across all sectors, driving innovation and specialized offerings. Mergers and acquisition (M&A) activities, with an estimated XX M&A deals in the historical period and xx in the forecast period, are strategically employed by leading companies to expand product portfolios, geographic reach, and technological capabilities, further shaping the competitive landscape. The market share of key players is estimated to be dominated by the top 5, holding approximately 60-70% of the total market value.

US Electrical Enclosures Industry Industry Insights & Trends

The US electrical enclosures industry is projected for robust growth, driven by escalating demand for reliable and safe electrical infrastructure across various sectors. The market size is estimated to reach USD XXXX Million by 2033, growing at a Compound Annual Growth Rate (CAGR) of XX% from USD XXXX Million in 2025. This growth is fueled by substantial investments in power generation and distribution networks, the expansion of renewable energy projects, and the modernization of existing electrical systems. Technological disruptions, including the integration of IoT capabilities within enclosures for remote monitoring and control, are transforming traditional product offerings into smart solutions. The increasing adoption of advanced materials, such as high-performance non-metallic composites, is also contributing to market expansion, offering enhanced corrosion resistance and electrical insulation properties. Evolving consumer behaviors, particularly the emphasis on energy efficiency, sustainability, and integrated building management systems, are compelling manufacturers to develop more sophisticated and environmentally conscious electrical enclosure designs. The burgeoning data center industry, with its stringent cooling and power management requirements, presents a significant growth avenue for specialized server rack enclosures and industrial electrical enclosures. Furthermore, the ongoing trend of industrial automation and the proliferation of smart grids are creating sustained demand for robust and adaptable electrical enclosures. The resurgence of manufacturing in the US, coupled with government initiatives promoting infrastructure development, further underpins the positive growth trajectory of the electrical enclosure market.

Key Markets & Segments Leading US Electrical Enclosures Industry

The US electrical enclosures industry is experiencing significant expansion driven by specific sectors and material types.

Dominant Application Segments:

- Power Generation and Distribution: This segment is a cornerstone of the market, fueled by the continuous need for reliable power infrastructure, grid modernization, and the integration of renewable energy sources. Investments in new power plants and substations, alongside upgrades to existing transmission and distribution networks, directly translate to a high demand for durable and safe electrical enclosures.

- Commercial Spaces and Buildings: The growth in new construction and the retrofitting of existing commercial buildings for enhanced energy efficiency and smart technology integration are significant drivers. This includes retail spaces, office buildings, hospitals, and educational institutions requiring advanced electrical control panels and distribution boards.

- Industrial Sector: Across manufacturing, process industries, and oil and gas, the demand for robust and protective industrial electrical enclosures remains consistently high. Automation, increasing operational complexity, and stringent safety regulations in these environments necessitate high-quality enclosure solutions.

Dominant Material Type:

- Metallic Enclosures: These continue to dominate the market due to their superior strength, durability, and resistance to physical impact, making them ideal for harsh industrial environments, power substations, and outdoor applications. Stainless steel and aluminum are key materials, offering excellent corrosion resistance.

Dominant End-User Segments:

- Industrial: This segment is the largest consumer of electrical enclosures, driven by heavy manufacturing, process industries, and automation. The need for reliable protection of sensitive electrical equipment in demanding conditions is paramount.

- Commercial: The expansion of commercial infrastructure, including data centers, smart buildings, and public facilities, fuels the demand for a wide range of enclosures, from modular systems to specialized solutions.

The economic growth across the United States, coupled with ongoing infrastructure development projects and a strong emphasis on safety and compliance, further reinforces the dominance of these segments.

US Electrical Enclosures Industry Product Developments

Recent product developments in the US electrical enclosures industry highlight a clear trend towards enhanced functionality and user-centric designs. Manufacturers are increasingly integrating smart technologies, enabling remote monitoring, diagnostics, and predictive maintenance of electrical systems housed within. Advancements in materials science are leading to lighter, more durable, and environmentally resistant enclosures, catering to specific application needs. For instance, the release of new lighting control panels with centralized connection points, as exemplified by Hubbell Control Solutions' NX Distributed Intelligence Lighting Control Panel, showcases a focus on reducing deployment time and costs while ensuring code compliance. Similarly, expansions in manufacturing capacity, like Hammond Manufacturing Ltd's investment in painting and metal fabrication, underscore the industry's commitment to meeting growing demand with improved production capabilities and a wider range of metallic and non-metallic enclosure solutions. These innovations are crucial for maintaining a competitive edge and addressing the evolving requirements of diverse end-user applications.

Challenges in the US Electrical Enclosures Industry Market

The US electrical enclosures industry faces several challenges that impact growth and profitability. Stringent and evolving regulatory compliance requirements, particularly concerning safety standards and environmental regulations, can lead to increased R&D and manufacturing costs. Supply chain disruptions, including raw material price volatility and availability issues for metals and specialized components, pose a significant threat to production timelines and cost management. Intense competition from both established players and new entrants, particularly in the low-cost segment, pressures profit margins. Furthermore, the need for skilled labor to design, manufacture, and install sophisticated enclosure systems presents a persistent challenge for many companies. Cybersecurity concerns related to smart enclosures also require continuous attention and investment in robust security measures.

Forces Driving US Electrical Enclosures Industry Growth

The US electrical enclosures industry is propelled by a confluence of powerful growth drivers. The ongoing digital transformation and the proliferation of smart technologies necessitate advanced enclosure solutions to house and protect connected devices and critical infrastructure. Significant government investments in modernizing aging power grids and expanding renewable energy capacity are creating substantial demand for both standard and specialized electrical enclosures. The burgeoning data center construction boom, driven by cloud computing and AI, requires highly specialized and secure server rack enclosures and data infrastructure solutions. Furthermore, increasing safety regulations and a growing awareness of the importance of equipment protection in harsh environments are driving the adoption of high-quality, certified industrial electrical enclosures. The overall economic expansion and infrastructure development initiatives further contribute to a robust market outlook.

Challenges in the US Electrical Enclosures Industry Market

The long-term growth catalysts for the US electrical enclosures industry lie in embracing innovation and strategic market expansion. The continuous development of smart and connected enclosures, integrating IoT capabilities for enhanced monitoring, control, and data analytics, represents a significant growth avenue. Partnerships and collaborations between enclosure manufacturers and technology providers will be crucial for developing integrated solutions. Expanding into emerging applications, such as electric vehicle charging infrastructure and advanced energy storage systems, offers substantial future potential. Furthermore, a focus on sustainability and the development of enclosures made from recycled or eco-friendly materials can cater to a growing environmentally conscious market. Continuous improvement in manufacturing processes, leveraging automation and Industry 4.0 principles, will be vital for maintaining competitiveness and delivering cost-effective, high-quality electrical enclosure products.

Emerging Opportunities in US Electrical Enclosures Industry

Emerging opportunities in the US electrical enclosures industry are abundant, driven by technological advancements and evolving market needs. The widespread adoption of electric vehicles (EVs) presents a significant opportunity for specialized charging station enclosures and solutions for EV battery management systems. The increasing deployment of 5G infrastructure requires compact, weather-resistant enclosures for communication equipment in diverse locations. The growing trend towards distributed energy resources (DERs) and microgrids necessitates flexible and scalable enclosure solutions for managing localized power generation and storage. Furthermore, the demand for intelligent, modular, and customizable enclosures in smart city initiatives and advanced building automation systems is on the rise. Opportunities also exist in offering enhanced cybersecurity features within smart enclosures to protect against evolving threats.

Leading Players in the US Electrical Enclosures Industry Sector

- ABB Ltd

- Adalet (Scott Fetzer Company)

- Austin Electrical Enclosures

- Hubbell Inc

- Legrand SA

- Emerson Electric Co

- Siemens AG

- Schneider Electric SE

- Rittal GmbH & Co Kg

- AZZ Inc

- Nvent Electric PLC

- Hammond Manufacturing Ltd

- Eaton Corporation

Key Milestones in US Electrical Enclosures Industry Industry

- August 2021: Hammond Manufacturing Ltd announced a USD 24 million expansion to provide more painting and metal fabrication capacity. The new 96,000-sq. Ft facility is scheduled to be operational by the end of 2022. The company manufactures electronic and electrical products, including metallic and non-metallic enclosures, racks, small cases, outlet strips, surge suppressors, and electronic transformers.

- March 2021: Hubbell Control Solutions in South Carolina, the United States, announced the release of a new and improved NX Distributed Intelligence Lighting Control Panel (NXP2 Series) that centralizes connection points in an enclosure providing a solution that reduces time and costs to deploy code-compliant lighting control. It comes with surface mount and flushes mount enclosure options.

Strategic Outlook for US Electrical Enclosures Industry Market

The strategic outlook for the US electrical enclosures industry is characterized by continued innovation and market diversification. Key growth accelerators include the integration of IoT and AI for intelligent, connected enclosures, catering to the demands of smart grids, smart buildings, and industrial automation. Strategic opportunities lie in expanding product offerings to support emerging technologies like electric vehicle charging infrastructure, 5G deployments, and advanced energy storage solutions. Partnerships with technology providers and a focus on customized, high-performance solutions for specialized applications will be crucial for sustained success. Furthermore, companies that prioritize sustainability and develop eco-friendly enclosure options will gain a competitive advantage. The industry is poised for sustained growth driven by the ongoing need for robust, reliable, and technologically advanced protection for electrical components across all sectors.

US Electrical Enclosures Industry Segmentation

-

1. Material Type

- 1.1. Metallic

- 1.2. Non-metallic

-

2. Application

- 2.1. Power Generation and Distribution

- 2.2. Metal and Mining

- 2.3. Transportation

- 2.4. Oil and Gas

- 2.5. Commercial Spaces and Buildings

- 2.6. Process Industries

- 2.7. Other Applications

-

3. End-User

- 3.1. Industrial

- 3.2. Commercial

- 3.3. Residential

US Electrical Enclosures Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

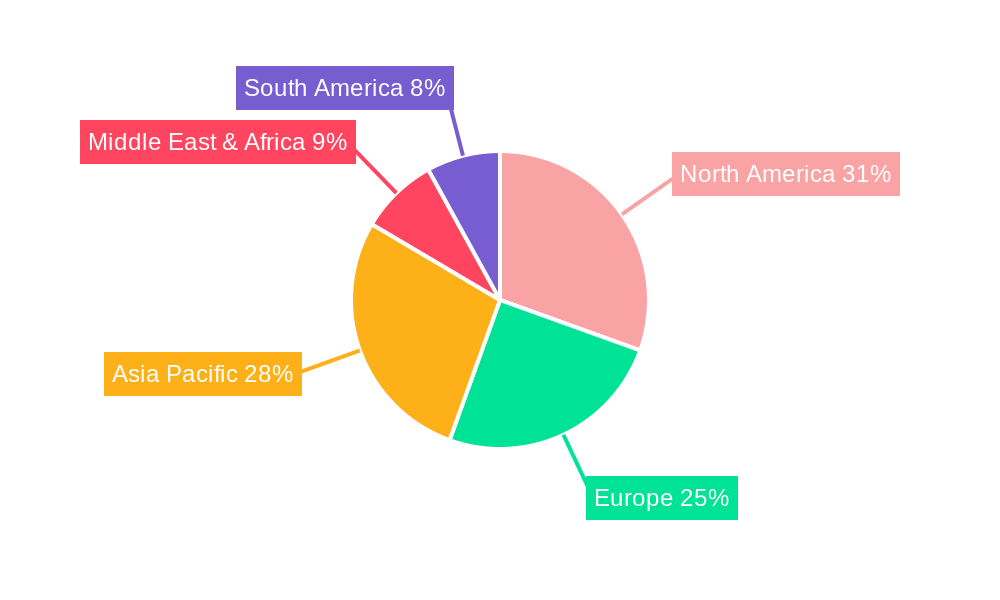

US Electrical Enclosures Industry Regional Market Share

Geographic Coverage of US Electrical Enclosures Industry

US Electrical Enclosures Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption and Capacity of Renewable Energy; Aging Power Generation and Distribution Network

- 3.3. Market Restrains

- 3.3.1. Economic Slowdown in Industries

- 3.4. Market Trends

- 3.4.1. Commercial spaces and buildings industry to drive the market demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Electrical Enclosures Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Metallic

- 5.1.2. Non-metallic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation and Distribution

- 5.2.2. Metal and Mining

- 5.2.3. Transportation

- 5.2.4. Oil and Gas

- 5.2.5. Commercial Spaces and Buildings

- 5.2.6. Process Industries

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Industrial

- 5.3.2. Commercial

- 5.3.3. Residential

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America US Electrical Enclosures Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Metallic

- 6.1.2. Non-metallic

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Power Generation and Distribution

- 6.2.2. Metal and Mining

- 6.2.3. Transportation

- 6.2.4. Oil and Gas

- 6.2.5. Commercial Spaces and Buildings

- 6.2.6. Process Industries

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Industrial

- 6.3.2. Commercial

- 6.3.3. Residential

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. South America US Electrical Enclosures Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Metallic

- 7.1.2. Non-metallic

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Power Generation and Distribution

- 7.2.2. Metal and Mining

- 7.2.3. Transportation

- 7.2.4. Oil and Gas

- 7.2.5. Commercial Spaces and Buildings

- 7.2.6. Process Industries

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Industrial

- 7.3.2. Commercial

- 7.3.3. Residential

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Europe US Electrical Enclosures Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Metallic

- 8.1.2. Non-metallic

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Power Generation and Distribution

- 8.2.2. Metal and Mining

- 8.2.3. Transportation

- 8.2.4. Oil and Gas

- 8.2.5. Commercial Spaces and Buildings

- 8.2.6. Process Industries

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Industrial

- 8.3.2. Commercial

- 8.3.3. Residential

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Middle East & Africa US Electrical Enclosures Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Metallic

- 9.1.2. Non-metallic

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Power Generation and Distribution

- 9.2.2. Metal and Mining

- 9.2.3. Transportation

- 9.2.4. Oil and Gas

- 9.2.5. Commercial Spaces and Buildings

- 9.2.6. Process Industries

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Industrial

- 9.3.2. Commercial

- 9.3.3. Residential

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Asia Pacific US Electrical Enclosures Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Metallic

- 10.1.2. Non-metallic

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Power Generation and Distribution

- 10.2.2. Metal and Mining

- 10.2.3. Transportation

- 10.2.4. Oil and Gas

- 10.2.5. Commercial Spaces and Buildings

- 10.2.6. Process Industries

- 10.2.7. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Industrial

- 10.3.2. Commercial

- 10.3.3. Residential

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Adalet (Scott Fetzer Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Austin Electrical Enclosures

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hubbell Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Legrand SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Emerson Electric Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schneider Electric SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rittal GmbH & Co Kg

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AZZ Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nvent Electric PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hammond Manufacturing Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eaton Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global US Electrical Enclosures Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Electrical Enclosures Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 3: North America US Electrical Enclosures Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America US Electrical Enclosures Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America US Electrical Enclosures Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America US Electrical Enclosures Industry Revenue (Million), by End-User 2025 & 2033

- Figure 7: North America US Electrical Enclosures Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America US Electrical Enclosures Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America US Electrical Enclosures Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Electrical Enclosures Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 11: South America US Electrical Enclosures Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: South America US Electrical Enclosures Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: South America US Electrical Enclosures Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America US Electrical Enclosures Industry Revenue (Million), by End-User 2025 & 2033

- Figure 15: South America US Electrical Enclosures Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 16: South America US Electrical Enclosures Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America US Electrical Enclosures Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Electrical Enclosures Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 19: Europe US Electrical Enclosures Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Europe US Electrical Enclosures Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe US Electrical Enclosures Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe US Electrical Enclosures Industry Revenue (Million), by End-User 2025 & 2033

- Figure 23: Europe US Electrical Enclosures Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Europe US Electrical Enclosures Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe US Electrical Enclosures Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Electrical Enclosures Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 27: Middle East & Africa US Electrical Enclosures Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Middle East & Africa US Electrical Enclosures Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East & Africa US Electrical Enclosures Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa US Electrical Enclosures Industry Revenue (Million), by End-User 2025 & 2033

- Figure 31: Middle East & Africa US Electrical Enclosures Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East & Africa US Electrical Enclosures Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Electrical Enclosures Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Electrical Enclosures Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 35: Asia Pacific US Electrical Enclosures Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 36: Asia Pacific US Electrical Enclosures Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: Asia Pacific US Electrical Enclosures Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific US Electrical Enclosures Industry Revenue (Million), by End-User 2025 & 2033

- Figure 39: Asia Pacific US Electrical Enclosures Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Asia Pacific US Electrical Enclosures Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific US Electrical Enclosures Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Electrical Enclosures Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global US Electrical Enclosures Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global US Electrical Enclosures Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global US Electrical Enclosures Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global US Electrical Enclosures Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Global US Electrical Enclosures Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global US Electrical Enclosures Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global US Electrical Enclosures Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global US Electrical Enclosures Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 13: Global US Electrical Enclosures Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global US Electrical Enclosures Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Global US Electrical Enclosures Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global US Electrical Enclosures Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 20: Global US Electrical Enclosures Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global US Electrical Enclosures Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 22: Global US Electrical Enclosures Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global US Electrical Enclosures Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 33: Global US Electrical Enclosures Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global US Electrical Enclosures Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 35: Global US Electrical Enclosures Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global US Electrical Enclosures Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 43: Global US Electrical Enclosures Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global US Electrical Enclosures Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 45: Global US Electrical Enclosures Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Electrical Enclosures Industry?

The projected CAGR is approximately 7.91%.

2. Which companies are prominent players in the US Electrical Enclosures Industry?

Key companies in the market include ABB Ltd, Adalet (Scott Fetzer Company, Austin Electrical Enclosures, Hubbell Inc, Legrand SA, Emerson Electric Co, Siemens AG, Schneider Electric SE, Rittal GmbH & Co Kg, AZZ Inc, Nvent Electric PLC, Hammond Manufacturing Ltd, Eaton Corporation.

3. What are the main segments of the US Electrical Enclosures Industry?

The market segments include Material Type, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption and Capacity of Renewable Energy; Aging Power Generation and Distribution Network.

6. What are the notable trends driving market growth?

Commercial spaces and buildings industry to drive the market demand.

7. Are there any restraints impacting market growth?

Economic Slowdown in Industries.

8. Can you provide examples of recent developments in the market?

August 2021 - Hammond Manufacturing Ltd announced a USD 24 million expansion to provide more painting and metal fabrication capacity. The new 96,000-sq. Ft facility is scheduled to be operational by the end of 2022. The company manufactures electronic and electrical products, including metallic and non-metallic enclosures, racks, small cases, outlet strips, surge suppressors, and electronic transformers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Electrical Enclosures Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Electrical Enclosures Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Electrical Enclosures Industry?

To stay informed about further developments, trends, and reports in the US Electrical Enclosures Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence