Key Insights

The Taiwan Facility Management Market is projected for sustained expansion, with an estimated market size of $4.33 billion by 2024, driven by a Compound Annual Growth Rate (CAGR) of 2.7%. This growth is fueled by increasing infrastructure complexity and a heightened focus on operational efficiency across industries. Key drivers include a robust commercial real estate sector, expanding institutional facilities, and significant public infrastructure development. The adoption of smart building technologies and integrated solutions for optimizing energy consumption, security, and building performance further bolsters demand. Organizations are increasingly favoring bundled and integrated FM services for streamlined operations and cost-effectiveness.

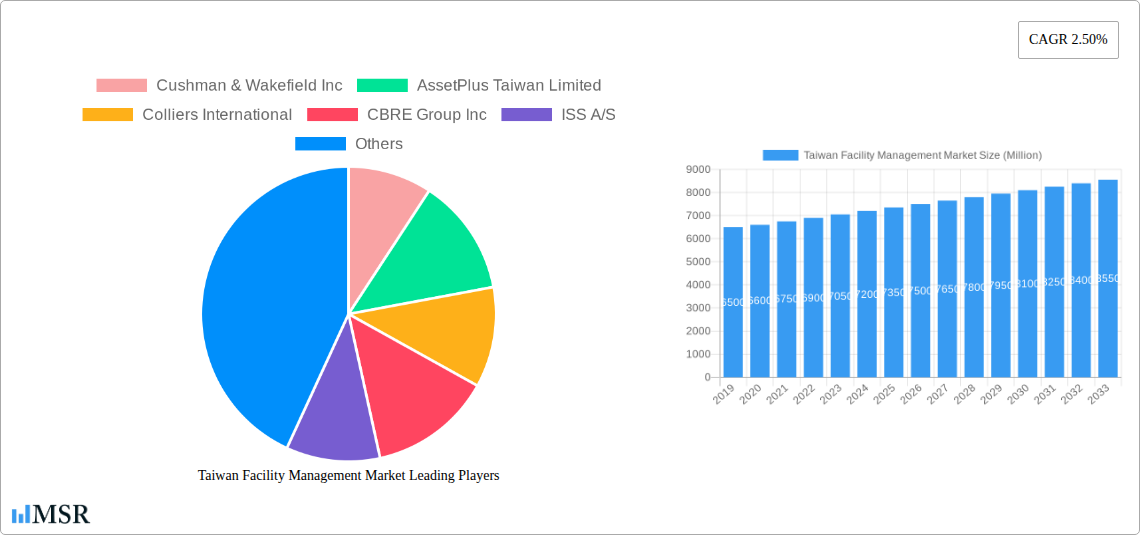

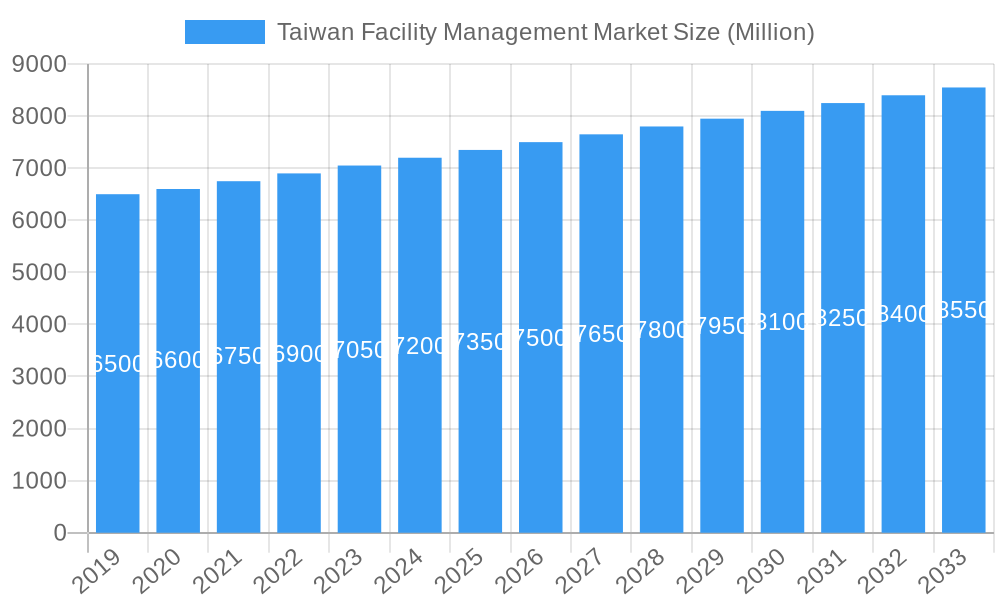

Taiwan Facility Management Market Market Size (In Billion)

Taiwan's facility management market features a competitive landscape with both global and domestic providers. The market is segmented by FM Type into In-House and Outsourced services, with a growing preference for Bundled and Integrated FM solutions. Offerings encompass Hard FM (technical services) and Soft FM (non-technical services), both experiencing strong demand. The diverse End-User base includes Commercial, Institutional, Public/Infrastructure, and Industrial sectors. While market growth is positive, potential challenges include a shortage of skilled labor and evolving regulatory requirements.

Taiwan Facility Management Market Company Market Share

Gain comprehensive insights into the Taiwan Facility Management Market with this detailed report. It offers granular analysis of market dynamics, growth drivers, emerging trends, and competitive strategies, providing actionable intelligence for stakeholders. This report covers the Base Year (2024) and the Forecast Period (2024-2033), serving as an essential resource for understanding the present and future of facility management in Taiwan.

Taiwan Facility Management Market Market Concentration & Dynamics

The Taiwan Facility Management Market exhibits a dynamic and evolving concentration, influenced by innovation, regulatory shifts, and increasing demand for integrated solutions. While fragmented in certain segments, leading players are consolidating their presence through strategic acquisitions and service expansion. The innovation ecosystem is characterized by a growing adoption of IoT (Internet of Things) and AI (Artificial Intelligence) in facility operations, driving efficiency and predictive maintenance. Regulatory frameworks, such as those supporting sustainable infrastructure development, are increasingly shaping service offerings. The threat of substitute products is minimal for core FM services, but technological advancements can disrupt traditional delivery models. End-user trends highlight a strong preference for Outsourced Facility Management, particularly Integrated FM solutions, driven by cost-efficiency and expertise. M&A activities are expected to remain a key trend as larger players seek to expand their service portfolios and geographical reach. Anticipated M&A deal counts are in the range of 5-10 significant transactions within the forecast period, impacting market share dynamics considerably.

Taiwan Facility Management Market Industry Insights & Trends

The Taiwan Facility Management Market is poised for significant growth, driven by robust economic development and a burgeoning demand for sophisticated facility services. The estimated market size for the base year 2025 is projected to be in the range of USD 7,500 Million, with a Compound Annual Growth Rate (CAGR) of XX% projected over the forecast period (2025-2033). Key growth drivers include the increasing complexity of modern infrastructure, the rising adoption of smart building technologies, and a growing emphasis on operational efficiency and cost reduction across various sectors. Technological disruptions, such as the integration of IoT for real-time monitoring and predictive maintenance of Hard FM services, and the use of AI for optimizing energy consumption and space utilization within Commercial and Institutional end-users, are transforming the market. Evolving consumer behaviors, particularly the demand for sustainable and eco-friendly facility management practices, are also shaping service offerings. The expansion of the Public/Infrastructure sector, fueled by government initiatives for urban development and smart city projects, presents substantial opportunities for both In-House Facility Management and Outsourced Facility Management, especially Bundled FM and Integrated FM models. The Industrial sector's need for specialized maintenance and safety protocols further contributes to market expansion. The report forecasts a market value reaching USD 12,000 Million by 2033.

Key Markets & Segments Leading Taiwan Facility Management Market

The Outsourced Facility Management segment is a dominant force in the Taiwan Facility Management Market, driven by its cost-effectiveness and the ability to provide specialized expertise. Within this segment, Integrated FM, which offers a holistic approach to managing multiple facility services under a single contract, is experiencing the most rapid growth. This is particularly evident in the Commercial and Institutional end-user segments, where businesses and organizations are seeking streamlined operations and enhanced operational efficiencies.

- Drivers for Outsourced & Integrated FM Dominance:

- Economic Growth: A strong Taiwanese economy encourages businesses to invest in efficient facility operations to maintain competitiveness.

- Technological Advancements: The increasing adoption of smart building technologies necessitates specialized knowledge and management, making outsourcing a logical choice.

- Focus on Core Competencies: Businesses prefer to delegate facility management to experts to concentrate on their primary business activities.

- Cost Optimization: Outsourcing can lead to significant cost savings through economies of scale and optimized resource allocation.

The Commercial sector, encompassing office buildings, retail spaces, and hospitality establishments, represents the largest end-user market, fueled by ongoing urbanization and business expansion. The Institutional sector, including educational institutions, healthcare facilities, and government buildings, is also a significant contributor, with a growing emphasis on occupant comfort, safety, and energy efficiency.

Hard FM services, such as building maintenance, HVAC systems, and electrical services, are crucial due to the aging infrastructure and the need for reliable operations. However, the demand for Soft FM services, including cleaning, security, pest control, and catering, is also on the rise, driven by increased awareness of hygiene standards and occupant well-being, especially post-pandemic. The Public/Infrastructure segment is poised for substantial growth, propelled by government investments in infrastructure development.

Taiwan Facility Management Market Product Developments

Product developments in the Taiwan Facility Management Market are increasingly focused on technological integration and sustainability. Innovations in IoT-enabled sensors for real-time monitoring of building systems, predictive maintenance software powered by AI, and integrated building management systems (BMS) are enhancing operational efficiency and reducing costs. The market relevance of these advancements lies in their ability to deliver proactive maintenance, optimize energy consumption for Hard FM services, and improve occupant comfort and safety in Soft FM offerings, thereby providing a competitive edge to service providers and significant value to end-users across Commercial, Institutional, and Industrial sectors.

Challenges in the Taiwan Facility Management Market Market

The Taiwan Facility Management Market faces several challenges, including a shortage of skilled labor, particularly for specialized technical roles in Hard FM. High operational costs, especially for energy-intensive services, and stringent regulatory compliance for safety and environmental standards can also be significant restraints. Furthermore, intense competition among service providers can lead to price pressures, impacting profit margins. The integration of new technologies requires substantial upfront investment, which can be a barrier for smaller players.

Forces Driving Taiwan Facility Management Market Growth

Several key forces are propelling the growth of the Taiwan Facility Management Market. The government's ongoing investments in infrastructure development, particularly in smart city initiatives and green energy projects, are creating new demand for FM services. The increasing adoption of advanced technologies like IoT and AI by businesses to enhance operational efficiency and sustainability is a major growth catalyst. Furthermore, the growing trend of outsourcing non-core functions by corporations to specialized FM providers, seeking cost savings and expertise, is significantly boosting the market.

Challenges in the Taiwan Facility Management Market Market

Long-term growth catalysts in the Taiwan Facility Management Market are deeply rooted in continuous innovation and strategic partnerships. The increasing demand for sustainable and green facility management solutions, driven by global environmental concerns, presents a significant opportunity for market expansion. The development and adoption of advanced digital platforms for integrated facility management, offering end-to-end solutions for Hard FM and Soft FM services, will be crucial. Moreover, strategic collaborations between technology providers and FM service companies will foster the creation of smarter, more efficient, and cost-effective facility management ecosystems.

Emerging Opportunities in Taiwan Facility Management Market

Emerging opportunities in the Taiwan Facility Management Market lie in the growing demand for specialized Soft FM services, such as advanced cleaning protocols, health and safety management, and occupant well-being programs, particularly in the post-pandemic era. The expansion of smart building technologies presents a significant opportunity for integrated FM providers offering IoT and AI solutions for energy management, predictive maintenance, and space optimization. Furthermore, the increasing focus on sustainable infrastructure and the circular economy is creating a niche for FM services that promote energy efficiency, waste reduction, and resource management, especially within the Public/Infrastructure and Industrial sectors.

Leading Players in the Taiwan Facility Management Market Sector

- Cushman & Wakefield Inc

- AssetPlus Taiwan Limited

- Colliers International

- CBRE Group Inc

- ISS A/S

- G4S Limited

- UEMS Solutions

- Jones Lang LaSalle IP Inc

- Rentokil Initial Plc

- Diversy Holdings Ltd

Key Milestones in Taiwan Facility Management Market Industry

- February 2022: The National Development Council (NDC), Taiwan, proposed a total of NTD 180 billion for the fourth phase of the country's forward-looking infrastructure development plan, with funds allocated for 2023-2024, following the third phase. This significant investment in infrastructure is expected to drive demand for facility management services across various sectors.

- February 2022: As per the National Development Council (NDC), Taiwan, the government announced its intention to allocate the fourth phase budget to a wide range of infrastructure projects including green energy, angstrom semiconductors, the Internet of Things, artificial intelligence, and cybersecurity. This strategic focus on advanced industries will necessitate sophisticated facility management solutions. The fourth phase will follow the third phase, for which the government had assigned NTD 124.06 billion for 2021, indicating a sustained commitment to infrastructure development.

Strategic Outlook for Taiwan Facility Management Market Market

The strategic outlook for the Taiwan Facility Management Market is marked by a strong trajectory of growth, fueled by technological adoption and evolving service demands. The integration of IoT and AI into facility operations will be a key differentiator, enabling predictive maintenance, energy efficiency, and enhanced occupant experiences. The increasing preference for Integrated FM solutions by a diverse range of end-users, from Commercial to Public/Infrastructure, will drive market consolidation and specialization. Strategic opportunities lie in developing sustainable FM practices, expanding service offerings in niche areas like cybersecurity for smart buildings, and forming partnerships with technology providers to deliver cutting-edge solutions, ensuring long-term market leadership and profitability.

Taiwan Facility Management Market Segmentation

-

1. Facility Management Type

- 1.1. In-House Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offerings

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End-User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Others

Taiwan Facility Management Market Segmentation By Geography

- 1. Taiwan

Taiwan Facility Management Market Regional Market Share

Geographic Coverage of Taiwan Facility Management Market

Taiwan Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Infrastructural Development Holds the biggest market share; Increasing Trendsof commercialisation and urban development in Real State Sector

- 3.3. Market Restrains

- 3.3.1. Geopolitical situation and Ongoing Changes in Macro-environment

- 3.4. Market Trends

- 3.4.1. Infrastructure Development Holds the Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 5.1.1. In-House Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offerings

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Facility Management Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cushman & Wakefield Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AssetPlus Taiwan Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Colliers International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CBRE Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ISS A/S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 G4S Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UEMS Solutions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Jones Lang LaSalle IP Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rentokil Initial Plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Diversy Holdings Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cushman & Wakefield Inc

List of Figures

- Figure 1: Taiwan Facility Management Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Taiwan Facility Management Market Share (%) by Company 2025

List of Tables

- Table 1: Taiwan Facility Management Market Revenue billion Forecast, by Facility Management Type 2020 & 2033

- Table 2: Taiwan Facility Management Market Revenue billion Forecast, by Offerings 2020 & 2033

- Table 3: Taiwan Facility Management Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Taiwan Facility Management Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Taiwan Facility Management Market Revenue billion Forecast, by Facility Management Type 2020 & 2033

- Table 6: Taiwan Facility Management Market Revenue billion Forecast, by Offerings 2020 & 2033

- Table 7: Taiwan Facility Management Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 8: Taiwan Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Facility Management Market?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the Taiwan Facility Management Market?

Key companies in the market include Cushman & Wakefield Inc, AssetPlus Taiwan Limited, Colliers International, CBRE Group Inc, ISS A/S, G4S Limited, UEMS Solutions, Jones Lang LaSalle IP Inc, Rentokil Initial Plc, Diversy Holdings Ltd.

3. What are the main segments of the Taiwan Facility Management Market?

The market segments include Facility Management Type, Offerings, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.33 billion as of 2022.

5. What are some drivers contributing to market growth?

Infrastructural Development Holds the biggest market share; Increasing Trendsof commercialisation and urban development in Real State Sector.

6. What are the notable trends driving market growth?

Infrastructure Development Holds the Major Market Share.

7. Are there any restraints impacting market growth?

Geopolitical situation and Ongoing Changes in Macro-environment.

8. Can you provide examples of recent developments in the market?

February 2022 - The National Development Council (NDC), Taiwan, proposed a total of NTD 180 billion for the fourth phase of the country's forward-looking infrastructure development plan. the amount will be spent 2023-2024 after the third phase.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Facility Management Market?

To stay informed about further developments, trends, and reports in the Taiwan Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence