Key Insights

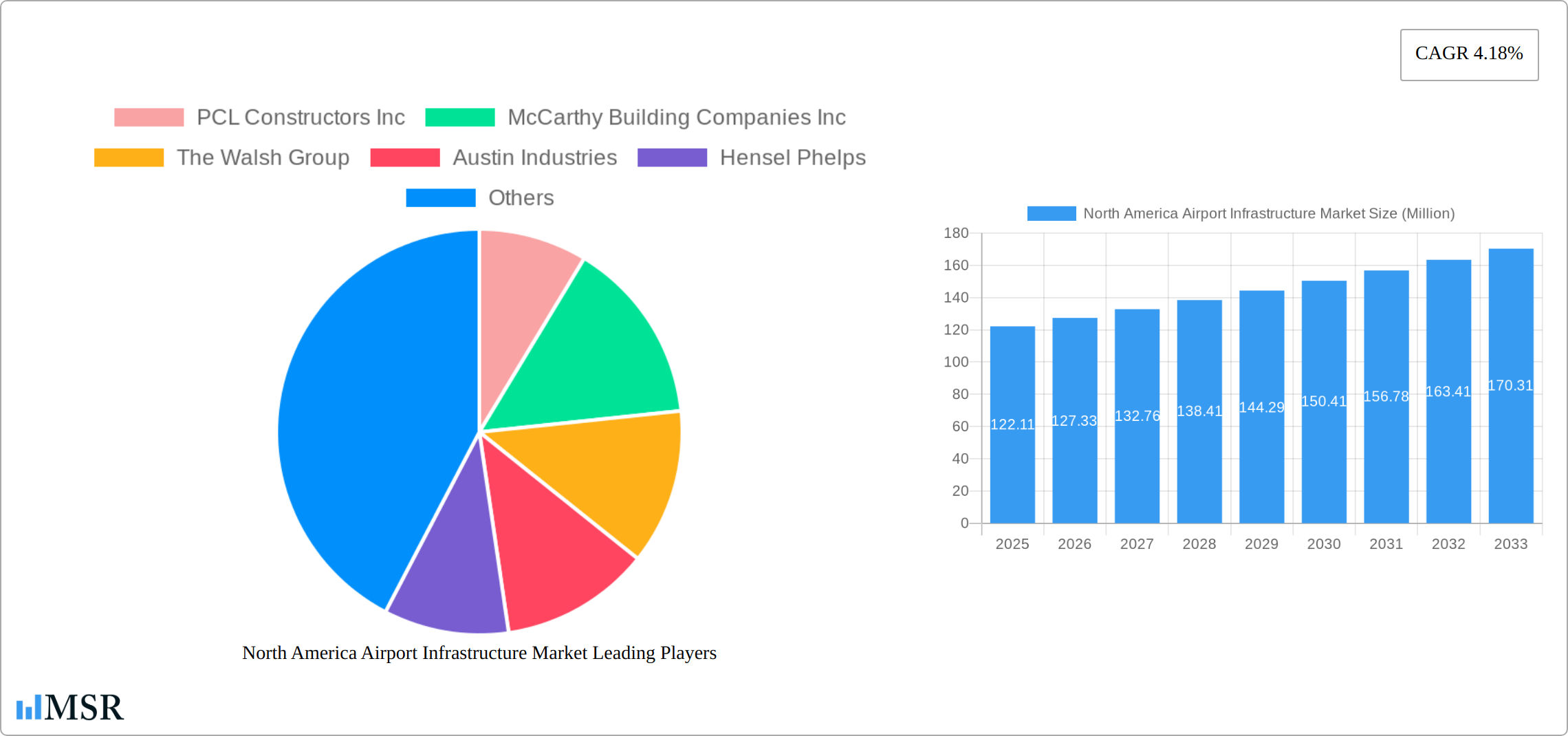

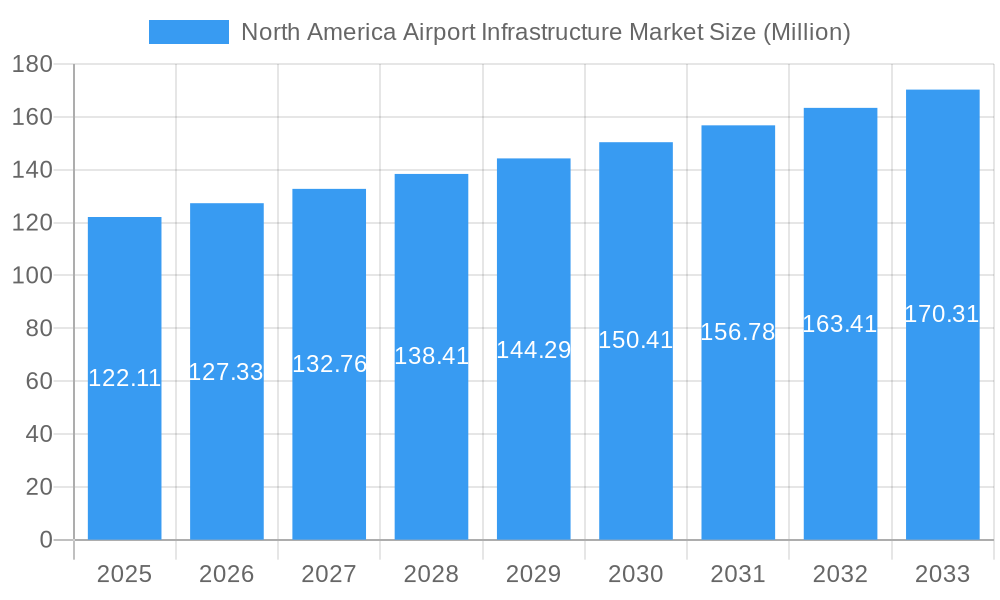

The North American airport infrastructure market, valued at $122.11 million in 2025, is projected to experience robust growth, driven by increasing air passenger traffic, government investments in airport modernization, and the expansion of air travel networks. This growth is further fueled by the rising demand for enhanced passenger experience, necessitating improvements in terminal facilities, baggage handling systems, and security infrastructure. The market segmentation reveals significant opportunities across various infrastructure types, with terminals, taxiways and runways, and aprons attracting substantial investments. Brownfield airport development projects are likely to dominate the market share initially, given the existing infrastructure and reduced upfront costs compared to Greenfield projects. Key players like PCL Constructors Inc., McCarthy Building Companies Inc., and AECOM are actively engaged in securing contracts and leveraging their expertise to capitalize on these market trends. The market’s steady growth is expected to continue through 2033, with a Compound Annual Growth Rate (CAGR) of 4.18%. However, potential restraints include funding constraints for certain projects, regulatory hurdles, and labor shortages in the construction sector. The focus on sustainable infrastructure development and incorporating advanced technologies such as smart airport solutions will also play a key role in shaping the future of this market.

North America Airport Infrastructure Market Market Size (In Million)

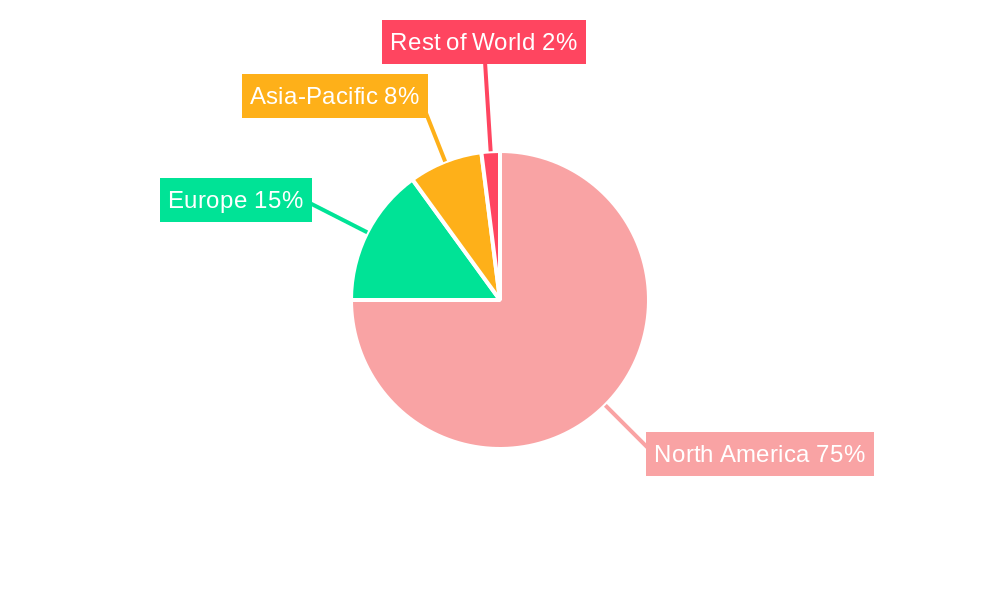

The United States is anticipated to hold the largest market share within North America, due to its extensive air travel network and substantial government spending on airport infrastructure development. Canada and Mexico will also contribute significantly, albeit at a smaller scale, driven by their respective national growth strategies and investments in improving existing airports and constructing new ones. The regional variations in growth rate will be influenced by factors like government policies, economic conditions, and the pace of air traffic growth in each country. The increasing adoption of public-private partnerships (PPPs) is expected to accelerate project development and attract private investment, further stimulating market expansion. This collaboration will help to overcome some of the financial constraints that might hinder growth. The market is expected to witness a surge in demand for specialized construction services and technologies as airports strive for efficiency, sustainability, and passenger satisfaction.

North America Airport Infrastructure Market Company Market Share

North America Airport Infrastructure Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America airport infrastructure market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033. The report meticulously examines market dynamics, key segments, leading players, and future growth opportunities within this vital sector. Market values are expressed in Millions.

North America Airport Infrastructure Market Concentration & Dynamics

The North America airport infrastructure market exhibits a moderately concentrated landscape, with a few major players holding significant market share.

Market Concentration: While precise market share figures for individual companies are proprietary data, the market is estimated to be characterized by a Herfindahl-Hirschman Index (HHI) of approximately xx, suggesting moderate concentration. This concentration is influenced by the large-scale nature of airport projects and the need for specialized expertise and financial resources.

Innovation Ecosystems: The market witnesses robust innovation, driven by the integration of advanced technologies like Building Information Modeling (BIM), smart sensors, and sustainable building materials. These innovations aim to improve efficiency, reduce costs, and enhance passenger experience.

Regulatory Frameworks: Stringent safety regulations, environmental compliance requirements, and complex permitting processes significantly influence market dynamics. These regulations often impact project timelines and costs.

Substitute Products: While direct substitutes are limited, the market faces indirect competition from alternative transportation modes (e.g., high-speed rail).

End-User Trends: Growing passenger traffic, increasing demand for enhanced passenger amenities, and a focus on improving operational efficiency are major end-user trends shaping market demand.

M&A Activities: The market has seen a moderate level of mergers and acquisitions (M&A) activity in recent years, with xx M&A deals recorded between 2019 and 2024. These activities are primarily aimed at expanding geographic reach, enhancing expertise, and securing larger projects.

North America Airport Infrastructure Market Industry Insights & Trends

The North America airport infrastructure market is experiencing robust growth, driven by a confluence of factors. While precise figures for 2025 market size and CAGR require further specification (replace "$xx Million" and "xx%"), the market's trajectory indicates substantial expansion projected through 2033. This expansion is fueled by several key drivers: a resurgence in air passenger travel post-pandemic, increased government funding dedicated to infrastructure development (including the Bipartisan Infrastructure Law in the US), and the critical need for modernization and expansion of existing airports to accommodate the growing demand for air travel. This demand extends beyond simple capacity increases; it includes a strong focus on enhancing the passenger experience with improved facilities and services. Furthermore, technological advancements are significantly impacting the market. The adoption of sustainable building materials, advanced automation technologies (e.g., AI-powered baggage handling), and smart infrastructure solutions are not only improving operational efficiency but also reducing environmental impact. This report also analyzes the influence of macroeconomic factors, including economic fluctuations and regional variations in growth, while carefully assessing potential market risks and uncertainties.

Key Markets & Segments Leading North America Airport Infrastructure Market

The North American airport infrastructure market presents diverse opportunities across key geographic regions and infrastructure types. Detailed analysis within the full report reveals the specific segments driving the most substantial growth.

- Dominant Regions: The report will pinpoint the leading states within the US and Canadian provinces demonstrating the highest levels of project development and investment, highlighting regional disparities and growth potential.

- Dominant Infrastructure Type: Terminals currently represent the largest market share, reflecting the escalating demand for enhanced passenger facilities. Taxiways and runways maintain a substantial presence due to ongoing needs for improved safety and efficiency. Aprons comprise a significant segment, while control towers, hangars, and other supporting infrastructure are expected to exhibit moderate but steady growth throughout the forecast period. The report will provide detailed market share breakdowns for each infrastructure type.

- Dominant Airport Type: Brownfield projects (modernization and expansion of existing airports) currently dominate the market, leveraging existing infrastructure and strategic location advantages. Greenfield airport development, while presenting significant long-term opportunities, constitutes a smaller, albeit growing, segment of the market. Analysis will detail the specific factors influencing this market segmentation.

Key Growth Drivers (across various segments):

- Increased air passenger traffic and a return to pre-pandemic travel patterns.

- Significant government investments in airport infrastructure, including dedicated funding programs.

- Modernization and expansion projects addressing capacity constraints and improving passenger experience.

- Technological advancements driving efficiency gains, safety improvements, and sustainability initiatives.

- A growing emphasis on environmentally sustainable airport design and operations.

- Economic growth and regional development in key markets impacting infrastructure demand.

North America Airport Infrastructure Market Product Developments

Recent product innovations are reshaping the airport infrastructure landscape. A strong focus on sustainable building materials (e.g., cross-laminated timber, recycled content concrete) minimizes environmental impact. Advanced security systems, integrating biometric technologies and AI-powered surveillance, enhance safety and efficiency. The integration of smart technologies, such as IoT sensors for real-time monitoring and predictive maintenance, optimizes airport operations and enhances the passenger experience. The adoption of Building Information Modeling (BIM) and digital twin technologies is streamlining design, construction, and operational management, leading to significant cost reductions and faster project completion times.

Challenges in the North America Airport Infrastructure Market Market

Several challenges hinder the growth of the North America airport infrastructure market. These include:

- Regulatory Hurdles: Complex permitting processes and stringent regulations can delay projects and increase costs. This has resulted in xx% of projects experiencing delays in the past year.

- Supply Chain Issues: Fluctuations in material costs and potential supply chain disruptions pose significant risks. In the recent past, these issues have contributed to a xx% increase in project costs for some projects.

- Competitive Pressures: Intense competition among contractors and the need for specialized expertise create challenges in securing projects.

Forces Driving North America Airport Infrastructure Market Growth

Key growth drivers include:

- Government funding: Significant government investments in airport infrastructure modernization and expansion programs are driving strong growth.

- Technological advancements: The adoption of new technologies such as BIM, AI, and IoT is improving efficiency and operational capabilities.

- Growing air travel: The increasing number of air passengers necessitates continuous upgrades and expansion of airport infrastructure.

Long-Term Growth Catalysts in the North America Airport Infrastructure Market

Long-term growth is projected to be fueled by innovative construction techniques, strategic partnerships between public and private sectors, and expanding into emerging markets within North America. Furthermore, the increasing adoption of sustainable practices and environmentally friendly infrastructure designs represents a key long-term catalyst for market expansion.

Emerging Opportunities in North America Airport Infrastructure Market

Emerging opportunities include:

- Smart airport technologies: The integration of IoT and AI to optimize airport operations and enhance passenger experience.

- Sustainable infrastructure: Growing demand for eco-friendly airport designs and construction materials.

- Regional airport development: Expansion of smaller airports to alleviate congestion in major hubs.

Leading Players in the North America Airport Infrastructure Market Sector

Key Milestones in North America Airport Infrastructure Market Industry

- 2020: The COVID-19 pandemic initially caused disruption, but post-pandemic recovery spurred a renewed focus on airport modernization and expansion projects.

- 2022: Significant investments in sustainable infrastructure projects gained momentum, reflecting a growing commitment to reducing carbon footprints and environmental responsibility.

- 2023: Several large-scale airport expansion projects commenced across North America, signifying robust market activity and ongoing investment.

- 2024: The introduction of innovative technological solutions continued to enhance operational efficiency, improve passenger experience, and drive further market growth. Examples should be included here if possible.

Strategic Outlook for North America Airport Infrastructure Market Market

The North America airport infrastructure market holds immense potential for future growth, driven by sustained investment in airport modernization and expansion, technological advancements and the growing demand for improved airport infrastructure. Strategic partnerships, embracing sustainable practices, and leveraging technological innovations will be crucial for players seeking to capitalize on this considerable market opportunity.

North America Airport Infrastructure Market Segmentation

-

1. Infrastructure Type

- 1.1. Terminals

- 1.2. Taxiway and Runways

- 1.3. Aprons

- 1.4. Control Towers

- 1.5. Hangars

- 1.6. Others

-

2. Airport Type

- 2.1. Brownfield Airports

- 2.2. Greenfield Airports

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Airport Infrastructure Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Airport Infrastructure Market Regional Market Share

Geographic Coverage of North America Airport Infrastructure Market

North America Airport Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Terminal Segment to Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.1.1. Terminals

- 5.1.2. Taxiway and Runways

- 5.1.3. Aprons

- 5.1.4. Control Towers

- 5.1.5. Hangars

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Airport Type

- 5.2.1. Brownfield Airports

- 5.2.2. Greenfield Airports

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6. United States North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.1.1. Terminals

- 6.1.2. Taxiway and Runways

- 6.1.3. Aprons

- 6.1.4. Control Towers

- 6.1.5. Hangars

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Airport Type

- 6.2.1. Brownfield Airports

- 6.2.2. Greenfield Airports

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7. Canada North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.1.1. Terminals

- 7.1.2. Taxiway and Runways

- 7.1.3. Aprons

- 7.1.4. Control Towers

- 7.1.5. Hangars

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Airport Type

- 7.2.1. Brownfield Airports

- 7.2.2. Greenfield Airports

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8. Mexico North America Airport Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8.1.1. Terminals

- 8.1.2. Taxiway and Runways

- 8.1.3. Aprons

- 8.1.4. Control Towers

- 8.1.5. Hangars

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Airport Type

- 8.2.1. Brownfield Airports

- 8.2.2. Greenfield Airports

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 PCL Constructors Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 McCarthy Building Companies Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 The Walsh Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Austin Industries

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Hensel Phelps

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Turner Construction Company

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 J E Dunn Construction Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 AECOM

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 PCL Constructors Inc

List of Figures

- Figure 1: North America Airport Infrastructure Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Airport Infrastructure Market Share (%) by Company 2025

List of Tables

- Table 1: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 2: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 3: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Airport Infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 6: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 7: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Airport Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 10: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 11: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Airport Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Airport Infrastructure Market Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 14: North America Airport Infrastructure Market Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 15: North America Airport Infrastructure Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Airport Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Airport Infrastructure Market?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the North America Airport Infrastructure Market?

Key companies in the market include PCL Constructors Inc, McCarthy Building Companies Inc, The Walsh Group, Austin Industries, Hensel Phelps, Turner Construction Company, J E Dunn Construction Company, AECOM.

3. What are the main segments of the North America Airport Infrastructure Market?

The market segments include Infrastructure Type, Airport Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 122.11 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Terminal Segment to Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Airport Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Airport Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Airport Infrastructure Market?

To stay informed about further developments, trends, and reports in the North America Airport Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence