Key Insights

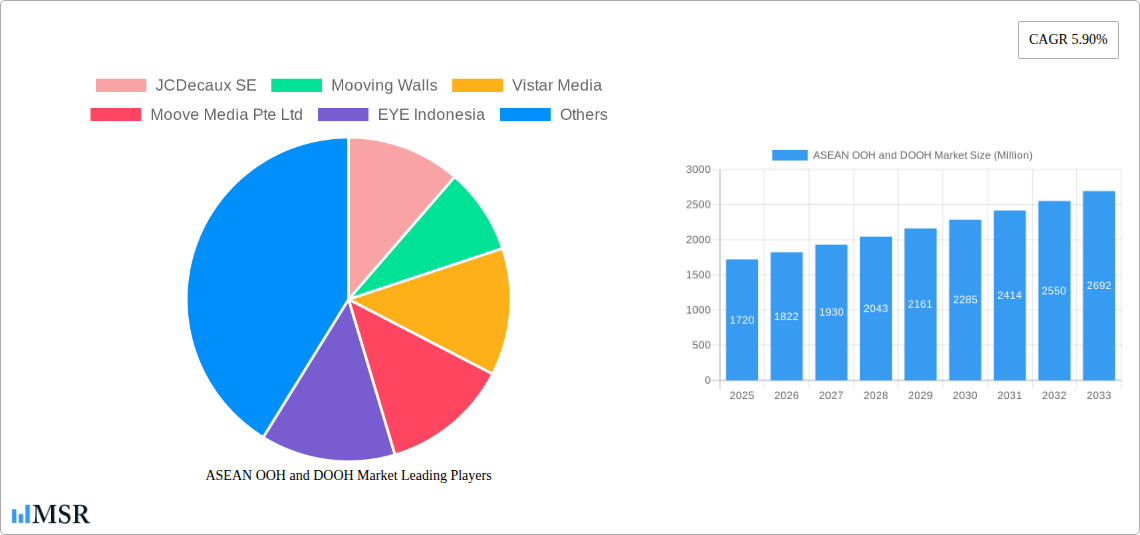

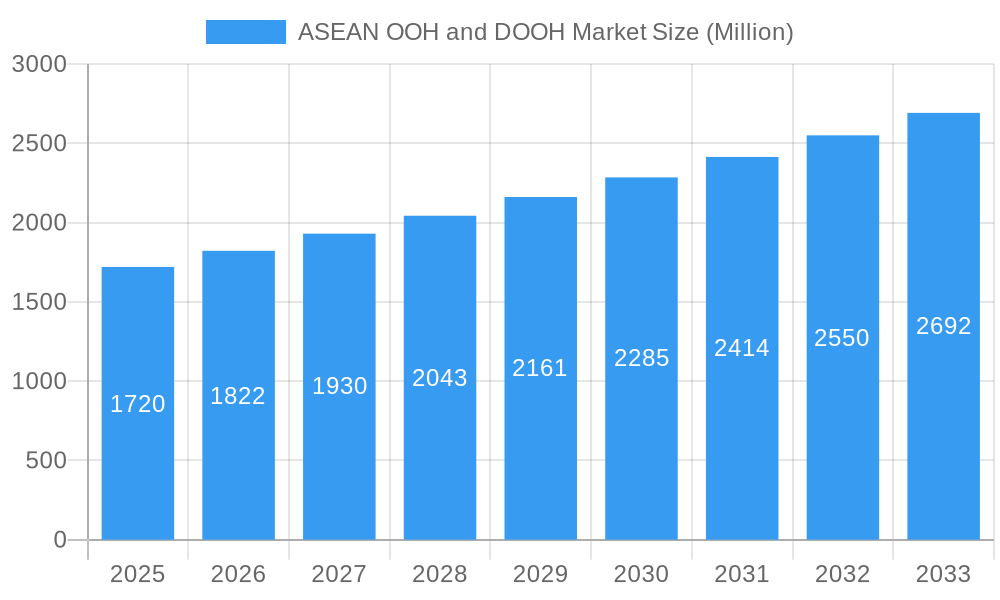

The ASEAN Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market is poised for robust expansion, driven by increasing urbanization, a burgeoning middle class, and a heightened demand for engaging advertising solutions across the region. With a current market size estimated at $1.72 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 5.90% from 2025 to 2033, the market is on a strong upward trajectory. Key growth enablers include the escalating adoption of programmatic DOOH technologies, offering greater targeting precision and campaign flexibility, and the innovative integration of dynamic content on digital screens, which captivates audiences more effectively than traditional static formats. Furthermore, significant investments in smart city initiatives and infrastructure development across ASEAN nations are creating prime locations for OOH and DOOH deployments, from busy transit hubs to retail centers, amplifying brand visibility and recall.

ASEAN OOH and DOOH Market Market Size (In Billion)

The market's diversification across various segments underscores its dynamic nature. The shift towards Digital OOH, including LED screens and programmatic advertising, is a dominant trend, offering advertisers real-time data insights and the ability to adapt campaigns on the fly. In terms of applications, Billboards and Transportation advertising, particularly in airports and on public transit, are expected to see sustained demand due to high footfall and captive audiences. The Retail and Consumer Goods sector continues to be a major end-user, leveraging OOH to drive point-of-purchase decisions and build brand awareness. The Automotive and BFSI sectors are also increasingly utilizing OOH for targeted campaigns. While the market benefits from these drivers, potential restraints may include the ongoing challenges of standardizing ad measurement across diverse platforms and the need for continued investment in digital infrastructure to fully realize programmatic capabilities in certain sub-regions. Nonetheless, the strategic expansion of key players and their focus on innovative solutions positions the ASEAN OOH and DOOH market for significant and sustained growth in the coming years.

ASEAN OOH and DOOH Market Company Market Share

Uncover the dynamic growth and evolving landscape of the Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising markets across Southeast Asia. This in-depth report provides critical insights, actionable strategies, and future projections for stakeholders navigating this rapidly expanding sector. Covering a study period from 2019 to 2033, with a base year of 2025, this analysis delves into market concentration, key industry trends, leading segments, product developments, challenges, growth drivers, emerging opportunities, and the pivotal players shaping the future of OOH and DOOH advertising in the ASEAN region.

The ASEAN OOH and DOOH market is experiencing robust expansion, driven by increasing urbanization, a burgeoning middle class, and the strategic adoption of digital technologies. This report offers a granular view of market dynamics, from static advertising's enduring appeal to the explosive growth of programmatic DOOH. With detailed analysis spanning 2019-2033, including historical trends (2019-2024), base year estimations (2025), and a comprehensive forecast period (2025-2033), stakeholders will gain unparalleled insights into market size, CAGR, competitive landscapes, and future revenue streams. Discover how innovations in LED screens, transit advertising, and place-based media are redefining consumer engagement and brand visibility. This report is an essential guide for advertisers, agencies, media owners, and technology providers seeking to capitalize on the immense potential of the ASEAN OOH and DOOH advertising ecosystem.

ASEAN OOH and DOOH Market Market Concentration & Dynamics

The ASEAN OOH and DOOH market exhibits a moderate level of concentration, characterized by a mix of large multinational corporations and agile local players. Innovation is rapidly transforming the landscape, with significant investments in programmatic DOOH platforms and advanced analytics to drive data-driven campaign optimization. Regulatory frameworks across ASEAN nations are evolving, with some countries actively promoting digital infrastructure while others maintain stricter controls on advertising content and placement. The threat of substitute products, such as highly targeted digital and mobile advertising, remains a consideration, but the inherent reach and impact of OOH continue to offer unique value propositions. End-user trends show a growing demand for measurable campaigns and integrated media strategies. Mergers and acquisitions (M&A) activities are on the rise as larger entities seek to consolidate market share and acquire specialized technological capabilities. Recent M&A deal counts indicate a strategic push towards acquiring programmatic capabilities and expanding regional footprints. Key players are actively exploring partnerships to enhance their digital offerings and expand their network reach, contributing to a dynamic and evolving market structure.

- Market Share Dynamics: Dominance by a few large players in major urban centers, with increasing fragmentation in emerging markets.

- Innovation Ecosystems: Rapid development of programmatic DOOH platforms, programmatic OOH, and data analytics solutions.

- Regulatory Frameworks: Varying levels of digital advertising regulation, with a trend towards liberalization in key markets.

- Substitute Products: Competition from digital, mobile, and social media advertising, necessitating OOH's focus on impact and measurability.

- End-User Trends: Demand for programmatic buying, transparent reporting, and integrated campaign measurement.

- M&A Activities: Strategic acquisitions to gain technological edge, expand market presence, and consolidate portfolios.

ASEAN OOH and DOOH Market Industry Insights & Trends

The ASEAN OOH and DOOH market is poised for significant growth, projected to reach approximately $15 Billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is underpinned by a confluence of factors, including robust economic development across the region, increasing urbanization, and a growing consumer base with higher disposable incomes. Technological disruptions are at the forefront of this evolution, with the widespread adoption of Digital Out-of-Home (DOOH) technologies, including LED screens and programmatic OOH platforms, fundamentally altering how brands engage with audiences. The proliferation of smart city initiatives and the increasing availability of high-speed internet infrastructure are further accelerating the deployment of dynamic and interactive digital OOH advertising solutions.

Consumer behavior is also playing a crucial role. As audiences spend more time in public spaces and transit hubs, OOH advertising offers a unique opportunity for high-impact, location-aware messaging. The ability of DOOH to deliver real-time, contextually relevant content, personalize advertisements based on audience demographics and behavior, and provide verifiable metrics for campaign effectiveness is highly attractive to advertisers. Furthermore, the increasing sophistication of programmatic buying in the OOH space allows for greater efficiency, targeting precision, and campaign flexibility, mirroring the advantages of digital advertising but with the unparalleled reach and impact of physical media. The integration of AI and machine learning is further enhancing the capabilities of DOOH, enabling predictive analytics for audience measurement and dynamic content optimization. The COVID-19 pandemic, while presenting initial challenges, also highlighted the resilience and essential nature of OOH media in conveying public health messages and supporting local economies, leading to a renewed appreciation for its role in the media mix. The trend towards experiential marketing also favors OOH, with its potential for creating immersive brand experiences in public spaces.

- Market Size: Projected to exceed $15 Billion by 2025.

- CAGR: Expected to be XX% during the forecast period (2025–2033).

- Urbanization: Increasing populations in major cities drive demand for OOH advertising.

- Digital Transformation: Rapid adoption of DOOH, programmatic OOH, and advanced digital signage.

- Consumer Engagement: High impact and location-based messaging in public spaces and transit.

- Programmatic DOOH: Enhanced efficiency, targeting, and measurability through automated buying.

- Smart City Initiatives: Integration of OOH with urban infrastructure for enhanced connectivity and data utilization.

- Experiential Marketing: Growing trend for immersive brand activations in public spaces.

Key Markets & Segments Leading ASEAN OOH and DOOH Market

The Billboard segment continues to be a dominant force in the ASEAN OOH and DOOH market, particularly in high-traffic urban areas and along major transportation arteries. Its enduring appeal lies in its large-scale visibility and ability to create significant brand awareness. However, Digital OOH (LED Screens) is rapidly gaining prominence, driven by its flexibility, dynamic content capabilities, and increasing deployment in prime locations such as shopping malls, airports, and transit stations. The sub-segment of Programmatic OOH is a key growth driver within DOOH, enabling automated, data-driven buying and selling of ad inventory, thereby increasing efficiency and targeting precision for advertisers.

Transportation (Transit), encompassing Airports and other applications like buses and train stations, represents another highly significant and rapidly growing segment. Airports, in particular, offer a captive audience with high dwell times and diverse demographics, making them prime locations for premium DOOH placements. The Automotive and Retail and Consumer Goods sectors are leading end-user industries, leveraging OOH and DOOH for product launches, brand reinforcement, and promotional campaigns. The BFSI sector is also increasingly utilizing OOH for brand building and reaching affluent consumer segments.

Dominant Segments:

- Type: Digital OOH (LED Screens) and Programmatic OOH are experiencing the highest growth rates, while Static (Traditional) OOH maintains a strong presence.

- Application: Billboards remain influential, but Transportation (Transit), especially Airports, is witnessing significant investment and innovation. Street Furniture is also gaining traction due to its localized reach.

- End-user Industry: Automotive and Retail & Consumer Goods are the primary spenders, with Healthcare and BFSI showing increasing adoption.

Key Market Drivers:

- Economic Growth: Rising disposable incomes and increased consumer spending in key ASEAN economies.

- Urbanization: Rapid growth of metropolitan areas and increased pedestrian and vehicular traffic.

- Infrastructure Development: Significant investment in transportation networks, including airports, railways, and highways.

- Technological Advancements: Proliferation of digital displays, programmatic platforms, and data analytics tools.

- Tourism Growth: Recovery and expansion of international and domestic tourism, creating opportunities in transit hubs and tourist destinations.

- Brand Investment: Growing recognition of OOH/DOOH's effectiveness in brand awareness and recall.

Country-Specific Dominance:

- Singapore: Leads in DOOH innovation and programmatic adoption, with a focus on premium placements in transit and retail environments.

- Thailand: Strong presence of large OOH media owners, with growing investments in digital billboards and transit advertising.

- Indonesia: Massive market size driven by urbanization and a large population, with significant potential for both traditional and digital OOH.

- Malaysia: Growing DOOH inventory, particularly in urban centers and shopping malls, supported by increasing digital ad spend.

- Vietnam: Emerging market with rapid growth in DOOH, driven by a young demographic and increasing foreign investment.

ASEAN OOH and DOOH Market Product Developments

Product innovation in the ASEAN OOH and DOOH market is characterized by the integration of advanced digital technologies and data analytics. The development of high-resolution LED screens, interactive digital displays, and transparent LED panels is enhancing visual appeal and user engagement. Programmatic OOH platforms are evolving to offer sophisticated audience segmentation, real-time bidding, and cross-channel campaign management. Innovations in smart city integration are leading to OOH displays that can provide real-time traffic updates, public information, and interactive services. Furthermore, the development of measurement tools leveraging AI and mobile data is enhancing the accountability and effectiveness of OOH campaigns, providing advertisers with greater insights into audience reach and impact.

Challenges in the ASEAN OOH and DOOH Market Market

Despite the robust growth, the ASEAN OOH and DOOH market faces several challenges. Regulatory complexities and inconsistencies across different countries can hinder seamless regional campaign execution. The high initial investment cost for digital OOH infrastructure and technology can be a barrier for smaller players. While programmatic DOOH offers efficiency, a lack of standardized measurement metrics and data privacy concerns can impact advertiser confidence. Supply chain disruptions and the availability of skilled labor for installation and maintenance of digital displays also pose potential obstacles. Finally, ensuring cybersecurity for networked digital OOH assets is crucial to prevent breaches and maintain operational integrity.

- Regulatory Hurdles: Inconsistent advertising laws and permit processes across ASEAN nations.

- High Capital Investment: Significant upfront costs for digital display hardware and software.

- Measurement Standardization: Lack of universally accepted metrics for DOOH campaign effectiveness.

- Data Privacy Concerns: Increasing scrutiny over the collection and use of audience data.

- Talent Shortage: Demand for skilled professionals in digital OOH technology and programmatic operations.

Forces Driving ASEAN OOH and DOOH Market Growth

Several powerful forces are driving the growth of the ASEAN OOH and DOOH market. The sustained economic growth and rising disposable incomes across the region are increasing consumer spending and brand advertising budgets. Rapid urbanization and increasing population density in major cities create a captive audience for OOH media. Technological advancements, particularly the widespread adoption of DOOH, programmatic OOH, and smart city infrastructure, are enhancing the capabilities and appeal of out-of-home advertising. The growing tourism sector, both international and domestic, provides lucrative advertising opportunities in transit hubs and popular destinations. Finally, brands are increasingly recognizing the unique ability of OOH to deliver high-impact, memorable advertising experiences that complement digital strategies.

- Economic Expansion: Robust GDP growth and increasing consumer purchasing power.

- Urbanization Trends: Growing populations in major cities, increasing ad visibility.

- Digital Infrastructure: Proliferation of high-speed internet and smart city technologies.

- Tourism Recovery: Resurgence of travel, creating prime advertising opportunities.

- Brand Reach & Impact: OOH's ability to command attention and build brand awareness.

Challenges in the ASEAN OOH and DOOH Market Market

Long-term growth catalysts for the ASEAN OOH and DOOH market lie in continued technological innovation, strategic partnerships, and market expansion. The further development and adoption of AI-powered audience analytics and dynamic content optimization will enhance the precision and effectiveness of DOOH campaigns. Strategic collaborations between OOH media owners, technology providers, and data analytics firms will foster a more integrated and data-driven ecosystem. Expanding into emerging Tier 2 and Tier 3 cities across ASEAN presents significant untapped potential for growth. The ongoing evolution of programmatic DOOH, with increased transparency and standardization, will further solidify its position as a key advertising channel.

Emerging Opportunities in ASEAN OOH and DOOH Market

Emerging opportunities in the ASEAN OOH and DOOH market are abundant, driven by new technologies and evolving consumer preferences. The growth of the metaverse and extended reality (XR) presents opportunities for integrating digital and physical advertising experiences. The increasing demand for sustainability and eco-friendly advertising solutions opens avenues for green OOH initiatives. Expansion into emerging markets within ASEAN, such as Cambodia, Laos, and Myanmar, offers significant untapped potential. Furthermore, the integration of OOH advertising with IoT devices and smart city services can create hyper-contextual and personalized advertising experiences. The demand for location-based marketing and drive-to-store campaigns continues to grow, leveraging OOH as a key driver.

- Metaverse & XR Integration: Blending digital and physical advertising experiences.

- Sustainability Focus: Development of eco-friendly OOH solutions.

- Emerging Market Expansion: Tapping into underserved Tier 2 and Tier 3 cities.

- IoT & Smart City Integration: Hyper-contextual and personalized advertising.

- Location-Based Marketing: Driving foot traffic and in-store visits.

Leading Players in the ASEAN OOH and DOOH Market Sector

- JCDecaux SE

- Mooving Walls

- Vistar Media

- Moove Media Pte Ltd

- EYE Indonesia

- Clear Channel Singapore Pte Ltd

- Plan B Media Public Company Limited

- Goldsun Media Group

- Unique Media Group

- On Digitals Company Limited

Key Milestones in ASEAN OOH and DOOH Market Industry

- March 2024: Adeffi, an out-of-home (OOH) advertising company based in Bangladesh, announced a major expansion of its services into India, Nepal, Thailand, and Vietnam. This strategic move aims to transform how companies in these five countries approach OOH advertising, offering them a robust platform to promote their brands regionally.

- March 2024: Singapore Tourism Board (STB) launched a series of 3D billboards – aimed at providing an immersive showcase of the island city’s iconic landmarks and culinary attractions – in five major cities worldwide. The digital out-of-home (DOOH) activation is part of STB’s latest “Made in Singapore” global campaign, which aims to inspire travelers to choose Singapore as their next holiday destination.

Strategic Outlook for ASEAN OOH and DOOH Market Market

The strategic outlook for the ASEAN OOH and DOOH market is exceptionally positive, driven by continued technological advancements and evolving advertiser demands. The increasing adoption of programmatic DOOH will further enhance campaign efficiency and measurability, making OOH a more attractive proposition within integrated media plans. Investments in data analytics and AI will unlock new opportunities for hyper-targeting and real-time campaign optimization. The focus on creating immersive and interactive experiences will elevate the role of OOH beyond traditional advertising. Continued expansion into developing markets and the integration of OOH with emerging digital platforms like the metaverse are key growth accelerators. Stakeholders who embrace innovation, data-driven strategies, and strategic partnerships will be best positioned to capitalize on the substantial growth potential of this dynamic market.

ASEAN OOH and DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Other Digital OOH Tools

-

2. Application

- 2.1. Billboard

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Other Transportation Applications (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-based Media

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End-user Industries

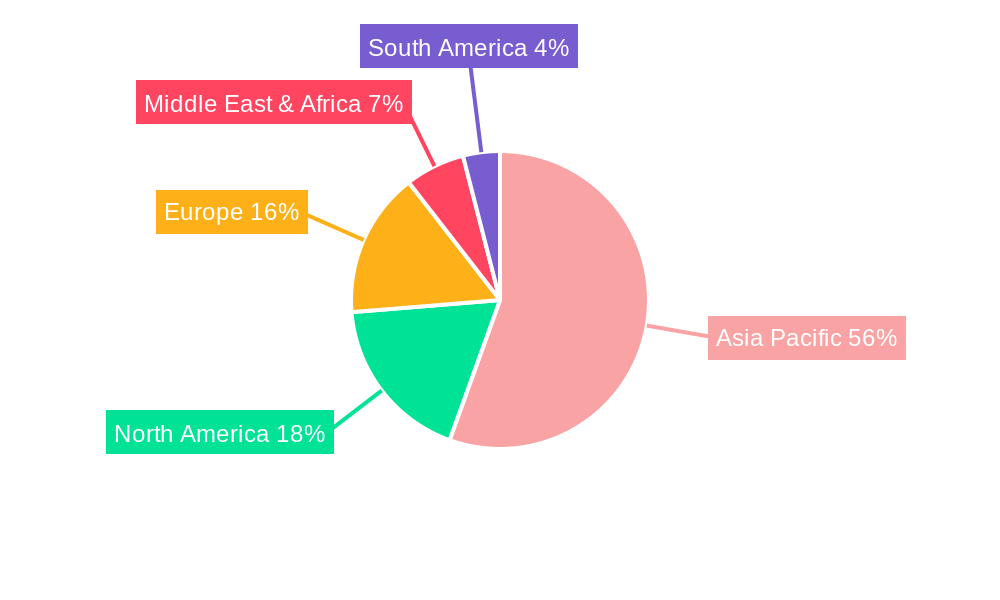

ASEAN OOH and DOOH Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

ASEAN OOH and DOOH Market Regional Market Share

Geographic Coverage of ASEAN OOH and DOOH Market

ASEAN OOH and DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry has Aided Spending on Airport Advertisements in ASEAN

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry has Aided Spending on Airport Advertisements in ASEAN

- 3.4. Market Trends

- 3.4.1. Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN OOH and DOOH Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Other Digital OOH Tools

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Billboard

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Other Transportation Applications (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-based Media

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America ASEAN OOH and DOOH Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Static (Traditional) OOH

- 6.1.2. Digital OOH (LED Screens)

- 6.1.2.1. Programmatic OOH

- 6.1.2.2. Other Digital OOH Tools

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Billboard

- 6.2.2. Transportation (Transit)

- 6.2.2.1. Airports

- 6.2.2.2. Other Transportation Applications (Buses, etc.)

- 6.2.3. Street Furniture

- 6.2.4. Other Place-based Media

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive

- 6.3.2. Retail and Consumer Goods

- 6.3.3. Healthcare

- 6.3.4. BFSI

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America ASEAN OOH and DOOH Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Static (Traditional) OOH

- 7.1.2. Digital OOH (LED Screens)

- 7.1.2.1. Programmatic OOH

- 7.1.2.2. Other Digital OOH Tools

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Billboard

- 7.2.2. Transportation (Transit)

- 7.2.2.1. Airports

- 7.2.2.2. Other Transportation Applications (Buses, etc.)

- 7.2.3. Street Furniture

- 7.2.4. Other Place-based Media

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive

- 7.3.2. Retail and Consumer Goods

- 7.3.3. Healthcare

- 7.3.4. BFSI

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe ASEAN OOH and DOOH Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Static (Traditional) OOH

- 8.1.2. Digital OOH (LED Screens)

- 8.1.2.1. Programmatic OOH

- 8.1.2.2. Other Digital OOH Tools

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Billboard

- 8.2.2. Transportation (Transit)

- 8.2.2.1. Airports

- 8.2.2.2. Other Transportation Applications (Buses, etc.)

- 8.2.3. Street Furniture

- 8.2.4. Other Place-based Media

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive

- 8.3.2. Retail and Consumer Goods

- 8.3.3. Healthcare

- 8.3.4. BFSI

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa ASEAN OOH and DOOH Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Static (Traditional) OOH

- 9.1.2. Digital OOH (LED Screens)

- 9.1.2.1. Programmatic OOH

- 9.1.2.2. Other Digital OOH Tools

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Billboard

- 9.2.2. Transportation (Transit)

- 9.2.2.1. Airports

- 9.2.2.2. Other Transportation Applications (Buses, etc.)

- 9.2.3. Street Furniture

- 9.2.4. Other Place-based Media

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive

- 9.3.2. Retail and Consumer Goods

- 9.3.3. Healthcare

- 9.3.4. BFSI

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific ASEAN OOH and DOOH Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Static (Traditional) OOH

- 10.1.2. Digital OOH (LED Screens)

- 10.1.2.1. Programmatic OOH

- 10.1.2.2. Other Digital OOH Tools

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Billboard

- 10.2.2. Transportation (Transit)

- 10.2.2.1. Airports

- 10.2.2.2. Other Transportation Applications (Buses, etc.)

- 10.2.3. Street Furniture

- 10.2.4. Other Place-based Media

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive

- 10.3.2. Retail and Consumer Goods

- 10.3.3. Healthcare

- 10.3.4. BFSI

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 JCDecaux SE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mooving Walls

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vistar Media

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Moove Media Pte Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EYE Indonesia

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Clear Channel Singapore Pte Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Plan B Media Public Company Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Goldsun Media Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Unique Media Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 On Digitals Company Limited*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 JCDecaux SE

List of Figures

- Figure 1: Global ASEAN OOH and DOOH Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global ASEAN OOH and DOOH Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America ASEAN OOH and DOOH Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America ASEAN OOH and DOOH Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America ASEAN OOH and DOOH Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America ASEAN OOH and DOOH Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America ASEAN OOH and DOOH Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America ASEAN OOH and DOOH Market Volume (Billion), by Application 2025 & 2033

- Figure 9: North America ASEAN OOH and DOOH Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America ASEAN OOH and DOOH Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America ASEAN OOH and DOOH Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 12: North America ASEAN OOH and DOOH Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 13: North America ASEAN OOH and DOOH Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: North America ASEAN OOH and DOOH Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: North America ASEAN OOH and DOOH Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America ASEAN OOH and DOOH Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America ASEAN OOH and DOOH Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America ASEAN OOH and DOOH Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America ASEAN OOH and DOOH Market Revenue (Million), by Type 2025 & 2033

- Figure 20: South America ASEAN OOH and DOOH Market Volume (Billion), by Type 2025 & 2033

- Figure 21: South America ASEAN OOH and DOOH Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America ASEAN OOH and DOOH Market Volume Share (%), by Type 2025 & 2033

- Figure 23: South America ASEAN OOH and DOOH Market Revenue (Million), by Application 2025 & 2033

- Figure 24: South America ASEAN OOH and DOOH Market Volume (Billion), by Application 2025 & 2033

- Figure 25: South America ASEAN OOH and DOOH Market Revenue Share (%), by Application 2025 & 2033

- Figure 26: South America ASEAN OOH and DOOH Market Volume Share (%), by Application 2025 & 2033

- Figure 27: South America ASEAN OOH and DOOH Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 28: South America ASEAN OOH and DOOH Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 29: South America ASEAN OOH and DOOH Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: South America ASEAN OOH and DOOH Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: South America ASEAN OOH and DOOH Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America ASEAN OOH and DOOH Market Volume (Billion), by Country 2025 & 2033

- Figure 33: South America ASEAN OOH and DOOH Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America ASEAN OOH and DOOH Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe ASEAN OOH and DOOH Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Europe ASEAN OOH and DOOH Market Volume (Billion), by Type 2025 & 2033

- Figure 37: Europe ASEAN OOH and DOOH Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Europe ASEAN OOH and DOOH Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Europe ASEAN OOH and DOOH Market Revenue (Million), by Application 2025 & 2033

- Figure 40: Europe ASEAN OOH and DOOH Market Volume (Billion), by Application 2025 & 2033

- Figure 41: Europe ASEAN OOH and DOOH Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Europe ASEAN OOH and DOOH Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Europe ASEAN OOH and DOOH Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: Europe ASEAN OOH and DOOH Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 45: Europe ASEAN OOH and DOOH Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Europe ASEAN OOH and DOOH Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Europe ASEAN OOH and DOOH Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe ASEAN OOH and DOOH Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Europe ASEAN OOH and DOOH Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe ASEAN OOH and DOOH Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa ASEAN OOH and DOOH Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East & Africa ASEAN OOH and DOOH Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East & Africa ASEAN OOH and DOOH Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East & Africa ASEAN OOH and DOOH Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East & Africa ASEAN OOH and DOOH Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East & Africa ASEAN OOH and DOOH Market Volume (Billion), by Application 2025 & 2033

- Figure 57: Middle East & Africa ASEAN OOH and DOOH Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East & Africa ASEAN OOH and DOOH Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East & Africa ASEAN OOH and DOOH Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 60: Middle East & Africa ASEAN OOH and DOOH Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 61: Middle East & Africa ASEAN OOH and DOOH Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: Middle East & Africa ASEAN OOH and DOOH Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: Middle East & Africa ASEAN OOH and DOOH Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa ASEAN OOH and DOOH Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Middle East & Africa ASEAN OOH and DOOH Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa ASEAN OOH and DOOH Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific ASEAN OOH and DOOH Market Revenue (Million), by Type 2025 & 2033

- Figure 68: Asia Pacific ASEAN OOH and DOOH Market Volume (Billion), by Type 2025 & 2033

- Figure 69: Asia Pacific ASEAN OOH and DOOH Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Asia Pacific ASEAN OOH and DOOH Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Asia Pacific ASEAN OOH and DOOH Market Revenue (Million), by Application 2025 & 2033

- Figure 72: Asia Pacific ASEAN OOH and DOOH Market Volume (Billion), by Application 2025 & 2033

- Figure 73: Asia Pacific ASEAN OOH and DOOH Market Revenue Share (%), by Application 2025 & 2033

- Figure 74: Asia Pacific ASEAN OOH and DOOH Market Volume Share (%), by Application 2025 & 2033

- Figure 75: Asia Pacific ASEAN OOH and DOOH Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 76: Asia Pacific ASEAN OOH and DOOH Market Volume (Billion), by End-user Industry 2025 & 2033

- Figure 77: Asia Pacific ASEAN OOH and DOOH Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Asia Pacific ASEAN OOH and DOOH Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Asia Pacific ASEAN OOH and DOOH Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific ASEAN OOH and DOOH Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Asia Pacific ASEAN OOH and DOOH Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific ASEAN OOH and DOOH Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Type 2020 & 2033

- Table 25: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Application 2020 & 2033

- Table 27: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 29: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Brazil ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Type 2020 & 2033

- Table 39: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Application 2020 & 2033

- Table 41: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 42: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 43: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Country 2020 & 2033

- Table 45: United Kingdom ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Germany ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: France ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Italy ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Spain ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Russia ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Benelux ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Nordics ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Type 2020 & 2033

- Table 65: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 66: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Application 2020 & 2033

- Table 67: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 68: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 69: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Country 2020 & 2033

- Table 71: Turkey ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Israel ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: GCC ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: North Africa ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: South Africa ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 84: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Type 2020 & 2033

- Table 85: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 86: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Application 2020 & 2033

- Table 87: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 88: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 89: Global ASEAN OOH and DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global ASEAN OOH and DOOH Market Volume Billion Forecast, by Country 2020 & 2033

- Table 91: China ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 93: India ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 95: Japan ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 97: South Korea ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 99: ASEAN ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 101: Oceania ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific ASEAN OOH and DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific ASEAN OOH and DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN OOH and DOOH Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the ASEAN OOH and DOOH Market?

Key companies in the market include JCDecaux SE, Mooving Walls, Vistar Media, Moove Media Pte Ltd, EYE Indonesia, Clear Channel Singapore Pte Ltd, Plan B Media Public Company Limited, Goldsun Media Group, Unique Media Group, On Digitals Company Limited*List Not Exhaustive.

3. What are the main segments of the ASEAN OOH and DOOH Market?

The market segments include Type, Application , End-user Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 1.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry has Aided Spending on Airport Advertisements in ASEAN.

6. What are the notable trends driving market growth?

Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects.

7. Are there any restraints impacting market growth?

Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry has Aided Spending on Airport Advertisements in ASEAN.

8. Can you provide examples of recent developments in the market?

March 2024: Adeffi, an out-of-home (OOH) advertising company based in Bangladesh, announced a major expansion of its services into India, Nepal, Thailand, and Vietnam. This strategic move aims to transform how companies in these five countries approach OOH advertising, offering them a robust platform to promote their brands regionally.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN OOH and DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN OOH and DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN OOH and DOOH Market?

To stay informed about further developments, trends, and reports in the ASEAN OOH and DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence