Key Insights

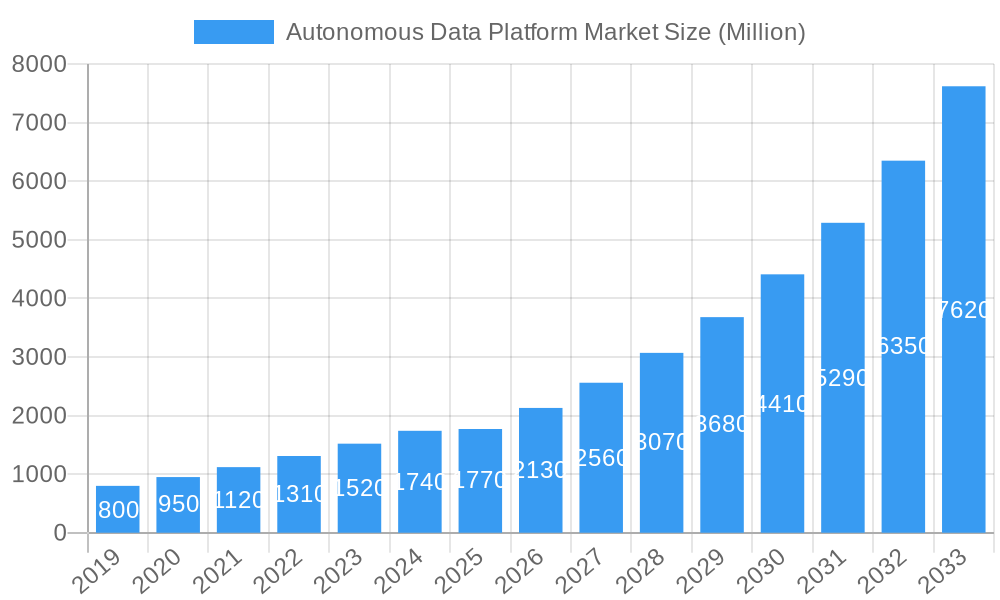

The Autonomous Data Platform market is poised for substantial growth, projected to reach an estimated $1.77 million by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 20.33% anticipated to continue through 2033. This robust expansion is fueled by an increasing demand for automated data management, streamlined data operations, and enhanced data governance across diverse industries. Key drivers include the escalating volume and complexity of data, the imperative for real-time analytics to gain competitive advantages, and the growing adoption of AI and machine learning technologies for predictive insights and operational efficiency. Organizations are increasingly recognizing the benefits of autonomous platforms in reducing manual intervention, minimizing human error, and accelerating time-to-insight, thereby enabling them to derive greater value from their data assets. The market's trajectory is further bolstered by the continuous innovation in data integration, data quality, and data security solutions, all contributing to a more intelligent and self-sufficient data ecosystem.

Autonomous Data Platform Market Market Size (In Million)

The market is segmented by organization size, with Large Enterprises leading adoption due to their extensive data needs and sophisticated IT infrastructures, while Small and Medium-Sized Enterprises (SMEs) are increasingly investing in these solutions to level the playing field and enhance their competitive agility. Deployment types are dominated by Public Cloud, offering scalability and cost-effectiveness, followed closely by Private and Hybrid Cloud models catering to specific security and control requirements. The BFSI sector is a significant adopter, driven by regulatory compliance and the need for robust risk management and personalized customer experiences. Healthcare and Life Sciences are also major beneficiaries, leveraging autonomous platforms for drug discovery, patient analytics, and operational efficiency. Retail and Consumer Goods, along with Media and Telecommunication, are further contributing to market growth through personalized marketing, enhanced customer engagement, and content optimization. While the market is experiencing rapid growth, challenges such as data privacy concerns, the need for skilled personnel to manage evolving technologies, and integration complexities with legacy systems may present some restraints. However, the overarching trend points towards a future where autonomous data platforms become indispensable for businesses seeking to harness the full potential of their data.

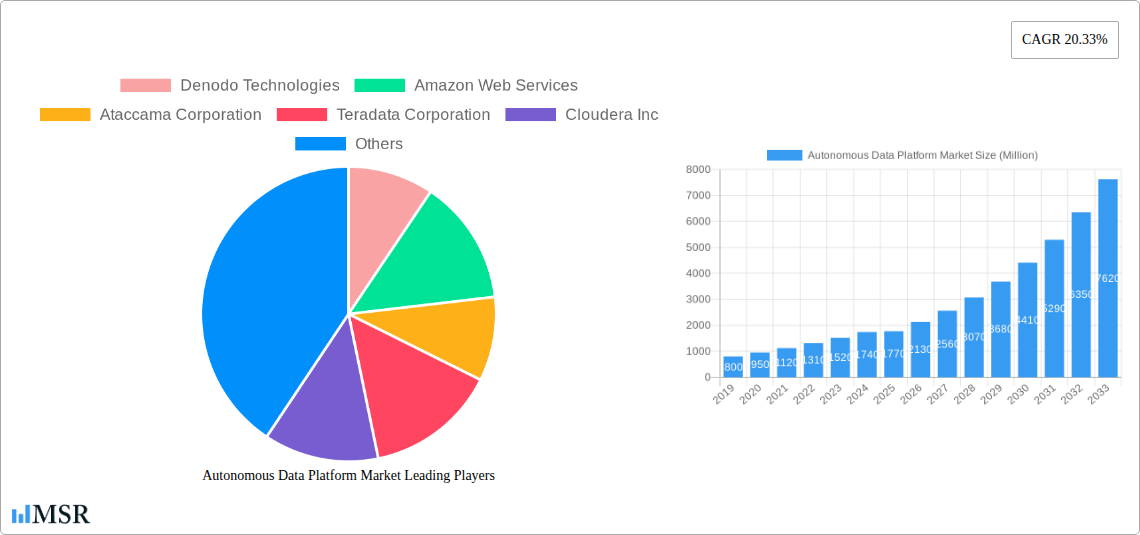

Autonomous Data Platform Market Company Market Share

This comprehensive Autonomous Data Platform Market report provides an in-depth analysis of the AI-powered data management landscape, predicting robust growth driven by the increasing need for automated data integration, governance, and analytics. Explore market size, CAGR, key trends, and strategic insights to leverage the full potential of your data assets. Discover how leading players like Denodo Technologies, Amazon Web Services, Ataccama Corporation, Teradata Corporation, Cloudera Inc, Zaloni Inc, International Business Machines Corporation, Gemini Data Inc, Qubole Inc, MapR Technologies Inc, Paxata Inc, Alteryx Inc, Oracle Corporation, Datrium Inc, are shaping the future of data platforms. This study covers the study period 2019–2033, with a base year and estimated year of 2025, and a forecast period from 2025–2033. Historical data from 2019–2024 is also included.

Autonomous Data Platform Market Market Concentration & Dynamics

The Autonomous Data Platform Market exhibits a dynamic and evolving concentration landscape, characterized by a blend of established technology giants and innovative startups vying for market share. Innovation ecosystems are flourishing, fueled by advancements in artificial intelligence (AI), machine learning (ML), and data virtualization, driving the development of sophisticated autonomous data capabilities. Regulatory frameworks surrounding data privacy and security, such as GDPR and CCPA, are increasingly influencing platform development and adoption, pushing for enhanced compliance features. Substitute products, including traditional data warehousing and ETL solutions, are facing pressure from the agility and efficiency offered by autonomous platforms. End-user trends highlight a growing demand for self-service data access, automated data preparation, and intelligent analytics, propelling the adoption of these advanced solutions. Mergers and acquisitions (M&A) activities are notable, with an estimated xx M&A deal counts observed within the historical period, reflecting the industry's consolidation and strategic realignment. Leading players like Amazon Web Services and International Business Machines Corporation maintain significant market share, while companies such as Denodo Technologies and Ataccama Corporation are carving out niche leadership through specialized solutions. The market's competitive intensity is moderate to high, with a strong emphasis on technological differentiation and strategic partnerships.

Autonomous Data Platform Market Industry Insights & Trends

The Autonomous Data Platform Market is poised for significant expansion, with an estimated market size of approximately $XX Billion in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is primarily fueled by the escalating volume and complexity of data generated across industries, coupled with the imperative for organizations to extract actionable insights rapidly and efficiently. AI and ML are at the core of this transformation, enabling data platforms to automate tasks such as data ingestion, cleansing, transformation, and integration, thereby reducing manual intervention and associated costs. The trend towards data democratization, empowering a wider range of users to access and analyze data, is a key driver, as autonomous platforms simplify data accessibility and usability. Furthermore, the increasing adoption of cloud-based solutions, including Public Cloud, Private Cloud, and Hybrid Cloud deployments, provides the scalable infrastructure necessary for autonomous data processing.

Technological disruptions, including the rise of data fabric architectures, data mesh principles, and intelligent metadata management, are reshaping the autonomous data platform landscape. These innovations allow for more decentralized and agile data governance, enabling organizations to manage diverse data sources effectively. Evolving consumer behaviors, characterized by a demand for personalized experiences and data-driven decision-making, are compelling businesses to invest in advanced analytics capabilities powered by autonomous platforms. The need for real-time data processing and analytics to support dynamic business strategies is also a critical growth factor. For instance, the BFSI sector is leveraging these platforms for fraud detection and personalized customer offerings, while Healthcare and Life Sciences is utilizing them for drug discovery and patient outcome analysis. The Retail and Consumer Goods industry benefits from improved inventory management and personalized marketing campaigns, and Media and Telecommunication firms are using them for audience segmentation and content optimization. The overall industry trajectory points towards a future where data management is largely self-sufficient, allowing human expertise to focus on higher-value strategic initiatives.

Key Markets & Segments Leading Autonomous Data Platform Market

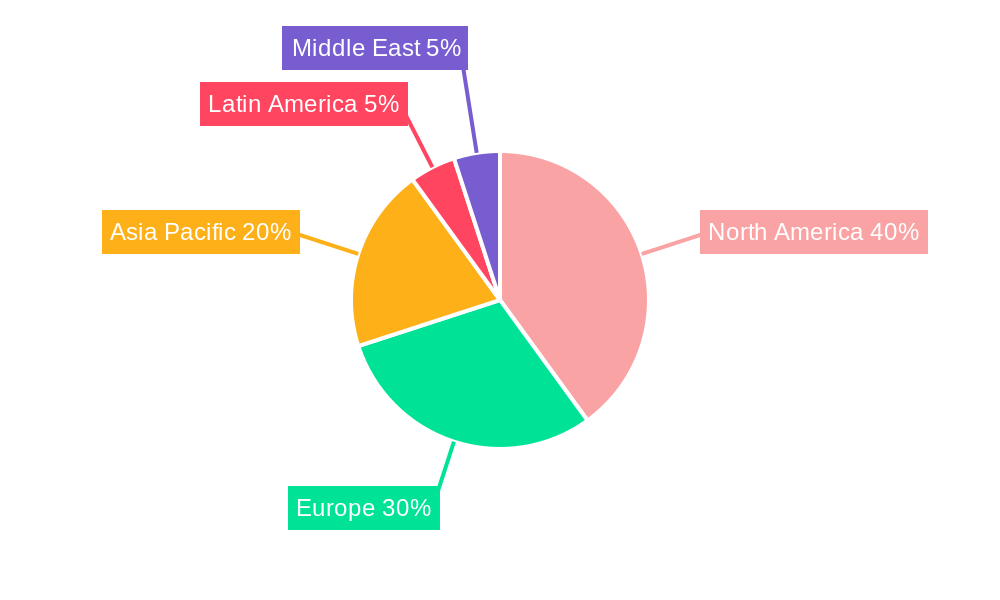

The Autonomous Data Platform Market is witnessing dominant growth driven by several key markets and segments, with North America emerging as a leading region due to its advanced technological infrastructure and high adoption rates of AI and big data solutions. Within this region, the United States spearheads innovation and investment in autonomous data platforms.

Organization Size:

- Large Enterprises: This segment represents a significant market share, driven by their substantial data volumes, complex data ecosystems, and the financial capacity to invest in advanced autonomous data solutions. These organizations are leveraging autonomous platforms to overcome data silos, enhance operational efficiency, and gain a competitive edge through sophisticated analytics. The need for robust data governance and compliance in large-scale operations further propels their adoption.

- Small and Medium-Sized Enterprises (SMEs): While historically slower to adopt, SMEs are increasingly recognizing the value proposition of autonomous data platforms, particularly cloud-based solutions, which offer cost-effectiveness and scalability. These platforms enable SMEs to compete with larger organizations by democratizing data access and providing advanced analytical capabilities without the need for extensive IT resources.

Deployment Type:

- Public Cloud: This deployment model is a major growth engine for autonomous data platforms, offering unparalleled scalability, flexibility, and cost-efficiency. Major cloud providers are investing heavily in autonomous data capabilities, making these solutions accessible to a broader market. The ease of deployment and managed services associated with public cloud further accelerate adoption.

- Hybrid Cloud: Organizations increasingly adopting a hybrid cloud strategy are also driving demand for autonomous data platforms that can seamlessly integrate data across on-premises and cloud environments, providing a unified data management experience.

End-user Vertical:

- BFSI: The Banking, Financial Services, and Insurance (BFSI) sector is a prime adopter, utilizing autonomous data platforms for enhanced fraud detection, risk management, personalized customer services, and regulatory compliance. The ability to process vast amounts of transactional data in real-time is crucial for this industry.

- Healthcare and Life Sciences: This vertical benefits immensely from autonomous platforms for accelerating drug discovery, optimizing clinical trials, improving patient care through predictive analytics, and managing sensitive health records securely. The complexity of biological and medical data makes autonomous solutions invaluable.

- Retail and Consumer Goods: Retailers are leveraging autonomous platforms for advanced customer segmentation, personalized marketing campaigns, supply chain optimization, inventory management, and understanding consumer behavior to drive sales and improve customer loyalty.

- Media and Telecommunication: This sector utilizes autonomous data platforms for audience analytics, personalized content delivery, optimizing advertising strategies, and network performance management.

Autonomous Data Platform Market Product Developments

Product developments in the Autonomous Data Platform Market are characterized by a relentless pursuit of enhanced automation, intelligence, and integration. Companies are innovating with AI-driven data cataloging, automated data quality checks, self-service data preparation tools, and intelligent data governance features. Advanced data virtualization techniques are enabling seamless access to disparate data sources without physical data movement. The market is also witnessing the integration of predictive analytics and ML models directly within data platforms, empowering users to derive deeper insights and make data-driven decisions faster. These advancements not only streamline data management processes but also significantly reduce the time and resources required for data-related tasks, offering a distinct competitive edge to early adopters.

Challenges in the Autonomous Data Platform Market Market

Despite the promising growth, the Autonomous Data Platform Market faces several challenges. Data security and privacy concerns remain paramount, with organizations apprehensive about handing over sensitive data to automated systems. The complexity of integrating these platforms with existing legacy systems can be a significant technical hurdle. Furthermore, the shortage of skilled professionals capable of managing and optimizing these advanced solutions poses a restraint. The initial investment cost for sophisticated autonomous data platforms can also be a barrier for smaller enterprises. The ongoing evolution of AI and ML technologies necessitates continuous updates and adaptation, adding to the operational burden.

Forces Driving Autonomous Data Platform Market Growth

The Autonomous Data Platform Market is propelled by several potent growth forces. The exponential growth of data across all industries necessitates automated solutions for efficient management and analysis. The increasing adoption of AI and ML technologies is a fundamental driver, enabling platforms to perform complex tasks autonomously. The demand for faster and more accurate insights to support business decision-making is also critical. Moreover, the push for digital transformation and data-driven cultures within organizations fuels the adoption of advanced data management tools. Government initiatives promoting data utilization and innovation further contribute to market expansion.

Challenges in the Autonomous Data Platform Market Market

Long-term growth catalysts for the Autonomous Data Platform Market lie in continuous innovation and strategic market expansion. The ongoing development of more sophisticated AI algorithms for predictive analytics and anomaly detection will unlock new use cases. Strategic partnerships between platform providers and cloud service providers will enhance scalability and accessibility. Furthermore, the expansion into emerging economies with rapidly growing data needs will open up significant new market opportunities. The increasing focus on data governance and compliance as a core feature of autonomous platforms will also solidify their position in the market.

Emerging Opportunities in Autonomous Data Platform Market

Emerging opportunities in the Autonomous Data Platform Market are diverse and exciting. The integration of generative AI capabilities for automated report generation and data storytelling presents a novel avenue. The growing demand for specialized autonomous data solutions tailored for specific industries, such as genomics or IoT analytics, offers significant potential. The development of federated learning capabilities within autonomous platforms will enable collaborative data analysis without centralizing sensitive data. Furthermore, the increasing emphasis on ethical AI and explainable AI (XAI) within autonomous platforms will cater to growing market demand for transparency and trustworthiness.

Leading Players in the Autonomous Data Platform Market Sector

- Denodo Technologies

- Amazon Web Services

- Ataccama Corporation

- Teradata Corporation

- Cloudera Inc

- Zaloni Inc

- International Business Machines Corporation

- Gemini Data Inc

- Qubole Inc

- MapR Technologies Inc

- Paxata Inc

- Alteryx Inc

- Oracle Corporation

- Datrium Inc

Key Milestones in Autonomous Data Platform Market Industry

- 2019: Widespread adoption of AI/ML for data integration and preparation begins to gain traction.

- 2020: Increased focus on cloud-native autonomous data platforms for scalability and flexibility.

- 2021: Emergence of data fabric concepts driving demand for interconnected autonomous data solutions.

- 2022: Significant advancements in automated data governance and compliance features within platforms.

- 2023: Growing market interest in self-service data analytics capabilities powered by autonomous platforms.

- 2024: Enhanced AI algorithms enable more predictive and prescriptive analytics within autonomous data environments.

Strategic Outlook for Autonomous Data Platform Market Market

The strategic outlook for the Autonomous Data Platform Market is exceptionally positive, driven by the fundamental need for organizations to harness the power of their data efficiently and intelligently. Growth accelerators include the continued evolution of AI and ML capabilities, enabling platforms to perform increasingly complex data management tasks autonomously. Strategic partnerships between technology providers and cloud hyperscalers will further expand market reach and accessibility. The increasing recognition of data as a critical strategic asset will continue to fuel investments in advanced autonomous data solutions. Companies that can effectively demonstrate the ROI of their autonomous platforms through enhanced operational efficiency, faster time-to-insight, and improved decision-making will be well-positioned for sustained success.

Autonomous Data Platform Market Segmentation

-

1. Organization Size

- 1.1. Large Enterprises

- 1.2. Small and Medium-Sized Enterprise

-

2. Deployment Type

- 2.1. Public Cloud

- 2.2. Private Cloud

- 2.3. Hybrid Cloud

-

3. End-user Vertical

- 3.1. BFSI

- 3.2. Healthcare and Life Sciences

- 3.3. Retail and Consumer Goods

- 3.4. Media and Telecommunication

- 3.5. Other En

Autonomous Data Platform Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Autonomous Data Platform Market Regional Market Share

Geographic Coverage of Autonomous Data Platform Market

Autonomous Data Platform Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Adoption of Cognitive Computing Technology and Advanced Analytics; Expanding Volume of Unstructured Data Due to the Phenomenal Growth of Interconnected Devices and Social Media

- 3.3. Market Restrains

- 3.3.1. ; Complex Analytical Process Requiring Skilled Professionals Services

- 3.4. Market Trends

- 3.4.1. Retail Vertical is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autonomous Data Platform Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. Large Enterprises

- 5.1.2. Small and Medium-Sized Enterprise

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. Public Cloud

- 5.2.2. Private Cloud

- 5.2.3. Hybrid Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. BFSI

- 5.3.2. Healthcare and Life Sciences

- 5.3.3. Retail and Consumer Goods

- 5.3.4. Media and Telecommunication

- 5.3.5. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. North America Autonomous Data Platform Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 6.1.1. Large Enterprises

- 6.1.2. Small and Medium-Sized Enterprise

- 6.2. Market Analysis, Insights and Forecast - by Deployment Type

- 6.2.1. Public Cloud

- 6.2.2. Private Cloud

- 6.2.3. Hybrid Cloud

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. BFSI

- 6.3.2. Healthcare and Life Sciences

- 6.3.3. Retail and Consumer Goods

- 6.3.4. Media and Telecommunication

- 6.3.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 7. Europe Autonomous Data Platform Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 7.1.1. Large Enterprises

- 7.1.2. Small and Medium-Sized Enterprise

- 7.2. Market Analysis, Insights and Forecast - by Deployment Type

- 7.2.1. Public Cloud

- 7.2.2. Private Cloud

- 7.2.3. Hybrid Cloud

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. BFSI

- 7.3.2. Healthcare and Life Sciences

- 7.3.3. Retail and Consumer Goods

- 7.3.4. Media and Telecommunication

- 7.3.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 8. Asia Pacific Autonomous Data Platform Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 8.1.1. Large Enterprises

- 8.1.2. Small and Medium-Sized Enterprise

- 8.2. Market Analysis, Insights and Forecast - by Deployment Type

- 8.2.1. Public Cloud

- 8.2.2. Private Cloud

- 8.2.3. Hybrid Cloud

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. BFSI

- 8.3.2. Healthcare and Life Sciences

- 8.3.3. Retail and Consumer Goods

- 8.3.4. Media and Telecommunication

- 8.3.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 9. Latin America Autonomous Data Platform Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 9.1.1. Large Enterprises

- 9.1.2. Small and Medium-Sized Enterprise

- 9.2. Market Analysis, Insights and Forecast - by Deployment Type

- 9.2.1. Public Cloud

- 9.2.2. Private Cloud

- 9.2.3. Hybrid Cloud

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. BFSI

- 9.3.2. Healthcare and Life Sciences

- 9.3.3. Retail and Consumer Goods

- 9.3.4. Media and Telecommunication

- 9.3.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 10. Middle East Autonomous Data Platform Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 10.1.1. Large Enterprises

- 10.1.2. Small and Medium-Sized Enterprise

- 10.2. Market Analysis, Insights and Forecast - by Deployment Type

- 10.2.1. Public Cloud

- 10.2.2. Private Cloud

- 10.2.3. Hybrid Cloud

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. BFSI

- 10.3.2. Healthcare and Life Sciences

- 10.3.3. Retail and Consumer Goods

- 10.3.4. Media and Telecommunication

- 10.3.5. Other En

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 11. North America Autonomous Data Platform Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Autonomous Data Platform Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Autonomous Data Platform Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Autonomous Data Platform Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Autonomous Data Platform Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 Denodo Technologies

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Amazon Web Services

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Ataccama Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Teradata Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Cloudera Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Zaloni Inc *List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 International Business Machines Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Gemini Data Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Qubole Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 MapR Technologies Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Paxata Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Alteryx Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Oracle Corporation

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Datrium Inc

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 Denodo Technologies

List of Figures

- Figure 1: Global Autonomous Data Platform Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Autonomous Data Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 3: North America Autonomous Data Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Autonomous Data Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe Autonomous Data Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Autonomous Data Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Autonomous Data Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Latin America Autonomous Data Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Latin America Autonomous Data Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Middle East Autonomous Data Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 11: Middle East Autonomous Data Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: North America Autonomous Data Platform Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 13: North America Autonomous Data Platform Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: North America Autonomous Data Platform Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 15: North America Autonomous Data Platform Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 16: North America Autonomous Data Platform Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 17: North America Autonomous Data Platform Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: North America Autonomous Data Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 19: North America Autonomous Data Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Europe Autonomous Data Platform Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 21: Europe Autonomous Data Platform Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Europe Autonomous Data Platform Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 23: Europe Autonomous Data Platform Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 24: Europe Autonomous Data Platform Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 25: Europe Autonomous Data Platform Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 26: Europe Autonomous Data Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 27: Europe Autonomous Data Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 28: Asia Pacific Autonomous Data Platform Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 29: Asia Pacific Autonomous Data Platform Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 30: Asia Pacific Autonomous Data Platform Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 31: Asia Pacific Autonomous Data Platform Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 32: Asia Pacific Autonomous Data Platform Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 33: Asia Pacific Autonomous Data Platform Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 34: Asia Pacific Autonomous Data Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 35: Asia Pacific Autonomous Data Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 36: Latin America Autonomous Data Platform Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 37: Latin America Autonomous Data Platform Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: Latin America Autonomous Data Platform Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 39: Latin America Autonomous Data Platform Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 40: Latin America Autonomous Data Platform Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 41: Latin America Autonomous Data Platform Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 42: Latin America Autonomous Data Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 43: Latin America Autonomous Data Platform Market Revenue Share (%), by Country 2025 & 2033

- Figure 44: Middle East Autonomous Data Platform Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 45: Middle East Autonomous Data Platform Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 46: Middle East Autonomous Data Platform Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 47: Middle East Autonomous Data Platform Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 48: Middle East Autonomous Data Platform Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 49: Middle East Autonomous Data Platform Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 50: Middle East Autonomous Data Platform Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East Autonomous Data Platform Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Autonomous Data Platform Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Autonomous Data Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 3: Global Autonomous Data Platform Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 4: Global Autonomous Data Platform Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 5: Global Autonomous Data Platform Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Autonomous Data Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Autonomous Data Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Autonomous Data Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Autonomous Data Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Autonomous Data Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Autonomous Data Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Autonomous Data Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Autonomous Data Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Autonomous Data Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Autonomous Data Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Autonomous Data Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 17: Global Autonomous Data Platform Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 18: Global Autonomous Data Platform Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 19: Global Autonomous Data Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Autonomous Data Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 21: Global Autonomous Data Platform Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 22: Global Autonomous Data Platform Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 23: Global Autonomous Data Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Autonomous Data Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 25: Global Autonomous Data Platform Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 26: Global Autonomous Data Platform Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 27: Global Autonomous Data Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Autonomous Data Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 29: Global Autonomous Data Platform Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 30: Global Autonomous Data Platform Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 31: Global Autonomous Data Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Autonomous Data Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 33: Global Autonomous Data Platform Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 34: Global Autonomous Data Platform Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 35: Global Autonomous Data Platform Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autonomous Data Platform Market?

The projected CAGR is approximately 20.33%.

2. Which companies are prominent players in the Autonomous Data Platform Market?

Key companies in the market include Denodo Technologies, Amazon Web Services, Ataccama Corporation, Teradata Corporation, Cloudera Inc, Zaloni Inc *List Not Exhaustive, International Business Machines Corporation, Gemini Data Inc, Qubole Inc, MapR Technologies Inc, Paxata Inc, Alteryx Inc, Oracle Corporation, Datrium Inc.

3. What are the main segments of the Autonomous Data Platform Market?

The market segments include Organization Size, Deployment Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.77 Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Adoption of Cognitive Computing Technology and Advanced Analytics; Expanding Volume of Unstructured Data Due to the Phenomenal Growth of Interconnected Devices and Social Media.

6. What are the notable trends driving market growth?

Retail Vertical is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

; Complex Analytical Process Requiring Skilled Professionals Services.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autonomous Data Platform Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autonomous Data Platform Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autonomous Data Platform Market?

To stay informed about further developments, trends, and reports in the Autonomous Data Platform Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence