Key Insights

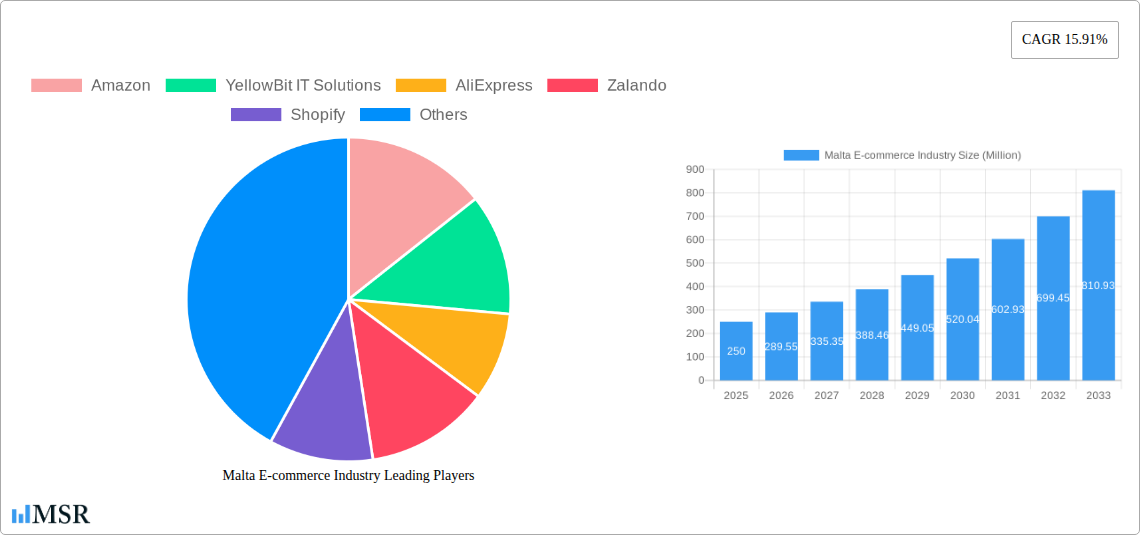

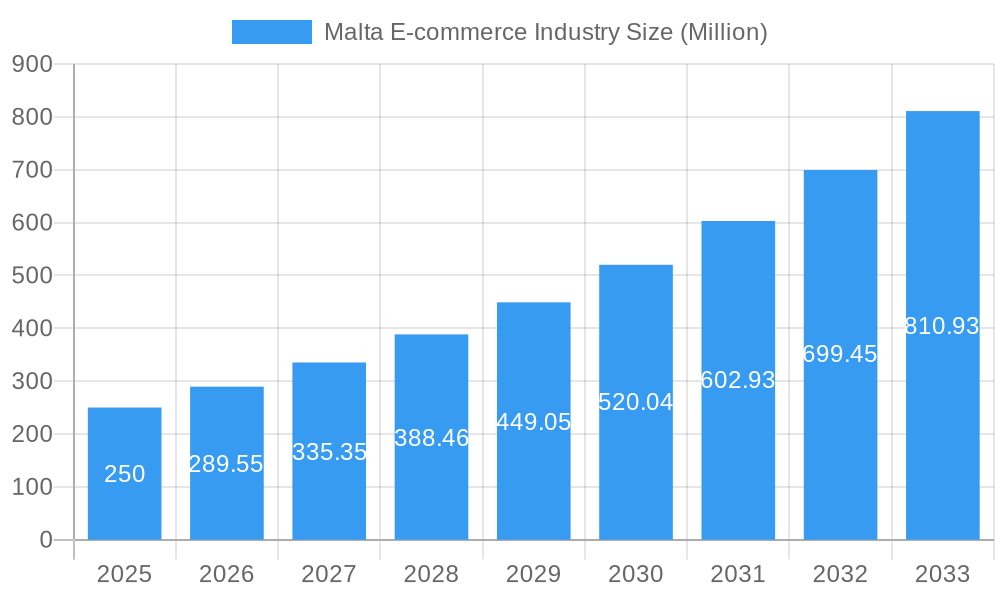

Malta's e-commerce sector is projected for significant growth, reaching an estimated market size of 64.44 million by 2025. The industry is expected to experience a Compound Annual Growth Rate (CAGR) of 15.91% through 2033. Key growth drivers include increasing internet and smartphone penetration, a rising consumer preference for digital payments, and the expanding influence of global e-commerce platforms. Consumers are increasingly adopting online shopping for its convenience, broader product availability, and competitive pricing, with significant traction in Beauty & Personal Care, Fashion & Apparel, and Consumer Electronics. Malta's EU membership also enhances cross-border e-commerce opportunities for both local businesses and international retailers.

Malta E-commerce Industry Market Size (In Million)

Emerging trends in the Maltese e-commerce market include a focus on personalized customer experiences, the adoption of augmented reality for product visualization, and the growing popularity of subscription services, particularly in beauty and food sectors. Mobile commerce (m-commerce) remains dominant, with an emphasis on intuitive mobile interfaces and streamlined checkout processes. Potential growth restraints include logistical complexities inherent to island distribution, consumer data security concerns, and the ongoing need for digital infrastructure development. Nevertheless, initiatives from e-commerce enablers like Shopify and Amazon, alongside local enterprises, are expected to address these challenges, fostering sustained growth in Malta's online retail environment.

Malta E-commerce Industry Company Market Share

This report provides an in-depth analysis of the Malta E-commerce Industry from 2019-2024, with a base year of 2025 and a forecast to 2033. It examines market concentration, growth catalysts, dominant segments, challenges, and emerging opportunities. The study evaluates the impact of global players such as Amazon, AliExpress, Shein, Apple, and eBay, alongside local entities like YellowBit IT Solutions and ISB Limited, and platforms including Shopify, Zalando, and Asos, on the Maltese online retail landscape.

Malta E-commerce Industry Market Concentration & Dynamics

The Malta E-commerce Industry, while exhibiting characteristics of a growing market, displays moderate concentration. Dominated by a mix of global e-commerce behemoths and increasingly sophisticated local solutions, market share is influenced by brand recognition and technological adoption. Innovation ecosystems are burgeoning, with a growing emphasis on localized customer experiences and efficient logistics. Regulatory frameworks are evolving to support online trade, ensuring consumer protection and fair competition, though continuous adaptation is crucial. Substitute products, primarily traditional brick-and-mortar retail, are facing increasing pressure from the convenience and wider selection offered online. End-user trends reveal a strong preference for mobile commerce and personalized shopping journeys. Merger and acquisition (M&A) activities, while not yet at peak levels, are anticipated to increase as larger players seek to consolidate their presence and smaller innovative firms aim for strategic partnerships or exits. We project approximately xx M&A deals within the historical period and anticipate a growth of xx% in M&A activities during the forecast period. The market share of leading players is estimated to be around xx% collectively.

Malta E-commerce Industry Industry Insights & Trends

The Malta E-commerce Industry is poised for significant growth, driven by a confluence of factors. The market size, estimated at over XX Million in the base year 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of XX% over the forecast period, reaching an estimated XX Million by 2033. Key growth drivers include the increasing penetration of high-speed internet and smartphones, a growing digitally-savvy population, and the continuous expansion of online payment infrastructure. Technological disruptions are at the forefront, with advancements in artificial intelligence (AI) for personalized recommendations, augmented reality (AR) for virtual try-ons, and sophisticated data analytics empowering businesses to understand and cater to evolving consumer behaviors. Evolving consumer behaviors indicate a heightened demand for seamless omnichannel experiences, same-day delivery options, and a greater emphasis on sustainable and ethical consumption. The pandemic accelerated the adoption of online shopping across all demographics, a trend that has largely persisted. Furthermore, cross-border e-commerce is a significant contributor, with Maltese consumers readily accessing global marketplaces like Amazon, AliExpress, and Shein.

Key Markets & Segments Leading Malta E-commerce Industry

Within the Malta E-commerce Industry, the Fashion & Apparel segment stands out as a dominant force, consistently capturing a significant market share. This dominance is attributed to several key drivers.

- Economic Growth: A stable and growing economy directly translates to increased disposable income, allowing consumers to invest more in discretionary purchases like fashion.

- Infrastructure Development: Robust logistics networks and efficient delivery services cater to the rapid delivery expectations for fashion items, minimizing returns and enhancing customer satisfaction.

- Social Media Influence: The pervasive influence of social media platforms fuels fashion trends and encourages impulse buying, which is particularly effective in the online retail space.

- Brand Accessibility: Online platforms provide unparalleled access to a vast array of international and local fashion brands, from fast fashion giants like Shein and Asos to niche boutiques, making them accessible to a wider audience.

- Technological Integration: The adoption of virtual try-on technologies and personalized styling recommendations within fashion e-commerce applications further enhances the online shopping experience, bridging the gap between online and offline.

The Consumer Electronics segment also exhibits strong performance, driven by continuous product innovation and a demand for the latest gadgets. Beauty & Personal Care is another rapidly growing segment, fueled by online influencer marketing and subscription box models. The Food & Beverage segment is witnessing a steady upward trajectory, driven by convenience and the proliferation of dedicated online grocery platforms. Furniture & Home also shows promise, especially with advancements in visualization tools.

Malta E-commerce Industry Product Developments

Product innovations in the Malta E-commerce Industry are increasingly focused on enhancing user experience and operational efficiency. Companies are leveraging AI-powered recommendation engines to provide highly personalized product suggestions, improving conversion rates and customer loyalty. The integration of AR technologies allows consumers to visualize products like furniture or apparel in their own spaces, reducing purchase uncertainty. Advancements in supply chain management and last-mile delivery solutions, including the exploration of drone delivery in certain contexts, are improving speed and cost-effectiveness. Mobile-first design principles and seamless app development are critical for engaging a predominantly mobile-centric user base. The focus is on creating intuitive, engaging, and friction-free online shopping journeys.

Challenges in the Malta E-commerce Industry Market

Despite its robust growth trajectory, the Malta E-commerce Industry faces several significant challenges.

- Logistics and Infrastructure: While improving, the efficiency and cost-effectiveness of last-mile delivery, particularly in less densely populated areas, can still pose a hurdle. Limited warehouse capacity can also be a constraint for growing businesses.

- Regulatory Hurdles: Adapting to evolving data privacy regulations (e.g., GDPR) and consumer protection laws requires constant vigilance and investment from e-commerce businesses.

- Cybersecurity Threats: Protecting sensitive customer data from cyberattacks is paramount. Breaches can lead to significant financial losses and reputational damage.

- Skilled Workforce Shortage: A lack of skilled professionals in areas like digital marketing, data analytics, and e-commerce operations can impede growth.

- Intense Competition: The presence of global e-commerce giants creates a highly competitive landscape, making it challenging for smaller local businesses to gain significant market share.

Forces Driving Malta E-commerce Industry Growth

Several potent forces are propelling the growth of the Malta E-commerce Industry.

- Technological Advancements: The widespread adoption of smartphones, increased internet penetration, and innovations in payment gateways and logistics technology are foundational.

- Evolving Consumer Behavior: A shift towards online purchasing, driven by convenience, wider product selection, and competitive pricing, is a major catalyst. The growing comfort with digital transactions and the demand for personalized experiences further fuel this trend.

- Government Support and Digitalization Initiatives: Policies aimed at promoting digital transformation and supporting small and medium-sized enterprises (SMEs) in adopting e-commerce solutions create a more favorable business environment.

- Growth of Mobile Commerce (M-commerce): The increasing reliance on mobile devices for everyday tasks, including shopping, is a significant growth engine.

Challenges in the Malta E-commerce Industry Market

Long-term growth catalysts in the Malta E-commerce Industry are intricately linked to continuous innovation and strategic market expansion. The increasing adoption of advanced analytics and AI will enable businesses to offer hyper-personalized customer experiences, fostering greater loyalty and driving repeat purchases. Partnerships between e-commerce platforms and logistics providers will continue to optimize delivery networks, reducing costs and improving efficiency. Furthermore, the exploration of new sales channels, such as social commerce and live shopping, will tap into emerging consumer preferences. As the market matures, strategic acquisitions and mergers will likely consolidate the industry, leading to more robust and competitive players.

Emerging Opportunities in Malta E-commerce Industry

Emerging opportunities in the Malta E-commerce Industry are ripe for exploration.

- Niche Market Development: Specializing in underserved segments, such as sustainable products, artisanal goods, or personalized health and wellness items, presents significant growth potential.

- Cross-Border E-commerce Expansion: Leveraging Malta's strategic location, opportunities exist to expand reach into neighboring North African and Mediterranean markets.

- Subscription Box Models: The increasing demand for curated experiences makes subscription boxes in various categories, from beauty to food, a promising avenue.

- Circular Economy Integration: Consumers are increasingly prioritizing sustainability, creating opportunities for e-commerce businesses to adopt and promote circular economy principles, such as resale and repair services.

- Voice Commerce: As smart speaker adoption rises, developing capabilities for voice-activated shopping will become increasingly important.

Leading Players in the Malta E-commerce Industry Sector

- Amazon

- YellowBit IT Solutions

- AliExpress

- Zalando

- Shopify

- ISB Limited

- Shein

- Apple

- eBay

- Asos

Key Milestones in Malta E-commerce Industry Industry

- February 2022: ASOS has renewed its cloud relationship with Microsoft, committing to using the Microsoft Cloud as its primary cloud platform for the next five years. ASOS leverages Microsoft Azure and its AI capabilities to power its digital media and supports new data-driven and innovative workstreams, building on a long history of working with Microsoft. This marks a significant investment in cloud infrastructure and AI, enhancing ASOS's operational capabilities and data analysis for improved customer engagement and operational efficiency.

- January 2022: Zalando, Europe's leading online fashion and lifestyle platform, has invested in Ambercycle Inc., a material science firm. Zalando, H&M CO: LAB, KIRKBI, Temasek, and BESTSELLER's Invest FWD participated in the company's Series A fundraising round. Ambercycle hopes to develop infrastructure and materials for circularity in the fashion sector with this additional funding. This strategic investment highlights Zalando's commitment to sustainability and the circular economy within the fashion industry, potentially influencing future product sourcing and supply chain practices in e-commerce.

Strategic Outlook for Malta E-commerce Industry Market

The strategic outlook for the Malta E-commerce Industry is exceptionally promising, driven by continued technological integration and a deepening understanding of consumer preferences. Future growth will be accelerated by a focus on enhancing customer loyalty through personalized marketing and exceptional post-purchase support. Strategic partnerships with fintech companies will further streamline payment processes, while collaborations with logistics providers will ensure efficient and cost-effective delivery. The industry is poised to benefit from increasing cross-border trade opportunities and the growing adoption of sustainable e-commerce practices. Investment in data analytics and AI will remain crucial for businesses seeking to gain a competitive edge and adapt to the ever-evolving digital marketplace.

Malta E-commerce Industry Segmentation

-

1. Application

- 1.1. Beauty & Personal Care

- 1.2. Consumer Electronics

- 1.3. Fashion & Apparel

- 1.4. Food & Beverage

- 1.5. Furniture & Home

- 1.6. Others (Toys, DIY, Media, etc.)

Malta E-commerce Industry Segmentation By Geography

- 1. Malta

Malta E-commerce Industry Regional Market Share

Geographic Coverage of Malta E-commerce Industry

Malta E-commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Penetration of Internet and Smartphone Usage; Increase in Initiatives by Government

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Equipment than Conventional Radiography is Discouraging the Market Growth

- 3.4. Market Trends

- 3.4.1. Increase in Initiatives by Government is Expected to Boost the E-commerce Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malta E-commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Beauty & Personal Care

- 5.1.2. Consumer Electronics

- 5.1.3. Fashion & Apparel

- 5.1.4. Food & Beverage

- 5.1.5. Furniture & Home

- 5.1.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Malta

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 YellowBit IT Solutions

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AliExpress

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zalando

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shopify

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ISB Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shein

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Apple

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 eBay

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Asos

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: Malta E-commerce Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Malta E-commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Malta E-commerce Industry Revenue million Forecast, by Application 2020 & 2033

- Table 2: Malta E-commerce Industry Revenue million Forecast, by Region 2020 & 2033

- Table 3: Malta E-commerce Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Malta E-commerce Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malta E-commerce Industry?

The projected CAGR is approximately 15.91%.

2. Which companies are prominent players in the Malta E-commerce Industry?

Key companies in the market include Amazon, YellowBit IT Solutions, AliExpress, Zalando, Shopify, ISB Limited, Shein, Apple, eBay, Asos.

3. What are the main segments of the Malta E-commerce Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.44 million as of 2022.

5. What are some drivers contributing to market growth?

Penetration of Internet and Smartphone Usage; Increase in Initiatives by Government.

6. What are the notable trends driving market growth?

Increase in Initiatives by Government is Expected to Boost the E-commerce Market.

7. Are there any restraints impacting market growth?

; High Cost of Equipment than Conventional Radiography is Discouraging the Market Growth.

8. Can you provide examples of recent developments in the market?

February 2022: ASOS has renewed its cloud relationship with Microsoft, committing to using the Microsoft Cloud as its primary cloud platform for the next five years. ASOS leverages Microsoft Azure and its AI capabilities to power its digital media and supports new data-driven and innovative workstreams, building on a long history of working with Microsoft.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malta E-commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malta E-commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malta E-commerce Industry?

To stay informed about further developments, trends, and reports in the Malta E-commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence