Key Insights

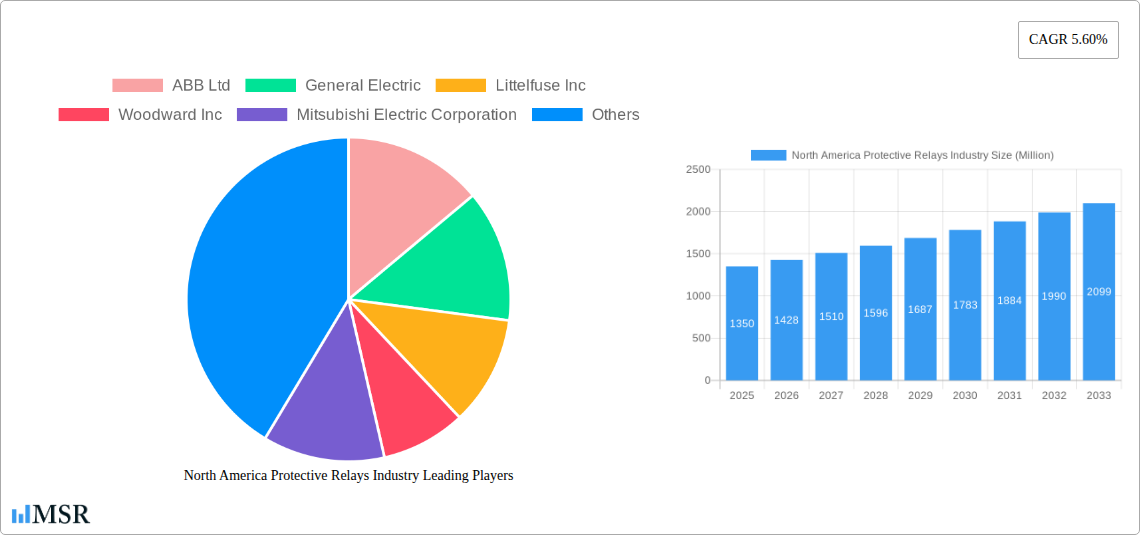

The North American protective relays market is poised for significant expansion, projecting a market size of approximately $1.35 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.60% expected to propel it to an estimated $1.96 billion by 2033. This growth is primarily fueled by the increasing demand for reliable and advanced grid infrastructure, driven by the ongoing modernization of power grids and the integration of renewable energy sources. The imperative to enhance grid stability and prevent costly outages, especially in light of aging infrastructure, is a critical driver. Furthermore, stringent safety regulations and the growing adoption of smart grid technologies, which necessitate sophisticated protection schemes, are contributing to market buoyancy. The market's expansion is also supported by substantial investments in upgrading existing power transmission and distribution networks across the United States, Canada, and Mexico.

North America Protective Relays Industry Market Size (In Billion)

Key trends shaping the North American protective relays landscape include the escalating adoption of digital and intelligent relays, offering enhanced monitoring, diagnostics, and communication capabilities essential for smart grids. The growing deployment of medium-voltage and high-voltage protective relays for feeder and transmission line protection is a significant segment. However, the market faces some restraints, including the high initial cost of advanced digital relay systems and the need for skilled personnel for their installation and maintenance. Cybersecurity concerns related to connected devices also present a challenge that manufacturers are actively addressing. Despite these hurdles, the overarching need for grid resilience, the decentralization of power generation, and the relentless pursuit of operational efficiency are expected to sustain the positive growth trajectory for the North American protective relays industry.

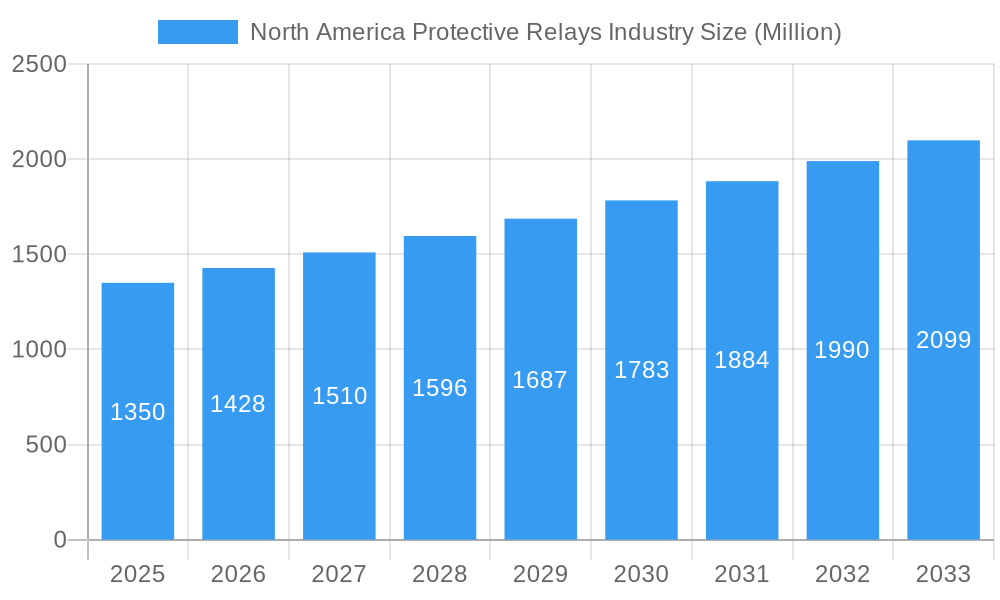

North America Protective Relays Industry Company Market Share

This comprehensive report offers an in-depth analysis of the North America Protective Relays Industry, providing critical insights for stakeholders navigating this dynamic sector. Covering the historical period from 2019-2024, base year 2025, and a robust forecast period extending to 2033, this report delivers actionable intelligence on market dynamics, key trends, segment dominance, and future opportunities. With an estimated market size of $X,XXX Million in 2025 and a projected CAGR of X.XX% during the forecast period, the North America Protective Relays Industry is poised for significant growth driven by infrastructure modernization and the increasing demand for grid reliability.

North America Protective Relays Industry Market Concentration & Dynamics

The North America Protective Relays Industry exhibits a highly concentrated market structure, dominated by a few key players who collectively hold a substantial market share, estimated to be over 70% in 2025. This concentration is a testament to the significant capital investment and technological expertise required to operate within this sector. Innovation ecosystems are robust, characterized by continuous research and development efforts focused on enhancing relay performance, intelligence, and communication capabilities. Regulatory frameworks, particularly those set by organizations like the North American Electric Reliability Corporation (NERC), play a crucial role in dictating product standards and ensuring grid security, thereby influencing market entry and product development. Substitute products, while present in simpler electrical protection applications, offer limited direct competition for advanced protective relay solutions in critical infrastructure. End-user trends are shifting towards greater digitalization, predictive maintenance, and enhanced cybersecurity within protection systems. Merger and acquisition (M&A) activities have been moderate, with approximately 3-5 significant deals recorded annually between 2019 and 2024, primarily aimed at consolidating market position, acquiring new technologies, or expanding product portfolios.

North America Protective Relays Industry Industry Insights & Trends

The North America Protective Relays Industry is on a robust growth trajectory, fueled by several interconnected factors. The estimated market size in 2025 is projected to reach $X,XXX Million, with an anticipated Compound Annual Growth Rate (CAGR) of X.XX% from 2025 to 2033. This growth is largely propelled by the ongoing modernization of aging power grids across the United States and Canada. Investments in upgrading transmission and distribution infrastructure, necessitated by increased demand, integration of renewable energy sources, and the need for enhanced grid resilience against extreme weather events, are primary market drivers. Technological disruptions are a constant feature, with advancements in digital substations, the Internet of Things (IoT) for grid monitoring, and artificial intelligence (AI) for fault detection and analysis playing increasingly pivotal roles. These innovations are leading to the development of "smart" protective relays that offer advanced diagnostic capabilities, remote monitoring, and faster response times, thereby minimizing downtime and improving overall system efficiency. Evolving consumer behaviors, particularly the growing demand for reliable and uninterrupted power supply, coupled with the increasing adoption of electric vehicles (EVs) and smart home technologies, are placing greater pressure on grid stability and, consequently, on the performance of protective relay systems. Furthermore, the growing emphasis on cybersecurity for critical infrastructure is driving demand for protective relays with integrated cyber defense mechanisms. The shift towards renewable energy integration, including solar and wind power, introduces intermittency challenges to the grid, necessitating more sophisticated and adaptable protective relay solutions to maintain system balance and prevent cascading failures.

Key Markets & Segments Leading North America Protective Relays Industry

The North America Protective Relays Industry is characterized by strong performance across various segments, with High-Voltage Protective Relays and Transmission Line Protection applications demonstrating particular dominance.

Dominant Region/Country: The United States stands as the primary market, accounting for an estimated 65-70% of the total North American market share in 2025. This dominance is attributed to its vast and aging electrical infrastructure, significant investments in grid modernization, and a robust industrial base. Canada represents the second-largest market, with its own substantial infrastructure development and grid enhancement initiatives.

Voltage Range Dominance:

- High-Voltage Protective Relays: This segment is leading the market, driven by the critical need for robust protection in high-voltage transmission networks that carry electricity over long distances. Economic growth and increased energy consumption necessitate the expansion and upgrading of these systems.

- Medium-Voltage Protective Relays: This segment also holds a significant share, vital for protecting distribution networks and industrial facilities. Infrastructure development projects and the increasing electrification of industrial processes are key drivers.

- Low-Voltage Protective Relays: While important for localized protection in commercial and residential settings, this segment's market share is comparatively smaller than its higher-voltage counterparts within the industrial and utility context of this report.

Application Dominance:

- Transmission Line Protection: This application segment is a major revenue generator. The extensive network of transmission lines requires highly sophisticated protective relays to detect and isolate faults rapidly, preventing widespread blackouts. Increased demand for electricity, grid expansion, and the integration of renewable energy sources further bolster this segment.

- Transformer Protection: Transformers are critical components of the power grid, and their protection is paramount to prevent costly damage and downtime. The sheer number of transformers in operation across transmission, distribution, and industrial settings makes this a consistently high-demand application.

- Feeder Protection: Essential for protecting distribution feeders, this segment is experiencing growth due to ongoing grid modernization efforts aimed at improving reliability and managing distributed energy resources.

- Motor Protection: As industrial automation and electrification continue to advance, the demand for reliable motor protection solutions remains strong across various manufacturing sectors.

- Other Applications: This category encompasses niche but growing applications in sectors such as renewable energy integration, data centers, and specialized industrial processes.

The dominance of High-Voltage Protective Relays and Transmission Line Protection is directly linked to the foundational requirements of a stable and reliable power grid. Investments in grid modernization, the integration of smart grid technologies, and the need for enhanced cybersecurity are further accelerating growth across all these key segments.

North America Protective Relays Industry Product Developments

Product innovation in the North America Protective Relays Industry is relentlessly focused on enhancing intelligence, connectivity, and adaptability. Recent developments, such as ABB's June 2021 launch of the REX610 relay, underscore the industry's commitment to supporting safe, smart, and sustainable electrification. This new addition to the Relion product family exemplifies the trend towards "innovative simplicity," aiming to make grid protection, industrial process safety, and personal protection more accessible and efficient. These advancements are driven by the integration of digital technologies, offering features like enhanced cybersecurity, remote monitoring and diagnostics, and seamless communication protocols, providing a competitive edge to manufacturers and improved reliability to end-users.

Challenges in the North America Protective Relays Industry Market

Despite robust growth prospects, the North America Protective Relays Industry faces several challenges. Stringent regulatory compliance and evolving cybersecurity standards can increase R&D and certification costs for manufacturers. Supply chain disruptions, as witnessed in recent years, can lead to extended lead times and increased component costs, impacting profitability and delivery schedules. Intense competition from established global players and emerging niche providers necessitates continuous innovation and competitive pricing strategies. Furthermore, the skilled labor shortage in specialized areas like cybersecurity and advanced relay engineering can hinder rapid deployment and support. Quantifiably, these challenges can translate to an estimated 5-10% increase in manufacturing costs and potential delays of up to 15% in product deployment.

Forces Driving North America Protective Relays Industry Growth

The North America Protective Relays Industry is propelled by a confluence of powerful growth drivers. Aging infrastructure requiring modernization is a primary catalyst, with significant investments channeled into upgrading transmission and distribution networks for enhanced reliability and capacity. The increasing integration of renewable energy sources, such as solar and wind power, necessitates advanced protective relay solutions to manage grid intermittency and ensure stability. The growing adoption of smart grid technologies and digitalization is driving demand for intelligent relays with advanced communication and monitoring capabilities. Furthermore, heightened concerns around grid security and resilience, driven by climate change impacts and the need to protect critical infrastructure from cyber threats, are creating sustained demand for sophisticated protective relays.

Challenges in the North America Protective Relays Industry Market

Looking beyond immediate hurdles, long-term growth catalysts for the North America Protective Relays Industry lie in continuous technological evolution and strategic market expansion. The advancement of AI and machine learning for predictive fault analysis and autonomous grid management will unlock new levels of operational efficiency and safety. Strategic partnerships and collaborations between relay manufacturers, utility companies, and technology providers will accelerate the development and adoption of integrated grid solutions. Market expansion into emerging applications, such as microgrids and advanced EV charging infrastructure, will open new revenue streams. The increasing focus on sustainability and decarbonization efforts within the energy sector will also drive demand for relays that support the efficient and reliable integration of distributed energy resources.

Emerging Opportunities in North America Protective Relays Industry

The North America Protective Relays Industry is ripe with emerging opportunities. The development and deployment of microgrids for enhanced energy resilience in critical facilities and remote communities present a significant growth avenue. The rapid expansion of electric vehicle (EV) charging infrastructure requires robust protection solutions for charging stations and the supporting grid. The increasing sophistication of cybersecurity threats is driving demand for protective relays with advanced, integrated cyber defense capabilities. Furthermore, the growing trend towards decentralized energy generation and the proliferation of distributed energy resources (DERs) necessitates intelligent and flexible protective relaying to maintain grid stability. There is also a growing opportunity in providing advanced asset management and predictive maintenance solutions leveraging the data capabilities of modern protective relays.

Leading Players in the North America Protective Relays Industry Sector

- ABB Ltd

- General Electric

- Littelfuse Inc

- Woodward Inc

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Toshiba Corporation

- Schweitzer Engineering Laboratories

- Eaton Corporation

Key Milestones in North America Protective Relays Industry Industry

- June 2021: ABB launched a new addition to its Relion product family, the REX610, designed for safe, smart, and sustainable electrification, emphasizing innovative simplicity for protecting grids, industrial processes, and people.

- 2022: General Electric continued its focus on enhancing the digital capabilities of its protective relays, integrating advanced analytics for predictive maintenance and grid optimization.

- 2023: Siemens AG expanded its portfolio with advanced protection relays featuring enhanced cybersecurity features to address the growing threat landscape for critical infrastructure.

- 2024: Schneider Electric SE introduced new generations of its protective relays incorporating improved interoperability and communication protocols for seamless integration into smart grid architectures.

Strategic Outlook for North America Protective Relays Industry Market

The strategic outlook for the North America Protective Relays Industry is exceptionally positive, characterized by sustained demand and significant technological advancement. Future growth will be fueled by the ongoing digital transformation of the power grid, the imperative for enhanced grid resilience against both physical and cyber threats, and the accelerating transition towards renewable energy. Investments in smart grid technologies, the increasing adoption of AI and IoT for grid management, and the expansion of critical infrastructure will continue to drive market expansion. Strategic opportunities lie in developing highly intelligent, self-healing protective systems, expanding product offerings for emerging applications like microgrids and advanced EV infrastructure, and forging strong partnerships across the value chain to deliver integrated solutions.

North America Protective Relays Industry Segmentation

-

1. Voltage Range

- 1.1. Low-Voltage Protective Relay

- 1.2. Medium-Voltage Protective Relay

- 1.3. High-Voltage Protective Relay

-

2. Application

- 2.1. Feeder Protection

- 2.2. Transmission Line Protection

- 2.3. Transformer Protection

- 2.4. Motor Protection

- 2.5. Other Applications

North America Protective Relays Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Protective Relays Industry Regional Market Share

Geographic Coverage of North America Protective Relays Industry

North America Protective Relays Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Electricity Consumption; Increasing Usage of Renewable Energy

- 3.3. Market Restrains

- 3.3.1. Higher Installation Costs

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Renewable Energy Will Increase the Demand of Protective Relays

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Protective Relays Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Voltage Range

- 5.1.1. Low-Voltage Protective Relay

- 5.1.2. Medium-Voltage Protective Relay

- 5.1.3. High-Voltage Protective Relay

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Feeder Protection

- 5.2.2. Transmission Line Protection

- 5.2.3. Transformer Protection

- 5.2.4. Motor Protection

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Voltage Range

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Electric

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Littelfuse Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Woodward Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Electric Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toshiba Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Schweitzer Engineering Laboratories

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eaton Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: North America Protective Relays Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Protective Relays Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Protective Relays Industry Revenue undefined Forecast, by Voltage Range 2020 & 2033

- Table 2: North America Protective Relays Industry Volume K Unit Forecast, by Voltage Range 2020 & 2033

- Table 3: North America Protective Relays Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: North America Protective Relays Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: North America Protective Relays Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: North America Protective Relays Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: North America Protective Relays Industry Revenue undefined Forecast, by Voltage Range 2020 & 2033

- Table 8: North America Protective Relays Industry Volume K Unit Forecast, by Voltage Range 2020 & 2033

- Table 9: North America Protective Relays Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: North America Protective Relays Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: North America Protective Relays Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: North America Protective Relays Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States North America Protective Relays Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States North America Protective Relays Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Protective Relays Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Protective Relays Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Protective Relays Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Protective Relays Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Protective Relays Industry?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the North America Protective Relays Industry?

Key companies in the market include ABB Ltd, General Electric, Littelfuse Inc, Woodward Inc, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Toshiba Corporation, Schweitzer Engineering Laboratories, Eaton Corporation.

3. What are the main segments of the North America Protective Relays Industry?

The market segments include Voltage Range, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growth in Electricity Consumption; Increasing Usage of Renewable Energy.

6. What are the notable trends driving market growth?

Increasing Adoption of Renewable Energy Will Increase the Demand of Protective Relays.

7. Are there any restraints impacting market growth?

Higher Installation Costs.

8. Can you provide examples of recent developments in the market?

Jun 2021 - ABB launched a new addition to its Relion product family, primarily designed to support safe, smart, and sustainable electrification. Packed with innovative simplicity, the REX610 makes protecting grids, industrial processes, and people easier.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Protective Relays Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Protective Relays Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Protective Relays Industry?

To stay informed about further developments, trends, and reports in the North America Protective Relays Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence