Key Insights

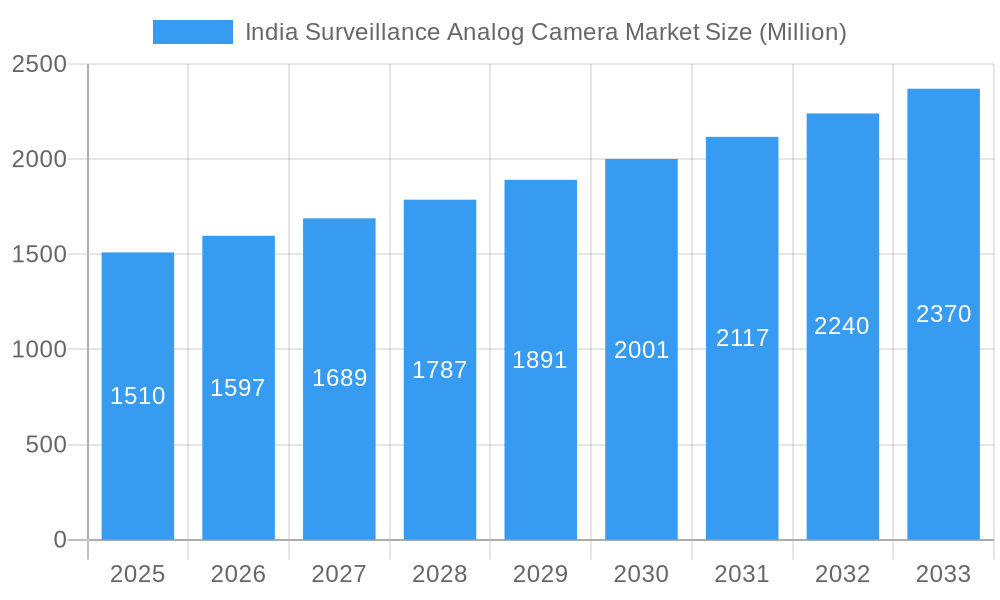

The Indian Surveillance Analog Camera Market is poised for significant growth, with an estimated market size of INR 1510 million in the base year 2025, and a projected Compound Annual Growth Rate (CAGR) of 5.65% throughout the forecast period of 2025-2033. This robust expansion is primarily fueled by escalating security concerns across various sectors, including government, banking, transportation, and industrial segments. The government's increasing focus on public safety and smart city initiatives, coupled with the persistent need for enhanced security in the highly regulated banking and financial services sector, are significant drivers. Furthermore, the transportation and logistics industry's demand for improved monitoring of infrastructure and cargo, along with the industrial sector's need for operational efficiency and asset protection, contributes to sustained market momentum. The analog camera segment, while facing competition from digital alternatives, continues to hold relevance due to its cost-effectiveness, ease of installation, and compatibility with existing infrastructure, making it a preferred choice for budget-conscious projects and legacy system upgrades.

India Surveillance Analog Camera Market Market Size (In Billion)

The market will witness evolving trends such as the integration of advanced features into analog cameras to bridge the gap with digital counterparts, including enhanced resolution and better low-light performance. The rise of hybrid surveillance systems, combining both analog and IP cameras, is also a notable trend, offering flexibility and phased upgradation strategies for businesses. However, the market faces restraints in the form of the rapid technological advancements and cost reduction in IP surveillance systems, which offer superior features like remote access, higher resolution, and advanced analytics. The ongoing shift towards digital and smart surveillance solutions presents a competitive challenge for the analog segment. Key market players like Hikvision India, CP Plus, and Dahua Technology are expected to influence market dynamics through their product innovation and distribution strategies, catering to diverse end-user needs and geographical expansions within India.

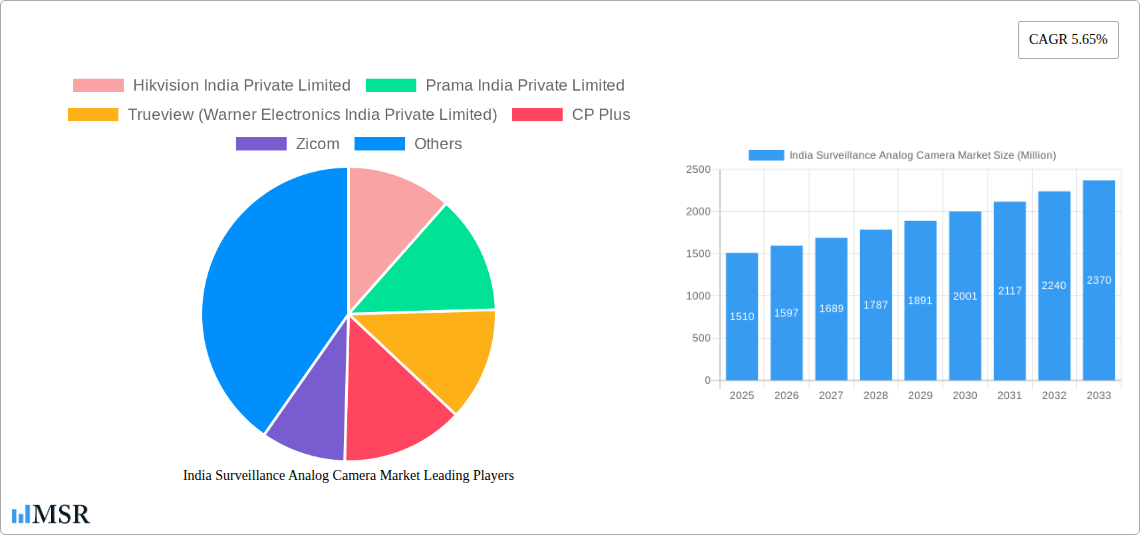

India Surveillance Analog Camera Market Company Market Share

Unlock critical insights into the dynamic India Surveillance Analog Camera Market. This in-depth report analyzes the market's evolution from 2019 to 2033, with a base year of 2025. It provides a granular examination of market concentration, industry trends, key segments, product developments, challenges, growth drivers, emerging opportunities, leading players, and pivotal milestones. Gain actionable intelligence for strategic decision-making in the rapidly expanding Indian analog surveillance sector.

India Surveillance Analog Camera Market Market Concentration & Dynamics

The India Surveillance Analog Camera Market is characterized by a moderately concentrated landscape, with key players like Hikvision India Private Limited, Prama India Private Limited, and CP Plus holding significant market share. The innovation ecosystem is steadily evolving, driven by the need for cost-effective and reliable surveillance solutions. Regulatory frameworks, particularly the recent revisions to the Compulsory Registration Order (CRO) by the Ministry of Electronics and Information Technology (MeitY) in April 2024, are playing a crucial role in shaping market dynamics by mandating STQC Certification for all CCTV products. Substitute products, primarily IP-based cameras, present a growing competitive challenge, although analog cameras continue to be favored in specific applications due to ease of installation and existing infrastructure. End-user trends lean towards enhanced security, affordability, and robust performance, particularly in critical sectors. Merger and acquisition activities are relatively limited, reflecting a stable, yet competitive market structure. The report estimates the market share of the top three players to be approximately 55-65%. M&A deal counts are projected to be around 2-4 significant transactions over the forecast period.

- Market Concentration: Moderate, with a few dominant players.

- Innovation Ecosystem: Driven by cost-effectiveness and performance.

- Regulatory Frameworks: Increasingly stringent, with a focus on quality and security.

- Substitute Products: IP cameras represent a growing competitive threat.

- End-User Trends: Demand for affordability, reliability, and ease of use.

- M&A Activities: Limited, indicating market maturity.

India Surveillance Analog Camera Market Industry Insights & Trends

The India Surveillance Analog Camera Market is poised for significant growth, projected to reach USD 1.5 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.8% during the forecast period of 2025–2033. This expansion is fueled by a confluence of factors including increasing government initiatives for public safety and smart city development, a surge in private sector investments in security infrastructure across various industries, and the persistent need for cost-effective surveillance solutions. The market benefits from the established analog infrastructure in many existing installations, allowing for easier upgrades rather than complete replacements. Technological disruptions, while more prominent in the IP camera segment, are indirectly influencing the analog market through improved sensor technology and image processing, leading to higher resolution and better low-light performance in analog cameras. Evolving consumer behaviors are also a key driver, with an increased awareness of security needs across both commercial and residential sectors, coupled with budget-conscious purchasing decisions. The affordability and simplicity of deployment for analog cameras continue to make them a preferred choice for small and medium-sized enterprises (SMEs) and in cost-sensitive government projects. The market size in the base year 2025 is estimated at USD 850 Million.

Key Markets & Segments Leading India Surveillance Analog Camera Market

The Government sector is a significant driver of the India Surveillance Analog Camera Market, underscoring the nation's commitment to enhanced public safety and security initiatives. The increasing adoption of surveillance systems in urban development projects, smart city endeavors, and critical infrastructure protection contributes substantially to market growth. Economic growth and the need for robust law enforcement infrastructure are key drivers within this segment.

- Government:

- Drivers: National security mandates, smart city projects, infrastructure protection, increased policing needs, large-scale public safety deployments.

- Dominance Analysis: Government spending on surveillance is a perennial demand, with projects often involving large quantities of cameras for widespread coverage. The implementation of surveillance in public spaces, transportation hubs, and border security areas necessitates reliable and cost-effective analog solutions.

The Banking sector also represents a crucial segment, driven by the imperative to secure financial assets and customer data. The continuous need for real-time monitoring and prevention of fraud and theft fuels the demand for analog cameras. Factors like increasing branch networks and the need for enhanced ATM security contribute to this segment's dominance.

- Banking:

- Drivers: ATM security, branch surveillance, fraud prevention, regulatory compliance, asset protection.

- Dominance Analysis: Financial institutions require high levels of security to protect against internal and external threats. Analog cameras offer a reliable and proven method for continuous monitoring of banking environments, ensuring accountability and deterrence.

The Industrial sector is another key contributor, with manufacturing plants, warehouses, and other industrial facilities adopting analog surveillance for operational monitoring, safety compliance, and asset security.

- Industrial:

- Drivers: Operational efficiency monitoring, workplace safety, inventory management, theft prevention, process control.

- Dominance Analysis: Industrial settings often require ruggedized and durable surveillance solutions capable of withstanding harsh environments. Analog cameras, with their robust build and cost-effectiveness, are well-suited for these applications.

India Surveillance Analog Camera Market Product Developments

Recent product developments are significantly enhancing the capabilities and market relevance of analog surveillance cameras. Hikvision's October 2023 introduction of ColorVu Fixed Turret and Bullet Cameras, featuring an F1.0 aperture for superior low-light, full-color imaging, showcases advancements in analog technology. These cameras offer 2 MP resolution and support HD over analog cabling, facilitating seamless upgrades from older systems. The integrated 3D Digital Noise Reduction (DNR) technology ensures clearer images with minimal interference, while the extended white light range up to 65 feet provides detailed night-time surveillance. These innovations are crucial in addressing the demand for enhanced performance and picture quality, even within the analog domain, offering competitive advantages and expanding application possibilities.

Challenges in the India Surveillance Analog Camera Market Market

The India Surveillance Analog Camera Market faces several challenges that impact its growth trajectory. Regulatory hurdles, particularly the evolving compliance requirements like STQC Certification, can increase production and import costs, potentially impacting affordability. Supply chain disruptions, influenced by global events and geopolitical factors, can lead to delays and price volatility. Intense competition, not only from domestic players but also from established international brands, pressures profit margins. Furthermore, the ongoing transition towards IP-based surveillance, offering advanced features and scalability, poses a significant long-term threat. The estimated impact of these challenges on market growth could be a reduction of 1-2% in the projected CAGR.

- Regulatory Hurdles: Compliance with new certifications and standards.

- Supply Chain Issues: Potential for delays and price fluctuations.

- Intense Competition: Pressure on pricing and market share.

- IP Surveillance Transition: Growing preference for digital solutions.

Forces Driving India Surveillance Analog Camera Market Growth

Several forces are propelling the growth of the India Surveillance Analog Camera Market. The increasing government focus on public safety, smart city initiatives, and crime prevention across urban and rural areas is a primary driver. A burgeoning economy and rising disposable incomes are leading to increased investments in private security by businesses and homeowners. The cost-effectiveness of analog camera systems, coupled with their ease of installation and compatibility with existing infrastructure, makes them an attractive option for a wide spectrum of users, particularly SMEs and in price-sensitive government projects. Continuous technological advancements in analog camera capabilities, such as improved image resolution and low-light performance, are also contributing to sustained demand.

Challenges in the India Surveillance Analog Camera Market Market

Long-term growth catalysts for the India Surveillance Analog Camera Market are centered around sustained innovation and strategic market penetration. Continued enhancement of analog camera technology, focusing on improving image quality, introducing advanced analytics capabilities (even if basic), and ensuring robust durability, will be crucial. Partnerships with system integrators and installers will be vital for wider adoption and effective deployment. Furthermore, exploring niche applications and focusing on specific end-user segments that still prioritize cost and simplicity over cutting-edge features can ensure sustained market relevance. Market expansion into Tier 2 and Tier 3 cities, where affordability remains a key consideration, presents significant opportunities for growth.

Emerging Opportunities in India Surveillance Analog Camera Market

Emerging opportunities in the India Surveillance Analog Camera Market lie in leveraging specific market niches and evolving consumer preferences. The increasing demand for affordable and reliable surveillance solutions in the rapidly growing small and medium-sized enterprise (SME) sector presents a significant avenue for growth. Government mandates for enhanced public safety and security in educational institutions, hospitals, and public transport infrastructure offer continuous opportunities. Furthermore, the development of hybrid systems that integrate analog cameras with basic digital functionalities can bridge the gap between traditional and advanced surveillance, catering to customers seeking incremental upgrades. The potential for expanding surveillance into less saturated markets within smaller towns and rural areas, where the cost-effectiveness of analog solutions is highly valued, also represents a promising frontier.

Leading Players in the India Surveillance Analog Camera Market Sector

- Hikvision India Private Limited

- Prama India Private Limited

- Trueview (Warner Electronics India Private Limited)

- CP Plus

- Zicom

- Godrej Security Solutions

- Zhejiang Dahua Technology Co Ltd

- Panasonic Life Solutions India Pvt Ltd

- Securico Electronics India Limited

- Shenzhen TVT Digital Technology Co Ltd

- Vantage Integrated Security Solutions

- Hanwha Vision

- Honeywell International Inc

- Mivant

Key Milestones in India Surveillance Analog Camera Market Industry

- April 2024: The Ministry of Electronics and Information Technology (MeitY) introduced revisions to the Compulsory Registration Order (CRO) for CCTV cameras in India, requiring STQC Certification for all CCTV products to enhance security and quality.

- October 2023: Hikvision launched ColorVu Fixed Turret and Bullet Cameras with F1.0 aperture, offering 2 MP analog cameras with continuous, high-quality, full-color imaging, HD over analog cabling, and 3D DNR technology for superior night vision.

Strategic Outlook for India Surveillance Analog Camera Market Market

The strategic outlook for the India Surveillance Analog Camera Market is one of sustained relevance through targeted innovation and market segmentation. While the market faces competition from IP-based solutions, its inherent cost-effectiveness and ease of deployment will ensure continued demand, especially in budget-conscious sectors. Growth accelerators will include leveraging government mandates for public safety, expanding into Tier 2/3 cities, and focusing on the SME segment. Strategic partnerships with installers and value-added resellers will be crucial for market penetration. Furthermore, product development focusing on enhanced image clarity, durability, and integration capabilities will allow analog cameras to maintain their competitive edge and cater to evolving security needs within their defined market space.

India Surveillance Analog Camera Market Segmentation

-

1. End-User Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation & Logistics

- 1.5. Industrial

- 1.6. Others

India Surveillance Analog Camera Market Segmentation By Geography

- 1. India

India Surveillance Analog Camera Market Regional Market Share

Geographic Coverage of India Surveillance Analog Camera Market

India Surveillance Analog Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Effectiveness and Affordability; Rising Public and Private Investment in Security and Surveillance Technologies

- 3.3. Market Restrains

- 3.3.1. Cost Effectiveness and Affordability; Rising Public and Private Investment in Security and Surveillance Technologies

- 3.4. Market Trends

- 3.4.1. Cost Effectiveness and Affordability to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Surveillance Analog Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation & Logistics

- 5.1.5. Industrial

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hikvision India Private Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Prama India Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trueview (Warner Electronics India Private Limited)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CP Plus

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zicom

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Godrej Security Solutions

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zhejiang Dahua Technology Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Panasonic Life Solutions India Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Securico Electronics India Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Shenzhen TVT Digital Technology Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vantage Integrated Security Solutions

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hanwha Vision

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Honeywell International Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Mivant

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Hikvision India Private Limited

List of Figures

- Figure 1: India Surveillance Analog Camera Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Surveillance Analog Camera Market Share (%) by Company 2025

List of Tables

- Table 1: India Surveillance Analog Camera Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 2: India Surveillance Analog Camera Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 3: India Surveillance Analog Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Surveillance Analog Camera Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: India Surveillance Analog Camera Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: India Surveillance Analog Camera Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: India Surveillance Analog Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: India Surveillance Analog Camera Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Surveillance Analog Camera Market?

The projected CAGR is approximately 5.65%.

2. Which companies are prominent players in the India Surveillance Analog Camera Market?

Key companies in the market include Hikvision India Private Limited, Prama India Private Limited, Trueview (Warner Electronics India Private Limited), CP Plus, Zicom, Godrej Security Solutions, Zhejiang Dahua Technology Co Ltd, Panasonic Life Solutions India Pvt Ltd, Securico Electronics India Limited, Shenzhen TVT Digital Technology Co Ltd, Vantage Integrated Security Solutions, Hanwha Vision, Honeywell International Inc, Mivant.

3. What are the main segments of the India Surveillance Analog Camera Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Effectiveness and Affordability; Rising Public and Private Investment in Security and Surveillance Technologies.

6. What are the notable trends driving market growth?

Cost Effectiveness and Affordability to Drive the Market.

7. Are there any restraints impacting market growth?

Cost Effectiveness and Affordability; Rising Public and Private Investment in Security and Surveillance Technologies.

8. Can you provide examples of recent developments in the market?

April 2024 - The Ministry of Electronics and Information Technology (MeitY) has introduced revisions to the Compulsory Registration Order (CRO) for CCTV cameras in India. This move aims to address rising concerns over the security and quality of these devices. As a proactive measure, the government now requires STQC Certification for all CCTV products, whether manufactured, imported, or sold in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Surveillance Analog Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Surveillance Analog Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Surveillance Analog Camera Market?

To stay informed about further developments, trends, and reports in the India Surveillance Analog Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence