Key Insights

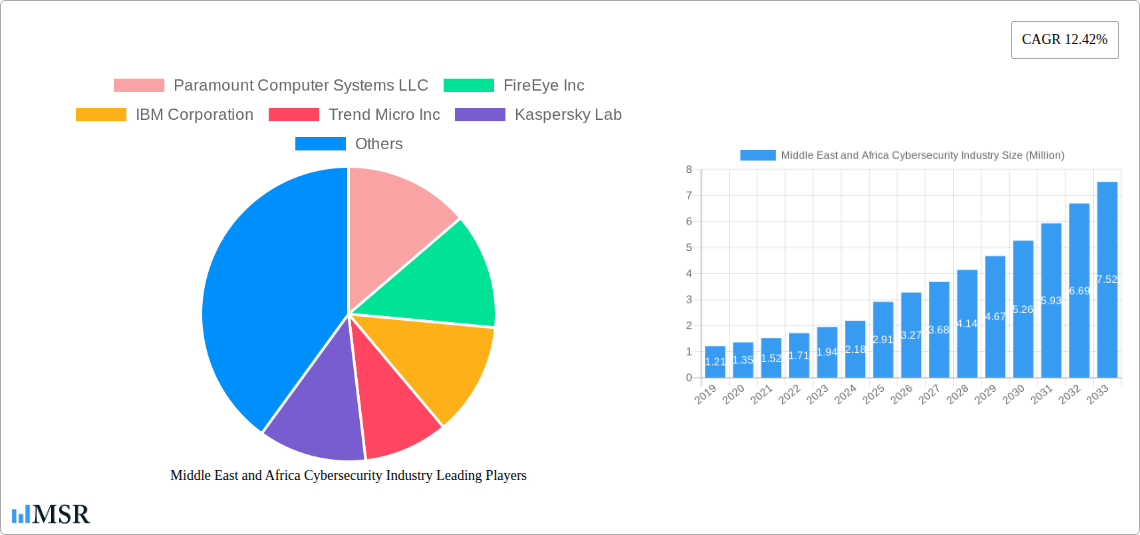

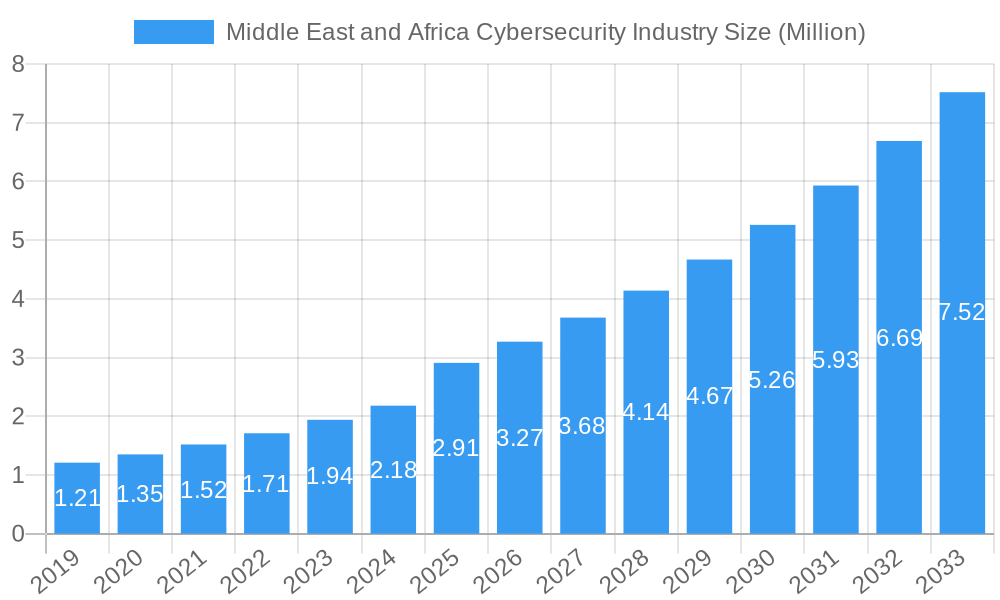

The Middle East and Africa (MEA) cybersecurity market is poised for remarkable expansion, projected to reach \$2.91 billion by 2025. This significant growth is fueled by a Compound Annual Growth Rate (CAGR) of 12.42% throughout the forecast period of 2025-2033. The escalating sophistication of cyber threats, coupled with increasing digitalization across critical sectors such as BFSI, Healthcare, and Government, are primary drivers. Organizations are heavily investing in robust security solutions to protect sensitive data and maintain operational continuity. Key market segments include Threat Intelligence and Response Management, Identity and Access Management, and Data Loss Prevention Management, reflecting the demand for comprehensive threat mitigation and data protection strategies. Managed Services and Professional Services are also experiencing robust demand as organizations seek expert assistance in navigating complex security landscapes and implementing advanced solutions.

Middle East and Africa Cybersecurity Industry Market Size (In Million)

The MEA region, particularly countries like Saudi Arabia and the United Arab Emirates, are at the forefront of this cybersecurity surge due to substantial government initiatives aimed at fostering digital economies and enhancing national security. The adoption of cloud-based security solutions is rapidly gaining traction, offering scalability and flexibility, while on-premise deployments continue to be relevant for organizations with stringent data residency requirements. The aerospace and defense, BFSI, healthcare, and government sectors are the most prominent end-users, underscoring the critical need for advanced cybersecurity measures in these high-stakes industries. Despite this strong growth trajectory, the market faces challenges such as a shortage of skilled cybersecurity professionals and the high cost of implementing advanced security technologies. However, the continuous evolution of threat landscapes and the increasing regulatory compliance mandates are expected to outweigh these restraints, propelling the MEA cybersecurity market towards sustained and accelerated growth.

Middle East and Africa Cybersecurity Industry Company Market Share

Unleash Your Competitive Edge: Middle East & Africa Cybersecurity Industry Report 2025-2033

Gain unparalleled insights into the booming Middle East and Africa (MEA) cybersecurity market. This comprehensive report provides an in-depth analysis of market dynamics, industry trends, and strategic opportunities from 2019-2033, with a strong focus on the base and estimated year of 2025 and the forecast period of 2025-2033. Discover how leading cybersecurity solutions, including Threat Intelligence and Response Management, Identity and Access Management, Data Loss Prevention Management, Security and Vulnerability Management, Unified Threat Management, and Enterprise Risk and Compliance, are shaping the region. Understand the pivotal role of Managed Services and Professional Services, and the impact of Cloud and On-premise deployments across critical end-user industries like Aerospace and Defense, BFSI, Healthcare, Manufacturing, Retail, Government, and IT and Telecommunication.

Middle East and Africa Cybersecurity Industry Market Concentration & Dynamics

The Middle East and Africa (MEA) cybersecurity market, while experiencing rapid growth, exhibits a moderate level of market concentration. Dominant players like IBM Corporation, Cisco Systems Inc, and Palo Alto Networks Inc hold significant market share, particularly in enterprise-grade solutions for BFSI and Government sectors. However, the burgeoning digital transformation across the region, coupled with increasing cyber threats, has fostered a dynamic innovation ecosystem. Numerous regional and international cybersecurity companies, including Paramount Computer Systems LLC, FireEye Inc, Trend Micro Inc, Kaspersky Lab, Check Point Software Technologies Ltd, Broadcom Inc (Symantec Corporation), DTS Solutions In, and Dell Technologies, are actively contributing to this landscape. Regulatory frameworks are evolving, with governments in the UAE, Saudi Arabia, and South Africa implementing stricter data protection and cybersecurity mandates, driving demand for compliance solutions. The threat of sophisticated cyberattacks acts as a significant differentiator, pushing the adoption of advanced security measures. M&A activities are on the rise as larger players seek to acquire niche technologies and expand their regional footprint. The number of M&A deals is projected to increase by 15% in the forecast period. Substitute products, such as traditional IT security measures, are gradually being replaced by integrated and advanced cybersecurity solutions. End-user trends indicate a strong preference for cloud-based security solutions, particularly among SMEs.

Middle East and Africa Cybersecurity Industry Industry Insights & Trends

The MEA cybersecurity market is poised for substantial growth, with an estimated market size of $35 Billion in 2025, projected to reach $80 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 10.5%. This robust expansion is driven by a confluence of factors, including the accelerating digital transformation initiatives across the region, the increasing sophistication and frequency of cyber threats, and the growing awareness among businesses and governments regarding the paramount importance of data security and privacy. The ongoing digital transformation, encompassing cloud adoption, IoT proliferation, and the rise of AI-driven applications, has significantly expanded the attack surface, necessitating advanced cybersecurity measures. Furthermore, the increasing adoption of remote work models has amplified the need for secure endpoint protection and identity and access management solutions. Technological disruptions, such as the advancement of AI and machine learning in cybersecurity, are enabling more proactive threat detection and response capabilities. The evolving consumer behaviors, driven by a greater emphasis on data privacy and the potential for reputational damage from breaches, are compelling organizations to invest heavily in comprehensive cybersecurity strategies. The escalating geopolitical tensions in certain parts of the MEA region also contribute to increased demand for robust national cybersecurity defenses. The growth in e-commerce and digital payment systems further underscores the need for secure transaction environments. The market is also witnessing a surge in demand for managed security services as organizations increasingly outsource their cybersecurity operations to specialized providers to enhance efficiency and expertise. The sheer volume of sensitive data being generated and processed across industries like BFSI and Government creates a continuous demand for sophisticated data loss prevention and security and vulnerability management solutions. The report forecasts a steady increase in cybersecurity spending by small and medium-sized enterprises (SMEs) by 12% annually, as they become more aware of their vulnerabilities.

Key Markets & Segments Leading Middle East and Africa Cybersecurity Industry

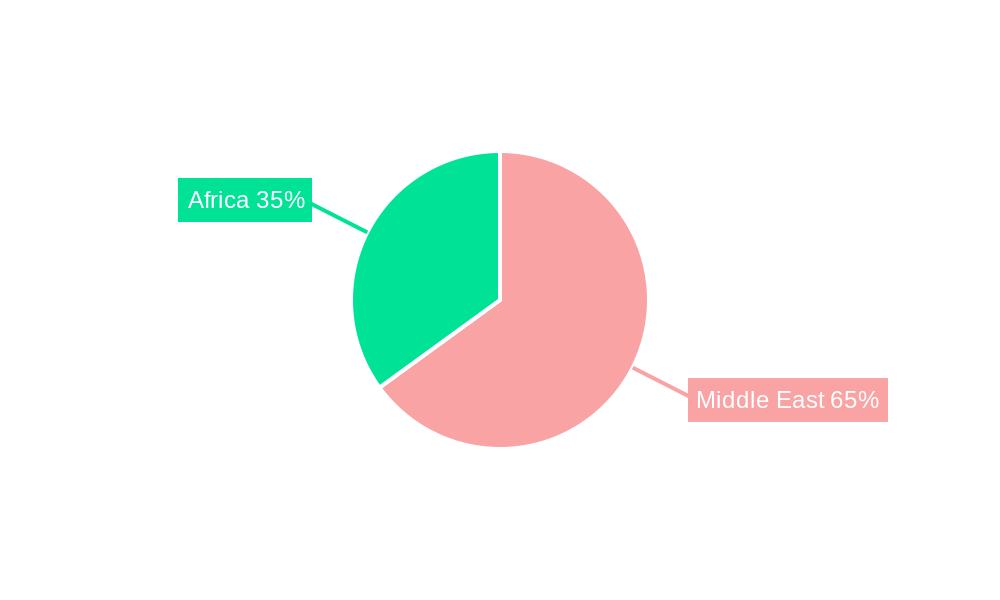

The Middle East, particularly the GCC countries (UAE, Saudi Arabia, Qatar), is emerging as the dominant region within the MEA cybersecurity landscape, driven by significant government investments in digital infrastructure, a thriving financial services sector, and a strong focus on national security. The BFSI sector leads in cybersecurity adoption, fueled by stringent regulatory requirements and the high value of financial data. The Government sector also presents a substantial market, with nations prioritizing the protection of critical infrastructure and sensitive citizen data.

Dominant Solutions:

- Threat Intelligence and Response Management: Crucial for proactive threat detection and rapid incident response, this segment is experiencing high demand across all sectors. Economic growth and increasing cyber-attack sophistication are key drivers.

- Identity and Access Management (IAM): With the rise of cloud adoption and remote work, ensuring secure user access and authentication is paramount. Regulatory compliance further boosts IAM adoption.

- Security and Vulnerability Management: Essential for identifying and mitigating security weaknesses, this segment is a foundational element of any robust cybersecurity strategy. The increasing complexity of IT environments makes this indispensable.

- Unified Threat Management (UTM): Particularly attractive to SMEs due to its cost-effectiveness and integrated security features, UTM solutions are gaining traction across the region.

Dominant Services:

- Managed Services: The increasing complexity of cybersecurity threats and the shortage of skilled cybersecurity professionals are driving the demand for managed security services. Organizations are leveraging external expertise to manage their security operations effectively. The UAE and Saudi Arabia are leading this trend with a projected 18% increase in managed services adoption.

- Professional Services: Consulting, implementation, and audit services are essential for organizations to develop and implement comprehensive cybersecurity strategies.

Dominant Deployments:

- Cloud: The rapid adoption of cloud computing across various industries makes cloud-based security solutions highly desirable. Cloud deployments offer scalability, flexibility, and cost-efficiency. The Middle East is expected to see a 20% surge in cloud-based cybersecurity deployments.

- On-premise: While cloud is dominant, on-premise solutions remain critical for organizations with highly sensitive data or stringent regulatory requirements, particularly in the government and defense sectors.

Dominant End Users:

- BFSI: Holds the largest market share due to regulatory pressures and the high value of financial data.

- Government: National security concerns and the protection of critical infrastructure drive significant investment.

- IT and Telecommunication: As the backbone of digital transformation, this sector requires robust cybersecurity to protect its own infrastructure and the services it provides to other industries.

Middle East and Africa Cybersecurity Industry Product Developments

The MEA cybersecurity market is witnessing rapid product innovation focused on enhancing threat detection and response capabilities. Advanced solutions incorporating Artificial Intelligence (AI) and Machine Learning (ML) are becoming mainstream, enabling predictive threat analysis and automated incident remediation. Key product developments include sophisticated endpoint detection and response (EDR) tools, cloud-native security platforms offering seamless integration, and next-generation firewalls with advanced threat prevention features. The emphasis is on creating integrated security ecosystems that provide comprehensive protection against evolving cyber threats, including ransomware, zero-day exploits, and insider threats.

Challenges in the Middle East and Africa Cybersecurity Industry Market

The MEA cybersecurity market faces several challenges, including a significant cybersecurity skills gap, with an estimated shortage of 50,000 professionals. Diverse regulatory landscapes across different countries can create compliance complexities. The high cost of advanced cybersecurity solutions can be a barrier for smaller enterprises. Additionally, the increasing sophistication of cyberattacks requires continuous investment in cutting-edge technologies, which can strain IT budgets. Geopolitical instability in certain regions also poses a unique challenge, demanding robust and adaptable security frameworks.

Forces Driving Middle East and Africa Cybersecurity Industry Growth

The growth of the MEA cybersecurity industry is propelled by several key forces. The rapid digital transformation across the region, encompassing cloud adoption and the expansion of IoT, creates an ever-expanding attack surface. Escalating cyber threats, from state-sponsored attacks to sophisticated ransomware campaigns, are compelling organizations to prioritize cybersecurity investments. Stringent government regulations and data privacy laws, such as those in the UAE and Saudi Arabia, are mandating compliance and driving demand for security solutions. Furthermore, increasing awareness among businesses about the financial and reputational costs of cyber breaches is a significant growth catalyst.

Challenges in the Middle East and Africa Cybersecurity Industry Market

Long-term growth catalysts for the MEA cybersecurity market are anchored in continuous innovation and strategic market expansion. The increasing adoption of AI and machine learning in cybersecurity solutions will enable more proactive and intelligent threat mitigation. The growing trend of cloud migration across industries will fuel the demand for cloud-native security platforms and services. Strategic partnerships between global cybersecurity leaders and local system integrators will facilitate wider market penetration and tailored solutions for regional needs. Furthermore, the development of robust national cybersecurity strategies by governments will create sustained demand and foster a more secure digital ecosystem.

Emerging Opportunities in Middle East and Africa Cybersecurity Industry

Emerging opportunities in the MEA cybersecurity industry are abundant. The burgeoning SME sector presents a significant untapped market for affordable and scalable cybersecurity solutions. The growing demand for specialized security services, such as penetration testing and security awareness training, is creating new business avenues. The expansion of 5G networks will necessitate robust security measures for increased connectivity and data flow. Furthermore, the development of smart cities across the region will require comprehensive cybersecurity frameworks to protect critical infrastructure and citizen data, opening doors for innovative IoT security solutions.

Leading Players in the Middle East and Africa Cybersecurity Industry Sector

- Paramount Computer Systems LLC

- FireEye Inc

- IBM Corporation

- Trend Micro Inc

- Kaspersky Lab

- Check Point Software Technologies Ltd

- Cisco Systems Inc

- Broadcom Inc (Symantec Corporation)

- DTS Solutions In

- Palo Alto Networks Inc

- Dell Technologies

Key Milestones in Middle East and Africa Cybersecurity Industry Industry

- February 2023: Mastercard partnered with Nigeria-based digital payment startup NowNow to help SMEs avoid the risk of cyberattacks. The alliance aims to provide free resources to SMEs for education and strengthening their cybersecurity ecosystem through regular web application penetration tests.

- January 2023: Tata Communications International Pte Ltd expanded its collaboration with Intertec Systems, a UAE-based system integrator, to offer managed services in the region. Tata Communications contributes its Cyber Security Operations Centre (SOC) and managed security services to bolster regional cyber defenses.

Strategic Outlook for Middle East and Africa Cybersecurity Industry Market

The strategic outlook for the MEA cybersecurity market remains exceptionally strong, driven by the imperative for enhanced digital resilience. Future growth will be accelerated by the increasing adoption of AI-powered security solutions, the continued migration to cloud environments, and the strategic expansion of managed security services. Focus on public-private partnerships and government initiatives to bolster national cybersecurity infrastructure will create sustained demand. Emerging opportunities in sectors like IoT security and advanced threat intelligence present significant growth accelerators, positioning the MEA region as a critical hub for cybersecurity innovation and investment.

Middle East and Africa Cybersecurity Industry Segmentation

-

1. Solution

- 1.1. Threat Intelligence and Response Management

- 1.2. Identity and Access Management

- 1.3. Data Loss Prevention Management

- 1.4. Security and Vulnerability Management

- 1.5. Unified Threat Management

- 1.6. Enterprise Risk and Compliance

-

2. Service

- 2.1. Managed Services

- 2.2. Professional Services

-

3. Deployment

- 3.1. Cloud

- 3.2. On-premise

-

4. End User

- 4.1. Aerospace and Defense

- 4.2. BFSI

- 4.3. Healthcare

- 4.4. Manufacturing

- 4.5. Retail

- 4.6. Government

- 4.7. IT and Telecommunication

- 4.8. Other End users

Middle East and Africa Cybersecurity Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Cybersecurity Industry Regional Market Share

Geographic Coverage of Middle East and Africa Cybersecurity Industry

Middle East and Africa Cybersecurity Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Cyber Security Incidents; Consistent Threats From the Underground Market

- 3.3. Market Restrains

- 3.3.1. Lack of Cyber Security Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness

- 3.4. Market Trends

- 3.4.1. Cloud Segment is expected to grow at a higher pace.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Cybersecurity Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Threat Intelligence and Response Management

- 5.1.2. Identity and Access Management

- 5.1.3. Data Loss Prevention Management

- 5.1.4. Security and Vulnerability Management

- 5.1.5. Unified Threat Management

- 5.1.6. Enterprise Risk and Compliance

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Managed Services

- 5.2.2. Professional Services

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. Cloud

- 5.3.2. On-premise

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Aerospace and Defense

- 5.4.2. BFSI

- 5.4.3. Healthcare

- 5.4.4. Manufacturing

- 5.4.5. Retail

- 5.4.6. Government

- 5.4.7. IT and Telecommunication

- 5.4.8. Other End users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. South Africa Middle East and Africa Cybersecurity Industry Analysis, Insights and Forecast, 2020-2032

- 7. Sudan Middle East and Africa Cybersecurity Industry Analysis, Insights and Forecast, 2020-2032

- 8. Uganda Middle East and Africa Cybersecurity Industry Analysis, Insights and Forecast, 2020-2032

- 9. Tanzania Middle East and Africa Cybersecurity Industry Analysis, Insights and Forecast, 2020-2032

- 10. Kenya Middle East and Africa Cybersecurity Industry Analysis, Insights and Forecast, 2020-2032

- 11. Rest of Africa Middle East and Africa Cybersecurity Industry Analysis, Insights and Forecast, 2020-2032

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Paramount Computer Systems LLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 FireEye Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IBM Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Trend Micro Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kaspersky Lab

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Check Point Software Technologies Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cisco Systems Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Broadcom Inc (Symantec Corporation)

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 DTS Solutions In

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Palo Alto Networks Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Dell Technologies

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Paramount Computer Systems LLC

List of Figures

- Figure 1: Middle East and Africa Cybersecurity Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Cybersecurity Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 3: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 5: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: South Africa Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Sudan Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Uganda Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Tanzania Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Kenya Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Africa Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 15: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 16: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 17: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Middle East and Africa Cybersecurity Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Saudi Arabia Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Arab Emirates Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Israel Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Qatar Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Kuwait Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Oman Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Bahrain Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Jordan Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Lebanon Middle East and Africa Cybersecurity Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Cybersecurity Industry?

The projected CAGR is approximately 12.42%.

2. Which companies are prominent players in the Middle East and Africa Cybersecurity Industry?

Key companies in the market include Paramount Computer Systems LLC, FireEye Inc, IBM Corporation, Trend Micro Inc, Kaspersky Lab, Check Point Software Technologies Ltd, Cisco Systems Inc, Broadcom Inc (Symantec Corporation), DTS Solutions In, Palo Alto Networks Inc, Dell Technologies.

3. What are the main segments of the Middle East and Africa Cybersecurity Industry?

The market segments include Solution, Service, Deployment , End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Cyber Security Incidents; Consistent Threats From the Underground Market.

6. What are the notable trends driving market growth?

Cloud Segment is expected to grow at a higher pace..

7. Are there any restraints impacting market growth?

Lack of Cyber Security Professionals; High Reliance on Traditional Authentication Methods and Low Preparedness.

8. Can you provide examples of recent developments in the market?

February 2023: Mastercard has partnered with Nigeria-based digital payment startup NowNow to help SMEs avoid the risk of cyberattacks. The alliance intends to accomplish this by giving free resources to SMEs to assist in educating and strengthening their cybersecurity ecosystem. Through regular web application penetration tests, NowNow strives to protect SMEs. Such checks guarantee that SMEs' apps are not vulnerable to cyber threats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Cybersecurity Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Cybersecurity Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Cybersecurity Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Cybersecurity Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence