Key Insights

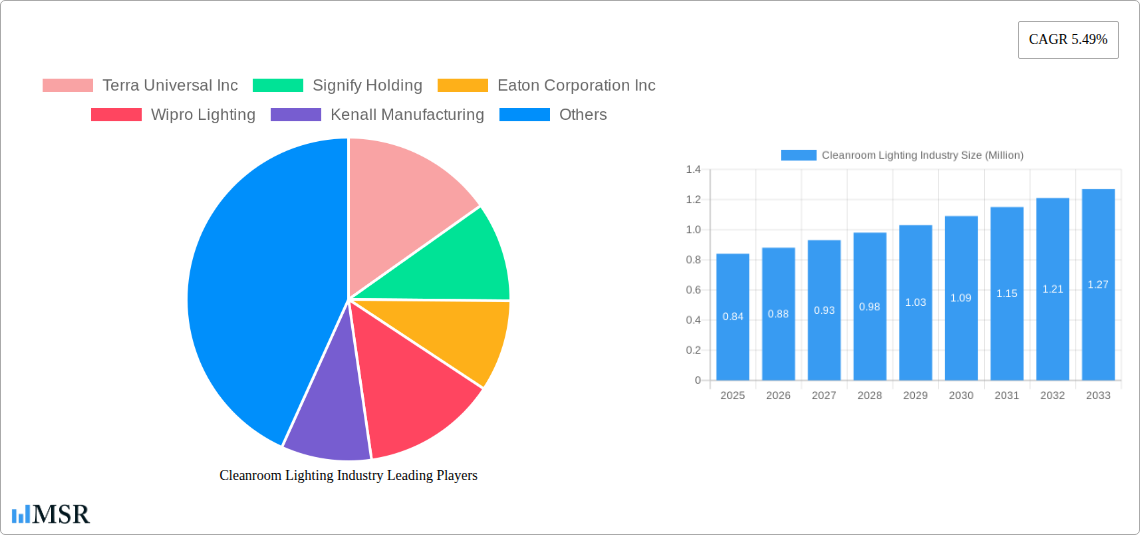

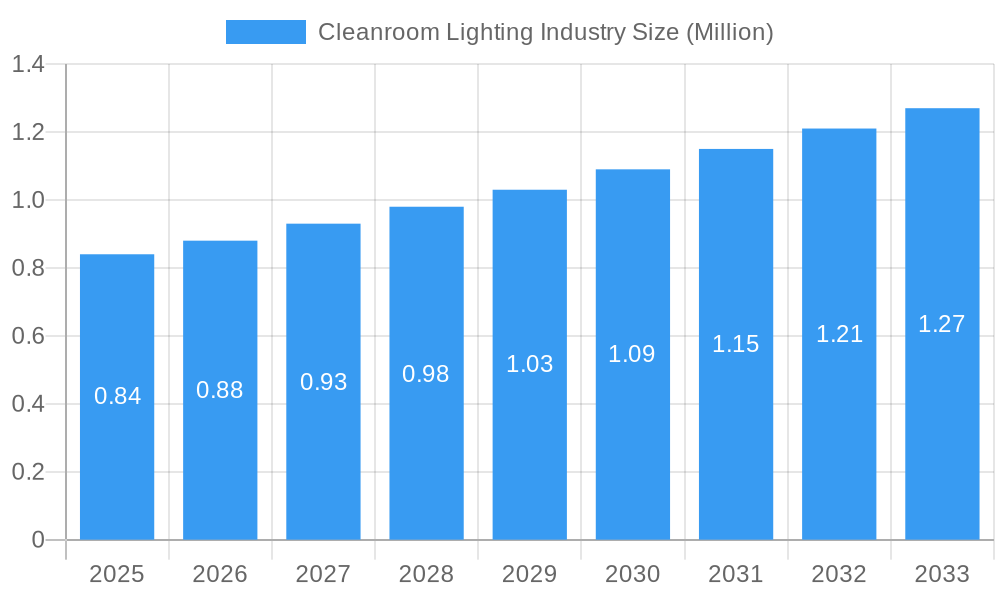

The global Cleanroom Lighting market is poised for substantial growth, projected to reach a market size of approximately USD 0.84 million in 2025. This expansion is fueled by a robust Compound Annual Growth Rate (CAGR) of 5.49% throughout the forecast period of 2025-2033. A key driver for this market is the increasing demand for stringent contamination control across various high-tech and sensitive industries. Sectors like Healthcare & Life Sciences, Electronics and Semiconductor, and Food & Beverage are increasingly investing in advanced cleanroom environments to ensure product integrity, patient safety, and regulatory compliance. This necessitates specialized lighting solutions that minimize particulate generation, offer consistent illumination, and can withstand rigorous cleaning protocols.

Cleanroom Lighting Industry Market Size (In Million)

Further reinforcing this growth trajectory are emerging trends such as the widespread adoption of energy-efficient LED lighting, which offers superior lifespan, reduced heat output, and enhanced controllability, all crucial for maintaining stable cleanroom conditions. Advanced features like dimming capabilities and specialized color temperature options are also gaining traction to optimize visibility and reduce eye strain for personnel. While the market exhibits strong positive momentum, certain restraints, such as the high initial cost of specialized cleanroom lighting systems and the complexity of installation and maintenance in sterile environments, need to be addressed. However, the overarching need for contamination-free manufacturing and research spaces, coupled with technological advancements, is expected to drive continued innovation and market expansion, particularly in regions with established and growing high-tech manufacturing bases.

Cleanroom Lighting Industry Company Market Share

Cleanroom Lighting Industry: Market Dynamics, Growth Drivers, and Strategic Outlook (2019–2033)

This comprehensive report offers an in-depth analysis of the global Cleanroom Lighting Industry, providing critical insights for stakeholders including manufacturers, suppliers, end-users, and investors. Covering the historical period from 2019 to 2024, the base year of 2025, and a forecast period extending to 2033, this study dissects market concentration, identifies key growth drivers, explores dominant segments, and outlines future opportunities. Leveraging high-ranking keywords such as cleanroom lighting solutions, LED cleanroom lights, pharmaceutical cleanroom lighting, semiconductor cleanroom fixtures, and ISO cleanroom standards, this report aims to be the definitive resource for understanding the evolving cleanroom illumination market.

Cleanroom Lighting Industry Market Concentration & Dynamics

The cleanroom lighting industry exhibits a moderate to high level of market concentration, with a few key players dominating the global landscape. Innovation ecosystems are robust, driven by the stringent demands of end-user industries like healthcare and life sciences and electronics and semiconductor manufacturing. Regulatory frameworks, particularly concerning ISO cleanroom standards and energy efficiency, significantly influence product development and market entry. Substitute products, while present, often fall short of meeting the specialized performance criteria required for critical environments. End-user trends are leaning towards energy-efficient and sustainable lighting solutions, with a growing demand for smart cleanroom lighting systems that offer advanced control and monitoring capabilities. Mergers and acquisitions (M&A) activities, though not extensively publicized, are observed as companies seek to expand their product portfolios and geographical reach within this specialized sector. The market share distribution is dynamic, with companies actively investing in R&D to secure a competitive advantage. M&A deal counts, while not readily available for every transaction, indicate a strategic consolidation driven by the need for specialized expertise and market access.

Cleanroom Lighting Industry Industry Insights & Trends

The cleanroom lighting industry is projected for robust growth, driven by an increasing global demand for contamination-free environments across diverse sectors. The global cleanroom lighting market size is estimated to reach USD 2,500 Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. Key growth drivers include the expanding pharmaceutical and biotechnology industries, the continuous advancements in semiconductor technology requiring ultra-clean manufacturing processes, and the growing stringency of regulations governing sterile environments in food and beverage production. Technological disruptions are primarily centered around the widespread adoption of LED cleanroom lights, offering superior energy efficiency, extended lifespan, and improved light quality compared to traditional fluorescent lighting. These advancements in cleanroom illumination technology allow for precise spectral control and reduced heat emission, crucial for sensitive applications. Evolving consumer behaviors are characterized by an increased focus on operational efficiency, sustainability, and adherence to international cleanroom lighting standards. The demand for integrated lighting solutions that offer dimming capabilities, remote monitoring, and integration with building management systems is also on the rise. Furthermore, the increasing investment in new cleanroom facilities and upgrades to existing ones worldwide directly fuels the demand for specialized lighting systems. The rise of industries such as advanced battery manufacturing and personalized medicine further expands the addressable market for high-performance cleanroom lighting.

Key Markets & Segments Leading Cleanroom Lighting Industry

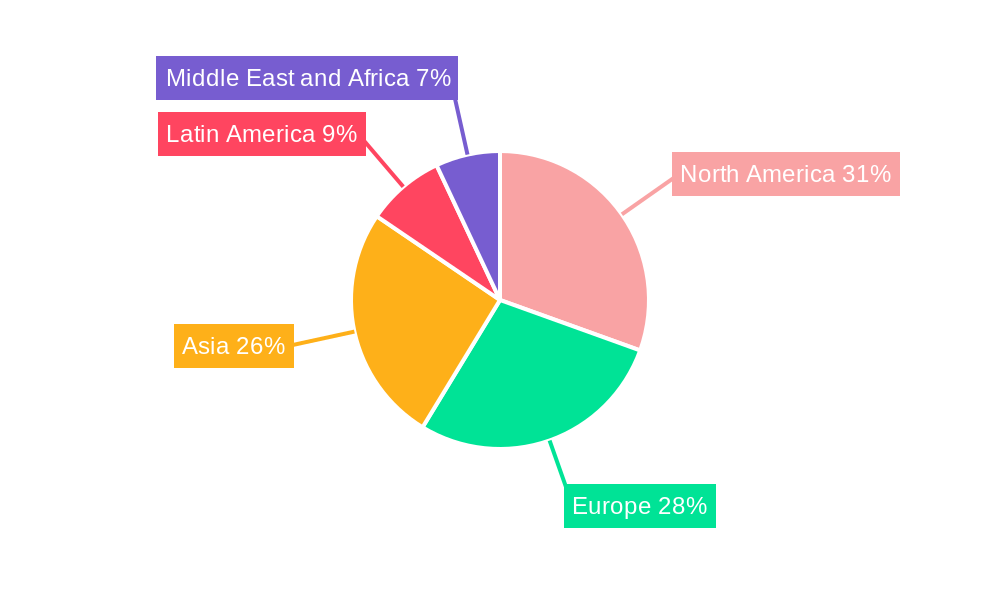

The cleanroom lighting industry is experiencing significant leadership from the Asia Pacific region, driven by rapid industrialization and substantial investments in the electronics and semiconductor and pharmaceutical and biotechnology sectors in countries like China, South Korea, and Taiwan. The United States also represents a mature and significant market, particularly for healthcare and life sciences applications and advanced semiconductor fabrication.

Light Source: LED

- Drivers: Superior energy efficiency, longer lifespan, reduced heat output, enhanced controllability, compliance with environmental regulations.

- Dominance Analysis: LED technology has overwhelmingly surpassed traditional fluorescent lighting in the cleanroom lighting market. Its ability to provide consistent, high-quality illumination without compromising the integrity of the cleanroom environment, coupled with significant operational cost savings, makes it the undisputed choice. The continuous innovation in LED efficacy and spectrum control further solidifies its dominance.

Mounting Type: Recessed

- Drivers: Seamless integration with cleanroom ceiling systems, reduced particulate accumulation, aesthetic appeal, ease of maintenance.

- Dominance Analysis: Recessed mounting is the preferred method for cleanroom lighting fixtures in most high-specification cleanrooms, especially those adhering to ISO Class 1 to ISO Class 5 standards. This mounting type ensures a flush surface, minimizing ledges where particles can accumulate, and contributes to the overall laminar airflow within the cleanroom.

End-user Industry: Healthcare & Life Sciences

- Drivers: Stringent regulatory requirements for sterile environments, growth in pharmaceutical R&D and manufacturing, increasing demand for aseptic processing.

- Dominance Analysis: The healthcare and life sciences sector, encompassing pharmaceuticals, biotechnology, medical device manufacturing, and sterile compounding, consistently represents the largest segment for cleanroom lighting solutions. The critical need for precise environmental control, minimized contamination risks, and compliance with global cGMP and FDA guidelines drives significant investment in high-performance cleanroom lighting.

End-user Industry: Electronics and Semiconductor

- Drivers: Continuous miniaturization of electronic components, increasing complexity of semiconductor manufacturing, need for ultra-clean fabrication facilities.

- Dominance Analysis: The electronics and semiconductor industry is a close second and a rapidly growing segment. The relentless pursuit of smaller and more powerful microchips necessitates increasingly stringent cleanroom conditions, demanding lighting solutions that offer exceptional uniformity, minimal particulate generation, and precise spectral output to prevent light-induced defects.

End-user Industry: Food & Beverage

- Drivers: Growing demand for food safety and quality, increasing adoption of HACCP and other food safety standards, expansion of processed food manufacturing.

- Dominance Analysis: While not as demanding as pharmaceutical or semiconductor applications, the food and beverage industry is a significant consumer of cleanroom lighting. Compliance with food safety regulations, prevention of microbial contamination, and the need for adequate illumination for inspection and packaging processes make specialized cleanroom lighting essential.

Cleanroom Lighting Industry Product Developments

Recent product developments in the cleanroom lighting industry are heavily focused on enhanced performance and intelligent integration. Innovations include the introduction of energy-efficient LED cleanroom lights with improved lumen output and extended lifespan, exceeding 100,000 hours. Manufacturers are also developing smart cleanroom lighting systems incorporating IoT capabilities for remote monitoring, dimming control, and integration with building management systems. Antimicrobial coatings on fixture surfaces are gaining traction, further contributing to contamination control in sterile environments. Customizable spectral outputs for specific applications, such as UV-free lighting for sensitive materials, are also a growing area of innovation, offering a distinct competitive edge.

Challenges in the Cleanroom Lighting Industry Market

The cleanroom lighting industry faces several challenges. High initial investment costs for advanced cleanroom illumination technology can be a barrier for smaller enterprises. Stringent and evolving cleanroom lighting standards require continuous R&D and compliance efforts. Supply chain disruptions for specialized components, coupled with the skilled labor required for installation and maintenance, present ongoing operational hurdles. Intense competition from both established players and emerging manufacturers also exerts pricing pressures.

Forces Driving Cleanroom Lighting Industry Growth

The primary forces driving the growth of the cleanroom lighting industry are the escalating global demand for sterile and contamination-free manufacturing environments. This is propelled by the expansion of the pharmaceutical and biotechnology sectors, the relentless advancement in semiconductor manufacturing, and the increasing stringency of regulations in the food and beverage industry and healthcare. The shift towards energy-efficient LED cleanroom lights and the growing emphasis on sustainability further act as significant growth catalysts.

Challenges in the Cleanroom Lighting Industry Market

Long-term growth catalysts for the cleanroom lighting industry are firmly rooted in continuous technological innovation and strategic market expansion. The ongoing development of intelligent cleanroom lighting systems with advanced analytics and predictive maintenance capabilities, along with the exploration of novel materials for improved durability and particle reduction, will sustain demand. Partnerships and collaborations between lighting manufacturers and cleanroom construction firms are crucial for integrated solutions. Furthermore, the expansion into emerging economies with developing cleanroom infrastructure offers substantial future growth potential.

Emerging Opportunities in Cleanroom Lighting Industry

Emerging opportunities in the cleanroom lighting industry lie in the development of specialized lighting for new and rapidly growing sectors such as lithium-ion battery manufacturing, vertical farming, and advanced cell therapy production. The integration of AI and machine learning for optimizing lighting performance and energy consumption within cleanrooms presents a significant technological frontier. Furthermore, the increasing demand for retrofit solutions for older cleanroom facilities, offering upgrades to modern LED cleanroom lighting, represents a substantial market segment. The focus on sustainable and circular economy principles in product design also opens avenues for innovation.

Leading Players in the Cleanroom Lighting Industry Sector

- Terra Universal Inc

- Signify Holding

- Eaton Corporation Inc

- Wipro Lighting

- Kenall Manufacturing

- Solite Europe Ltd

- LUG Light Factory Sp z o o

- AB Fagerhult

- Crompton Greaves Consumer Electricals Ltd

- Paramount Industries

Key Milestones in Cleanroom Lighting Industry Industry

- December 2022: Nicomac Taikisha Cleanrooms announced an investment of INR 126.2 crore (USD 15.2 Million) to set up its third manufacturing facility in Hyderabad, India. Taikisha's significant role in providing cleanrooms and HVAC systems for electronic devices, food, lithium-ion battery manufacturing, and hydroponic farming, as well as cleanroom facilities for pharmaceuticals and vaccines, highlights the interconnected growth of cleanroom infrastructure and its impact on lighting demand.

- May 2022: LOG, a pharma primary packaging specialist, announced a multi-million-dollar investment to expand its manufacturing floor, including the construction of a new multi-million-dollar ISO Class 8 cleanroom. This expansion directly signals increased demand for specialized cleanroom environments and, consequently, their essential lighting components.

Strategic Outlook for Cleanroom Lighting Industry Market

The strategic outlook for the cleanroom lighting industry is exceptionally positive, driven by sustained global investments in critical manufacturing sectors. The continuous demand for enhanced cleanliness, energy efficiency, and compliance with rigorous ISO cleanroom standards will propel market growth. Future success hinges on embracing technological advancements, particularly in LED cleanroom lighting and smart integration, while strategically targeting high-growth end-user industries and geographical regions. Companies that focus on offering customized solutions, robust support, and a commitment to sustainability are poised to capture significant market share and drive the future of cleanroom illumination.

Cleanroom Lighting Industry Segmentation

-

1. Light Source

- 1.1. LED

- 1.2. Fluorescent

-

2. Mounting Type

- 2.1. Recessed

- 2.2. Surface Mount

-

3. End-user Industry

- 3.1. Healthcare & Life Sciences

- 3.2. Electronics and Semiconductor

- 3.3. Food & Beverage

- 3.4. Other End-user Industries

Cleanroom Lighting Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Cleanroom Lighting Industry Regional Market Share

Geographic Coverage of Cleanroom Lighting Industry

Cleanroom Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Regulations in Healthcare and Food Processing Industries; Rising Demand for Sterile Manufacturing Areas in Pharmaceuticals Industry

- 3.3. Market Restrains

- 3.3.1. High Cost Associated With Cleanrooms and their Operations

- 3.4. Market Trends

- 3.4.1. Healthcare and Life Sciences Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cleanroom Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Light Source

- 5.1.1. LED

- 5.1.2. Fluorescent

- 5.2. Market Analysis, Insights and Forecast - by Mounting Type

- 5.2.1. Recessed

- 5.2.2. Surface Mount

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Healthcare & Life Sciences

- 5.3.2. Electronics and Semiconductor

- 5.3.3. Food & Beverage

- 5.3.4. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Light Source

- 6. North America Cleanroom Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Light Source

- 6.1.1. LED

- 6.1.2. Fluorescent

- 6.2. Market Analysis, Insights and Forecast - by Mounting Type

- 6.2.1. Recessed

- 6.2.2. Surface Mount

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Healthcare & Life Sciences

- 6.3.2. Electronics and Semiconductor

- 6.3.3. Food & Beverage

- 6.3.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Light Source

- 7. Europe Cleanroom Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Light Source

- 7.1.1. LED

- 7.1.2. Fluorescent

- 7.2. Market Analysis, Insights and Forecast - by Mounting Type

- 7.2.1. Recessed

- 7.2.2. Surface Mount

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Healthcare & Life Sciences

- 7.3.2. Electronics and Semiconductor

- 7.3.3. Food & Beverage

- 7.3.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Light Source

- 8. Asia Cleanroom Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Light Source

- 8.1.1. LED

- 8.1.2. Fluorescent

- 8.2. Market Analysis, Insights and Forecast - by Mounting Type

- 8.2.1. Recessed

- 8.2.2. Surface Mount

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Healthcare & Life Sciences

- 8.3.2. Electronics and Semiconductor

- 8.3.3. Food & Beverage

- 8.3.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Light Source

- 9. Latin America Cleanroom Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Light Source

- 9.1.1. LED

- 9.1.2. Fluorescent

- 9.2. Market Analysis, Insights and Forecast - by Mounting Type

- 9.2.1. Recessed

- 9.2.2. Surface Mount

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Healthcare & Life Sciences

- 9.3.2. Electronics and Semiconductor

- 9.3.3. Food & Beverage

- 9.3.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Light Source

- 10. Middle East and Africa Cleanroom Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Light Source

- 10.1.1. LED

- 10.1.2. Fluorescent

- 10.2. Market Analysis, Insights and Forecast - by Mounting Type

- 10.2.1. Recessed

- 10.2.2. Surface Mount

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Healthcare & Life Sciences

- 10.3.2. Electronics and Semiconductor

- 10.3.3. Food & Beverage

- 10.3.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Light Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Terra Universal Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Signify Holding

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eaton Corporation Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wipro Lighting

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kenall Manufacturing

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Solite Europe Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LUG Light Factory Sp z o o

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AB Fagerhult*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Crompton Greaves Consumer Electricals Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Paramount Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Terra Universal Inc

List of Figures

- Figure 1: Global Cleanroom Lighting Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cleanroom Lighting Industry Revenue (Million), by Light Source 2025 & 2033

- Figure 3: North America Cleanroom Lighting Industry Revenue Share (%), by Light Source 2025 & 2033

- Figure 4: North America Cleanroom Lighting Industry Revenue (Million), by Mounting Type 2025 & 2033

- Figure 5: North America Cleanroom Lighting Industry Revenue Share (%), by Mounting Type 2025 & 2033

- Figure 6: North America Cleanroom Lighting Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Cleanroom Lighting Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Cleanroom Lighting Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Cleanroom Lighting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Cleanroom Lighting Industry Revenue (Million), by Light Source 2025 & 2033

- Figure 11: Europe Cleanroom Lighting Industry Revenue Share (%), by Light Source 2025 & 2033

- Figure 12: Europe Cleanroom Lighting Industry Revenue (Million), by Mounting Type 2025 & 2033

- Figure 13: Europe Cleanroom Lighting Industry Revenue Share (%), by Mounting Type 2025 & 2033

- Figure 14: Europe Cleanroom Lighting Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Cleanroom Lighting Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Cleanroom Lighting Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Cleanroom Lighting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Cleanroom Lighting Industry Revenue (Million), by Light Source 2025 & 2033

- Figure 19: Asia Cleanroom Lighting Industry Revenue Share (%), by Light Source 2025 & 2033

- Figure 20: Asia Cleanroom Lighting Industry Revenue (Million), by Mounting Type 2025 & 2033

- Figure 21: Asia Cleanroom Lighting Industry Revenue Share (%), by Mounting Type 2025 & 2033

- Figure 22: Asia Cleanroom Lighting Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Cleanroom Lighting Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Cleanroom Lighting Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Cleanroom Lighting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Cleanroom Lighting Industry Revenue (Million), by Light Source 2025 & 2033

- Figure 27: Latin America Cleanroom Lighting Industry Revenue Share (%), by Light Source 2025 & 2033

- Figure 28: Latin America Cleanroom Lighting Industry Revenue (Million), by Mounting Type 2025 & 2033

- Figure 29: Latin America Cleanroom Lighting Industry Revenue Share (%), by Mounting Type 2025 & 2033

- Figure 30: Latin America Cleanroom Lighting Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Cleanroom Lighting Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Cleanroom Lighting Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Cleanroom Lighting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Cleanroom Lighting Industry Revenue (Million), by Light Source 2025 & 2033

- Figure 35: Middle East and Africa Cleanroom Lighting Industry Revenue Share (%), by Light Source 2025 & 2033

- Figure 36: Middle East and Africa Cleanroom Lighting Industry Revenue (Million), by Mounting Type 2025 & 2033

- Figure 37: Middle East and Africa Cleanroom Lighting Industry Revenue Share (%), by Mounting Type 2025 & 2033

- Figure 38: Middle East and Africa Cleanroom Lighting Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Cleanroom Lighting Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Cleanroom Lighting Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Cleanroom Lighting Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cleanroom Lighting Industry Revenue Million Forecast, by Light Source 2020 & 2033

- Table 2: Global Cleanroom Lighting Industry Revenue Million Forecast, by Mounting Type 2020 & 2033

- Table 3: Global Cleanroom Lighting Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Cleanroom Lighting Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cleanroom Lighting Industry Revenue Million Forecast, by Light Source 2020 & 2033

- Table 6: Global Cleanroom Lighting Industry Revenue Million Forecast, by Mounting Type 2020 & 2033

- Table 7: Global Cleanroom Lighting Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Cleanroom Lighting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Cleanroom Lighting Industry Revenue Million Forecast, by Light Source 2020 & 2033

- Table 10: Global Cleanroom Lighting Industry Revenue Million Forecast, by Mounting Type 2020 & 2033

- Table 11: Global Cleanroom Lighting Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Cleanroom Lighting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Cleanroom Lighting Industry Revenue Million Forecast, by Light Source 2020 & 2033

- Table 14: Global Cleanroom Lighting Industry Revenue Million Forecast, by Mounting Type 2020 & 2033

- Table 15: Global Cleanroom Lighting Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Cleanroom Lighting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Cleanroom Lighting Industry Revenue Million Forecast, by Light Source 2020 & 2033

- Table 18: Global Cleanroom Lighting Industry Revenue Million Forecast, by Mounting Type 2020 & 2033

- Table 19: Global Cleanroom Lighting Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Cleanroom Lighting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Cleanroom Lighting Industry Revenue Million Forecast, by Light Source 2020 & 2033

- Table 22: Global Cleanroom Lighting Industry Revenue Million Forecast, by Mounting Type 2020 & 2033

- Table 23: Global Cleanroom Lighting Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Cleanroom Lighting Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cleanroom Lighting Industry?

The projected CAGR is approximately 5.49%.

2. Which companies are prominent players in the Cleanroom Lighting Industry?

Key companies in the market include Terra Universal Inc, Signify Holding, Eaton Corporation Inc, Wipro Lighting, Kenall Manufacturing, Solite Europe Ltd, LUG Light Factory Sp z o o, AB Fagerhult*List Not Exhaustive, Crompton Greaves Consumer Electricals Ltd, Paramount Industries.

3. What are the main segments of the Cleanroom Lighting Industry?

The market segments include Light Source, Mounting Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Regulations in Healthcare and Food Processing Industries; Rising Demand for Sterile Manufacturing Areas in Pharmaceuticals Industry.

6. What are the notable trends driving market growth?

Healthcare and Life Sciences Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Cost Associated With Cleanrooms and their Operations.

8. Can you provide examples of recent developments in the market?

December 2022: Nicomac Taikisha Cleanrooms announced an investment of INR 126.2 crore (USD 15.2 million) to set up its third manufacturing facility in Hyderabad, India. Taikisha is a significant provider of cleanrooms and HVAC systems for electronic devices, the food industry, lithium-ion battery manufacturing, and hydroponic farming. The company also manufactures and constructs cleanroom facilities for pharmaceuticals and vaccines in sterile industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cleanroom Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cleanroom Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cleanroom Lighting Industry?

To stay informed about further developments, trends, and reports in the Cleanroom Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence