Key Insights

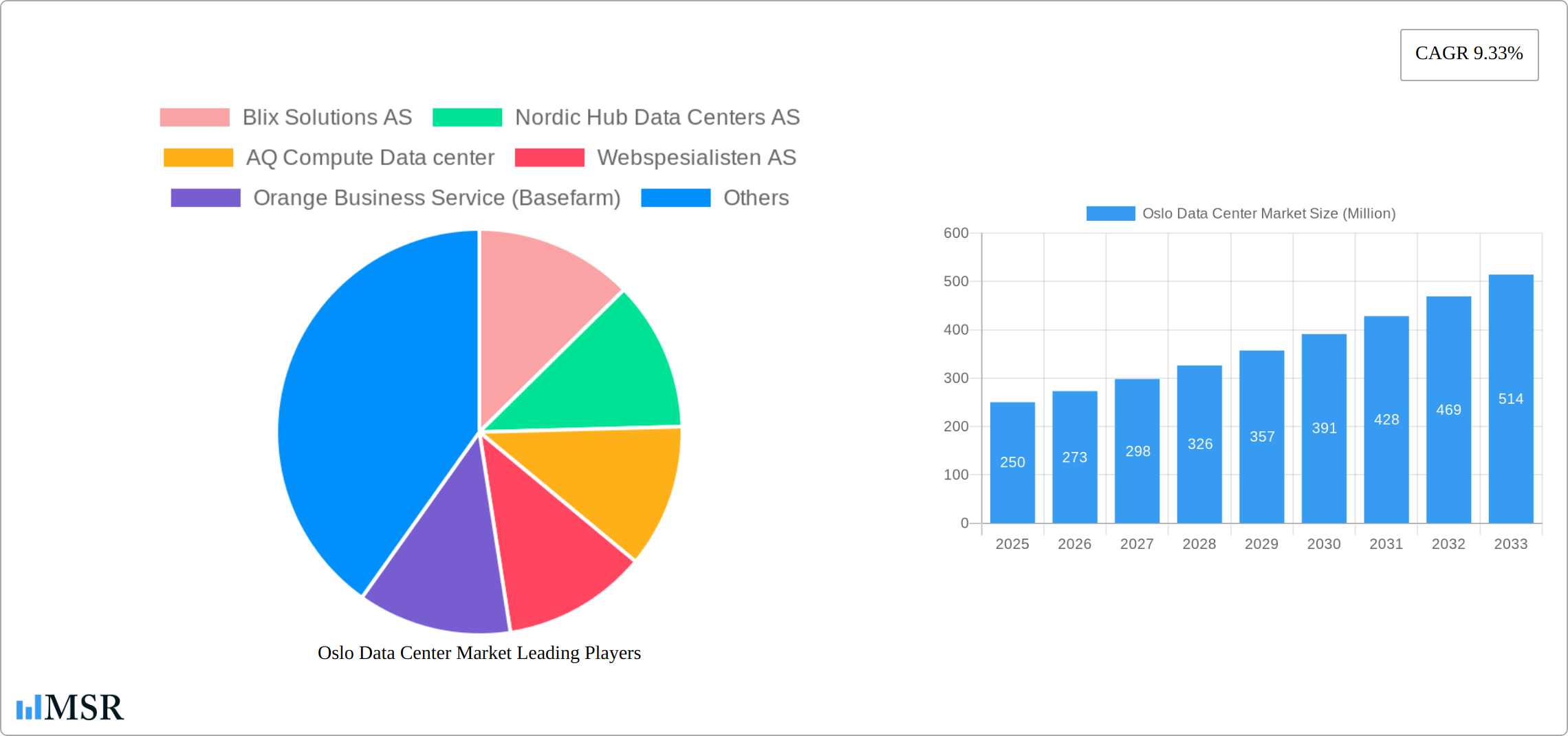

The Oslo data center market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 9.33%, presents a lucrative investment opportunity. Driven by increasing digitalization across sectors like cloud computing, telecom, media & entertainment, and BFSI within Norway and the wider Nordic region, the market is experiencing significant expansion. The demand for colocation services, particularly from hyperscale providers seeking low-latency connectivity and sustainable energy solutions, is a key driver. While the precise market size in 2025 (the base year) is not provided, considering a CAGR of 9.33% and a projected growth over the forecast period (2025-2033), we can infer a substantial market value, potentially in the hundreds of millions of USD. The market is segmented by absorption (utilized vs. non-utilized capacity), colocation type (retail, wholesale, hyperscale), end-user, data center size (small to mega), and tier level. While Europe holds a significant share, the penetration of data centers in other regions is anticipated to increase. Key players like Blix Solutions AS, Nordic Hub Data Centers AS, and Green Mountain AS are capitalizing on this growth, competing through service offerings and strategic partnerships. However, regulatory hurdles and land scarcity could pose challenges to future market expansion.

The substantial growth potential of the Oslo data center market is further bolstered by the region’s strong digital infrastructure, access to renewable energy sources, and favorable government policies that promote digitalization. The ongoing expansion of cloud computing and the increasing adoption of digital services across various industry verticals will continue to fuel the demand for data center space. However, competition is intensifying with new entrants and existing players expanding their capacity. The market's future success hinges on addressing sustainability concerns, ensuring sufficient power supply, and navigating potential regulatory changes related to data sovereignty and security. Further segment-specific analysis would refine this outlook, for example, detailing the relative growth rates of wholesale vs. retail colocation or the expansion within specific end-user sectors.

Oslo Data Center Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Oslo data center market, offering crucial insights for investors, industry stakeholders, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this study meticulously examines market dynamics, growth drivers, challenges, and emerging opportunities within the Norwegian data center landscape. The report leverages historical data (2019-2024) and forecast data (2025-2033) to deliver a clear and actionable understanding of this rapidly evolving market. The market size is expected to reach xx Million USD by 2033, exhibiting a CAGR of xx%.

Oslo Data Center Market Concentration & Dynamics

This section assesses the competitive landscape, regulatory environment, and market trends impacting Oslo's data center sector. The market exhibits a moderately concentrated structure with key players like Blix Solutions AS, Nordic Hub Data Centers AS, AQ Compute Data Center, Webspesialisten AS, Orange Business Service (Basefarm), Bulk Infrastructure Group AS, and Green Mountain AS holding significant shares. However, the entry of new players and expansion initiatives by existing ones are shaping the dynamics.

Market Share Analysis (MW): Bulk Infrastructure Group AS holds an estimated xx% market share, followed by Green Mountain AS at xx%, with the remaining market share distributed among other players. (Note: Precise MW-based market share data requires further detailed research and may vary depending on available information.)

M&A Activity: The Oslo data center market has witnessed xx M&A deals in the past five years, indicating a moderate level of consolidation. This is projected to increase in line with industry growth.

Regulatory Framework: Norway's supportive regulatory environment, focusing on renewable energy and digital infrastructure development, fosters growth.

Innovation Ecosystem: The presence of research institutions and technology providers contributes to a vibrant innovation ecosystem.

Substitute Products: Cloud computing and edge computing present potential substitutes, yet colocation remains crucial for specific needs.

End-User Trends: Growing demand from Cloud & IT, Telecom, and Media & Entertainment sectors drives market expansion. The BFSI and Government sectors also contribute significantly.

Oslo Data Center Market Industry Insights & Trends

The Oslo data center market is experiencing robust growth, driven by several factors. Increased digitalization, the rise of cloud computing, and government initiatives supporting digital infrastructure development are key contributors. The high penetration of renewable energy sources further strengthens the market's attractiveness. The market is witnessing a shift towards sustainable practices, with companies increasingly adopting green energy solutions. Technological advancements, like AI and IoT, are fueling the demand for advanced data center infrastructure. Growing data volumes and the need for low-latency services are also major drivers of this expansion. The shift towards hyperscale data centers is another significant trend, enabling greater scalability and efficiency.

Key Markets & Segments Leading Oslo Data Center Market

The Oslo data center market is dominated by the Utilized absorption segment, reflecting the high demand for data center services. Within colocation, the Wholesale segment is experiencing significant growth, driven by large-scale deployments by hyperscale providers.

Key Drivers:

- Economic Growth: Norway's robust economy fuels demand for data center services.

- Government Initiatives: Government policies promoting digitalization and infrastructure development.

- Renewable Energy: Abundance of renewable energy sources makes Oslo an attractive location.

Dominance Analysis:

The Cloud & IT end-user segment is the most prominent, followed by the Telecom sector. Demand from the Media & Entertainment and BFSI sectors is also on the rise. In terms of data center size, Large and Mega data centers are gaining prominence due to their scalability and efficiency. Tier III and Tier IV data centers are preferred for their high availability and reliability. The Non-Utilized segment represents potential future capacity expansion.

Oslo Data Center Market Product Developments

Significant advancements are being made in cooling technologies, power efficiency, and data center infrastructure management (DCIM). The adoption of modular designs, AI-powered analytics, and edge computing solutions further enhances operational efficiency and flexibility. These innovations deliver competitive advantages, attracting major players and investment.

Challenges in the Oslo Data Center Market Market

The market faces challenges including limited land availability, high construction costs, and competition for skilled labor. Regulatory compliance and ensuring sustainable practices add to the complexity. These factors influence the speed of expansion and profitability, limiting the potential of some smaller players.

Forces Driving Oslo Data Center Market Growth

Technological advancements in areas like AI, IoT, and 5G are driving demand for advanced data center infrastructure. The increasing adoption of cloud computing and the growth of the digital economy contribute significantly to this growth. The Norwegian government's supportive policies promoting digital transformation are crucial as well.

Long-Term Growth Catalysts in the Oslo Data Center Market

Continued innovation in data center technologies, strategic partnerships between data center operators and technology providers, and expansion into new markets (e.g., edge computing) are expected to fuel the long-term growth of the Oslo data center market.

Emerging Opportunities in Oslo Data Center Market

The rising demand for edge computing, the increasing adoption of sustainable data center practices, and the potential for growth in emerging sectors like e-commerce and FinTech present significant opportunities in the Oslo data center market.

Leading Players in the Oslo Data Center Market Sector

- Blix Solutions AS

- Nordic Hub Data Centers AS

- AQ Compute Data center

- Webspesialisten AS

- Orange Business Service (Basefarm)

- Bulk Infrastructure Group AS

- Green Mountain AS

- Stack Infrastructure Inc

Key Milestones in Oslo Data Center Market Industry

September 2022: Bulk Infrastructure Group AS announced significant expansion initiatives, investing in power infrastructure and land acquisition for its Norwegian data centers. This expansion underscores the market's growth potential and Bulk's commitment to the region. The completion of the N01 substation further demonstrates their dedication to providing reliable and sustainable capacity.

September 2022: Stack Infrastructure successfully connected an Oslo data center to the local district heating system, leveraging waste heat to provide sustainable energy solutions and showcasing environmentally conscious operations. This initiative highlights the increasing focus on sustainable data center practices within the Oslo market.

Strategic Outlook for Oslo Data Center Market Market

The Oslo data center market presents a strong outlook, driven by robust economic growth, supportive government policies, and a commitment to sustainability. Strategic opportunities exist in leveraging renewable energy sources, adopting innovative technologies, and catering to the evolving needs of diverse end-user segments. The market's future hinges on addressing challenges like land availability and skilled labor while embracing sustainable practices to ensure long-term growth and competitiveness.

Oslo Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End-User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End-User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Oslo Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oslo Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Growth of Number of Social Media Users; Increased Emphasis on Target Marketing and Competitive Intelligence

- 3.3. Market Restrains

- 3.3.1. Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers

- 3.4. Market Trends

- 3.4.1. Tier 3 is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oslo Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End-User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End-User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Oslo Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.1.4. Massive

- 6.1.5. Mega

- 6.2. Market Analysis, Insights and Forecast - by Tier Type

- 6.2.1. Tier 1 & 2

- 6.2.2. Tier 3

- 6.2.3. Tier 4

- 6.3. Market Analysis, Insights and Forecast - by Absorption

- 6.3.1. Utilized

- 6.3.1.1. Colocation Type

- 6.3.1.1.1. Retail

- 6.3.1.1.2. Wholesale

- 6.3.1.1.3. Hyperscale

- 6.3.1.2. End-User

- 6.3.1.2.1. Cloud & IT

- 6.3.1.2.2. Telecom

- 6.3.1.2.3. Media & Entertainment

- 6.3.1.2.4. Government

- 6.3.1.2.5. BFSI

- 6.3.1.2.6. Manufacturing

- 6.3.1.2.7. E-Commerce

- 6.3.1.2.8. Other End-User

- 6.3.1.1. Colocation Type

- 6.3.2. Non-Utilized

- 6.3.1. Utilized

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 7. South America Oslo Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.1.4. Massive

- 7.1.5. Mega

- 7.2. Market Analysis, Insights and Forecast - by Tier Type

- 7.2.1. Tier 1 & 2

- 7.2.2. Tier 3

- 7.2.3. Tier 4

- 7.3. Market Analysis, Insights and Forecast - by Absorption

- 7.3.1. Utilized

- 7.3.1.1. Colocation Type

- 7.3.1.1.1. Retail

- 7.3.1.1.2. Wholesale

- 7.3.1.1.3. Hyperscale

- 7.3.1.2. End-User

- 7.3.1.2.1. Cloud & IT

- 7.3.1.2.2. Telecom

- 7.3.1.2.3. Media & Entertainment

- 7.3.1.2.4. Government

- 7.3.1.2.5. BFSI

- 7.3.1.2.6. Manufacturing

- 7.3.1.2.7. E-Commerce

- 7.3.1.2.8. Other End-User

- 7.3.1.1. Colocation Type

- 7.3.2. Non-Utilized

- 7.3.1. Utilized

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 8. Europe Oslo Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.1.4. Massive

- 8.1.5. Mega

- 8.2. Market Analysis, Insights and Forecast - by Tier Type

- 8.2.1. Tier 1 & 2

- 8.2.2. Tier 3

- 8.2.3. Tier 4

- 8.3. Market Analysis, Insights and Forecast - by Absorption

- 8.3.1. Utilized

- 8.3.1.1. Colocation Type

- 8.3.1.1.1. Retail

- 8.3.1.1.2. Wholesale

- 8.3.1.1.3. Hyperscale

- 8.3.1.2. End-User

- 8.3.1.2.1. Cloud & IT

- 8.3.1.2.2. Telecom

- 8.3.1.2.3. Media & Entertainment

- 8.3.1.2.4. Government

- 8.3.1.2.5. BFSI

- 8.3.1.2.6. Manufacturing

- 8.3.1.2.7. E-Commerce

- 8.3.1.2.8. Other End-User

- 8.3.1.1. Colocation Type

- 8.3.2. Non-Utilized

- 8.3.1. Utilized

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 9. Middle East & Africa Oslo Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.1.4. Massive

- 9.1.5. Mega

- 9.2. Market Analysis, Insights and Forecast - by Tier Type

- 9.2.1. Tier 1 & 2

- 9.2.2. Tier 3

- 9.2.3. Tier 4

- 9.3. Market Analysis, Insights and Forecast - by Absorption

- 9.3.1. Utilized

- 9.3.1.1. Colocation Type

- 9.3.1.1.1. Retail

- 9.3.1.1.2. Wholesale

- 9.3.1.1.3. Hyperscale

- 9.3.1.2. End-User

- 9.3.1.2.1. Cloud & IT

- 9.3.1.2.2. Telecom

- 9.3.1.2.3. Media & Entertainment

- 9.3.1.2.4. Government

- 9.3.1.2.5. BFSI

- 9.3.1.2.6. Manufacturing

- 9.3.1.2.7. E-Commerce

- 9.3.1.2.8. Other End-User

- 9.3.1.1. Colocation Type

- 9.3.2. Non-Utilized

- 9.3.1. Utilized

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 10. Asia Pacific Oslo Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.1.4. Massive

- 10.1.5. Mega

- 10.2. Market Analysis, Insights and Forecast - by Tier Type

- 10.2.1. Tier 1 & 2

- 10.2.2. Tier 3

- 10.2.3. Tier 4

- 10.3. Market Analysis, Insights and Forecast - by Absorption

- 10.3.1. Utilized

- 10.3.1.1. Colocation Type

- 10.3.1.1.1. Retail

- 10.3.1.1.2. Wholesale

- 10.3.1.1.3. Hyperscale

- 10.3.1.2. End-User

- 10.3.1.2.1. Cloud & IT

- 10.3.1.2.2. Telecom

- 10.3.1.2.3. Media & Entertainment

- 10.3.1.2.4. Government

- 10.3.1.2.5. BFSI

- 10.3.1.2.6. Manufacturing

- 10.3.1.2.7. E-Commerce

- 10.3.1.2.8. Other End-User

- 10.3.1.1. Colocation Type

- 10.3.2. Non-Utilized

- 10.3.1. Utilized

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 11. North America Oslo Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Oslo Data Center Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Oslo Data Center Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Oslo Data Center Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Oslo Data Center Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Blix Solutions AS

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Nordic Hub Data Centers AS

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 AQ Compute Data center

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Webspesialisten AS

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Orange Business Service (Basefarm)

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Bulk Infrastructure Group AS

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Green Mountain AS*List Not Exhaustive 7 2 Market share analysis (In terms of MW)7 3 List of Companie

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Stack Infrastructure Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 Blix Solutions AS

List of Figures

- Figure 1: Global Oslo Data Center Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Oslo Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Oslo Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Oslo Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Oslo Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Oslo Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Oslo Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Oslo Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Oslo Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Oslo Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Oslo Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Oslo Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 13: North America Oslo Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 14: North America Oslo Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 15: North America Oslo Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 16: North America Oslo Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 17: North America Oslo Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 18: North America Oslo Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Oslo Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Oslo Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 21: South America Oslo Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 22: South America Oslo Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 23: South America Oslo Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 24: South America Oslo Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 25: South America Oslo Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 26: South America Oslo Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 27: South America Oslo Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe Oslo Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 29: Europe Oslo Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 30: Europe Oslo Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 31: Europe Oslo Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 32: Europe Oslo Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 33: Europe Oslo Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 34: Europe Oslo Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Oslo Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East & Africa Oslo Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 37: Middle East & Africa Oslo Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 38: Middle East & Africa Oslo Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 39: Middle East & Africa Oslo Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 40: Middle East & Africa Oslo Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 41: Middle East & Africa Oslo Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 42: Middle East & Africa Oslo Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Oslo Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Oslo Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 45: Asia Pacific Oslo Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 46: Asia Pacific Oslo Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 47: Asia Pacific Oslo Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 48: Asia Pacific Oslo Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 49: Asia Pacific Oslo Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 50: Asia Pacific Oslo Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific Oslo Data Center Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Oslo Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Oslo Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Global Oslo Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Global Oslo Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Global Oslo Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Oslo Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Oslo Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Oslo Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Oslo Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Oslo Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Oslo Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 17: Global Oslo Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 18: Global Oslo Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 19: Global Oslo Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Oslo Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 24: Global Oslo Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 25: Global Oslo Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Global Oslo Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Oslo Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 31: Global Oslo Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 32: Global Oslo Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 33: Global Oslo Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United Kingdom Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Germany Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Italy Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Spain Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Russia Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Benelux Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Nordics Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Oslo Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 44: Global Oslo Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 45: Global Oslo Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 46: Global Oslo Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Turkey Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Israel Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: GCC Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: North Africa Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Africa Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Middle East & Africa Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Oslo Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 54: Global Oslo Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 55: Global Oslo Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 56: Global Oslo Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: China Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: India Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Japan Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Korea Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: ASEAN Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Oceania Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of Asia Pacific Oslo Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oslo Data Center Market?

The projected CAGR is approximately 9.33%.

2. Which companies are prominent players in the Oslo Data Center Market?

Key companies in the market include Blix Solutions AS, Nordic Hub Data Centers AS, AQ Compute Data center, Webspesialisten AS, Orange Business Service (Basefarm), Bulk Infrastructure Group AS, Green Mountain AS*List Not Exhaustive 7 2 Market share analysis (In terms of MW)7 3 List of Companie, Stack Infrastructure Inc.

3. What are the main segments of the Oslo Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Growth of Number of Social Media Users; Increased Emphasis on Target Marketing and Competitive Intelligence.

6. What are the notable trends driving market growth?

Tier 3 is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers.

8. Can you provide examples of recent developments in the market?

September 2022: Bulk announced several expansion initiatives at its Norwegian data center locations, with investments focused on ensuring long-term power and land availability. Highly connected and scalable sites powered by 100% renewable energy are provided. With many European locations battling with power restrictions and increasing demand for data center capacity, Bulk completed the installation of the N01 onsite substation, which provides 125 MVA of dual connections to the adjacent Kristiansand substation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oslo Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oslo Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oslo Data Center Market?

To stay informed about further developments, trends, and reports in the Oslo Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence