Key Insights

The Indonesian mobile payments market is experiencing significant expansion, driven by widespread smartphone adoption, increasing internet penetration, and a thriving digital economy. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.73%. By 2025, the market size is estimated to reach 39.4 billion. This growth is propelled by a young, tech-savvy demographic embracing digital finance, government-led financial inclusion initiatives, and the widespread use of e-commerce platforms. The inherent convenience and security of mobile payments, coupled with limited traditional banking access in some regions, further accelerate this growth. Key segments, including proximity and remote payments, are gaining substantial traction across BFSI, retail, and e-commerce sectors, highlighting a diverse and rapidly evolving market. The competitive arena is led by established entities like GoPay, DANA, and OVO, alongside innovative fintech startups vying for market share. Despite ongoing concerns regarding cybersecurity and digital literacy, the future outlook for the Indonesian mobile payments market is highly optimistic.

Indonesia Mobile Payments Industry Market Size (In Billion)

Future projections indicate continued market growth beyond 2033, potentially at a more moderated pace as maturity sets in. Expansion will likely be fueled by the increasing integration of financial and lifestyle services within super-apps, advancements in mobile payment technologies such as biometrics and NFC, and deeper penetration into rural, underserved areas. The competitive landscape is expected to witness further consolidation and innovation, with companies prioritizing enhanced user experience, expanded payment options, and robust security measures. Government regulations will remain instrumental in shaping the market's trajectory, fostering a secure and transparent mobile payments ecosystem. Emphasis on interoperability and seamless cross-border transactions will be crucial for the long-term sustainability and growth of Indonesia's mobile payments industry.

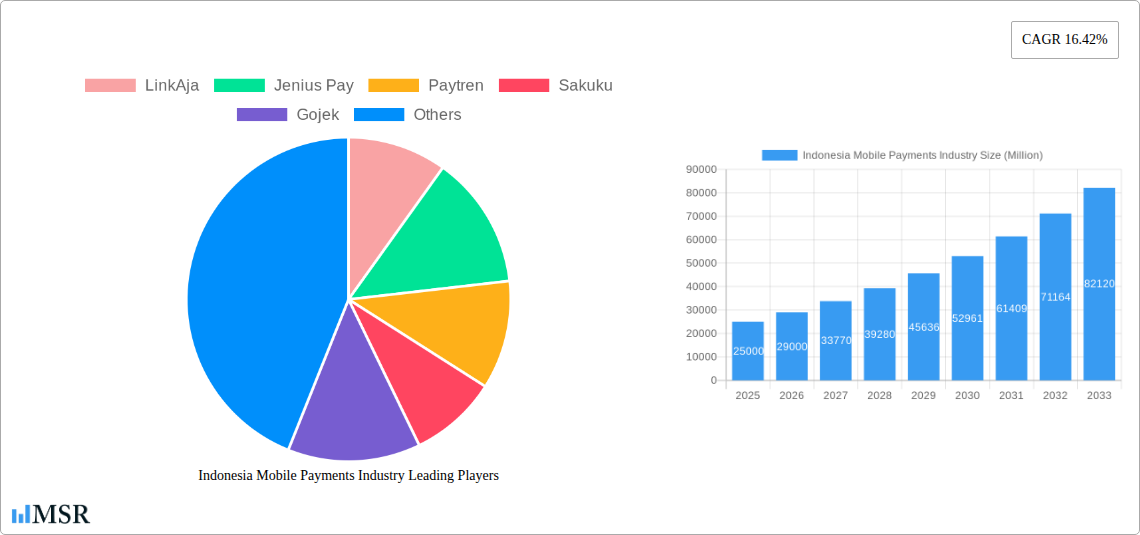

Indonesia Mobile Payments Industry Company Market Share

Indonesia Mobile Payments Industry: Market Analysis and Forecast (2019-2033)

This comprehensive report offers an in-depth analysis of the dynamic Indonesian mobile payments industry, covering market size, growth catalysts, competitive dynamics, and future projections. Covering the period from 2019 to 2033, with a base year of 2025, this report is an essential resource for industry stakeholders, investors, and decision-makers. The forecast period extends from 2025 to 2033, building upon the historical analysis of 2019-2024. Utilizing robust data, the report provides concrete insights into market evolution, with a focus on key players including GoPay, DANA, OVO, Gojek, and LinkAja.

Indonesia Mobile Payments Industry Market Concentration & Dynamics

The Indonesian mobile payments market exhibits a high degree of concentration, with a few dominant players commanding significant market share. GoPay S R O, OVO, and DANA currently hold the largest portions of the market, estimated at xx%, xx%, and xx% respectively, in 2025. This concentration is influenced by several factors. The regulatory framework, while evolving, continues to play a crucial role in shaping the competitive landscape. The emergence of BI-FAST (Bank Indonesia Fast Payment) is expected to further influence market dynamics and potentially encourage more competition.

- Market Share: GoPay S R O (xx%), DANA (xx%), OVO (xx%), LinkAja (xx%), others (xx%).

- M&A Activity: A total of xx M&A deals were recorded in the historical period (2019-2024), indicating a moderately active consolidation phase. This number is projected to increase to xx in the forecast period (2025-2033).

- Innovation Ecosystems: A vibrant ecosystem of fintech startups and established players fosters continuous innovation in payment technologies, driving adoption among consumers.

- Substitute Products: While mobile payments are the dominant force, traditional methods like cash and card payments continue to coexist, particularly in less digitally penetrated areas. The shift from cash is expected to be gradual yet steady.

- End-User Trends: Rising smartphone penetration and increasing internet access continue to be significant drivers of mobile payment adoption across various demographics.

Indonesia Mobile Payments Industry Industry Insights & Trends

The Indonesian mobile payments market is experiencing exponential growth, driven by a burgeoning digital economy and the increasing preference for cashless transactions. The market size, estimated at xx Million USD in 2025, is projected to reach xx Million USD by 2033, registering a CAGR of xx% during the forecast period. This growth is propelled by several key factors: the expansion of e-commerce, the rise of mobile banking, and the government's ongoing initiatives to promote digital financial inclusion. Technological disruptions, including the introduction of BI-FAST and innovations in mobile wallets, further fuel this growth. Consumer behaviors are evolving rapidly, with younger generations displaying a strong preference for digital payments, further accelerating the shift towards cashless transactions. The rising adoption of super apps and increased financial literacy among consumers are also significant contributors.

Key Markets & Segments Leading Indonesia Mobile Payments Industry

The Indonesian mobile payments market is characterized by robust growth across various segments. While urban centers currently lead in adoption, penetration is steadily increasing in rural areas.

By Type: Remote payments, facilitated by mobile wallets and online platforms, comprise the largest segment, with proximity payments playing a supporting role. This is attributed to the convenience and accessibility of remote payment solutions.

By End-User Industry: The BFSI (Banking, Financial Services, and Insurance) sector demonstrates the highest usage, followed closely by Retail and e-commerce. However, significant growth potential exists within Healthcare, Government, and Transportation and Logistics sectors, primarily fueled by digitization efforts and improvements in digital infrastructure.

- Drivers for Growth:

- Rapid economic growth

- Increasing smartphone and internet penetration

- Government initiatives promoting digital financial inclusion

- Rising e-commerce activity

- Development of robust digital infrastructure

Indonesia Mobile Payments Industry Product Developments

Recent product innovations focus on enhancing security, convenience, and interoperability. New features such as biometric authentication, peer-to-peer (P2P) transfers, and integration with other financial services are enhancing user experience and driving wider adoption. The competitive edge increasingly rests on offering superior security features, attractive rewards programs, and seamless integration across various platforms and applications.

Challenges in the Indonesia Mobile Payments Industry Market

Despite impressive growth, the industry faces challenges including infrastructure gaps in certain regions, particularly in rural areas, resulting in limited access to mobile payment services for a sizable population. This limits the overall market potential. Regulatory uncertainty, though diminishing, still poses a challenge to long-term planning for certain businesses. Finally, Intense competition among established players and new entrants creates pricing pressure and necessitates continuous innovation.

Forces Driving Indonesia Mobile Payments Industry Growth

Several factors contribute to the sustained growth of the Indonesian mobile payments industry. Technological advancements, especially in areas like mobile wallet technology and improved security protocols, continue to drive market expansion. Government initiatives promoting digital financial inclusion and expanding internet infrastructure further contribute to this growth. The increasing adoption of mobile banking and e-commerce reinforces this positive trend.

Long-Term Growth Catalysts in the Indonesia Mobile Payments Industry

Long-term growth in the Indonesian mobile payments industry will be fueled by ongoing investments in digital infrastructure, creating broader access to mobile payments. The continuous innovation of payment methods and the expansion of partnerships between payment providers and other industries will further accelerate adoption. The potential for expansion into underserved markets represents a major driver of future growth.

Emerging Opportunities in Indonesia Mobile Payments Industry

Emerging opportunities include the expansion of mobile payments into previously underserved rural markets, the growth of mobile payment solutions targeted at SMEs, and the increasing adoption of innovative technologies such as blockchain and AI for enhanced security and efficiency. The potential for further integration with other financial services and the growth of super-apps present additional lucrative opportunities for businesses within the sector.

Key Milestones in Indonesia Mobile Payments Industry Industry

- December 2021: Bank Indonesia launched the BI-FAST system, significantly improving the speed and efficiency of retail payment transactions. This milestone has a major positive impact on the market, enhancing accessibility and encouraging wider adoption.

- December 2021: The partnership between Kaddra and DOKU aims to empower SMEs with affordable and advanced mobile commerce solutions, potentially fostering broader participation within the mobile payment ecosystem. This strengthens the overall market.

Strategic Outlook for Indonesia Mobile Payments Industry Market

The future of the Indonesian mobile payments industry is exceptionally promising. Continued growth is anticipated, driven by the expansion of digital infrastructure, rising smartphone penetration, and increasing government support. Strategic opportunities exist for players who can effectively leverage technological advancements, develop innovative payment solutions, and cater to the evolving needs of the diverse Indonesian market. The focus on financial inclusion and the enhancement of security protocols will be crucial for long-term success within this dynamic sector.

Indonesia Mobile Payments Industry Segmentation

-

1. Type

- 1.1. Proximity Payment

- 1.2. Remote Payment

-

2. End-user Industry

- 2.1. BFSI

- 2.2. IT and Telecommunication

- 2.3. Retail

- 2.4. Healthcare

- 2.5. Government

- 2.6. Media and Entertainment

- 2.7. Transportation and Logistics

- 2.8. Other End-user Industries

Indonesia Mobile Payments Industry Segmentation By Geography

- 1. Indonesia

Indonesia Mobile Payments Industry Regional Market Share

Geographic Coverage of Indonesia Mobile Payments Industry

Indonesia Mobile Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Internet Penetration and Growing M-commerce Market; Increasing Number of Loyality Benefits in Mobile Environment

- 3.3. Market Restrains

- 3.3.1. Security Issues Associated with Mobile Payments

- 3.4. Market Trends

- 3.4.1. Rise in e-Wallet Platforms Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Mobile Payments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Proximity Payment

- 5.1.2. Remote Payment

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. BFSI

- 5.2.2. IT and Telecommunication

- 5.2.3. Retail

- 5.2.4. Healthcare

- 5.2.5. Government

- 5.2.6. Media and Entertainment

- 5.2.7. Transportation and Logistics

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LinkAja

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jenius Pay

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Paytren

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sakuku

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gojek

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 i saku

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DOKU

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DANA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GoPay S R O

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 LinkAja

List of Figures

- Figure 1: Indonesia Mobile Payments Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Mobile Payments Industry Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Mobile Payments Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Indonesia Mobile Payments Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Indonesia Mobile Payments Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Indonesia Mobile Payments Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Indonesia Mobile Payments Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Indonesia Mobile Payments Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Mobile Payments Industry?

The projected CAGR is approximately 13.73%.

2. Which companies are prominent players in the Indonesia Mobile Payments Industry?

Key companies in the market include LinkAja, Jenius Pay, Paytren, Sakuku, Gojek, i saku, DOKU, DANA, GoPay S R O.

3. What are the main segments of the Indonesia Mobile Payments Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Internet Penetration and Growing M-commerce Market; Increasing Number of Loyality Benefits in Mobile Environment.

6. What are the notable trends driving market growth?

Rise in e-Wallet Platforms Drives the Market.

7. Are there any restraints impacting market growth?

Security Issues Associated with Mobile Payments.

8. Can you provide examples of recent developments in the market?

December 2021 - Bank Indonesia launched the Bank Indonesia Fast Payment (BI-FAST) system virtually, entitled 'Payment System Digital Transformation to Accelerate National Economic Recovery.' BI-FAST is a payment system infrastructure provided by Bank Indonesia and accessible via applications offered by the payment system industry to facilitate retail payment transactions for the public. BI-FAST is being rolled out by banks to their customers gradually in line with the respective bank's plan to offer different payment channels to their customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Mobile Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Mobile Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Mobile Payments Industry?

To stay informed about further developments, trends, and reports in the Indonesia Mobile Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence