Key Insights

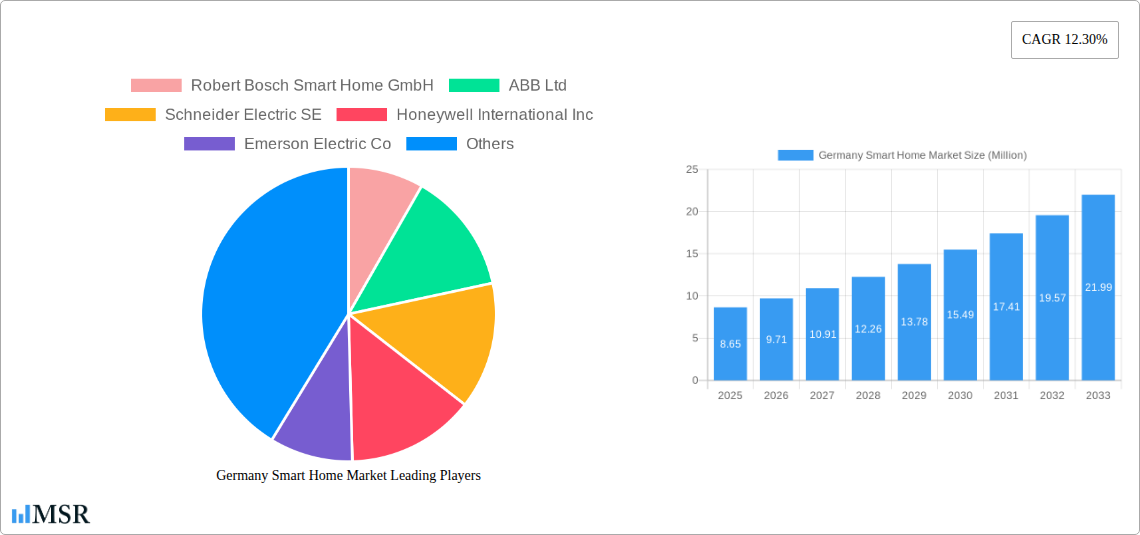

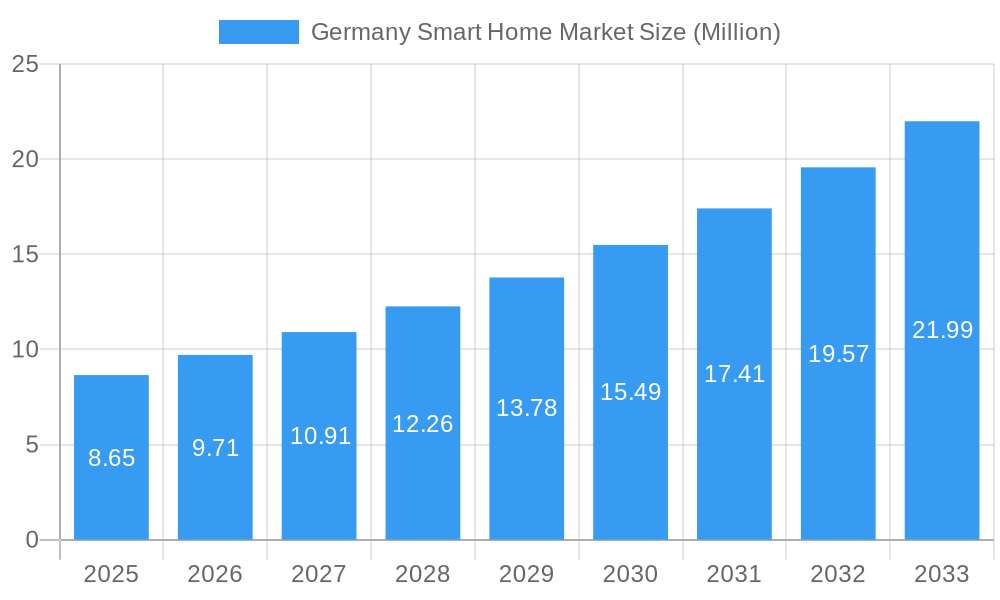

The German smart home market is poised for significant expansion, driven by increasing consumer demand for convenience, security, and energy efficiency. With a current market size of approximately $8.65 million and a robust Compound Annual Growth Rate (CAGR) of 12.30% projected from 2025 to 2033, Germany is emerging as a leading European hub for smart home adoption. This growth is fueled by advancements in connected technologies, a strong digital infrastructure, and a growing awareness of the benefits that smart home solutions offer, from enhanced comfort and lighting control to sophisticated energy management systems. The market is witnessing a surge in adoption across various segments, including security systems, smart appliances, and home entertainment, reflecting a broader trend towards integrated and intelligent living spaces.

Germany Smart Home Market Market Size (In Million)

Key market drivers include government initiatives promoting energy efficiency and digitalization, coupled with rising disposable incomes that empower consumers to invest in advanced home automation. The increasing availability of user-friendly smart home devices and platforms, alongside growing concerns about home security and energy costs, further bolster market prospects. While the market is characterized by intense competition among established players and innovative startups, it also presents substantial opportunities for growth. The anticipated expansion highlights Germany's commitment to embracing smart technologies, paving the way for a more connected and sustainable future for its households.

Germany Smart Home Market Company Market Share

Here's your SEO-optimized and engaging report description for the Germany Smart Home Market:

Unlock the Future of Living: Germany Smart Home Market Analysis 2025-2033

Dive deep into the burgeoning Germany smart home market with our comprehensive report, meticulously covering the study period 2019-2033, base year 2025, and an insightful forecast period 2025-2033. This essential resource for IoT device manufacturers, smart home technology providers, real estate developers, and consumer electronics companies offers unparalleled insights into market dynamics, growth drivers, and emerging opportunities. Explore the latest smart home trends and connected living solutions shaping Germany's residential landscape.

Germany Smart Home Market Market Concentration & Dynamics

The Germany smart home market exhibits moderate concentration, with key players like Robert Bosch Smart Home GmbH, ABB Ltd, Schneider Electric SE, Honeywell International Inc, Emerson Electric Co, Siemens AG, Google LLC (Alphabet Inc), LG Electronic Inc, Samsung, and United Technologies Corporation actively shaping its trajectory. Innovation ecosystems are thriving, fueled by substantial investments in R&D and a strong emphasis on energy management solutions, smart security systems, and home entertainment integration. Regulatory frameworks, particularly those concerning data privacy and interoperability standards, play a crucial role in market development. Substitute products, such as traditional home automation systems, are gradually being displaced by more sophisticated AI-powered smart home devices. End-user trends reveal a growing consumer preference for convenience, energy efficiency, and enhanced security. Mergers and acquisitions (M&A) activities, with an estimated X M&A deal counts in the historical period, are instrumental in consolidating market share and expanding product portfolios, driving market growth towards an estimated market share of $XX Billion by 2033.

Germany Smart Home Market Industry Insights & Trends

The Germany smart home market is poised for significant expansion, driven by increasing consumer awareness of the benefits of connected living, coupled with declining hardware costs and the proliferation of high-speed internet infrastructure. The market size is projected to reach $XX Billion in the base year 2025, with an impressive Compound Annual Growth Rate (CAGR) of XX% anticipated throughout the forecast period. Technological disruptions, including advancements in AI, machine learning, and the Internet of Things (IoT), are revolutionizing product offerings, leading to more intuitive and personalized user experiences. Consumers are increasingly seeking integrated solutions that enhance comfort, security, and energy efficiency. The demand for smart appliances, energy management systems, and advanced security solutions is particularly robust. Evolving consumer behaviors reflect a greater willingness to invest in smart home technologies that offer tangible benefits, such as reduced energy consumption and improved home safety. The integration of voice assistants and mobile applications further enhances user accessibility and control, creating a more seamless and interconnected home environment. Smart lighting solutions and home entertainment systems are also experiencing substantial growth as consumers prioritize convenience and enhanced living experiences. The increasing adoption of these technologies underscores a fundamental shift towards smarter, more responsive, and sustainable homes.

Key Markets & Segments Leading Germany Smart Home Market

The Germany smart home market is characterized by strong performance across several key segments, with Control and Connectivity and Security emerging as dominant forces. The Comfort and Lighting segment is also experiencing robust growth, driven by increasing consumer demand for enhanced living experiences and energy efficiency.

- Control and Connectivity: This segment leads due to the foundational role of smart hubs, gateways, and wireless communication technologies (Wi-Fi, Zigbee, Z-Wave) in enabling seamless interaction between various smart devices.

- Drivers: Increasing adoption of smartphones and tablets as primary control interfaces, growing demand for unified home automation platforms, and the need for interoperability between different brands and devices.

- Security: The heightened consumer awareness regarding home safety and the desire for remote monitoring capabilities have propelled the security segment.

- Drivers: Rising incidence of burglaries, increasing availability of affordable smart cameras, video doorbells, and smart locks, and the integration of AI for advanced threat detection.

- Comfort and Lighting: This segment benefits from the desire for personalized ambient settings and energy-saving solutions.

- Drivers: Growing popularity of smart thermostats and smart lighting systems, government initiatives promoting energy efficiency, and the aesthetic appeal of customizable lighting moods.

- Energy Management: Driven by escalating energy costs and environmental consciousness.

- Drivers: Smart meters, energy monitoring devices, and smart plugs that facilitate reduced energy consumption and cost savings.

- Home Entertainment: Fueled by the demand for immersive audio-visual experiences.

- Drivers: Smart TVs, smart speakers, and integrated home theater systems that offer enhanced connectivity and convenience.

- Smart Appliances: Witnessing steady growth as consumers embrace connected devices for everyday chores.

- Drivers: Internet-connected refrigerators, washing machines, and ovens offering remote control, diagnostics, and enhanced functionality.

Germany Smart Home Market Product Developments

Recent product developments highlight the rapid innovation within the Germany smart home market. In April 2024, Samsung launched its Bespoke AI appliances, featuring Wi-Fi connectivity, internal cameras, and AI chips for enhanced user experience and seamless integration. The introduction of the AI Home, a 7-inch LCD display, simplifies device control with features like a 3D Map View for easy appliance navigation. In March 2024, IKEA introduced its TRETAKT Plug, bundled with a RODRET remote control, enabling remote operation of household devices via smart home systems, voice assistants, or the IKEA Home smart app. These innovations underscore a clear market trend towards smarter, more intuitive, and interconnected home ecosystems, enhancing user convenience and operational efficiency.

Challenges in the Germany Smart Home Market Market

Despite significant growth, the Germany smart home market faces several challenges. High upfront costs for comprehensive smart home installations can deter some consumers. Data privacy and security concerns remain paramount, with users seeking robust protection for their personal information. Interoperability issues between devices from different manufacturers can also create user frustration and limit the seamless integration of smart home ecosystems. Furthermore, the complexity of some systems may present a learning curve for less tech-savvy consumers, necessitating more intuitive user interfaces and accessible customer support. Regulatory compliance regarding data handling and product safety also adds another layer of complexity for manufacturers.

Forces Driving Germany Smart Home Market Growth

Several key forces are driving the growth of the Germany smart home market. The increasing affordability and accessibility of smart home devices, coupled with the widespread availability of high-speed internet, are major catalysts. Growing consumer demand for convenience, enhanced security, and energy efficiency plays a pivotal role. Government initiatives promoting energy conservation and smart city development also contribute positively. Furthermore, technological advancements in AI, IoT, and voice recognition are creating more sophisticated and user-friendly smart home solutions, further stimulating market expansion. The evolving lifestyle preferences towards integrated and automated living experiences are also a significant driving factor.

Challenges in the Germany Smart Home Market Market

Long-term growth catalysts in the Germany smart home market are deeply rooted in continuous innovation and strategic market expansion. The integration of Artificial Intelligence (AI) and Machine Learning (ML) will unlock more predictive and personalized user experiences, moving beyond simple command-and-control. Strategic partnerships between technology providers, utility companies, and real estate developers are crucial for creating comprehensive smart home ecosystems and bundled offerings. Furthermore, the expansion of smart home solutions into new sectors, such as elder care and assisted living, presents a significant untapped market potential. Standardization efforts to ensure seamless interoperability will also foster broader adoption and customer loyalty, solidifying the market's robust long-term growth trajectory.

Emerging Opportunities in Germany Smart Home Market

Emerging opportunities in the Germany smart home market are plentiful and diverse. The increasing demand for sustainable and energy-efficient homes presents a significant avenue for growth, with smart energy management solutions and home battery storage systems gaining traction. The integration of smart home technology with healthcare services, particularly for elderly care and remote patient monitoring, offers a substantial untapped market. Furthermore, the development of more sophisticated AI-powered predictive maintenance for home appliances and systems, coupled with the growing popularity of voice-controlled interfaces and ambient computing, will enhance user experiences and drive adoption. The increasing focus on cybersecurity and data privacy will also create opportunities for specialized security solutions and services.

Leading Players in the Germany Smart Home Market Sector

- Robert Bosch Smart Home GmbH

- ABB Ltd

- Schneider Electric SE

- Honeywell International Inc

- Emerson Electric Co

- Siemens AG

- Google LLC (Alphabet Inc )

- LG Electronic Inc

- Samsung

- United Technologies Corporation

Key Milestones in Germany Smart Home Market Industry

- April 2024: Samsung launched Bespoke AI appliances, integrating Wi-Fi, internal cameras, and AI chips for enhanced connectivity and user experience. The AI Home, a 7-inch LCD display, facilitates intuitive control of connected devices, featuring a 3D Map View for easy appliance navigation. Mobile Smart Connect sends alerts to smartphones for quick appliance control. 'Calm Onboarding' simplifies product registration, while the Knox security platform ensures data protection.

- March 2024: IKEA introduced its new TRETAKT Plug online in the EU. Bundled with a RODRET remote control, the plug enables remote control of household devices via smart home devices, voice assistants, or the IKEA Home smart app. Pairing with DIRIGERA or TRADFRI gateways allows access to app controls. With a white plastic casing, it offers a built-in on/off button and a maximum output of 3,680W.

Strategic Outlook for Germany Smart Home Market Market

The strategic outlook for the Germany smart home market is exceptionally positive, driven by sustained technological innovation and evolving consumer demand for integrated and intelligent living spaces. Key growth accelerators include the ongoing development of AI-powered features for predictive automation and enhanced personalization, alongside strategic partnerships that foster wider interoperability and ecosystem development. The increasing consumer focus on energy efficiency and sustainability will continue to fuel demand for smart energy management solutions. Furthermore, the market is expected to see a rise in bundled service offerings and subscription models, providing recurring revenue streams and deeper customer engagement. Addressing consumer concerns around data security and privacy through robust encryption and transparent data policies will be paramount for long-term success and market expansion.

Germany Smart Home Market Segmentation

-

1. Product

- 1.1. Comfort and Lighting

- 1.2. Control and Connectivity

- 1.3. Energy Management

- 1.4. Home Entertainment

- 1.5. Security

- 1.6. Smart Appliances

Germany Smart Home Market Segmentation By Geography

- 1. Germany

Germany Smart Home Market Regional Market Share

Geographic Coverage of Germany Smart Home Market

Germany Smart Home Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Subsidies; Increasing Consumer Awareness about Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. Government Subsidies; Increasing Consumer Awareness about Energy Efficiency

- 3.4. Market Trends

- 3.4.1. Smart Energy Management is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Smart Home Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Comfort and Lighting

- 5.1.2. Control and Connectivity

- 5.1.3. Energy Management

- 5.1.4. Home Entertainment

- 5.1.5. Security

- 5.1.6. Smart Appliances

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Robert Bosch Smart Home GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schneider Electric SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Emerson Electric Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Google LLC (Alphabet Inc )

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LG Electronic Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samsung

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 United Technologies Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Robert Bosch Smart Home GmbH

List of Figures

- Figure 1: Germany Smart Home Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Smart Home Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Smart Home Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Germany Smart Home Market Volume Billion Forecast, by Product 2020 & 2033

- Table 3: Germany Smart Home Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Germany Smart Home Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Germany Smart Home Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Germany Smart Home Market Volume Billion Forecast, by Product 2020 & 2033

- Table 7: Germany Smart Home Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Germany Smart Home Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Smart Home Market?

The projected CAGR is approximately 12.30%.

2. Which companies are prominent players in the Germany Smart Home Market?

Key companies in the market include Robert Bosch Smart Home GmbH, ABB Ltd, Schneider Electric SE, Honeywell International Inc, Emerson Electric Co, Siemens AG, Google LLC (Alphabet Inc ), LG Electronic Inc, Samsung, United Technologies Corporatio.

3. What are the main segments of the Germany Smart Home Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Subsidies; Increasing Consumer Awareness about Energy Efficiency.

6. What are the notable trends driving market growth?

Smart Energy Management is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Government Subsidies; Increasing Consumer Awareness about Energy Efficiency.

8. Can you provide examples of recent developments in the market?

April 2024: Samsung launched Bespoke AI appliances, integrating Wi-Fi, internal cameras, and AI chips for enhanced connectivity and user experience. The AI Home, a 7-inch LCD display, facilitates intuitive control of connected devices, featuring a 3D Map View for easy appliance navigation. Mobile Smart Connect sends alerts to smartphones for quick appliance control. 'Calm Onboarding' simplifies product registration, while the Knox security platform ensures data protection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Smart Home Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Smart Home Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Smart Home Market?

To stay informed about further developments, trends, and reports in the Germany Smart Home Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence