Key Insights

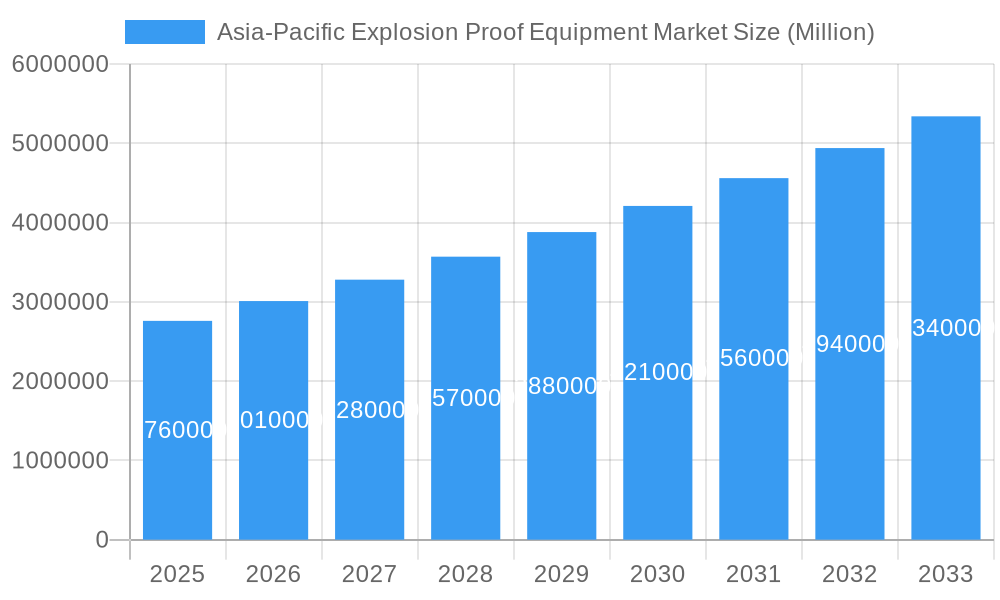

The Asia-Pacific Explosion Proof Equipment Market is poised for substantial growth, projected to reach approximately USD 2.76 million with a compelling Compound Annual Growth Rate (CAGR) of 9.06% from 2019 to 2033. This robust expansion is driven by the increasing stringency of safety regulations across the region, coupled with a significant surge in industrial activities within sectors such as chemical and petrochemical, oil & gas, mining, and pharmaceutical manufacturing. The burgeoning need for reliable explosion-proof solutions to safeguard personnel and assets in hazardous environments, particularly in rapidly industrializing economies like China and India, forms the bedrock of this market's upward trajectory. Furthermore, advancements in explosion prevention and segregation technologies, alongside the growing adoption of automation and surveillance systems designed for hazardous zones, are key contributors to this dynamic market. The market's segmentation highlights a strong demand across various zones (Zone 0 to Zone 22) and system types, indicating a comprehensive need for specialized explosion-proof equipment.

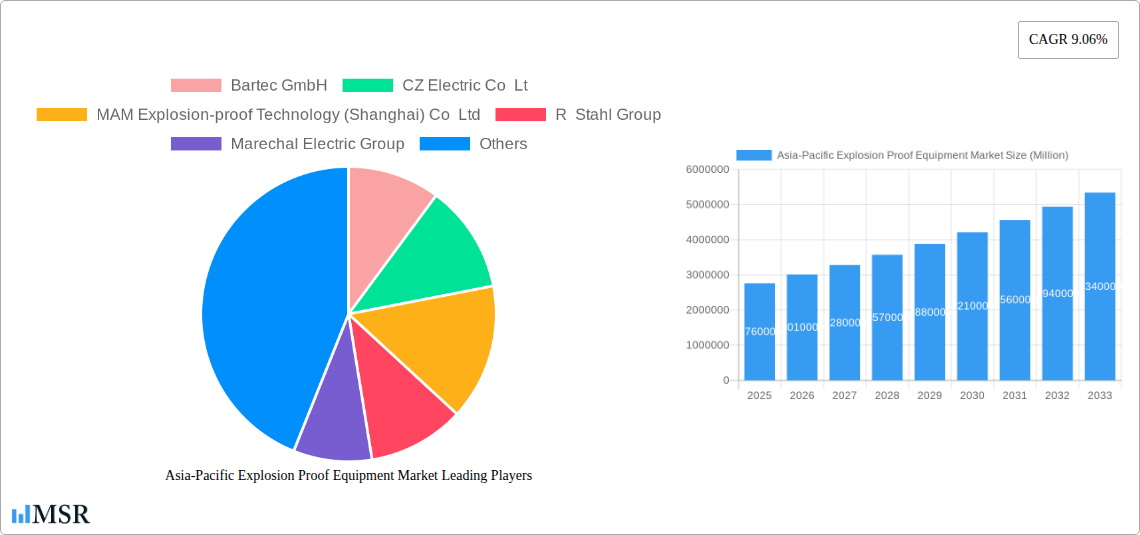

Asia-Pacific Explosion Proof Equipment Market Market Size (In Billion)

The market's forward momentum is further fueled by ongoing investments in infrastructure development and the modernization of existing industrial facilities across Asia Pacific. Key players are actively innovating and expanding their product portfolios to cater to the diverse needs of end-users. For instance, the demand for explosion-proof solutions in the energy and power sector, including renewable energy installations, is anticipated to witness significant uplift. While rapid industrialization presents immense opportunities, potential challenges may include the high initial cost of some advanced explosion-proof technologies and the need for skilled personnel for installation and maintenance. However, the overarching commitment to workplace safety and the continuous evolution of industrial processes are expected to outweigh these restraints, ensuring sustained and vigorous growth for the Asia-Pacific Explosion Proof Equipment Market throughout the forecast period.

Asia-Pacific Explosion Proof Equipment Market Company Market Share

Asia-Pacific Explosion Proof Equipment Market: Comprehensive Insights and Forecasts (2019-2033)

This in-depth report provides an exhaustive analysis of the Asia-Pacific Explosion Proof Equipment Market, offering critical insights into market dynamics, growth drivers, key segments, and competitive landscapes. Covering the historical period from 2019 to 2024 and a forecast period from 2025 to 2033, with a base year of 2025, this study is an indispensable resource for industry stakeholders seeking to understand and capitalize on the evolving opportunities within this vital sector. The report delves into explosion-proof, explosion prevention, and explosion segregation equipment across various hazardous zones (Zone 0, 20, 1, 21, 22) and end-user industries, including Pharmaceutical, Chemical and Petrochemical, Energy and Power, Mining, Food Processing, and Oil & Gas. Explore critical system applications such as Power Supply, Material Handling, Motors, Automation, and Surveillance, and gain actionable intelligence to navigate this dynamic market.

Asia-Pacific Explosion Proof Equipment Market Market Concentration & Dynamics

The Asia-Pacific Explosion Proof Equipment Market exhibits a moderately concentrated landscape, characterized by a blend of established global players and emerging regional manufacturers. Innovation ecosystems are thriving, driven by increasing demand for enhanced safety standards in hazardous environments across diverse industries. Regulatory frameworks, while varied across countries, are generally tightening, mandating the adoption of certified explosion-proof solutions. The market faces competition from substitute products and solutions, necessitating continuous product development and differentiation. End-user trends indicate a growing preference for intelligent, integrated, and remote monitoring explosion-proof systems. Mergers & Acquisition (M&A) activities are sporadic, primarily focused on consolidating market share, acquiring new technologies, or expanding geographical reach. Key players like Bartec GmbH, R Stahl Group, and ABB Limited hold significant market share, while companies such as MAM Explosion-proof Technology (Shanghai) Co Ltd and Warom Technology Inc are expanding their influence. The number of M&A deals remains relatively low, reflecting a mature market structure but with potential for strategic consolidation.

Asia-Pacific Explosion Proof Equipment Market Industry Insights & Trends

The Asia-Pacific Explosion Proof Equipment Market is poised for robust growth, projected to reach approximately $XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This expansion is primarily fueled by the escalating stringency of safety regulations across the region, particularly in burgeoning economies such as China, India, and Southeast Asian nations. Industries like Oil & Gas, Chemical and Petrochemical, and Mining are witnessing substantial investments in infrastructure upgrades and new project developments, directly translating into increased demand for explosion-proof equipment. Technological disruptions are playing a pivotal role, with a notable shift towards intelligent, IoT-enabled explosion-proof devices offering enhanced monitoring, diagnostics, and remote control capabilities. These advancements improve operational efficiency, reduce downtime, and minimize risks associated with hazardous environments. Evolving consumer behaviors are characterized by a greater emphasis on long-term cost-effectiveness, reliability, and compliance with international safety standards. End-users are increasingly seeking integrated solutions rather than standalone products, driving demand for comprehensive safety systems. Furthermore, the growing adoption of digitalization and automation across industrial sectors amplifies the need for explosion-proof components within these advanced systems. The pharmaceutical sector, with its stringent hygiene and safety requirements, also presents a significant growth avenue. The energy and power sector, driven by renewable energy expansion and traditional power plant modernization, further contributes to market expansion. The market size was estimated at $XX Billion in the base year 2025.

Key Markets & Segments Leading Asia-Pacific Explosion Proof Equipment Market

The Asia-Pacific Explosion Proof Equipment Market is characterized by the dominance of several key markets and segments. Geographically, China stands out as the largest and fastest-growing market, driven by its extensive industrial base, significant investments in infrastructure, and stringent enforcement of safety regulations. Following closely are India and South Korea, propelled by their expanding manufacturing sectors and energy demands.

End Users:

- Oil & Gas: This segment remains a cornerstone of the market, with continuous exploration, production, and refining activities necessitating high levels of safety. The ongoing development of offshore oil fields and the expansion of refining capacities in countries like Indonesia and Malaysia are significant drivers.

- Chemical and Petrochemical: The robust growth of the chemical industry in the region, fueled by demand for various downstream products, directly translates to a consistent need for explosion-proof equipment.

- Energy and Power: This segment is experiencing a surge due to the expansion of both traditional power generation facilities and the increasing integration of renewable energy sources, which often involve complex electrical systems in potentially hazardous environments.

Zones:

- Zone 21 and Zone 22: These zones, characterized by the potential presence of flammable atmospheres under normal operating conditions (Zone 21) and intermittent or unlikely presence (Zone 22), represent the largest segments in terms of volume. This is due to their widespread applicability in general industrial settings.

- Zone 1 and Zone 20: These zones, with a higher likelihood of explosive atmospheres, are critical for specialized applications within the Oil & Gas and Chemical sectors, driving demand for premium explosion-proof solutions.

Types:

- Explosion Proof: This category encompasses equipment designed to prevent explosions from occurring by containing internal sparks or flames. Its broad applicability across all hazardous zones makes it a dominant segment.

- Explosion Prevention: This type focuses on mitigating the conditions that lead to an explosive atmosphere, such as controlling oxygen levels or temperature, and is gaining traction with advancements in monitoring and control systems.

Systems:

- Power Supply System: The fundamental need for reliable and safe power delivery in hazardous areas makes this a consistently high-demand segment.

- Automation System: As industries embrace Industry 4.0, the integration of explosion-proof components within automated processes, including control systems and sensors, is a significant growth area.

Economic growth, rapid industrialization, and the increasing focus on worker safety and environmental protection are key drivers underpinning the dominance of these segments and regions.

Asia-Pacific Explosion Proof Equipment Market Product Developments

Recent product developments are significantly shaping the Asia-Pacific Explosion Proof Equipment Market. Innovations are focused on enhancing safety, efficiency, and connectivity. For instance, the development of cutting-edge electronic switching technology, as seen with Siemens' SENTRON ECPD, offers advanced circuit protection that electronically switches off faults, minimizing risks and downtime. Similarly, R. STAHL's next-generation YODALEX/3 signaling devices provide advanced audible and visual alerts, crucial for operational awareness in hazardous environments. These advancements demonstrate a clear industry trend towards intelligent, integrated, and more sophisticated explosion-proof solutions designed to meet increasingly stringent safety standards and operational demands across diverse industrial applications.

Challenges in the Asia-Pacific Explosion Proof Equipment Market Market

Despite robust growth, the Asia-Pacific Explosion Proof Equipment Market faces several challenges. Stringent and varied certification processes across different countries can create hurdles for manufacturers seeking to enter new markets. Supply chain disruptions, exacerbated by geopolitical factors and logistical complexities, can impact production timelines and costs. Price sensitivity in some emerging economies, coupled with intense competition from both established and new players, can exert downward pressure on profit margins. Furthermore, a shortage of skilled personnel for installation and maintenance of specialized explosion-proof equipment can hinder adoption in certain regions.

Forces Driving Asia-Pacific Explosion Proof Equipment Market Growth

Several key forces are propelling the Asia-Pacific Explosion Proof Equipment Market forward. Increasingly stringent government regulations mandating safety in hazardous industrial environments are a primary driver. Rapid industrialization and infrastructure development across the region, particularly in the Oil & Gas, Chemical, and Manufacturing sectors, create a sustained demand. Technological advancements leading to smarter, more efficient, and integrated explosion-proof solutions are enhancing their appeal. Growing awareness of workplace safety and environmental protection among businesses and consumers further boosts demand. The expansion of the mining sector in resource-rich nations and the modernization of energy infrastructure also contribute significantly to market growth.

Challenges in the Asia-Pacific Explosion Proof Equipment Market Market

Long-term growth catalysts for the Asia-Pacific Explosion Proof Equipment Market are embedded in continuous innovation and strategic market expansion. The increasing adoption of Industry 4.0 principles, which necessitates explosion-proof components within automated and digitalized industrial processes, presents a significant opportunity. Furthermore, the growing demand for energy-efficient and sustainable solutions is pushing manufacturers to develop explosion-proof equipment with lower energy consumption. Strategic partnerships and collaborations between equipment manufacturers and end-users can foster the development of tailored solutions and accelerate market penetration. The expansion into untapped or emerging industrial hubs within the region, coupled with localized manufacturing and service capabilities, will be crucial for sustained growth.

Emerging Opportunities in Asia-Pacific Explosion Proof Equipment Market

Emerging opportunities in the Asia-Pacific Explosion Proof Equipment Market are diverse and promising. The increasing demand for specialized explosion-proof equipment in renewable energy installations, such as wind farms and solar power plants, presents a significant growth avenue. The development of advanced explosion-proof sensors and monitoring systems equipped with AI and machine learning capabilities for predictive maintenance and real-time risk assessment is a key technological trend. Furthermore, the growing focus on upgrading legacy industrial facilities with modern safety standards is creating substantial retrofit opportunities. The expansion of the pharmaceutical and food processing industries, with their stringent safety and hygiene requirements, offers niche but high-value market segments.

Leading Players in the Asia-Pacific Explosion Proof Equipment Market Sector

- Bartec GmbH

- CZ Electric Co Lt

- MAM Explosion-proof Technology (Shanghai) Co Ltd

- R Stahl Group

- Marechal Electric Group

- G M International SRL

- Eaton Corporation PLC

- Cordex Instruments

- Phoenix Mecano

- Rae Systems (Acquired By Honeywell)

- Adalet

- Pepperl+Fuchs

- ABB Limited

- Alloy Industry Co Ltd

- Warom Technology Inc

Key Milestones in Asia-Pacific Explosion Proof Equipment Market Industry

- March 2024: Siemens developed one of the world’s most innovative circuit protection devices with cutting-edge electronic switching technology. SENTRON ECPD (electronic circuit protection device) electronically switches off circuit faults if errors occur and, if necessary, trips the mechanical isolating contact downstream. This development enhances safety and operational reliability in electrical systems.

- November 2023: R. STAHL announced the launch of its next-generation signaling devices. YODALEX/3 signaling devices are the ideal solution for alerting staff or notifying them of the status of production lines and processes. These devices are available as audible or visual devices, individually or combined. The devices give loud and clear signals for automatic synchronization in systems with multiple units, improving situational awareness and safety protocols.

Strategic Outlook for Asia-Pacific Explosion Proof Equipment Market Market

The strategic outlook for the Asia-Pacific Explosion Proof Equipment Market is overwhelmingly positive, driven by a confluence of factors that underscore sustained demand and significant growth potential. The relentless pursuit of enhanced safety standards across all hazardous industrial sectors, mandated by increasingly stringent regulatory frameworks, will continue to be a primary growth accelerator. Furthermore, the ongoing digital transformation of industries, embracing automation and the Industrial Internet of Things (IIoT), necessitates the integration of intelligent and connected explosion-proof equipment, creating substantial opportunities for advanced solutions. Strategic investments in smart manufacturing, renewable energy infrastructure, and the expansion of critical industries like pharmaceuticals and chemicals will further fuel market expansion. Manufacturers who focus on developing technologically advanced, cost-effective, and compliant explosion-proof equipment, while also building robust regional supply chains and service networks, will be best positioned to capitalize on the promising future of this market.

Asia-Pacific Explosion Proof Equipment Market Segmentation

-

1. Type

- 1.1. Explosion Proof

- 1.2. Explosion Prevention

- 1.3. Explosion Segregation

-

2. Zone

- 2.1. Zone 0

- 2.2. Zone 20

- 2.3. Zone 1

- 2.4. Zone 21

- 2.5. Zone 22

-

3. End User

- 3.1. Pharmaceutical

- 3.2. Chemical and Petrochemical

- 3.3. Energy and Power

- 3.4. Mining

- 3.5. Food Processing

- 3.6. Oil & Gas

- 3.7. Other End Users

-

4. System

- 4.1. Power Supply System

- 4.2. Material Handling

- 4.3. Motor

- 4.4. Automation System

- 4.5. Surveillance System

- 4.6. Other Systems

Asia-Pacific Explosion Proof Equipment Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Explosion Proof Equipment Market Regional Market Share

Geographic Coverage of Asia-Pacific Explosion Proof Equipment Market

Asia-Pacific Explosion Proof Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stricter Regulations for Handling Hazardous Areas and Substances; Increasing Energy Requirements Driving the Demand for Exploration of New Mines and Oil and Gas Resources

- 3.3. Market Restrains

- 3.3.1. Pricey Investments Due to High Costs of Installation of the Equipment

- 3.4. Market Trends

- 3.4.1. The Oil and Gas Industry to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Explosion Proof Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Explosion Proof

- 5.1.2. Explosion Prevention

- 5.1.3. Explosion Segregation

- 5.2. Market Analysis, Insights and Forecast - by Zone

- 5.2.1. Zone 0

- 5.2.2. Zone 20

- 5.2.3. Zone 1

- 5.2.4. Zone 21

- 5.2.5. Zone 22

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical

- 5.3.2. Chemical and Petrochemical

- 5.3.3. Energy and Power

- 5.3.4. Mining

- 5.3.5. Food Processing

- 5.3.6. Oil & Gas

- 5.3.7. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by System

- 5.4.1. Power Supply System

- 5.4.2. Material Handling

- 5.4.3. Motor

- 5.4.4. Automation System

- 5.4.5. Surveillance System

- 5.4.6. Other Systems

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Explosion Proof Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7. Japan Asia-Pacific Explosion Proof Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8. India Asia-Pacific Explosion Proof Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9. South Korea Asia-Pacific Explosion Proof Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10. Taiwan Asia-Pacific Explosion Proof Equipment Market Analysis, Insights and Forecast, 2020-2032

- 11. Australia Asia-Pacific Explosion Proof Equipment Market Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Asia-Pacific Asia-Pacific Explosion Proof Equipment Market Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Bartec GmbH

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 CZ Electric Co Lt

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 MAM Explosion-proof Technology (Shanghai) Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 R Stahl Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Marechal Electric Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 G M International SRL

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Eaton Corporation PLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Cordex Instruments

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Phoenix Mecano

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Rae Systems (Acquired By Honeywell)

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Adalet

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Pepperl+Fuchs

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 ABB Limited

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Alloy Industry Co Ltd

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Warom Technology Inc

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 Bartec GmbH

List of Figures

- Figure 1: Asia-Pacific Explosion Proof Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Explosion Proof Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Explosion Proof Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Asia-Pacific Explosion Proof Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Explosion Proof Equipment Market Revenue Million Forecast, by Zone 2020 & 2033

- Table 4: Asia-Pacific Explosion Proof Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 5: Asia-Pacific Explosion Proof Equipment Market Revenue Million Forecast, by System 2020 & 2033

- Table 6: Asia-Pacific Explosion Proof Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Explosion Proof Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: China Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Taiwan Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Asia-Pacific Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Explosion Proof Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 16: Asia-Pacific Explosion Proof Equipment Market Revenue Million Forecast, by Zone 2020 & 2033

- Table 17: Asia-Pacific Explosion Proof Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Asia-Pacific Explosion Proof Equipment Market Revenue Million Forecast, by System 2020 & 2033

- Table 19: Asia-Pacific Explosion Proof Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Australia Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: New Zealand Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Singapore Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Thailand Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Vietnam Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Philippines Asia-Pacific Explosion Proof Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Explosion Proof Equipment Market?

The projected CAGR is approximately 9.06%.

2. Which companies are prominent players in the Asia-Pacific Explosion Proof Equipment Market?

Key companies in the market include Bartec GmbH, CZ Electric Co Lt, MAM Explosion-proof Technology (Shanghai) Co Ltd, R Stahl Group, Marechal Electric Group, G M International SRL, Eaton Corporation PLC, Cordex Instruments, Phoenix Mecano, Rae Systems (Acquired By Honeywell), Adalet, Pepperl+Fuchs, ABB Limited, Alloy Industry Co Ltd, Warom Technology Inc.

3. What are the main segments of the Asia-Pacific Explosion Proof Equipment Market?

The market segments include Type, Zone, End User, System.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Stricter Regulations for Handling Hazardous Areas and Substances; Increasing Energy Requirements Driving the Demand for Exploration of New Mines and Oil and Gas Resources.

6. What are the notable trends driving market growth?

The Oil and Gas Industry to Show Significant Growth.

7. Are there any restraints impacting market growth?

Pricey Investments Due to High Costs of Installation of the Equipment.

8. Can you provide examples of recent developments in the market?

March 2024: Siemens developed one of the world’s most innovative circuit protection devices with cutting-edge electronic switching technology. SENTRON ECPD (electronic circuit protection device) electronically switches off circuit faults if errors occur and, if necessary, trips the mechanical isolating contact downstream.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Explosion Proof Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Explosion Proof Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Explosion Proof Equipment Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Explosion Proof Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence