Key Insights

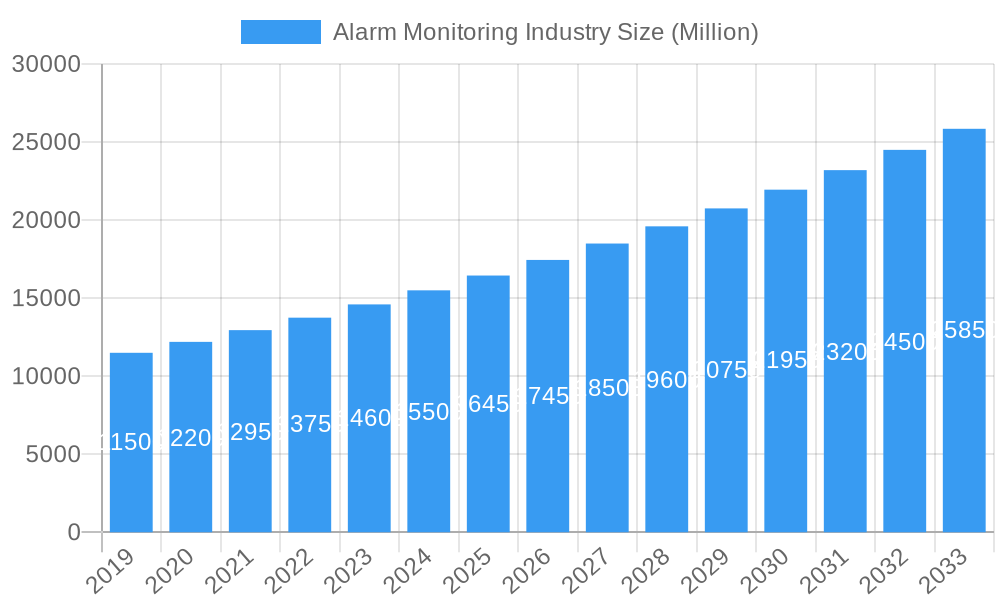

The global Alarm Monitoring Industry is projected for robust expansion, with a significant market size of approximately $15,500 million in 2025, anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.20% through 2033. This sustained growth is fueled by escalating security concerns across residential, commercial, and industrial sectors, driving demand for advanced alarm systems and integrated monitoring solutions. Key drivers include the increasing adoption of smart home technologies, the rise in sophisticated cyber threats necessitating robust digital security, and stringent government regulations mandating enhanced safety measures in public and private spaces. The industry's dynamism is further propelled by technological advancements such as the integration of AI and machine learning for predictive threat analysis, enhanced sensor accuracy, and seamless connectivity through diverse communication networks.

Alarm Monitoring Industry Market Size (In Billion)

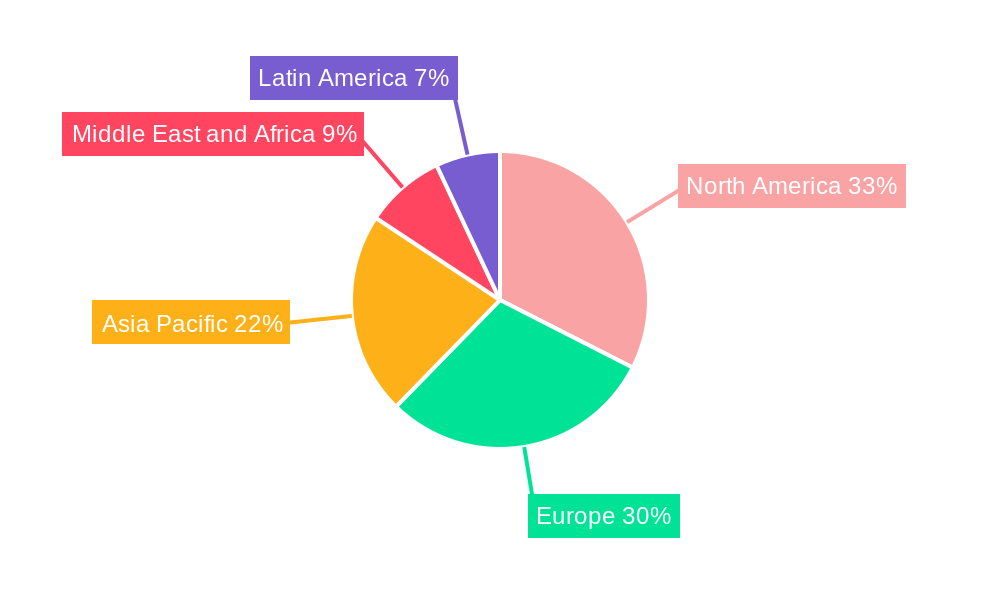

The market is segmented across various offerings, communication technologies, and applications, reflecting a diverse and evolving demand landscape. Hardware, encompassing RTUs, alarm sensors, and communication gateways, forms a substantial segment, complemented by growth in software solutions for intelligent management and professional services for installation and maintenance. The widespread adoption of cellular wireless networks and IP networks for reliable and real-time data transmission underscores a shift towards more connected and responsive security infrastructures. Geographically, North America and Europe currently lead the market share due to established infrastructure and high consumer spending on security. However, the Asia Pacific region is poised for substantial growth, driven by rapid urbanization, increasing disposable incomes, and a growing awareness of security needs. Challenges such as high initial installation costs and concerns about data privacy, particularly with cloud-based solutions, may moderate growth in certain segments, but the overarching trend points towards continued innovation and market penetration.

Alarm Monitoring Industry Company Market Share

Unlocking Security: The Definitive Alarm Monitoring Industry Report (2019-2033)

Gain unparalleled insights into the dynamic alarm monitoring industry, a sector projected to reach $XX Billion by 2033. This comprehensive report, covering the historical period of 2019-2024 and the forecast period of 2025-2033, offers strategic intelligence for stakeholders navigating this rapidly evolving landscape. Dive deep into market drivers, technological advancements, competitive dynamics, and emerging opportunities within the global security systems market. This report is essential for anyone involved in alarm systems, surveillance technology, smart home security, and building automation.

Alarm Monitoring Industry Market Concentration & Dynamics

The alarm monitoring industry exhibits a moderate to high level of market concentration, with major players like Honeywell International Inc, Johnson Controls International Plc, and Siemens AG commanding significant market share, estimated in the high tens of billions of dollars. The innovation ecosystem is driven by continuous advancements in AI, IoT, and cloud-based solutions, fostering a competitive environment. Regulatory frameworks, focusing on data privacy and security standards, play a crucial role in shaping market entry and product development. While substitute products exist, such as DIY security solutions, the demand for professional alarm monitoring services remains robust due to reliability and comprehensive protection. End-user trends lean towards integrated smart security solutions and proactive threat detection. Merger and acquisition (M&A) activities are prevalent, with an estimated XX M&A deals in the past three years, indicating consolidation and strategic expansion within the industry. Key players actively acquire smaller innovative firms to enhance their technological capabilities and expand their service offerings.

Alarm Monitoring Industry Industry Insights & Trends

The alarm monitoring industry is experiencing robust growth, driven by escalating concerns for personal safety, asset protection, and the increasing adoption of interconnected smart home devices and IoT security. The market size was valued at approximately $XX Billion in the base year of 2025, and it is projected to grow at a compound annual growth rate (CAGR) of XX% during the forecast period of 2025–2033. Technological disruptions, particularly in artificial intelligence, machine learning, and advanced sensor technology, are revolutionizing alarm capabilities, enabling sophisticated threat detection and reducing false alarms. Evolving consumer behaviors, characterized by a demand for integrated security solutions that offer convenience, remote access, and customizable features, are further fueling market expansion. The proliferation of wireless alarm systems and cellular communication networks is making advanced security more accessible and easier to install across residential and commercial sectors. The integration of video surveillance with alarm monitoring provides enhanced situational awareness and evidence collection, a trend increasingly favored by consumers and businesses alike. The shift towards managed security services and subscription-based models is also a significant trend, offering recurring revenue streams for providers and predictable costs for end-users.

Key Markets & Segments Leading Alarm Monitoring Industry

The alarm monitoring industry is dominated by the Building Alarm Monitoring application segment, which is estimated to contribute over XX% to the global market revenue in the base year of 2025. This dominance is propelled by the increasing demand for enhanced safety and security in commercial, industrial, and residential buildings, driven by factors like urbanization and stringent building safety regulations.

Offering:

- Hardware: This segment, particularly Alarms Sensor and Communication Networks and Gateways, holds a significant market share, estimated at XX% in 2025. The continuous innovation in sensor technology, such as IoT-enabled sensors and advanced motion detectors, alongside the development of robust and secure communication infrastructure, underpins this segment's strength. Remote Terminal Units (RTUS) are crucial for system integration in industrial applications.

- Services: The Services segment is experiencing rapid growth, with an estimated market share of XX% in 2025. This includes installation, maintenance, and professional alarm monitoring services, driven by the increasing complexity of security systems and the need for expert oversight.

- Software: The Software segment, accounting for approximately XX% in 2025, is crucial for managing, analyzing, and responding to alarm events, including cloud-based platforms and AI-powered analytics.

Communication Technology:

- IP Network: The IP Network segment is the leading communication technology, projected to capture XX% of the market in 2025, due to its high bandwidth, reliability, and seamless integration capabilities with other IP-based systems.

- Cellular Wireless Network: Cellular Wireless Network is a rapidly growing segment, estimated at XX% in 2025, offering flexibility and ease of installation, especially in areas with limited wired infrastructure.

Application:

- Building Alarm Monitoring: This remains the most dominant application, with an estimated XX% market share in 2025. This is driven by the need for comprehensive security solutions in a wide range of structures, from homes and offices to critical infrastructure and public spaces. Economic growth and increasing investments in infrastructure development across regions like North America and Europe further fuel this segment.

Alarm Monitoring Industry Product Developments

Recent product developments in the alarm monitoring industry are characterized by a strong emphasis on intelligent and integrated solutions. Innovations include AI-powered anomaly detection, enhanced cybersecurity features to protect against breaches, and the seamless integration of alarm systems with smart home ecosystems and video analytics. For instance, the development of advanced wireless alarm sensors with extended battery life and improved signal reliability is enhancing user experience and reducing maintenance overhead. The focus is on proactive threat identification, real-time alerts, and automated response mechanisms, providing a more robust and responsive security posture for both residential and commercial users.

Challenges in the Alarm Monitoring Industry Market

Key challenges facing the alarm monitoring industry include the increasing sophistication of cyber threats, which necessitates robust cybersecurity measures for connected systems. Regulatory hurdles related to data privacy and alarm response protocols can also pose complexity. Furthermore, the supply chain issues impacting the availability of crucial electronic components can lead to production delays and increased costs. Intense competitive pressures from both established players and new entrants, particularly in the DIY smart security segment, also require continuous innovation and competitive pricing strategies. The impact of these challenges can result in slower market penetration and reduced profit margins for companies unable to adapt.

Forces Driving Alarm Monitoring Industry Growth

The alarm monitoring industry is propelled by several key growth drivers. Firstly, the escalating global concern for security and safety, coupled with rising instances of crime, fuels the demand for advanced alarm systems. Secondly, the rapid proliferation of IoT technology and the increasing adoption of smart homes create fertile ground for integrated security solutions. Thirdly, government initiatives and regulations promoting enhanced building safety standards are significant accelerators. Lastly, the development of more affordable and user-friendly wireless alarm technology is expanding market accessibility.

Challenges in the Alarm Monitoring Industry Market

Long-term growth catalysts for the alarm monitoring industry lie in continuous technological innovation. The integration of predictive analytics to anticipate potential threats, the development of biometric authentication for access control, and the expansion of AI-driven video analytics for comprehensive threat detection are significant opportunities. Furthermore, strategic partnerships between alarm monitoring companies and internet service providers, smart home device manufacturers, and insurance companies can unlock new market segments and revenue streams. Market expansions into developing economies with growing security needs also represent a crucial long-term growth catalyst.

Emerging Opportunities in Alarm Monitoring Industry

Emerging opportunities in the alarm monitoring industry are abundant. The growing demand for integrated smart building solutions presents a significant avenue for growth, combining security with energy management and automation. The expansion of vehicle alarm monitoring systems, incorporating advanced GPS tracking and anti-theft features, is another burgeoning market. Furthermore, the increasing focus on public safety and security in public spaces, such as schools and commercial venues, is driving demand for advanced threat detection systems, including gunshot detection technology. The increasing preference for managed security services and subscription models offers recurring revenue opportunities.

Leading Players in the Alarm Monitoring Industry Sector

- Honeywell International Inc

- ABB Ltd

- UTC Fire & Security (Carrier Global Corporation)

- Samsung Electronics Co Ltd

- Johnson Controls International Plc

- Siemens AG

- Schneider Electric SE

- CPI Security System Inc

- Rockwell Automation Inc

- ADT Corporation

- Diebold Nixdorf

- Tyco International Plc

Key Milestones in Alarm Monitoring Industry Industry

- February 2022: Siemens Building Technologies Division announced a partnership with Skanska Walsh Joint Venture for the redevelopment of New York's La Guardia Airport's Central Terminal B, deploying a Siemens intelligent infrastructure solution featuring integrated building automation and fire/life safety systems. This collaboration aims to create a more efficient and safer terminal, utilizing Siemens' Desigo CC platform for dynamic system control and the Desigo Fire XLS-V fire alarm panel for critical fire detection.

- December 2021: Siemens Shooter Detection Systems, in collaboration with Alarm.com, integrated technologies to enhance public safety during active shooter situations. This integration between the Guardian Indoor Active Shooter Detection System and Surveillance Video system software allows for automatic alarm triggering, real-time video feed association with shot locations on floor plans, and automated responses upon gunfire detection.

Strategic Outlook for Alarm Monitoring Industry Market

The alarm monitoring industry is poised for significant expansion driven by technological innovation and increasing global demand for security. Growth accelerators include the ongoing integration of AI and IoT into security systems, offering predictive capabilities and enhanced automation. Strategic opportunities lie in expanding service offerings beyond traditional monitoring to encompass comprehensive smart security management and cybersecurity solutions. The increasing trend towards remote monitoring and the development of more sophisticated wireless communication technologies will further enhance market reach. Focus on end-user experience, proactive threat mitigation, and robust data security will be paramount for sustained growth and market leadership.

Alarm Monitoring Industry Segmentation

-

1. Offering

-

1.1. Hardware

- 1.1.1. Remote Terminal Units (RTUS)

- 1.1.2. Alarms Sensor

- 1.1.3. Communication Networks and Gateways

- 1.1.4. Other Hardware

- 1.2. Software

- 1.3. Services

-

1.1. Hardware

-

2. Communication Technology

- 2.1. Wired Telecommunication Network

- 2.2. Cellular Wireless Network

- 2.3. Wireless Radio Network

- 2.4. IP Network

-

3. Application

- 3.1. Vehicle Alarm Monitoring

- 3.2. Building Alarm Monitoring

- 3.3. Other Applications

Alarm Monitoring Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

Alarm Monitoring Industry Regional Market Share

Geographic Coverage of Alarm Monitoring Industry

Alarm Monitoring Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence for gas sensors in HVAC system; Increasing need for air quality monitoring in smart cities; Growth in government standards and regulations concerning emission control; Rising Demand for Safety Systems in the Oil and Gas Industry

- 3.3. Market Restrains

- 3.3.1. High initial cost of the device

- 3.4. Market Trends

- 3.4.1. Vehicle Alarm Monitoring Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Alarm Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Hardware

- 5.1.1.1. Remote Terminal Units (RTUS)

- 5.1.1.2. Alarms Sensor

- 5.1.1.3. Communication Networks and Gateways

- 5.1.1.4. Other Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Communication Technology

- 5.2.1. Wired Telecommunication Network

- 5.2.2. Cellular Wireless Network

- 5.2.3. Wireless Radio Network

- 5.2.4. IP Network

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Vehicle Alarm Monitoring

- 5.3.2. Building Alarm Monitoring

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Alarm Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Hardware

- 6.1.1.1. Remote Terminal Units (RTUS)

- 6.1.1.2. Alarms Sensor

- 6.1.1.3. Communication Networks and Gateways

- 6.1.1.4. Other Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.1.1. Hardware

- 6.2. Market Analysis, Insights and Forecast - by Communication Technology

- 6.2.1. Wired Telecommunication Network

- 6.2.2. Cellular Wireless Network

- 6.2.3. Wireless Radio Network

- 6.2.4. IP Network

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Vehicle Alarm Monitoring

- 6.3.2. Building Alarm Monitoring

- 6.3.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Alarm Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Hardware

- 7.1.1.1. Remote Terminal Units (RTUS)

- 7.1.1.2. Alarms Sensor

- 7.1.1.3. Communication Networks and Gateways

- 7.1.1.4. Other Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.1.1. Hardware

- 7.2. Market Analysis, Insights and Forecast - by Communication Technology

- 7.2.1. Wired Telecommunication Network

- 7.2.2. Cellular Wireless Network

- 7.2.3. Wireless Radio Network

- 7.2.4. IP Network

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Vehicle Alarm Monitoring

- 7.3.2. Building Alarm Monitoring

- 7.3.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Alarm Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Hardware

- 8.1.1.1. Remote Terminal Units (RTUS)

- 8.1.1.2. Alarms Sensor

- 8.1.1.3. Communication Networks and Gateways

- 8.1.1.4. Other Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.1.1. Hardware

- 8.2. Market Analysis, Insights and Forecast - by Communication Technology

- 8.2.1. Wired Telecommunication Network

- 8.2.2. Cellular Wireless Network

- 8.2.3. Wireless Radio Network

- 8.2.4. IP Network

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Vehicle Alarm Monitoring

- 8.3.2. Building Alarm Monitoring

- 8.3.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Middle East and Africa Alarm Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Hardware

- 9.1.1.1. Remote Terminal Units (RTUS)

- 9.1.1.2. Alarms Sensor

- 9.1.1.3. Communication Networks and Gateways

- 9.1.1.4. Other Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.1.1. Hardware

- 9.2. Market Analysis, Insights and Forecast - by Communication Technology

- 9.2.1. Wired Telecommunication Network

- 9.2.2. Cellular Wireless Network

- 9.2.3. Wireless Radio Network

- 9.2.4. IP Network

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Vehicle Alarm Monitoring

- 9.3.2. Building Alarm Monitoring

- 9.3.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Latin America Alarm Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Hardware

- 10.1.1.1. Remote Terminal Units (RTUS)

- 10.1.1.2. Alarms Sensor

- 10.1.1.3. Communication Networks and Gateways

- 10.1.1.4. Other Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.1.1. Hardware

- 10.2. Market Analysis, Insights and Forecast - by Communication Technology

- 10.2.1. Wired Telecommunication Network

- 10.2.2. Cellular Wireless Network

- 10.2.3. Wireless Radio Network

- 10.2.4. IP Network

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Vehicle Alarm Monitoring

- 10.3.2. Building Alarm Monitoring

- 10.3.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UTC Fire & Security (Carrier Global Corporation)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samsung Electronics Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson Controls International Plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schneider Electric SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CPI Security System Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rockwell Automation Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ADT Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Diebold Nixdorf

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Tyco International Plc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Alarm Monitoring Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Alarm Monitoring Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Alarm Monitoring Industry Revenue (undefined), by Offering 2025 & 2033

- Figure 4: North America Alarm Monitoring Industry Volume (K Unit), by Offering 2025 & 2033

- Figure 5: North America Alarm Monitoring Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 6: North America Alarm Monitoring Industry Volume Share (%), by Offering 2025 & 2033

- Figure 7: North America Alarm Monitoring Industry Revenue (undefined), by Communication Technology 2025 & 2033

- Figure 8: North America Alarm Monitoring Industry Volume (K Unit), by Communication Technology 2025 & 2033

- Figure 9: North America Alarm Monitoring Industry Revenue Share (%), by Communication Technology 2025 & 2033

- Figure 10: North America Alarm Monitoring Industry Volume Share (%), by Communication Technology 2025 & 2033

- Figure 11: North America Alarm Monitoring Industry Revenue (undefined), by Application 2025 & 2033

- Figure 12: North America Alarm Monitoring Industry Volume (K Unit), by Application 2025 & 2033

- Figure 13: North America Alarm Monitoring Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Alarm Monitoring Industry Volume Share (%), by Application 2025 & 2033

- Figure 15: North America Alarm Monitoring Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Alarm Monitoring Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Alarm Monitoring Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Alarm Monitoring Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Alarm Monitoring Industry Revenue (undefined), by Offering 2025 & 2033

- Figure 20: Europe Alarm Monitoring Industry Volume (K Unit), by Offering 2025 & 2033

- Figure 21: Europe Alarm Monitoring Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 22: Europe Alarm Monitoring Industry Volume Share (%), by Offering 2025 & 2033

- Figure 23: Europe Alarm Monitoring Industry Revenue (undefined), by Communication Technology 2025 & 2033

- Figure 24: Europe Alarm Monitoring Industry Volume (K Unit), by Communication Technology 2025 & 2033

- Figure 25: Europe Alarm Monitoring Industry Revenue Share (%), by Communication Technology 2025 & 2033

- Figure 26: Europe Alarm Monitoring Industry Volume Share (%), by Communication Technology 2025 & 2033

- Figure 27: Europe Alarm Monitoring Industry Revenue (undefined), by Application 2025 & 2033

- Figure 28: Europe Alarm Monitoring Industry Volume (K Unit), by Application 2025 & 2033

- Figure 29: Europe Alarm Monitoring Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Alarm Monitoring Industry Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Alarm Monitoring Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: Europe Alarm Monitoring Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Alarm Monitoring Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Alarm Monitoring Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Alarm Monitoring Industry Revenue (undefined), by Offering 2025 & 2033

- Figure 36: Asia Pacific Alarm Monitoring Industry Volume (K Unit), by Offering 2025 & 2033

- Figure 37: Asia Pacific Alarm Monitoring Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 38: Asia Pacific Alarm Monitoring Industry Volume Share (%), by Offering 2025 & 2033

- Figure 39: Asia Pacific Alarm Monitoring Industry Revenue (undefined), by Communication Technology 2025 & 2033

- Figure 40: Asia Pacific Alarm Monitoring Industry Volume (K Unit), by Communication Technology 2025 & 2033

- Figure 41: Asia Pacific Alarm Monitoring Industry Revenue Share (%), by Communication Technology 2025 & 2033

- Figure 42: Asia Pacific Alarm Monitoring Industry Volume Share (%), by Communication Technology 2025 & 2033

- Figure 43: Asia Pacific Alarm Monitoring Industry Revenue (undefined), by Application 2025 & 2033

- Figure 44: Asia Pacific Alarm Monitoring Industry Volume (K Unit), by Application 2025 & 2033

- Figure 45: Asia Pacific Alarm Monitoring Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Asia Pacific Alarm Monitoring Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Asia Pacific Alarm Monitoring Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Asia Pacific Alarm Monitoring Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Alarm Monitoring Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Alarm Monitoring Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Alarm Monitoring Industry Revenue (undefined), by Offering 2025 & 2033

- Figure 52: Middle East and Africa Alarm Monitoring Industry Volume (K Unit), by Offering 2025 & 2033

- Figure 53: Middle East and Africa Alarm Monitoring Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 54: Middle East and Africa Alarm Monitoring Industry Volume Share (%), by Offering 2025 & 2033

- Figure 55: Middle East and Africa Alarm Monitoring Industry Revenue (undefined), by Communication Technology 2025 & 2033

- Figure 56: Middle East and Africa Alarm Monitoring Industry Volume (K Unit), by Communication Technology 2025 & 2033

- Figure 57: Middle East and Africa Alarm Monitoring Industry Revenue Share (%), by Communication Technology 2025 & 2033

- Figure 58: Middle East and Africa Alarm Monitoring Industry Volume Share (%), by Communication Technology 2025 & 2033

- Figure 59: Middle East and Africa Alarm Monitoring Industry Revenue (undefined), by Application 2025 & 2033

- Figure 60: Middle East and Africa Alarm Monitoring Industry Volume (K Unit), by Application 2025 & 2033

- Figure 61: Middle East and Africa Alarm Monitoring Industry Revenue Share (%), by Application 2025 & 2033

- Figure 62: Middle East and Africa Alarm Monitoring Industry Volume Share (%), by Application 2025 & 2033

- Figure 63: Middle East and Africa Alarm Monitoring Industry Revenue (undefined), by Country 2025 & 2033

- Figure 64: Middle East and Africa Alarm Monitoring Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Alarm Monitoring Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Alarm Monitoring Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Latin America Alarm Monitoring Industry Revenue (undefined), by Offering 2025 & 2033

- Figure 68: Latin America Alarm Monitoring Industry Volume (K Unit), by Offering 2025 & 2033

- Figure 69: Latin America Alarm Monitoring Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 70: Latin America Alarm Monitoring Industry Volume Share (%), by Offering 2025 & 2033

- Figure 71: Latin America Alarm Monitoring Industry Revenue (undefined), by Communication Technology 2025 & 2033

- Figure 72: Latin America Alarm Monitoring Industry Volume (K Unit), by Communication Technology 2025 & 2033

- Figure 73: Latin America Alarm Monitoring Industry Revenue Share (%), by Communication Technology 2025 & 2033

- Figure 74: Latin America Alarm Monitoring Industry Volume Share (%), by Communication Technology 2025 & 2033

- Figure 75: Latin America Alarm Monitoring Industry Revenue (undefined), by Application 2025 & 2033

- Figure 76: Latin America Alarm Monitoring Industry Volume (K Unit), by Application 2025 & 2033

- Figure 77: Latin America Alarm Monitoring Industry Revenue Share (%), by Application 2025 & 2033

- Figure 78: Latin America Alarm Monitoring Industry Volume Share (%), by Application 2025 & 2033

- Figure 79: Latin America Alarm Monitoring Industry Revenue (undefined), by Country 2025 & 2033

- Figure 80: Latin America Alarm Monitoring Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Latin America Alarm Monitoring Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Latin America Alarm Monitoring Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Alarm Monitoring Industry Revenue undefined Forecast, by Offering 2020 & 2033

- Table 2: Global Alarm Monitoring Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 3: Global Alarm Monitoring Industry Revenue undefined Forecast, by Communication Technology 2020 & 2033

- Table 4: Global Alarm Monitoring Industry Volume K Unit Forecast, by Communication Technology 2020 & 2033

- Table 5: Global Alarm Monitoring Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Alarm Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: Global Alarm Monitoring Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Alarm Monitoring Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Alarm Monitoring Industry Revenue undefined Forecast, by Offering 2020 & 2033

- Table 10: Global Alarm Monitoring Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 11: Global Alarm Monitoring Industry Revenue undefined Forecast, by Communication Technology 2020 & 2033

- Table 12: Global Alarm Monitoring Industry Volume K Unit Forecast, by Communication Technology 2020 & 2033

- Table 13: Global Alarm Monitoring Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Alarm Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Global Alarm Monitoring Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global Alarm Monitoring Industry Revenue undefined Forecast, by Offering 2020 & 2033

- Table 18: Global Alarm Monitoring Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 19: Global Alarm Monitoring Industry Revenue undefined Forecast, by Communication Technology 2020 & 2033

- Table 20: Global Alarm Monitoring Industry Volume K Unit Forecast, by Communication Technology 2020 & 2033

- Table 21: Global Alarm Monitoring Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global Alarm Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Alarm Monitoring Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Alarm Monitoring Industry Revenue undefined Forecast, by Offering 2020 & 2033

- Table 26: Global Alarm Monitoring Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 27: Global Alarm Monitoring Industry Revenue undefined Forecast, by Communication Technology 2020 & 2033

- Table 28: Global Alarm Monitoring Industry Volume K Unit Forecast, by Communication Technology 2020 & 2033

- Table 29: Global Alarm Monitoring Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Alarm Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 31: Global Alarm Monitoring Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Global Alarm Monitoring Industry Revenue undefined Forecast, by Offering 2020 & 2033

- Table 34: Global Alarm Monitoring Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 35: Global Alarm Monitoring Industry Revenue undefined Forecast, by Communication Technology 2020 & 2033

- Table 36: Global Alarm Monitoring Industry Volume K Unit Forecast, by Communication Technology 2020 & 2033

- Table 37: Global Alarm Monitoring Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Alarm Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 39: Global Alarm Monitoring Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global Alarm Monitoring Industry Revenue undefined Forecast, by Offering 2020 & 2033

- Table 42: Global Alarm Monitoring Industry Volume K Unit Forecast, by Offering 2020 & 2033

- Table 43: Global Alarm Monitoring Industry Revenue undefined Forecast, by Communication Technology 2020 & 2033

- Table 44: Global Alarm Monitoring Industry Volume K Unit Forecast, by Communication Technology 2020 & 2033

- Table 45: Global Alarm Monitoring Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 46: Global Alarm Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 47: Global Alarm Monitoring Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Global Alarm Monitoring Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Alarm Monitoring Industry?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Alarm Monitoring Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, UTC Fire & Security (Carrier Global Corporation), Samsung Electronics Co Ltd , Johnson Controls International Plc, Siemens AG, Schneider Electric SE, CPI Security System Inc, Rockwell Automation Inc, ADT Corporation, Diebold Nixdorf, Tyco International Plc.

3. What are the main segments of the Alarm Monitoring Industry?

The market segments include Offering, Communication Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Emergence for gas sensors in HVAC system; Increasing need for air quality monitoring in smart cities; Growth in government standards and regulations concerning emission control; Rising Demand for Safety Systems in the Oil and Gas Industry.

6. What are the notable trends driving market growth?

Vehicle Alarm Monitoring Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

High initial cost of the device.

8. Can you provide examples of recent developments in the market?

February 2022 - Siemens Building Technologies Division announced a partnership with Skanska Walsh Joint Venture, the design-build contractor for the redevelopment of New York's La Guardia Airport's Central Terminal B, to deploy a Siemens intelligent infrastructure solution that comprises integrated building automation and fire/life safety system for the new central terminal complex. The new Terminal B would be more efficient and safer than its predecessor, built in 1964. Siemens' Desigo CC integrated building management platform would monitor the building automation, facilitating dynamic control of the facility's systems to respond to the changing needs of the terminal's operations. The Desigo Fire XLS-V fire alarm panel with voice capability would be at the heart of the fire alarm system, operating in Terminal B and the central plant.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Alarm Monitoring Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Alarm Monitoring Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Alarm Monitoring Industry?

To stay informed about further developments, trends, and reports in the Alarm Monitoring Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence