Key Insights

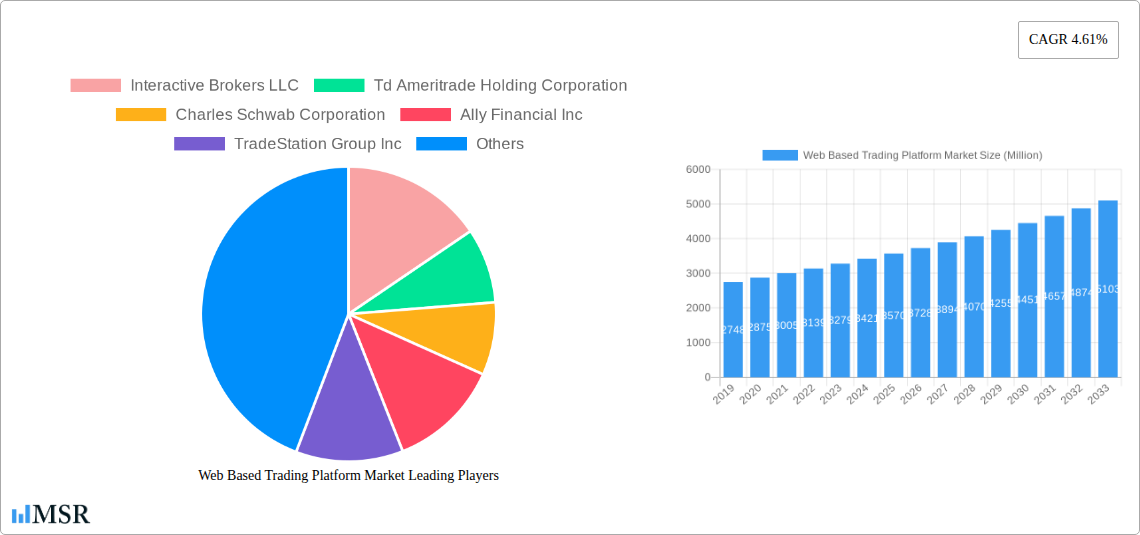

The global Web Based Trading Platform Market is projected for substantial growth, with an estimated market size of $3.21 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 4.61% through 2033. This robust expansion is fueled by several key drivers, primarily the increasing accessibility of online trading for retail investors and the growing adoption of digital financial services across all demographics. The surge in mobile trading and the proliferation of commission-free trading models have democratized investment opportunities, attracting a wider participant base. Furthermore, advancements in platform technology, offering sophisticated analytical tools, real-time data, and seamless user experiences, are continuously enhancing user engagement and platform competitiveness. The demand for user-friendly interfaces and integrated financial management solutions is also a significant contributor to this upward trajectory, enabling investors to make more informed decisions and manage their portfolios effectively.

Web Based Trading Platform Market Market Size (In Billion)

The market's evolution is further shaped by evolving trends such as the increasing integration of artificial intelligence and machine learning for personalized investment advice and automated trading strategies, and the growing popularity of cryptocurrency trading platforms. The shift towards cloud-based deployment is a dominant trend, offering scalability, cost-effectiveness, and enhanced accessibility for both platform providers and users. However, certain restraints, including stringent regulatory frameworks across different regions and concerns surrounding data security and privacy, could temper growth to some extent. Despite these challenges, the overarching trend of digital transformation in finance, coupled with the increasing wealth and investment appetite of both institutional and retail investors, positions the Web Based Trading Platform Market for sustained and significant expansion in the coming years.

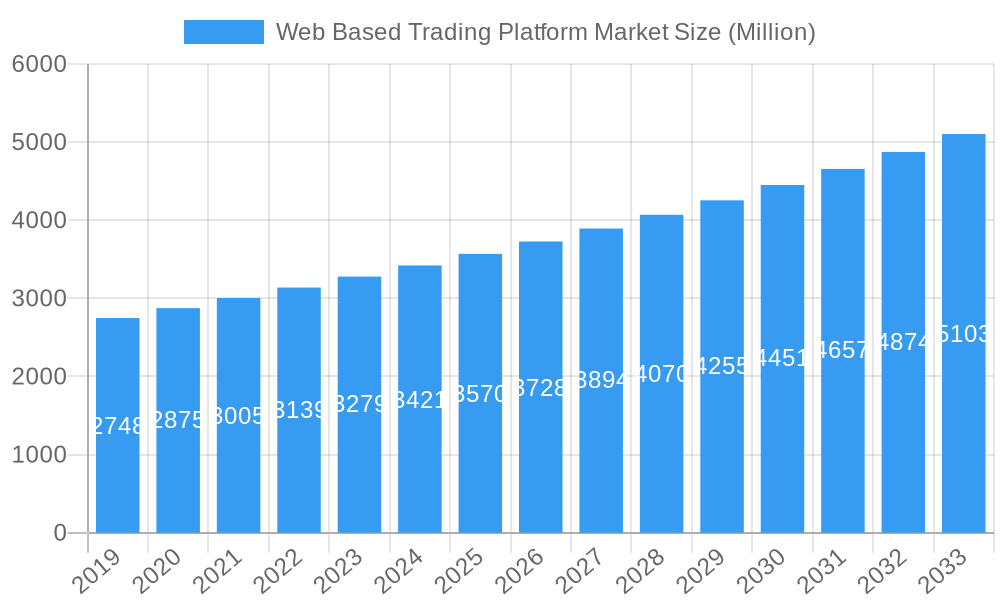

Web Based Trading Platform Market Company Market Share

This comprehensive Web Based Trading Platform Market report offers an in-depth analysis of the global landscape, projected to reach $XX Million by 2033. Spanning the historical period of 2019–2024 and extending through the forecast period of 2025–2033, with a base and estimated year of 2025, this study is your definitive guide to understanding market dynamics, key players, and future trajectories. We delve into the intricate details of online trading platforms, digital brokerage solutions, and fintech innovation that are revolutionizing how individuals and institutions access financial markets. This report is essential for institutional investors, retail investors, fintech companies, and financial institutions seeking to capitalize on the burgeoning digital investment revolution.

Web Based Trading Platform Market Market Concentration & Dynamics

The Web Based Trading Platform Market exhibits a dynamic concentration, influenced by continuous innovation and strategic alliances. The competitive landscape features established giants alongside agile fintech disruptors. Key market players are actively engaged in research and development, fostering robust innovation ecosystems to enhance user experience and expand service offerings. Regulatory frameworks, while evolving, play a crucial role in shaping market entry and operational strategies. Substitute products, such as traditional brokerage services and less accessible trading methods, are increasingly being supplanted by the convenience and accessibility of web-based platforms. End-user trends, driven by a growing demand for intuitive digital tools and diversified investment options, are compelling platform providers to adapt and innovate. Mergers and acquisitions (M&A) remain a significant catalyst for market consolidation and expansion, with an estimated XX M&A deal counts projected over the forecast period. The market share distribution is characterized by a few dominant players holding significant portions, while a multitude of smaller entities compete for niche segments. This ongoing evolution necessitates a keen understanding of the market's intricate dynamics for sustained success.

- Market Concentration: Moderate to High, with key players dominating specific segments.

- Innovation Ecosystems: Strong focus on AI-driven analytics, user-friendly interfaces, and mobile accessibility.

- Regulatory Frameworks: Evolving global regulations impacting data security, KYC/AML, and crypto trading.

- Substitute Products: Traditional brokerage, direct market access (DMA) through specialized software.

- End-User Trends: Demand for commission-free trading, fractional shares, alternative investments, and seamless mobile experiences.

- M&A Activities: Strategic acquisitions aimed at expanding service portfolios, geographical reach, and technological capabilities.

Web Based Trading Platform Market Industry Insights & Trends

The Web Based Trading Platform Market is experiencing unprecedented growth, driven by a confluence of technological advancements, shifting investor demographics, and a global surge in digital adoption. The market size for web-based trading platforms was valued at $XX Million in the base year 2025, and is projected to ascend at a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is primarily fueled by the increasing accessibility of financial markets to a broader population, thanks to intuitive and user-friendly online interfaces. The proliferation of smartphones and high-speed internet connectivity has democratized investment, enabling retail investors to participate more actively. Technological disruptions, including the integration of Artificial Intelligence (AI) and Machine Learning (ML) for personalized investment advice, algorithmic trading capabilities, and enhanced risk management tools, are redefining the investor experience. Furthermore, the growing popularity of cryptocurrencies and other alternative assets has prompted platform providers to expand their offerings, catering to a more diverse investment appetite. Evolving consumer behaviors, characterized by a preference for self-directed investing, a desire for transparent fee structures, and an increasing demand for educational resources, are compelling platform providers to continuously innovate and refine their services. The shift towards commission-free trading models has also significantly lowered the barrier to entry, attracting a new generation of investors. The underlying infrastructure supporting these platforms, often cloud-based, ensures scalability, reliability, and global accessibility, further propelling market growth.

Key Markets & Segments Leading Web Based Trading Platform Market

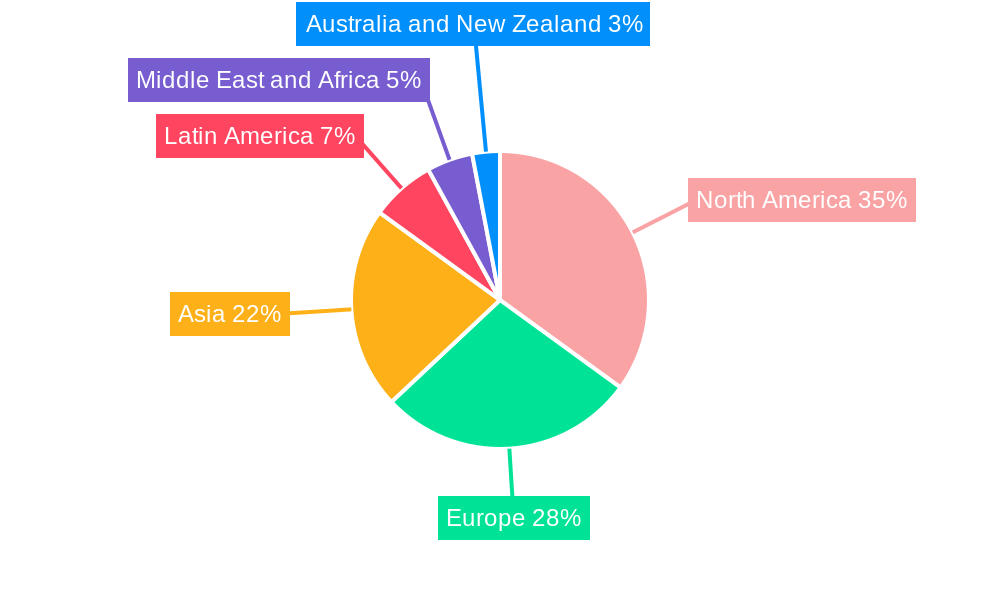

The Web Based Trading Platform Market is experiencing significant growth across various segments, with distinct regional and sectoral leadership. Globally, North America, particularly the United States, has emerged as a dominant region, driven by a mature financial ecosystem, high disposable incomes, and a strong appetite for investment. This dominance is further bolstered by robust technological infrastructure and favorable regulatory environments that encourage financial innovation.

Component: Platform

- Platform Dominance: The core trading platform itself, offering a comprehensive suite of tools for order execution, charting, news feeds, and account management, is the primary driver of value. Its intuitive design and advanced functionalities are critical for attracting and retaining users.

- Drivers: Economic growth, high per capita income, strong investor education initiatives, and government support for financial inclusion.

- Market Share: The platform segment is expected to capture a significant portion of the market revenue due to its foundational role in all web-based trading activities.

Component: Services

- Service Expansion: Value-added services such as research reports, financial advisory tools, portfolio management, and educational resources are increasingly differentiating platforms and driving revenue diversification.

- Drivers: Growing demand for personalized investment strategies, increasing complexity of financial markets, and the need for investor guidance.

Type: Commissions & Transaction Fees

- Commission-Free Revolution: While transaction fees and commissions have historically been revenue generators, the trend towards commission-free trading, particularly for equities, has reshaped this segment. Platforms now focus on generating revenue through other means, such as order flow payments, premium services, or interest on uninvested cash.

- Drivers: Competitive pressure, regulatory push for transparency, and a desire to attract a larger user base.

Deployment Mode: Cloud

- Cloud Supremacy: Cloud deployment is overwhelmingly leading the market due to its inherent scalability, cost-effectiveness, and flexibility. It allows for seamless updates, rapid deployment of new features, and robust disaster recovery capabilities.

- Drivers: Cost efficiency, enhanced security, global accessibility, and faster innovation cycles.

- On-Premise Decline: While on-premise solutions offer greater control, their high implementation costs and maintenance complexities make them less attractive for most new entrants and even established players seeking agility.

Application: Retail Investors

- Retail Investor Surge: The retail investor segment is experiencing exponential growth, fueled by increased financial literacy, social media influence, and the availability of user-friendly mobile trading apps. These investors are driving demand for accessible, low-cost trading solutions.

- Drivers: Democratization of investing, rise of mobile-first solutions, accessible educational content, and the desire for financial independence.

- Institutional Investor Focus: While institutional investors contribute significantly to trading volume and revenue through higher transaction values, the sheer volume and growth rate of retail participation make it a leading segment in terms of user acquisition and overall market expansion. Institutional platforms, though more sophisticated, often leverage similar underlying technology, but cater to different needs such as algorithmic trading and direct market access.

Web Based Trading Platform Market Product Developments

The Web Based Trading Platform Market is witnessing a rapid evolution of product offerings, driven by technological advancements and the pursuit of competitive differentiation. Key innovations include the integration of advanced AI and machine learning algorithms to provide personalized investment recommendations, sophisticated charting tools, and real-time market sentiment analysis. The expansion into alternative asset classes, such as cryptocurrencies and NFTs, represents a significant product development, catering to the diversifying interests of investors. Furthermore, the enhanced focus on mobile-first design and user experience continues to drive the development of intuitive and seamless trading applications. These advancements are crucial for attracting and retaining new investors and for providing existing ones with powerful, yet accessible, trading capabilities.

Challenges in the Web Based Trading Platform Market Market

The Web Based Trading Platform Market faces several critical challenges that could impede its growth. Regulatory scrutiny and compliance requirements, especially concerning data privacy and anti-money laundering (AML) protocols, can increase operational costs and complexity. Cybersecurity threats, including data breaches and platform manipulation, pose a significant risk to user trust and financial security. Intense competition leads to price wars and pressure on profit margins, particularly in commission-based revenue models. The need for continuous technological investment to keep pace with evolving client expectations and emerging fintech innovations also presents a substantial financial burden for many market participants.

- Regulatory Hurdles: Evolving global financial regulations, including those related to cryptocurrency trading, can create compliance complexities.

- Cybersecurity Threats: The increasing sophistication of cyberattacks requires constant vigilance and investment in robust security measures.

- Margin Compression: The trend towards commission-free trading puts pressure on traditional revenue streams, forcing platforms to explore alternative monetization strategies.

- Technological Obsolescence: The rapid pace of technological advancement necessitates continuous investment in platform upgrades and new feature development.

Forces Driving Web Based Trading Platform Market Growth

Several powerful forces are propelling the Web Based Trading Platform Market forward. The increasing democratization of finance, driven by readily accessible online platforms, is drawing in a new generation of retail investors. The rapid advancements in fintech, particularly in AI and data analytics, are enabling more sophisticated and personalized trading experiences. Furthermore, the global shift towards digital-first solutions across all industries has naturally extended to financial markets, fostering a demand for convenient and efficient online trading. Favorable economic conditions, including periods of market growth and increased disposable income, also contribute significantly to investor participation and, consequently, platform usage.

- Increased Financial Literacy and Accessibility: Growing awareness of investment opportunities and the ease of access through web-based platforms.

- Technological Advancements: AI, ML, and big data analytics are enhancing trading tools and user experiences.

- Globalization and Connectivity: The internet enables cross-border trading and access to a wider range of markets.

- Low-Interest Rate Environments: Historically low interest rates encourage investors to seek higher returns through capital markets.

Challenges in the Web Based Trading Platform Market Market

While the outlook for the Web Based Trading Platform Market is bright, several long-term growth catalysts require careful navigation. The continuous evolution of regulatory landscapes across different jurisdictions demands agility and adaptability from platform providers. The ongoing technological arms race, where companies must consistently innovate to stay ahead, necessitates substantial and sustained investment in research and development. Moreover, building and maintaining strong user trust in an environment prone to market volatility and potential security breaches is paramount for long-term success. Expanding into emerging markets with varying levels of financial infrastructure and digital literacy presents both opportunities and challenges that require tailored strategies.

Emerging Opportunities in Web Based Trading Platform Market

The Web Based Trading Platform Market is ripe with emerging opportunities, particularly in the integration of decentralized finance (DeFi) protocols, offering investors access to a wider array of financial products and services. The continued expansion of cryptocurrency trading and the exploration of blockchain-based trading solutions present significant growth avenues. Furthermore, the development of hyper-personalized investment experiences through advanced AI, catering to individual risk appetites and financial goals, is a key trend. The increasing demand for ESG (Environmental, Social, and Governance) investing options is also creating opportunities for platforms to curate and offer sustainable investment portfolios.

- DeFi Integration: Opportunities to bridge traditional finance with decentralized finance protocols.

- Expansion of Digital Assets: Growing demand for trading cryptocurrencies, NFTs, and other digital assets.

- Hyper-Personalized Investing: AI-driven tools that tailor investment strategies to individual needs.

- ESG Investing: Demand for platforms that offer sustainable and ethical investment options.

Leading Players in the Web Based Trading Platform Market Sector

- Interactive Brokers LLC

- Td Ameritrade Holding Corporation

- Charles Schwab Corporation

- Ally Financial Inc

- TradeStation Group Inc

- E-Trade

- MarketAxess Holdings Inc

- Huobi Group

- Plus500

- DigiFinex Limited

Key Milestones in Web Based Trading Platform Market Industry

- August 2022: The Customers of Interactive Brokers were provided access to 24-hour crypto trading via an improved online application made by Paxos Trust Company. Customers who choose to handle their account funding at Paxos can pre-fund their accounts during standard US banking hours and then trade Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH), as well as other coins, round-the-clock.

- March 2022: IBKR GlobalTrader, a simple mobile trading tool, was launched by Interactive Brokers that allows investors to trade stocks anywhere around the globe. The app's minimalist design makes it simple for inexperienced investors to use while still being robust enough for experienced stock traders. On more than 80 stock exchanges in North America, Europe, and Asia, the platform enables investors to open an account for trading stocks in a matter of minutes.

Strategic Outlook for Web Based Trading Platform Market Market

The strategic outlook for the Web Based Trading Platform Market is characterized by a continued emphasis on innovation, user experience, and market expansion. Key growth accelerators will include the deeper integration of AI for predictive analytics and personalized advice, the expansion of trading capabilities into nascent asset classes, and the refinement of mobile-first trading solutions. Strategic partnerships with fintech providers and a focus on enhancing cybersecurity infrastructure will be crucial for building long-term competitive advantage. Furthermore, tailoring offerings to meet the diverse needs of both retail and institutional investors, while navigating evolving global regulatory landscapes, will define success in this dynamic market. The future holds immense potential for platforms that can offer seamless, secure, and intelligent investment experiences.

Web Based Trading Platform Market Segmentation

-

1. Component

- 1.1. Platform

- 1.2. Services

-

2. Type

- 2.1. Commissions

- 2.2. Transaction Fees

-

3. Deployment Mode

- 3.1. On-premise

- 3.2. Cloud

-

4. Application

- 4.1. Institutional Investors

- 4.2. Retail Investors

Web Based Trading Platform Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

- 6. Australia and New Zealand

Web Based Trading Platform Market Regional Market Share

Geographic Coverage of Web Based Trading Platform Market

Web Based Trading Platform Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand For Reduction in the Transaction Costs; Surge in the Demand for Market Surveillance

- 3.3. Market Restrains

- 3.3.1. Implementation of stringent rules and regulations by the governments

- 3.4. Market Trends

- 3.4.1. Wide adoption of Artificial Intelligence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Web Based Trading Platform Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Platform

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Commissions

- 5.2.2. Transaction Fees

- 5.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.3.1. On-premise

- 5.3.2. Cloud

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Institutional Investors

- 5.4.2. Retail Investors

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.5.6. Australia and New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Web Based Trading Platform Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Platform

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Commissions

- 6.2.2. Transaction Fees

- 6.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.3.1. On-premise

- 6.3.2. Cloud

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Institutional Investors

- 6.4.2. Retail Investors

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Web Based Trading Platform Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Platform

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Commissions

- 7.2.2. Transaction Fees

- 7.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.3.1. On-premise

- 7.3.2. Cloud

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Institutional Investors

- 7.4.2. Retail Investors

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Web Based Trading Platform Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Platform

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Commissions

- 8.2.2. Transaction Fees

- 8.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.3.1. On-premise

- 8.3.2. Cloud

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Institutional Investors

- 8.4.2. Retail Investors

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Web Based Trading Platform Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Platform

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Commissions

- 9.2.2. Transaction Fees

- 9.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.3.1. On-premise

- 9.3.2. Cloud

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Institutional Investors

- 9.4.2. Retail Investors

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Web Based Trading Platform Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Platform

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Commissions

- 10.2.2. Transaction Fees

- 10.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.3.1. On-premise

- 10.3.2. Cloud

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Institutional Investors

- 10.4.2. Retail Investors

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Australia and New Zealand Web Based Trading Platform Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Platform

- 11.1.2. Services

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Commissions

- 11.2.2. Transaction Fees

- 11.3. Market Analysis, Insights and Forecast - by Deployment Mode

- 11.3.1. On-premise

- 11.3.2. Cloud

- 11.4. Market Analysis, Insights and Forecast - by Application

- 11.4.1. Institutional Investors

- 11.4.2. Retail Investors

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Interactive Brokers LLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Td Ameritrade Holding Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Charles Schwab Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Ally Financial Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 TradeStation Group Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 E-Trade

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 MarketAxess Holdings Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Huobi Group

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Plus500*List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 DigiFinex Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Interactive Brokers LLC

List of Figures

- Figure 1: Global Web Based Trading Platform Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Web Based Trading Platform Market Revenue (Million), by Component 2025 & 2033

- Figure 3: North America Web Based Trading Platform Market Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Web Based Trading Platform Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Web Based Trading Platform Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Web Based Trading Platform Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 7: North America Web Based Trading Platform Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 8: North America Web Based Trading Platform Market Revenue (Million), by Application 2025 & 2033

- Figure 9: North America Web Based Trading Platform Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Web Based Trading Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Web Based Trading Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Web Based Trading Platform Market Revenue (Million), by Component 2025 & 2033

- Figure 13: Europe Web Based Trading Platform Market Revenue Share (%), by Component 2025 & 2033

- Figure 14: Europe Web Based Trading Platform Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Web Based Trading Platform Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Web Based Trading Platform Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 17: Europe Web Based Trading Platform Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 18: Europe Web Based Trading Platform Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Europe Web Based Trading Platform Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Web Based Trading Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Web Based Trading Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Web Based Trading Platform Market Revenue (Million), by Component 2025 & 2033

- Figure 23: Asia Web Based Trading Platform Market Revenue Share (%), by Component 2025 & 2033

- Figure 24: Asia Web Based Trading Platform Market Revenue (Million), by Type 2025 & 2033

- Figure 25: Asia Web Based Trading Platform Market Revenue Share (%), by Type 2025 & 2033

- Figure 26: Asia Web Based Trading Platform Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 27: Asia Web Based Trading Platform Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 28: Asia Web Based Trading Platform Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Web Based Trading Platform Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Web Based Trading Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Web Based Trading Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Web Based Trading Platform Market Revenue (Million), by Component 2025 & 2033

- Figure 33: Latin America Web Based Trading Platform Market Revenue Share (%), by Component 2025 & 2033

- Figure 34: Latin America Web Based Trading Platform Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Latin America Web Based Trading Platform Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Latin America Web Based Trading Platform Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 37: Latin America Web Based Trading Platform Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 38: Latin America Web Based Trading Platform Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Latin America Web Based Trading Platform Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Latin America Web Based Trading Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Web Based Trading Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Web Based Trading Platform Market Revenue (Million), by Component 2025 & 2033

- Figure 43: Middle East and Africa Web Based Trading Platform Market Revenue Share (%), by Component 2025 & 2033

- Figure 44: Middle East and Africa Web Based Trading Platform Market Revenue (Million), by Type 2025 & 2033

- Figure 45: Middle East and Africa Web Based Trading Platform Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East and Africa Web Based Trading Platform Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 47: Middle East and Africa Web Based Trading Platform Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 48: Middle East and Africa Web Based Trading Platform Market Revenue (Million), by Application 2025 & 2033

- Figure 49: Middle East and Africa Web Based Trading Platform Market Revenue Share (%), by Application 2025 & 2033

- Figure 50: Middle East and Africa Web Based Trading Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Web Based Trading Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 52: Australia and New Zealand Web Based Trading Platform Market Revenue (Million), by Component 2025 & 2033

- Figure 53: Australia and New Zealand Web Based Trading Platform Market Revenue Share (%), by Component 2025 & 2033

- Figure 54: Australia and New Zealand Web Based Trading Platform Market Revenue (Million), by Type 2025 & 2033

- Figure 55: Australia and New Zealand Web Based Trading Platform Market Revenue Share (%), by Type 2025 & 2033

- Figure 56: Australia and New Zealand Web Based Trading Platform Market Revenue (Million), by Deployment Mode 2025 & 2033

- Figure 57: Australia and New Zealand Web Based Trading Platform Market Revenue Share (%), by Deployment Mode 2025 & 2033

- Figure 58: Australia and New Zealand Web Based Trading Platform Market Revenue (Million), by Application 2025 & 2033

- Figure 59: Australia and New Zealand Web Based Trading Platform Market Revenue Share (%), by Application 2025 & 2033

- Figure 60: Australia and New Zealand Web Based Trading Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Australia and New Zealand Web Based Trading Platform Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Web Based Trading Platform Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Web Based Trading Platform Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Web Based Trading Platform Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 4: Global Web Based Trading Platform Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Web Based Trading Platform Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Web Based Trading Platform Market Revenue Million Forecast, by Component 2020 & 2033

- Table 7: Global Web Based Trading Platform Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Web Based Trading Platform Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 9: Global Web Based Trading Platform Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Web Based Trading Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Web Based Trading Platform Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global Web Based Trading Platform Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Web Based Trading Platform Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 14: Global Web Based Trading Platform Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Web Based Trading Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Web Based Trading Platform Market Revenue Million Forecast, by Component 2020 & 2033

- Table 17: Global Web Based Trading Platform Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Web Based Trading Platform Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 19: Global Web Based Trading Platform Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Web Based Trading Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Web Based Trading Platform Market Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global Web Based Trading Platform Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Web Based Trading Platform Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 24: Global Web Based Trading Platform Market Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Web Based Trading Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Web Based Trading Platform Market Revenue Million Forecast, by Component 2020 & 2033

- Table 27: Global Web Based Trading Platform Market Revenue Million Forecast, by Type 2020 & 2033

- Table 28: Global Web Based Trading Platform Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 29: Global Web Based Trading Platform Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Web Based Trading Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global Web Based Trading Platform Market Revenue Million Forecast, by Component 2020 & 2033

- Table 32: Global Web Based Trading Platform Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Web Based Trading Platform Market Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 34: Global Web Based Trading Platform Market Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global Web Based Trading Platform Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Web Based Trading Platform Market?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the Web Based Trading Platform Market?

Key companies in the market include Interactive Brokers LLC, Td Ameritrade Holding Corporation, Charles Schwab Corporation, Ally Financial Inc, TradeStation Group Inc, E-Trade, MarketAxess Holdings Inc, Huobi Group, Plus500*List Not Exhaustive, DigiFinex Limited.

3. What are the main segments of the Web Based Trading Platform Market?

The market segments include Component, Type, Deployment Mode, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand For Reduction in the Transaction Costs; Surge in the Demand for Market Surveillance.

6. What are the notable trends driving market growth?

Wide adoption of Artificial Intelligence.

7. Are there any restraints impacting market growth?

Implementation of stringent rules and regulations by the governments.

8. Can you provide examples of recent developments in the market?

August 2022 - The Customers of Interactive Brokers were provided access to 24-hour crypto trading via an improved online application made by Paxos Trust Company. Customers who choose to handle their account funding at Paxos can pre-fund their accounts during standard US banking hours and then trade Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH), as well as other coins, round-the-clock.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Web Based Trading Platform Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Web Based Trading Platform Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Web Based Trading Platform Market?

To stay informed about further developments, trends, and reports in the Web Based Trading Platform Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence