Key Insights

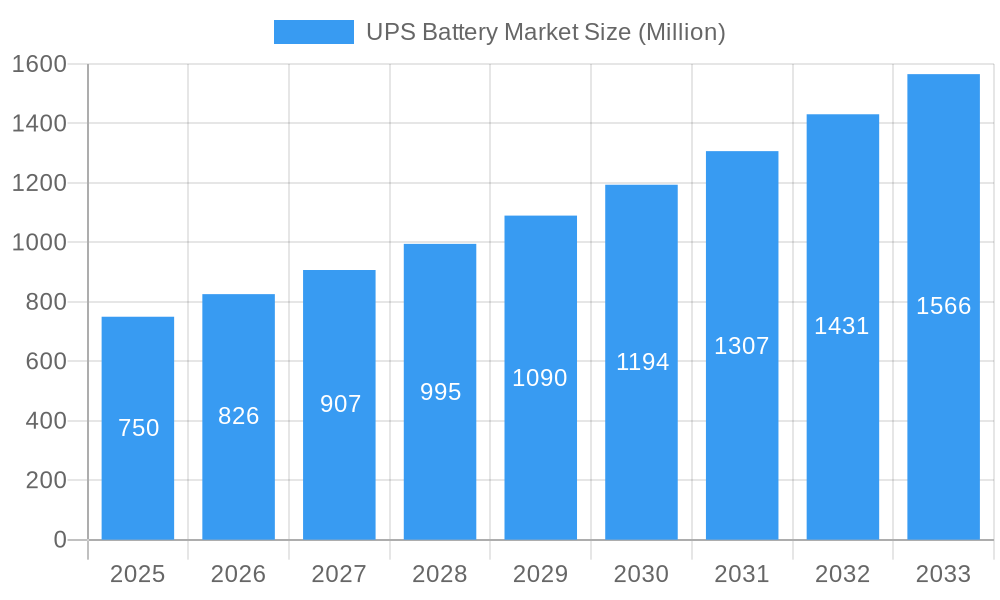

The global UPS battery market is poised for significant expansion, projected to reach a substantial valuation driven by a robust Compound Annual Growth Rate (CAGR) of 10.09%. This upward trajectory is primarily fueled by the escalating demand for uninterrupted power supply across critical sectors such as data centers, healthcare facilities, and telecommunications, where power outages can lead to catastrophic financial and operational losses. The increasing adoption of renewable energy sources, coupled with the intermittent nature of their power generation, further accentuates the need for reliable energy storage solutions like UPS batteries to ensure grid stability and continuous power flow. Furthermore, the burgeoning digitalization trend, leading to an exponential increase in data generation and consumption, necessitates more powerful and dependable data storage and processing infrastructure, directly translating into heightened demand for UPS systems and their integral battery components. Emerging economies, with their rapid industrialization and urbanization, are also emerging as key growth areas, driven by infrastructure development and the increasing reliance on electricity for both commercial and residential purposes.

UPS Battery Market Market Size (In Million)

The market's segmentation reveals a dynamic landscape where Lithium-Ion batteries are increasingly gaining traction over traditional Nickel Cadmium and Lead Acid batteries, owing to their superior energy density, longer lifespan, and enhanced safety features, despite a potentially higher initial cost. This shift is particularly evident in high-demand applications such as commercial establishments and power utilities. Residential applications, while historically dominated by more cost-effective solutions, are also seeing a gradual integration of advanced battery technologies. Key players in the market are actively investing in research and development to innovate battery chemistries and optimize system designs, focusing on sustainability, improved performance, and cost-effectiveness. Strategic partnerships and mergers & acquisitions are also shaping the competitive environment, as companies strive to expand their product portfolios and geographical reach to capitalize on the projected market growth. The industry is also keenly observing trends towards smart grid integration and the development of battery management systems that enhance efficiency and predictive maintenance capabilities.

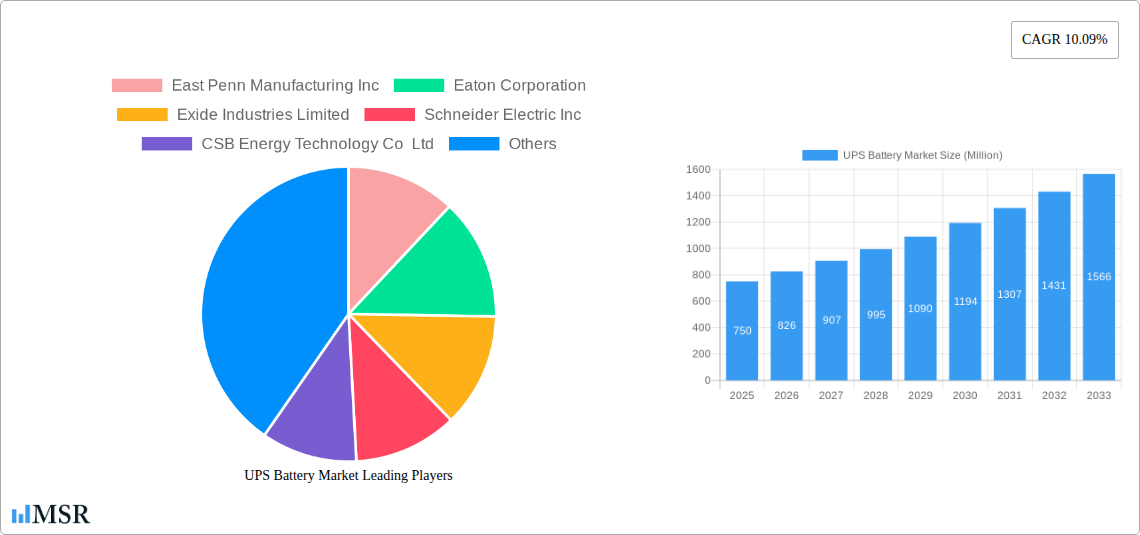

UPS Battery Market Company Market Share

UPS Battery Market Report Description: Unlocking Critical Power Solutions and Future Growth (2019–2033)

Explore the dynamic global UPS Battery Market with our comprehensive, SEO-optimized report. Dive deep into market trends, technological innovations, and strategic insights from 2019–2033, with a base year of 2025 and a forecast period extending to 2033. This in-depth analysis will equip industry stakeholders with the actionable intelligence needed to navigate the rapidly evolving landscape of uninterruptible power supply (UPS) batteries, crucial for safeguarding critical infrastructure and ensuring business continuity.

This report analyzes the UPS Battery Market, a vital sector projected for significant growth driven by increasing demand for reliable power solutions across residential, commercial, industrial, and power & utilities applications. With an estimated market size of XXX Million in 2025, the market is poised for substantial expansion, fueled by technological advancements in battery chemistries like Lithium-Ion and Nickel Cadmium, and supported by leading companies including East Penn Manufacturing Inc, Eaton Corporation, Exide Industries Limited, Schneider Electric Inc, CSB Energy Technology Co Ltd, ZincFive Inc, Enersys Inc, Fiamm Energy Technology S p A, Leoch International Technology Limited, and Vertiv Group Corporation.

UPS Battery Market Market Concentration & Dynamics

The global UPS Battery Market exhibits a moderate level of concentration, with a mix of large multinational corporations and specialized regional players. Innovation ecosystems are thriving, driven by ongoing research and development in battery chemistries and energy management systems. Regulatory frameworks are evolving to support the integration of advanced battery technologies and to ensure the safety and reliability of UPS systems. Substitute products, primarily from emerging energy storage solutions, pose a competitive challenge, though traditional UPS batteries maintain a strong foothold due to established reliability and cost-effectiveness. End-user trends highlight a growing demand for higher energy density, longer lifespans, and sustainable battery solutions, particularly within data centers and critical infrastructure. Merger and acquisition (M&A) activities, with an estimated X M&A deal count during the historical period, are observed as companies seek to expand their product portfolios, gain market share, and acquire new technologies. Key players like East Penn Manufacturing Inc and Eaton Corporation are actively involved in strategic consolidations to strengthen their market positions. Market share analysis reveals a competitive landscape where leading companies are vying for dominance through product differentiation and strategic partnerships.

UPS Battery Market Industry Insights & Trends

The UPS Battery Market is experiencing robust growth, with an estimated market size of XXX Million in 2025 and a projected Compound Annual Growth Rate (CAGR) of X% during the forecast period (2025–2033). This expansion is primarily fueled by the escalating need for uninterrupted power across a multitude of critical applications. Technological disruptions are a major catalyst, with significant advancements in Lithium-Ion battery technology offering higher energy density, faster charging capabilities, and extended lifespans compared to traditional Lead Acid batteries. The increasing prevalence of data centers, the burgeoning adoption of cloud computing, and the expansion of telecommunications infrastructure are key demand drivers. Furthermore, the growing emphasis on renewable energy integration and grid stability necessitates sophisticated UPS solutions to manage intermittent power sources. Evolving consumer behaviors also play a crucial role; businesses and institutions are increasingly prioritizing business continuity and operational resilience, leading to higher investments in advanced UPS systems. The demand for smart UPS solutions, equipped with advanced monitoring, diagnostics, and remote management capabilities, is on the rise. Regulatory initiatives promoting energy efficiency and grid modernization are also contributing to market growth. The shift towards sustainable and environmentally friendly battery chemistries, such as those explored by ZincFive Inc, is another significant trend shaping the future of the UPS battery market. The increasing adoption of electric vehicles (EVs) also indirectly fuels the demand for advanced battery technologies, with spillover effects on the UPS battery sector. The ongoing digital transformation across various industries, from manufacturing to healthcare, further underscores the critical role of reliable power supply, making UPS batteries an indispensable component.

Key Markets & Segments Leading UPS Battery Market

The Lithium-Ion segment is emerging as a dominant force within the UPS Battery Market, driven by its superior performance characteristics. This segment's growth is propelled by:

- Technological Superiority: Higher energy density, faster charging, longer cycle life, and a wider operating temperature range compared to traditional chemistries.

- Weight and Space Efficiency: Crucial for compact UPS solutions in space-constrained environments like data centers.

- Decreasing Costs: Economies of scale and manufacturing advancements are making Lithium-Ion batteries more cost-competitive.

The Commercial application segment is also a leading contributor to market expansion, fueled by:

- Data Center Growth: The exponential growth of data centers, driven by cloud computing and big data, demands robust and reliable UPS systems for uninterrupted operations.

- Small and Medium-sized Businesses (SMBs): Increasing reliance on IT infrastructure and the need to protect sensitive data from power disruptions.

- Healthcare and Finance: Critical sectors where downtime can have severe financial and operational consequences.

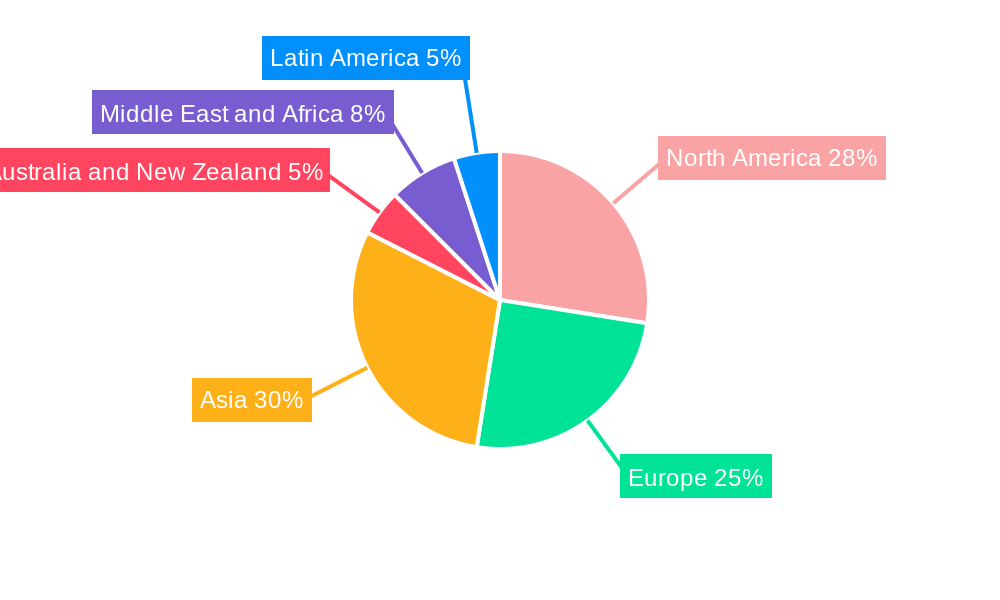

Geographically, North America and Asia Pacific are leading markets for UPS batteries.

- North America: Driven by a mature IT infrastructure, extensive data center development, and stringent regulations for power reliability. Countries like the United States are major consumers due to their advanced technological adoption and critical infrastructure needs.

- Asia Pacific: Experiencing rapid industrialization and digitalization, leading to a surge in demand for UPS systems in countries like China, India, and Southeast Asian nations. Government initiatives supporting smart city development and digital infrastructure further accelerate market penetration.

The Power and Utilities sector is also a significant driver, with utilities requiring reliable backup power for substations, control systems, and grid management to ensure uninterrupted electricity supply. The Industrial segment, encompassing manufacturing plants and heavy industries, also relies heavily on UPS systems to prevent costly production halts due to power outages. While Lead Acid batteries continue to hold a substantial market share due to their established infrastructure and lower upfront cost, the long-term trend indicates a clear shift towards Lithium-Ion for its superior lifecycle cost and performance.

UPS Battery Market Product Developments

Product development in the UPS Battery Market is characterized by a strong focus on enhancing energy density, improving safety, and increasing sustainability. Recent innovations include the introduction of advanced Lithium-Ion chemistries, such as Nickel-Manganese-Cobalt (NMC) and Lithium Iron Phosphate (LFP), offering improved thermal stability and longer operational lifespans. Companies are also exploring novel battery technologies, like nickel-zinc (NiZn) batteries, as demonstrated by ABB Limited's integration into its MegaFlex lineup. These developments aim to cater to the evolving demands for high-power, high-density UPS solutions, especially for data centers and critical power applications, providing safer and more resilient energy storage alternatives.

Challenges in the UPS Battery Market Market

Despite the robust growth trajectory, the UPS Battery Market faces several challenges. The upfront cost of advanced battery technologies, particularly Lithium-Ion, can be a significant barrier for some segments, especially in price-sensitive markets or for smaller applications. Supply chain disruptions and raw material price volatility for key components like lithium and cobalt can impact production costs and lead times. Stringent regulatory requirements and evolving safety standards for battery disposal and recycling add complexity to the market. Furthermore, intense competition from established players and new entrants necessitates continuous innovation and cost optimization. The need for skilled labor for installation, maintenance, and end-of-life management of advanced battery systems also presents a challenge.

Forces Driving UPS Battery Market Growth

Several key forces are driving the growth of the UPS Battery Market. The relentless expansion of data centers and the increasing adoption of cloud computing are paramount, demanding continuous and reliable power to safeguard critical data and operations. The growing digitalization across all industries, from manufacturing to healthcare, further amplifies the need for uninterrupted power supply. The rise of smart grids and the integration of renewable energy sources necessitate advanced UPS solutions for grid stability and power quality management. Government initiatives promoting energy efficiency, cybersecurity, and critical infrastructure protection also play a crucial role. Technological advancements, particularly in Lithium-Ion battery technology offering higher energy density and longer lifespans, are making UPS systems more efficient and cost-effective.

Challenges in the UPS Battery Market Market

Long-term growth catalysts for the UPS Battery Market are deeply intertwined with ongoing technological innovation and strategic market expansion. The development of next-generation battery chemistries that offer even higher energy densities, faster charging, and enhanced safety profiles will be crucial. The increasing focus on the circular economy and battery recycling will not only address environmental concerns but also create new business models and revenue streams. Strategic partnerships and collaborations between battery manufacturers, UPS system providers, and end-users will foster integrated solutions and accelerate adoption. Expansion into emerging economies with rapidly developing infrastructure and increasing reliance on digital technologies presents significant untapped potential. Furthermore, the evolution of smart grid technologies and the growing demand for grid-scale energy storage solutions will create new avenues for UPS battery applications.

Emerging Opportunities in UPS Battery Market

Emerging opportunities in the UPS Battery Market are abundant, driven by a confluence of technological advancements and evolving market demands. The increasing deployment of 5G networks and the proliferation of IoT devices create a significant need for reliable, localized power backup solutions. The growth of edge computing, requiring data processing closer to the source, further fuels demand for compact and efficient UPS systems. The electrification of transportation, while not directly UPS batteries, is driving innovation in battery technology that can have spillover benefits. Furthermore, the development of modular and scalable UPS solutions that can adapt to changing power requirements offers substantial opportunities. The growing emphasis on sustainability and the desire for green IT infrastructure are creating demand for eco-friendly battery solutions and robust recycling programs. The integration of AI and machine learning in UPS management systems presents opportunities for predictive maintenance, optimized energy usage, and enhanced operational efficiency.

Leading Players in the UPS Battery Market Sector

- East Penn Manufacturing Inc

- Eaton Corporation

- Exide Industries Limited

- Schneider Electric Inc

- CSB Energy Technology Co Ltd

- ZincFive Inc

- Enersys Inc

- Fiamm Energy Technology S p A

- Leoch International Technology Limited

- Vertiv Group Corporation

Key Milestones in UPS Battery Market Industry

- May 2024: ABB Limited has added nickel-zinc (NiZn) batteries to its MegaFlex lineup, known for its high-power, high-density UPS solutions tailored for data centres and critical power applications. These NiZn batteries from ZincFive offer a safe, resilient, and sustainable energy storage alternative, distinguishing themselves from conventional chemistries. ABB's MegaFlex global UPS platform guarantees power availability, with capacities reaching up to 1.6 MW (UL) and 2.0 MW (IEC).

- February 2024: Consistent Infosystems, an Indian firm renowned for its expertise in IT hardware, security and surveillance solutions, electronics, and home entertainment products, has launched its newest product: the Consistent UPS Battery. Designed to focus on efficiency, accuracy, and durability, the Consistent UPS Battery provides uninterrupted power during electrical outages or fluctuations. Whether safeguarding vital data centres, ensuring the continuity of essential services, or enhancing telecommunications infrastructure, this new UPS battery promises operational resilience and peace of mind in various settings.

Strategic Outlook for UPS Battery Market Market

The strategic outlook for the UPS Battery Market is highly positive, marked by consistent growth and evolving technological landscapes. Future market potential lies in the continued innovation and adoption of advanced battery chemistries, particularly Lithium-Ion variants, to meet the increasing demands for higher energy density, longer lifespan, and enhanced safety. Strategic opportunities will arise from the expansion of data centers, the growth of edge computing, and the increasing need for reliable power in telecommunications and critical infrastructure. Companies that focus on developing sustainable battery solutions, implementing efficient recycling programs, and offering integrated smart UPS management systems will be well-positioned for success. Furthermore, strategic partnerships and geographical expansion into rapidly developing economies will unlock new revenue streams and market penetration. The ongoing digital transformation across industries underscores the indispensable role of UPS batteries, making this market a crucial component of global technological advancement and operational resilience.

UPS Battery Market Segmentation

-

1. Type

- 1.1. Lithium-Ion

- 1.2. Nickel Cadmium

- 1.3. Lead Acid

- 1.4. Others

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

- 2.4. Power and Utilities

- 2.5. Others

UPS Battery Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Middle East and Africa

- 6. Latin America

UPS Battery Market Regional Market Share

Geographic Coverage of UPS Battery Market

UPS Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidents of Power Outages; Increasing Demand for Data Centers and IT Infrastructure

- 3.3. Market Restrains

- 3.3.1. Rising Incidents of Power Outages; Increasing Demand for Data Centers and IT Infrastructure

- 3.4. Market Trends

- 3.4.1. Lithium-Ion Batteries Segment is Expected to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UPS Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lithium-Ion

- 5.1.2. Nickel Cadmium

- 5.1.3. Lead Acid

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.2.4. Power and Utilities

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Middle East and Africa

- 5.3.6. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UPS Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lithium-Ion

- 6.1.2. Nickel Cadmium

- 6.1.3. Lead Acid

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.2.4. Power and Utilities

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe UPS Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lithium-Ion

- 7.1.2. Nickel Cadmium

- 7.1.3. Lead Acid

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.2.4. Power and Utilities

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia UPS Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lithium-Ion

- 8.1.2. Nickel Cadmium

- 8.1.3. Lead Acid

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.2.4. Power and Utilities

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand UPS Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lithium-Ion

- 9.1.2. Nickel Cadmium

- 9.1.3. Lead Acid

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.2.4. Power and Utilities

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa UPS Battery Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Lithium-Ion

- 10.1.2. Nickel Cadmium

- 10.1.3. Lead Acid

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.2.4. Power and Utilities

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Latin America UPS Battery Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Lithium-Ion

- 11.1.2. Nickel Cadmium

- 11.1.3. Lead Acid

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Residential

- 11.2.2. Commercial

- 11.2.3. Industrial

- 11.2.4. Power and Utilities

- 11.2.5. Others

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 East Penn Manufacturing Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Eaton Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Exide Industries Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Schneider Electric Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 CSB Energy Technology Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 ZincFive Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Enersys Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Fiamm Energy Technology S p A

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Leoch International Technology Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Vertiv Group Corporatio

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 East Penn Manufacturing Inc

List of Figures

- Figure 1: Global UPS Battery Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UPS Battery Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America UPS Battery Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America UPS Battery Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America UPS Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America UPS Battery Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America UPS Battery Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America UPS Battery Market Volume (Billion), by Application 2025 & 2033

- Figure 9: North America UPS Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America UPS Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America UPS Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America UPS Battery Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America UPS Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America UPS Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe UPS Battery Market Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe UPS Battery Market Volume (Billion), by Type 2025 & 2033

- Figure 17: Europe UPS Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe UPS Battery Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe UPS Battery Market Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe UPS Battery Market Volume (Billion), by Application 2025 & 2033

- Figure 21: Europe UPS Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe UPS Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe UPS Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe UPS Battery Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe UPS Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe UPS Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia UPS Battery Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Asia UPS Battery Market Volume (Billion), by Type 2025 & 2033

- Figure 29: Asia UPS Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia UPS Battery Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia UPS Battery Market Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia UPS Battery Market Volume (Billion), by Application 2025 & 2033

- Figure 33: Asia UPS Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia UPS Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia UPS Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia UPS Battery Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia UPS Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia UPS Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand UPS Battery Market Revenue (Million), by Type 2025 & 2033

- Figure 40: Australia and New Zealand UPS Battery Market Volume (Billion), by Type 2025 & 2033

- Figure 41: Australia and New Zealand UPS Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Australia and New Zealand UPS Battery Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Australia and New Zealand UPS Battery Market Revenue (Million), by Application 2025 & 2033

- Figure 44: Australia and New Zealand UPS Battery Market Volume (Billion), by Application 2025 & 2033

- Figure 45: Australia and New Zealand UPS Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Australia and New Zealand UPS Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Australia and New Zealand UPS Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand UPS Battery Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Australia and New Zealand UPS Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand UPS Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa UPS Battery Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa UPS Battery Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East and Africa UPS Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa UPS Battery Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa UPS Battery Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa UPS Battery Market Volume (Billion), by Application 2025 & 2033

- Figure 57: Middle East and Africa UPS Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa UPS Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa UPS Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa UPS Battery Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa UPS Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa UPS Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Latin America UPS Battery Market Revenue (Million), by Type 2025 & 2033

- Figure 64: Latin America UPS Battery Market Volume (Billion), by Type 2025 & 2033

- Figure 65: Latin America UPS Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 66: Latin America UPS Battery Market Volume Share (%), by Type 2025 & 2033

- Figure 67: Latin America UPS Battery Market Revenue (Million), by Application 2025 & 2033

- Figure 68: Latin America UPS Battery Market Volume (Billion), by Application 2025 & 2033

- Figure 69: Latin America UPS Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 70: Latin America UPS Battery Market Volume Share (%), by Application 2025 & 2033

- Figure 71: Latin America UPS Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Latin America UPS Battery Market Volume (Billion), by Country 2025 & 2033

- Figure 73: Latin America UPS Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Latin America UPS Battery Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UPS Battery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UPS Battery Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global UPS Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global UPS Battery Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global UPS Battery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global UPS Battery Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global UPS Battery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global UPS Battery Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Global UPS Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global UPS Battery Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global UPS Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global UPS Battery Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global UPS Battery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global UPS Battery Market Volume Billion Forecast, by Type 2020 & 2033

- Table 15: Global UPS Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Global UPS Battery Market Volume Billion Forecast, by Application 2020 & 2033

- Table 17: Global UPS Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global UPS Battery Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global UPS Battery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global UPS Battery Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global UPS Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global UPS Battery Market Volume Billion Forecast, by Application 2020 & 2033

- Table 23: Global UPS Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global UPS Battery Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global UPS Battery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global UPS Battery Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Global UPS Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global UPS Battery Market Volume Billion Forecast, by Application 2020 & 2033

- Table 29: Global UPS Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global UPS Battery Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global UPS Battery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global UPS Battery Market Volume Billion Forecast, by Type 2020 & 2033

- Table 33: Global UPS Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global UPS Battery Market Volume Billion Forecast, by Application 2020 & 2033

- Table 35: Global UPS Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global UPS Battery Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Global UPS Battery Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global UPS Battery Market Volume Billion Forecast, by Type 2020 & 2033

- Table 39: Global UPS Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global UPS Battery Market Volume Billion Forecast, by Application 2020 & 2033

- Table 41: Global UPS Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global UPS Battery Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UPS Battery Market?

The projected CAGR is approximately 10.09%.

2. Which companies are prominent players in the UPS Battery Market?

Key companies in the market include East Penn Manufacturing Inc, Eaton Corporation, Exide Industries Limited, Schneider Electric Inc, CSB Energy Technology Co Ltd, ZincFive Inc, Enersys Inc, Fiamm Energy Technology S p A, Leoch International Technology Limited, Vertiv Group Corporatio.

3. What are the main segments of the UPS Battery Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidents of Power Outages; Increasing Demand for Data Centers and IT Infrastructure.

6. What are the notable trends driving market growth?

Lithium-Ion Batteries Segment is Expected to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Rising Incidents of Power Outages; Increasing Demand for Data Centers and IT Infrastructure.

8. Can you provide examples of recent developments in the market?

May 2024 - ABB Limited has added nickel-zinc (NiZn) batteries to its MegaFlex lineup, known for its high-power, high-density UPS solutions tailored for data centres and critical power applications. These NiZn batteries from ZincFive offer a safe, resilient, and sustainable energy storage alternative, distinguishing themselves from conventional chemistries. ABB's MegaFlex global UPS platform guarantees power availability, with capacities reaching up to 1.6 MW (UL) and 2.0 MW (IEC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UPS Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UPS Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UPS Battery Market?

To stay informed about further developments, trends, and reports in the UPS Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence