Key Insights

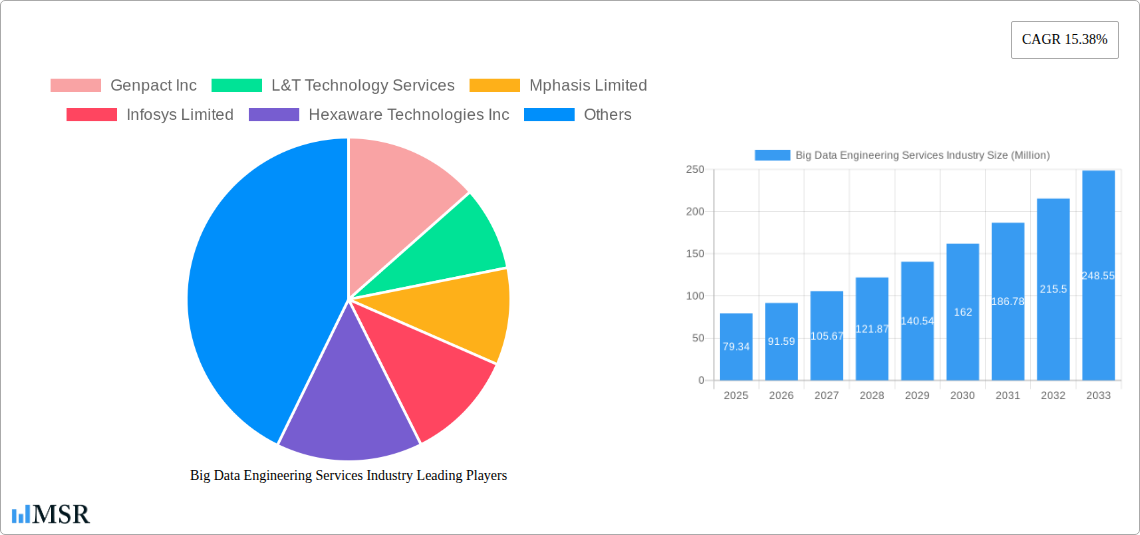

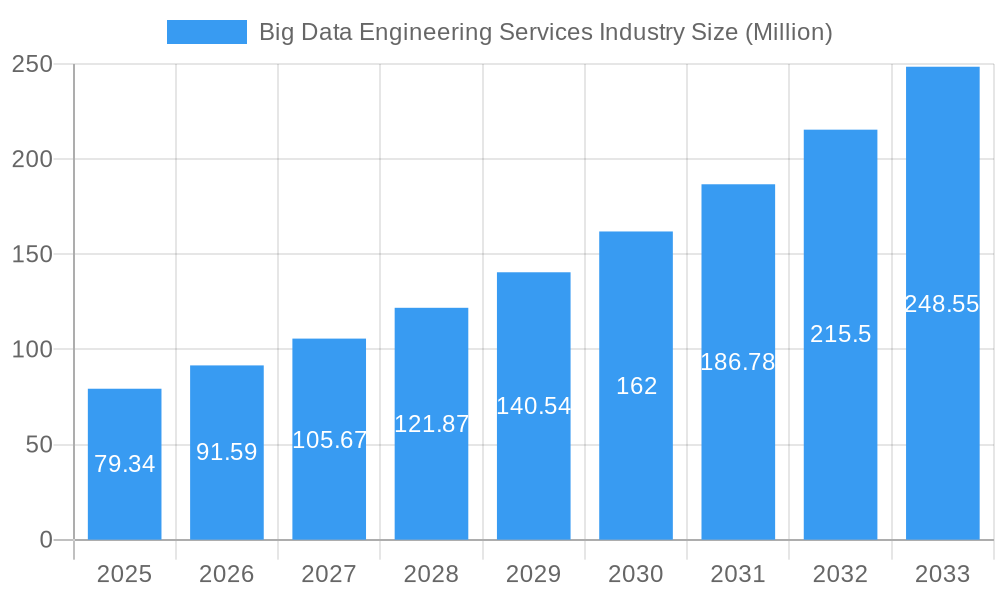

The Big Data Engineering Services market is poised for substantial expansion, projected to reach $79.34 million with a robust Compound Annual Growth Rate (CAGR) of 15.38% from 2025 to 2033. This remarkable growth is fueled by an increasing demand for sophisticated data management, integration, and analytics capabilities across diverse industries. Key drivers include the proliferation of data sources, the imperative for data-driven decision-making, and the growing adoption of cloud-based solutions that offer scalability and cost-efficiency. The market is segmenting into specialized areas such as Data Modelling, Data Integration, Data Quality, and Analytics, reflecting the nuanced needs of businesses. Furthermore, the adoption of big data engineering services is transcending traditional IT departments, with significant uptake across Marketing and Sales, Finance, Operations, and Human Resources functions, underscoring its strategic importance for organizational success. Small and Medium Enterprises (SMEs) are increasingly leveraging these services to compete effectively, while large enterprises are optimizing their vast data ecosystems.

Big Data Engineering Services Industry Market Size (In Million)

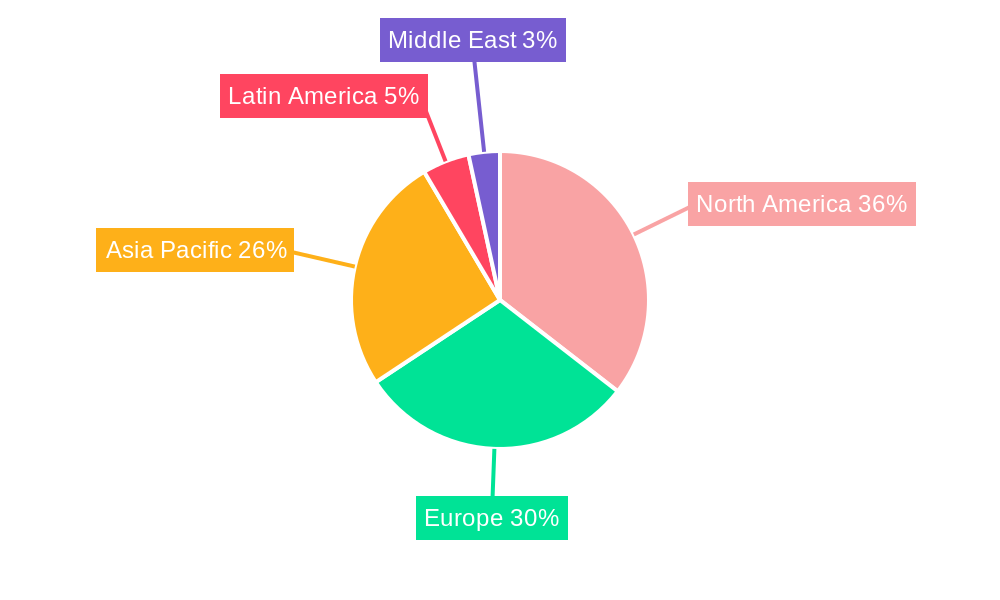

The industry's trajectory is further shaped by critical trends, including the rise of AI and Machine Learning applications that rely heavily on well-engineered data pipelines, and the growing emphasis on data governance and privacy compliance. While the cloud deployment model dominates due to its flexibility and accessibility, on-premise solutions continue to be relevant for organizations with stringent data security or regulatory requirements. End-user industries like BFSI, Healthcare, and Retail are leading the charge in big data adoption, recognizing its potential to drive innovation, enhance customer experiences, and optimize operational efficiencies. Geographically, North America and Europe are anticipated to remain dominant markets, with Asia Pacific showing the fastest growth due to rapid digitalization and increasing investments in data infrastructure. Despite strong growth, challenges such as a shortage of skilled big data engineers and the complexity of integrating legacy systems pose considerable restraints, necessitating strategic investments in talent development and interoperability solutions.

Big Data Engineering Services Industry Company Market Share

Big Data Engineering Services Industry: Comprehensive Market Analysis and Future Outlook (2019-2033)

Gain unparalleled insights into the Big Data Engineering Services Industry with this in-depth market report. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report provides a definitive analysis of market dynamics, growth drivers, key segments, and leading players. Essential for stakeholders seeking to navigate the rapidly evolving landscape of data integration, data modelling, data quality, and analytics services across BFSI, Healthcare, Retail, Manufacturing, and Government sectors. Explore strategies for leveraging cloud and on-premise deployments to optimize marketing and sales, finance, operations, and human resource functions. Understand the impact of innovations and strategic partnerships shaping the future of big data solutions and advanced analytics services.

Big Data Engineering Services Industry Market Concentration & Dynamics

The Big Data Engineering Services Industry is characterized by a dynamic market concentration, with a blend of established global IT giants and specialized analytics firms driving innovation. Key players such as Accenture PLC, Capgemini SE, Infosys Limited, and Cognizant Technology Solutions Corporation hold significant market share, often through extensive service portfolios encompassing data integration and data modelling. However, niche players like Latentview Analytics Corporation are carving out substantial segments by focusing on specialized advanced analytics. The innovation ecosystem thrives on continuous development in areas like real-time data processing, AI/ML integration, and data governance. Regulatory frameworks, particularly concerning data privacy (e.g., GDPR, CCPA), significantly influence service offerings and compliance requirements. Substitute products, primarily in-house data science teams and off-the-shelf analytics platforms, present a competitive challenge, though the complexity and scale of big data often necessitate specialized external expertise. End-user trends lean towards data-driven decision-making across all business functions, with a growing demand for predictive analytics and personalized customer experiences. Mergers and Acquisitions (M&A) activities are prominent, as larger firms seek to acquire specialized capabilities or expand their geographic reach. For instance, the projected M&A deal count for the forecast period is estimated to be in the range of 15-20 significant transactions annually, reflecting industry consolidation and strategic growth.

Big Data Engineering Services Industry Industry Insights & Trends

The Big Data Engineering Services Industry is poised for robust growth, fueled by an insatiable demand for actionable insights derived from vast datasets. The market size is projected to reach an estimated $350 Million by the end of 2025 and is expected to experience a compound annual growth rate (CAGR) of approximately 18% throughout the forecast period (2025-2033). This substantial growth is primarily driven by the increasing volume, velocity, and variety of data generated across all sectors. Organizations are increasingly recognizing the strategic imperative to transform raw data into tangible business value, leading to a surge in demand for sophisticated big data engineering services. Technological disruptions are a constant feature, with advancements in cloud computing, distributed systems (like Hadoop and Spark), and AI/ML algorithms continuously reshaping the service landscape. These technologies enable more efficient data storage, processing, and analysis, unlocking new possibilities for predictive modeling, anomaly detection, and hyper-personalization. Evolving consumer behaviors, characterized by a desire for personalized experiences and instant gratification, are compelling businesses to leverage big data for deeper customer understanding and tailored offerings. This shift necessitates advanced analytics capabilities and robust data integration solutions to create a unified view of the customer. The adoption of data lakes, data warehouses, and data mesh architectures is becoming standard practice for organizations aiming to democratize data access and foster a data-centric culture. Furthermore, the growing importance of data governance and privacy compliance is driving demand for services focused on data quality and security.

Key Markets & Segments Leading Big Data Engineering Services Industry

The Big Data Engineering Services Industry exhibits strong leadership across several key markets and segments. Geographically, North America and Europe currently dominate the market due to their established technological infrastructure, high adoption rates of advanced analytics, and significant investments in digital transformation initiatives. Within these regions, countries like the United States, Germany, and the United Kingdom are at the forefront of big data engineering adoption.

Dominant Segments by Type:

- Data Integration: This segment is a foundational pillar, with businesses heavily investing in services that consolidate data from disparate sources. The increasing complexity of IT environments and the need for a unified view of operations and customers make robust data integration a critical requirement.

- Analytics: The pursuit of actionable insights drives the demand for advanced analytics services. This includes descriptive, diagnostic, predictive, and prescriptive analytics, enabling businesses to make informed decisions and gain a competitive edge.

- Data Modelling: As datasets grow, effective data modelling becomes essential for organizing, storing, and retrieving data efficiently. This segment supports the development of scalable and optimized data architectures.

- Data Quality: Ensuring the accuracy, completeness, and consistency of data is paramount. Services focused on data quality are crucial for building trust in data-driven insights and complying with regulatory standards.

Dominant Segments by Business Function:

- Marketing and Sales: This function leads in leveraging big data for customer segmentation, personalized marketing campaigns, sales forecasting, and churn prediction.

- Finance: Big data engineering is critical for fraud detection, risk management, financial forecasting, and regulatory compliance within the finance sector.

- Operations: Optimizing supply chains, improving manufacturing efficiency, and enhancing operational logistics are key areas where big data is transforming operations.

Dominant Segments by Organization Size:

- Large Enterprises: These organizations, with their extensive data volumes and complex business processes, are major consumers of comprehensive big data engineering services, often seeking end-to-end solutions.

- Small and Medium Enterprises (SMEs): Increasingly, SMEs are recognizing the competitive advantage offered by big data, leading to a growing demand for scalable and cost-effective big data solutions.

Dominant Segments by Deployment Type:

- Cloud: The agility, scalability, and cost-effectiveness of cloud deployments are making them the preferred choice for most organizations. Services are increasingly designed to leverage public, private, and hybrid cloud environments.

- On-premise: While adoption is shifting towards the cloud, some organizations, particularly those with stringent data security or regulatory requirements, continue to utilize on-premise solutions.

Dominant Segments by End-user Industry:

- BFSI (Banking, Financial Services, and Insurance): This sector is a pioneer in leveraging big data for fraud detection, risk assessment, customer analytics, and personalized financial products.

- Healthcare: Big data is revolutionizing healthcare through predictive diagnostics, personalized medicine, drug discovery, and operational efficiency improvements.

- Retail: For retailers, big data is crucial for understanding consumer behavior, optimizing inventory, personalizing promotions, and enhancing the customer experience.

- Manufacturing: The industry uses big data for predictive maintenance, supply chain optimization, quality control, and smart factory initiatives.

The continued growth in these segments is supported by economic growth, ongoing digital transformation initiatives, and the increasing availability of skilled big data engineering professionals.

Big Data Engineering Services Industry Product Developments

Recent product developments in the Big Data Engineering Services Industry are focused on enhancing data integration capabilities and democratizing access to advanced analytics. Innovations in real-time data processing, AI-powered data quality tools, and self-service data modelling platforms are gaining traction. Companies are developing more robust connectors for diverse data sources, including IoT devices and social media platforms, alongside pre-built templates for common analytical tasks. These advancements aim to reduce the time-to-insight for businesses, enabling faster decision-making and more agile responses to market dynamics. The emphasis is on creating intuitive interfaces and automating complex engineering tasks, making sophisticated big data solutions accessible to a wider range of users within an organization.

Challenges in the Big Data Engineering Services Industry Market

The Big Data Engineering Services Industry faces several significant challenges that can impede growth and adoption. Regulatory hurdles related to data privacy and security are paramount, requiring substantial investment in compliance and secure data integration practices. Supply chain issues, though less direct, can impact the availability of specialized hardware and software components necessary for large-scale data infrastructure projects. Competitive pressures from in-house data science teams and the constant emergence of new technologies necessitate continuous adaptation and skill development. Quantifiable impacts include potential delays in project deployment due to regulatory reviews and increased operational costs associated with maintaining compliance and retraining workforce.

Forces Driving Big Data Engineering Services Industry Growth

Several key forces are propelling the growth of the Big Data Engineering Services Industry. The exponential increase in data generation from diverse sources, including IoT devices and digital interactions, creates an imperative for businesses to effectively manage and analyze this information. Technological advancements in cloud computing, AI, and machine learning are providing more powerful and cost-effective tools for big data engineering. Furthermore, a growing understanding among organizations of the strategic advantage derived from data-driven decision-making is a primary economic driver. The push for personalized customer experiences and operational efficiency across industries like BFSI, Healthcare, and Retail directly translates into increased demand for big data solutions.

Challenges in the Big Data Engineering Services Industry Market

Long-term growth catalysts for the Big Data Engineering Services Industry are deeply rooted in continuous innovation and strategic collaborations. The ongoing evolution of AI and ML algorithms, coupled with advancements in distributed computing, presents fertile ground for developing more sophisticated analytics and data modelling capabilities. Partnerships between technology providers, cloud vendors, and service companies are crucial for creating integrated ecosystems that simplify the adoption of complex big data solutions. Furthermore, market expansions into emerging economies and specialized industry verticals, driven by increasing digital maturity, offer significant untapped potential for growth.

Emerging Opportunities in Big Data Engineering Services Industry

Emerging opportunities in the Big Data Engineering Services Industry are abundant, driven by new technological frontiers and evolving business needs. The burgeoning field of edge computing presents a significant opportunity for specialized data integration and processing services at the source of data generation. The increasing focus on sustainability and ESG (Environmental, Social, and Governance) reporting is creating demand for big data analytics services to track and optimize environmental impact. Furthermore, the rise of generative AI opens new avenues for creating advanced content, personalized customer interactions, and novel data synthesis applications, requiring specialized big data engineering expertise. The demand for robust data quality frameworks to support AI initiatives is also a significant growth area.

Leading Players in the Big Data Engineering Services Industry Sector

- Accenture PLC

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Ernst & Young LLP

- Genpact Inc

- Hexaware Technologies Inc

- Infosys Limited

- KPMG LLP

- Latentview Analytics Corporation

- L&T Technology Services

- Mphasis Limited

- NTT Data Inc

Key Milestones in Big Data Engineering Services Industry Industry

- August 2023: Five9 finalized an agreement to acquire Aceyus, a key player in advanced data integration and analytics. Aceyus specializes in ingesting data from various sources, including CRM, WEM systems, ACDs, communication platforms, and digital channels. Their robust catalog of pre-built integrations enables seamless data migration from legacy systems to the Five9 platform. By maintaining consistent reports, data visualization, and dashboards, Aceyus ensures a smooth transition for businesses during migration and beyond. This strategic move enhances Five9’s ability to deliver personalized customer experiences by leveraging contextual data from disparate sources.

- April 2023: Siemens Digital Industries Software and IBM introduced the expansion of their long-term partnership by collaborating to build a combined software solution by integrating their respective offerings for service lifecycle management, systems engineering, and asset management. The companies will build a combined software solution in order to help organizations optimize product lifecycles, make it simpler to enhance traceability across processes, prototype and test concepts much earlier in development, and adopt more sustainable product designs.

Strategic Outlook for Big Data Engineering Services Industry Market

The strategic outlook for the Big Data Engineering Services Industry is exceptionally positive, driven by the continuous digital transformation across all sectors. Growth accelerators include the increasing adoption of AI and ML, the pervasive shift towards cloud-native architectures, and the growing demand for real-time analytics. Organizations that can effectively leverage these trends by offering integrated data integration, data modelling, and data quality services will be well-positioned for success. Future market potential lies in developing specialized solutions for emerging industries and expanding service offerings into areas like data ethics and AI governance, ensuring responsible and impactful utilization of big data.

Big Data Engineering Services Industry Segmentation

-

1. Type

- 1.1. Data Modelling

- 1.2. Data Integration

- 1.3. Data Quality

- 1.4. Analytics

-

2. Business Function

- 2.1. Marketing and Sales

- 2.2. Finance

- 2.3. Operations

- 2.4. Human Resource

-

3. Organization Size

- 3.1. Small and Medium Enterprizes

- 3.2. Large Enterprises

-

4. Deployement Type

- 4.1. Cloud

- 4.2. On-premise

-

5. End-user Industry

- 5.1. BFSI

- 5.2. Government

- 5.3. Media and Telecommunication

- 5.4. Retail

- 5.5. Manufacturing

- 5.6. Healthcare

- 5.7. Other End-user Verticals

Big Data Engineering Services Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Big Data Engineering Services Industry Regional Market Share

Geographic Coverage of Big Data Engineering Services Industry

Big Data Engineering Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Volume of Unstructured Data due to the Phenomenal Growth of Interconnected Devices and Social Media; Cost-effective Services and Cutting-edge Expertise Rendered by Data Servicing Companies

- 3.3. Market Restrains

- 3.3.1. Inability of Service Providers to Provide Real-time Insights

- 3.4. Market Trends

- 3.4.1. Big Data Analytics in Banking is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Big Data Engineering Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Data Modelling

- 5.1.2. Data Integration

- 5.1.3. Data Quality

- 5.1.4. Analytics

- 5.2. Market Analysis, Insights and Forecast - by Business Function

- 5.2.1. Marketing and Sales

- 5.2.2. Finance

- 5.2.3. Operations

- 5.2.4. Human Resource

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. Small and Medium Enterprizes

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Deployement Type

- 5.4.1. Cloud

- 5.4.2. On-premise

- 5.5. Market Analysis, Insights and Forecast - by End-user Industry

- 5.5.1. BFSI

- 5.5.2. Government

- 5.5.3. Media and Telecommunication

- 5.5.4. Retail

- 5.5.5. Manufacturing

- 5.5.6. Healthcare

- 5.5.7. Other End-user Verticals

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Latin America

- 5.6.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Big Data Engineering Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Data Modelling

- 6.1.2. Data Integration

- 6.1.3. Data Quality

- 6.1.4. Analytics

- 6.2. Market Analysis, Insights and Forecast - by Business Function

- 6.2.1. Marketing and Sales

- 6.2.2. Finance

- 6.2.3. Operations

- 6.2.4. Human Resource

- 6.3. Market Analysis, Insights and Forecast - by Organization Size

- 6.3.1. Small and Medium Enterprizes

- 6.3.2. Large Enterprises

- 6.4. Market Analysis, Insights and Forecast - by Deployement Type

- 6.4.1. Cloud

- 6.4.2. On-premise

- 6.5. Market Analysis, Insights and Forecast - by End-user Industry

- 6.5.1. BFSI

- 6.5.2. Government

- 6.5.3. Media and Telecommunication

- 6.5.4. Retail

- 6.5.5. Manufacturing

- 6.5.6. Healthcare

- 6.5.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Big Data Engineering Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Data Modelling

- 7.1.2. Data Integration

- 7.1.3. Data Quality

- 7.1.4. Analytics

- 7.2. Market Analysis, Insights and Forecast - by Business Function

- 7.2.1. Marketing and Sales

- 7.2.2. Finance

- 7.2.3. Operations

- 7.2.4. Human Resource

- 7.3. Market Analysis, Insights and Forecast - by Organization Size

- 7.3.1. Small and Medium Enterprizes

- 7.3.2. Large Enterprises

- 7.4. Market Analysis, Insights and Forecast - by Deployement Type

- 7.4.1. Cloud

- 7.4.2. On-premise

- 7.5. Market Analysis, Insights and Forecast - by End-user Industry

- 7.5.1. BFSI

- 7.5.2. Government

- 7.5.3. Media and Telecommunication

- 7.5.4. Retail

- 7.5.5. Manufacturing

- 7.5.6. Healthcare

- 7.5.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Big Data Engineering Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Data Modelling

- 8.1.2. Data Integration

- 8.1.3. Data Quality

- 8.1.4. Analytics

- 8.2. Market Analysis, Insights and Forecast - by Business Function

- 8.2.1. Marketing and Sales

- 8.2.2. Finance

- 8.2.3. Operations

- 8.2.4. Human Resource

- 8.3. Market Analysis, Insights and Forecast - by Organization Size

- 8.3.1. Small and Medium Enterprizes

- 8.3.2. Large Enterprises

- 8.4. Market Analysis, Insights and Forecast - by Deployement Type

- 8.4.1. Cloud

- 8.4.2. On-premise

- 8.5. Market Analysis, Insights and Forecast - by End-user Industry

- 8.5.1. BFSI

- 8.5.2. Government

- 8.5.3. Media and Telecommunication

- 8.5.4. Retail

- 8.5.5. Manufacturing

- 8.5.6. Healthcare

- 8.5.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Big Data Engineering Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Data Modelling

- 9.1.2. Data Integration

- 9.1.3. Data Quality

- 9.1.4. Analytics

- 9.2. Market Analysis, Insights and Forecast - by Business Function

- 9.2.1. Marketing and Sales

- 9.2.2. Finance

- 9.2.3. Operations

- 9.2.4. Human Resource

- 9.3. Market Analysis, Insights and Forecast - by Organization Size

- 9.3.1. Small and Medium Enterprizes

- 9.3.2. Large Enterprises

- 9.4. Market Analysis, Insights and Forecast - by Deployement Type

- 9.4.1. Cloud

- 9.4.2. On-premise

- 9.5. Market Analysis, Insights and Forecast - by End-user Industry

- 9.5.1. BFSI

- 9.5.2. Government

- 9.5.3. Media and Telecommunication

- 9.5.4. Retail

- 9.5.5. Manufacturing

- 9.5.6. Healthcare

- 9.5.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Big Data Engineering Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Data Modelling

- 10.1.2. Data Integration

- 10.1.3. Data Quality

- 10.1.4. Analytics

- 10.2. Market Analysis, Insights and Forecast - by Business Function

- 10.2.1. Marketing and Sales

- 10.2.2. Finance

- 10.2.3. Operations

- 10.2.4. Human Resource

- 10.3. Market Analysis, Insights and Forecast - by Organization Size

- 10.3.1. Small and Medium Enterprizes

- 10.3.2. Large Enterprises

- 10.4. Market Analysis, Insights and Forecast - by Deployement Type

- 10.4.1. Cloud

- 10.4.2. On-premise

- 10.5. Market Analysis, Insights and Forecast - by End-user Industry

- 10.5.1. BFSI

- 10.5.2. Government

- 10.5.3. Media and Telecommunication

- 10.5.4. Retail

- 10.5.5. Manufacturing

- 10.5.6. Healthcare

- 10.5.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Genpact Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 L&T Technology Services

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mphasis Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Infosys Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hexaware Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Accenture PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Capgemini SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NTT Data Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ernst & Young LLP

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KPMG LLP

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cognizant Technology Solutions Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Latentview Analytics Corporatio

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Genpact Inc

List of Figures

- Figure 1: Global Big Data Engineering Services Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Big Data Engineering Services Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Big Data Engineering Services Industry Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Big Data Engineering Services Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Big Data Engineering Services Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Big Data Engineering Services Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Big Data Engineering Services Industry Revenue (Million), by Business Function 2025 & 2033

- Figure 8: North America Big Data Engineering Services Industry Volume (K Unit), by Business Function 2025 & 2033

- Figure 9: North America Big Data Engineering Services Industry Revenue Share (%), by Business Function 2025 & 2033

- Figure 10: North America Big Data Engineering Services Industry Volume Share (%), by Business Function 2025 & 2033

- Figure 11: North America Big Data Engineering Services Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 12: North America Big Data Engineering Services Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 13: North America Big Data Engineering Services Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 14: North America Big Data Engineering Services Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 15: North America Big Data Engineering Services Industry Revenue (Million), by Deployement Type 2025 & 2033

- Figure 16: North America Big Data Engineering Services Industry Volume (K Unit), by Deployement Type 2025 & 2033

- Figure 17: North America Big Data Engineering Services Industry Revenue Share (%), by Deployement Type 2025 & 2033

- Figure 18: North America Big Data Engineering Services Industry Volume Share (%), by Deployement Type 2025 & 2033

- Figure 19: North America Big Data Engineering Services Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 20: North America Big Data Engineering Services Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 21: North America Big Data Engineering Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: North America Big Data Engineering Services Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: North America Big Data Engineering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Big Data Engineering Services Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: North America Big Data Engineering Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Big Data Engineering Services Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Big Data Engineering Services Industry Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Big Data Engineering Services Industry Volume (K Unit), by Type 2025 & 2033

- Figure 29: Europe Big Data Engineering Services Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Big Data Engineering Services Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Big Data Engineering Services Industry Revenue (Million), by Business Function 2025 & 2033

- Figure 32: Europe Big Data Engineering Services Industry Volume (K Unit), by Business Function 2025 & 2033

- Figure 33: Europe Big Data Engineering Services Industry Revenue Share (%), by Business Function 2025 & 2033

- Figure 34: Europe Big Data Engineering Services Industry Volume Share (%), by Business Function 2025 & 2033

- Figure 35: Europe Big Data Engineering Services Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 36: Europe Big Data Engineering Services Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 37: Europe Big Data Engineering Services Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: Europe Big Data Engineering Services Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 39: Europe Big Data Engineering Services Industry Revenue (Million), by Deployement Type 2025 & 2033

- Figure 40: Europe Big Data Engineering Services Industry Volume (K Unit), by Deployement Type 2025 & 2033

- Figure 41: Europe Big Data Engineering Services Industry Revenue Share (%), by Deployement Type 2025 & 2033

- Figure 42: Europe Big Data Engineering Services Industry Volume Share (%), by Deployement Type 2025 & 2033

- Figure 43: Europe Big Data Engineering Services Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: Europe Big Data Engineering Services Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Europe Big Data Engineering Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Europe Big Data Engineering Services Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Europe Big Data Engineering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe Big Data Engineering Services Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Europe Big Data Engineering Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Big Data Engineering Services Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Big Data Engineering Services Industry Revenue (Million), by Type 2025 & 2033

- Figure 52: Asia Pacific Big Data Engineering Services Industry Volume (K Unit), by Type 2025 & 2033

- Figure 53: Asia Pacific Big Data Engineering Services Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Asia Pacific Big Data Engineering Services Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Asia Pacific Big Data Engineering Services Industry Revenue (Million), by Business Function 2025 & 2033

- Figure 56: Asia Pacific Big Data Engineering Services Industry Volume (K Unit), by Business Function 2025 & 2033

- Figure 57: Asia Pacific Big Data Engineering Services Industry Revenue Share (%), by Business Function 2025 & 2033

- Figure 58: Asia Pacific Big Data Engineering Services Industry Volume Share (%), by Business Function 2025 & 2033

- Figure 59: Asia Pacific Big Data Engineering Services Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 60: Asia Pacific Big Data Engineering Services Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 61: Asia Pacific Big Data Engineering Services Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 62: Asia Pacific Big Data Engineering Services Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 63: Asia Pacific Big Data Engineering Services Industry Revenue (Million), by Deployement Type 2025 & 2033

- Figure 64: Asia Pacific Big Data Engineering Services Industry Volume (K Unit), by Deployement Type 2025 & 2033

- Figure 65: Asia Pacific Big Data Engineering Services Industry Revenue Share (%), by Deployement Type 2025 & 2033

- Figure 66: Asia Pacific Big Data Engineering Services Industry Volume Share (%), by Deployement Type 2025 & 2033

- Figure 67: Asia Pacific Big Data Engineering Services Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 68: Asia Pacific Big Data Engineering Services Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 69: Asia Pacific Big Data Engineering Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 70: Asia Pacific Big Data Engineering Services Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 71: Asia Pacific Big Data Engineering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 72: Asia Pacific Big Data Engineering Services Industry Volume (K Unit), by Country 2025 & 2033

- Figure 73: Asia Pacific Big Data Engineering Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Asia Pacific Big Data Engineering Services Industry Volume Share (%), by Country 2025 & 2033

- Figure 75: Latin America Big Data Engineering Services Industry Revenue (Million), by Type 2025 & 2033

- Figure 76: Latin America Big Data Engineering Services Industry Volume (K Unit), by Type 2025 & 2033

- Figure 77: Latin America Big Data Engineering Services Industry Revenue Share (%), by Type 2025 & 2033

- Figure 78: Latin America Big Data Engineering Services Industry Volume Share (%), by Type 2025 & 2033

- Figure 79: Latin America Big Data Engineering Services Industry Revenue (Million), by Business Function 2025 & 2033

- Figure 80: Latin America Big Data Engineering Services Industry Volume (K Unit), by Business Function 2025 & 2033

- Figure 81: Latin America Big Data Engineering Services Industry Revenue Share (%), by Business Function 2025 & 2033

- Figure 82: Latin America Big Data Engineering Services Industry Volume Share (%), by Business Function 2025 & 2033

- Figure 83: Latin America Big Data Engineering Services Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 84: Latin America Big Data Engineering Services Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 85: Latin America Big Data Engineering Services Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 86: Latin America Big Data Engineering Services Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 87: Latin America Big Data Engineering Services Industry Revenue (Million), by Deployement Type 2025 & 2033

- Figure 88: Latin America Big Data Engineering Services Industry Volume (K Unit), by Deployement Type 2025 & 2033

- Figure 89: Latin America Big Data Engineering Services Industry Revenue Share (%), by Deployement Type 2025 & 2033

- Figure 90: Latin America Big Data Engineering Services Industry Volume Share (%), by Deployement Type 2025 & 2033

- Figure 91: Latin America Big Data Engineering Services Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 92: Latin America Big Data Engineering Services Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 93: Latin America Big Data Engineering Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 94: Latin America Big Data Engineering Services Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 95: Latin America Big Data Engineering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 96: Latin America Big Data Engineering Services Industry Volume (K Unit), by Country 2025 & 2033

- Figure 97: Latin America Big Data Engineering Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Latin America Big Data Engineering Services Industry Volume Share (%), by Country 2025 & 2033

- Figure 99: Middle East Big Data Engineering Services Industry Revenue (Million), by Type 2025 & 2033

- Figure 100: Middle East Big Data Engineering Services Industry Volume (K Unit), by Type 2025 & 2033

- Figure 101: Middle East Big Data Engineering Services Industry Revenue Share (%), by Type 2025 & 2033

- Figure 102: Middle East Big Data Engineering Services Industry Volume Share (%), by Type 2025 & 2033

- Figure 103: Middle East Big Data Engineering Services Industry Revenue (Million), by Business Function 2025 & 2033

- Figure 104: Middle East Big Data Engineering Services Industry Volume (K Unit), by Business Function 2025 & 2033

- Figure 105: Middle East Big Data Engineering Services Industry Revenue Share (%), by Business Function 2025 & 2033

- Figure 106: Middle East Big Data Engineering Services Industry Volume Share (%), by Business Function 2025 & 2033

- Figure 107: Middle East Big Data Engineering Services Industry Revenue (Million), by Organization Size 2025 & 2033

- Figure 108: Middle East Big Data Engineering Services Industry Volume (K Unit), by Organization Size 2025 & 2033

- Figure 109: Middle East Big Data Engineering Services Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 110: Middle East Big Data Engineering Services Industry Volume Share (%), by Organization Size 2025 & 2033

- Figure 111: Middle East Big Data Engineering Services Industry Revenue (Million), by Deployement Type 2025 & 2033

- Figure 112: Middle East Big Data Engineering Services Industry Volume (K Unit), by Deployement Type 2025 & 2033

- Figure 113: Middle East Big Data Engineering Services Industry Revenue Share (%), by Deployement Type 2025 & 2033

- Figure 114: Middle East Big Data Engineering Services Industry Volume Share (%), by Deployement Type 2025 & 2033

- Figure 115: Middle East Big Data Engineering Services Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 116: Middle East Big Data Engineering Services Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 117: Middle East Big Data Engineering Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 118: Middle East Big Data Engineering Services Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 119: Middle East Big Data Engineering Services Industry Revenue (Million), by Country 2025 & 2033

- Figure 120: Middle East Big Data Engineering Services Industry Volume (K Unit), by Country 2025 & 2033

- Figure 121: Middle East Big Data Engineering Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 122: Middle East Big Data Engineering Services Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Big Data Engineering Services Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Big Data Engineering Services Industry Revenue Million Forecast, by Business Function 2020 & 2033

- Table 4: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Business Function 2020 & 2033

- Table 5: Global Big Data Engineering Services Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 6: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 7: Global Big Data Engineering Services Industry Revenue Million Forecast, by Deployement Type 2020 & 2033

- Table 8: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Deployement Type 2020 & 2033

- Table 9: Global Big Data Engineering Services Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Big Data Engineering Services Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Big Data Engineering Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 13: Global Big Data Engineering Services Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Big Data Engineering Services Industry Revenue Million Forecast, by Business Function 2020 & 2033

- Table 16: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Business Function 2020 & 2033

- Table 17: Global Big Data Engineering Services Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 18: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 19: Global Big Data Engineering Services Industry Revenue Million Forecast, by Deployement Type 2020 & 2033

- Table 20: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Deployement Type 2020 & 2033

- Table 21: Global Big Data Engineering Services Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Big Data Engineering Services Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Big Data Engineering Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Big Data Engineering Services Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Big Data Engineering Services Industry Revenue Million Forecast, by Business Function 2020 & 2033

- Table 28: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Business Function 2020 & 2033

- Table 29: Global Big Data Engineering Services Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 30: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 31: Global Big Data Engineering Services Industry Revenue Million Forecast, by Deployement Type 2020 & 2033

- Table 32: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Deployement Type 2020 & 2033

- Table 33: Global Big Data Engineering Services Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Big Data Engineering Services Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Big Data Engineering Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Global Big Data Engineering Services Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 39: Global Big Data Engineering Services Industry Revenue Million Forecast, by Business Function 2020 & 2033

- Table 40: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Business Function 2020 & 2033

- Table 41: Global Big Data Engineering Services Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 42: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 43: Global Big Data Engineering Services Industry Revenue Million Forecast, by Deployement Type 2020 & 2033

- Table 44: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Deployement Type 2020 & 2033

- Table 45: Global Big Data Engineering Services Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 46: Global Big Data Engineering Services Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 47: Global Big Data Engineering Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Global Big Data Engineering Services Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 50: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 51: Global Big Data Engineering Services Industry Revenue Million Forecast, by Business Function 2020 & 2033

- Table 52: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Business Function 2020 & 2033

- Table 53: Global Big Data Engineering Services Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 54: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 55: Global Big Data Engineering Services Industry Revenue Million Forecast, by Deployement Type 2020 & 2033

- Table 56: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Deployement Type 2020 & 2033

- Table 57: Global Big Data Engineering Services Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 58: Global Big Data Engineering Services Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 59: Global Big Data Engineering Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Global Big Data Engineering Services Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 62: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 63: Global Big Data Engineering Services Industry Revenue Million Forecast, by Business Function 2020 & 2033

- Table 64: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Business Function 2020 & 2033

- Table 65: Global Big Data Engineering Services Industry Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 66: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 67: Global Big Data Engineering Services Industry Revenue Million Forecast, by Deployement Type 2020 & 2033

- Table 68: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Deployement Type 2020 & 2033

- Table 69: Global Big Data Engineering Services Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 70: Global Big Data Engineering Services Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 71: Global Big Data Engineering Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Big Data Engineering Services Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Big Data Engineering Services Industry?

The projected CAGR is approximately 15.38%.

2. Which companies are prominent players in the Big Data Engineering Services Industry?

Key companies in the market include Genpact Inc, L&T Technology Services, Mphasis Limited, Infosys Limited, Hexaware Technologies Inc, Accenture PLC, Capgemini SE, NTT Data Inc, Ernst & Young LLP, KPMG LLP, Cognizant Technology Solutions Corporation, Latentview Analytics Corporatio.

3. What are the main segments of the Big Data Engineering Services Industry?

The market segments include Type, Business Function, Organization Size, Deployement Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 79.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volume of Unstructured Data due to the Phenomenal Growth of Interconnected Devices and Social Media; Cost-effective Services and Cutting-edge Expertise Rendered by Data Servicing Companies.

6. What are the notable trends driving market growth?

Big Data Analytics in Banking is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Inability of Service Providers to Provide Real-time Insights.

8. Can you provide examples of recent developments in the market?

August 2023: Five9, a CX Platform provider, finalized an agreement to acquire Aceyus, a key player in advanced data integration and analytics. Aceyus specializes in ingesting data from various sources, including CRM, WEM systems, ACDs, communication platforms, and digital channels. Their robust catalog of pre-built integrations enables seamless data migration from legacy systems to the Five9 platform. By maintaining consistent reports, data visualization, and dashboards, Aceyus ensures a smooth transition for businesses during migration and beyond. This strategic move enhances Five9’s ability to deliver personalized customer experiences by leveraging contextual data from disparate sources.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Big Data Engineering Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Big Data Engineering Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Big Data Engineering Services Industry?

To stay informed about further developments, trends, and reports in the Big Data Engineering Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence