Key Insights

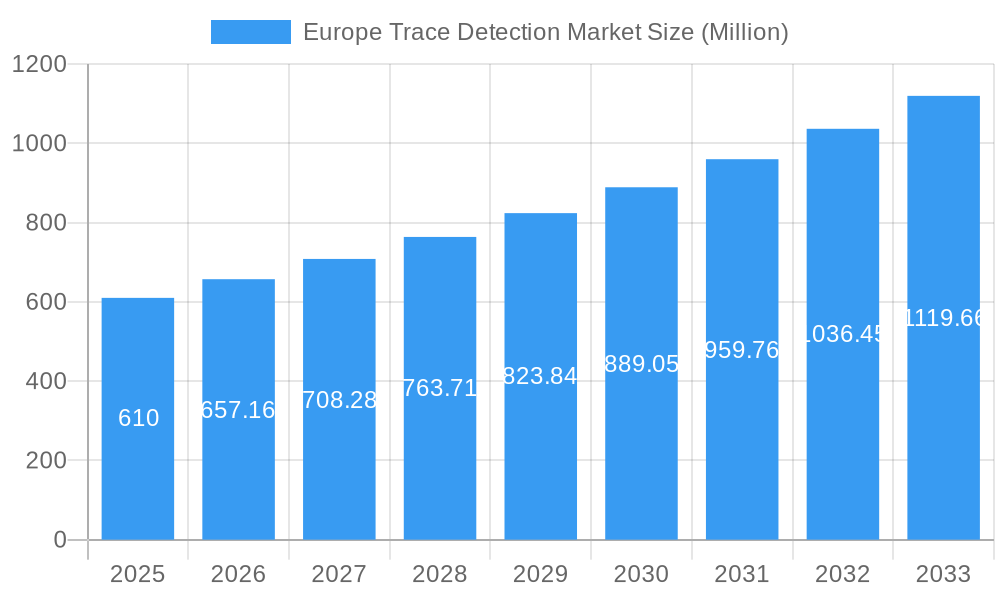

The European trace detection market is poised for significant expansion, projected to reach an estimated USD 610 million in 2025. This growth is fueled by an anticipated Compound Annual Growth Rate (CAGR) of 7.60% throughout the forecast period of 2025-2033. A primary driver behind this robust growth is the escalating need for enhanced security measures across various sectors, including commercial aviation, public transportation, critical infrastructure, and law enforcement. The increasing threat of terrorism, coupled with the rise in illicit activities such as drug trafficking and the smuggling of hazardous materials, necessitates advanced trace detection solutions. The market's dynamism is further propelled by continuous technological advancements, leading to the development of more sensitive, faster, and user-friendly detection systems. Handheld and portable devices are gaining prominence due to their flexibility and suitability for on-site screening, offering rapid threat identification in diverse environments.

Europe Trace Detection Market Market Size (In Million)

The European landscape for trace detection is characterized by a strong focus on national security and public safety initiatives. Countries like the United Kingdom, Germany, France, and Spain are leading the adoption of these technologies, driven by stringent regulatory frameworks and substantial government investments in security infrastructure. The market segmentation reveals a diverse application range, with explosives and narcotics detection being key areas. While the military and defense sector remains a significant end-user, the commercial industry, particularly airports and ports, represents a rapidly growing segment. Law enforcement agencies are also increasingly deploying trace detection systems to combat crime and ensure public order. However, the market is not without its challenges. High initial investment costs for sophisticated equipment and the need for specialized training for personnel can act as restraints. Furthermore, the evolving nature of threats requires continuous innovation and adaptation of detection technologies to maintain their efficacy.

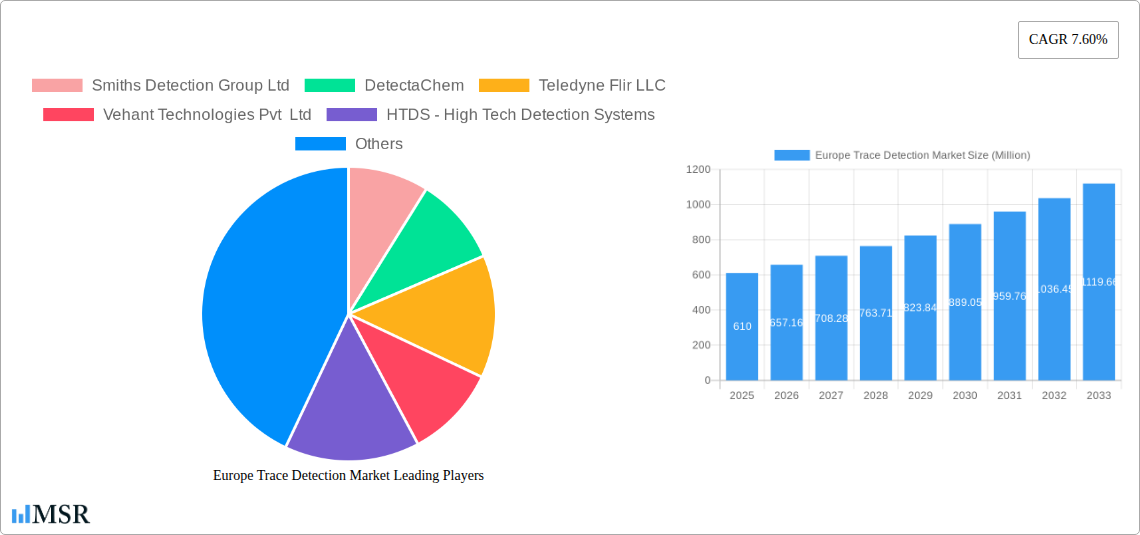

Europe Trace Detection Market Company Market Share

Europe Trace Detection Market: Comprehensive Insights and Forecasts (2024-2033)

This in-depth report provides a strategic analysis of the Europe Trace Detection Market, offering critical insights into market dynamics, key trends, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025, this research is essential for industry stakeholders seeking to understand and capitalize on the evolving landscape of explosive trace detection (ETD) and narcotics trace detection (NTD) technologies across the continent. The report delves into detailed segmentation by type, product, and end-user industry, highlighting dominant markets and emerging opportunities.

Europe Trace Detection Market Market Concentration & Dynamics

The Europe Trace Detection Market exhibits a moderate to high level of concentration, with key players like Smiths Detection Group Ltd, Teledyne Flir LLC, and Bruker Corporation holding significant market shares. The innovation ecosystem is driven by continuous research and development in sensor technology, miniaturization, and software integration, leading to more accurate and faster detection capabilities for explosives and narcotics. Regulatory frameworks, particularly those from the European Civil Aviation Conference (ECAC), play a crucial role in dictating product standards and driving adoption for airport security. Substitute products, while present, often lack the specificity and sensitivity of dedicated trace detection systems. End-user trends indicate a growing demand for integrated security solutions and increased deployment in public safety and law enforcement applications beyond traditional aviation security. Mergers and acquisitions (M&A) activities are relatively limited but strategic, focusing on acquiring advanced technologies or expanding geographic reach. For instance, the procurement of Bruker's DE-tector flex systems by Fraport AG and Flughafen Zürich AG signifies a consolidation of advanced technology adoption by major airport operators.

Europe Trace Detection Market Industry Insights & Trends

The Europe Trace Detection Market is poised for robust growth, driven by escalating security concerns, stringent regulatory mandates, and advancements in detection technologies. The market size, valued at approximately XX Million in 2025, is projected to reach XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Growing threats of terrorism and illicit drug trafficking continue to be primary market accelerators, compelling governments and private entities to invest heavily in sophisticated screening solutions. The increasing adoption of handheld trace detectors for their portability and ease of use in various environments, from checkpoints to covert surveillance, is a significant trend. Technological disruptions, such as the integration of artificial intelligence (AI) for enhanced data analysis and the development of non-radioactive ionization sources in devices like the Bruker DE-tector flex, are enhancing performance and user safety. Evolving consumer behaviors, particularly within the aviation sector, demand faster yet more effective passenger screening processes, pushing for the deployment of next-generation trace detection systems. The increasing focus on ports and borders security also represents a substantial growth avenue.

Key Markets & Segments Leading Europe Trace Detection Market

The Europe Trace Detection Market is dominated by key segments and regions driven by specific security needs and investment levels.

Dominant Regions: Western Europe, particularly countries like Germany, the UK, France, and Switzerland, leads the market due to significant investment in national security, a well-established aviation infrastructure, and the presence of major international airports.

Type Dominance:

- Explosive Trace Detection (ETD): This segment remains dominant due to the persistent threat of IEDs and terrorist attacks. High-profile incidents continually reinforce the need for effective ETD solutions in public spaces and critical infrastructure.

- Narcotics Trace Detection (NTD): Growing concerns over drug smuggling and the opioid crisis are fueling demand for NTD capabilities, making it a rapidly expanding segment.

Product Dominance:

- Handheld Trace Detectors: These are experiencing the highest growth due to their versatility, mobility, and affordability, making them ideal for a wide range of applications from quick checks to detailed investigations.

- Portable/Movable Trace Detectors: These offer a balance of portability and advanced capabilities, often used for screening larger areas or at fixed checkpoints where mobility is still a factor.

End-user Industry Dominance:

- Military and Defense: This sector consistently represents a significant portion of the market, driven by the need for battlefield security, threat detection, and personnel protection.

- Law Enforcement: With increasing responsibilities in combating crime and terrorism, law enforcement agencies are significant adopters of trace detection technologies for evidence collection and scene security.

- Ports and Borders: The critical role of securing national frontiers against the ingress of illicit materials makes this a key and growing end-user industry.

- Public Safety: This encompasses a broad range of applications, including event security, critical infrastructure protection, and emergency response, contributing to sustained market growth.

Europe Trace Detection Market Product Developments

Product developments in the Europe Trace Detection Market are characterized by a relentless pursuit of enhanced sensitivity, reduced false alarm rates, and improved user experience. Innovations in sensor technology, such as advancements in ion mobility spectrometry (IMS) and surface acoustic wave (SAW) sensors, are enabling faster and more accurate detection of a wider range of explosives and narcotics. The integration of AI and machine learning is also playing a pivotal role in improving identification algorithms and data interpretation. Miniaturization is leading to more compact and lightweight devices, making handheld trace detectors more practical for extensive use. Furthermore, the development of non-radioactive ionization sources, as seen in Bruker's DE-tector flex, addresses environmental and regulatory concerns while maintaining high performance. These advancements collectively enhance the market's ability to address evolving security threats effectively.

Challenges in the Europe Trace Detection Market Market

Despite its growth, the Europe Trace Detection Market faces several challenges that could impact its trajectory.

- High Initial Investment: The cost of advanced trace detection systems can be a significant barrier for smaller organizations and municipalities.

- Regulatory Complexity: Navigating diverse national and EU-level regulations for the deployment and approval of security equipment can be time-consuming and resource-intensive.

- Interoperability Issues: Ensuring seamless integration of new trace detection devices with existing security infrastructure can be challenging.

- Skilled Workforce Shortage: The operation and maintenance of sophisticated trace detection equipment require trained personnel, and a shortage of such professionals can hinder widespread adoption.

- Environmental Sensitivity: Some detection technologies can be affected by environmental factors such as humidity and temperature, potentially impacting accuracy.

Forces Driving Europe Trace Detection Market Growth

Several forces are propelling the growth of the Europe Trace Detection Market. The persistent and evolving threat landscape, encompassing terrorism and organized crime, is a primary driver, necessitating continuous investment in advanced security solutions. Stringent government regulations and mandates, particularly within the aviation and transportation sectors, compel organizations to adopt state-of-the-art trace detection technologies. Technological advancements in sensor capabilities, miniaturization, and AI-driven analytics are creating more effective and user-friendly devices. Increased awareness and proactive security measures adopted by both public and private entities, driven by past security incidents, also contribute significantly to market expansion. Furthermore, growing concerns over the illicit drug trade are amplifying the demand for narcotics trace detection capabilities.

Challenges in the Europe Trace Detection Market Market

Long-term growth catalysts for the Europe Trace Detection Market are multifaceted. The ongoing evolution of threat methodologies by malicious actors necessitates continuous innovation in detection technologies, ensuring that trace detection systems remain effective against novel threats. Strategic partnerships between technology providers and end-users, such as those seen with airport authorities, foster product development tailored to specific operational needs. Furthermore, the expansion of trace detection applications beyond traditional security checkpoints into areas like cargo screening, public event security, and critical infrastructure monitoring presents substantial growth opportunities. The development of more cost-effective and user-friendly solutions will also democratize access to these critical technologies, broadening market penetration.

Emerging Opportunities in Europe Trace Detection Market

Emerging opportunities in the Europe Trace Detection Market are being shaped by evolving societal needs and technological frontiers. The increasing focus on public safety in crowded venues, such as sporting events and concerts, presents a growing market for portable and rapidly deployable trace detection solutions. The burgeoning drone technology sector, both for commercial and potentially malicious use, opens avenues for specialized drone-based detection systems. Furthermore, the growing emphasis on supply chain security and the detection of illicit substances within logistics networks offers a significant, largely untapped market. The development of integrated security platforms that combine trace detection with other screening modalities, such as X-ray and biometric identification, represents a key future trend.

Leading Players in the Europe Trace Detection Market Sector

- Bruker Corporation

- Smiths Detection Group Ltd

- Teledyne Flir LLC

- DetectaChem

- Vehant Technologies Pvt Ltd

- HTDS - High Tech Detection Systems

- DSA Detection LLC

- Rapiscan Systems Inc

- Leidos Holdings Inc

- Westminster Group PL

- Autoclear LLC

- Mass Spec Analytical Ltd

Key Milestones in Europe Trace Detection Market Industry

- September 2023: Fraport AG selected Bruker for up to 220 DE-tector flex explosives and narcotics trace detectors, slated for multi-year installation from 2023-2027 to modernize Frankfurt Airport (FRA) security. These advanced systems will replace earlier Bruker ETD models.

- August 2023: Flughafen Zürich AG ordered 60 Bruker DE-tector flex narcotics and explosives trace detectors for installation over 24 months in 2024-2025 to enhance passenger screening at Zurich Airport. These next-generation systems replace earlier ETD models, complementing existing deployments at Geneva Airport. The DE-tector flex systems are ECAC-certified and utilize a non-radioactive ionization source.

Strategic Outlook for Europe Trace Detection Market Market

The strategic outlook for the Europe Trace Detection Market is one of sustained growth and technological evolution. The market is expected to witness increased adoption of next-generation technologies, including AI-powered analytics and non-radioactive detection methods, driven by both security demands and regulatory advancements. Key growth accelerators will include the continuous need for enhanced airport security, the expanding role of trace detection in law enforcement and border control, and the rising importance of public safety measures in various public spaces. Strategic opportunities lie in developing integrated solutions, focusing on user-friendly interfaces, and addressing the specific needs of diverse end-user industries through targeted product development and strategic partnerships. The market will continue to be shaped by a commitment to innovation and the persistent global imperative for enhanced security.

Europe Trace Detection Market Segmentation

-

1. Type

- 1.1. Explosive

- 1.2. Narcotics

-

2. Product

- 2.1. Handheld

- 2.2. Portable/Movable

- 2.3. Fixed

-

3. End-user Industry

- 3.1. Commercial

- 3.2. Military and Defense

- 3.3. Law Enforcement

- 3.4. Ports and Borders

- 3.5. Public Safety

- 3.6. Other End-user Industries

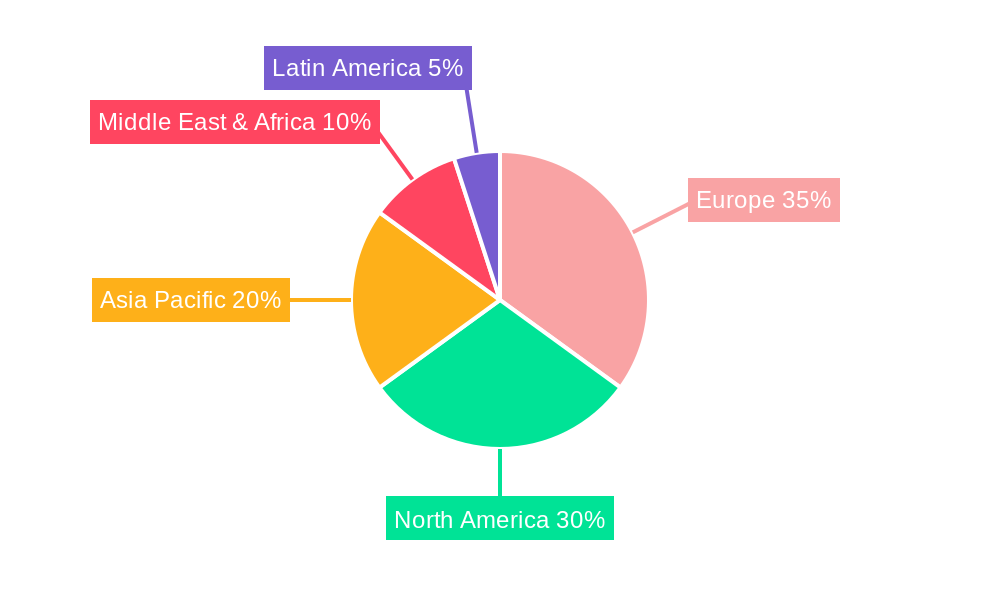

Europe Trace Detection Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Trace Detection Market Regional Market Share

Geographic Coverage of Europe Trace Detection Market

Europe Trace Detection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Upsurge in Terrorist Activities Across the Region; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel

- 3.4. Market Trends

- 3.4.1. The Law Enforcement Segment is Anticipated to Drive the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Trace Detection Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Explosive

- 5.1.2. Narcotics

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Handheld

- 5.2.2. Portable/Movable

- 5.2.3. Fixed

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial

- 5.3.2. Military and Defense

- 5.3.3. Law Enforcement

- 5.3.4. Ports and Borders

- 5.3.5. Public Safety

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Smiths Detection Group Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DetectaChem

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Teledyne Flir LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vehant Technologies Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HTDS - High Tech Detection Systems

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DSA Detection LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rapiscan Systems Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Leidos Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Westminster Group PL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Autoclear LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bruker Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mass Spec Analytical Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Smiths Detection Group Ltd

List of Figures

- Figure 1: Europe Trace Detection Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Trace Detection Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Trace Detection Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Trace Detection Market Revenue Million Forecast, by Product 2020 & 2033

- Table 3: Europe Trace Detection Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Trace Detection Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Trace Detection Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Europe Trace Detection Market Revenue Million Forecast, by Product 2020 & 2033

- Table 7: Europe Trace Detection Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe Trace Detection Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Trace Detection Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Trace Detection Market?

The projected CAGR is approximately 7.60%.

2. Which companies are prominent players in the Europe Trace Detection Market?

Key companies in the market include Smiths Detection Group Ltd, DetectaChem, Teledyne Flir LLC, Vehant Technologies Pvt Ltd, HTDS - High Tech Detection Systems, DSA Detection LLC, Rapiscan Systems Inc, Leidos Holdings Inc, Westminster Group PL, Autoclear LLC, Bruker Corporation, Mass Spec Analytical Ltd.

3. What are the main segments of the Europe Trace Detection Market?

The market segments include Type, Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 610 Million as of 2022.

5. What are some drivers contributing to market growth?

Upsurge in Terrorist Activities Across the Region; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening.

6. What are the notable trends driving market growth?

The Law Enforcement Segment is Anticipated to Drive the Market Demand.

7. Are there any restraints impacting market growth?

High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel.

8. Can you provide examples of recent developments in the market?

September 2023 - Fraport AG announced the procurement decision in favor of Bruker for providing up to 220 DE-tector flex explosives and narcotics trace detectors to help their airport security measures. The installations are planned over a multi-year period from 2023 to 2027 to modernize the screening of passengers at Germany’s busiest airport, FRA. The advanced, high-performance Bruker DE-tector flex systems are intended to replace earlier-generation Bruker ETD systems at Frankfurt airport. As per the company, traces of most explosives and many illegal drug substances can be accurately traced by wiping surfaces with multi-use, disposable swabs and inserting them into the DE-tector flex.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Trace Detection Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Trace Detection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Trace Detection Market?

To stay informed about further developments, trends, and reports in the Europe Trace Detection Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence