Key Insights

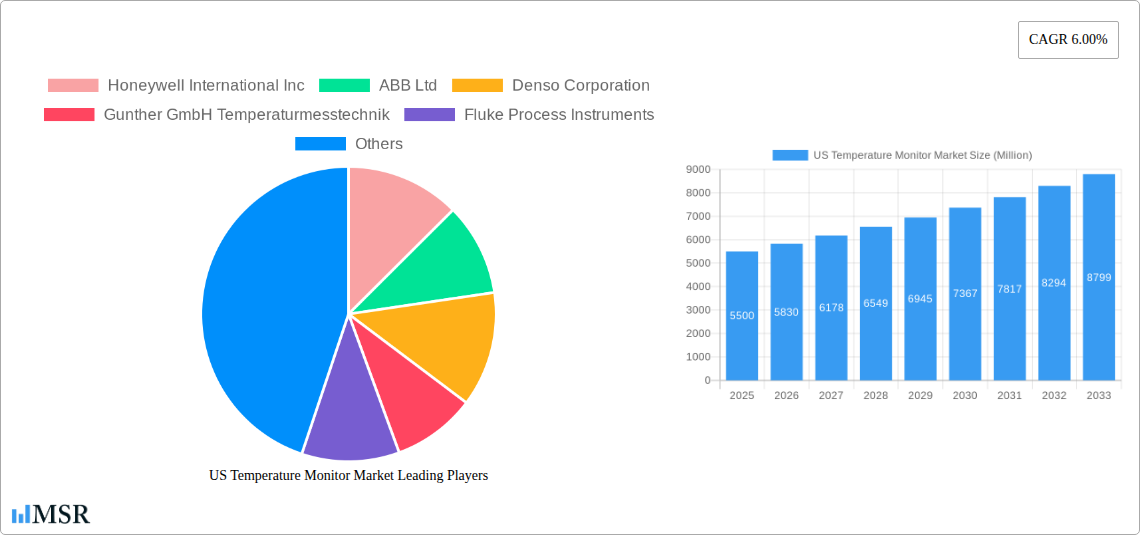

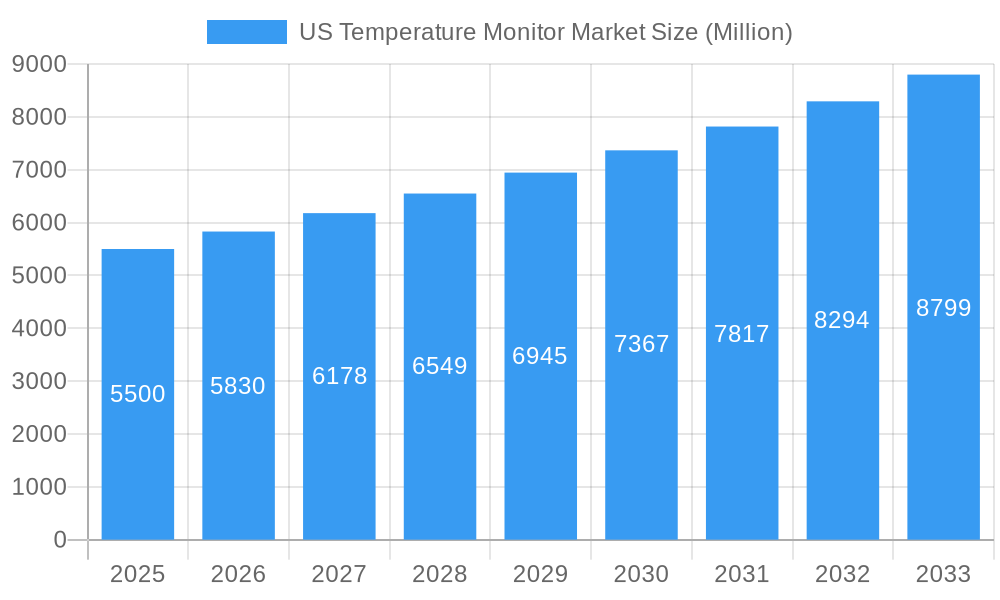

The US temperature monitor market is poised for robust growth, driven by increasing demand across diverse end-user industries and technological advancements. With an estimated market size of $XX million in 2025, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of 6.00% through 2033. This growth is significantly fueled by the stringent requirements for temperature monitoring in sectors like pharmaceuticals, food and beverage, and chemicals, where maintaining precise temperature is critical for product integrity and safety. The burgeoning adoption of IoT-enabled temperature monitoring solutions is also a key driver, offering real-time data, remote access, and enhanced predictive capabilities. Furthermore, the increasing complexity of industrial processes and the need for efficient energy management are compelling industries to invest in sophisticated temperature monitoring systems.

US Temperature Monitor Market Market Size (In Billion)

The market's expansion is further supported by ongoing innovation in sensor technology, leading to the development of more accurate, durable, and cost-effective temperature monitoring devices. While wired solutions remain prevalent, the rapid adoption of wireless technologies, particularly in hard-to-reach or mobile applications, signifies a significant shift. Emerging trends include the integration of artificial intelligence and machine learning for advanced analytics and anomaly detection, as well as the increasing use of fiber optic sensors for specialized industrial environments. However, the market also faces certain restraints, such as the high initial investment cost for advanced systems and the need for skilled personnel to operate and maintain them. Despite these challenges, the overarching demand for enhanced safety, quality control, and operational efficiency across key industries ensures a positive growth trajectory for the US temperature monitor market.

US Temperature Monitor Market Company Market Share

This comprehensive report provides an in-depth analysis of the US Temperature Monitor Market, offering critical insights into market dynamics, technological advancements, and future growth trajectories. Covering the period from 2019 to 2033, with a base year of 2025, this study is an indispensable resource for industry stakeholders, investors, and decision-makers seeking to navigate this rapidly evolving landscape. The US temperature sensor market is poised for significant expansion, driven by increasing demand across diverse end-user industries and continuous technological innovation in wireless temperature monitoring and infrared temperature sensors.

US Temperature Monitor Market Market Concentration & Dynamics

The US Temperature Monitor Market exhibits a moderate to high concentration, characterized by the presence of several large, established players alongside a growing number of specialized technology providers. The innovation ecosystem is robust, fueled by ongoing research and development in sensor technologies, data analytics, and IoT integration. Regulatory frameworks, particularly those related to industrial safety and healthcare, play a crucial role in shaping market entry and product standards. The availability of substitute products, such as manual thermometers, is diminishing as the advantages of automated and connected temperature monitoring solutions become more apparent. End-user trends indicate a strong preference for real-time data, predictive maintenance capabilities, and seamless integration with existing industrial control systems. Mergers and acquisitions (M&A) activities have been observed, though not at an exceptionally high volume, reflecting strategic consolidations and market expansion efforts by key players. We project the US Temperature Monitor Market to witness a steady increase in M&A activities as companies seek to acquire innovative technologies or expand their market reach. Key companies driving this market include Honeywell International Inc, ABB Ltd, Siemens AG, and Emerson Electric Company.

- Market Concentration: Moderate to High

- Innovation Ecosystem: Robust, driven by IoT and advanced sensor R&D.

- Regulatory Frameworks: Influential in industrial safety and healthcare.

- Substitute Products: Declining relevance of manual alternatives.

- End-User Trends: Demand for real-time data, predictive maintenance, and IoT integration.

- M&A Activities: Strategic consolidations and market expansion.

US Temperature Monitor Market Industry Insights & Trends

The US Temperature Monitor Market is experiencing dynamic growth, projected to reach approximately $12 Billion by 2025, with a Compound Annual Growth Rate (CAGR) of around 7.5% during the forecast period of 2025–2033. This growth is significantly propelled by the increasing adoption of advanced temperature monitoring solutions across a wide spectrum of industries, including chemical and petrochemical, oil and gas, and food and beverage. The burgeoning demand for sophisticated wireless temperature sensors and highly accurate thermocouple temperature monitors is a testament to their growing indispensability in ensuring operational efficiency, product quality, and safety compliance. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, are revolutionizing how temperature data is utilized, moving beyond simple monitoring to proactive issue resolution. Furthermore, evolving consumer behaviors, particularly in the industrial sector, emphasize a shift towards smart, connected devices that offer remote accessibility and data-driven decision-making. The increasing regulatory scrutiny on temperature-sensitive processes and products further underpins the sustained demand for reliable temperature monitoring systems. The US temperature transmitter market is also a significant contributor to overall market expansion, facilitating seamless data flow and control. The market's robustness is further evidenced by the continuous introduction of new and improved resistance temperature detectors and thermistor temperature sensors.

Key Markets & Segments Leading US Temperature Monitor Market

The US Temperature Monitor Market is characterized by the dominance of specific segments and industries, reflecting the varied applications and technological preferences. The Wireless segment is emerging as a frontrunner, driven by its flexibility, ease of installation, and cost-effectiveness in large-scale deployments. This is closely followed by Wired solutions, which continue to hold a strong position in applications demanding high reliability and precision. In terms of technology, Infrared Temperature Sensors are gaining substantial traction due to their non-contact measurement capabilities, crucial for high-temperature or hazardous environments. Thermocouple and Resistance Temperature Detector (RTD) technologies remain foundational, offering robust and accurate measurements across a broad temperature range, particularly in industrial settings. The Thermistor segment is also significant, especially in applications requiring high sensitivity and fast response times.

Dominant End-User Industries:

- Chemical and Petrochemical: Critical for process control, safety, and product integrity. Economic growth and stringent safety regulations fuel demand for advanced monitoring.

- Oil and Gas: Essential for upstream, midstream, and downstream operations, ensuring safety and preventing equipment failure in harsh environments.

- Food and Beverage: Paramount for maintaining product quality, safety, and regulatory compliance throughout the supply chain, from production to storage and transportation.

- Power Generation: Vital for monitoring critical components like turbines, boilers, and transformers to prevent downtime and ensure efficient energy production.

- Automotive: Increasingly important for engine management, battery monitoring, and cabin climate control, with the growth of electric vehicles driving new applications.

- Medical: Essential for pharmaceutical manufacturing, vaccine storage, and patient temperature monitoring, with stringent regulatory requirements.

Key Technology Drivers:

- Infrared: Growing demand for non-contact, rapid, and safe temperature measurement.

- Thermocouple & RTD: Continued reliance on these proven technologies for industrial accuracy and durability.

- Thermistor: Increasing use in applications requiring high sensitivity and precise control.

- Temperature Transmitter: Integral for converting sensor signals into usable data for control systems.

- Wireless Technology: Enables remote monitoring, IoT integration, and reduced installation costs.

US Temperature Monitor Market Product Developments

The US Temperature Monitor Market is witnessing a wave of product innovations aimed at enhancing accuracy, connectivity, and user-friendliness. Companies are focusing on miniaturization, increased ruggedness for harsh environments, and the integration of advanced analytics. The development of smart sensors with built-in diagnostic capabilities and remote access features is a key trend. For instance, advancements in fiber optic temperature sensors are opening new possibilities in demanding applications like high-voltage environments and hazardous areas. The market relevance of these developments is underscored by their ability to address specific industry pain points, such as reducing downtime, improving energy efficiency, and ensuring compliance with evolving standards.

Challenges in the US Temperature Monitor Market Market

Despite its robust growth, the US Temperature Monitor Market faces several challenges. These include the high initial investment cost for advanced temperature monitoring systems, particularly for small and medium-sized enterprises. Supply chain disruptions, as seen in recent global events, can impact the availability and pricing of critical components, affecting lead times. Intense competition among numerous players, both established and emerging, can lead to pricing pressures and necessitate continuous innovation to maintain market share. Furthermore, the complexity of integrating new monitoring solutions with legacy industrial systems can pose a significant hurdle for some end-users.

- High Initial Investment: Cost of advanced sensors and infrastructure.

- Supply Chain Volatility: Potential for component shortages and price fluctuations.

- Intense Competition: Leading to pricing pressures and the need for differentiation.

- Integration Challenges: Difficulties in connecting with existing industrial systems.

- Skilled Workforce Shortage: Lack of trained personnel for installation and maintenance.

Forces Driving US Temperature Monitor Market Growth

The US Temperature Monitor Market is propelled by several potent growth drivers. The escalating need for enhanced safety and compliance in industries like oil and gas and chemical and petrochemical is a primary catalyst. The rapid adoption of the Industrial Internet of Things (IIoT) and smart manufacturing initiatives is driving demand for connected temperature monitoring devices. Advancements in sensor technology, leading to more accurate, reliable, and cost-effective solutions, further stimulate market expansion. Economic growth across various sectors also translates into increased investment in infrastructure and process optimization, directly benefiting the temperature sensor market.

- Safety and Compliance Mandates: Stringent regulations across industries.

- IIoT and Smart Manufacturing Adoption: Integration of connected devices.

- Technological Advancements: Improved accuracy, reliability, and cost-effectiveness.

- Industrial Automation Growth: Increased investment in process control.

- Predictive Maintenance Demand: Focus on preventing equipment failures.

Challenges in the US Temperature Monitor Market Market

While several factors contribute to the growth of the US Temperature Monitor Market, long-term growth catalysts are primarily rooted in continuous innovation and strategic market expansion. The development of more sophisticated AI-powered predictive analytics that can anticipate potential issues before they arise will be a significant differentiator. Partnerships between sensor manufacturers and software providers will be crucial for offering integrated solutions that deliver actionable insights. Market expansion into emerging applications, such as advanced climate control in data centers and precision agriculture, will further fuel sustained growth. The increasing focus on energy efficiency and sustainability also presents an opportunity for temperature monitoring solutions that can optimize energy consumption.

Emerging Opportunities in US Temperature Monitor Market

The US Temperature Monitor Market presents a fertile ground for emerging opportunities. The growing demand for specialized temperature monitoring in the burgeoning electric vehicle (EV) battery management sector is a significant growth avenue. The expansion of smart city initiatives, particularly in areas requiring environmental monitoring and infrastructure management, offers new application landscapes. The increasing adoption of advanced temperature monitoring in the pharmaceutical cold chain and food safety is another key opportunity. Furthermore, the development of highly miniaturized and energy-efficient sensors for wearable technology and IoT devices will open up new consumer and industrial markets.

- EV Battery Management: Critical for performance and safety.

- Smart City Infrastructure: Environmental and operational monitoring.

- Pharmaceutical Cold Chain & Food Safety: Ensuring integrity and compliance.

- Wearable Technology & Consumer IoT: Miniaturized and energy-efficient sensors.

- Data Center Cooling Optimization: Enhancing efficiency and preventing overheating.

Leading Players in the US Temperature Monitor Market Sector

- Honeywell International Inc

- ABB Ltd

- Denso Corporation

- Gunther GmbH Temperaturmesstechnik

- Fluke Process Instruments

- NXP Semiconductors NV

- Kongsberg Gruppen

- GE Sensing & Inspection Technologies GmbH

- Maxim Integrated Products

- STMicroelectronics

- Siemens AG

- TE Connectivity Ltd

- Robert Bosch GmbH

- Texas Instruments Incorporated

- Microchip Technology Incorporated

- Analog Devices Inc

- Omron Corporation

- FLIR Systems

- Panasonic Corporation

- Thermometris

- Emerson Electric Company

Key Milestones in US Temperature Monitor Market Industry

- November 2020: FLIR Systems launched a new FLIR SV87 Kit, which can be installed on any surface with Wi-Fi access. The kit allows maintenance personnel to track variations in vibration and heat in real-time, allowing them to predict potentially severe problems before they occur.

- May 2021: Honeywell installed advanced skin temperature screening systems (Honeywell Thermo Rebellion) in Terminal One of New York's John F. Kennedy International Airport for passengers and employees.

Strategic Outlook for US Temperature Monitor Market Market

The strategic outlook for the US Temperature Monitor Market is overwhelmingly positive, driven by sustained demand for precision, reliability, and connectivity. Growth accelerators will include the continued integration of AI and machine learning for predictive analytics, enabling proactive maintenance and operational optimization. Strategic partnerships between technology providers and end-users will foster the development of tailored solutions addressing specific industry needs. The expansion of the wireless temperature monitoring segment and the diversification of applications in sectors like healthcare and renewable energy will further solidify market growth. Companies that prioritize innovation in infrared temperature sensors, thermocouples, and RTDs, while also focusing on seamless data integration and user experience, are poised to capture significant market share in the coming years.

US Temperature Monitor Market Segmentation

-

1. Type

- 1.1. Wired

- 1.2. Wireless

-

2. Technology

- 2.1. Infrared

- 2.2. Thermocouple

- 2.3. Resistance Temperature Detector

- 2.4. Thermistor

- 2.5. Temperature Transmitter

- 2.6. Fiber Optic

- 2.7. Others

-

3. End-user Industry

- 3.1. Chemical and Petrochemical

- 3.2. Oil and Gas

- 3.3. Metal and Mining

- 3.4. Power Generation

- 3.5. Food and Beverage

- 3.6. Automotive

- 3.7. Medical

- 3.8. Aerospace and Military

- 3.9. Consumer Electronics

- 3.10. Other End-user Industries

US Temperature Monitor Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

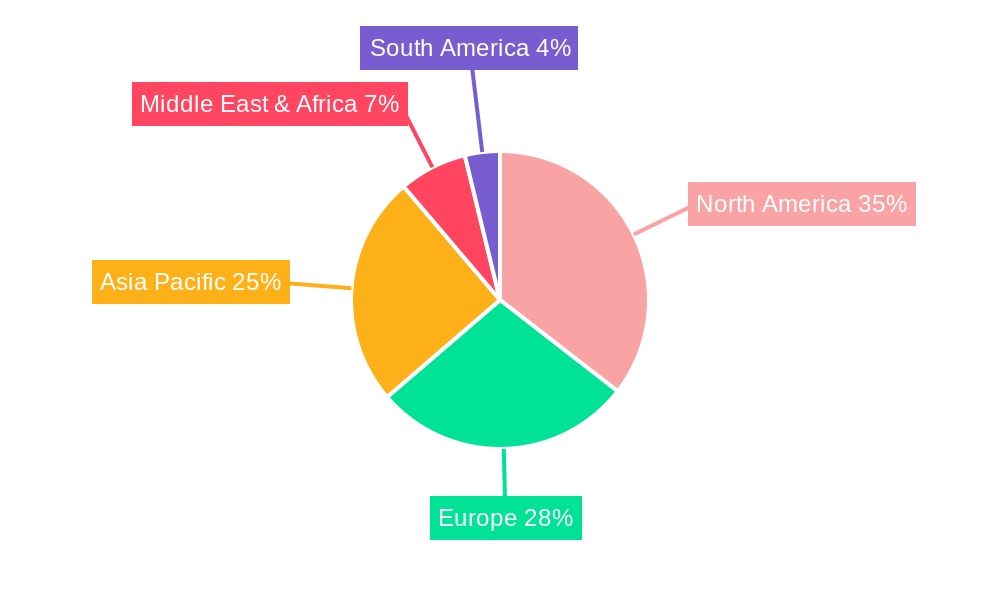

US Temperature Monitor Market Regional Market Share

Geographic Coverage of US Temperature Monitor Market

US Temperature Monitor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Industry 4.0 and Rapid Factory Automation; Increasing Demand for Wearable in Consumer Electronics

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. infrared Temperature Sensors to drive the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Temperature Monitor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Infrared

- 5.2.2. Thermocouple

- 5.2.3. Resistance Temperature Detector

- 5.2.4. Thermistor

- 5.2.5. Temperature Transmitter

- 5.2.6. Fiber Optic

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Chemical and Petrochemical

- 5.3.2. Oil and Gas

- 5.3.3. Metal and Mining

- 5.3.4. Power Generation

- 5.3.5. Food and Beverage

- 5.3.6. Automotive

- 5.3.7. Medical

- 5.3.8. Aerospace and Military

- 5.3.9. Consumer Electronics

- 5.3.10. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Temperature Monitor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wired

- 6.1.2. Wireless

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Infrared

- 6.2.2. Thermocouple

- 6.2.3. Resistance Temperature Detector

- 6.2.4. Thermistor

- 6.2.5. Temperature Transmitter

- 6.2.6. Fiber Optic

- 6.2.7. Others

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Chemical and Petrochemical

- 6.3.2. Oil and Gas

- 6.3.3. Metal and Mining

- 6.3.4. Power Generation

- 6.3.5. Food and Beverage

- 6.3.6. Automotive

- 6.3.7. Medical

- 6.3.8. Aerospace and Military

- 6.3.9. Consumer Electronics

- 6.3.10. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Temperature Monitor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wired

- 7.1.2. Wireless

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Infrared

- 7.2.2. Thermocouple

- 7.2.3. Resistance Temperature Detector

- 7.2.4. Thermistor

- 7.2.5. Temperature Transmitter

- 7.2.6. Fiber Optic

- 7.2.7. Others

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Chemical and Petrochemical

- 7.3.2. Oil and Gas

- 7.3.3. Metal and Mining

- 7.3.4. Power Generation

- 7.3.5. Food and Beverage

- 7.3.6. Automotive

- 7.3.7. Medical

- 7.3.8. Aerospace and Military

- 7.3.9. Consumer Electronics

- 7.3.10. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Temperature Monitor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wired

- 8.1.2. Wireless

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Infrared

- 8.2.2. Thermocouple

- 8.2.3. Resistance Temperature Detector

- 8.2.4. Thermistor

- 8.2.5. Temperature Transmitter

- 8.2.6. Fiber Optic

- 8.2.7. Others

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Chemical and Petrochemical

- 8.3.2. Oil and Gas

- 8.3.3. Metal and Mining

- 8.3.4. Power Generation

- 8.3.5. Food and Beverage

- 8.3.6. Automotive

- 8.3.7. Medical

- 8.3.8. Aerospace and Military

- 8.3.9. Consumer Electronics

- 8.3.10. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Temperature Monitor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wired

- 9.1.2. Wireless

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Infrared

- 9.2.2. Thermocouple

- 9.2.3. Resistance Temperature Detector

- 9.2.4. Thermistor

- 9.2.5. Temperature Transmitter

- 9.2.6. Fiber Optic

- 9.2.7. Others

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Chemical and Petrochemical

- 9.3.2. Oil and Gas

- 9.3.3. Metal and Mining

- 9.3.4. Power Generation

- 9.3.5. Food and Beverage

- 9.3.6. Automotive

- 9.3.7. Medical

- 9.3.8. Aerospace and Military

- 9.3.9. Consumer Electronics

- 9.3.10. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Temperature Monitor Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wired

- 10.1.2. Wireless

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Infrared

- 10.2.2. Thermocouple

- 10.2.3. Resistance Temperature Detector

- 10.2.4. Thermistor

- 10.2.5. Temperature Transmitter

- 10.2.6. Fiber Optic

- 10.2.7. Others

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Chemical and Petrochemical

- 10.3.2. Oil and Gas

- 10.3.3. Metal and Mining

- 10.3.4. Power Generation

- 10.3.5. Food and Beverage

- 10.3.6. Automotive

- 10.3.7. Medical

- 10.3.8. Aerospace and Military

- 10.3.9. Consumer Electronics

- 10.3.10. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Northeast US Temperature Monitor Market Analysis, Insights and Forecast, 2020-2032

- 12. Southeast US Temperature Monitor Market Analysis, Insights and Forecast, 2020-2032

- 13. Midwest US Temperature Monitor Market Analysis, Insights and Forecast, 2020-2032

- 14. Southwest US Temperature Monitor Market Analysis, Insights and Forecast, 2020-2032

- 15. West US Temperature Monitor Market Analysis, Insights and Forecast, 2020-2032

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 Honeywell International Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ABB Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Denso Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Gunther GmbH Temperaturmesstechnik

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Fluke Process Instruments

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 NXP Semiconductors NV

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Kongsberg Gruppen*List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 GE Sensing & Inspection Technologies GmbH

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Maxim Integrated Products

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 STMicroelectronics

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Siemens AG

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 TE Connectivity Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Robert Bosch GmbH

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Texas Instruments Incorporated

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Microchip Technology Incorporated

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Analog Devices Inc

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 Omron Corporatio

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.18 FLIR Systems

- 16.2.18.1. Overview

- 16.2.18.2. Products

- 16.2.18.3. SWOT Analysis

- 16.2.18.4. Recent Developments

- 16.2.18.5. Financials (Based on Availability)

- 16.2.19 Panasonic Corporation

- 16.2.19.1. Overview

- 16.2.19.2. Products

- 16.2.19.3. SWOT Analysis

- 16.2.19.4. Recent Developments

- 16.2.19.5. Financials (Based on Availability)

- 16.2.20 Thermometris

- 16.2.20.1. Overview

- 16.2.20.2. Products

- 16.2.20.3. SWOT Analysis

- 16.2.20.4. Recent Developments

- 16.2.20.5. Financials (Based on Availability)

- 16.2.21 Emerson Electric Company

- 16.2.21.1. Overview

- 16.2.21.2. Products

- 16.2.21.3. SWOT Analysis

- 16.2.21.4. Recent Developments

- 16.2.21.5. Financials (Based on Availability)

- 16.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global US Temperature Monitor Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: United states US Temperature Monitor Market Revenue (Million), by Country 2025 & 2033

- Figure 3: United states US Temperature Monitor Market Revenue Share (%), by Country 2025 & 2033

- Figure 4: North America US Temperature Monitor Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America US Temperature Monitor Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America US Temperature Monitor Market Revenue (Million), by Technology 2025 & 2033

- Figure 7: North America US Temperature Monitor Market Revenue Share (%), by Technology 2025 & 2033

- Figure 8: North America US Temperature Monitor Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 9: North America US Temperature Monitor Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America US Temperature Monitor Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America US Temperature Monitor Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America US Temperature Monitor Market Revenue (Million), by Type 2025 & 2033

- Figure 13: South America US Temperature Monitor Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America US Temperature Monitor Market Revenue (Million), by Technology 2025 & 2033

- Figure 15: South America US Temperature Monitor Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: South America US Temperature Monitor Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: South America US Temperature Monitor Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: South America US Temperature Monitor Market Revenue (Million), by Country 2025 & 2033

- Figure 19: South America US Temperature Monitor Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Europe US Temperature Monitor Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Europe US Temperature Monitor Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe US Temperature Monitor Market Revenue (Million), by Technology 2025 & 2033

- Figure 23: Europe US Temperature Monitor Market Revenue Share (%), by Technology 2025 & 2033

- Figure 24: Europe US Temperature Monitor Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 25: Europe US Temperature Monitor Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 26: Europe US Temperature Monitor Market Revenue (Million), by Country 2025 & 2033

- Figure 27: Europe US Temperature Monitor Market Revenue Share (%), by Country 2025 & 2033

- Figure 28: Middle East & Africa US Temperature Monitor Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Middle East & Africa US Temperature Monitor Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East & Africa US Temperature Monitor Market Revenue (Million), by Technology 2025 & 2033

- Figure 31: Middle East & Africa US Temperature Monitor Market Revenue Share (%), by Technology 2025 & 2033

- Figure 32: Middle East & Africa US Temperature Monitor Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 33: Middle East & Africa US Temperature Monitor Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Middle East & Africa US Temperature Monitor Market Revenue (Million), by Country 2025 & 2033

- Figure 35: Middle East & Africa US Temperature Monitor Market Revenue Share (%), by Country 2025 & 2033

- Figure 36: Asia Pacific US Temperature Monitor Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Asia Pacific US Temperature Monitor Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific US Temperature Monitor Market Revenue (Million), by Technology 2025 & 2033

- Figure 39: Asia Pacific US Temperature Monitor Market Revenue Share (%), by Technology 2025 & 2033

- Figure 40: Asia Pacific US Temperature Monitor Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 41: Asia Pacific US Temperature Monitor Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 42: Asia Pacific US Temperature Monitor Market Revenue (Million), by Country 2025 & 2033

- Figure 43: Asia Pacific US Temperature Monitor Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Temperature Monitor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global US Temperature Monitor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global US Temperature Monitor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Global US Temperature Monitor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Global US Temperature Monitor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global US Temperature Monitor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Northeast US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Southeast US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Midwest US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Southwest US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: West US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global US Temperature Monitor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global US Temperature Monitor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global US Temperature Monitor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global US Temperature Monitor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Canada US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global US Temperature Monitor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global US Temperature Monitor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 21: Global US Temperature Monitor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global US Temperature Monitor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Brazil US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Argentina US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of South America US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global US Temperature Monitor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global US Temperature Monitor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 28: Global US Temperature Monitor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 29: Global US Temperature Monitor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: United Kingdom US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Germany US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: France US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Italy US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Russia US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Benelux US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Nordics US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Europe US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global US Temperature Monitor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 40: Global US Temperature Monitor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 41: Global US Temperature Monitor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 42: Global US Temperature Monitor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Turkey US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Israel US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: GCC US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: North Africa US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: South Africa US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Middle East & Africa US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Global US Temperature Monitor Market Revenue Million Forecast, by Type 2020 & 2033

- Table 50: Global US Temperature Monitor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 51: Global US Temperature Monitor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 52: Global US Temperature Monitor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 53: China US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: India US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: Japan US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: South Korea US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: ASEAN US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Oceania US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: Rest of Asia Pacific US Temperature Monitor Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Temperature Monitor Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the US Temperature Monitor Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Denso Corporation, Gunther GmbH Temperaturmesstechnik, Fluke Process Instruments, NXP Semiconductors NV, Kongsberg Gruppen*List Not Exhaustive, GE Sensing & Inspection Technologies GmbH, Maxim Integrated Products, STMicroelectronics, Siemens AG, TE Connectivity Ltd, Robert Bosch GmbH, Texas Instruments Incorporated, Microchip Technology Incorporated, Analog Devices Inc, Omron Corporatio, FLIR Systems, Panasonic Corporation, Thermometris, Emerson Electric Company.

3. What are the main segments of the US Temperature Monitor Market?

The market segments include Type, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Industry 4.0 and Rapid Factory Automation; Increasing Demand for Wearable in Consumer Electronics.

6. What are the notable trends driving market growth?

infrared Temperature Sensors to drive the market growth.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

Nov 2020 - The company launched a new FLIR SV87 Kit, which can be installed on any surface with Wi-Fi access. The kit allows maintenance personnel to track variations in vibration and heat in real-time, allowing them to predict potentially severe problems before they occur.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Temperature Monitor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Temperature Monitor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Temperature Monitor Market?

To stay informed about further developments, trends, and reports in the US Temperature Monitor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence