Key Insights

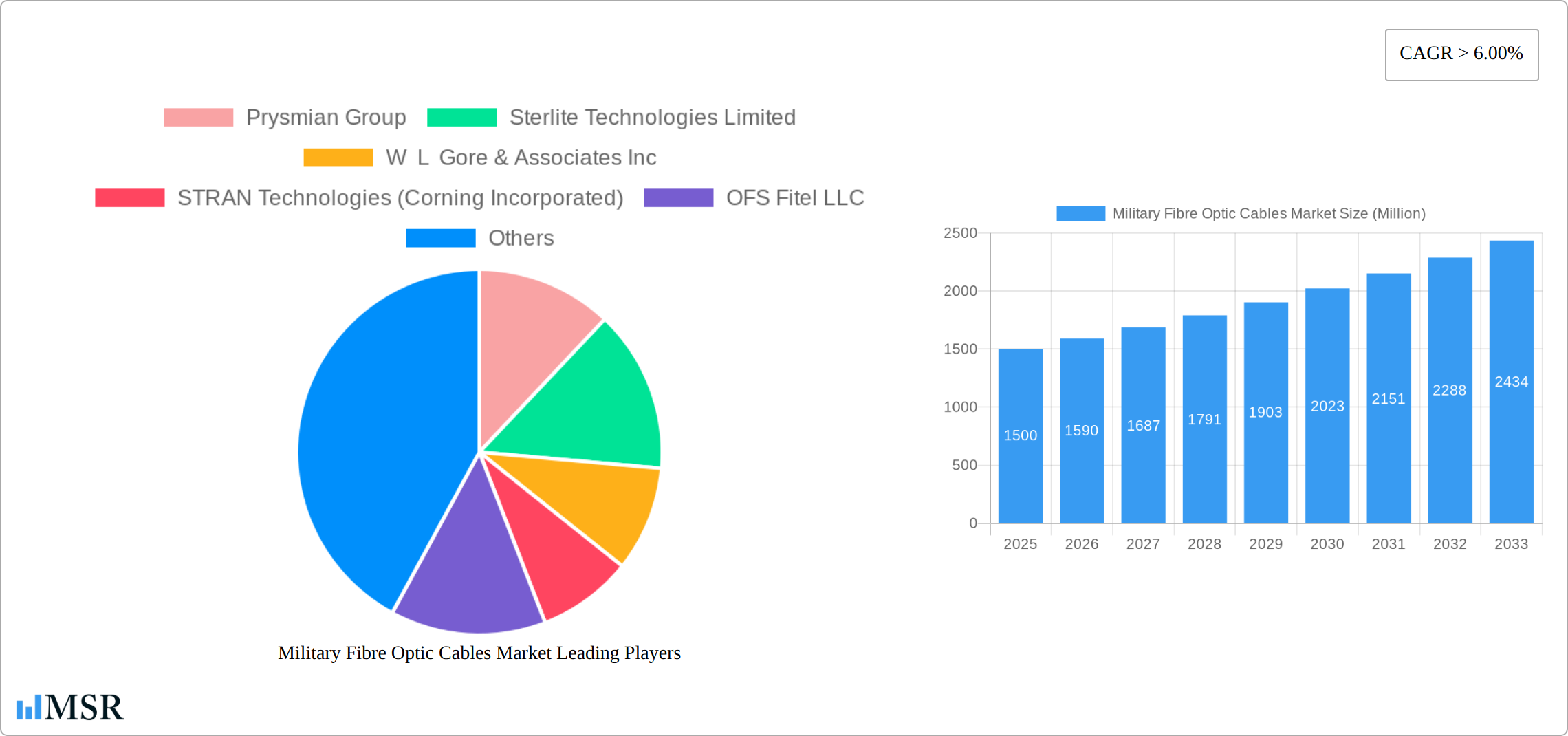

The Military Fibre Optic Cables market is experiencing robust growth, driven by increasing demand for secure and high-bandwidth communication systems within defense applications. The market's Compound Annual Growth Rate (CAGR) exceeding 6% from 2019-2024 indicates a consistently expanding market size. Key drivers include the modernization of military communication infrastructure, the rise of unmanned aerial vehicles (UAVs) and autonomous systems requiring reliable data transmission, and the growing adoption of advanced technologies like sensor networks and battlefield surveillance systems. The increasing preference for fiber optic cables over traditional copper wiring, due to their superior bandwidth, security, and resistance to electromagnetic interference (EMI), further fuels market expansion. Segmentation reveals a preference for single-mode fiber for long-distance transmission and glass optical fiber for enhanced performance and durability. Leading players like Prysmian Group, Sterlite Technologies, and Corning Incorporated are actively shaping the market landscape through innovation and strategic partnerships. Regional analysis suggests that North America and Europe currently hold significant market shares, while the Asia-Pacific region is projected to experience substantial growth owing to rising defense budgets and infrastructure development.

Looking ahead to 2025-2033, the market is poised for continued expansion. Technological advancements in fiber optic cable design, such as the development of smaller, lighter, and more robust cables, will further drive market growth. Government investments in defense modernization programs across various nations will continue to stimulate demand. However, challenges like the high initial investment costs associated with fiber optic cable deployment and the potential for supply chain disruptions could pose restraints. Despite these challenges, the long-term prospects remain positive, with the market anticipated to reach a substantial size by 2033, driven by consistent technological advancements, increasing defense spending, and the sustained demand for secure and reliable military communication systems.

Military Fibre Optic Cables Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Military Fibre Optic Cables Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market dynamics, key segments, leading players, and emerging opportunities, providing actionable intelligence for informed business strategies. The global market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Military Fibre Optic Cables Market Market Concentration & Dynamics

The Military Fibre Optic Cables Market exhibits a moderately concentrated landscape, with key players like Prysmian Group, Sterlite Technologies Limited, and Nexans holding significant market share. However, the presence of several smaller, specialized players fosters competition and innovation. The market is driven by increasing demand for secure and high-bandwidth communication systems in defense applications, coupled with ongoing technological advancements in fiber optic cable technology.

Market Concentration Metrics:

- Market Share of Top 3 Players: xx% (Estimated)

- Market Share of Top 5 Players: xx% (Estimated)

- Number of M&A Deals (2019-2024): xx

Market Dynamics:

- Innovation Ecosystems: Robust R&D efforts by leading players are pushing the boundaries of fiber optic cable technology, particularly in areas like multicore fibers and enhanced durability.

- Regulatory Frameworks: Government regulations concerning defense procurement and cybersecurity significantly influence market growth.

- Substitute Products: While limited, alternative communication technologies exist; however, fiber optics retain a significant advantage in terms of bandwidth and security.

- End-User Trends: The increasing adoption of advanced communication systems within military operations is a primary growth driver.

- M&A Activities: Strategic acquisitions and mergers are expected to continue shaping the market landscape, leading to consolidation.

Military Fibre Optic Cables Market Industry Insights & Trends

The Military Fibre Optic Cables Market is experiencing robust growth, driven by factors such as rising defense budgets globally, the increasing need for secure and reliable communication networks in military operations, and the growing adoption of advanced technologies like unmanned aerial vehicles (UAVs) and autonomous systems. Technological disruptions, particularly in the development of more resilient and higher-bandwidth fiber optic cables, are further fueling market expansion. The market size in 2025 is estimated to be xx Million, and is projected to reach xx Million by 2033. Evolving consumer behaviors, in this case the specific needs of military users, are heavily influencing product development, leading to specialized cables optimized for specific applications and environmental conditions. This involves an increasing demand for cables capable of withstanding harsh conditions and delivering superior performance in challenging environments.

Key Markets & Segments Leading Military Fibre Optic Cables Market

The North American region is currently the dominant market for military fibre optic cables, driven by substantial defense spending and the presence of major technology manufacturers. However, Asia-Pacific is expected to witness significant growth in the coming years, fueled by increasing military modernization efforts in several countries within the region.

Dominant Segments:

- Cable Type: Glass Optical Fibre holds a larger market share due to its superior performance characteristics compared to Plastic Optical Fibre. Single-mode fibers are prevalent, offering higher bandwidth capabilities crucial for advanced military applications.

- Material Type: Glass Optical Fibre dominates the market due to its higher bandwidth capacity and lower signal attenuation.

Regional Drivers:

- North America: High defense budgets, technological advancements, and robust infrastructure.

- Europe: Significant defense spending and ongoing modernization programs.

- Asia-Pacific: Increasing military expenditure and modernization initiatives in several countries.

Military Fibre Optic Cables Market Product Developments

Recent innovations include the development of multicore fibers that significantly increase bandwidth capacity within a single cable, as demonstrated by OFS's TeraWave SCUBA 4X Multicore Ocean Fiber launch in March 2023. This advancement offers a competitive edge by improving data transmission capabilities in demanding environments. Further advancements focus on enhancing cable durability and resistance to environmental factors like extreme temperatures and physical stress.

Challenges in the Military Fibre Optic Cables Market Market

The market faces challenges including stringent regulatory compliance requirements, potential supply chain disruptions impacting raw material availability, and intense competition among established and emerging players. These factors can lead to increased costs and potentially affect market growth trajectory. For example, xx% of supply chain disruptions in 2024 impacted production timelines and cost xx million in lost revenue (estimated).

Forces Driving Military Fibre Optic Cables Market Growth

Key growth drivers include escalating defense budgets worldwide, increased demand for high-bandwidth communication systems in military operations, the adoption of advanced military technologies (e.g., UAVs), and continuous technological improvements in fiber optic cable technology resulting in enhanced performance and durability. Government initiatives promoting domestic production and cybersecurity further stimulate market expansion.

Long-Term Growth Catalysts in the Military Fibre Optic Cables Market

Long-term growth will be fueled by ongoing technological innovations, strategic partnerships between cable manufacturers and defense contractors, and market expansion into emerging economies with growing military spending. Focus on developing specialized cables for specific applications (e.g., underwater, airborne) and increased collaboration across the supply chain will play a crucial role in shaping future market growth.

Emerging Opportunities in Military Fibre Optic Cables Market

Emerging opportunities lie in developing specialized cables for underwater and airborne applications, incorporating advanced sensor integration into fiber optic cables for enhanced situational awareness, and exploring the potential of utilizing fiber optics for power transmission in military applications. Expansion into new markets in developing countries with modernization efforts presents significant potential.

Leading Players in the Military Fibre Optic Cables Market Sector

- Prysmian Group

- Sterlite Technologies Limited

- W L Gore & Associates Inc

- STRAN Technologies (Corning Incorporated)

- OFS Fitel LLC

- Timbercon Inc

- Nexans

- G&H

- Sumitomo Electric Lightwave Corp

- Infinite Electronics International Inc

- OCC

Key Milestones in Military Fibre Optic Cables Market Industry

- November 2021: Nexans and Terna announced a contract exceeding EUR 650 million for the Tyrrhenian Link project, highlighting significant investment in subsea cable infrastructure.

- March 2023: OFS announced the TeraWave SCUBA 4X Multicore Ocean Fiber, representing a substantial advancement in high-bandwidth ocean applications.

Strategic Outlook for Military Fibre Optic Cables Market Market

The Military Fibre Optic Cables Market is poised for continued growth, driven by technological advancements, increasing defense spending, and evolving military communication requirements. Strategic opportunities exist for companies to focus on innovation, strategic partnerships, and expansion into new geographical markets. The market's future trajectory is strongly tied to the ongoing technological advancements and the geopolitical landscape influencing military spending worldwide.

Military Fibre Optic Cables Market Segmentation

-

1. Cable Type

- 1.1. Single-mode

- 1.2. Multi-mode

-

2. Material Type

- 2.1. Plastic Optical Fibre

- 2.2. Glass Optical Fibre

Military Fibre Optic Cables Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Military Fibre Optic Cables Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Plastic Optical Fiber to Dominate Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 5.1.1. Single-mode

- 5.1.2. Multi-mode

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Plastic Optical Fibre

- 5.2.2. Glass Optical Fibre

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Cable Type

- 6. North America Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Cable Type

- 6.1.1. Single-mode

- 6.1.2. Multi-mode

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Plastic Optical Fibre

- 6.2.2. Glass Optical Fibre

- 6.1. Market Analysis, Insights and Forecast - by Cable Type

- 7. Europe Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Cable Type

- 7.1.1. Single-mode

- 7.1.2. Multi-mode

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Plastic Optical Fibre

- 7.2.2. Glass Optical Fibre

- 7.1. Market Analysis, Insights and Forecast - by Cable Type

- 8. Asia Pacific Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Cable Type

- 8.1.1. Single-mode

- 8.1.2. Multi-mode

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Plastic Optical Fibre

- 8.2.2. Glass Optical Fibre

- 8.1. Market Analysis, Insights and Forecast - by Cable Type

- 9. Rest of the World Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Cable Type

- 9.1.1. Single-mode

- 9.1.2. Multi-mode

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Plastic Optical Fibre

- 9.2.2. Glass Optical Fibre

- 9.1. Market Analysis, Insights and Forecast - by Cable Type

- 10. North America Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Military Fibre Optic Cables Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Prysmian Group

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Sterlite Technologies Limited

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 W L Gore & Associates Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 STRAN Technologies (Corning Incorporated)

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 OFS Fitel LLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Timbercon Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Nexans

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 G&H

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Sumitomo Electric Lightwave Corp

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Infinite Electronics International Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 OCC

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Prysmian Group

List of Figures

- Figure 1: Global Military Fibre Optic Cables Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Military Fibre Optic Cables Market Revenue (Million), by Cable Type 2024 & 2032

- Figure 11: North America Military Fibre Optic Cables Market Revenue Share (%), by Cable Type 2024 & 2032

- Figure 12: North America Military Fibre Optic Cables Market Revenue (Million), by Material Type 2024 & 2032

- Figure 13: North America Military Fibre Optic Cables Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 14: North America Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Military Fibre Optic Cables Market Revenue (Million), by Cable Type 2024 & 2032

- Figure 17: Europe Military Fibre Optic Cables Market Revenue Share (%), by Cable Type 2024 & 2032

- Figure 18: Europe Military Fibre Optic Cables Market Revenue (Million), by Material Type 2024 & 2032

- Figure 19: Europe Military Fibre Optic Cables Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 20: Europe Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Military Fibre Optic Cables Market Revenue (Million), by Cable Type 2024 & 2032

- Figure 23: Asia Pacific Military Fibre Optic Cables Market Revenue Share (%), by Cable Type 2024 & 2032

- Figure 24: Asia Pacific Military Fibre Optic Cables Market Revenue (Million), by Material Type 2024 & 2032

- Figure 25: Asia Pacific Military Fibre Optic Cables Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 26: Asia Pacific Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Military Fibre Optic Cables Market Revenue (Million), by Cable Type 2024 & 2032

- Figure 29: Rest of the World Military Fibre Optic Cables Market Revenue Share (%), by Cable Type 2024 & 2032

- Figure 30: Rest of the World Military Fibre Optic Cables Market Revenue (Million), by Material Type 2024 & 2032

- Figure 31: Rest of the World Military Fibre Optic Cables Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 32: Rest of the World Military Fibre Optic Cables Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Military Fibre Optic Cables Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 3: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 4: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Military Fibre Optic Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Military Fibre Optic Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Military Fibre Optic Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Military Fibre Optic Cables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 14: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 15: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 17: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 18: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 20: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 21: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Cable Type 2019 & 2032

- Table 23: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 24: Global Military Fibre Optic Cables Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Fibre Optic Cables Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Military Fibre Optic Cables Market?

Key companies in the market include Prysmian Group, Sterlite Technologies Limited, W L Gore & Associates Inc, STRAN Technologies (Corning Incorporated), OFS Fitel LLC, Timbercon Inc, Nexans, G&H, Sumitomo Electric Lightwave Corp, Infinite Electronics International Inc, OCC.

3. What are the main segments of the Military Fibre Optic Cables Market?

The market segments include Cable Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Plastic Optical Fiber to Dominate Market Share.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In November 2021, Nexans and Terna announced a contract of more than EUR 650 million. As per the terms of the contract, Nexans will provide 500km of 500kV HVDC mass-impregnated subsea cable link for the Tyrrhenian Link project to build a new electricity corridor connecting Sicily and Sardinia to Italy's mainland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Fibre Optic Cables Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Fibre Optic Cables Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Fibre Optic Cables Market?

To stay informed about further developments, trends, and reports in the Military Fibre Optic Cables Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence