Key Insights

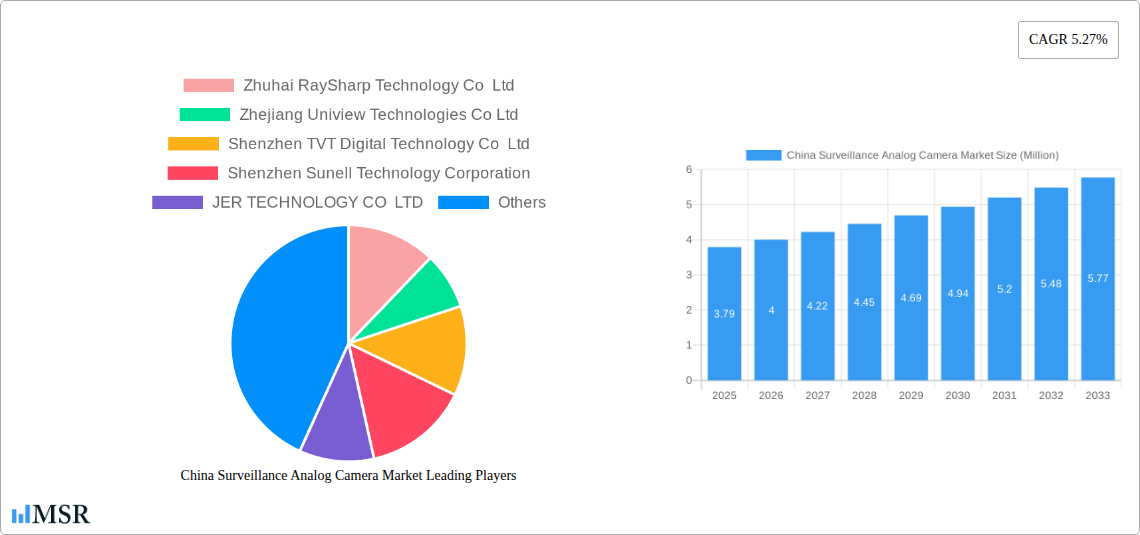

The China Surveillance Analog Camera Market is poised for significant expansion, with an estimated market size of USD 3.79 billion in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 5.27% through 2033. This sustained growth is underpinned by several key drivers. The increasing demand for enhanced security across various sectors, including government, banking, healthcare, and transportation, is a primary catalyst. As these industries continue to invest in robust surveillance infrastructure to protect assets, personnel, and sensitive data, analog cameras, despite the rise of digital alternatives, maintain their relevance due to their cost-effectiveness and reliability. Furthermore, ongoing urbanization and infrastructure development projects across China necessitate extensive surveillance solutions, contributing to market expansion. The government's continued focus on public safety and smart city initiatives also plays a crucial role in driving the adoption of surveillance technologies.

China Surveillance Analog Camera Market Market Size (In Million)

The market is characterized by dynamic trends and evolving competitive landscapes. While digital surveillance systems are gaining traction, analog cameras are not being phased out but rather evolving to offer improved resolution and advanced features. The focus is on integrating analog systems with existing digital infrastructure for a hybrid approach, offering a cost-efficient upgrade path. Emerging trends include the integration of AI-powered analytics with analog systems, albeit at a nascent stage, and the development of more robust and weather-resistant analog cameras for outdoor applications. However, the market also faces certain restraints. The rapid technological advancements in IP (Internet Protocol) cameras, offering higher resolutions, remote accessibility, and advanced analytics, present a competitive challenge. The initial investment cost for upgrading to entirely IP-based systems can also be a deterrent for some organizations, particularly smaller enterprises. Nevertheless, the established infrastructure, ease of installation, and lower total cost of ownership for analog solutions in certain applications continue to ensure its sustained demand within the vast Chinese market.

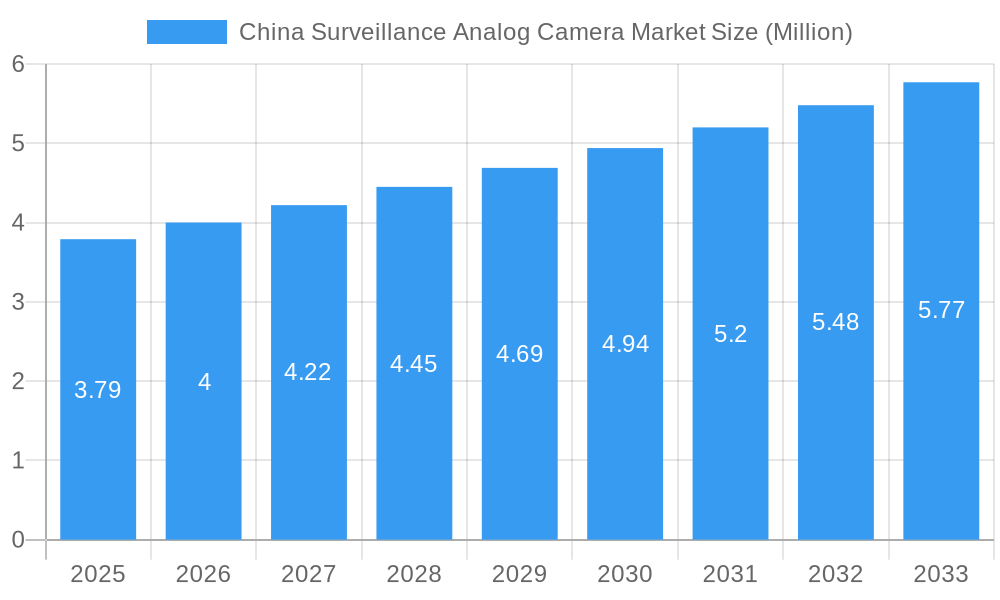

China Surveillance Analog Camera Market Company Market Share

Gain a comprehensive understanding of the China surveillance analog camera market with this in-depth report. Explore key market dynamics, industry insights, product developments, and strategic outlooks from 2019–2033, with a focus on the base year 2025 and a forecast period of 2025–2033. This report is meticulously crafted for industry stakeholders, offering actionable intelligence and high-ranking keywords to enhance search visibility.

China Surveillance Analog Camera Market Market Concentration & Dynamics

The China surveillance analog camera market exhibits a moderate to high market concentration, with a few dominant players controlling significant market share, estimated at XX%. The innovation ecosystem is robust, driven by continuous R&D in areas like enhanced image quality, longer transmission distances, and improved durability. Regulatory frameworks, though evolving, primarily focus on data security and privacy standards, influencing product development and market entry. Substitute products, predominantly IP cameras, pose a competitive threat, yet analog cameras maintain their appeal due to cost-effectiveness and ease of installation in certain legacy systems. End-user trends are shifting towards integrated security solutions and higher resolution demands. Merger and acquisition (M&A) activities are present, though less frequent than in the IP segment, with XX M&A deals recorded during the historical period.

China Surveillance Analog Camera Market Industry Insights & Trends

The China surveillance analog camera market is poised for sustained growth, projected to reach a market size of USD XX Billion by 2025 and expand to USD XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is propelled by several key growth drivers, including the burgeoning demand for enhanced security in public spaces, commercial establishments, and critical infrastructure. The government’s continued emphasis on public safety initiatives and smart city development fuels the adoption of surveillance solutions. Technologically, advancements in analog High Definition (HD) technologies, such as HD-TVI, HD-CVI, and AHD, have significantly improved image quality, allowing analog systems to rival their digital counterparts in resolution and performance without the need for extensive network infrastructure upgrades. This technological leap makes analog cameras a cost-effective solution for upgrading existing surveillance systems. Evolving consumer behaviors and end-user preferences lean towards reliable, easy-to-deploy, and budget-friendly security systems, which analog cameras continue to offer. The market also benefits from the ongoing urbanization across China, leading to increased construction of residential and commercial buildings, each requiring robust surveillance infrastructure. Furthermore, the cost of maintenance and the inherent simplicity of analog systems, compared to IP networks, contribute to their enduring appeal, especially in sectors where budget constraints are a primary consideration. The inherent robustness and resilience of analog systems in challenging environmental conditions also play a crucial role in their sustained adoption.

Key Markets & Segments Leading China Surveillance Analog Camera Market

The Government sector stands as a dominant segment in the China surveillance analog camera market, driven by substantial investments in public security, smart city initiatives, and border surveillance.

- Drivers in Government Sector:

- National security mandates and increased funding for public safety.

- Expansion of smart city projects requiring widespread camera deployment.

- Need for reliable and cost-effective surveillance in public spaces like streets, parks, and transportation hubs.

- Upgrading aging surveillance infrastructure with cost-efficient analog solutions.

The Transportation and Logistics sector also presents significant demand, propelled by the need for enhanced safety and security in transit networks and supply chains.

- Drivers in Transportation and Logistics Sector:

- Securing airports, railway stations, ports, and major highways.

- Monitoring cargo movement and preventing theft in logistics operations.

- Improving traffic management and incident detection.

- Cost-effective installation and maintenance for vast networks.

The Industrial sector, encompassing manufacturing plants, energy facilities, and construction sites, demonstrates consistent demand for robust analog surveillance solutions.

- Drivers in Industrial Sector:

- Monitoring of production lines and operational efficiency.

- Ensuring safety compliance and preventing accidents.

- Securing valuable assets and intellectual property.

- Durability and performance in harsh industrial environments.

The Banking sector, while increasingly adopting IP solutions, continues to utilize analog cameras for specific applications, particularly in ATMs and branch security, due to their established infrastructure and lower initial investment. The Healthcare segment is also a growing market, with demand for surveillance in hospitals and clinics for patient safety and asset protection. The Others segment, encompassing retail, education, and residential complexes, contributes to the market’s breadth, often opting for analog solutions due to their affordability and ease of integration.

China Surveillance Analog Camera Market Product Developments

Product innovation in the China surveillance analog camera market is centered on enhancing image quality and expanding functionality within the analog framework. Manufacturers are focusing on higher resolution analog technologies that offer clearer footage, even in challenging lighting conditions. Advancements in low-light performance, such as improved infrared capabilities and Wide Dynamic Range (WDR), are making analog cameras more versatile. Furthermore, developments include cameras with wider focal lengths and more robust weatherproofing for outdoor applications. The integration of features traditionally associated with IP cameras, like basic analytics (e.g., motion detection), is also emerging, offering a hybrid approach and a competitive edge.

Challenges in the China Surveillance Analog Camera Market Market

Key challenges in the China surveillance analog camera market include the persistent competition from the rapidly advancing IP camera market, which offers higher resolutions and advanced features. The ongoing transition towards digital infrastructure in many sectors necessitates strategic positioning for analog manufacturers. Supply chain disruptions and the increasing cost of raw materials can impact profit margins, particularly for lower-end products. Additionally, evolving data privacy regulations and cybersecurity concerns, while more directly impacting IP systems, can indirectly influence perceptions of analog security solutions.

Forces Driving China Surveillance Analog Camera Market Growth

Significant forces driving growth in the China surveillance analog camera market include the strong government push for enhanced public safety and smart city development, which necessitates widespread surveillance infrastructure. The cost-effectiveness of analog cameras remains a primary driver, especially for large-scale deployments and for organizations with budget constraints looking to upgrade existing analog systems. The continuous improvements in analog HD technology, delivering higher resolutions and better image quality, are crucial in maintaining market relevance against IP alternatives. Furthermore, the ease of installation and maintenance of analog systems appeals to many end-users, reducing operational complexities and associated costs.

Challenges in the China Surveillance Analog Camera Market Market

Long-term growth catalysts for the China surveillance analog camera market are anchored in strategic innovation and market adaptation. Continued investment in R&D to push the boundaries of analog HD technology, potentially integrating more advanced analytics or improving remote accessibility features, will be critical. Partnerships with system integrators and security solution providers will enable broader market penetration and tailored solutions. Exploring niche applications where analog remains superior, such as extreme environmental conditions or where network infrastructure is limited, will secure market share. Moreover, focusing on hybrid solutions that seamlessly integrate analog and IP systems will cater to evolving customer needs.

Emerging Opportunities in China Surveillance Analog Camera Market

Emerging opportunities in the China surveillance analog camera market lie in developing more intelligent analog cameras that incorporate basic AI functionalities like object detection and facial recognition, offering a cost-effective entry point into smart surveillance. The growing demand for refurbished and upgradeable analog systems presents a segment for cost-conscious consumers. Furthermore, the increasing need for surveillance in developing regions and smaller enterprises, where the cost of IP infrastructure is prohibitive, offers a significant expansion avenue. Exploring partnerships for bundled security solutions, combining analog cameras with other security devices, can also unlock new revenue streams.

Leading Players in the China Surveillance Analog Camera Market Sector

- Zhuhai RaySharp Technology Co Ltd

- Zhejiang Uniview Technologies Co Ltd

- Shenzhen TVT Digital Technology Co Ltd

- Shenzhen Sunell Technology Corporation

- JER TECHNOLOGY CO LTD

- Hanwha Vision Co Ltd

- Shenzhen MVTEAM Technology CoLtd

- Shenzhen LOYALTY-SECU Technology Co LTD

- Jovision Technology Co Ltd

- CP PLUS

- Dahua Technology Co Ltd

- Hangzhou Hikvision Digital Technology Co Ltd

Key Milestones in China Surveillance Analog Camera Market Industry

- April 2024: Hikvision announced the latest iteration of its Turbo HD analog security products, Turbo HD 8.0. This upgraded version promises users a more immersive and interactive security experience, enhancing their surveillance capabilities. Turbo HD 8.0 introduces four key innovations: real-time communication, 180-degree video coverage, enhanced night vision, and a broader product range. These upgrades include features like two-way audio, compact dual-lens cameras with stitching technology, and Smart Hybrid Light functionality across the entire Turbo HD camera lineup. Additionally, the launch features a new advanced pro-series DVR equipped with AcuSense technology.

- October 2023: Hikvision unveiled 2 MP analog cameras, showcasing an F1.0 aperture. This milestone was marked by the launch of the ColorVu Fixed Turret (DS-2CE70DF0T-MF) and Bullet (DS-2CE10DF0T-F) Cameras. These innovative cameras deliver top-notch, full-color imaging 24/7, support HD over analog cabling for seamless upgrades, and boast features like 3D Digital Noise Reduction (DNR) technology and an impressive white light range.

Strategic Outlook for China Surveillance Analog Camera Market Market

The strategic outlook for the China surveillance analog camera market is characterized by a focus on leveraging existing strengths while adapting to technological advancements. Manufacturers are expected to concentrate on enhancing the performance and features of analog HD technology to compete effectively with IP solutions, particularly in terms of image quality, transmission range, and low-light capabilities. The market will likely see a greater emphasis on integrated solutions that combine analog cameras with advanced analytics, offering a cost-effective path to intelligent surveillance. Strategic partnerships and a focus on niche applications where analog cameras excel will be crucial for sustained growth. The report forecasts continued demand from sectors prioritizing budget-friendly and easy-to-deploy security, ensuring the market's resilience.

China Surveillance Analog Camera Market Segmentation

-

1. End-User Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation and Logistics

- 1.5. Industrial

- 1.6. Others (

China Surveillance Analog Camera Market Segmentation By Geography

- 1. China

China Surveillance Analog Camera Market Regional Market Share

Geographic Coverage of China Surveillance Analog Camera Market

China Surveillance Analog Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Cost-Effectiveness of Analog Cameras' Appeals to Smaller Businesses

- 3.2.2 Local Governments

- 3.2.3 and Projects with Budget Constraints

- 3.2.4 Thereby Supporting the Market's Growth; Analog Cameras Boast Simpler Technology and User Interfaces

- 3.2.5 Rendering them Easier to Install

- 3.3. Market Restrains

- 3.3.1 Cost-Effectiveness of Analog Cameras' Appeals to Smaller Businesses

- 3.3.2 Local Governments

- 3.3.3 and Projects with Budget Constraints

- 3.3.4 Thereby Supporting the Market's Growth; Analog Cameras Boast Simpler Technology and User Interfaces

- 3.3.5 Rendering them Easier to Install

- 3.4. Market Trends

- 3.4.1 Cost-Effectiveness of Analog Cameras' Appeals to Smaller Businesses and Projects with Budget Constraints

- 3.4.2 thereby Supporting the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Surveillance Analog Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation and Logistics

- 5.1.5. Industrial

- 5.1.6. Others (

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zhuhai RaySharp Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zhejiang Uniview Technologies Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shenzhen TVT Digital Technology Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shenzhen Sunell Technology Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JER TECHNOLOGY CO LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hanwha Vision Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shenzhen MVTEAM Technology CoLtd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shenzhen LOYALTY-SECU Technology Co LTD

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jovision Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CP PLUS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dahua Technology Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Zhuhai RaySharp Technology Co Ltd

List of Figures

- Figure 1: China Surveillance Analog Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Surveillance Analog Camera Market Share (%) by Company 2025

List of Tables

- Table 1: China Surveillance Analog Camera Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 2: China Surveillance Analog Camera Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 3: China Surveillance Analog Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Surveillance Analog Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: China Surveillance Analog Camera Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: China Surveillance Analog Camera Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: China Surveillance Analog Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: China Surveillance Analog Camera Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Surveillance Analog Camera Market?

The projected CAGR is approximately 5.27%.

2. Which companies are prominent players in the China Surveillance Analog Camera Market?

Key companies in the market include Zhuhai RaySharp Technology Co Ltd, Zhejiang Uniview Technologies Co Ltd, Shenzhen TVT Digital Technology Co Ltd, Shenzhen Sunell Technology Corporation, JER TECHNOLOGY CO LTD, Hanwha Vision Co Ltd, Shenzhen MVTEAM Technology CoLtd, Shenzhen LOYALTY-SECU Technology Co LTD, Jovision Technology Co Ltd, CP PLUS, Dahua Technology Co Ltd, Hangzhou Hikvision Digital Technology Co Ltd.

3. What are the main segments of the China Surveillance Analog Camera Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost-Effectiveness of Analog Cameras' Appeals to Smaller Businesses. Local Governments. and Projects with Budget Constraints. Thereby Supporting the Market's Growth; Analog Cameras Boast Simpler Technology and User Interfaces. Rendering them Easier to Install.

6. What are the notable trends driving market growth?

Cost-Effectiveness of Analog Cameras' Appeals to Smaller Businesses and Projects with Budget Constraints. thereby Supporting the Market's Growth.

7. Are there any restraints impacting market growth?

Cost-Effectiveness of Analog Cameras' Appeals to Smaller Businesses. Local Governments. and Projects with Budget Constraints. Thereby Supporting the Market's Growth; Analog Cameras Boast Simpler Technology and User Interfaces. Rendering them Easier to Install.

8. Can you provide examples of recent developments in the market?

April 2024: Hikvision announced the latest iteration of its Turbo HD analog security products, Turbo HD 8.0. This upgraded version promises users a more immersive and interactive security experience, enhancing their surveillance capabilities. Turbo HD 8.0 introduces four key innovations: real-time communication, 180-degree video coverage, enhanced night vision, and a broader product range. These upgrades include features like two-way audio, compact dual-lens cameras with stitching technology, and Smart Hybrid Light functionality across the entire Turbo HD camera lineup. Additionally, the launch features a new advanced pro-series DVR equipped with AcuSense technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Surveillance Analog Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Surveillance Analog Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Surveillance Analog Camera Market?

To stay informed about further developments, trends, and reports in the China Surveillance Analog Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence