Key Insights

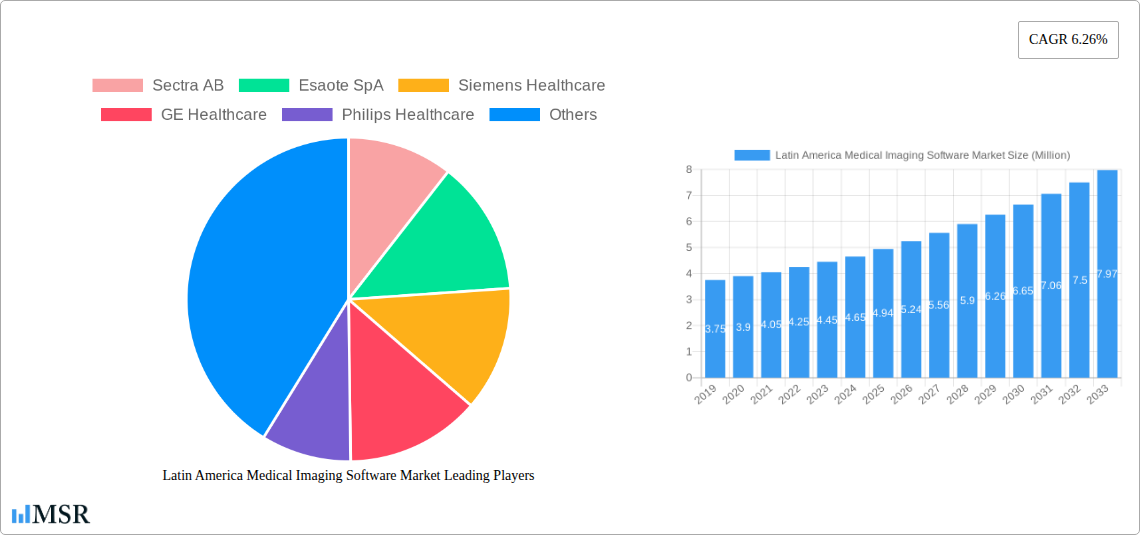

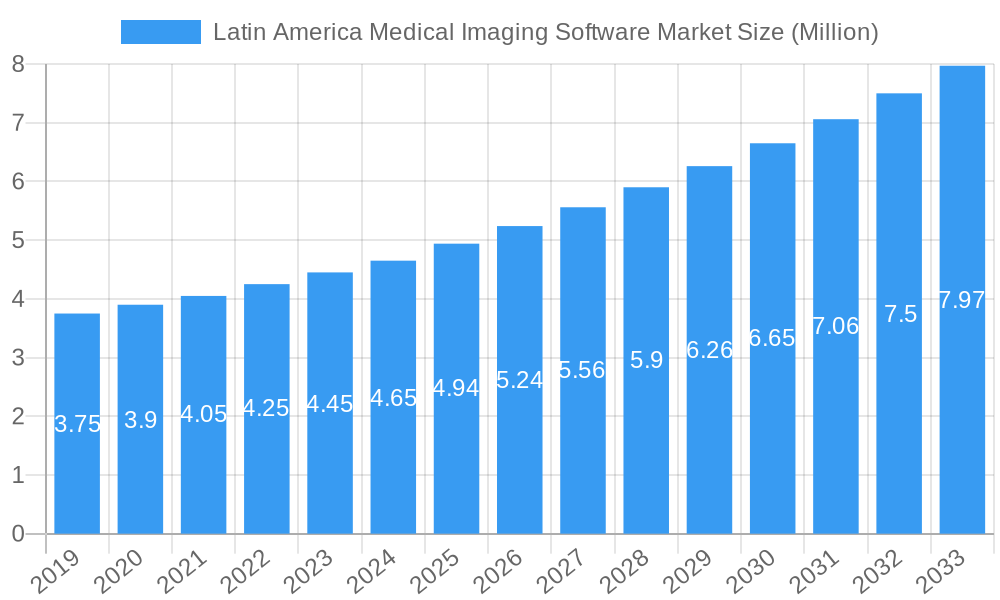

The Latin America Medical Imaging Software Market is poised for significant expansion, projected to reach a market size of approximately USD 4.94 million by 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.26% through 2033. This growth is fueled by several key drivers. The increasing prevalence of chronic diseases such as cardiovascular conditions, orthopedic ailments, and cancer across Latin America necessitates advanced diagnostic capabilities, driving demand for sophisticated medical imaging software. Furthermore, government initiatives aimed at improving healthcare infrastructure and increasing access to advanced medical technologies in countries like Brazil, Mexico, and Colombia are playing a pivotal role. The rising adoption of 3D and 4D imaging technologies for enhanced diagnostic accuracy and treatment planning, particularly in cardiology, obstetrics, and orthopedics, is another significant growth stimulant. Moreover, the growing awareness among healthcare professionals and patients about the benefits of early and precise diagnosis through advanced imaging solutions is propelling market adoption. The market's trajectory is also influenced by technological advancements, including AI-powered analytics and cloud-based solutions that improve workflow efficiency and data management.

Latin America Medical Imaging Software Market Market Size (In Million)

The market for medical imaging software in Latin America is segmented across various imaging types and applications, reflecting the diverse needs of the healthcare sector. While 2D imaging remains a foundational technology, the increasing demand for higher resolution and more comprehensive diagnostic information is driving the adoption of 3D and 4D imaging. Key application segments contributing to market growth include dental, orthopaedic, cardiology, obstetrics and gynaecology, mammography, and urology and nephrology. The expansion of specialized clinics and diagnostic centers, alongside the upgrading of existing hospital infrastructure, further supports this growth. Despite the positive outlook, certain restraints could influence the market's pace, such as the high initial investment costs for advanced software and hardware, and the need for skilled personnel to operate and interpret complex imaging data. However, the commitment from major global players like Siemens Healthcare, GE Healthcare, and Philips Healthcare, along with regional innovators, to develop tailored solutions for the Latin American market, is expected to mitigate these challenges and ensure continued market development.

Latin America Medical Imaging Software Market Company Market Share

Dive deep into the dynamic Latin America medical imaging software market with this in-depth analysis covering 2019-2033. Our report, focusing on the base year of 2025 and a robust forecast period of 2025-2033, provides critical insights into market size, segmentation, key players, and future trends. Discover opportunities within 2D imaging, 3D imaging, and 4D imaging segments, alongside applications spanning dental, orthopaedic, cardiology, obstetrics & gynaecology, mammography, urology & nephrology, and more. This report is your essential guide to navigating healthcare IT solutions and radiology software in this rapidly expanding region.

Latin America Medical Imaging Software Market Market Concentration & Dynamics

The Latin America medical imaging software market exhibits a moderate to high level of concentration, driven by the presence of global giants alongside emerging local players. Innovation ecosystems are flourishing, particularly in countries like Brazil and Mexico, fueled by increased investment in digital health solutions and a growing demand for advanced diagnostic imaging technologies. Regulatory frameworks, while evolving, are becoming more harmonized, encouraging market entry and cross-border collaboration. Substitute products, such as standalone PACS systems without advanced AI analytics, are gradually being phased out as healthcare providers seek integrated Picture Archiving and Communication Systems (PACS) and Radiology Information Systems (RIS). End-user trends lean towards cloud-based solutions for enhanced accessibility and collaboration, and a strong preference for AI-powered analytics for faster and more accurate diagnoses. Mergers and acquisitions (M&A) activities are expected to intensify as larger companies seek to expand their portfolios and market reach, with an estimated 10-15 M&A deals anticipated in the forecast period. Key players like Siemens Healthcare, GE Healthcare, and Philips Healthcare command significant market share, estimated between 15-20% each, while companies like Sectra AB, Canon Medical Systems Corporation, and Esaote SpA are strategically expanding their presence.

Latin America Medical Imaging Software Market Industry Insights & Trends

The Latin America medical imaging software market is poised for significant expansion, projected to reach an estimated USD 2,500 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% from the base year of 2025. This growth is propelled by several key factors. The increasing prevalence of chronic diseases, such as cardiovascular conditions and cancer, is driving the demand for sophisticated diagnostic imaging software and associated hardware. Furthermore, a burgeoning middle class and rising healthcare expenditure across Latin American nations are enabling greater adoption of advanced medical technologies, including AI in medical imaging and enterprise imaging solutions. The push towards digitalization of healthcare infrastructure, coupled with government initiatives to improve healthcare accessibility and quality, is creating a fertile ground for market players. Technological disruptions, particularly in the realm of Artificial Intelligence (AI) and Machine Learning (ML), are revolutionizing how medical images are analyzed, leading to improved diagnostic accuracy and efficiency. This is evident in the growing interest in AI medical imaging algorithms for tasks such as lesion detection and disease prediction. Evolving consumer behaviors, characterized by a greater emphasis on preventative healthcare and personalized medicine, are further fueling the demand for advanced imaging capabilities. The market is witnessing a steady migration from traditional, on-premise solutions to more flexible and scalable cloud-based platforms, offering benefits like remote access, data security, and cost-effectiveness. The market size in the historical period (2019-2024) reached approximately USD 1,800 Million, indicating a strong upward trajectory.

Key Markets & Segments Leading Latin America Medical Imaging Software Market

Brazil is currently the dominant country in the Latin America medical imaging software market, driven by its large population, established healthcare infrastructure, and increasing investments in medical technology. Following closely are Mexico and Colombia, which are also witnessing substantial growth in the adoption of advanced imaging informatics.

The Imaging Type segment is led by 2D Imaging, accounting for an estimated 60% of the market share due to its widespread use and affordability. However, 3D Imaging is experiencing rapid growth, projected to capture 25% of the market by 2033, fueled by its enhanced visualization capabilities for complex anatomical structures. 4D Imaging holds a smaller but growing share of approximately 15%, primarily utilized in specialized applications like cardiac imaging.

In terms of Application, Cardiology Applications represent the largest segment, estimated at 20% of the market, due to the high burden of cardiovascular diseases. Orthopaedic Applications and Obstetrics and Gynaecology Applications follow closely, each contributing around 15% respectively, driven by the increasing demand for detailed imaging for musculoskeletal and prenatal care. Mammography Applications are also significant, with an estimated 12% market share, driven by growing awareness and screening programs for breast cancer.

- Drivers for Dominance in Brazil:

- Significant government investment in public healthcare modernization.

- A large number of accredited medical institutions and hospitals.

- The presence of major global medical imaging software vendors.

- Increasing adoption of AI-driven diagnostic tools.

- Drivers for Growth in 3D Imaging:

- Enhanced diagnostic accuracy and surgical planning capabilities.

- Improved patient communication and understanding of diagnoses.

- Advancements in imaging hardware that support 3D reconstruction.

- Drivers for Cardiology Applications:

- High incidence rates of heart disease across the region.

- Technological advancements in cardiac imaging modalities (e.g., CT, MRI).

- Increasing demand for interventional cardiology procedures.

Latin America Medical Imaging Software Market Product Developments

The Latin America medical imaging software market is characterized by continuous innovation, with companies focusing on developing AI-powered solutions and cloud-based platforms. Key product developments include advanced radiology AI tools for automated image analysis, improved workflow efficiency, and enhanced diagnostic accuracy in areas like oncology and neurology. Furthermore, there is a growing emphasis on integrating PACS and RIS functionalities with enterprise imaging strategies to provide a unified view of patient data. This drive for integrated and intelligent solutions aims to streamline diagnostic processes and improve patient outcomes.

Challenges in the Latin America Medical Imaging Software Market Market

The Latin America medical imaging software market faces several hurdles, including the high cost of advanced medical imaging software solutions, which can be a significant barrier for smaller healthcare facilities. Inconsistent internet connectivity in some rural areas can also hinder the adoption of cloud-based solutions. Moreover, the need for specialized training to operate complex diagnostic imaging software and interpret AI-generated insights presents a workforce challenge. Regulatory complexities and varying data privacy laws across different countries can also create compliance challenges for market players. The market faces an estimated 10-15% impact from these barriers annually.

Forces Driving Latin America Medical Imaging Software Market Growth

Several forces are propelling the growth of the Latin America medical imaging software market. A significant driver is the increasing adoption of digital health technologies and the growing demand for improved healthcare infrastructure. The rising incidence of chronic diseases necessitates advanced diagnostic imaging software for early detection and effective management. Furthermore, government initiatives promoting healthcare digitalization and technological advancements, particularly in AI for medical imaging, are creating substantial opportunities for market expansion. The expanding healthcare workforce, coupled with a greater emphasis on patient-centric care, is also contributing to this growth trajectory.

Challenges in the Latin America Medical Imaging Software Market Market

Long-term growth catalysts in the Latin America medical imaging software market include the ongoing digital transformation of healthcare systems across the region. The increasing focus on value-based healthcare is driving the demand for solutions that can demonstrate improved patient outcomes and cost efficiencies. Strategic partnerships between technology providers and healthcare institutions are crucial for fostering innovation and ensuring the successful implementation of advanced medical imaging software. The growing demand for interoperability and data standardization will also play a vital role in shaping the future of this market, enabling seamless data exchange and enhanced collaboration among healthcare professionals.

Emerging Opportunities in Latin America Medical Imaging Software Market

Emerging opportunities in the Latin America medical imaging software market are vast and varied. The growing adoption of telemedicine and remote diagnostics presents a significant avenue for growth, allowing for expanded access to specialized imaging services. The increasing demand for personalized medicine and precision diagnostics is creating a market for advanced AI-powered medical imaging analytics. Furthermore, the untapped potential in emerging economies within Latin America, coupled with the ongoing development of affordable and scalable imaging informatics solutions, offers substantial opportunities for market penetration and expansion.

Leading Players in the Latin America Medical Imaging Software Market Sector

- Sectra AB

- Esaote SpA

- Siemens Healthcare

- GE Healthcare

- Philips Healthcare

- Agfa Gevaert HealthCare

- Carestream Health

- MIM Software Inc

- Canon Medical Systems Corporation

- Delft Imaging

Key Milestones in Latin America Medical Imaging Software Market Industry

- June 2023: The Hospital Israelita Albert Einstein in Sao Paulo, Brazil, signed a three-year software license deal with Lunit, a global supplier of AI-powered cancer treatments. Lunit will provide its AI solution, Lunit INSIGHT CXR, for processing chest x-ray images. This agreement highlights the growing integration of AI in medical imaging for diagnostic purposes within major Latin American healthcare facilities.

- May 2023: A collaborative deal between Thermo Fisher Scientific and Pfizer was signed to expand localized access to next-generation sequencing (NGS)-based diagnostics for cancer patients in foreign markets, including Latin America. This initiative aims to speed up the study of genes related to lung and breast cancer, underscoring the trend towards more sophisticated genomic testing and diagnostics in the region, which often integrates with advanced imaging data.

Strategic Outlook for Latin America Medical Imaging Software Market Market

The strategic outlook for the Latin America medical imaging software market is highly promising, driven by a confluence of technological advancements and increasing healthcare investments. Market players should focus on developing and offering integrated enterprise imaging solutions that encompass PACS, RIS, and advanced AI analytics. Strategic partnerships with local healthcare providers and government bodies will be crucial for market penetration and successful adoption of radiology software. The growing demand for cloud-based solutions and telehealth integration presents significant growth accelerators, enabling wider access to high-quality diagnostic services across the region. Investing in localized training and support will also be key to overcoming adoption barriers and ensuring sustained market growth.

Latin America Medical Imaging Software Market Segmentation

-

1. Imaging Type

- 1.1. 2D Imaging

- 1.2. 3D Imaging

- 1.3. 4D Imaging

-

2. Application

- 2.1. Dental Applications

- 2.2. Orthopaedic Applications

- 2.3. Cardiology Applications

- 2.4. Obstetrics and Gynaecology Applications

- 2.5. Mammography Applications

- 2.6. Urology and Nephrology Applications

- 2.7. Other Applications

Latin America Medical Imaging Software Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Medical Imaging Software Market Regional Market Share

Geographic Coverage of Latin America Medical Imaging Software Market

Latin America Medical Imaging Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Imaging Equipment Due to Rising Prevalence of Chronic Diseases; Growing Application of Computer-Aided Diagnostic Methods

- 3.3. Market Restrains

- 3.3.1 High Set-up Cost of the Equipment; Limited Healthcare Infrastructure

- 3.3.2 Particularly in Rural and Remote Areas

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Imaging Equipment Due to Rising Prevalence of Chronic Diseases to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Medical Imaging Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Imaging Type

- 5.1.1. 2D Imaging

- 5.1.2. 3D Imaging

- 5.1.3. 4D Imaging

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dental Applications

- 5.2.2. Orthopaedic Applications

- 5.2.3. Cardiology Applications

- 5.2.4. Obstetrics and Gynaecology Applications

- 5.2.5. Mammography Applications

- 5.2.6. Urology and Nephrology Applications

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Imaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sectra AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Esaote SpA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GE Healthcare

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Philips Healthcare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agfa Gevaert HealthCare

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Carestream Health

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MIM Software Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Canon Medical Systems Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Delft Imagin

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sectra AB

List of Figures

- Figure 1: Latin America Medical Imaging Software Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Medical Imaging Software Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Medical Imaging Software Market Revenue Million Forecast, by Imaging Type 2020 & 2033

- Table 2: Latin America Medical Imaging Software Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Latin America Medical Imaging Software Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America Medical Imaging Software Market Revenue Million Forecast, by Imaging Type 2020 & 2033

- Table 5: Latin America Medical Imaging Software Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Latin America Medical Imaging Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Medical Imaging Software Market?

The projected CAGR is approximately 6.26%.

2. Which companies are prominent players in the Latin America Medical Imaging Software Market?

Key companies in the market include Sectra AB, Esaote SpA, Siemens Healthcare, GE Healthcare, Philips Healthcare, Agfa Gevaert HealthCare, Carestream Health, MIM Software Inc, Canon Medical Systems Corporation, Delft Imagin.

3. What are the main segments of the Latin America Medical Imaging Software Market?

The market segments include Imaging Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Imaging Equipment Due to Rising Prevalence of Chronic Diseases; Growing Application of Computer-Aided Diagnostic Methods.

6. What are the notable trends driving market growth?

Increasing Usage of Imaging Equipment Due to Rising Prevalence of Chronic Diseases to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Set-up Cost of the Equipment; Limited Healthcare Infrastructure. Particularly in Rural and Remote Areas.

8. Can you provide examples of recent developments in the market?

June 2023: The Hospital Israelita Albert Einstein in Sao Paulo, Brazil, and Lunit, a global supplier of AI-powered cancer treatments, have signed a software license deal. According to the agreement, Lunit will provide Hospital Israelita Albert Einstein for three years, or until 2025, with its artificial intelligence (AI) solution for chest x-ray image processing, Lunit INSIGHT CXR. The hospital intends to use Lunit's AI technology to screen chest X-ray images in its emergency room, intensive care unit, and during in-patient exams.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Medical Imaging Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Medical Imaging Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Medical Imaging Software Market?

To stay informed about further developments, trends, and reports in the Latin America Medical Imaging Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence