Key Insights

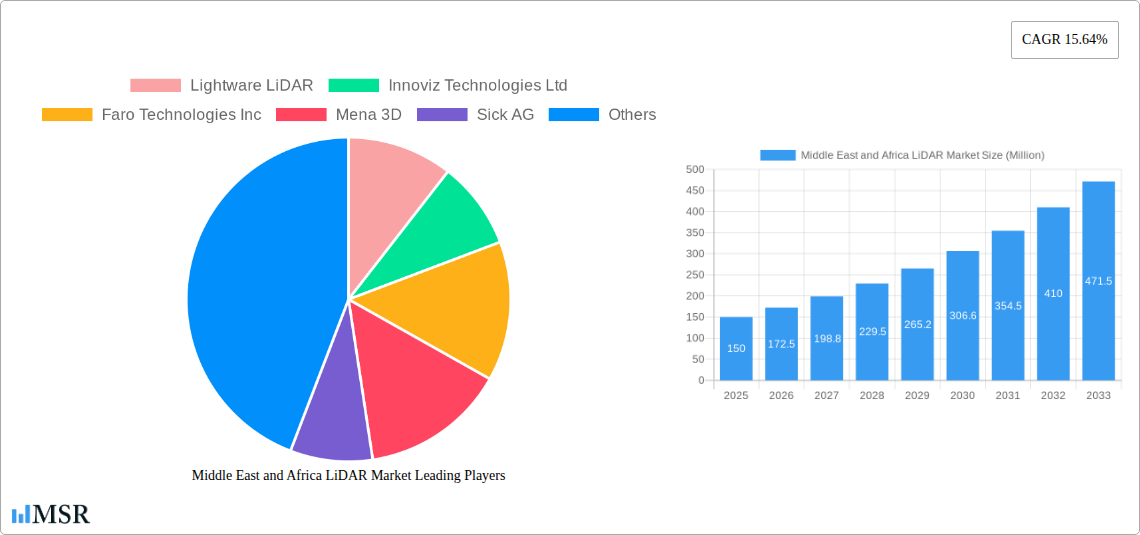

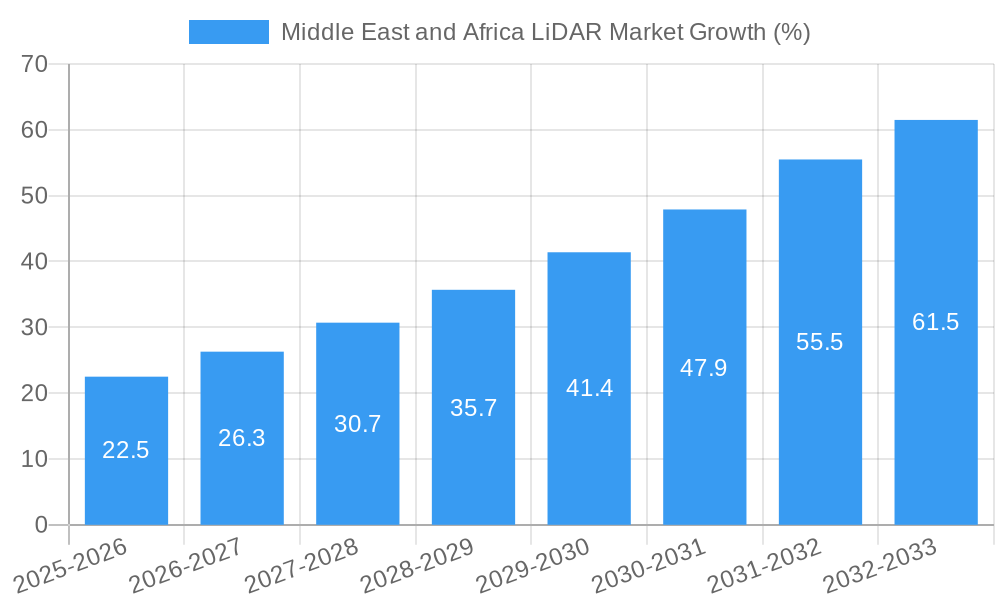

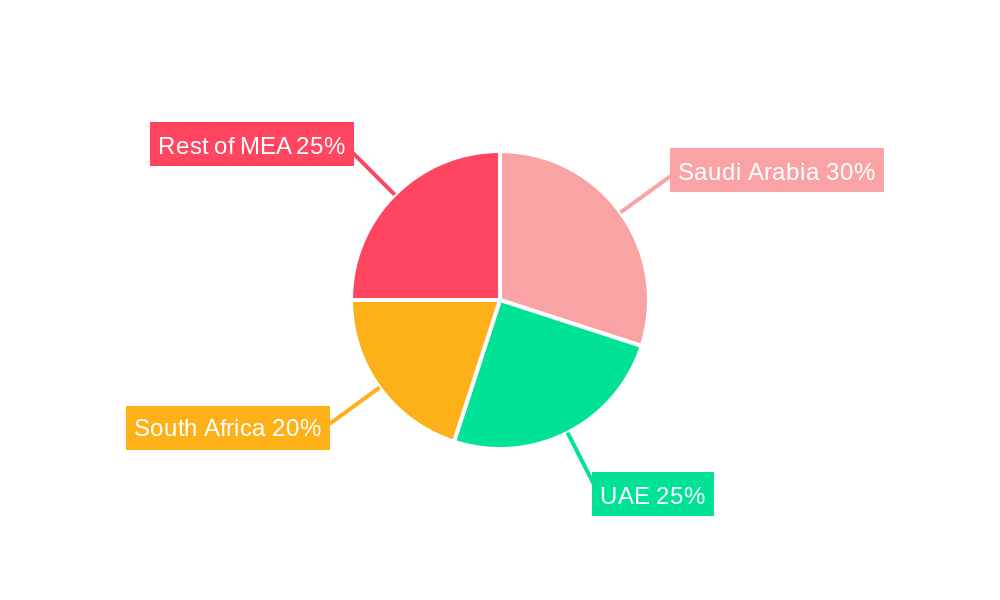

The Middle East and Africa (MEA) LiDAR market is experiencing robust growth, driven by increasing infrastructure development, rapid urbanization, and the burgeoning adoption of autonomous vehicles and precision agriculture. The market's Compound Annual Growth Rate (CAGR) of 15.64% from 2019 to 2024 indicates significant potential. Key application areas driving this growth include engineering and construction surveys, mining operations, high-definition mapping for autonomous driving initiatives, and advancements in precision agriculture techniques. The prevalence of challenging terrains across the region is also fueling demand for LiDAR solutions offering superior accuracy and efficiency compared to traditional surveying methods. Specific countries like Saudi Arabia and the UAE are leading the market due to substantial investments in infrastructure projects, while South Africa shows promising growth due to its mining sector and developing automotive industry. The market is segmented into Aerial LiDAR, Ground-based LiDAR, and various components like GPS, Laser Scanners, and Inertial Measurement Units. The increasing availability of sophisticated LiDAR systems at competitive prices is further boosting market penetration. However, challenges such as high initial investment costs, the need for skilled professionals to operate the technology, and data processing complexities might somewhat restrain the market's growth trajectory in certain regions. Nevertheless, ongoing technological advancements, such as improved sensor accuracy and miniaturization, and the integration of LiDAR with other sensor technologies are expected to overcome these limitations in the long run, fostering continued expansion.

The MEA LiDAR market shows a promising outlook for the forecast period (2025-2033). While precise market size figures for 2025 and beyond require more specific data, extrapolating from the historical CAGR of 15.64% and considering the region's projected infrastructure and technological developments, a significant increase in market value is anticipated. This expansion will be fueled by government initiatives promoting smart cities and digitalization, the rising adoption of advanced technologies across diverse sectors, and continuous improvements in LiDAR technology itself. Competition among established players like Leica Geosystems, Trimble, and emerging local companies is likely to further intensify, leading to innovation and potentially driving down prices, making LiDAR technology more accessible to a broader range of applications and users across the MEA region.

Middle East and Africa LiDAR Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa LiDAR market, offering actionable insights for stakeholders across the industry value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers crucial data for informed decision-making. The market is segmented by product (Aerial LiDAR, Ground-based LiDAR), components (GPS, Laser Scanners, Inertial Measurement Unit, Other Components), end-user (Engineering, Automotive, Industrial, Aerospace & Defense), and key countries (Saudi Arabia, United Arab Emirates, South Africa, Rest of Middle East and Africa). Key players analyzed include Lightware LiDAR, Innoviz Technologies Ltd, Faro Technologies Inc, Mena 3D, Sick AG, Falcon-3D, Trimble Inc, Globalscan Technologies LLC, Neptec Technologies Corp, and Leica Geosystems Ag. The report is packed with valuable data, including market size estimations, CAGR projections, and competitive landscape analysis.

Middle East and Africa LiDAR Market Market Concentration & Dynamics

The Middle East and Africa LiDAR market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of several smaller, specialized companies fosters a dynamic competitive environment. Market concentration is influenced by factors such as technological advancements, regulatory frameworks, and the adoption of LiDAR technology across various end-user segments. The innovation ecosystem is growing, driven by investments in R&D and partnerships between technology providers and end-users. Regulatory frameworks vary across countries, influencing market access and adoption rates. Substitute technologies, such as photogrammetry, pose a level of competition, but LiDAR's superior accuracy and data density often outweigh these alternatives. End-user trends indicate a growing preference for higher accuracy and efficiency in data acquisition, particularly within the surveying, mapping, and autonomous vehicle sectors. M&A activity has been moderate, with a projected xx number of deals in the forecast period, mostly focusing on consolidating market share and acquiring specialized technologies.

- Market Share: Top 5 players hold approximately xx% of the market share in 2025.

- M&A Deal Count (2019-2024): xx deals.

- Projected M&A Deal Count (2025-2033): xx deals.

Middle East and Africa LiDAR Market Industry Insights & Trends

The Middle East and Africa LiDAR market is experiencing robust growth, driven by factors such as increasing infrastructure development, rising adoption of autonomous vehicles, and the growing demand for high-precision mapping and surveying services. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Technological disruptions, such as the development of solid-state LiDAR and advancements in sensor fusion technologies, are further accelerating market expansion. Evolving consumer behavior, marked by an increased preference for data-driven decision-making across various sectors, is driving the adoption of LiDAR technology. The demand for accurate 3D data is fueling innovation in LiDAR applications, ranging from precision agriculture to urban planning and infrastructure monitoring. The market is also witnessing increased investments in R&D, leading to the development of cost-effective and more efficient LiDAR systems.

Key Markets & Segments Leading Middle East and Africa LiDAR Market

The Saudi Arabia and the United Arab Emirates represent the largest LiDAR markets within the region, fueled by significant investments in infrastructure development and smart city initiatives. The Ground-based LiDAR segment currently dominates, primarily due to its widespread use in surveying and mapping applications. However, the Aerial LiDAR segment is projected to witness substantial growth in the forecast period due to increasing demand for large-scale mapping and 3D modeling projects.

Key Drivers:

- Saudi Arabia & UAE: Large-scale infrastructure projects, smart city initiatives, and rising investments in autonomous driving technologies.

- South Africa: Growing mining and construction sectors driving demand for high-precision surveying and mapping.

- Rest of MEA: Increasing government investment in infrastructure and adoption of LiDAR in various applications.

Segment Dominance:

- Product: Ground-based LiDAR currently holds the largest market share, while Aerial LiDAR is expected to grow significantly.

- Component: Laser Scanners form the largest component segment.

- End-user: The Engineering sector is currently the largest end-user, closely followed by the Automotive sector.

Middle East and Africa LiDAR Market Product Developments

Recent years have seen significant advancements in LiDAR technology, leading to the development of smaller, lighter, and more cost-effective systems. Solid-state LiDAR technology is gaining traction, offering improved reliability and reduced maintenance costs. New applications are emerging, including precision agriculture, autonomous delivery systems, and improved robotics in various sectors. These technological advancements are enhancing the competitive landscape, providing businesses with improved accuracy, efficiency, and data-processing capabilities.

Challenges in the Middle East and Africa LiDAR Market Market

The Middle East and Africa LiDAR market faces several challenges, including the high initial investment costs associated with LiDAR systems. Supply chain disruptions, especially during periods of global uncertainty, can impact the availability and pricing of LiDAR components. Strict regulatory frameworks and data privacy concerns can sometimes hinder the widespread adoption of LiDAR technology. Furthermore, competition from established players and the emergence of new entrants create competitive pressures within the market. These factors can collectively constrain market growth to a certain extent.

Forces Driving Middle East and Africa LiDAR Market Growth

Several key factors are driving the growth of the Middle East and Africa LiDAR market. Technological advancements, such as the development of solid-state LiDAR and improved sensor fusion, are leading to more accurate, efficient, and cost-effective systems. Significant investments in infrastructure development across the region are increasing demand for high-precision surveying and mapping services. Government initiatives supporting the adoption of autonomous vehicles and smart city technologies are also boosting market growth. Furthermore, the growing need for data-driven decision-making in various sectors is fueling the adoption of LiDAR technology.

Challenges in the Middle East and Africa LiDAR Market Market

Long-term growth will be driven by continuous technological innovation, strategic partnerships between LiDAR manufacturers and end-users, and expanding market applications. The development of new applications in sectors like precision agriculture and environmental monitoring will further stimulate growth. Furthermore, the integration of LiDAR with other technologies, such as AI and machine learning, will unlock new opportunities and enhance market potential in the long run.

Emerging Opportunities in Middle East and Africa LiDAR Market

Emerging opportunities include the expansion of LiDAR applications into new markets, such as renewable energy and mining, and the development of new sensor fusion technologies. The increasing demand for high-resolution 3D mapping for urban planning and infrastructure management represents a substantial opportunity. Furthermore, the growing adoption of autonomous vehicles and drones creates potential for significant market expansion.

Leading Players in the Middle East and Africa LiDAR Market Sector

- Lightware LiDAR

- Innoviz Technologies Ltd

- Faro Technologies Inc

- Mena 3D

- Sick AG

- Falcon-3D

- Trimble Inc

- Globalscan Technologies LLC

- Neptec Technologies Corp

- Leica Geosystems Ag

Key Milestones in Middle East and Africa LiDAR Market Industry

- 2020: Launch of a new solid-state LiDAR sensor by a major player.

- 2021: Successful implementation of LiDAR technology in a large-scale infrastructure project in the UAE.

- 2022: Significant investment in LiDAR-based autonomous vehicle technology by a regional automotive company.

- 2023: Partnership between a LiDAR manufacturer and a leading surveying firm in South Africa.

- 2024: Introduction of new regulations impacting the use of LiDAR in certain applications.

Strategic Outlook for Middle East and Africa LiDAR Market Market

The Middle East and Africa LiDAR market presents significant growth potential in the coming years. Strategic partnerships, technological advancements, and the continued expansion into new sectors will fuel market growth. The focus on improving the accuracy, efficiency, and affordability of LiDAR systems is key to unlocking the full potential of this technology across the region. Companies that effectively adapt to changing market dynamics and invest in R&D will be well-positioned to capitalize on emerging opportunities.

Middle East and Africa LiDAR Market Segmentation

-

1. Product

- 1.1. Aerial LiDAR

- 1.2. Ground-based LiDAR

-

2. Components

- 2.1. GPS

- 2.2. Laser Scanners

- 2.3. Inertial Measurement Unit

- 2.4. Other Components

-

3. End-User

- 3.1. Engineering

- 3.2. Automotive

- 3.3. Industrial

- 3.4. Aerospace & Defense

Middle East and Africa LiDAR Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa LiDAR Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Applications In Government Sector; Increasing Demand of LiDAR Sensors in Oil and Gas Industry

- 3.3. Market Restrains

- 3.3.1. ; High Cost of The LiDAR Systems

- 3.4. Market Trends

- 3.4.1. The Growing Usage of Drones will drive the Growth of this Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Aerial LiDAR

- 5.1.2. Ground-based LiDAR

- 5.2. Market Analysis, Insights and Forecast - by Components

- 5.2.1. GPS

- 5.2.2. Laser Scanners

- 5.2.3. Inertial Measurement Unit

- 5.2.4. Other Components

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Engineering

- 5.3.2. Automotive

- 5.3.3. Industrial

- 5.3.4. Aerospace & Defense

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. South Africa Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Lightware LiDAR

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Innoviz Technologies Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Faro Technologies Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Mena 3D

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Sick AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Falcon-3D

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Trimble Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Globalscan Technologies LLC*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Neptec Technologies Corp

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Leica Geosystems Ag

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Lightware LiDAR

List of Figures

- Figure 1: Middle East and Africa LiDAR Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa LiDAR Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa LiDAR Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa LiDAR Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Middle East and Africa LiDAR Market Revenue Million Forecast, by Components 2019 & 2032

- Table 4: Middle East and Africa LiDAR Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Middle East and Africa LiDAR Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East and Africa LiDAR Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East and Africa LiDAR Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Middle East and Africa LiDAR Market Revenue Million Forecast, by Components 2019 & 2032

- Table 15: Middle East and Africa LiDAR Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: Middle East and Africa LiDAR Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Saudi Arabia Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Arab Emirates Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Israel Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Qatar Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Kuwait Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Oman Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bahrain Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Jordan Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Lebanon Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa LiDAR Market?

The projected CAGR is approximately 15.64%.

2. Which companies are prominent players in the Middle East and Africa LiDAR Market?

Key companies in the market include Lightware LiDAR, Innoviz Technologies Ltd, Faro Technologies Inc, Mena 3D, Sick AG, Falcon-3D, Trimble Inc, Globalscan Technologies LLC*List Not Exhaustive, Neptec Technologies Corp, Leica Geosystems Ag.

3. What are the main segments of the Middle East and Africa LiDAR Market?

The market segments include Product, Components, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Applications In Government Sector; Increasing Demand of LiDAR Sensors in Oil and Gas Industry.

6. What are the notable trends driving market growth?

The Growing Usage of Drones will drive the Growth of this Market.

7. Are there any restraints impacting market growth?

; High Cost of The LiDAR Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa LiDAR Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa LiDAR Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa LiDAR Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa LiDAR Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence