Key Insights

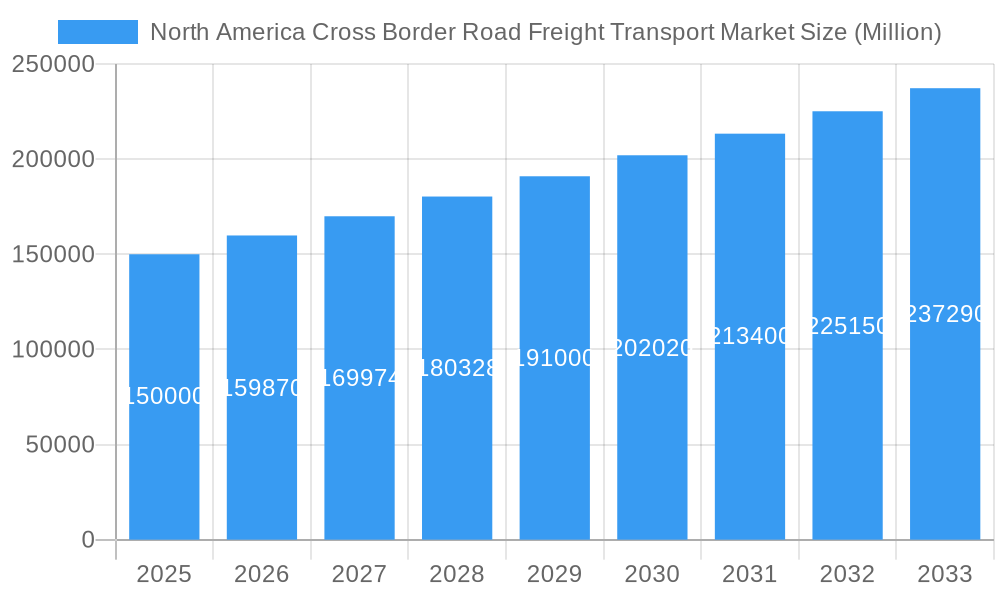

The North America cross-border road freight transport market, encompassing the United States, Canada, Mexico, and the Rest of North America, is experiencing robust growth. Driven by the increasing cross-border trade between these nations, particularly within the USMCA (United States-Mexico-Canada Agreement) framework, the market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of 5.98% from 2025 to 2033. Key growth drivers include the expansion of e-commerce, necessitating efficient and timely delivery of goods across borders, and the growth of manufacturing and industrial sectors demanding reliable transportation solutions. Furthermore, the ongoing development of infrastructure, such as improved border crossing facilities and highway networks, is facilitating smoother and faster cross-border movements. However, challenges remain, including fluctuating fuel prices, driver shortages, and increasing regulatory complexities related to cross-border shipments. The segmentation reveals a strong demand across various end-user industries, with significant contributions from agriculture, manufacturing, oil and gas, and retail sectors. Major players like XPO Inc, Landstar System Inc, and UPS are leveraging technological advancements and strategic partnerships to gain a competitive edge in this dynamic market. The market's future hinges on addressing supply chain vulnerabilities, embracing sustainable transportation practices, and navigating geopolitical uncertainties.

North America Cross Border Road Freight Transport Market Market Size (In Billion)

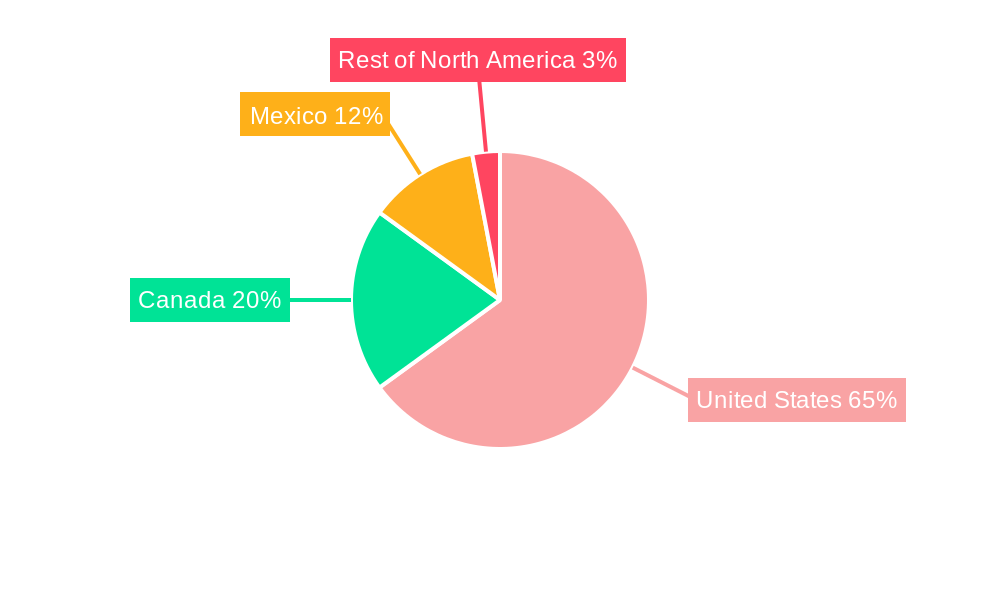

The market's regional distribution indicates a larger share for the United States, given its economic size and extensive trade relationships with both Canada and Mexico. Mexico’s participation is notably influenced by its proximity to the US market and its role as a significant manufacturing hub. Canada's involvement is largely shaped by its bilateral trade with the US. The "Rest of North America" segment, while smaller in comparison, still presents opportunities for growth. The competitive landscape is fiercely contested, with established players competing on the basis of service quality, pricing, and technological capabilities. Emerging trends indicate a surge in demand for specialized transport solutions, such as refrigerated trucking for perishable goods, and an increasing adoption of digital freight platforms that optimize logistics and improve visibility throughout the supply chain. Future market projections need to account for uncertainties like potential trade policy changes and the ongoing impact of global economic fluctuations.

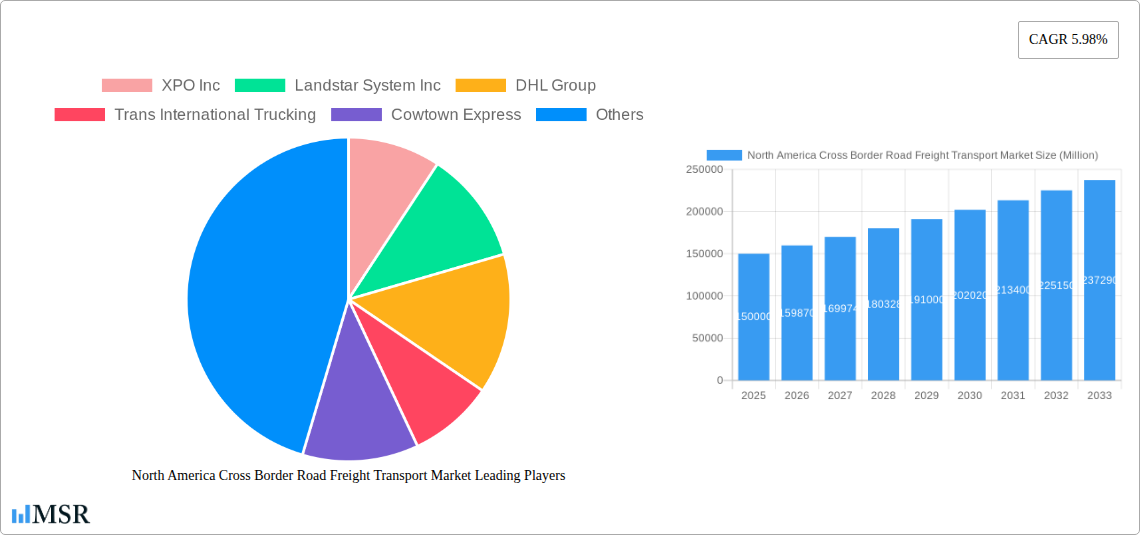

North America Cross Border Road Freight Transport Market Company Market Share

North America Cross Border Road Freight Transport Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America cross-border road freight transport market, offering invaluable insights for stakeholders across the industry. Covering the period from 2019 to 2033, with a base year of 2025, this study meticulously examines market dynamics, key segments, leading players, and emerging opportunities. Expect detailed forecasts, crucial market sizing data, and actionable intelligence to navigate this dynamic landscape. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Cross Border Road Freight Transport Market Market Concentration & Dynamics

The North American cross-border road freight transport market exhibits a moderately concentrated structure, with several major players holding significant market share. XPO Inc., Landstar System Inc., DHL Group, and UPS dominate the landscape, collectively accounting for an estimated xx% of the market in 2025. However, a significant number of smaller, regional players also contribute to the overall market volume.

The market is characterized by a dynamic innovation ecosystem, with companies continuously investing in technological advancements to enhance efficiency and optimize logistics. This includes the adoption of telematics, route optimization software, and the integration of blockchain technology for improved supply chain transparency.

Regulatory frameworks, particularly concerning cross-border regulations and safety standards, significantly influence market operations. Compliance costs and complexities pose challenges for smaller players, while established companies often possess greater resources for navigating these hurdles. Substitute products, such as rail and air freight, exert competitive pressure, particularly for long-haul transportation.

End-user trends, particularly the shift towards e-commerce and the growing demand for faster delivery times, drive market growth. The manufacturing, wholesale and retail trade, and oil and gas sectors represent major end-user segments.

Mergers and acquisitions (M&A) activity has been notable in recent years, reflecting industry consolidation and the pursuit of scale and diversification. In 2023 alone, there were xx significant M&A deals in the North American cross-border road freight transport market. These acquisitions often focus on expanding geographical reach, enhancing technological capabilities, and accessing specialized logistics services.

North America Cross Border Road Freight Transport Market Industry Insights & Trends

The North American cross-border road freight transport market is experiencing robust growth, driven by several key factors. The expanding e-commerce sector fuels demand for efficient and timely delivery services, particularly across borders. Furthermore, the increasing globalization of manufacturing and trade necessitates robust cross-border logistics solutions. Technological advancements, including the deployment of advanced telematics and automation technologies, are enhancing efficiency and reducing costs. Finally, favorable government policies and infrastructure investments contribute to market expansion. The market size in 2025 is estimated at xx Million and is expected to reach xx Million by 2033. This growth reflects evolving consumer behaviour which emphasizes convenience and speed of delivery for both B2B and B2C transactions.

Key Markets & Segments Leading North America Cross Border Road Freight Transport Market

The United States constitutes the largest market within North America, owing to its extensive road network, robust manufacturing base, and significant e-commerce activity. Mexico and Canada follow, both exhibiting significant growth potential due to increasing trade and economic expansion. The Rest of North America segment represents a smaller share of the overall market.

Key Drivers by Segment:

- United States: Extensive highway infrastructure, large consumer base, high manufacturing output.

- Mexico: Growing manufacturing sector, proximity to the US market, increasing trade with the US.

- Canada: Strong resource sector, proximity to the US market, robust e-commerce growth.

- Agriculture, Fishing, and Forestry: Seasonal demand fluctuations, specialized transportation requirements.

- Manufacturing: High volume shipments, just-in-time delivery requirements.

- Oil and Gas: Specialized transportation needs for hazardous materials.

- Wholesale and Retail Trade: High volume, time-sensitive deliveries.

The Wholesale and Retail Trade sector is the largest end-user segment, driven by the booming e-commerce industry. Manufacturing and Oil & Gas also represent substantial end-user segments.

North America Cross Border Road Freight Transport Market Product Developments

Recent product innovations focus on enhancing efficiency, sustainability, and safety. This includes the integration of advanced telematics systems for real-time tracking and route optimization, the adoption of electric and alternative fuel vehicles to reduce environmental impact, and the development of sophisticated security measures to protect shipments. These innovations provide a significant competitive edge in a market characterized by fierce competition and stringent regulatory requirements.

Challenges in the North America Cross Border Road Freight Transport Market Market

The market faces challenges such as fluctuating fuel prices, increasing driver shortages, and stringent cross-border regulations which impact operational costs and efficiency. Border crossing delays and complexities add to logistical challenges. Increased competition among providers intensifies pressure on profit margins. These factors collectively contribute to an estimated xx% reduction in profitability for some smaller operators in 2024.

Forces Driving North America Cross Border Road Freight Transport Market Growth

Technological advancements, particularly in telematics, automation, and route optimization, are enhancing efficiency and reducing costs. The growth of e-commerce is driving a surge in demand for fast and reliable cross-border delivery services. Favorable government policies and investments in infrastructure facilitate smoother cross-border transportation. Finally, the increasing globalization of trade continues to fuel demand.

Challenges in the North America Cross Border Road Freight Transport Market Market

Long-term growth will be driven by continued technological advancements, strategic partnerships to enhance service offerings, and expansion into new markets. Investing in sustainable transportation solutions will also play a crucial role in long-term market success. Collaboration between industry players and government agencies to streamline cross-border processes will further fuel market growth.

Emerging Opportunities in North America Cross Border Road Freight Transport Market

Emerging opportunities include the growth of last-mile delivery solutions tailored to the needs of e-commerce businesses, the expansion of cross-border e-commerce, and the increasing demand for specialized transportation services catering to specific industry needs such as temperature-controlled and hazardous materials transport. The adoption of drone and autonomous vehicle technology presents a long-term transformative potential.

Leading Players in the North America Cross Border Road Freight Transport Market Sector

- XPO Inc.

- Landstar System Inc.

- DHL Group

- Trans International Trucking

- Cowtown Express

- Fastfrate Group

- Knight-Swift Transportation Holdings Inc.

- United Parcel Service of America Inc (UPS)

- Werner Enterprises

- Ryder System Inc.

Key Milestones in North America Cross Border Road Freight Transport Market Industry

- September 2023: UPS' acquisition of MNX Global Logistics expands its capabilities in time-critical logistics and temperature-controlled transport, enhancing its healthcare logistics segment. This signals a trend toward consolidation and specialized service expansion.

- September 2023: Ryder Systems' deployment of BrightDrop electric vans demonstrates a commitment to sustainability and a move toward environmentally friendly fleet modernization, setting a precedent for future industry trends.

- October 2023: Ryder Systems' expansion of its multiclient warehouse network showcases a focus on efficient supply chain management and fulfillment for consumer packaged goods, strengthening its position in the market.

Strategic Outlook for North America Cross Border Road Freight Transport Market Market

The North American cross-border road freight transport market presents significant growth potential driven by continued e-commerce expansion, technological advancements, and increasing globalization. Strategic opportunities exist for companies to invest in sustainable solutions, expand their service offerings into specialized niches, and leverage technological advancements to enhance efficiency and improve customer service. Companies that can adapt to changing regulations and effectively manage the evolving challenges within the industry will be best positioned for future success.

North America Cross Border Road Freight Transport Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

North America Cross Border Road Freight Transport Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Cross Border Road Freight Transport Market Regional Market Share

Geographic Coverage of North America Cross Border Road Freight Transport Market

North America Cross Border Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cross Border Road Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 XPO Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Landstar System Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Trans International Trucking

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cowtown Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fastfrate Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Knight-Swift Transportation Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Parcel Service of America Inc (UPS)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Werner Enterprises

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ryder System Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 XPO Inc

List of Figures

- Figure 1: North America Cross Border Road Freight Transport Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Cross Border Road Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: North America Cross Border Road Freight Transport Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 2: North America Cross Border Road Freight Transport Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: North America Cross Border Road Freight Transport Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 4: North America Cross Border Road Freight Transport Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States North America Cross Border Road Freight Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Cross Border Road Freight Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Cross Border Road Freight Transport Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cross Border Road Freight Transport Market?

The projected CAGR is approximately 1.8%.

2. Which companies are prominent players in the North America Cross Border Road Freight Transport Market?

Key companies in the market include XPO Inc, Landstar System Inc, DHL Group, Trans International Trucking, Cowtown Express, Fastfrate Group, Knight-Swift Transportation Holdings Inc, United Parcel Service of America Inc (UPS), Werner Enterprises, Ryder System Inc.

3. What are the main segments of the North America Cross Border Road Freight Transport Market?

The market segments include End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

October 2023: Ryder Systems continues to expand its multiclient warehouse network, adding a 400,000-square-foot distribution center in Aurora, Ill. The newly built facility is the latest addition to a now six-building campus totaling 2.4 million square feet, primarily serving shippers of consumer packaged goods (CPG), including food and beverage, food ingredients, health and beauty, household products, and general retail merchandise.September 2023: UPS has entered into an agreement to acquire MNX Global Logistics (MNX), a global time-critical logistics provider. MNX’s capabilities in radio-pharmaceuticals and temperature-controlled logistics will help UPS’ healthcare segment and clinical trial logistics subsidiary Marken meet the growing demand for these services. The transaction is expected to close by the end of the year.September 2023: Ryder Systems announced the deployment of its first BrightDrop Zevo 600 electric vans at four strategic Ryder facilities in California, Texas, and New York. Earlier in 2023, Ryder announced plans to introduce 4,000 BrightDrop electric vans to its fleet through 2025, with the first 200 ordered this year. With a cargo capacity of 615 cubic feet, BrightDrop’s electric light commercial van offers the benefits of an electric powertrain with ample cargo space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cross Border Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cross Border Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cross Border Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the North America Cross Border Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence