Key Insights

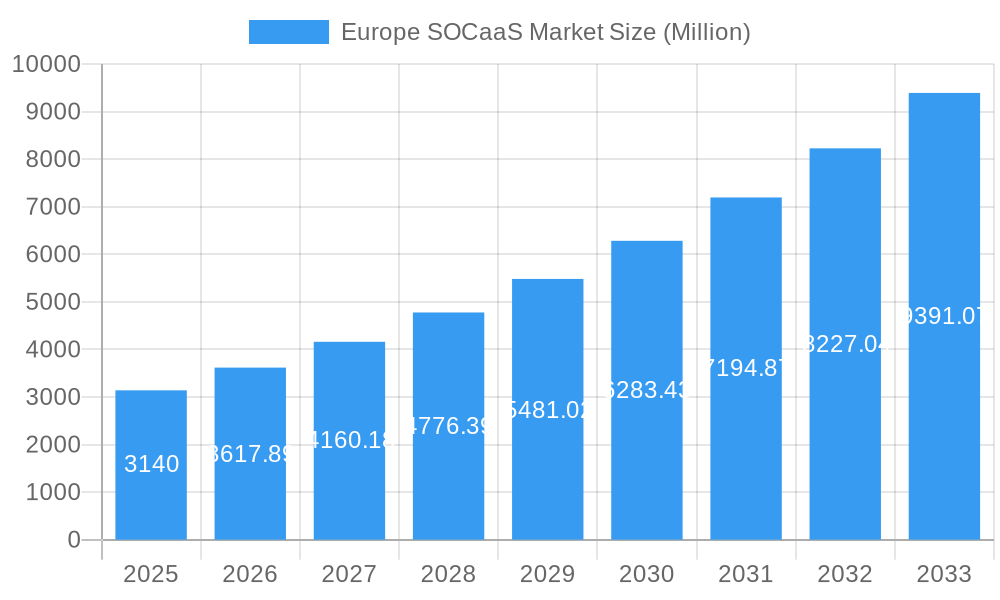

The European SOCaaS (Security Operations Center as a Service) market is poised for significant expansion, with a current market size estimated at $3.14 billion in 2025. This robust growth is fueled by a projected Compound Annual Growth Rate (CAGR) of 14.85% throughout the forecast period of 2025-2033. This upward trajectory is driven by the escalating sophistication and frequency of cyber threats across the continent, compelling organizations of all sizes to seek advanced, outsourced security solutions. Small and Medium-sized Enterprises (SMEs), in particular, are increasingly adopting SOCaaS to bridge the gap in their internal cybersecurity expertise and resources, while large enterprises leverage it for specialized threat detection and response capabilities. Key end-user industries, including IT and Telecom, BFSI, Retail and Consumer Goods, Healthcare, Manufacturing, and Government sectors, are all actively investing in SOCaaS to safeguard their critical data and operations against evolving cyber risks.

Europe SOCaaS Market Market Size (In Billion)

Several interconnected trends are shaping the European SOCaaS landscape. The increasing adoption of cloud-based infrastructure and the remote work paradigm have broadened the attack surface, necessitating continuous monitoring and rapid response, which SOCaaS providers are well-equipped to offer. Furthermore, the growing shortage of skilled cybersecurity professionals is a major catalyst for SOCaaS adoption, as organizations find it more cost-effective and efficient to outsource these critical functions. Regulatory compliance mandates, such as GDPR, also play a crucial role, pushing businesses to strengthen their security postures. While the market enjoys strong growth drivers, certain restraints exist, including concerns around data privacy and vendor lock-in, which may influence adoption rates for some organizations. Nonetheless, the overwhelming need for advanced threat intelligence, 24/7 monitoring, and proactive incident management positions the European SOCaaS market for substantial and sustained growth.

Europe SOCaaS Market Company Market Share

Europe SOCaaS Market: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock the potential of the European Security Operations Center as a Service (SOCaaS) market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study provides critical insights into market dynamics, key trends, and future opportunities. We delve into segments including SMEs and Large Enterprises, and analyze adoption across IT & Telecom, BFSI, Retail & Consumer Goods, Healthcare, Manufacturing, Government, and Other End Users. Discover strategies to navigate challenges and capitalize on growth drivers in this rapidly evolving cybersecurity landscape.

Europe SOCaaS Market Market Concentration & Dynamics

The Europe SOCaaS market exhibits a moderate to high market concentration, with a few key players holding significant market share. This concentration is driven by the high capital investment required for advanced technology infrastructure and skilled personnel, alongside the need for strong brand reputation and client trust in the cybersecurity domain. Innovation ecosystems are thriving, with a growing emphasis on leveraging Artificial Intelligence (AI) and Machine Learning (ML) for proactive threat detection and faster response times. Regulatory frameworks, such as GDPR, are increasingly influencing market strategies, compelling organizations to adopt robust security measures and compliance-oriented SOCaaS solutions. The threat landscape is dynamic, with sophisticated cyberattacks like ransomware and phishing constantly evolving, driving demand for continuous monitoring and incident response services. Substitute products, including in-house SOCs and traditional managed security services (MSSPs), exist but are often outcompeted by the scalability, cost-effectiveness, and specialized expertise offered by SOCaaS providers. End-user trends indicate a growing preference for cloud-native solutions, integrated platforms, and flexible service models that can adapt to fluctuating business needs. Merger and acquisition (M&A) activities are expected to continue as larger players seek to consolidate market share, acquire new technologies, and expand their service portfolios. While specific M&A deal counts are dynamic, the trend signifies a maturing market consolidating around key strategic players.

Europe SOCaaS Market Industry Insights & Trends

The Europe SOCaaS market is poised for significant expansion, driven by an escalating cyber threat landscape and the growing complexity of digital infrastructures. The market size is projected to reach $8,500 Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period of 2025–2033. A primary growth driver is the increasing sophistication and frequency of cyberattacks, including advanced persistent threats (APTs) and ransomware, which overwhelm the capabilities of many organizations to manage internally. This necessitates the adoption of specialized SOCaaS solutions to ensure continuous monitoring, rapid threat detection, and effective incident response. Furthermore, the widespread adoption of cloud computing and the proliferation of IoT devices have expanded the attack surface, creating a demand for comprehensive, cloud-agnostic security solutions.

Technological disruptions are profoundly shaping the market. The integration of AI and ML algorithms into SOCaaS platforms is a key trend, enabling predictive analytics, automated threat hunting, and intelligent anomaly detection. This not only enhances the speed and accuracy of security operations but also optimizes resource allocation. The evolution of Extended Detection and Response (XDR) technologies is another significant development, providing a unified approach to security data correlation across various security layers, from endpoints to cloud environments.

Evolving consumer behaviors and business needs are also fueling market growth. Organizations are increasingly prioritizing operational resilience and business continuity. SOCaaS offers a compelling solution by providing 24/7 security coverage, minimizing downtime, and protecting sensitive data. The shift towards remote work models has further amplified the need for robust cybersecurity measures that can secure distributed workforces and their endpoints. Moreover, the growing cybersecurity talent shortage globally makes SOCaaS an attractive option for companies that lack in-house expertise or struggle to recruit and retain skilled security professionals. The need for compliance with stringent data privacy regulations, such as the GDPR, also acts as a significant catalyst, pushing businesses to invest in advanced security services that ensure data protection and regulatory adherence. The rising adoption of digital transformation initiatives across various industries necessitates equally robust digital security, further boosting the demand for SOCaaS.

Key Markets & Segments Leading Europe SOCaaS Market

The Europe SOCaaS market is characterized by distinct regional and segmental dominance, driven by a confluence of economic factors, regulatory pressures, and industry-specific vulnerabilities.

Dominant Region: Western Europe, particularly countries like the United Kingdom, Germany, and France, leads the market. These nations boast highly developed economies, significant digital infrastructure investments, and a strong regulatory environment that mandates robust cybersecurity. The presence of a large concentration of enterprises across critical sectors, coupled with a higher awareness of cyber threats, fuels substantial demand for advanced SOCaaS solutions. Economic growth in these regions directly translates to increased IT spending, including cybersecurity budgets.

Dominant Segments by End User:

- BFSI (Banking, Financial Services, and Insurance): This sector is a primary driver due to the high volume of sensitive financial data processed and stored, making it a prime target for cybercriminals. Stringent regulatory requirements and the imperative for customer trust necessitate sophisticated security operations. The recent development of Infosys establishing a proximity center in Sofia, Bulgaria, specifically for the BFSI sector, underscores the region's focus on enhancing cybersecurity and digital journeys for financial institutions.

- IT and Telecom: This sector is at the forefront of technological adoption and is inherently exposed to a vast array of cyber threats. The constant evolution of networks, cloud services, and data centers creates a continuous demand for proactive security monitoring and incident response.

- Government: Governments across Europe are increasingly investing in SOCaaS to protect critical national infrastructure, sensitive citizen data, and national security interests. The growing threat landscape targeting public sector entities makes this segment a significant contributor to market growth.

Dominant Segments by Organization Size:

- Large Enterprises: These organizations typically have larger IT infrastructures, more complex security needs, and a higher volume of sensitive data, making them more susceptible to sophisticated attacks. They often have the budget and recognized need for comprehensive SOCaaS solutions, including advanced threat detection and managed extended detection and response (MXDR) services. The partnership between Beeks Group and BlueVoyant to enhance cloud security for the banking industry highlights the strategic importance of advanced SOCaaS for large enterprises in critical sectors.

- SMEs (Small and Medium-sized Enterprises): While historically having smaller security budgets, SMEs are increasingly adopting SOCaaS to leverage specialized expertise and advanced technologies they cannot afford to build in-house. The growing realization of their vulnerability to cyberattacks, coupled with the cost-effectiveness of cloud-based SOCaaS, is driving adoption.

The dominance of these segments is further reinforced by factors such as the increasing digitalization across all industries, the need for compliance with evolving data protection laws, and the ongoing shortage of skilled cybersecurity professionals, making managed SOCaaS a pragmatic and effective solution.

Europe SOCaaS Market Product Developments

Product developments in the Europe SOCaaS market are increasingly focused on enhancing threat detection, response capabilities, and integration. Key advancements include the proliferation of AI and ML-powered platforms for predictive analytics, automated threat hunting, and intelligent anomaly detection. Extended Detection and Response (XDR) solutions are gaining traction, offering a unified view of security events across endpoints, networks, cloud, and applications, thereby streamlining incident investigation and response. Furthermore, providers are emphasizing the development of scalable, cloud-native architectures that enable seamless integration with existing IT environments and offer greater flexibility. The inclusion of advanced threat intelligence feeds and proactive vulnerability management is also becoming a standard offering, allowing SOCaaS providers to deliver more comprehensive and proactive security for their clients, providing a significant competitive edge.

Challenges in the Europe SOCaaS Market Market

Despite robust growth, the Europe SOCaaS market faces several challenges. Regulatory hurdles can be complex, with varying interpretations and enforcement of data protection laws across different member states, increasing compliance burdens. Supply chain issues in hardware and software procurement for advanced security tools can lead to delays and increased costs. Competitive pressures are intense, with numerous players vying for market share, leading to price sensitivity and the need for continuous innovation to differentiate offerings. The shortage of skilled cybersecurity professionals remains a persistent challenge for both providers and end-users, impacting service delivery and adoption rates. Quantifiably, these challenges can lead to slower adoption cycles in certain regions and increased operational costs for SOCaaS providers, potentially impacting profit margins.

Forces Driving Europe SOCaaS Market Growth

Several key forces are propelling the Europe SOCaaS market forward. The escalating volume and sophistication of cyber threats, including ransomware, phishing, and state-sponsored attacks, are compelling organizations to seek external expertise for continuous monitoring and rapid response. Increasing regulatory compliance requirements, such as GDPR, mandate robust data protection measures, making managed security services indispensable. The growing adoption of cloud computing and hybrid IT environments expands the attack surface, requiring comprehensive and scalable security solutions. Furthermore, the global shortage of skilled cybersecurity professionals makes outsourcing SOC functions to specialized providers a cost-effective and efficient solution for many businesses. Digital transformation initiatives across industries further necessitate enhanced cybersecurity to protect evolving digital assets.

Challenges in the Europe SOCaaS Market Market

Long-term growth catalysts in the Europe SOCaaS market are rooted in continuous innovation and strategic market expansion. The advancement of AI and ML technologies will enable more predictive and proactive threat intelligence, moving beyond reactive defense. Strategic partnerships between SOCaaS providers and other cybersecurity vendors, as well as cloud service providers, will foster integrated security ecosystems and broader service offerings. Market expansions into emerging economies within Europe and strategic focus on niche sectors with high security needs will unlock new revenue streams. The ongoing evolution of the threat landscape will also necessitate a constant upgrade of services, ensuring SOCaaS remains a critical component of enterprise security strategies.

Emerging Opportunities in Europe SOCaaS Market

Emerging opportunities in the Europe SOCaaS market are abundant, driven by evolving technology and changing business needs. The rise of IoT security, with the proliferation of connected devices across industries, presents a significant avenue for specialized SOCaaS offerings. Zero Trust security models are gaining traction, creating demand for integrated SOCaaS solutions that enforce granular access controls and continuous verification. The increasing adoption of DevSecOps practices offers opportunities for SOCaaS providers to embed security earlier in the development lifecycle. Furthermore, specialized services for specific industries, such as healthcare's sensitive patient data or manufacturing's operational technology (OT) security needs, represent growing niche markets. The increasing demand for managed extended detection and response (MXDR) services, as exemplified by the Beeks Group and BlueVoyant partnership, signifies a strong trend towards more comprehensive, unified security operations.

Leading Players in the Europe SOCaaS Market Sector

- Lumen Technologies

- Sophos Lt

- Thales

- Wipro

- Atos SE

- Cloudflare Inc

- ConnectWise LLC

- Teceze Limited

- Ontinue Inc

- Plusserver

Key Milestones in Europe SOCaaS Market Industry

- January 2024: Beeks Group, a cloud computing and analytics supplier, partnered with BlueVoyant, a cybersecurity company. Beeks Group will now receive BlueVoyant's managed extended detection and response (MXDR) services, enhancing operational resilience and security. This partnership will enable Beeks to offer improved cloud security solutions for the banking industry and operate a 24/7 comprehensive SOC leveraging BlueVoyant's expertise within its Microsoft technology infrastructure.

- November 2023: Infosys, a provider of cybersecurity services, opened a new proximity center in Sofia, Bulgaria, as part of its European expansion. This center is designed to support companies in the BFSI sector, accelerating their AI and Cloud-led digital journeys. The initiative focuses on building resilient cybersecurity programs, improving operational efficiency, and reducing costs through advancements in security operations centers (SOC), AI/ML-based integrated cybersecurity platforms, and strategic partnerships.

Strategic Outlook for Europe SOCaaS Market Market

The strategic outlook for the Europe SOCaaS market is overwhelmingly positive, fueled by an ever-growing demand for advanced cybersecurity solutions. Future growth will be accelerated by the continued integration of Artificial Intelligence and Machine Learning for sophisticated threat prediction and automated response. Strategic opportunities lie in the expansion of managed extended detection and response (MXDR) services, offering a holistic approach to security across an organization's entire digital footprint. The increasing focus on cloud security and the protection of hybrid cloud environments presents a significant growth area. Furthermore, providers that can offer tailored SOCaaS solutions for specific industries, addressing their unique regulatory and operational challenges, will gain a competitive advantage. The market is also likely to see further consolidation and partnerships, leading to more comprehensive and integrated service offerings that cater to the evolving needs of businesses navigating a complex and dynamic threat landscape. The ongoing digital transformation across Europe will continuously drive the need for robust, scalable, and expert-led security operations.

Europe SOCaaS Market Segmentation

-

1. Organization Size

- 1.1. SMEs

- 1.2. Large Enterprises

-

2. End User

- 2.1. IT and Telecom

- 2.2. BFSI

- 2.3. Retail and Consumer Goods

- 2.4. Healthcare

- 2.5. Manufacturing

- 2.6. Government

- 2.7. Other End Users

Europe SOCaaS Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

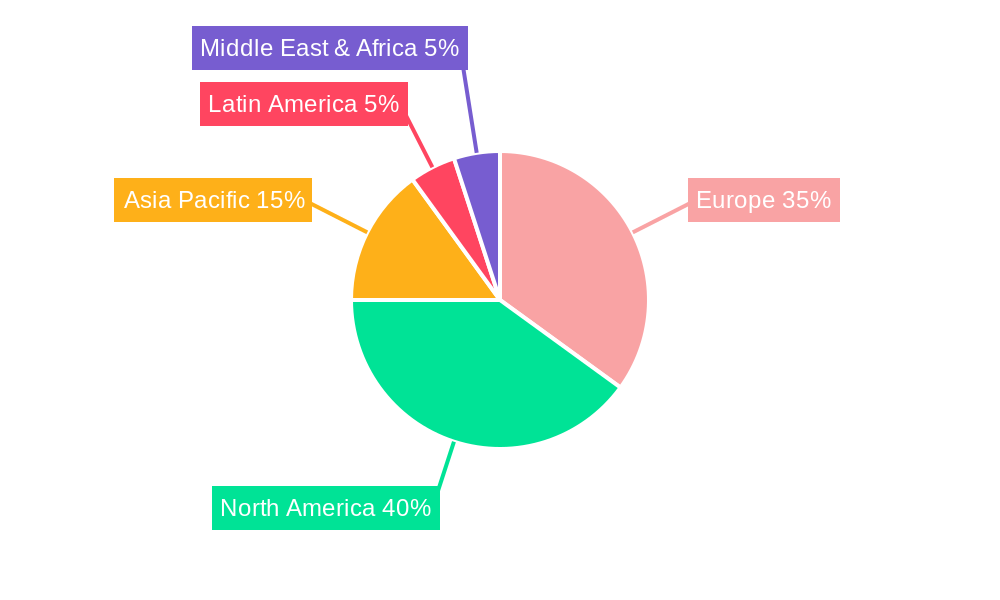

Europe SOCaaS Market Regional Market Share

Geographic Coverage of Europe SOCaaS Market

Europe SOCaaS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Adoption of Pay-per-use Model Owing to Reduction in Capex; Rapid Adoption of Cloud Deployment in SMEs; Mobile Workforce and Associated Vulnerabilities

- 3.3. Market Restrains

- 3.3.1. Challenges Associated With Data Control and Total Cost of Ownership

- 3.4. Market Trends

- 3.4.1. Retail and Consumer Goods to be the Fastest Growing End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe SOCaaS Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. SMEs

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecom

- 5.2.2. BFSI

- 5.2.3. Retail and Consumer Goods

- 5.2.4. Healthcare

- 5.2.5. Manufacturing

- 5.2.6. Government

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. Germany Europe SOCaaS Market Analysis, Insights and Forecast, 2020-2032

- 7. France Europe SOCaaS Market Analysis, Insights and Forecast, 2020-2032

- 8. Italy Europe SOCaaS Market Analysis, Insights and Forecast, 2020-2032

- 9. United Kingdom Europe SOCaaS Market Analysis, Insights and Forecast, 2020-2032

- 10. Netherlands Europe SOCaaS Market Analysis, Insights and Forecast, 2020-2032

- 11. Sweden Europe SOCaaS Market Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Europe Europe SOCaaS Market Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Lumen Technologies

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Sophos Lt

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Thales

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Wipro

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Atos SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Cloudflare Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 ConnectWise LLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Teceze Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ontinue Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Plusserver

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Lumen Technologies

List of Figures

- Figure 1: Europe SOCaaS Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe SOCaaS Market Share (%) by Company 2025

List of Tables

- Table 1: Europe SOCaaS Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Europe SOCaaS Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 3: Europe SOCaaS Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Europe SOCaaS Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe SOCaaS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 6: Germany Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: United Kingdom Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Sweden Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Europe SOCaaS Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 14: Europe SOCaaS Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Europe SOCaaS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Germany Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Netherlands Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Norway Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Poland Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Denmark Europe SOCaaS Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe SOCaaS Market?

The projected CAGR is approximately 14.85%.

2. Which companies are prominent players in the Europe SOCaaS Market?

Key companies in the market include Lumen Technologies, Sophos Lt, Thales, Wipro, Atos SE, Cloudflare Inc, ConnectWise LLC, Teceze Limited, Ontinue Inc, Plusserver.

3. What are the main segments of the Europe SOCaaS Market?

The market segments include Organization Size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Adoption of Pay-per-use Model Owing to Reduction in Capex; Rapid Adoption of Cloud Deployment in SMEs; Mobile Workforce and Associated Vulnerabilities.

6. What are the notable trends driving market growth?

Retail and Consumer Goods to be the Fastest Growing End-user Industry.

7. Are there any restraints impacting market growth?

Challenges Associated With Data Control and Total Cost of Ownership.

8. Can you provide examples of recent developments in the market?

January 2024 - The cloud computing and analytics supplier for the world's financial markets, Beaks Group, partnered with BlueVoyant, a cybersecurity company that identifies, verifies, and addresses internal and external threats. Beeks group will receive BlueVoyant's renowned managed extended detection and response (MXDR) services, which boost operational resilience and security. Beeks will provide improved cloud security solutions for the banking industry by utilizing BlueVoyant solution as part of its current Microsoft technology infrastructure; Beeks will be able to run an around-the-clock comprehensive security operations center (SOC) with the aid of BlueVoyant services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe SOCaaS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe SOCaaS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe SOCaaS Market?

To stay informed about further developments, trends, and reports in the Europe SOCaaS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence