Key Insights

The Italian Point-of-Sale (POS) terminals market is projected to reach a market size of 32.33 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.31% forecast for the period 2025-2033. This significant expansion is driven by the increasing adoption of digital payments, the demand for enhanced customer experiences, and the imperative for businesses to optimize operations with modern POS technology. Italy's ongoing digital transformation and government initiatives promoting cashless transactions and e-invoicing further accelerate market growth. Key trends include a strong shift towards mobile and portable POS terminals, suiting dynamic business environments and enabling omnichannel strategies for improved customer engagement.

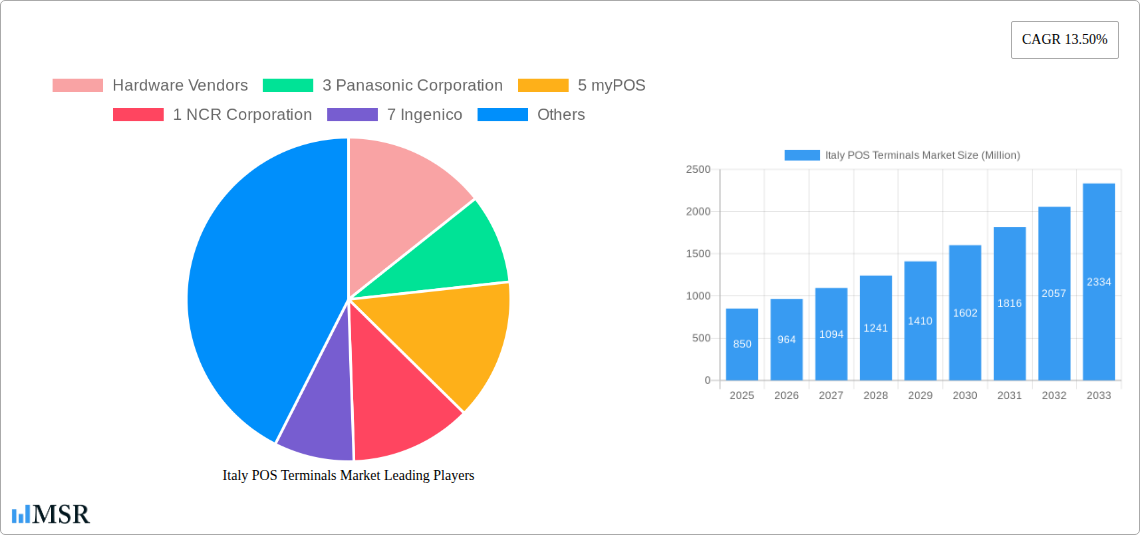

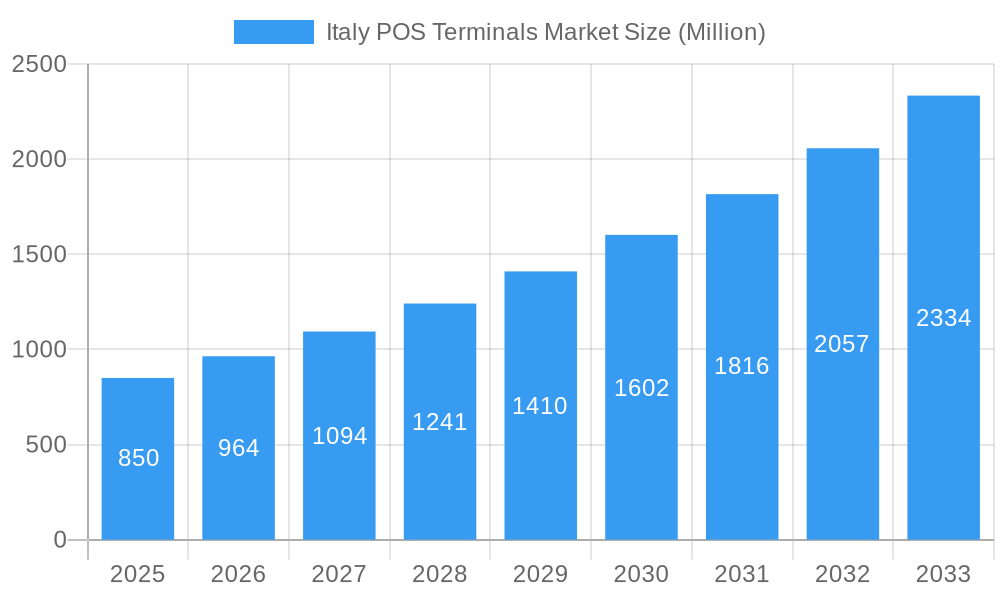

Italy POS Terminals Market Market Size (In Billion)

The Italian POS terminals market serves diverse end-user industries, with Retail, Hospitality, and Healthcare as primary adopters. In retail, advanced POS systems are vital for inventory management, sales tracking, and personalized service. The hospitality sector leverages mobile POS for efficient table-side operations, enhancing service speed and customer satisfaction. Healthcare utilizes POS terminals for patient registration, billing, and pharmaceutical sales management. While initial investment costs and resistance to change in smaller businesses may pose challenges, the market's overall trajectory is strongly positive, offering substantial opportunities for hardware and software vendors.

Italy POS Terminals Market Company Market Share

This comprehensive report provides an in-depth analysis of the Italy POS terminals market, covering key trends, dynamics, and projections from 2025 to 2033. With a base year of 2025, this study offers critical insights for POS hardware vendors, POS software vendors, payment solution providers, and stakeholders navigating the evolving point-of-sale technology landscape in Italy. The report details market segmentation by type and end-user industry, highlights technological advancements, and identifies emerging opportunities.

Italy POS Terminals Market Market Concentration & Dynamics

The Italy POS terminals market exhibits a moderately concentrated structure, with a blend of established global players and agile local providers. Innovation ecosystems are robust, driven by the continuous integration of new payment technologies and software functionalities. Regulatory frameworks, particularly concerning data security and payment processing, play a significant role in shaping market entry and operational strategies. While substitute products like online payment gateways exist, the demand for in-person transaction solutions remains strong. End-user trends are leaning towards unified commerce solutions, demanding seamless integration between online and offline sales channels. Mergers and acquisitions (M&A) activities are observed, indicative of strategic consolidation and expansion efforts. Recent M&A activities in the broader payment processing sector, such as Nexi's strategic acquisition, indirectly influence the POS terminal market by consolidating payment infrastructure and potentially leading to bundled POS solutions.

- Market Concentration: Moderate, with key players holding significant market share.

- Innovation Focus: Contactless payments, mobile POS, integrated software solutions, data analytics.

- Regulatory Impact: GDPR compliance, PCI DSS certification, evolving PSD2 regulations.

- End-User Trends: Demand for enhanced customer experience, loyalty programs, inventory management integration.

- M&A Activities: Strategic acquisitions aimed at expanding service portfolios and market reach.

Italy POS Terminals Market Industry Insights & Trends

The Italy POS terminals market is poised for significant expansion, driven by several compelling factors. The increasing adoption of digital payments, spurred by government initiatives promoting cashless transactions and evolving consumer preferences for convenience, acts as a primary growth catalyst. The retail sector, a cornerstone of the Italian economy, continues to be a major adopter of advanced POS solutions, seeking to optimize checkout processes and enhance customer engagement. Similarly, the hospitality industry, encompassing restaurants, hotels, and tourism, is increasingly investing in mobile POS systems to facilitate table-side ordering and payment, improving operational efficiency and guest satisfaction. The healthcare sector is also witnessing a growing demand for secure and efficient POS systems for billing and payment processing. Technological disruptions, including the proliferation of NFC technology, QR code payments, and the integration of AI-powered analytics into POS software, are redefining the capabilities and functionalities of these devices. The forecast period is expected to witness robust growth, with the market size projected to reach approximately USD 4 Billion by 2033, growing at a CAGR of approximately 6.5% during the forecast period (2025-2033). The historical period (2019-2024) has laid the groundwork for this expansion, marked by steady technological advancements and increasing merchant adoption.

Key Markets & Segments Leading Italy POS Terminals Market

The Italy POS terminals market is predominantly influenced by the retail segment, which constitutes the largest end-user industry. This dominance is driven by Italy's vibrant retail landscape, encompassing fashion, food and beverage, electronics, and luxury goods, all of which require efficient and sophisticated point-of-sale solutions to manage transactions and customer interactions. The hospitality sector emerges as a strong second, with the increasing adoption of mobile POS terminals revolutionizing table service and checkout processes in restaurants, cafes, and hotels.

Within the type segmentation, Fixed Point-of-Sale Terminals continue to hold a substantial market share due to their reliability and suitability for traditional retail environments. However, Mobile/Portable Point-of-Sale Terminals are experiencing accelerated growth, fueled by the demand for flexibility and mobility, particularly in the hospitality and small business sectors.

- Retail Sector Drivers:

- High volume of transactions.

- Need for inventory management integration.

- Demand for enhanced customer loyalty programs.

- Shift towards omnichannel retail strategies.

- Hospitality Sector Drivers:

- Increased adoption of mobile ordering and payment.

- Focus on improving guest experience and operational efficiency.

- Growth of food delivery and takeaway services.

- Fixed POS Terminal Dominance:

- Established infrastructure in traditional retail settings.

- Perceived reliability for high-volume transactions.

- Cost-effectiveness for certain business models.

- Mobile POS Terminal Growth:

- Flexibility for on-the-go transactions.

- Enhanced customer service capabilities.

- Reduced infrastructure costs for startups and small businesses.

Italy POS Terminals Market Product Developments

Product development in the Italy POS terminals market is characterized by a relentless pursuit of innovation. Manufacturers are focusing on enhancing security features, integrating advanced processing capabilities, and developing user-friendly interfaces. The trend towards converged devices, capable of handling payments, inventory, customer relationship management, and even loyalty programs, is gaining traction. This includes the development of sophisticated Android POS terminals and iOS-based POS solutions that offer greater flexibility and app integration. Furthermore, there's a growing emphasis on the aesthetic appeal and compact design of POS terminals to align with modern retail and hospitality environments. The integration of cloud-based software solutions further enhances the functionality and scalability of these devices, offering businesses real-time data access and management.

Challenges in the Italy POS Terminals Market Market

The Italy POS terminals market faces several challenges that can impede growth. Regulatory hurdles, particularly around data privacy and evolving payment security standards, require continuous adaptation and investment from vendors and merchants. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of hardware components, affecting production timelines and pricing. Intense competitive pressure from both established players and emerging technology startups can lead to price wars and necessitate significant investment in research and development. Merchant resistance to adopting new technologies, particularly among smaller businesses, can slow down the transition from traditional systems to modern POS solutions. Furthermore, cybersecurity threats remain a constant concern, requiring robust security measures to protect sensitive transaction data.

Forces Driving Italy POS Terminals Market Growth

Several key forces are propelling the growth of the Italy POS terminals market. The increasing digital transformation across all business sectors is a primary driver, with merchants recognizing the necessity of efficient and modern payment solutions. The proliferation of smartphones and the widespread adoption of contactless payment methods, such as NFC and QR codes, are significantly boosting the demand for mobile POS systems and terminals supporting these technologies. Government initiatives promoting cashless economies and reducing transaction costs for businesses further incentivize the adoption of electronic payment systems. Evolving consumer expectations for faster, more convenient, and secure payment experiences are also pushing merchants to upgrade their POS infrastructure. The growing tourism industry in Italy also contributes to market growth, as businesses cater to international visitors who often prefer contactless and digital payment options.

Challenges in the Italy POS Terminals Market Market

- Cybersecurity Threats: Protecting sensitive customer data from evolving cyber threats remains a paramount concern.

- Integration Complexity: Seamless integration of POS systems with existing business software (ERP, CRM) can be challenging.

- Merchant Training and Adoption: Ensuring adequate training for staff and overcoming resistance to change among merchants are crucial for successful implementation.

- Hardware Obsolescence: Rapid technological advancements necessitate frequent hardware upgrades, impacting cost considerations for businesses.

- Economic Volatility: Fluctuations in the Italian and broader European economy can influence business investment in new POS technologies.

Emerging Opportunities in Italy POS Terminals Market

The Italy POS terminals market presents several exciting emerging opportunities. The increasing demand for unified commerce solutions, seamlessly integrating online and offline sales channels, offers significant growth potential for POS providers who can offer comprehensive platforms. The burgeoning e-commerce sector is also driving the need for POS systems that can manage click-and-collect orders and facilitate returns. Furthermore, the development of AI-powered analytics within POS systems presents an opportunity to offer businesses deeper insights into customer behavior, sales trends, and inventory management. The growing adoption of IoT devices and their integration with POS systems for enhanced operational efficiency and data collection also represents a promising avenue. Finally, the increasing focus on sustainability could lead to opportunities for POS solutions that incorporate energy-efficient hardware and eco-friendly materials.

Leading Players in the Italy POS Terminals Market Sector

- Ingenico

- VeriFone Inc

- Diebold Nixdorf

- Panasonic Corporation

- NCR Corporation

- Toshiba Global Commerce Solutions

- Cegid Group

- Adyen

- myPOS

- Aptos Inc

- NEC Corporation

- Toshiba Tec Corporation

- Fujitsu Ltd

- Samsung Electronics Co Ltd

- Casio Computer Co Ltd

- Credit Agricole

Key Milestones in Italy POS Terminals Market Industry

- June 2022: Nexi, an Italian payments organization, agreed to buy BPER Banca and Banco Di Sardegna's shop payments business for up to EUR 384 million (USD 412 million), bringing in a network of more than 110,000 stores. This significant acquisition demonstrates consolidation within the Italian payment ecosystem, impacting the POS terminal landscape.

- August 2021: In the northern Italian city of Bergamo, public transportation companies such as bus and funicular railway operator Azienda Trasporti Bergamo (ATB) and tram operator Tramvie Elettriche Bergasmasche (TEB) implemented account-based ticketing services on all of their vehicles, as well as contactless validators across their networks. Passengers can pay for their tickets using their NFC-enabled mobile device's credit, debit card, or digital wallet. This highlights the growing adoption of contactless payment solutions in public transportation, influencing the demand for compatible POS validators.

Strategic Outlook for Italy POS Terminals Market Market

The strategic outlook for the Italy POS terminals market is exceptionally positive, driven by continuous technological advancements and evolving consumer behavior. Future growth will be propelled by the increasing demand for integrated solutions that offer more than just payment processing, encompassing inventory management, customer relationship management, and data analytics. The ongoing shift towards omnichannel retail strategies will necessitate POS systems that can seamlessly bridge the gap between online and offline customer experiences. Investments in research and development focused on AI, IoT, and enhanced cybersecurity will be crucial for market leaders. Furthermore, partnerships between hardware manufacturers, software developers, and payment processors will be instrumental in delivering comprehensive and competitive offerings. The market is set to witness a rise in the adoption of sophisticated, cloud-connected POS devices that empower businesses with real-time insights and operational flexibility.

Italy POS Terminals Market Segmentation

-

1. Type

- 1.1. Fixed Point-of-Sale Terminals

- 1.2. Mobile/Portable Point-of-Sale Terminals

-

2. End-user Industries

- 2.1. Retail

- 2.2. Hospitality

- 2.3. Healthcare

- 2.4. Others

Italy POS Terminals Market Segmentation By Geography

- 1. Italy

Italy POS Terminals Market Regional Market Share

Geographic Coverage of Italy POS Terminals Market

Italy POS Terminals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. mPOS is Booming the POS Terminals Market in Italy; Government Initiatives towards the Go cashless drives the POS Terminals Market in Italy; Mobile proximity payments

- 3.3. Market Restrains

- 3.3.1. Operational and ROI Concerns

- 3.4. Market Trends

- 3.4.1. mPOS is Booming the POS Terminals Market in Italy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy POS Terminals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Point-of-Sale Terminals

- 5.1.2. Mobile/Portable Point-of-Sale Terminals

- 5.2. Market Analysis, Insights and Forecast - by End-user Industries

- 5.2.1. Retail

- 5.2.2. Hospitality

- 5.2.3. Healthcare

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hardware Vendors

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3 Panasonic Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 5 myPOS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 1 NCR Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 7 Ingenico

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 4 Adyen

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 9 Diebold Nixdorf

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 2 Ingenico

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 6 Credit Agricole

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 2 Cegid Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 4 NEC Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 7 Toshiba Global Commerce Solutions

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 1 Aptos Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 8 VeriFone Inc *List Not Exhaustive 7 2 Market Share of Key Player

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 8 Fujitsu Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 5 Casio Computer Co Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 6 Samsung Electronics Co Ltd

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Software Vendors

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 3 Toshiba Tec Corporation

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.1 Hardware Vendors

List of Figures

- Figure 1: Italy POS Terminals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy POS Terminals Market Share (%) by Company 2025

List of Tables

- Table 1: Italy POS Terminals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Italy POS Terminals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 3: Italy POS Terminals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Italy POS Terminals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Italy POS Terminals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 6: Italy POS Terminals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy POS Terminals Market?

The projected CAGR is approximately 8.31%.

2. Which companies are prominent players in the Italy POS Terminals Market?

Key companies in the market include Hardware Vendors, 3 Panasonic Corporation, 5 myPOS, 1 NCR Corporation, 7 Ingenico, 4 Adyen, 9 Diebold Nixdorf, 2 Ingenico, 6 Credit Agricole, 2 Cegid Group, 4 NEC Corporation, 7 Toshiba Global Commerce Solutions, 1 Aptos Inc, 8 VeriFone Inc *List Not Exhaustive 7 2 Market Share of Key Player, 8 Fujitsu Ltd, 5 Casio Computer Co Ltd, 6 Samsung Electronics Co Ltd, Software Vendors, 3 Toshiba Tec Corporation.

3. What are the main segments of the Italy POS Terminals Market?

The market segments include Type, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.33 billion as of 2022.

5. What are some drivers contributing to market growth?

mPOS is Booming the POS Terminals Market in Italy; Government Initiatives towards the Go cashless drives the POS Terminals Market in Italy; Mobile proximity payments.

6. What are the notable trends driving market growth?

mPOS is Booming the POS Terminals Market in Italy.

7. Are there any restraints impacting market growth?

Operational and ROI Concerns.

8. Can you provide examples of recent developments in the market?

June 2022 - Nexi, an Italian payments organization, has agreed to buy BPER Banca and Banco Di Sardegna's shop payments business for up to EUR 384 million (USD 412 million), bringing in a network of more than 110,000 stores.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy POS Terminals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy POS Terminals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy POS Terminals Market?

To stay informed about further developments, trends, and reports in the Italy POS Terminals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence