Key Insights

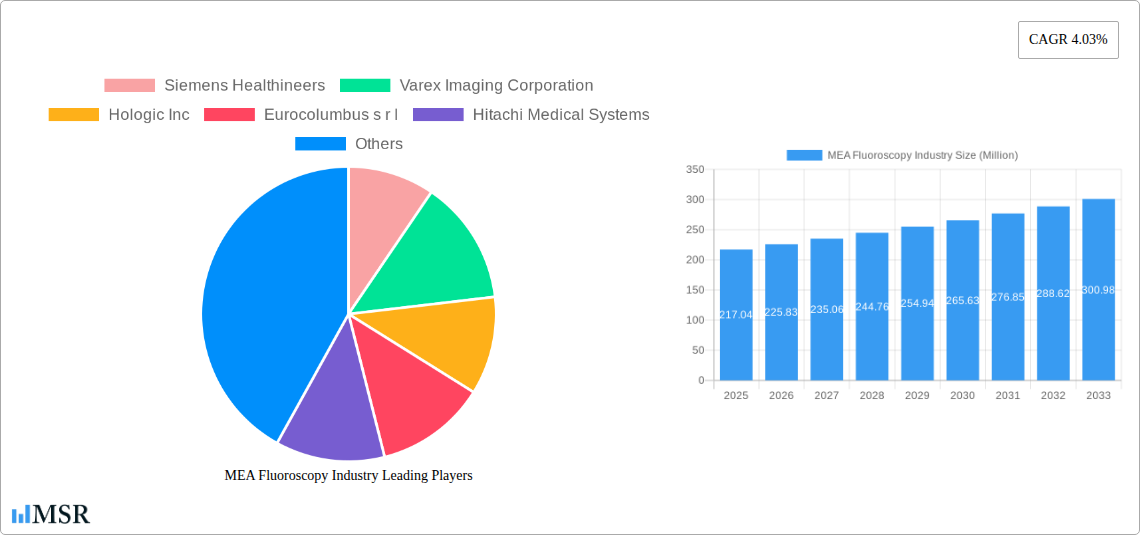

The Middle East and Africa (MEA) fluoroscopy market, valued at $217.04 million in 2025, is projected to experience steady growth, driven by increasing prevalence of chronic diseases requiring minimally invasive procedures, rising healthcare expenditure, and technological advancements in imaging systems. The market's Compound Annual Growth Rate (CAGR) of 4.03% from 2025 to 2033 indicates a consistent expansion, although this rate may be influenced by factors such as economic fluctuations and healthcare policy changes within individual MEA countries. The segment encompassing fixed fluoroscopes is likely to dominate due to their superior image quality and advanced features, though mobile fluoroscopes will see growth fueled by their portability and suitability for various settings. Applications like cardiology and orthopedics are expected to contribute significantly to the market's revenue, while segments like neurology and urology show potential for future expansion given the rising prevalence of related diseases in the region. Major players such as Siemens Healthineers, GE Healthcare, and Philips are actively competing through product innovation and strategic partnerships, further shaping the market landscape. Growth may be moderated by factors including high equipment costs, limited healthcare infrastructure in certain regions, and the need for skilled professionals to operate and maintain these advanced technologies.

The growth of the MEA fluoroscopy market is further influenced by the diverse healthcare landscape of the region. Countries within the Gulf Cooperation Council (GCC) are expected to exhibit higher growth rates due to increased investments in healthcare infrastructure and advanced medical technologies. South Africa, as a major economy in the region, will also contribute significantly. However, variations in healthcare spending across different MEA nations will impact market penetration rates. The market is expected to witness an increasing adoption of digital fluoroscopy systems due to their advantages in image quality, dose reduction, and post-processing capabilities. Furthermore, the growing demand for minimally invasive procedures and the increasing number of specialized medical centers will drive the adoption of fluoroscopy systems across diverse applications. The competitive dynamics will remain intense, with established players and new entrants striving to innovate and capture market share through advanced product features, competitive pricing strategies, and strong distribution networks.

MEA Fluoroscopy Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa (MEA) Fluoroscopy industry, offering invaluable insights for stakeholders including manufacturers, healthcare providers, and investors. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. Discover key trends, market drivers, challenges, and opportunities shaping this dynamic sector. The report's detailed segmentation by device type (Fixed and Mobile Fluoroscopes) and application (Orthopedic, Cardiovascular, Pain Management & Trauma, Neurology, Gastrointestinal, Urology, General Surgery, and Other Applications) allows for a granular understanding of market dynamics.

MEA Fluoroscopy Industry Market Concentration & Dynamics

The MEA fluoroscopy market exhibits a moderately concentrated landscape, with key players like Siemens Healthineers, GE Healthcare, and Philips holding significant market share. However, the presence of several regional and specialized players fosters competition and innovation. The market's growth is influenced by several factors, including:

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025, indicating a moderately concentrated market. This is expected to slightly decrease to xx% by 2033 due to the entry of new players and technological advancements.

- Innovation Ecosystems: The MEA region is witnessing increasing investments in medical technology, fostering innovation in fluoroscopy systems, particularly in areas such as deep learning image reconstruction and mobile fluoroscopy.

- Regulatory Frameworks: Regulatory bodies are playing a crucial role in ensuring the quality and safety of fluoroscopy devices. Compliance with international standards and regional regulations significantly impacts market access.

- Substitute Products: While fluoroscopy remains a crucial diagnostic tool, advancements in other imaging modalities like ultrasound and MRI present some level of substitution, although fluoroscopy's real-time imaging capabilities maintain its significance.

- End-User Trends: The increasing prevalence of chronic diseases, aging population, and rising healthcare expenditure are driving demand for advanced fluoroscopy systems across various applications.

- M&A Activities: The number of mergers and acquisitions in the MEA fluoroscopy market was xx in the historical period (2019-2024), with an expected increase to xx deals in the forecast period (2025-2033). This signifies consolidation and expansion strategies among industry players.

MEA Fluoroscopy Industry Insights & Trends

The MEA fluoroscopy market is projected to experience significant growth during the forecast period (2025-2033). The market size in 2025 is estimated at $xx Million, with a Compound Annual Growth Rate (CAGR) of xx% expected until 2033, reaching a projected $xx Million by the end of the forecast period. This growth is primarily driven by several key factors:

- Rising Healthcare Expenditure: Increased government spending on healthcare infrastructure and technological advancements in several MEA countries is a major catalyst.

- Growing Prevalence of Chronic Diseases: The increasing incidence of cardiovascular diseases, orthopedic conditions, and other ailments requiring fluoroscopic procedures fuels market expansion.

- Technological Advancements: The integration of AI, deep learning, and advanced image processing technologies in fluoroscopy systems is enhancing diagnostic accuracy and efficiency, driving adoption rates.

- Increasing Number of Specialized Hospitals and Clinics: The rise in specialized healthcare facilities equipped with advanced imaging technologies significantly boosts demand for fluoroscopy systems.

- Growing Awareness and Demand for Minimally Invasive Procedures: The increasing preference for minimally invasive surgical procedures that utilize fluoroscopy is a significant growth driver.

Key Markets & Segments Leading MEA Fluoroscopy Industry

The MEA fluoroscopy market is characterized by diverse applications and device types. While the market is spread across several countries, key growth is concentrated in regions experiencing rapid economic development and investment in healthcare infrastructure.

- Dominant Region: The [insert country - e.g., United Arab Emirates] holds the largest market share driven by its robust healthcare infrastructure and high adoption of advanced medical technologies.

- Dominant Device Type: Fixed fluoroscopy systems currently dominate the market due to their precision and advanced features, however, the demand for mobile fluoroscopy systems is growing rapidly owing to increasing demand for point-of-care diagnostics and minimally invasive procedures.

- Dominant Application: Cardiovascular applications account for the largest segment, followed by Orthopedics and general surgery. This is driven by the high prevalence of cardiovascular diseases and the rising number of orthopedic surgeries performed in the region.

Drivers for Key Segments:

- Economic Growth: Rapid economic growth in several MEA countries is directly correlating to increased healthcare spending.

- Infrastructure Development: Investments in healthcare infrastructure, including advanced imaging facilities, boost market growth.

- Government Initiatives: Government initiatives focused on improving healthcare access and quality directly support market expansion.

MEA Fluoroscopy Industry Product Developments

Recent product innovations in the MEA fluoroscopy market include the development of systems with enhanced image quality, advanced features like deep-learning image reconstruction, mobile and portable units allowing for increased accessibility, and improved radiation dose reduction techniques. These advancements are enhancing diagnostic accuracy, improving workflow efficiency, and reducing patient exposure to radiation, thereby driving adoption and creating a competitive advantage for manufacturers.

Challenges in the MEA Fluoroscopy Industry Market

Several factors hinder the growth of the MEA fluoroscopy market. These include high initial investment costs for advanced systems, stringent regulatory approvals which often cause delays, potential supply chain disruptions impacting device availability, and intense competition among established and emerging players. These challenges collectively impact market penetration and growth rate. The estimated impact of these challenges on market growth is approximately xx% reduction in the overall CAGR during the forecast period.

Forces Driving MEA Fluoroscopy Industry Growth

The MEA fluoroscopy market is propelled by several key factors: technological advancements enabling better image quality and minimally invasive procedures, rising healthcare expenditure driven by both government investments and a growing private sector, and supportive regulatory frameworks that facilitate market entry and innovation. The increasing prevalence of chronic diseases also significantly contributes to market growth.

Long-Term Growth Catalysts in the MEA Fluoroscopy Industry

Long-term growth in the MEA fluoroscopy market will be driven by continued innovation in system design, image processing, and AI integration. Strategic partnerships between manufacturers and healthcare providers will play a key role in expanding market access and adoption. The development of cost-effective and portable devices will broaden the market reach into underserved areas.

Emerging Opportunities in MEA Fluoroscopy Industry

Emerging opportunities lie in the development of specialized fluoroscopy systems for specific applications, such as interventional radiology and minimally invasive surgeries. The integration of AI and machine learning for improved diagnostic accuracy and automation presents significant growth potential. Expansion into underserved markets and the development of telemedicine-enabled fluoroscopy will open new avenues for market expansion.

Leading Players in the MEA Fluoroscopy Industry Sector

- Siemens Healthineers

- Varex Imaging Corporation

- Hologic Inc

- Eurocolumbus s.r.l

- Hitachi Medical Systems

- Ziehm Imaging GmbH

- Koninklijke Philips NV

- Canon Medical Systems Corporation

- GE Healthcare (GE Company)

- Shimadzu Corporation

Key Milestones in MEA Fluoroscopy Industry Industry

- April 2022: Dubai London Hospital opens, incorporating advanced deep-learning reconstruction technology in its radiology department. This signifies the adoption of cutting-edge technology in a major healthcare facility.

- February 2022: Almoosa Specialist Hospital and Siemens Healthineers sign a multi-modality deal for equipping the radiology department with advanced Siemens technologies. This strategic partnership underscores the market's focus on technological advancement and highlights the role of key players in driving market growth.

Strategic Outlook for MEA Fluoroscopy Industry Market

The MEA fluoroscopy market presents substantial growth potential driven by ongoing technological advancements, rising healthcare expenditure, and increasing demand for advanced diagnostic imaging. Strategic partnerships, investments in research and development, and targeted expansion into high-growth segments will be crucial for players seeking to capitalize on this market's potential. The integration of AI and the development of specialized fluoroscopy systems will further shape the market's future.

MEA Fluoroscopy Industry Segmentation

-

1. Device Type

- 1.1. Fixed Fluoroscopes

- 1.2. Mobile Fluoroscopes

-

2. Application

- 2.1. Orthopedic

- 2.2. Cardiovascular

- 2.3. Pain Management and Trauma

- 2.4. Neurology

- 2.5. Gastrointestinal

- 2.6. Urology

- 2.7. General Surgery

- 2.8. Other Applications

-

3. Geography

-

3.1. Middle-East & Africa

- 3.1.1. GCC

- 3.1.2. South Africa

- 3.1.3. Rest of Middle-East & Africa

-

3.1. Middle-East & Africa

MEA Fluoroscopy Industry Segmentation By Geography

- 1. Middle East

-

2. GCC

- 2.1. South Africa

- 2.2. Rest of Middle East

MEA Fluoroscopy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Minimally-invasive Surgeries; Growing Geriatric Population and Prevalence of Chronic Diseases; Advantages Associated With Fluoroscopy

- 3.3. Market Restrains

- 3.3.1. Side Effects due to Radiation Exposure; Rising Adoption of Refurbished Systems

- 3.4. Market Trends

- 3.4.1. Cardiovascular Segment is Expected to Hold Significant Market Share over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Fluoroscopy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Fixed Fluoroscopes

- 5.1.2. Mobile Fluoroscopes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Orthopedic

- 5.2.2. Cardiovascular

- 5.2.3. Pain Management and Trauma

- 5.2.4. Neurology

- 5.2.5. Gastrointestinal

- 5.2.6. Urology

- 5.2.7. General Surgery

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Middle-East & Africa

- 5.3.1.1. GCC

- 5.3.1.2. South Africa

- 5.3.1.3. Rest of Middle-East & Africa

- 5.3.1. Middle-East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.4.2. GCC

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Middle East MEA Fluoroscopy Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Fixed Fluoroscopes

- 6.1.2. Mobile Fluoroscopes

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Orthopedic

- 6.2.2. Cardiovascular

- 6.2.3. Pain Management and Trauma

- 6.2.4. Neurology

- 6.2.5. Gastrointestinal

- 6.2.6. Urology

- 6.2.7. General Surgery

- 6.2.8. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Middle-East & Africa

- 6.3.1.1. GCC

- 6.3.1.2. South Africa

- 6.3.1.3. Rest of Middle-East & Africa

- 6.3.1. Middle-East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. GCC MEA Fluoroscopy Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Fixed Fluoroscopes

- 7.1.2. Mobile Fluoroscopes

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Orthopedic

- 7.2.2. Cardiovascular

- 7.2.3. Pain Management and Trauma

- 7.2.4. Neurology

- 7.2.5. Gastrointestinal

- 7.2.6. Urology

- 7.2.7. General Surgery

- 7.2.8. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Middle-East & Africa

- 7.3.1.1. GCC

- 7.3.1.2. South Africa

- 7.3.1.3. Rest of Middle-East & Africa

- 7.3.1. Middle-East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Middle East MEA Fluoroscopy Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. GCC MEA Fluoroscopy Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 South Africa

- 9.1.2 Rest of Middle East

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Siemens Healthineers

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Varex Imaging Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hologic Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Eurocolumbus s r l

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hitachi Medical Systems

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ziehm Imaging GmbH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Koninklijke Philips NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Canon Medical Systems Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 GE Healthcare (GE Company)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Shimadzu Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Siemens Healthineers

List of Figures

- Figure 1: MEA Fluoroscopy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: MEA Fluoroscopy Industry Share (%) by Company 2024

List of Tables

- Table 1: MEA Fluoroscopy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: MEA Fluoroscopy Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 3: MEA Fluoroscopy Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: MEA Fluoroscopy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: MEA Fluoroscopy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: MEA Fluoroscopy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: MEA Fluoroscopy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: MEA Fluoroscopy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa MEA Fluoroscopy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Middle East MEA Fluoroscopy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: MEA Fluoroscopy Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 12: MEA Fluoroscopy Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 13: MEA Fluoroscopy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: MEA Fluoroscopy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: MEA Fluoroscopy Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 16: MEA Fluoroscopy Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: MEA Fluoroscopy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: MEA Fluoroscopy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: South Africa MEA Fluoroscopy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Middle East MEA Fluoroscopy Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Fluoroscopy Industry?

The projected CAGR is approximately 4.03%.

2. Which companies are prominent players in the MEA Fluoroscopy Industry?

Key companies in the market include Siemens Healthineers, Varex Imaging Corporation, Hologic Inc, Eurocolumbus s r l, Hitachi Medical Systems, Ziehm Imaging GmbH, Koninklijke Philips NV, Canon Medical Systems Corporation, GE Healthcare (GE Company), Shimadzu Corporation.

3. What are the main segments of the MEA Fluoroscopy Industry?

The market segments include Device Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 217.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Minimally-invasive Surgeries; Growing Geriatric Population and Prevalence of Chronic Diseases; Advantages Associated With Fluoroscopy.

6. What are the notable trends driving market growth?

Cardiovascular Segment is Expected to Hold Significant Market Share over the Forecast Period.

7. Are there any restraints impacting market growth?

Side Effects due to Radiation Exposure; Rising Adoption of Refurbished Systems.

8. Can you provide examples of recent developments in the market?

In April 2022, Dubai London Hospital opened its doors to patients at Jumeirah Beach Road. The hospital is a part of the established Dubai London Clinic and Speciality Hospital and has a radiology department using advanced deep-learning reconstruction technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Fluoroscopy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Fluoroscopy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Fluoroscopy Industry?

To stay informed about further developments, trends, and reports in the MEA Fluoroscopy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence