Key Insights

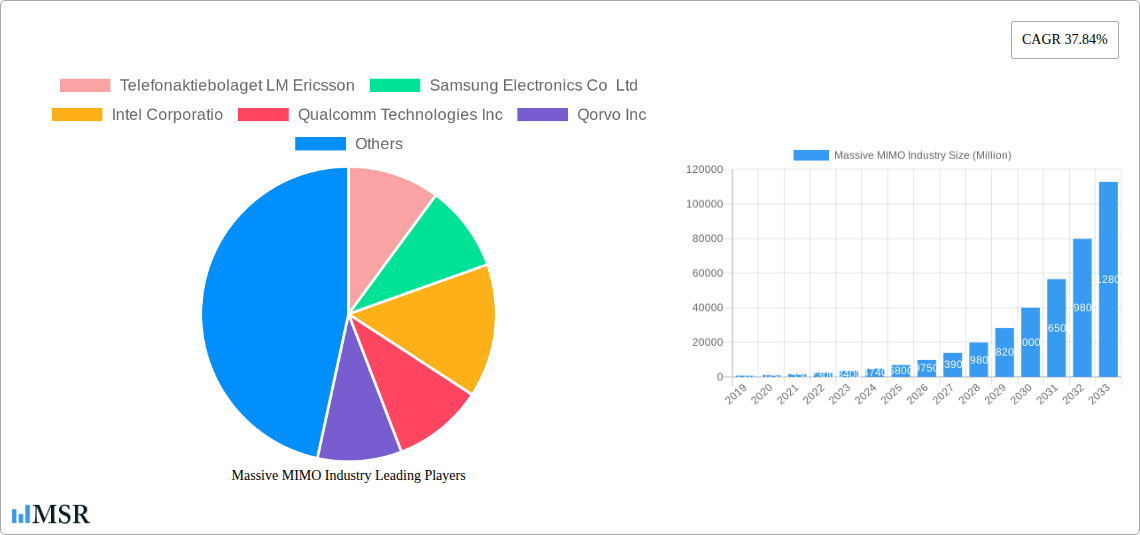

The Massive MIMO market is experiencing explosive growth, projected to reach a substantial valuation of $4.74 billion by 2025, driven by an unprecedented Compound Annual Growth Rate (CAGR) of 37.84%. This remarkable expansion is fueled by the relentless demand for enhanced mobile broadband, the widespread adoption of 5G networks, and the increasing need for efficient spectrum utilization. The technology's ability to significantly boost network capacity, improve signal quality, and reduce interference makes it an indispensable component for telecommunication providers aiming to deliver superior user experiences and support the burgeoning ecosystem of connected devices. Key technological advancements in antenna configurations, such as the proliferation of 64T64R, 128T128R, and even higher order systems, are central to unlocking the full potential of Massive MIMO.

Massive MIMO Industry Market Size (In Million)

This dynamic market is characterized by robust competition and innovation from leading industry players including Ericsson, Samsung, Intel, Qualcomm, Qorvo, NEC, Texas Instruments, Huawei, ZTE, and Nokia. These companies are actively investing in research and development to refine Massive MIMO solutions, optimize performance, and reduce costs, thereby accelerating market penetration. Emerging trends include the integration of AI and machine learning for intelligent beamforming, the development of more compact and energy-efficient antenna arrays, and the increasing deployment of Massive MIMO in enterprise private networks and industrial IoT applications. While the market is poised for significant growth, potential restraints such as high initial deployment costs and the need for skilled personnel for implementation and maintenance could present challenges. Nonetheless, the overarching drive towards higher data speeds, lower latency, and greater network efficiency ensures a highly promising trajectory for the Massive MIMO industry.

Massive MIMO Industry Company Market Share

Unlock the full potential of next-generation wireless with our comprehensive Massive MIMO Industry report. This in-depth analysis, covering the historical period of 2019–2024 and a robust forecast period from 2025–2033, provides critical insights into the burgeoning Massive MIMO market. Driven by the ever-increasing demand for enhanced network capacity and superior mobile experiences, Massive MIMO technology is revolutionizing the telecommunications landscape. This report is an essential resource for telecom operators, equipment manufacturers, technology providers, investors, and regulators seeking to navigate this dynamic and rapidly evolving sector.

Our research delves into the intricate market dynamics, technological advancements, and strategic imperatives shaping the Massive MIMO ecosystem. With a base year of 2025 and an estimated year of 2025, this report leverages extensive data to project future trajectories and identify lucrative opportunities. Prepare to gain a profound understanding of how Massive MIMO is empowering 5G deployments, driving innovation in antenna technology, and redefining wireless communication standards globally.

Massive MIMO Industry Market Concentration & Dynamics

The Massive MIMO industry is characterized by a highly competitive market concentration, with a few dominant players like Telefonaktiebolaget LM Ericsson, Samsung Electronics Co Ltd, Intel Corporation, Qualcomm Technologies Inc, and Huawei Technologies Co Ltd holding significant market share. The innovation ecosystem thrives on continuous R&D, particularly in antenna design and signal processing, with companies investing tens of millions annually. Regulatory frameworks, focused on spectrum allocation and deployment standards, play a crucial role in shaping market entry and growth. Substitute products, while emerging, are yet to fully match the comprehensive performance benefits of Massive MIMO. End-user trends heavily favor enhanced data speeds, reduced latency, and increased network capacity, directly fueling Massive MIMO adoption. Mergers and acquisitions (M&A) activities, though not at an extremely high volume, are strategic, focusing on acquiring niche technologies or expanding geographical reach. Recent M&A deals have been valued in the hundreds of millions of dollars, reflecting the strategic importance of this technology. The market is poised for further consolidation as key players seek to strengthen their portfolios.

Massive MIMO Industry Industry Insights & Trends

The Massive MIMO industry is experiencing unprecedented growth, propelled by the relentless demand for faster, more reliable wireless connectivity. The global market size is projected to reach billions of dollars by the end of the forecast period, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX%. Key market growth drivers include the widespread deployment of 5G networks, which fundamentally rely on Massive MIMO to achieve their promised capabilities of higher bandwidth and lower latency. The proliferation of data-intensive applications, such as augmented reality (AR), virtual reality (VR), and the Internet of Things (IoT), further necessitates the advanced capabilities offered by Massive MIMO. Technological disruptions are constantly emerging, with continuous improvements in antenna element density, beamforming algorithms, and power efficiency. Evolving consumer behaviors, characterized by an insatiable appetite for seamless multimedia streaming, online gaming, and real-time communication, are pushing network operators to invest heavily in advanced infrastructure like Massive MIMO. The transition from 4G LTE to 5G is a significant catalyst, with operators leveraging Massive MIMO to maximize spectral efficiency and deliver superior user experiences. Furthermore, the development of intelligent algorithms for dynamic beam management and interference mitigation is enhancing the performance and adaptability of Massive MIMO systems, making them indispensable for future wireless networks. The market is also witnessing increased focus on energy efficiency, with manufacturers developing solutions that reduce power consumption without compromising performance, aligning with global sustainability goals and contributing to a reduced operational expenditure for telecom providers.

Key Markets & Segments Leading Massive MIMO Industry

The 5G segment is unequivocally the dominant force driving the Massive MIMO industry, with its advanced capabilities perfectly aligning with the high-performance demands of next-generation mobile networks.

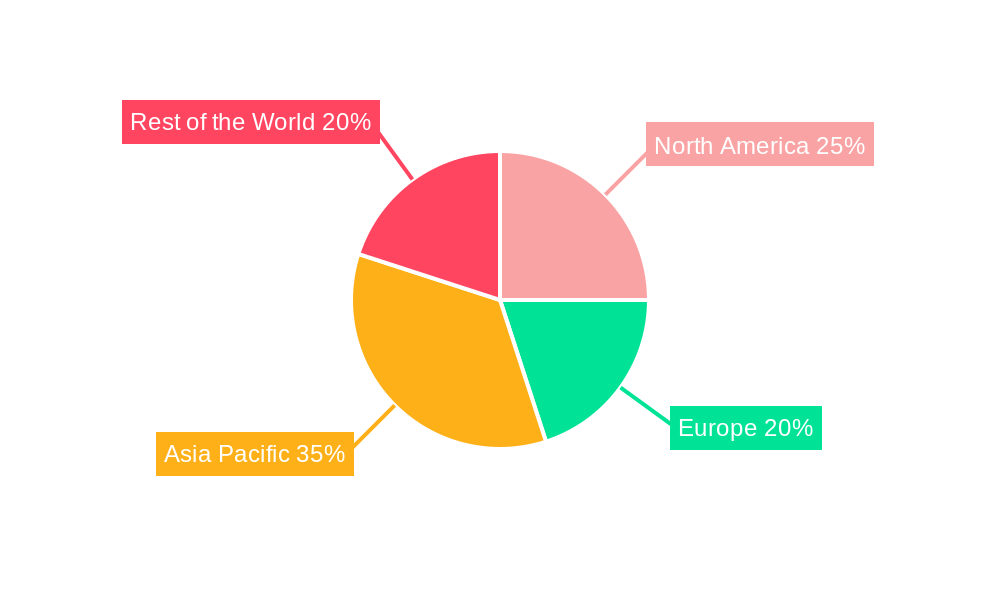

- Dominant Region: North America and Asia Pacific are leading the charge in Massive MIMO adoption, driven by aggressive 5G rollouts and substantial investments in telecommunications infrastructure. Countries like the United States, China, South Korea, and Japan are at the forefront.

- Drivers:

- Government initiatives and spectrum auctions prioritizing 5G deployment.

- High consumer demand for advanced mobile services and high-speed internet.

- Presence of major telecommunication operators and technology giants investing heavily in R&D and deployment.

- Rapid expansion of smart cities and IoT ecosystems requiring robust network connectivity.

- Drivers:

- Dominant Technology: While LTE networks are still significant, the 5G segment is experiencing the most rapid growth and innovation within Massive MIMO. The architecture of 5G is inherently designed to leverage the full potential of Massive MIMO for enhanced capacity, coverage, and spectral efficiency.

- Drivers:

- The fundamental need for 5G to deliver on its promises of multi-gigabit speeds and ultra-low latency.

- Massive MIMO is a core enabler for achieving these performance metrics in dense urban environments and for supporting a high density of connected devices.

- Future 6G research is already building upon the foundational principles of Massive MIMO, indicating its long-term relevance.

- Drivers:

- Dominant Antenna Type: The 128T128R and Above antenna configurations are emerging as critical for high-density deployments and advanced 5G use cases, offering unparalleled spectral efficiency and capacity. However, 64T64R remains a widely deployed and cost-effective solution for many current 5G deployments.

- Drivers:

- 128T128R and Above: Essential for meeting the extreme capacity demands of future 5G Advanced and 6G networks, supporting massive IoT deployments and critical communications. The increasing number of antenna elements allows for more sophisticated beamforming techniques and finer spatial multiplexing.

- 64T64R: Provides a significant performance uplift over lower configurations and is a workhorse for current 5G macrocell deployments, balancing performance with deployment costs and complexity.

- The continuous drive for greater spectral efficiency and improved user experience in increasingly congested wireless environments.

- Drivers:

Massive MIMO Industry Product Developments

Recent product developments in the Massive MIMO industry highlight a strong focus on enhanced performance, energy efficiency, and network flexibility. Companies are continuously innovating antenna designs and base station technologies to support the evolving demands of 5G and beyond. Innovations include more compact and energy-efficient radios, advanced beamforming algorithms for optimized signal delivery, and integrated solutions that simplify deployment and management. These advancements are crucial for enabling higher data rates, lower latency, and greater network capacity, directly impacting user experience and supporting a wider range of applications, from enhanced mobile broadband to critical IoT services. The competitive landscape is driven by the need to offer solutions that are not only technologically superior but also cost-effective and sustainable.

Challenges in the Massive MIMO Industry Market

The Massive MIMO industry faces several significant challenges that could impede its widespread adoption and growth.

- High Deployment Costs: The initial investment in Massive MIMO infrastructure, including advanced antennas and processing units, remains substantial, posing a barrier for some operators.

- Spectrum Availability and Congestion: Securing sufficient and contiguous spectrum for optimal Massive MIMO performance is a constant challenge, especially in crowded urban areas.

- Technical Complexity and Skill Gap: The intricate nature of Massive MIMO technology requires specialized expertise for deployment, optimization, and maintenance, leading to a potential skill gap in the workforce.

- Interference Management: Effectively managing interference in highly dense Massive MIMO deployments requires sophisticated algorithms and careful network planning.

- Power Consumption Concerns: While advancements are being made, the energy consumption of Massive MIMO systems, particularly with a large number of antenna elements, can be a concern for operational costs and environmental sustainability.

Forces Driving Massive MIMO Industry Growth

Several powerful forces are propelling the growth of the Massive MIMO industry, ensuring its continued expansion and technological evolution.

- The Insatiable Demand for Data: The exponential growth in mobile data consumption, driven by video streaming, online gaming, and social media, necessitates higher network capacity, which Massive MIMO uniquely provides.

- 5G Network Deployment: Massive MIMO is a cornerstone technology for realizing the full potential of 5G, enabling the promised enhancements in speed, latency, and device connectivity.

- Growth of IoT and Connected Devices: The burgeoning Internet of Things ecosystem, with its vast number of connected devices, requires the increased capacity and reliability that Massive MIMO offers.

- Technological Advancements: Continuous innovation in antenna design, signal processing, and artificial intelligence is making Massive MIMO more efficient, cost-effective, and performant.

- Government Support and Investment: Many governments worldwide are actively promoting and investing in advanced wireless infrastructure, including 5G and Massive MIMO, to foster economic growth and digital transformation.

Challenges in the Massive MIMO Industry Market

The path to full Massive MIMO integration is not without its hurdles, with certain long-term growth catalysts needing careful consideration and strategic management.

- Scalability and Integration: Seamlessly scaling Massive MIMO deployments across diverse network environments and integrating them with existing infrastructure presents ongoing technical challenges.

- Standardization Evolution: As standards like 5G Advanced and future 6G evolve, ensuring that Massive MIMO solutions remain compliant and future-proof requires continuous adaptation and development.

- Algorithm Optimization: Developing and refining sophisticated algorithms for dynamic beamforming, interference cancellation, and resource allocation is crucial for maximizing performance and efficiency, especially in complex scenarios.

- Supply Chain Resilience: Ensuring a robust and resilient supply chain for critical components, particularly advanced semiconductor chips and specialized antenna materials, is vital for sustained production and deployment.

- Business Model Innovation: Identifying and implementing effective business models that monetize the enhanced capabilities of Massive MIMO, such as specialized enterprise services and ultra-reliable low-latency communications (URLLC), is key to driving operator investment.

Emerging Opportunities in Massive MIMO Industry

The Massive MIMO industry is ripe with emerging opportunities driven by new technological frontiers and evolving market demands.

- Private 5G Networks: The growth of private 5G networks for industrial automation, logistics, and enterprise applications presents a significant opportunity for tailored Massive MIMO solutions, offering enhanced control and security.

- Edge Computing Integration: The convergence of Massive MIMO with edge computing offers the potential for real-time data processing and localized AI capabilities, unlocking new applications in areas like autonomous vehicles and smart manufacturing.

- Open RAN Architectures: The rise of Open Radio Access Network (Open RAN) architectures provides opportunities for disaggregated and interoperable Massive MIMO solutions, fostering greater vendor diversity and innovation.

- Advanced Antenna Technologies: Continued research into new antenna element designs, including reconfigurable intelligent surfaces (RIS) and intelligent reflecting surfaces (IRS), promises to further enhance the capabilities of Massive MIMO.

- Sustainability Solutions: Developing and promoting energy-efficient Massive MIMO deployments and solutions that contribute to reduced carbon footprints will be increasingly important, aligning with global environmental goals and attracting environmentally conscious operators.

Leading Players in the Massive MIMO Industry Sector

- Telefonaktiebolaget LM Ericsson

- Samsung Electronics Co Ltd

- Intel Corporation

- Qualcomm Technologies Inc

- Qorvo Inc

- NEC Corporation

- Texas Instruments Incorporated

- Huawei Technologies Co Ltd

- ZTE Corporation

- Nokia Corporation

Key Milestones in Massive MIMO Industry Industry

- November 2022: Jazz, the leading digital operator in Pakistan, deployed ZTE's 1st 5G technology-based 4G FDD massive-MIMO in their network, resulting in an average network traffic increase of 15% and an average single-user speed gain of 160%. This deployment highlighted the effectiveness of features like Power Boosting, Re-transmit Resource Block Optimization, and Power Amplifier Enhancement in boosting network capacity and user experience.

- February 2023: Cohere Technologies launched a new automated MU-MIMO beamforming technology. This innovation aims to calibrate existing 4G and 5G network and spectrum resources, allowing for continued benefit from 4G FDD networks while significantly enhancing the performance of 5G FDD networks through improved MIMO technology.

- February 2023: Nokia introduced the Habrok Radio, a new AirScale massive MIMO 5G radio designed to address all massive MIMO use cases and deployment scenarios. These new radios are notably more energy-efficient, consuming 30% less power, which directly supports its customers' sustainability objectives.

Strategic Outlook for Massive MIMO Industry Market

The strategic outlook for the Massive MIMO industry remains exceptionally positive, driven by the relentless evolution of wireless communication standards and the escalating global demand for high-capacity, low-latency connectivity. Key growth accelerators include the ongoing global rollout of 5G networks, the increasing adoption of private 5G for enterprise use cases, and the integration of Massive MIMO with emerging technologies like AI and edge computing. Strategic opportunities lie in developing solutions for enhanced mobile broadband (eMBB), ultra-reliable low-latency communications (URLLC), and massive machine-type communications (mMTC), catering to a diverse range of applications. Furthermore, the focus on energy-efficient designs and Open RAN architectures presents avenues for market differentiation and expanded partnerships. Companies that can effectively navigate the technological complexities, address spectrum challenges, and innovate in deployment models will be well-positioned for sustained success in this transformative market. The industry is on a trajectory to redefine wireless connectivity, paving the way for a more connected and intelligent future.

Massive MIMO Industry Segmentation

-

1. Technology

- 1.1. LTE

- 1.2. 5G

-

2. Type of Antenna

- 2.1. 16T16R

- 2.2. 32T32R

- 2.3. 64T64R

- 2.4. 128T128R and Above

Massive MIMO Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Massive MIMO Industry Regional Market Share

Geographic Coverage of Massive MIMO Industry

Massive MIMO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 37.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing number of Mobile Devices; Increasing 5G Deployment

- 3.3. Market Restrains

- 3.3.1. Reliability Issues

- 3.4. Market Trends

- 3.4.1. Increasing 5G Deployment May Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Massive MIMO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. LTE

- 5.1.2. 5G

- 5.2. Market Analysis, Insights and Forecast - by Type of Antenna

- 5.2.1. 16T16R

- 5.2.2. 32T32R

- 5.2.3. 64T64R

- 5.2.4. 128T128R and Above

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Massive MIMO Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. LTE

- 6.1.2. 5G

- 6.2. Market Analysis, Insights and Forecast - by Type of Antenna

- 6.2.1. 16T16R

- 6.2.2. 32T32R

- 6.2.3. 64T64R

- 6.2.4. 128T128R and Above

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Massive MIMO Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. LTE

- 7.1.2. 5G

- 7.2. Market Analysis, Insights and Forecast - by Type of Antenna

- 7.2.1. 16T16R

- 7.2.2. 32T32R

- 7.2.3. 64T64R

- 7.2.4. 128T128R and Above

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Massive MIMO Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. LTE

- 8.1.2. 5G

- 8.2. Market Analysis, Insights and Forecast - by Type of Antenna

- 8.2.1. 16T16R

- 8.2.2. 32T32R

- 8.2.3. 64T64R

- 8.2.4. 128T128R and Above

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of the World Massive MIMO Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. LTE

- 9.1.2. 5G

- 9.2. Market Analysis, Insights and Forecast - by Type of Antenna

- 9.2.1. 16T16R

- 9.2.2. 32T32R

- 9.2.3. 64T64R

- 9.2.4. 128T128R and Above

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Telefonaktiebolaget LM Ericsson

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Samsung Electronics Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Intel Corporatio

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Qualcomm Technologies Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Qorvo Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NEC Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Texas Instruments Incorporated

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Huawei Technologies Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 ZTE Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nokia Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Telefonaktiebolaget LM Ericsson

List of Figures

- Figure 1: Global Massive MIMO Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Massive MIMO Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Massive MIMO Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Massive MIMO Industry Revenue (Million), by Type of Antenna 2025 & 2033

- Figure 5: North America Massive MIMO Industry Revenue Share (%), by Type of Antenna 2025 & 2033

- Figure 6: North America Massive MIMO Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Massive MIMO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Massive MIMO Industry Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Massive MIMO Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Massive MIMO Industry Revenue (Million), by Type of Antenna 2025 & 2033

- Figure 11: Europe Massive MIMO Industry Revenue Share (%), by Type of Antenna 2025 & 2033

- Figure 12: Europe Massive MIMO Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Massive MIMO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Massive MIMO Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Massive MIMO Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Massive MIMO Industry Revenue (Million), by Type of Antenna 2025 & 2033

- Figure 17: Asia Pacific Massive MIMO Industry Revenue Share (%), by Type of Antenna 2025 & 2033

- Figure 18: Asia Pacific Massive MIMO Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Massive MIMO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Massive MIMO Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Rest of the World Massive MIMO Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Rest of the World Massive MIMO Industry Revenue (Million), by Type of Antenna 2025 & 2033

- Figure 23: Rest of the World Massive MIMO Industry Revenue Share (%), by Type of Antenna 2025 & 2033

- Figure 24: Rest of the World Massive MIMO Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Massive MIMO Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Massive MIMO Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Massive MIMO Industry Revenue Million Forecast, by Type of Antenna 2020 & 2033

- Table 3: Global Massive MIMO Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Massive MIMO Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Massive MIMO Industry Revenue Million Forecast, by Type of Antenna 2020 & 2033

- Table 6: Global Massive MIMO Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Massive MIMO Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: Global Massive MIMO Industry Revenue Million Forecast, by Type of Antenna 2020 & 2033

- Table 9: Global Massive MIMO Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Massive MIMO Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Massive MIMO Industry Revenue Million Forecast, by Type of Antenna 2020 & 2033

- Table 12: Global Massive MIMO Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Massive MIMO Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global Massive MIMO Industry Revenue Million Forecast, by Type of Antenna 2020 & 2033

- Table 15: Global Massive MIMO Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Massive MIMO Industry?

The projected CAGR is approximately 37.84%.

2. Which companies are prominent players in the Massive MIMO Industry?

Key companies in the market include Telefonaktiebolaget LM Ericsson, Samsung Electronics Co Ltd, Intel Corporatio, Qualcomm Technologies Inc, Qorvo Inc, NEC Corporation, Texas Instruments Incorporated, Huawei Technologies Co Ltd, ZTE Corporation, Nokia Corporation.

3. What are the main segments of the Massive MIMO Industry?

The market segments include Technology, Type of Antenna.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing number of Mobile Devices; Increasing 5G Deployment.

6. What are the notable trends driving market growth?

Increasing 5G Deployment May Drive the Market Growth.

7. Are there any restraints impacting market growth?

Reliability Issues.

8. Can you provide examples of recent developments in the market?

November 2022 - Jazz, the leading digital operator in Pakistan, used ZTE's 1st 5G technology based 4G FDD massive-MIMO (Multi Input Multi Output) in their network. This will add to average network traffic of 15% and average single-user speed gain of 160%. Features like Power Boosting, Re-transmit Resource Block Optimization, and Power Amplifier Enhancement will enhance the network capacity and user experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Massive MIMO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Massive MIMO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Massive MIMO Industry?

To stay informed about further developments, trends, and reports in the Massive MIMO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence