Key Insights

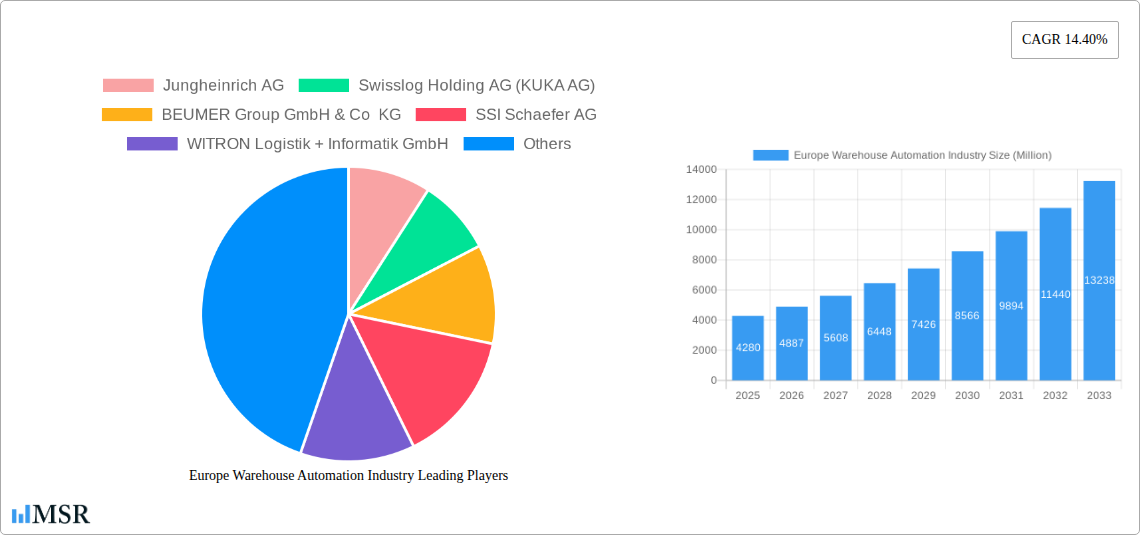

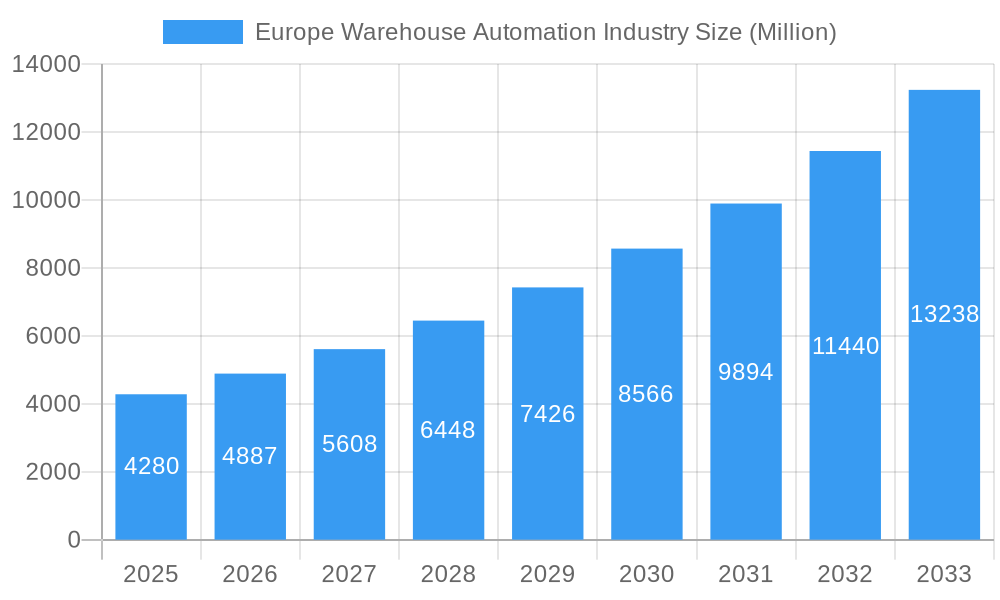

The European warehouse automation market, currently valued at €4.28 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 14.40% from 2025 to 2033. This significant expansion is driven by several key factors. E-commerce's unrelenting rise necessitates efficient order fulfillment, fueling demand for automated solutions like piece-picking robots and advanced warehouse management systems (WMS). Simultaneously, labor shortages across Europe are forcing businesses to adopt automation to maintain productivity and competitiveness. Furthermore, the increasing focus on supply chain optimization and the need to reduce operational costs are contributing to the market's growth trajectory. Germany, France, and the United Kingdom represent the largest national markets within Europe, reflecting their established logistics infrastructure and substantial e-commerce sectors. The market is segmented by component (hardware, software, services), end-user industry (food and beverage, post and parcel, groceries, etc.), and country, providing a granular view of market dynamics. Growth is further fueled by technological advancements in robotics, artificial intelligence, and data analytics, enabling more sophisticated and efficient warehouse automation solutions.

Europe Warehouse Automation Industry Market Size (In Billion)

The competitive landscape is characterized by a mix of established players like Jungheinrich AG, Swisslog Holding AG, and Dematic, and smaller specialized companies. These companies are continuously innovating to offer comprehensive solutions encompassing hardware, software, and services. The market's growth is, however, subject to certain restraints. High initial investment costs for automation technologies can be a barrier for smaller businesses. Furthermore, the complexity of integrating new systems into existing infrastructure and the need for skilled workforce to manage and maintain automated systems present challenges to market penetration. Despite these challenges, the long-term outlook for the European warehouse automation market remains positive, driven by sustained e-commerce growth and the ongoing need for efficient and cost-effective logistics operations. The integration of emerging technologies like the Internet of Things (IoT) and cloud computing is expected to further accelerate market growth in the coming years.

Europe Warehouse Automation Industry Company Market Share

Europe Warehouse Automation Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European warehouse automation industry, offering invaluable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delves into market dynamics, key players, and future growth prospects. The report covers a market valued at xx Million in 2025, projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Europe Warehouse Automation Industry Market Concentration & Dynamics

This section analyzes the competitive landscape of the European warehouse automation market, examining market concentration, innovation, regulatory frameworks, and market dynamics. The industry demonstrates a moderately concentrated structure with key players holding significant market share. For example, Jungheinrich AG, Swisslog Holding AG (KUKA AG), and Dematic (Kion Group AG) collectively hold an estimated xx% market share in 2025.

- Market Concentration: The market is characterized by a mix of large multinational corporations and specialized niche players.

- Innovation Ecosystems: Significant investments in R&D drive innovation in areas like AI-powered robotics, autonomous mobile robots (AMRs), and advanced warehouse management systems (WMS).

- Regulatory Frameworks: EU regulations on data privacy, worker safety, and environmental standards impact market players' strategies.

- Substitute Products: While automation offers significant advantages, traditional manual processes remain a substitute, particularly in smaller businesses or niche segments.

- End-User Trends: Growing e-commerce and the demand for faster delivery are major drivers of automation adoption.

- M&A Activities: The sector has witnessed numerous mergers and acquisitions in recent years, with xx major deals recorded between 2019 and 2024. These transactions indicate consolidation and the pursuit of technological capabilities.

Europe Warehouse Automation Industry Industry Insights & Trends

The European warehouse automation industry is experiencing robust growth, driven by several factors. The rising e-commerce penetration rate fuels demand for efficient order fulfillment solutions, impacting warehouse operations and necessitating automation. The increasing complexity of supply chains necessitates improved inventory management, leading to higher adoption rates of sophisticated WMS and WES. Furthermore, labor shortages in many European countries are accelerating the transition to automation as companies seek to optimize operational efficiency and minimize labor costs. This trend is further amplified by the rising cost of labor and the need to improve productivity. The market size, valued at xx Million in 2025, is projected to grow significantly in the forecast period, driven by these converging factors. Technological advancements, particularly in robotics and AI, are continuously improving the functionality and affordability of automation solutions, further accelerating market growth.

Key Markets & Segments Leading Europe Warehouse Automation Industry

The European warehouse automation market demonstrates significant variations across different regions and segments.

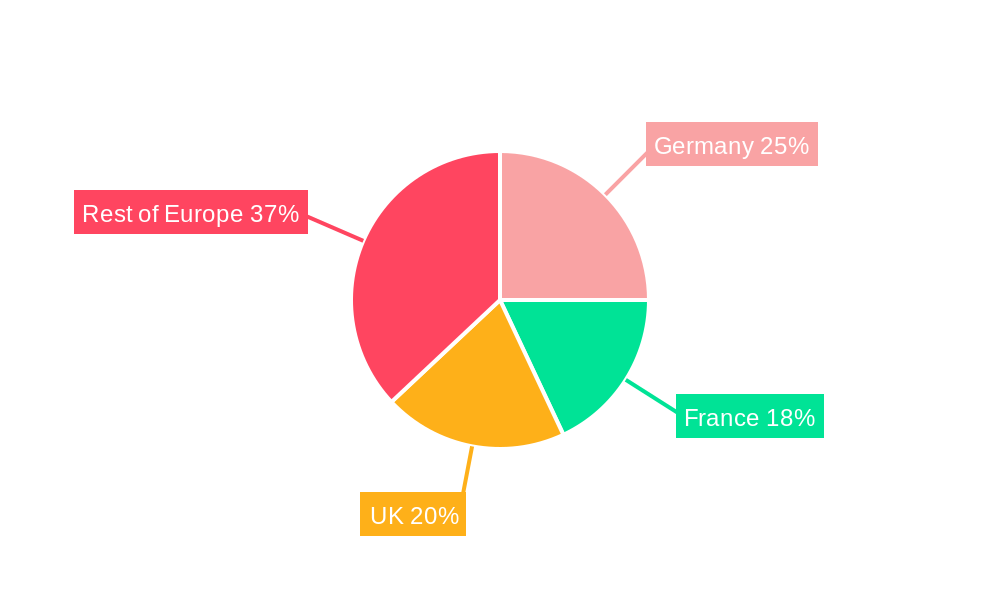

Dominant Regions: Germany and the United Kingdom are currently leading the market due to their robust e-commerce sectors and well-developed logistics infrastructure. France is also a significant market, showing strong growth potential. The "Rest of Europe" segment is expected to experience considerable expansion in the coming years.

Dominant Segments:

- End-User: Food and beverage (including manufacturing facilities and distribution centers) is a significant segment, along with the post and parcel industry and the rapidly expanding grocery sector. The manufacturing sector (both durable and non-durable goods) is also a key driver.

- Component: Hardware, including automated guided vehicles (AGVs), robotics and conveyors, constitutes a larger share of the market. However, software solutions (WMS and WES) are experiencing rapid growth, becoming increasingly critical for efficient warehouse operations.

- Growth Drivers:

- Economic growth and rising disposable incomes in several European countries.

- Expanding e-commerce and omnichannel retail strategies.

- Growing adoption of advanced warehouse management systems (WMS) and warehouse execution systems (WES).

- Increased demand for faster and more reliable delivery services.

- Stringent labor regulations and increasing labor costs.

- Technological advancements in robotics, AI, and IoT.

Europe Warehouse Automation Industry Product Developments

Recent product innovations are largely centered around Artificial Intelligence (AI), improving the efficiency and adaptability of robotic systems. This includes improved picking and placing technologies, advanced inventory management systems, and predictive maintenance capabilities that reduce downtime. Companies are also focusing on modular and scalable solutions to meet the diverse needs of various warehouse operations, leading to more flexible and cost-effective automation deployments. The integration of AI and IoT technologies is also enhancing real-time visibility and control over warehouse operations.

Challenges in the Europe Warehouse Automation Industry Market

Significant challenges include high initial investment costs for automation systems, which can be a barrier for smaller businesses. Integration complexities and the need for skilled workforce to manage and maintain the technology also pose a hurdle. Furthermore, concerns regarding data security and privacy in the context of increasingly connected warehouse operations add to the complexity. Supply chain disruptions also impact the timely delivery of components and equipment.

Forces Driving Europe Warehouse Automation Industry Growth

Several factors contribute to the sector's growth. The increasing demand for faster and more efficient order fulfillment, fueled by the rise of e-commerce, is a primary driver. Government initiatives promoting automation and digitalization are also creating a positive environment for growth. Labor shortages are further incentivizing businesses to adopt automation technologies to maintain productivity. The ongoing development of advanced technologies, such as AI and robotics, is continually improving automation solutions, making them more efficient and cost-effective.

Long-Term Growth Catalysts in Europe Warehouse Automation Industry

Long-term growth hinges on continued innovation, including the development of more sophisticated and adaptable robotics and AI solutions. Strategic partnerships between technology providers and warehouse operators are crucial for successful implementation and integration. Furthermore, expanding into new markets within Europe and exploring new applications for warehouse automation technologies will be key to sustaining growth.

Emerging Opportunities in Europe Warehouse Automation Industry

Significant opportunities lie in the increasing adoption of cloud-based WMS and WES solutions, enabling scalability and accessibility. The rising demand for customized automation solutions to cater to niche industry needs represents a significant growth area. Furthermore, exploring the potential of autonomous mobile robots (AMRs) and collaborative robots (cobots) offers further avenues for expansion.

Leading Players in the Europe Warehouse Automation Industry Sector

Key Milestones in Europe Warehouse Automation Industry Industry

- July 2021: ABB acquired ASTI Mobile Robotics Group, expanding its AMR portfolio.

- May 2022: Lineage Logistics expanded its automated warehouse in Peterborough, UK, significantly increasing its capacity.

Strategic Outlook for Europe Warehouse Automation Industry Market

The future of the European warehouse automation market looks bright. Continued technological advancements, coupled with increasing demand driven by e-commerce and labor shortages, will propel market growth. Companies focusing on innovative solutions, strategic partnerships, and efficient integration strategies will be best positioned to capitalize on emerging opportunities and achieve sustainable growth in this dynamic market.

Europe Warehouse Automation Industry Segmentation

-

1. Component

-

1.1. Hardware

- 1.1.1. Mobile Robots (AGV, AMR)

- 1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 1.1.3. Automated Conveyor & Sorting Systems

- 1.1.4. De-palletizing/Palletizing Systems

- 1.1.5. Automati

- 1.1.6. Piece Picking Robots

- 1.2. Software

- 1.3. Services (Value Added Services, Maintenance, etc.)

-

1.1. Hardware

-

2. End-User

- 2.1. Food and

- 2.2. Post and Parcel

- 2.3. Groceries

- 2.4. General Merchandise

- 2.5. Apparel

- 2.6. Manufacturing (Durable and Non-Durable)

- 2.7. Other End-user Industries

Europe Warehouse Automation Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Warehouse Automation Industry Regional Market Share

Geographic Coverage of Europe Warehouse Automation Industry

Europe Warehouse Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Growth of the E-commerce Industry and Customer Expectation; Increasing Manufacturing Complexity and Technology Availability; Industry 4.0 Investments Driving The Demand For Automation & Material Handling

- 3.3. Market Restrains

- 3.3.1. High Cost of Infrastructure set up

- 3.4. Market Trends

- 3.4.1. Autonomous Mobile Robots (AMRs) are Gaining Popularity Throughout Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. Mobile Robots (AGV, AMR)

- 5.1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.1.3. Automated Conveyor & Sorting Systems

- 5.1.1.4. De-palletizing/Palletizing Systems

- 5.1.1.5. Automati

- 5.1.1.6. Piece Picking Robots

- 5.1.2. Software

- 5.1.3. Services (Value Added Services, Maintenance, etc.)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Food and

- 5.2.2. Post and Parcel

- 5.2.3. Groceries

- 5.2.4. General Merchandise

- 5.2.5. Apparel

- 5.2.6. Manufacturing (Durable and Non-Durable)

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Germany Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2020-2032

- 7. France Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2020-2032

- 8. Italy Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2020-2032

- 9. United Kingdom Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2020-2032

- 10. Netherlands Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2020-2032

- 11. Sweden Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Europe Europe Warehouse Automation Industry Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Jungheinrich AG

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Swisslog Holding AG (KUKA AG)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 BEUMER Group GmbH & Co KG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 SSI Schaefer AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 WITRON Logistik + Informatik GmbH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 TGW Logistics Group GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Mecalux SA*List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Vanderlande Industries BV

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Kion Group AG (Dematic Group)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Knapp AG

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Jungheinrich AG

List of Figures

- Figure 1: Europe Warehouse Automation Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Warehouse Automation Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Warehouse Automation Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Europe Warehouse Automation Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Europe Warehouse Automation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Europe Warehouse Automation Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Warehouse Automation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 6: Germany Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: United Kingdom Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Sweden Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Europe Warehouse Automation Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Europe Warehouse Automation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Europe Warehouse Automation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Germany Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Netherlands Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Norway Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Poland Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Denmark Europe Warehouse Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Warehouse Automation Industry?

The projected CAGR is approximately 14.40%.

2. Which companies are prominent players in the Europe Warehouse Automation Industry?

Key companies in the market include Jungheinrich AG, Swisslog Holding AG (KUKA AG), BEUMER Group GmbH & Co KG, SSI Schaefer AG, WITRON Logistik + Informatik GmbH, TGW Logistics Group GmbH, Mecalux SA*List Not Exhaustive, Vanderlande Industries BV, Kion Group AG (Dematic Group), Knapp AG.

3. What are the main segments of the Europe Warehouse Automation Industry?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Growth of the E-commerce Industry and Customer Expectation; Increasing Manufacturing Complexity and Technology Availability; Industry 4.0 Investments Driving The Demand For Automation & Material Handling.

6. What are the notable trends driving market growth?

Autonomous Mobile Robots (AMRs) are Gaining Popularity Throughout Europe.

7. Are there any restraints impacting market growth?

High Cost of Infrastructure set up.

8. Can you provide examples of recent developments in the market?

May 2022 - Lineage expanded its fully automated warehouse in Peterborough by adding 45,000 pallet spots, bringing its total capacity to roughly 71,000 pallets. The additional warehouse creates a critical Southeast Superhub that will support retail and foodservice customers with specific supply chain needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Warehouse Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Warehouse Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Warehouse Automation Industry?

To stay informed about further developments, trends, and reports in the Europe Warehouse Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence