Key Insights

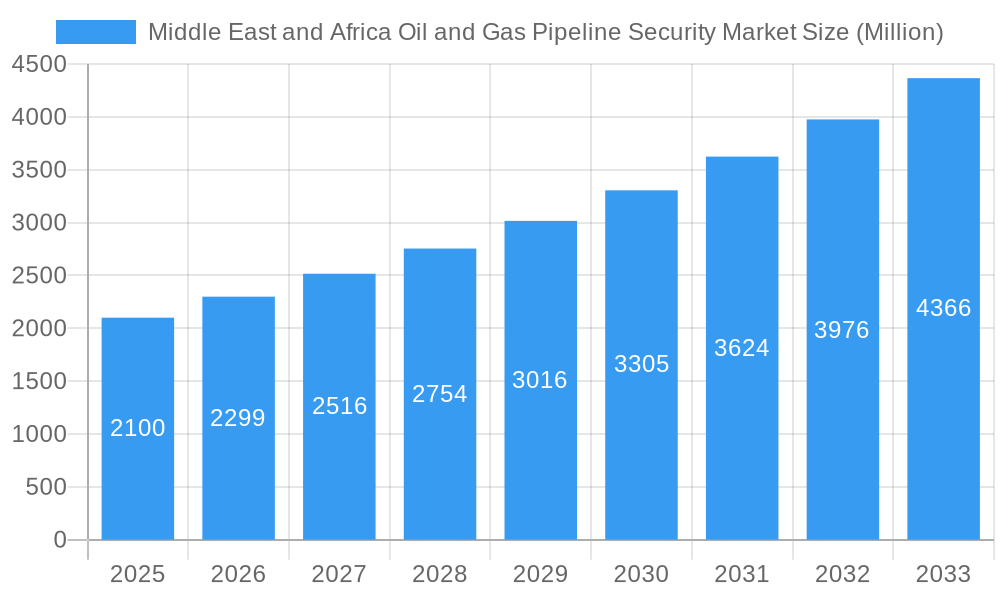

The Middle East and Africa Oil and Gas Pipeline Security Market is experiencing robust growth, projected to reach \$2.10 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.61% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the region's significant oil and gas reserves necessitate robust security measures to protect critical infrastructure from sabotage, theft, and terrorism. Secondly, technological advancements, particularly in areas like unmanned aerial systems (UAS), perimeter security systems, and advanced analytics, are enhancing surveillance capabilities and threat detection, driving market growth. Furthermore, increasing government regulations and stringent security protocols mandated by international organizations are creating a strong demand for sophisticated pipeline security solutions. The market is segmented by product type (Natural Gas, Crude Oil, Hazardous Liquid Pipelines/Chemicals, Water, Other Products) and technology (Unmanned Aerial Systems, Perimeter Security, Electric-Optic Systems, Ground Sensors, PIG Location Monitoring, Sub-Aqua Systems, Video Surveillance, Control Systems, and Other Technology and Solutions). The Middle East, particularly Saudi Arabia, UAE, and Qatar, constitutes a significant portion of this market due to its extensive pipeline networks and substantial oil and gas production. While challenges such as high initial investment costs for advanced technologies and the need for skilled personnel exist, the overall market outlook remains positive, driven by sustained production levels and heightened security concerns.

Middle East and Africa Oil and Gas Pipeline Security Market Market Size (In Billion)

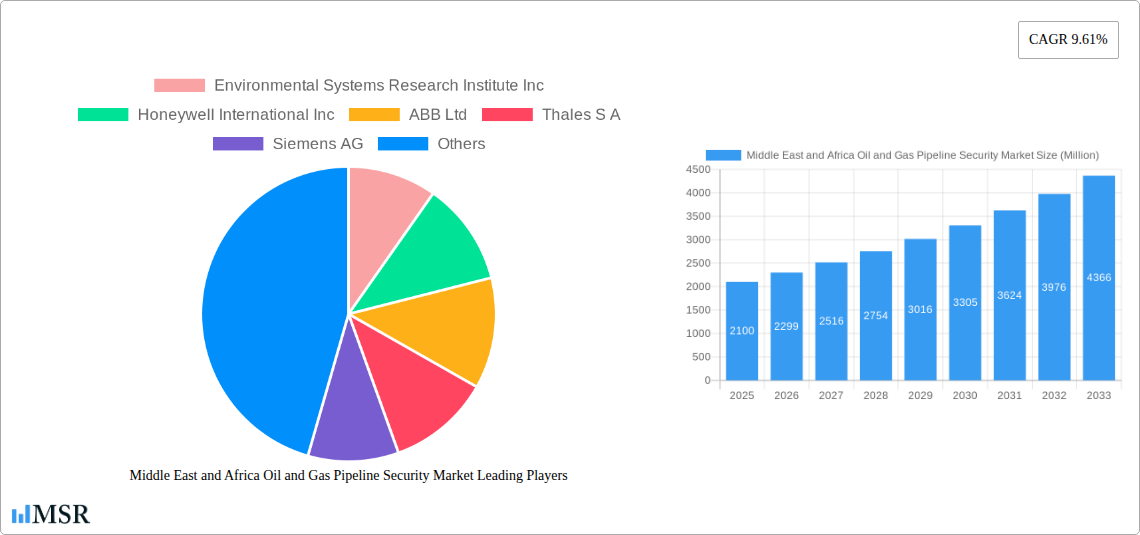

The competitive landscape is characterized by a mix of international technology giants like Honeywell, Siemens, and Thales, alongside specialized regional players focusing on localized solutions. These companies are constantly innovating and investing in research and development to improve the effectiveness and efficiency of their pipeline security offerings. The market's future growth hinges on continuous technological advancements, effective regulatory frameworks, and the successful implementation of comprehensive security strategies across the region. The adoption of integrated security solutions that leverage multiple technologies will be crucial for enhancing overall pipeline security and resilience against evolving threats. Further growth is expected from expansion into new pipeline projects and retrofits of existing infrastructure.

Middle East and Africa Oil and Gas Pipeline Security Market Company Market Share

Middle East & Africa Oil and Gas Pipeline Security Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa Oil and Gas Pipeline Security Market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this report details market dynamics, growth drivers, key players, and emerging opportunities. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Middle East and Africa Oil and Gas Pipeline Security Market Market Concentration & Dynamics

The Middle East and Africa Oil and Gas Pipeline Security Market exhibits a moderately concentrated landscape, with several major players holding significant market share. The market share distribution amongst the top five players is estimated at xx%, leaving a considerable segment for smaller specialized companies. Innovation is driven by a combination of established technology providers and emerging startups focusing on advanced surveillance and security solutions.

Regulatory frameworks vary across the region, impacting investment and adoption of new technologies. Substitute products, such as enhanced physical security measures, continue to exist, but the increasing sophistication of pipeline threats and the need for real-time monitoring drive demand for advanced technologies. End-user trends are towards integrated security systems that leverage data analytics and AI for enhanced threat detection and response. M&A activity in the sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024. These deals largely focus on expanding technological capabilities and geographical reach.

- Market Concentration: Moderately concentrated, top 5 players hold xx% market share.

- Innovation Ecosystem: Blend of established players and emerging startups.

- Regulatory Framework: Varies across the region, impacting investment.

- Substitute Products: Enhanced physical security measures exist, but advanced tech is preferred.

- End-User Trends: Demand for integrated, data-driven security systems.

- M&A Activity: Approximately xx deals between 2019 and 2024.

Middle East and Africa Oil and Gas Pipeline Security Market Industry Insights & Trends

The Middle East and Africa Oil and Gas Pipeline Security Market is witnessing robust growth, driven by increasing investments in oil and gas infrastructure, rising concerns over pipeline security threats, and the adoption of advanced technologies. The market size was valued at xx Million in 2024 and is expected to reach xx Million by 2033. Technological advancements such as the integration of AI, IoT, and big data analytics into security solutions are transforming the industry. These technologies improve threat detection, real-time monitoring, and predictive maintenance, driving efficiency and reducing operational costs. Consumer behavior is shifting towards proactive security strategies, favoring comprehensive and integrated solutions rather than stand-alone products. Growing geopolitical instability in certain regions is further accelerating demand for robust pipeline security systems. The market is segmented by product type (natural gas, crude oil, hazardous liquids, water, and others) and technology (unmanned aerial systems, perimeter security, electric-optic systems, ground sensors, PIG location monitoring, sub-aqua systems, video surveillance, control systems, and others).

Key Markets & Segments Leading Middle East and Africa Oil and Gas Pipeline Security Market

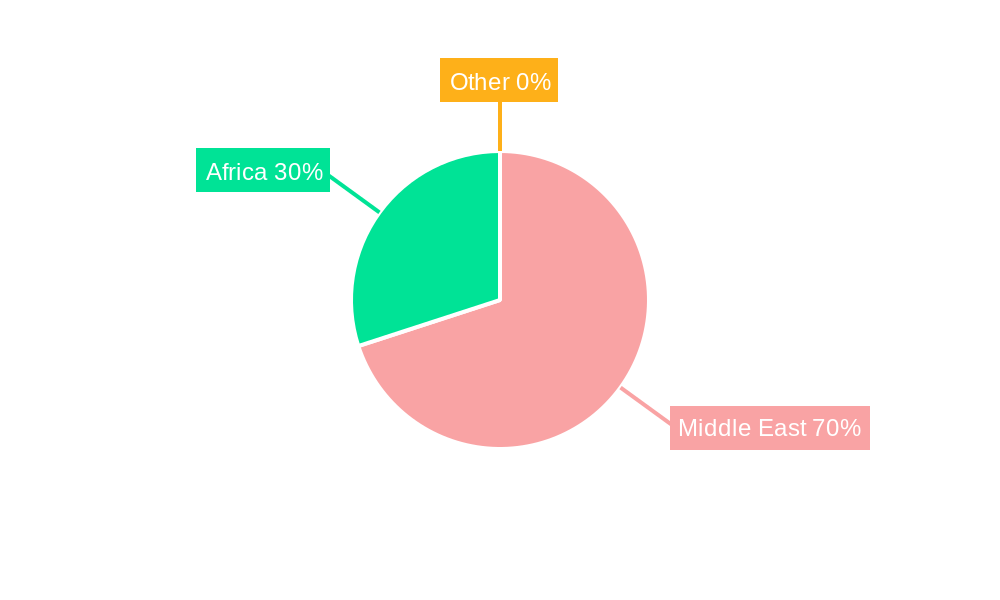

The Middle East and Africa Oil and Gas Pipeline Security Market is dominated by the Crude Oil segment within the Products category, owing to the region's significant oil production and export activities. The Perimeter Security segment leads the Technology and Solutions category due to its widespread applicability and proven effectiveness in deterring threats. Specific country markets within the region such as Nigeria, Saudi Arabia, and the UAE show exceptionally high growth owing to significant investments in oil and gas infrastructure and security.

Key Drivers for Dominant Segments:

- Crude Oil: High oil production and export volumes necessitate robust security measures.

- Perimeter Security: Cost-effectiveness and established effectiveness in deterring threats.

- Nigeria, Saudi Arabia, UAE: Significant infrastructure investment and higher security concerns.

Dominance Analysis:

The dominance of Crude Oil and Perimeter Security reflects the priorities of the industry— safeguarding valuable assets and creating physical barriers against threats. The strong performance in specific countries highlights the regional concentration of oil and gas activity and the corresponding security requirements.

Middle East and Africa Oil and Gas Pipeline Security Market Product Developments

Recent product innovations focus on integrating advanced technologies such as AI-powered video analytics, drone surveillance, and sophisticated sensor networks to enhance threat detection and response capabilities. These developments offer improved accuracy, real-time monitoring, and predictive maintenance capabilities, resulting in significant cost savings and enhanced security. The market also witnesses the introduction of more integrated and user-friendly systems, simplifying deployment and improving operational efficiency. This is driving the market towards more sophisticated and efficient solutions that are increasingly preferred by end-users.

Challenges in the Middle East and Africa Oil and Gas Pipeline Security Market Market

The Middle East and Africa Oil and Gas Pipeline Security Market faces challenges including stringent regulatory compliance requirements, supply chain disruptions impacting the availability of key components, and intense competition from both established players and new entrants. These factors can result in increased costs, delayed project timelines, and reduced profitability.

Forces Driving Middle East and Africa Oil and Gas Pipeline Security Market Growth

Key growth drivers include escalating geopolitical instability, rising crude oil prices stimulating pipeline infrastructure development, increasing adoption of advanced technologies for improved security, and supportive government regulations. Increased government investments in pipeline security projects further fuel market growth. The growing awareness of environmental concerns is also influencing the adoption of eco-friendly security solutions.

Challenges in the Middle East and Africa Oil and Gas Pipeline Security Market Market

Long-term growth catalysts include continued technological advancements, strategic partnerships and collaborations amongst key industry players, and expansion into new markets. The increasing adoption of integrated solutions is poised to further fuel growth in the coming years.

Emerging Opportunities in Middle East and Africa Oil and Gas Pipeline Security Market

Emerging opportunities lie in the adoption of advanced analytics, IoT-based solutions, and AI-powered threat detection systems. The expansion into new geographic regions, particularly those with growing oil and gas infrastructure development, presents significant potential for market expansion.

Leading Players in the Middle East and Africa Oil and Gas Pipeline Security Market Sector

- Environmental Systems Research Institute Inc

- Honeywell International Inc

- ABB Ltd

- Thales S A

- Siemens AG

- General Electric Co

- GE Grid Solutions SPA

- SkyWave Mobile Communications Inc

- Huawei Technologies Co Ltd

- SightLogix Inc

- Senstar Corporation

- Future Fiber Technologies Ltd

- Optasens Ltd

- Bae Systems Inc

Key Milestones in Middle East and Africa Oil and Gas Pipeline Security Market Industry

- August 2023: Agreement signed between Morocco and the UAE for the Africa-Atlantic gas pipeline, boosting West African energy security and economic integration.

- February 2023: General Electric Co. and Amazon Web Services (AWS) announced a strategic collaboration to accelerate grid modernization using intelligent grid orchestration solutions, indirectly impacting pipeline security through improved power grid reliability.

Strategic Outlook for Middle East and Africa Oil and Gas Pipeline Security Market Market

The Middle East and Africa Oil and Gas Pipeline Security Market is poised for significant growth driven by technological innovations, strategic partnerships, and increasing investments in pipeline infrastructure across the region. The adoption of integrated, data-driven security solutions will continue to be a key trend, creating lucrative opportunities for companies that offer cutting-edge technologies and comprehensive security solutions. The market's future potential is considerable, especially given the ongoing geopolitical factors and growing demand for energy security.

Middle East and Africa Oil and Gas Pipeline Security Market Segmentation

-

1. Products

- 1.1. Natural Gas

- 1.2. Crude Oil

- 1.3. Hazardous Liquid Pipelines/Chemicals

- 1.4. Water

- 1.5. Other Products

-

2. Technology and Solutions

- 2.1. Unmanned Aerial Systems

- 2.2. Perimeter Security

- 2.3. Electric-Optic Systems

- 2.4. Ground Sensors

- 2.5. PIG Location Monitoring

- 2.6. Sub-Aqua Systems

- 2.7. Video Surveillance

- 2.8. Control Systems

- 2.9. Other Technology and Solutions

Middle East and Africa Oil and Gas Pipeline Security Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Oil and Gas Pipeline Security Market Regional Market Share

Geographic Coverage of Middle East and Africa Oil and Gas Pipeline Security Market

Middle East and Africa Oil and Gas Pipeline Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Spending by Oil and Gas Companies for Reliable Protected Networks; Increased demand for natural gas and the upgradation of refineries; Rising Political Instability in the Region; Pipelines for the Transportation of Crude Oils to Drive the Demand

- 3.3. Market Restrains

- 3.3.1. High Installation & Maintenance Cost; Distributed Site Locations

- 3.4. Market Trends

- 3.4.1. Pipelines to Transport Crude Oil to Drive the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Natural Gas

- 5.1.2. Crude Oil

- 5.1.3. Hazardous Liquid Pipelines/Chemicals

- 5.1.4. Water

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Technology and Solutions

- 5.2.1. Unmanned Aerial Systems

- 5.2.2. Perimeter Security

- 5.2.3. Electric-Optic Systems

- 5.2.4. Ground Sensors

- 5.2.5. PIG Location Monitoring

- 5.2.6. Sub-Aqua Systems

- 5.2.7. Video Surveillance

- 5.2.8. Control Systems

- 5.2.9. Other Technology and Solutions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. South Africa Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2020-2032

- 7. Sudan Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2020-2032

- 8. Uganda Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2020-2032

- 9. Tanzania Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2020-2032

- 10. Kenya Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2020-2032

- 11. Rest of Africa Middle East and Africa Oil and Gas Pipeline Security Market Analysis, Insights and Forecast, 2020-2032

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Environmental Systems Research Institute Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Honeywell International Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ABB Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Thales S A

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Siemens AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 General Electric Co

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 GE Grid Solutions SPA

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 SkyWave Mobile Communications Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Huawei Technologies Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SightLogix Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Senstar Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Future Fiber Technologies Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Optasens Ltd

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Bae Systems Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Environmental Systems Research Institute Inc

List of Figures

- Figure 1: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Oil and Gas Pipeline Security Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Products 2020 & 2033

- Table 3: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Technology and Solutions 2020 & 2033

- Table 4: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 6: South Africa Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Sudan Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Uganda Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Tanzania Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Kenya Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Africa Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Products 2020 & 2033

- Table 13: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Technology and Solutions 2020 & 2033

- Table 14: Middle East and Africa Oil and Gas Pipeline Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Saudi Arabia Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Arab Emirates Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Israel Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Qatar Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Kuwait Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Oman Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Bahrain Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Jordan Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Lebanon Middle East and Africa Oil and Gas Pipeline Security Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Oil and Gas Pipeline Security Market?

The projected CAGR is approximately 9.61%.

2. Which companies are prominent players in the Middle East and Africa Oil and Gas Pipeline Security Market?

Key companies in the market include Environmental Systems Research Institute Inc, Honeywell International Inc, ABB Ltd, Thales S A, Siemens AG, General Electric Co, GE Grid Solutions SPA, SkyWave Mobile Communications Inc, Huawei Technologies Co Ltd, SightLogix Inc, Senstar Corporation, Future Fiber Technologies Ltd, Optasens Ltd, Bae Systems Inc.

3. What are the main segments of the Middle East and Africa Oil and Gas Pipeline Security Market?

The market segments include Products, Technology and Solutions.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Spending by Oil and Gas Companies for Reliable Protected Networks; Increased demand for natural gas and the upgradation of refineries; Rising Political Instability in the Region; Pipelines for the Transportation of Crude Oils to Drive the Demand.

6. What are the notable trends driving market growth?

Pipelines to Transport Crude Oil to Drive the Demand.

7. Are there any restraints impacting market growth?

High Installation & Maintenance Cost; Distributed Site Locations.

8. Can you provide examples of recent developments in the market?

August 2023 - A new agreement to invest in the construction of the Africa-Atlantic gas pipeline has been signed between Morocco and the United Arab Emirates to transport gas from Nigeria to North Africa and ultimately to Europe. This shows the commitment of UAE to support and is expected to promote economic integration and energy security in West Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Oil and Gas Pipeline Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Oil and Gas Pipeline Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Oil and Gas Pipeline Security Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Oil and Gas Pipeline Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence