Key Insights

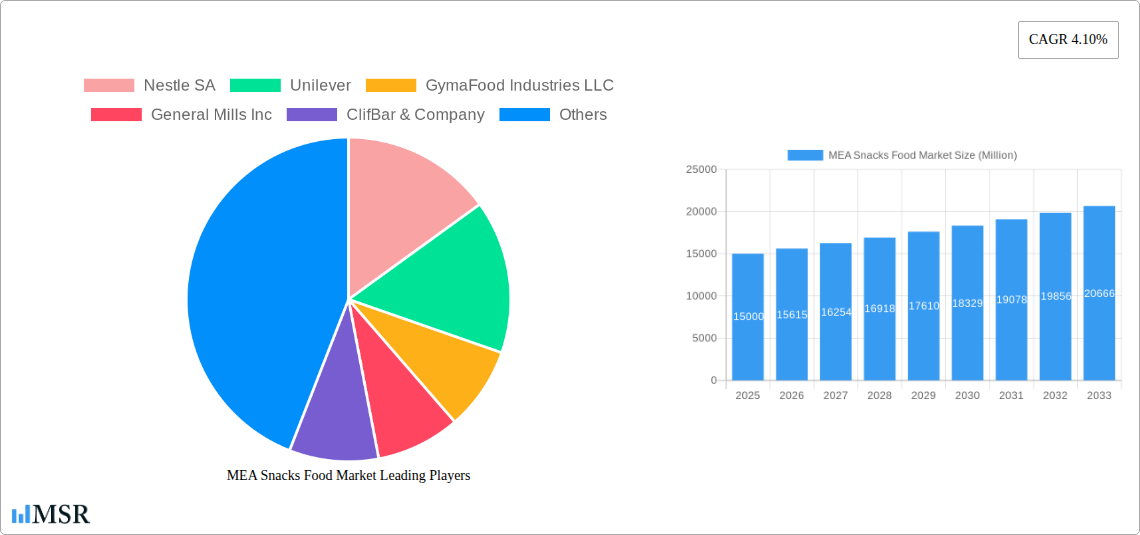

The MEA (Middle East and Africa) snacks food market presents a compelling investment opportunity, exhibiting a robust growth trajectory. While the precise market size for 2025 isn't provided, considering the global CAGR of 4.10% and the region's burgeoning population, particularly in urban areas with rising disposable incomes and changing lifestyle preferences, we can reasonably project significant expansion. Key drivers include the increasing popularity of convenient and on-the-go snacking options, the growing adoption of Westernized diets, and the expanding retail infrastructure, particularly in convenience stores and online platforms. Furthermore, the introduction of innovative snack products catering to specific health and dietary needs, such as healthier options with reduced sugar or gluten-free varieties, contributes significantly to market growth. However, challenges remain, including fluctuating raw material prices, economic instability in certain regions, and potential health concerns associated with excessive snack consumption. The market segmentation reveals strong potential within frozen snacks and confectionery snacks, driven by consumer demand for variety and indulgence. Supermarkets and hypermarkets represent the dominant distribution channel, while online retail is experiencing rapid growth, promising increased penetration in the coming years. Competition is fierce amongst key players, including international giants and regional brands, leading to continuous innovation and product diversification.

The competitive landscape necessitates strategic positioning for success. Companies must focus on catering to specific consumer preferences in diverse MEA markets, adapting product offerings to local tastes and dietary habits. Effective marketing and distribution strategies are crucial for reaching consumers across diverse regions and income levels. Moreover, emphasizing product quality, health and sustainability concerns and utilizing targeted digital marketing campaigns will prove critical in gaining market share. Given the projected growth, companies that invest in research and development, building strong distribution networks, and creating engaging branding strategies are best poised to capitalize on the considerable opportunities presented by the MEA snacks food market. Further research into specific country-level data within MEA would refine market projections and investment strategies.

MEA Snacks Food Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the MEA Snacks Food Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report dissects market dynamics, key segments, leading players, and emerging opportunities within the rapidly evolving MEA snacks landscape. The report leverages detailed data analysis to reveal actionable strategies for success in this lucrative market. The total market size is estimated at xx Million in 2025, with a Compound Annual Growth Rate (CAGR) of xx% projected for 2025-2033.

MEA Snacks Food Market Market Concentration & Dynamics

The MEA snacks food market exhibits a moderately concentrated structure, with key players like Nestlé SA, Unilever, and Mondelez International holding significant market share. However, the presence of numerous regional and local players creates a dynamic competitive landscape. Innovation is a key driver, with companies focusing on healthier options, novel flavors, and convenient packaging formats to cater to evolving consumer preferences. Regulatory frameworks vary across MEA countries, impacting product standards, labeling requirements, and import/export regulations. Substitute products, including fresh fruits, homemade snacks, and other readily available food items, pose a competitive challenge. End-user trends reveal a growing preference for healthier, convenient, and ethically sourced snacks, particularly amongst younger demographics. M&A activities have played a significant role in market consolidation, with xx major deals recorded in the historical period (2019-2024). For example, PepsiCo's acquisition of Senselet Food Processing showcases the strategic importance of regional expansion.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation Ecosystems: Strong emphasis on health and wellness, sustainable sourcing, and innovative packaging.

- Regulatory Frameworks: Varied across MEA countries, impacting product standards and labeling.

- Substitute Products: Fresh fruits, homemade snacks, and other readily available alternatives.

- End-User Trends: Growing demand for healthier, convenient, and ethically sourced snacks.

- M&A Activities: xx major deals recorded between 2019 and 2024, indicating market consolidation.

MEA Snacks Food Market Industry Insights & Trends

The MEA snacks food market is experiencing robust growth, fueled by factors such as rising disposable incomes, rapid urbanization, and changing lifestyle patterns. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033. This growth is further driven by the increasing popularity of convenient snacking options and the growing demand for healthier snacks. Technological advancements in food processing and packaging have enhanced product quality, shelf life, and overall consumer experience. Evolving consumer behaviors show a preference for personalized experiences, greater transparency in ingredients, and sustainable products. The market is witnessing a shift towards healthier options like fruit snacks and protein bars, driven by growing health consciousness. The CAGR for the forecast period (2025-2033) is estimated to be xx%.

Key Markets & Segments Leading MEA Snacks Food Market

The Savory Snacks segment currently dominates the MEA snacks food market, driven by strong demand for potato chips, pretzels, and other savory options. Within distribution channels, Supermarket & Hypermarkets maintain the largest share, followed by convenience stores and a steadily growing online retail sector. The UAE and Saudi Arabia are leading markets in the region, largely owing to high per capita consumption and robust economic growth.

Dominant Regions/Countries:

- UAE: High disposable incomes and a preference for international brands contribute to its dominance.

- Saudi Arabia: Growing population and increased snacking occasions drive demand.

- Egypt: Large population base and increasing urbanization create market opportunities.

Dominant Segments (Type):

- Savory Snacks: High consumption of potato chips, nuts, and other savory items.

- Confectionery Snacks: Strong demand for chocolate bars, candies, and other sweet treats.

- Bakery Snacks: Growing popularity of biscuits, cookies, and pastries.

Dominant Segments (Distribution):

- Supermarket & Hypermarkets: Traditional dominance due to wide reach and established infrastructure.

- Convenience Stores: Increasing popularity due to convenience and accessibility.

- Online Retail Stores: Rapid growth due to increasing internet penetration and e-commerce adoption.

Drivers:

- Economic Growth: Rising disposable incomes fuel spending on discretionary items like snacks.

- Urbanization: Increased urbanization leads to higher snack consumption patterns.

- Changing Lifestyle: Busier lifestyles drive demand for convenient snacking options.

MEA Snacks Food Market Product Developments

Recent years have witnessed significant product innovations in the MEA snacks food market, with a strong emphasis on healthier options, convenient formats, and diverse flavors. Companies are incorporating natural ingredients, reducing sugar and sodium content, and introducing gluten-free, vegan, and other specialized products to cater to specific dietary needs. Technological advancements in packaging, such as retort pouches and modified atmosphere packaging, have enhanced product shelf life and preservation. These innovations help create a competitive edge in the market, attracting health-conscious and convenience-seeking consumers.

Challenges in the MEA Snacks Food Market Market

The MEA snacks food market faces several challenges, including fluctuating raw material prices, stringent regulatory requirements across various countries, and maintaining a stable supply chain, particularly for imported ingredients. Intense competition from established and emerging players necessitates continuous innovation and strategic marketing to maintain market share. Consumer preferences for healthier products also put pressure on manufacturers to reformulate recipes and adjust pricing to meet changing demands. These factors collectively contribute to a complex and dynamic market environment.

Forces Driving MEA Snacks Food Market Growth

The MEA snacks food market is propelled by several key growth drivers. Rising disposable incomes and a burgeoning middle class are fostering higher snack consumption. Rapid urbanization and changing lifestyle patterns lead to increased demand for convenience foods. Technological advancements in food processing and packaging deliver more efficient production and enhanced product quality. Government initiatives promoting food safety and standards further enhance market stability. Favorable demographics, such as a growing youth population, contribute to the long-term growth potential of this market.

Long-Term Growth Catalysts in the MEA Snacks Food Market

Long-term growth in the MEA snacks food market is fueled by continued innovation in product offerings and an increased focus on health and wellness. Strategic partnerships between manufacturers and retailers are strengthening distribution networks. Market expansion into new regions and untapped consumer segments will continue to drive growth. The integration of sustainable practices across the supply chain, including responsible sourcing and eco-friendly packaging, further enhance market attractiveness and cater to the environmentally conscious consumer.

Emerging Opportunities in MEA Snacks Food Market

Emerging opportunities lie in expanding into less-penetrated markets within the MEA region. The growing demand for functional snacks, fortified with vitamins and minerals, presents a significant market segment. The increasing adoption of e-commerce platforms offers new opportunities for direct-to-consumer sales and enhanced brand visibility. Catering to specific dietary needs and preferences, such as gluten-free, vegan, and halal options, allows companies to capture niche markets. Developing innovative packaging solutions that enhance product freshness and shelf life offers a strong competitive edge.

Leading Players in the MEA Snacks Food Market Sector

- Nestle SA

- Unilever

- GymaFood Industries LLC

- General Mills Inc

- ClifBar & Company

- Gellatas Gullon

- BestfoodCo LLC

- Britannia Industries

- Kellogg Company

- Mondelez International

Key Milestones in MEA Snacks Food Market Industry

- October 2021: Launch of TNF Pure Fruit Bar in the UAE, highlighting the growing demand for healthy and vegan options.

- July 2021: Khabib Nurmagomedov launches Fitroo premium protein bars, capitalizing on the rising health and fitness consciousness in the UAE.

- January 2020: PepsiCo acquires Senselet Food Processing, signifying strategic expansion into the Ethiopian market and the growing significance of local sourcing.

Strategic Outlook for MEA Snacks Food Market Market

The MEA snacks food market presents substantial growth potential, driven by expanding consumer bases, rising incomes, and increasing demand for convenient and healthy snacking options. Strategic partnerships, product diversification, and the adoption of sustainable practices are crucial for sustained success. Companies that leverage technological advancements in food processing, packaging, and marketing will gain a competitive edge. The long-term outlook for the MEA snacks food market remains highly positive, with opportunities for both established players and emerging brands to capitalize on the region's growing demand for innovative and appealing snack products.

MEA Snacks Food Market Segmentation

-

1. Type

- 1.1. Frozen Snacks

- 1.2. Savory Snacks

- 1.3. Fruit Snacks

- 1.4. Confectionery Snacks

- 1.5. Bakery Snacks

- 1.6. Others

-

2. Distribution

- 2.1. Supermarket & Hypermarkets

- 2.2. Convenience stores

- 2.3. Online retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. South Africa

- 3.2. Saudi Arabia

- 3.3. Rest of Middle East & Africa

MEA Snacks Food Market Segmentation By Geography

- 1. South Africa

- 2. Saudi Arabia

- 3. Rest of Middle East

MEA Snacks Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid urbanization and busy lifestyles in the MEA region lead to higher consumption of convenient snack foods as part of on-the-go eating habits.

- 3.3. Market Restrains

- 3.3.1 Increasing awareness of health issues related to high sugar

- 3.3.2 salt

- 3.3.3 and fat content in traditional snacks can limit consumption and push consumers towards healthier alternatives.

- 3.4. Market Trends

- 3.4.1. Surging demand for clean-label and free-from snacks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Snacks Food Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Frozen Snacks

- 5.1.2. Savory Snacks

- 5.1.3. Fruit Snacks

- 5.1.4. Confectionery Snacks

- 5.1.5. Bakery Snacks

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution

- 5.2.1. Supermarket & Hypermarkets

- 5.2.2. Convenience stores

- 5.2.3. Online retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Saudi Arabia

- 5.3.3. Rest of Middle East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Saudi Arabia

- 5.4.3. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa MEA Snacks Food Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Frozen Snacks

- 6.1.2. Savory Snacks

- 6.1.3. Fruit Snacks

- 6.1.4. Confectionery Snacks

- 6.1.5. Bakery Snacks

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution

- 6.2.1. Supermarket & Hypermarkets

- 6.2.2. Convenience stores

- 6.2.3. Online retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Saudi Arabia

- 6.3.3. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Saudi Arabia MEA Snacks Food Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Frozen Snacks

- 7.1.2. Savory Snacks

- 7.1.3. Fruit Snacks

- 7.1.4. Confectionery Snacks

- 7.1.5. Bakery Snacks

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution

- 7.2.1. Supermarket & Hypermarkets

- 7.2.2. Convenience stores

- 7.2.3. Online retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Saudi Arabia

- 7.3.3. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of Middle East MEA Snacks Food Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Frozen Snacks

- 8.1.2. Savory Snacks

- 8.1.3. Fruit Snacks

- 8.1.4. Confectionery Snacks

- 8.1.5. Bakery Snacks

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution

- 8.2.1. Supermarket & Hypermarkets

- 8.2.2. Convenience stores

- 8.2.3. Online retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Saudi Arabia

- 8.3.3. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. North America MEA Snacks Food Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 United States

- 9.1.2 Canada

- 9.1.3 Mexico

- 10. Europe MEA Snacks Food Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 Germany

- 10.1.2 United Kingdom

- 10.1.3 France

- 10.1.4 Spain

- 10.1.5 Italy

- 10.1.6 Spain

- 10.1.7 Belgium

- 10.1.8 Netherland

- 10.1.9 Nordics

- 10.1.10 Rest of Europe

- 11. Asia Pacific MEA Snacks Food Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 Japan

- 11.1.3 India

- 11.1.4 South Korea

- 11.1.5 Southeast Asia

- 11.1.6 Australia

- 11.1.7 Indonesia

- 11.1.8 Phillipes

- 11.1.9 Singapore

- 11.1.10 Thailandc

- 11.1.11 Rest of Asia Pacific

- 12. South America MEA Snacks Food Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Brazil

- 12.1.2 Argentina

- 12.1.3 Peru

- 12.1.4 Chile

- 12.1.5 Colombia

- 12.1.6 Ecuador

- 12.1.7 Venezuela

- 12.1.8 Rest of South America

- 13. North America MEA Snacks Food Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United States

- 13.1.2 Canada

- 13.1.3 Mexico

- 14. MEA MEA Snacks Food Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 United Arab Emirates

- 14.1.2 Saudi Arabia

- 14.1.3 South Africa

- 14.1.4 Rest of Middle East and Africa

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Nestle SA

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Unilever

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 GymaFood Industries LLC

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 General Mills Inc

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 ClifBar & Company

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Gellatas Gullon

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 BestfoodCo LLC

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Britannia Industries

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Kellogg Company

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Mondelez International

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Nestle SA

List of Figures

- Figure 1: Global MEA Snacks Food Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America MEA Snacks Food Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America MEA Snacks Food Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe MEA Snacks Food Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe MEA Snacks Food Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific MEA Snacks Food Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific MEA Snacks Food Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America MEA Snacks Food Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America MEA Snacks Food Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America MEA Snacks Food Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America MEA Snacks Food Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA MEA Snacks Food Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA MEA Snacks Food Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: South Africa MEA Snacks Food Market Revenue (Million), by Type 2024 & 2032

- Figure 15: South Africa MEA Snacks Food Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: South Africa MEA Snacks Food Market Revenue (Million), by Distribution 2024 & 2032

- Figure 17: South Africa MEA Snacks Food Market Revenue Share (%), by Distribution 2024 & 2032

- Figure 18: South Africa MEA Snacks Food Market Revenue (Million), by Geography 2024 & 2032

- Figure 19: South Africa MEA Snacks Food Market Revenue Share (%), by Geography 2024 & 2032

- Figure 20: South Africa MEA Snacks Food Market Revenue (Million), by Country 2024 & 2032

- Figure 21: South Africa MEA Snacks Food Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Saudi Arabia MEA Snacks Food Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Saudi Arabia MEA Snacks Food Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Saudi Arabia MEA Snacks Food Market Revenue (Million), by Distribution 2024 & 2032

- Figure 25: Saudi Arabia MEA Snacks Food Market Revenue Share (%), by Distribution 2024 & 2032

- Figure 26: Saudi Arabia MEA Snacks Food Market Revenue (Million), by Geography 2024 & 2032

- Figure 27: Saudi Arabia MEA Snacks Food Market Revenue Share (%), by Geography 2024 & 2032

- Figure 28: Saudi Arabia MEA Snacks Food Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Saudi Arabia MEA Snacks Food Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Rest of Middle East MEA Snacks Food Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Rest of Middle East MEA Snacks Food Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Rest of Middle East MEA Snacks Food Market Revenue (Million), by Distribution 2024 & 2032

- Figure 33: Rest of Middle East MEA Snacks Food Market Revenue Share (%), by Distribution 2024 & 2032

- Figure 34: Rest of Middle East MEA Snacks Food Market Revenue (Million), by Geography 2024 & 2032

- Figure 35: Rest of Middle East MEA Snacks Food Market Revenue Share (%), by Geography 2024 & 2032

- Figure 36: Rest of Middle East MEA Snacks Food Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Rest of Middle East MEA Snacks Food Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global MEA Snacks Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global MEA Snacks Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global MEA Snacks Food Market Revenue Million Forecast, by Distribution 2019 & 2032

- Table 4: Global MEA Snacks Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global MEA Snacks Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global MEA Snacks Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global MEA Snacks Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Belgium MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherland MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Nordics MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global MEA Snacks Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Southeast Asia MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Phillipes MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global MEA Snacks Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Peru MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Chile MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Colombia MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Ecuador MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Venezuela MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global MEA Snacks Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United States MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Canada MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mexico MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global MEA Snacks Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: United Arab Emirates MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Saudi Arabia MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East and Africa MEA Snacks Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global MEA Snacks Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global MEA Snacks Food Market Revenue Million Forecast, by Distribution 2019 & 2032

- Table 53: Global MEA Snacks Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 54: Global MEA Snacks Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global MEA Snacks Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Global MEA Snacks Food Market Revenue Million Forecast, by Distribution 2019 & 2032

- Table 57: Global MEA Snacks Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 58: Global MEA Snacks Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global MEA Snacks Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Global MEA Snacks Food Market Revenue Million Forecast, by Distribution 2019 & 2032

- Table 61: Global MEA Snacks Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 62: Global MEA Snacks Food Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Snacks Food Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the MEA Snacks Food Market?

Key companies in the market include Nestle SA, Unilever, GymaFood Industries LLC, General Mills Inc, ClifBar & Company, Gellatas Gullon, BestfoodCo LLC, Britannia Industries, Kellogg Company, Mondelez International.

3. What are the main segments of the MEA Snacks Food Market?

The market segments include Type, Distribution, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid urbanization and busy lifestyles in the MEA region lead to higher consumption of convenient snack foods as part of on-the-go eating habits..

6. What are the notable trends driving market growth?

Surging demand for clean-label and free-from snacks.

7. Are there any restraints impacting market growth?

Increasing awareness of health issues related to high sugar. salt. and fat content in traditional snacks can limit consumption and push consumers towards healthier alternatives..

8. Can you provide examples of recent developments in the market?

In October 2021, the TNF Pure Fruit Bar brand launched in the United Arab Emirates. The fruit bars are vegan and vegetarian, gluten-free, dairy-free, and nut-free, and have no preservatives, additives, or colorants. The bars are available in three variants Strawberry, Apricot, and Raspberry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Snacks Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Snacks Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Snacks Food Market?

To stay informed about further developments, trends, and reports in the MEA Snacks Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence