Key Insights

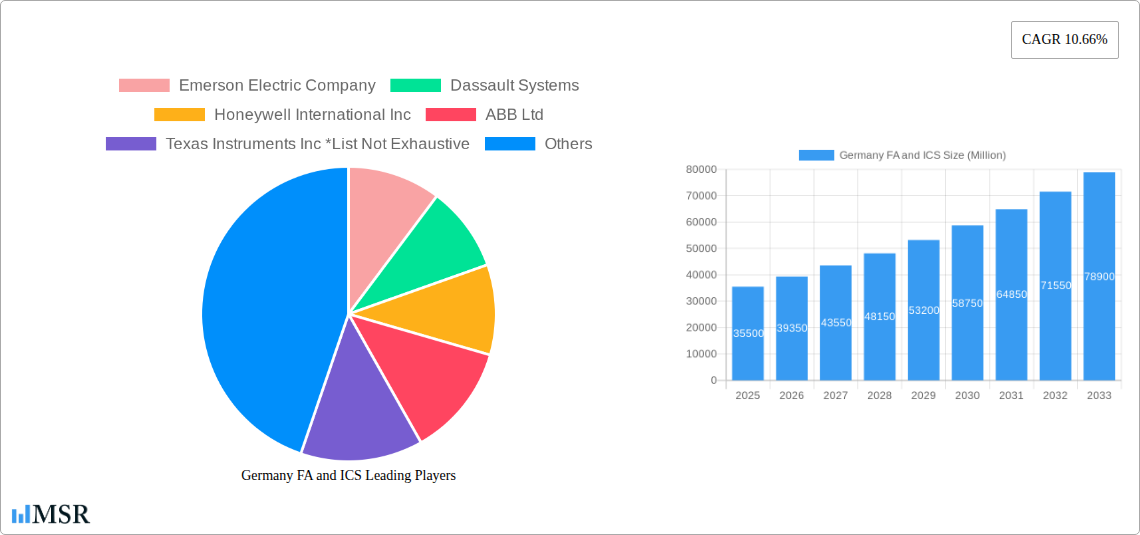

The German Factory Automation (FA) and Industrial Control Systems (ICS) market is poised for significant expansion, driven by a projected market size of approximately USD 35,500 million in 2025 and a robust Compound Annual Growth Rate (CAGR) of 10.66% through 2033. This growth is fueled by Germany's entrenched position as a manufacturing powerhouse, where industries like automotive, chemical, and pharmaceuticals are heavily invested in digital transformation and Industry 4.0 initiatives. Key drivers include the increasing demand for enhanced operational efficiency, stringent safety regulations, and the imperative to reduce production costs and energy consumption. The proliferation of smart manufacturing technologies, predictive maintenance, and the integration of AI and machine learning into industrial processes are further propelling the adoption of advanced FA and ICS solutions. Sectors such as oil and gas and power and utilities are also contributing to market dynamism through their ongoing modernization efforts and the need for resilient and secure control systems.

Germany FA and ICS Market Size (In Billion)

The market segmentation reveals a strong demand for core ICS components like Distributed Control Systems (DCS), Programmable Logic Controllers (PLC), and Supervisory Control and Data Acquisition (SCADA) systems, which form the backbone of automated operations. Alongside these, Manufacturing Execution Systems (MES) and Human Machine Interfaces (HMI) are crucial for optimizing production workflows and enabling intuitive operator interaction. The field devices segment is experiencing rapid innovation, with Machine Vision, Industrial Robotics, and advanced Sensors & Transmitters playing a pivotal role in data collection and automated decision-making. Despite the strong growth trajectory, the market faces certain restraints, including the high initial investment costs associated with sophisticated automation solutions and the ongoing need for skilled personnel to manage and maintain these complex systems. However, the overwhelming benefits in terms of productivity, quality, and competitiveness are expected to outweigh these challenges, ensuring sustained market development in Germany.

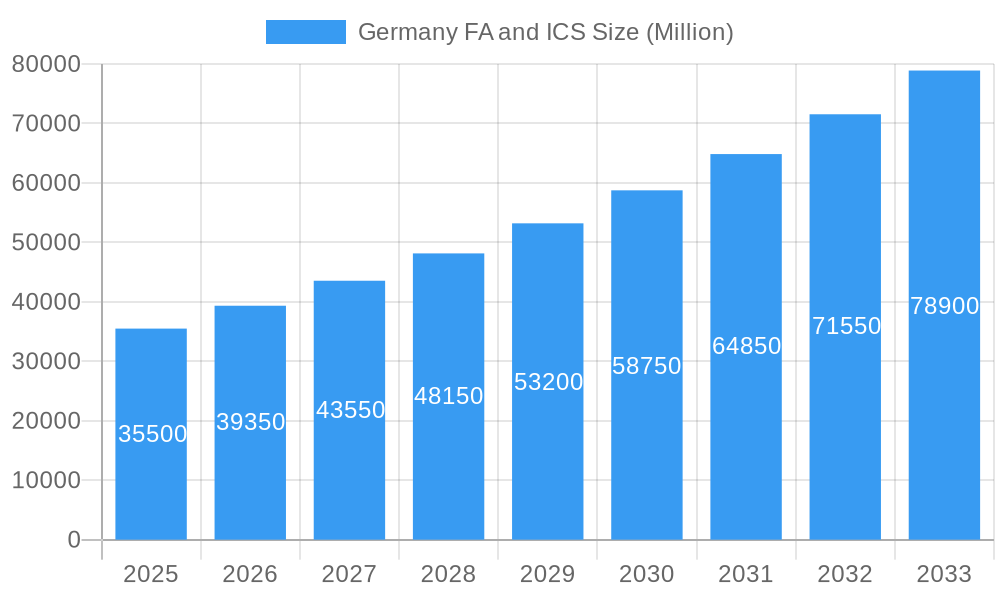

Germany FA and ICS Company Market Share

Germany FA and ICS Market Analysis: Unlocking Growth & Innovation (2019-2033)

This comprehensive report offers an in-depth analysis of the Germany Factory Automation (FA) and Industrial Control Systems (ICS) market, providing critical insights for industry stakeholders. Covering the historical period from 2019 to 2024, a base year of 2025, and a robust forecast period extending to 2033, this report is your definitive guide to understanding market dynamics, key players, and future trajectories. Discover actionable intelligence on industrial automation Germany, PLC market Germany, DCS market Germany, SCADA systems Germany, robotics in manufacturing Germany, and digital transformation in German industry.

Germany FA and ICS Market Concentration & Dynamics

The Germany FA and ICS market exhibits a moderate to high concentration, with leading global players like Siemens AG, ABB Ltd, and Rockwell Automation Inc. commanding significant market share. The innovation ecosystem is vibrant, fueled by substantial R&D investments from companies such as Emerson Electric Company and Honeywell International Inc. Strong regulatory frameworks, particularly concerning industrial safety and data security, are shaping market entry and product development. The threat of substitute products is relatively low, given the specialized nature of FA and ICS solutions. End-user trends indicate a strong push towards Industry 4.0 adoption, smart manufacturing, and increased automation across all sectors. Mergers and acquisitions (M&A) activities, although not at an extreme level, are observed, indicating strategic consolidation and portfolio expansion among key participants. We estimate a total M&A deal count of 35 during the historical period, with an average deal value of xx Million EUR.

Germany FA and ICS Industry Insights & Trends

The Germany FA and ICS market is poised for substantial growth, projected to reach a market size of xx Billion EUR by 2033, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Key growth drivers include the relentless pursuit of operational efficiency, enhanced productivity, and stringent quality control measures across German manufacturing. Technological disruptions, such as the proliferation of the Internet of Things (IoT), Artificial Intelligence (AI) in industrial applications, and advanced robotics, are fundamentally reshaping the landscape. Evolving consumer behaviors, demanding customized products and shorter lead times, further accelerate the adoption of agile and automated manufacturing processes. The ongoing digitalization of German industries is a paramount trend, driving demand for integrated industrial control systems, field devices, and software solutions like Product Lifecycle Management (PLM) and Manufacturing Execution Systems (MES).

Key Markets & Segments Leading Germany FA and ICS

The Industrial Control Systems (ICS) segment, encompassing Distributed Control Systems (DCS), Programmable Logic Controllers (PLC), and Supervisory Control and Data Acquisition (SCADA), currently dominates the Germany FA and ICS market. This dominance is driven by the foundational role these systems play in modern manufacturing operations, enabling precise control, monitoring, and data management. Within the Field Devices segment, Machine Vision and Industrial Robotics are experiencing accelerated growth, fueled by the need for sophisticated automation and quality inspection. The Automotive and Transportation and Chemical and Petrochemical end-user industries represent the largest revenue contributors, owing to their high levels of automation investment and complex operational requirements.

- Drivers for ICS Dominance:

- Industry 4.0 Adoption: Essential for creating smart factories and interconnected operations.

- Operational Efficiency: Enables streamlined production processes and reduced downtime.

- Data Integration: Facilitates real-time data collection for informed decision-making.

- Drivers for Field Device Growth:

- Automation Advancement: Robotics and machine vision are crucial for high-precision tasks.

- Safety Standards: Advanced safety systems are paramount in industrial settings.

- Precision Measurement: Sensors and transmitters ensure accurate process control.

- Dominance in End-User Industries:

- Automotive: High demand for robotic assembly, sophisticated control systems, and PLM solutions.

- Chemical & Petrochemical: Critical need for robust DCS, SCADA, and safety systems due to hazardous environments and complex processes.

- Power & Utilities: Growing investment in smart grids and automated power generation requires advanced ICS.

Germany FA and ICS Product Developments

Product development in the Germany FA and ICS market is characterized by a strong focus on intelligent automation, predictive maintenance, and enhanced connectivity. Companies are investing heavily in AI-powered analytics for PLCs and DCS, enabling proactive fault detection and optimized performance. The integration of IoT capabilities into sensors & transmitters and Human Machine Interfaces (HMIs) is creating more intuitive and data-rich operational environments. Advancements in machine vision are enabling higher levels of defect detection and quality control, while more collaborative and dexterous industrial robots are being developed for intricate tasks. The emphasis is on creating modular, scalable, and secure solutions that support the evolving demands of smart manufacturing and digital transformation.

Challenges in the Germany FA and ICS Market

Despite robust growth prospects, the Germany FA and ICS market faces several challenges. Cybersecurity threats remain a significant concern, necessitating continuous investment in robust security solutions for networked industrial systems. The shortage of skilled labor in automation and control engineering poses a barrier to the full adoption and implementation of advanced technologies. Furthermore, the initial capital investment required for implementing sophisticated FA and ICS solutions can be substantial, particularly for small and medium-sized enterprises (SMEs). Regulatory compliance and evolving standards add complexity to product development and deployment. We estimate the total cost of cybersecurity breaches in the sector to be xx Million EUR annually.

Forces Driving Germany FA and ICS Growth

Several powerful forces are propelling the Germany FA and ICS market forward. The global imperative for enhanced manufacturing competitiveness and increased operational efficiency is a primary driver. The ongoing digital transformation and the widespread adoption of Industry 4.0 principles are creating unprecedented demand for interconnected and intelligent automation solutions. Government initiatives promoting industrial modernization and the development of smart factories further stimulate market growth. Additionally, the increasing focus on sustainability and energy efficiency in industrial processes is driving the adoption of advanced control systems and automation technologies that optimize resource utilization.

Challenges in the Germany FA and ICS Market

Looking ahead, long-term growth catalysts for the Germany FA and ICS market are centered around continuous innovation and strategic market expansion. The development of next-generation AI and machine learning algorithms for industrial applications will unlock new levels of predictive analytics and autonomous operations. Partnerships and collaborations between technology providers and end-users will foster tailored solutions and accelerate adoption. Expanding the reach of automation into emerging industrial sectors and geographical regions presents significant growth opportunities. Furthermore, the ongoing refinement of cybersecurity protocols will build greater trust and enable wider deployment of interconnected systems, ensuring the resilience and integrity of industrial operations.

Emerging Opportunities in Germany FA and ICS

Emerging opportunities in the Germany FA and ICS market are diverse and promising. The growing demand for sustainable manufacturing is creating a market for automation solutions that optimize energy consumption and reduce waste. The advancement of edge computing in industrial settings offers opportunities for localized data processing and real-time decision-making, enhancing the responsiveness of FA and ICS. The increasing adoption of digital twins for process simulation and optimization presents a significant growth avenue. Furthermore, the expansion of automation in sectors like pharmaceuticals and food and beverage for enhanced traceability and compliance opens new market segments. The trend towards more flexible and agile manufacturing also drives demand for modular and adaptable ICS solutions.

Leading Players in the Germany FA and ICS Sector

- Emerson Electric Company

- Dassault Systems

- Honeywell International Inc.

- ABB Ltd

- Texas Instruments Inc

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Autodesk Inc.

- Robert Bosch GmbH

- Rockwell Automation Inc.

Key Milestones in Germany FA and ICS Industry

- March 2021: BP and SABIC (Saudi Basic Industries Corp.) signed an agreement to jointly work at the Gelsenkirchen, Germany chemical complex. This collaboration aims to increase the production of certified circular products from used mixed plastics, reducing fossil resource dependency.

- July 2020: K+S, an international mining company, implemented an AP Sensing Linear Heat Detection (LHD) solution for early fire detection at their salt production site in Germany.

Strategic Outlook for Germany FA and ICS Market

The strategic outlook for the Germany FA and ICS market is exceptionally positive, driven by a confluence of technological advancements and strong industrial demand. Growth accelerators include the continued push for smart manufacturing, the integration of AI and IoT across the value chain, and the increasing adoption of cybersecurity-resilient solutions. Companies that focus on offering integrated platforms, innovative software solutions, and comprehensive support services will be best positioned for success. The market is expected to witness further consolidation and strategic partnerships, fostering an environment of continuous innovation and enhanced competitive offerings. The commitment to Industry 4.0 principles by German industries underpins a sustained demand for advanced FA and ICS.

Germany FA and ICS Segmentation

-

1. Type

-

1.1. Industrial Control Systems

- 1.1.1. Distributed Control System (DCS)

- 1.1.2. Programable Logic Controller (PLC)

- 1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 1.1.4. Product Lifecycle Management (PLM)

- 1.1.5. Manufacturing Execution System (MES)

- 1.1.6. Human Machine Interface (HMI)

- 1.1.7. Other Industrial Control Systems

-

1.2. Field Devices

- 1.2.1. Machine Vision

- 1.2.2. Industrial Robotics

- 1.2.3. Electric Motors

- 1.2.4. Safety Systems

- 1.2.5. Sensors & Transmitters

- 1.2.6. Other Field Devices

-

1.1. Industrial Control Systems

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemical

- 2.3. Power and Utilities

- 2.4. Food and Beverage

- 2.5. Automotive and Transportation

- 2.6. Pharmaceutical

- 2.7. Other End-user Industries

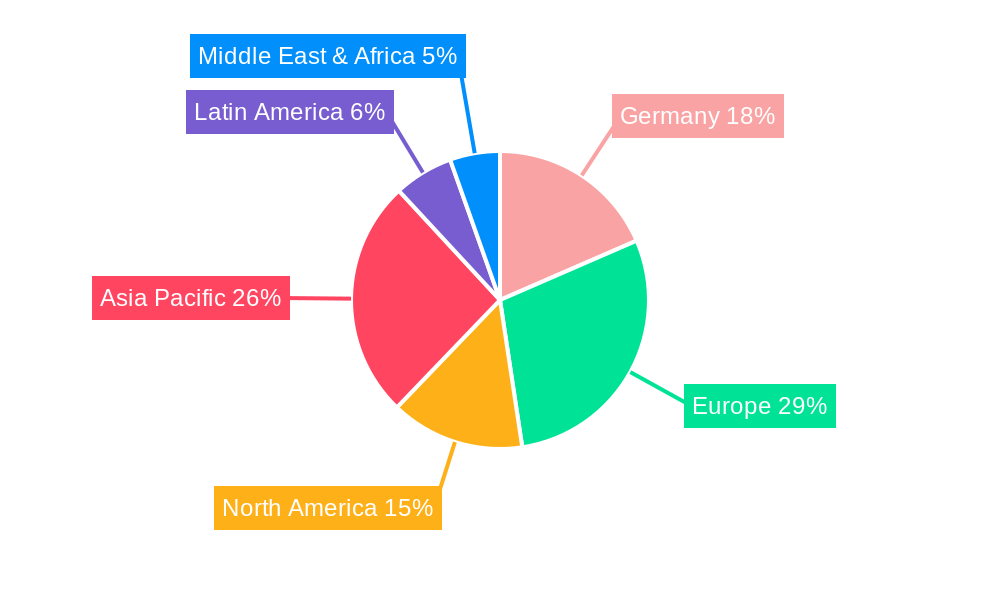

Germany FA and ICS Segmentation By Geography

- 1. Germany

Germany FA and ICS Regional Market Share

Geographic Coverage of Germany FA and ICS

Germany FA and ICS REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Gaining Prominence for Automation Technologies; Increasing Focus Towards Cost Optimization and Business Process Improvement

- 3.3. Market Restrains

- 3.3.1. ; High Initial Investment and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Electric Motors Segment is Observing Significant Increase

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany FA and ICS Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Control Systems

- 5.1.1.1. Distributed Control System (DCS)

- 5.1.1.2. Programable Logic Controller (PLC)

- 5.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 5.1.1.4. Product Lifecycle Management (PLM)

- 5.1.1.5. Manufacturing Execution System (MES)

- 5.1.1.6. Human Machine Interface (HMI)

- 5.1.1.7. Other Industrial Control Systems

- 5.1.2. Field Devices

- 5.1.2.1. Machine Vision

- 5.1.2.2. Industrial Robotics

- 5.1.2.3. Electric Motors

- 5.1.2.4. Safety Systems

- 5.1.2.5. Sensors & Transmitters

- 5.1.2.6. Other Field Devices

- 5.1.1. Industrial Control Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Power and Utilities

- 5.2.4. Food and Beverage

- 5.2.5. Automotive and Transportation

- 5.2.6. Pharmaceutical

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North Rhine-Westphalia Germany FA and ICS Analysis, Insights and Forecast, 2020-2032

- 7. Bavaria Germany FA and ICS Analysis, Insights and Forecast, 2020-2032

- 8. Baden-Württemberg Germany FA and ICS Analysis, Insights and Forecast, 2020-2032

- 9. Lower Saxony Germany FA and ICS Analysis, Insights and Forecast, 2020-2032

- 10. Hesse Germany FA and ICS Analysis, Insights and Forecast, 2020-2032

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Emerson Electric Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dassault Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ABB Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Texas Instruments Inc *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitsubishi Electric Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schneider Electric SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Autodesk Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Robert Bosch GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rockwell Automation Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Emerson Electric Company

List of Figures

- Figure 1: Germany FA and ICS Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Germany FA and ICS Share (%) by Company 2025

List of Tables

- Table 1: Germany FA and ICS Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Germany FA and ICS Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Germany FA and ICS Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Germany FA and ICS Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Germany FA and ICS Revenue undefined Forecast, by Country 2020 & 2033

- Table 6: North Rhine-Westphalia Germany FA and ICS Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Bavaria Germany FA and ICS Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Baden-Württemberg Germany FA and ICS Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Lower Saxony Germany FA and ICS Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Hesse Germany FA and ICS Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Germany FA and ICS Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Germany FA and ICS Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 13: Germany FA and ICS Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany FA and ICS?

The projected CAGR is approximately 6.78%.

2. Which companies are prominent players in the Germany FA and ICS?

Key companies in the market include Emerson Electric Company, Dassault Systems, Honeywell International Inc, ABB Ltd, Texas Instruments Inc *List Not Exhaustive, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Autodesk Inc, Robert Bosch GmbH, Rockwell Automation Inc.

3. What are the main segments of the Germany FA and ICS?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Gaining Prominence for Automation Technologies; Increasing Focus Towards Cost Optimization and Business Process Improvement.

6. What are the notable trends driving market growth?

Electric Motors Segment is Observing Significant Increase.

7. Are there any restraints impacting market growth?

; High Initial Investment and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

March 2021 - BP and SABIC (Saudi Basic Industries Corp.), Riyadh, Saudi Arabia, signed an agreement to jointly work at the Gelsenkirchen, Germany, a chemical complex. The companies say the new collaboration will help to increase the production of certified circular products that take used mixed plastics to make feedstock, reducing the number of fossil resources required in the petrochemical plants at the site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany FA and ICS," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany FA and ICS report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany FA and ICS?

To stay informed about further developments, trends, and reports in the Germany FA and ICS, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence