Key Insights

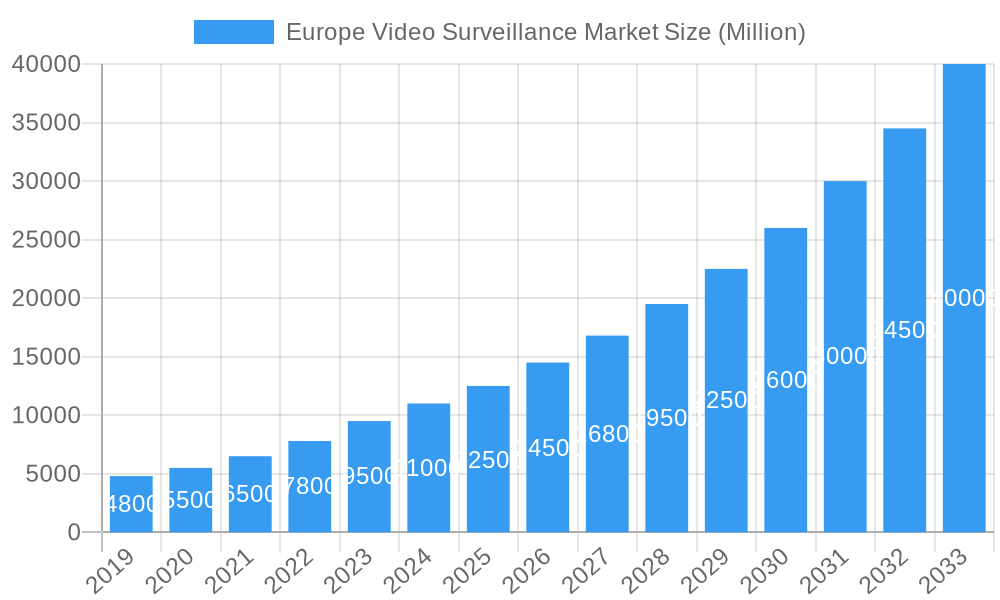

The European video surveillance market is set for substantial growth, projected to reach $56.11 billion by 2025, driven by a CAGR of 7.8%. Increasing security concerns across commercial and industrial sectors are fueling demand for advanced monitoring solutions. Key drivers include the widespread adoption of IP cameras, sophisticated video analytics for threat detection, and the growing popularity of Video as a Service (VSaaS) for scalable cloud-based surveillance. Government investments in public safety and critical infrastructure also significantly boost market expansion, alongside rising awareness and affordability of smart home security systems in the residential segment.

Europe Video Surveillance Market Market Size (In Billion)

Technological advancements and evolving end-user needs define the market. High-resolution IP cameras and robust storage solutions remain critical hardware components. However, the strategic importance of software, including advanced video analytics and Video Management Software (VMS), is rapidly increasing for smarter data interpretation. Trends such as Artificial Intelligence (AI) and machine learning for predictive analytics and facial recognition are transforming the industry. Potential restraints, including stringent European data privacy regulations like GDPR and the initial cost of advanced systems, may temper growth. Nevertheless, the persistent demand for enhanced security, continuous innovation, and a broader range of accessible solutions are expected to propel the European video surveillance market forward. Key countries such as the United Kingdom, Germany, and France are leading this expansion.

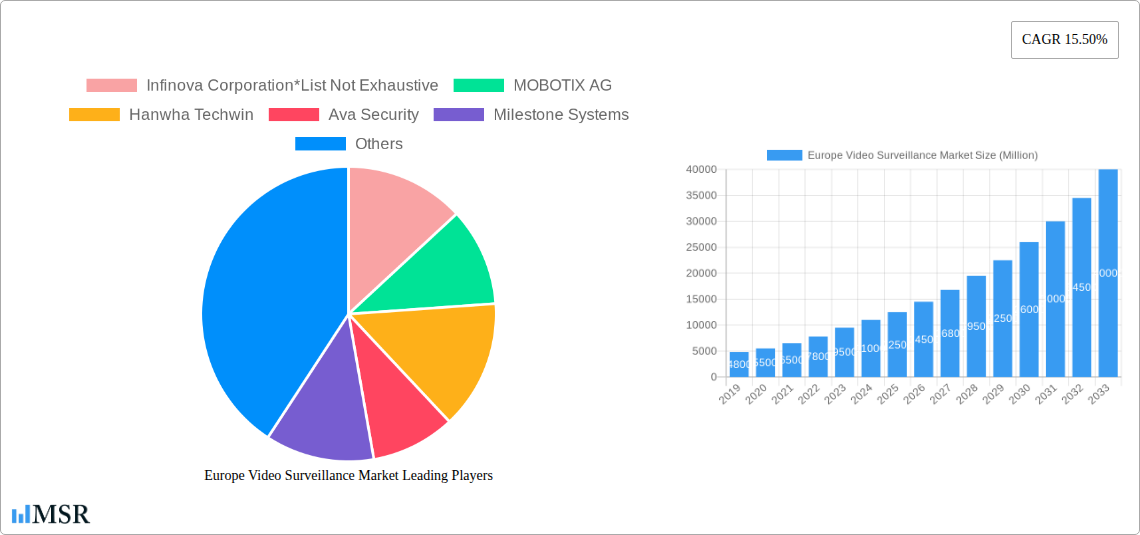

Europe Video Surveillance Market Company Market Share

Gain strategic insights into the thriving Europe Video Surveillance Market. This comprehensive report analyzes key trends, market dynamics, and future opportunities within this rapidly evolving sector. Our research covers hardware, software, VSaaS, and diverse end-user segments, delivering actionable intelligence for all stakeholders. Spanning a study period from 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report offers a definitive guide to navigating the European video surveillance landscape. The estimated market size for 2025 is valued at $56.11 billion, with a projected Compound Annual Growth Rate (CAGR) of 7.8% throughout the forecast period. Explore market concentration, industry insights, leading segments, product developments, challenges, growth drivers, emerging opportunities, and competitive landscapes, optimized with high-ranking keywords like "Europe video surveillance," "IP cameras Europe," "video analytics market," "VSaaS adoption," and "CCTV security trends."

Europe Video Surveillance Market Market Concentration & Dynamics

The Europe Video Surveillance Market is characterized by moderate to high concentration, with a few dominant players holding significant market share. Innovation is a key differentiator, driven by substantial investments in research and development, particularly in AI-powered video analytics and edge computing. The ecosystem is shaped by robust regulatory frameworks, including GDPR, which influences data privacy and security measures, impacting product design and deployment strategies. Substitute products, such as alarm systems and access control, exist but are often integrated with comprehensive video surveillance solutions. End-user trends are shifting towards intelligent video analysis for proactive threat detection and operational efficiency. Mergers and Acquisitions (M&A) are a notable dynamic, with XX M&A deals recorded in the historical period (2019-2024), indicating strategic consolidation and expansion efforts by key companies. The market share of the top 5 players is estimated at XX%, showcasing a competitive yet consolidating environment.

Europe Video Surveillance Market Industry Insights & Trends

The Europe Video Surveillance Market is experiencing robust growth, fueled by an escalating demand for enhanced security and safety across various sectors. The increasing adoption of IP cameras over traditional analog systems is a significant technological disruption, offering higher resolution, better network capabilities, and remote accessibility. The proliferation of video analytics is transforming surveillance from passive monitoring to active intelligence, enabling real-time event detection, facial recognition, and behavior analysis. This surge in intelligent features is a direct response to rising crime rates and security concerns, particularly in urban centers and critical infrastructure. Furthermore, the growing popularity of Video as a Service (VSaaS) is democratizing advanced surveillance capabilities, making them more accessible and cost-effective for small and medium-sized enterprises (SMEs) and residential users. The shift towards cloud-based solutions also addresses data storage challenges and facilitates easier system management. Evolving consumer behaviors, driven by a greater awareness of personal safety and property protection, are also contributing to market expansion, particularly in the residential segment. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into surveillance systems is another pivotal trend, enhancing accuracy, reducing false alarms, and providing deeper insights from video data. The market size for Europe Video Surveillance was approximately €XX Billion in 2023 and is projected to reach €XX Billion by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033).

Key Markets & Segments Leading Europe Video Surveillance Market

The Hardware segment, particularly IP cameras, is a dominant force within the Europe Video Surveillance Market, driven by their superior image quality, network connectivity, and advanced features compared to analog alternatives. The sub-segment of IP cameras is experiencing rapid growth due to ongoing technological advancements and increasing affordability. Storage solutions, essential for retaining video footage, also represent a significant market component, with a growing demand for high-capacity and secure storage options, including Network Attached Storage (NAS) and cloud-based storage.

Within the Software segment, Video Analytics is a key growth driver, as businesses and governments increasingly leverage AI and machine learning for intelligent monitoring, threat detection, and operational insights. The demand for sophisticated analytical capabilities such as object detection, facial recognition, and anomaly detection is soaring. Video Management Software (VMS) remains crucial for integrating and managing multiple cameras and recording devices, with a trend towards cloud-native VMS platforms offering scalability and flexibility.

The Video as a Service (VSaaS) segment is rapidly gaining traction, offering a subscription-based model for cloud storage, management, and analytics, making advanced surveillance solutions accessible to a broader market, including SMEs and residential users. This segment is particularly appealing due to its cost-effectiveness and ease of deployment.

By End-User, the Commercial sector, encompassing retail, hospitality, and corporate offices, is a leading segment, driven by the need to prevent theft, monitor employee productivity, and ensure customer safety. The Industrial sector, including manufacturing plants, logistics hubs, and energy facilities, also presents substantial demand for robust surveillance solutions to secure assets and prevent operational disruptions. The Government sector, encompassing public safety, law enforcement, and transportation infrastructure, is a significant and consistent driver of market growth, particularly for large-scale surveillance projects and smart city initiatives. While smaller, the Residential segment is experiencing notable growth, fueled by increasing home security awareness and the availability of user-friendly smart home surveillance devices.

Europe Video Surveillance Market Product Developments

Product developments in the Europe Video Surveillance Market are heavily focused on enhancing intelligence and integration. The introduction of AI-powered edge devices allows for real-time data processing and analysis directly at the camera, reducing latency and bandwidth requirements. Innovations in thermal imaging and low-light performance are expanding surveillance capabilities into challenging environmental conditions. Furthermore, the seamless integration of video surveillance with other security systems, such as access control and alarm systems, through open APIs and standardized protocols is a significant trend, creating comprehensive security ecosystems. The emphasis on cybersecurity features, including end-to-end encryption and secure firmware updates, is also paramount, addressing growing concerns about data breaches.

Challenges in the Europe Video Surveillance Market Market

Despite strong growth, the Europe Video Surveillance Market faces several challenges. Stringent data privacy regulations, such as GDPR, impose compliance burdens and can limit the scope of data collection and analysis. The high initial cost of advanced IP cameras and sophisticated video analytics software can be a barrier for some smaller businesses and residential users. Supply chain disruptions, particularly for electronic components, can impact production timelines and product availability. Intense competition among numerous vendors leads to price pressures, affecting profit margins. Furthermore, public perception and concerns about surveillance creep can sometimes lead to resistance in public spaces.

Forces Driving Europe Video Surveillance Market Growth

Several key forces are propelling the Europe Video Surveillance Market. The relentless rise in security threats, both physical and cyber, is a primary driver, compelling organizations and individuals to invest in robust surveillance systems. Technological advancements, particularly in AI, machine learning, and high-resolution imaging, are making surveillance more effective and intelligent. The increasing adoption of smart city initiatives and the growing need for public safety in urban areas are creating significant demand. Economic growth and infrastructure development across Europe also contribute to the expansion of commercial and industrial sectors, which in turn require enhanced security. The growing acceptance of cloud-based solutions and VSaaS is making advanced surveillance more accessible.

Challenges in the Europe Video Surveillance Market Market

Long-term growth catalysts in the Europe Video Surveillance Market are deeply intertwined with ongoing technological evolution and market adaptation. The continuous advancement of AI-powered video analytics, enabling predictive capabilities and proactive threat identification, will be a significant growth accelerator. The expansion of Edge AI solutions, which process data locally, will enhance efficiency and reduce reliance on cloud infrastructure for certain applications. Partnerships and collaborations between hardware manufacturers, software developers, and service providers will foster integrated solutions and create new market opportunities. Furthermore, the increasing global focus on critical infrastructure protection and smart city development will continue to fuel demand for advanced and scalable surveillance technologies.

Emerging Opportunities in Europe Video Surveillance Market

Emerging opportunities in the Europe Video Surveillance Market are abundant and diverse. The growing demand for AI-driven security solutions, particularly in retail for loss prevention and customer analytics, presents a significant avenue for growth. The expansion of the VSaaS market, catering to SMEs and remote monitoring needs, offers substantial potential. The integration of video surveillance with the Internet of Things (IoT) ecosystem, enabling smart home automation and industrial IoT applications, is another key opportunity. Furthermore, the increasing focus on cybersecurity within surveillance systems themselves, creating demand for secure and resilient solutions, opens new market niches. The development of specialized video analytics for niche applications, such as healthcare or environmental monitoring, also presents emerging opportunities.

Leading Players in the Europe Video Surveillance Market Sector

- Infinova Corporation

- MOBOTIX AG

- Hanwha Techwin

- Ava Security

- Milestone Systems

- Videotec SpA

- ABUS Security Tech Germany

- Robert Bosch GmbH

- Hangzhou Hikvision Digital Technology Co Ltd

- Axis Communications AB

Key Milestones in Europe Video Surveillance Market Industry

- June 2021: Atos completed the acquisition of Ipsotek, a provider of AI-enhanced video analytics software. This acquisition significantly strengthened Atos' position in the Edge AI and Computer Vision market by integrating key software capabilities and intellectual property, offering a unique value proposition to clients across various sectors.

- November 2021: Videoloft, a UK-based cloud video surveillance company, announced new direct integration with CCTV manufacturer Vivotek. This development streamlined the connection of Vivotek cameras to the Videoloft cloud, enhancing compatibility with Vivotek NVRs/DVRs and simplifying the setup process for users, building on previous ONVIF compatibility.

Strategic Outlook for Europe Video Surveillance Market Market

The strategic outlook for the Europe Video Surveillance Market remains exceptionally strong, driven by innovation and increasing adoption across all segments. The continued integration of AI and machine learning into IP cameras and video analytics will be a key differentiator, enabling more sophisticated threat detection and operational insights. The expansion of VSaaS offerings will democratize access to advanced surveillance, particularly for SMEs and residential users, fostering market penetration. Strategic partnerships and collaborations between technology providers, integrators, and end-users will be crucial for developing comprehensive, end-to-end solutions. Furthermore, the growing emphasis on cybersecurity within surveillance systems will create opportunities for vendors offering robust and secure platforms. The market is poised for sustained growth, with a clear trajectory towards intelligent, integrated, and cloud-enabled video surveillance solutions.

Europe Video Surveillance Market Segmentation

-

1. Component

-

1.1. Hardware

-

1.1.1. Camera

- 1.1.1.1. Analog

- 1.1.1.2. IP Cameras

- 1.1.1.3. Hybrid

- 1.1.2. Storage

-

1.1.1. Camera

-

1.2. Software

- 1.2.1. Video Analytics

- 1.2.2. Video Management Software

- 1.3. Video as a Service (VSaaS)

-

1.1. Hardware

-

2. End-User

- 2.1. Commercial

- 2.2. Industrial

- 2.3. Residential

- 2.4. Government

Europe Video Surveillance Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

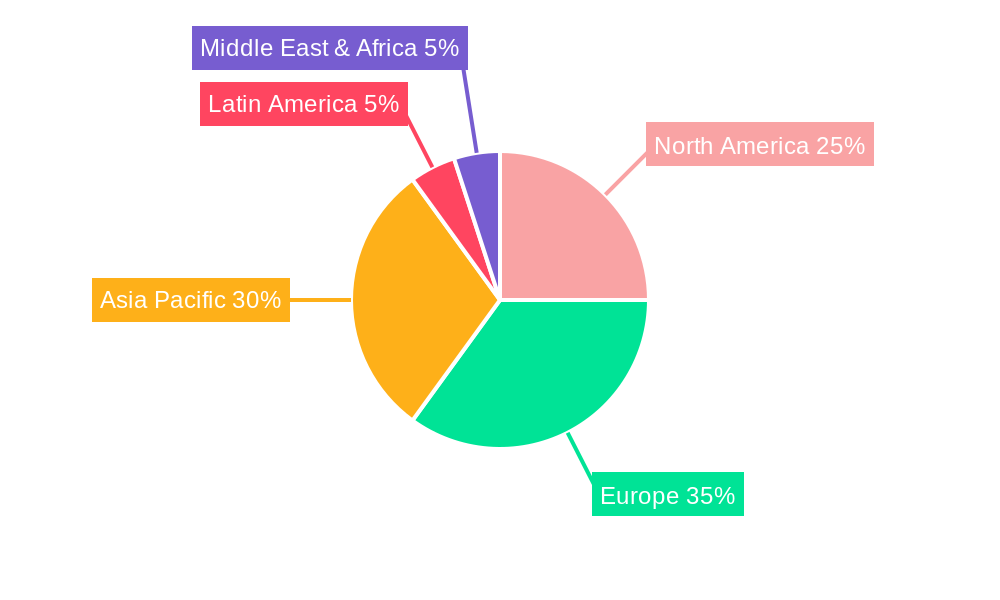

Europe Video Surveillance Market Regional Market Share

Geographic Coverage of Europe Video Surveillance Market

Europe Video Surveillance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Spending in Advanced Security Systems; Growth in Public and Private Infrastructure

- 3.3. Market Restrains

- 3.3.1. Lack of Standardization in Sensor Fusion Technology

- 3.4. Market Trends

- 3.4.1. Hardware Segment to Hold A Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Video Surveillance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. Camera

- 5.1.1.1.1. Analog

- 5.1.1.1.2. IP Cameras

- 5.1.1.1.3. Hybrid

- 5.1.1.2. Storage

- 5.1.1.1. Camera

- 5.1.2. Software

- 5.1.2.1. Video Analytics

- 5.1.2.2. Video Management Software

- 5.1.3. Video as a Service (VSaaS)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Commercial

- 5.2.2. Industrial

- 5.2.3. Residential

- 5.2.4. Government

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Infinova Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MOBOTIX AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hanwha Techwin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ava Security

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Milestone Systems

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Videotec SpA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ABUS Security Tech Germany

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Robert Bosch GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Axis Communications AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Infinova Corporation*List Not Exhaustive

List of Figures

- Figure 1: Europe Video Surveillance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Video Surveillance Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Video Surveillance Market Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Europe Video Surveillance Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Europe Video Surveillance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Video Surveillance Market Revenue billion Forecast, by Component 2020 & 2033

- Table 5: Europe Video Surveillance Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Europe Video Surveillance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Video Surveillance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Video Surveillance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Video Surveillance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Video Surveillance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Video Surveillance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Video Surveillance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Video Surveillance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Video Surveillance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Video Surveillance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Video Surveillance Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Video Surveillance Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Video Surveillance Market?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Europe Video Surveillance Market?

Key companies in the market include Infinova Corporation*List Not Exhaustive, MOBOTIX AG, Hanwha Techwin, Ava Security, Milestone Systems, Videotec SpA, ABUS Security Tech Germany, Robert Bosch GmbH, Hangzhou Hikvision Digital Technology Co Ltd, Axis Communications AB.

3. What are the main segments of the Europe Video Surveillance Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 56.11 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Spending in Advanced Security Systems; Growth in Public and Private Infrastructure.

6. What are the notable trends driving market growth?

Hardware Segment to Hold A Major Market Share.

7. Are there any restraints impacting market growth?

Lack of Standardization in Sensor Fusion Technology.

8. Can you provide examples of recent developments in the market?

June 2021 - Atos completed the acquisition of Ipsotek, a provider of AI-enhanced video analytics software. The acquisition helped Atos strengthen its position in Edge AI and Computer Vision market by adding key software capabilities and IP to its solutions portfolio, thereby providing a unique offering to clients across various sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Video Surveillance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Video Surveillance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Video Surveillance Market?

To stay informed about further developments, trends, and reports in the Europe Video Surveillance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence