Key Insights

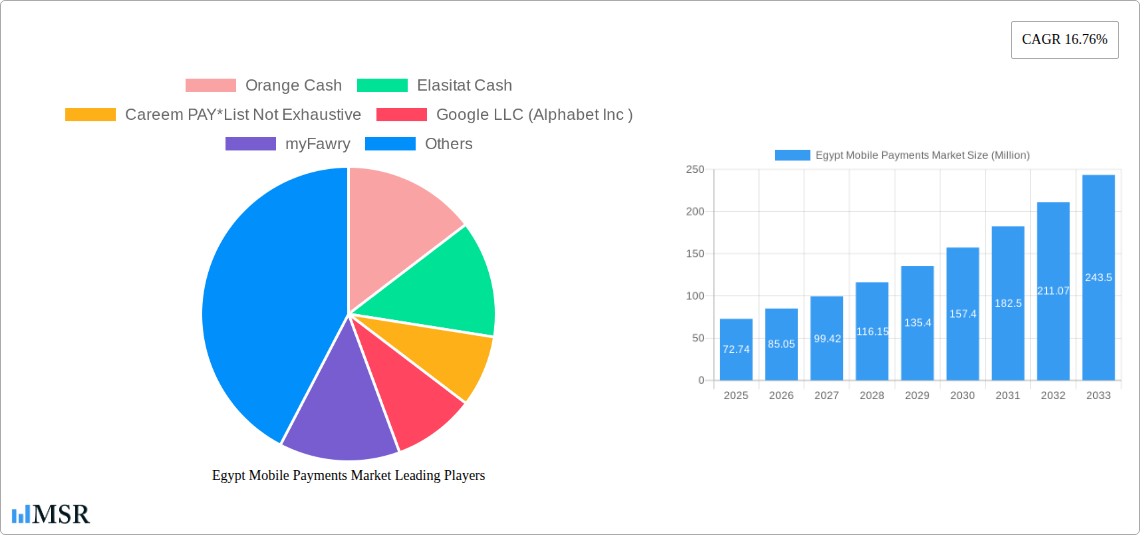

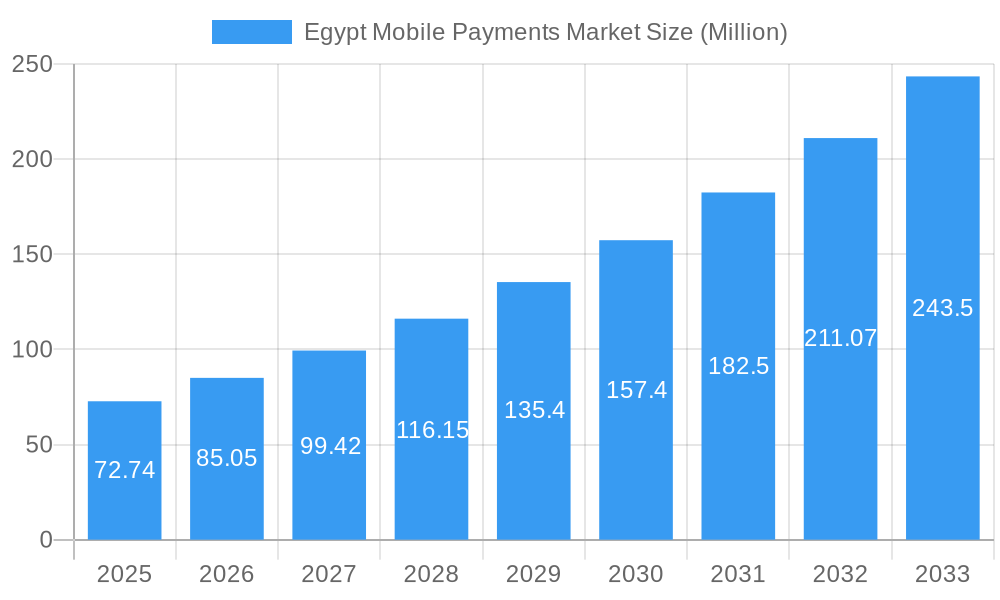

The Egypt Mobile Payments Market is poised for remarkable expansion, projected to reach a substantial USD 72.74 million by 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 16.76%. This dynamic growth is fueled by several key factors. Increasing smartphone penetration and widespread internet access across Egypt are creating a fertile ground for mobile payment adoption. Furthermore, supportive government initiatives and a growing fintech ecosystem are actively promoting digital transactions, leading to a decline in the reliance on cash. The convenience and security offered by mobile payment solutions are resonating with consumers, particularly the younger, tech-savvy demographic. This trend is further amplified by the increasing adoption of mobile money services by individuals and businesses alike for everyday transactions, remittances, and e-commerce purchases. The COVID-19 pandemic also significantly accelerated the shift towards contactless payments, embedding digital payment habits more deeply within the Egyptian populace.

Egypt Mobile Payments Market Market Size (In Million)

Looking ahead, the market's trajectory is expected to be characterized by continued innovation and the introduction of more sophisticated mobile payment solutions. The emergence of contactless payment technologies, QR code-based transactions, and the integration of mobile payments into various loyalty programs will further entrench their use. Mobile virtual network operators (MVNOs) like Orange Cash and Vodafone Cash, alongside global giants such as Google Pay and Apple Pay, alongside prominent local players like myFawry and regional entities like Careem PAY, are actively competing and collaborating to expand their reach and service offerings. While the market is largely dominated by mobile money services, the evolving landscape suggests a strong potential for growth in areas such as in-app payments and peer-to-peer transfers. Key restraints, such as varying levels of digital literacy in certain segments of the population and occasional concerns around data security, are being addressed through ongoing educational campaigns and enhanced security protocols by service providers, paving the way for sustained and robust market growth throughout the forecast period.

Egypt Mobile Payments Market Company Market Share

Unlock the Future of Finance: Egypt Mobile Payments Market Report (2024-2033)

Dive deep into the dynamic landscape of Egypt's mobile payments revolution with this comprehensive, data-driven report. Covering the study period from 2019 to 2033, with a base year and estimated year of 2025, this report provides unparalleled insights into market dynamics, industry trends, and emerging opportunities. Forecast period 2025-2033 and historical period 2019-2024 are meticulously analyzed. This report is your definitive guide to understanding and capitalizing on the rapid growth of digital transactions in Egypt, leveraging high-ranking keywords like "Egypt mobile payments," "digital wallets Egypt," "fintech Egypt," and "mobile banking Egypt."

Egypt Mobile Payments Market Market Concentration & Dynamics

The Egypt mobile payments market is characterized by a moderate level of concentration, with key players like Vodafone Cash, Orange Cash, and myFawry holding significant market share. However, the burgeoning fintech ecosystem is fostering innovation, creating a dynamic environment for new entrants and established technology giants. Regulatory frameworks are continuously evolving to support the digital transformation, with initiatives aimed at enhancing financial inclusion and security. Substitute products, such as traditional banking channels and cash, are gradually being displaced by the convenience and accessibility of mobile payment solutions. End-user trends indicate a strong preference for contactless payments, peer-to-peer transfers, and online merchant payments, driven by a younger, tech-savvy population. Mergers and acquisitions (M&A) activity, though not yet at peak levels, is anticipated to increase as larger players seek to expand their reach and offerings. For instance, strategic partnerships and service integrations, such as the one between FawryPay and My Fatoorah, highlight the trend of collaboration to enhance user experience.

- Market Share Dominance: Leading mobile network operators (MNOs) like Vodafone Cash and Orange Cash command substantial user bases and transaction volumes.

- Innovation Ecosystem: A growing number of fintech startups are introducing innovative solutions, from digital lending to micro-investments, enriching the competitive landscape.

- Regulatory Evolution: Government initiatives are prioritizing digital payment infrastructure development and consumer protection, fostering trust and adoption.

- Substitute Product Displacement: The convenience of mobile payments is steadily eroding the reliance on cash and traditional payment methods for daily transactions.

- M&A Activity Outlook: Anticipated increase in M&A as companies seek consolidation and market expansion.

Egypt Mobile Payments Market Industry Insights & Trends

The Egypt mobile payments market is experiencing exponential growth, projected to reach USD XX Billion by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This surge is primarily fueled by increasing smartphone penetration, a growing digitally-literate population, and supportive government policies promoting financial inclusion. The convenience of mobile wallets for everyday transactions, from utility bill payments to e-commerce purchases, is a major adoption driver. Furthermore, the expansion of agent networks and the increasing acceptance of QR code payments are further accelerating market penetration. Technological advancements, including the integration of AI for fraud detection and personalized user experiences, are enhancing security and usability. Evolving consumer behaviors, such as a preference for contactless and seamless payment experiences, are pushing service providers to innovate and offer more integrated solutions. The pandemic significantly accelerated the adoption of digital payments, cementing their place in the daily lives of Egyptians.

- Market Size: Projected to reach USD XX Billion by 2033, indicating substantial growth potential.

- CAGR: Estimated at XX% from 2025 to 2033, highlighting a strong upward trajectory.

- Key Growth Drivers:

- Rising smartphone adoption and internet accessibility.

- Government initiatives for financial inclusion and digital transformation.

- Increasing demand for convenient and secure payment solutions.

- Growth of the e-commerce and gig economy sectors.

- Technological Advancements:

- Integration of AI and machine learning for enhanced security and personalized services.

- Development of faster and more efficient payment gateways.

- Expansion of QR code payment infrastructure.

- Evolving Consumer Behavior:

- Preference for contactless and contactless payments.

- Growing adoption of mobile wallets for P2P and B2C transactions.

- Increased online spending and digital service consumption.

Key Markets & Segments Leading Egypt Mobile Payments Market

Within the Egypt mobile payments market, the Remote segment is poised to dominate, driven by the burgeoning e-commerce sector and the increasing prevalence of online services. This segment encompasses transactions conducted online, via mobile apps, or through digital platforms, where the physical proximity of the payer and payee is not a requirement. The convenience and accessibility of remote payments for everything from online shopping to digital content subscriptions are key drivers. Furthermore, the growth of digital remittances and cross-border transactions facilitated by mobile platforms is also contributing significantly to the dominance of the remote segment.

The Proximity segment, while important, is expected to witness a more gradual but steady growth. This segment includes point-of-sale (POS) transactions made using mobile devices, such as contactless payments at retail stores, restaurants, and transportation hubs. The increasing adoption of NFC (Near Field Communication) technology in smartphones and the expansion of merchant acceptance points are crucial for the growth of proximity payments. Initiatives by telecommunication companies and payment service providers to offer integrated POS solutions are also contributing to this segment's development.

Dominant Segment: Remote Payments

- Drivers:

- Rapid growth of e-commerce and online marketplaces.

- Increasing adoption of digital services (streaming, gaming, subscriptions).

- Growth in digital remittances and cross-border online transactions.

- Convenience of one-click payments and saved payment methods.

- Detailed Dominance Analysis: The shift towards online consumption patterns, accelerated by digital lifestyle changes, positions remote payments as the primary driver of market expansion. Consumers are increasingly comfortable making all types of purchases and paying for services digitally, without the need for physical interaction. This trend is further bolstered by the availability of diverse online platforms and the ease of integrating mobile payment solutions into these services.

- Drivers:

Growing Segment: Proximity Payments

- Drivers:

- Expansion of merchant acceptance for contactless payments.

- Increasing availability of NFC-enabled smartphones.

- Government push for cashless transactions at physical points of sale.

- Integration of mobile payments into loyalty programs and retail offers.

- Detailed Dominance Analysis: While lagging behind remote payments in terms of current volume, the proximity segment holds significant future growth potential. As more businesses invest in modern POS systems and consumers become more accustomed to tapping to pay, the ease and speed of proximity mobile payments will drive adoption. The synergy between mobile wallets and in-store retail experiences, including personalized offers and loyalty rewards, will be crucial for its sustained growth.

- Drivers:

Egypt Mobile Payments Market Product Developments

Product innovation is a key differentiator in the Egyptian mobile payments market. Companies are continuously enhancing their offerings with advanced features to attract and retain users. This includes the development of integrated payment ecosystems that allow for seamless transactions across various platforms, from e-commerce to ride-hailing services. Mobile wallets are evolving to incorporate budgeting tools, savings features, and even micro-investment options, transforming them into comprehensive personal finance management platforms. The integration of AI for personalized recommendations and fraud detection, along with the expansion of cross-border payment capabilities, are also significant product developments. For instance, PayPal's recent introduction of new features for small businesses, including Apple Pay as a checkout option, highlights a strategic move to broaden payment acceptance and improve user experience for merchants.

Challenges in the Egypt Mobile Payments Market Market

Despite the robust growth, the Egypt mobile payments market faces several challenges. Regulatory hurdles, particularly concerning data privacy and compliance with evolving financial regulations, can slow down innovation and market entry for new players. Infrastructure limitations, such as inconsistent internet connectivity in certain regions, can hinder widespread adoption, especially in rural areas. Intense competition among existing players and the emergence of new fintech solutions necessitate continuous investment in technology and marketing to maintain market share. Furthermore, building and maintaining user trust regarding the security of mobile transactions remains a critical challenge, requiring robust security measures and transparent communication.

- Regulatory Compliance: Navigating evolving financial regulations and data privacy laws.

- Infrastructure Gaps: Ensuring consistent internet access and network stability across all regions.

- Cybersecurity Threats: Continuous need for advanced security measures to combat fraud and data breaches.

- User Trust and Education: Building confidence in digital payment security and educating the public on safe practices.

Forces Driving Egypt Mobile Payments Market Growth

Several powerful forces are propelling the growth of the Egypt mobile payments market. A significant driver is the young and rapidly urbanizing population, which is inherently tech-savvy and receptive to digital innovations. Government initiatives aimed at promoting financial inclusion and transitioning to a cashless economy through regulatory support and public awareness campaigns are also critical. The increasing penetration of smartphones and affordable data plans makes mobile payment solutions accessible to a broader demographic. Moreover, the robust growth of the e-commerce sector and the digital economy creates a natural demand for efficient and convenient payment methods. The convenience and cost-effectiveness of mobile payments compared to traditional banking services further contribute to their appeal.

- Demographic Shifts: A young, digitally native population eager for convenient financial solutions.

- Government Support: Proactive policies and incentives driving digital adoption and financial inclusion.

- Technological Accessibility: Widespread availability of smartphones and affordable internet access.

- E-commerce Expansion: A thriving online retail landscape demanding seamless payment gateways.

Challenges in the Egypt Mobile Payments Market Market

While opportunities abound, long-term growth catalysts in the Egypt mobile payments market will be driven by continued innovation and strategic market expansion. The ongoing development of interoperable payment systems that allow seamless transactions across different platforms and financial institutions will be crucial. Partnerships between mobile network operators, fintech companies, and traditional banks will foster a more integrated and user-friendly financial ecosystem. Expanding mobile payment solutions to underserved populations, including rural communities and small businesses, will unlock significant untapped potential. Furthermore, the introduction of new value-added services, such as micro-insurance, digital lending, and loyalty programs integrated into mobile wallets, will enhance customer stickiness and drive deeper engagement with mobile payment platforms.

Emerging Opportunities in Egypt Mobile Payments Market

Emerging opportunities in the Egypt mobile payments market are diverse and promising. The expansion of cross-border mobile payment solutions to facilitate remittances and international trade presents a significant avenue for growth. There is a growing demand for specialized mobile payment solutions for specific industries, such as healthcare, education, and the gig economy. The integration of biometric authentication and advanced AI-driven security features will enhance user experience and trust. Furthermore, the development of offline payment capabilities for areas with intermittent internet connectivity could unlock adoption in previously inaccessible markets. Tapping into the unbanked and underbanked population through simplified onboarding processes and accessible product offerings represents a substantial opportunity for financial inclusion and market penetration.

Leading Players in the Egypt Mobile Payments Market Sector

- Orange Cash

- Elasitat Cash

- Careem PAY

- Google LLC (Alphabet Inc)

- myFawry

- Amazon com Inc

- Vodafone Cash

- Paypal Holdings Inc

- Samsung Corporation

- Apple Inc

- American Express Co

Key Milestones in Egypt Mobile Payments Market Industry

- April 2023: PayPal Holdings, Inc announced the addition of its New Features to Its Complete Payments Solution for small businesses. PayPal will also give small businesses access to four new features to help them drive payment acceptance and enhance how they run their business. This will include Apple Pay as a checkout option2, the ability for customers to save payment methods with the PayPal vault for faster future checkout, and a real-time account updater to help customers keep their payment methods up to date.

- February 2023: Fawry provided FawryPay reference code service to My Fatoorah customers and merchants in the Egyptian market as increasing demand in the Egyptian market among users towards electronic payment solutions and options, where Fatoorah offers a wide range of electronic payment solutions at the regional level, which in turn are expected to enrich the payments market with many advanced services and technologies in terms of digital payment solutions.

Strategic Outlook for Egypt Mobile Payments Market Market

The strategic outlook for the Egypt mobile payments market is exceptionally bright, driven by a confluence of favorable factors. Continued investment in digital infrastructure, regulatory support for fintech innovation, and a rapidly growing digitally-engaged consumer base will serve as key growth accelerators. Companies that focus on enhancing user experience, building robust security frameworks, and offering integrated financial services beyond simple payments will be well-positioned for success. Strategic partnerships and collaborations will be crucial for expanding reach and market penetration, particularly in reaching underserved segments. The market is ripe for disruption and growth, offering substantial opportunities for stakeholders who can adapt to evolving consumer needs and technological advancements.

Egypt Mobile Payments Market Segmentation

-

1. Type

- 1.1. Proximity

- 1.2. Remote

Egypt Mobile Payments Market Segmentation By Geography

- 1. Egypt

Egypt Mobile Payments Market Regional Market Share

Geographic Coverage of Egypt Mobile Payments Market

Egypt Mobile Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Internet Penetration and Growing E-commerce Market; Increasing Number of Loyalty Benefits in Mobile Environment

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulations in the Payments Industry

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration and Growing E-commerce Market Sector to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Mobile Payments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Proximity

- 5.1.2. Remote

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Orange Cash

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Elasitat Cash

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Careem PAY*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Google LLC (Alphabet Inc )

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 myFawry

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amazon com Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vodafone Cash

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Paypal Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samsung Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apple Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 American Express Co

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Orange Cash

List of Figures

- Figure 1: Egypt Mobile Payments Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Egypt Mobile Payments Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Mobile Payments Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Egypt Mobile Payments Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Egypt Mobile Payments Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Egypt Mobile Payments Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Mobile Payments Market?

The projected CAGR is approximately 16.76%.

2. Which companies are prominent players in the Egypt Mobile Payments Market?

Key companies in the market include Orange Cash, Elasitat Cash, Careem PAY*List Not Exhaustive, Google LLC (Alphabet Inc ), myFawry, Amazon com Inc, Vodafone Cash, Paypal Holdings Inc, Samsung Corporation, Apple Inc, American Express Co.

3. What are the main segments of the Egypt Mobile Payments Market?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 72.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Internet Penetration and Growing E-commerce Market; Increasing Number of Loyalty Benefits in Mobile Environment.

6. What are the notable trends driving market growth?

Increasing Internet Penetration and Growing E-commerce Market Sector to Drive the Market.

7. Are there any restraints impacting market growth?

; Stringent Regulations in the Payments Industry.

8. Can you provide examples of recent developments in the market?

April 2023: PayPal Holdings, Inc announced the addition of its New Features to Its Complete Payments Solution for small businesses. PayPal will also give small businesses access to four new features to help them drive payment acceptance and enhance how they run their business. This will include Apple Pay as a checkout option2, the ability for customers to save payment methods with the PayPal vault for faster future checkout, and a real-time account updater to help customers keep their payment methods up to date.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Mobile Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Mobile Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Mobile Payments Market?

To stay informed about further developments, trends, and reports in the Egypt Mobile Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence