Key Insights

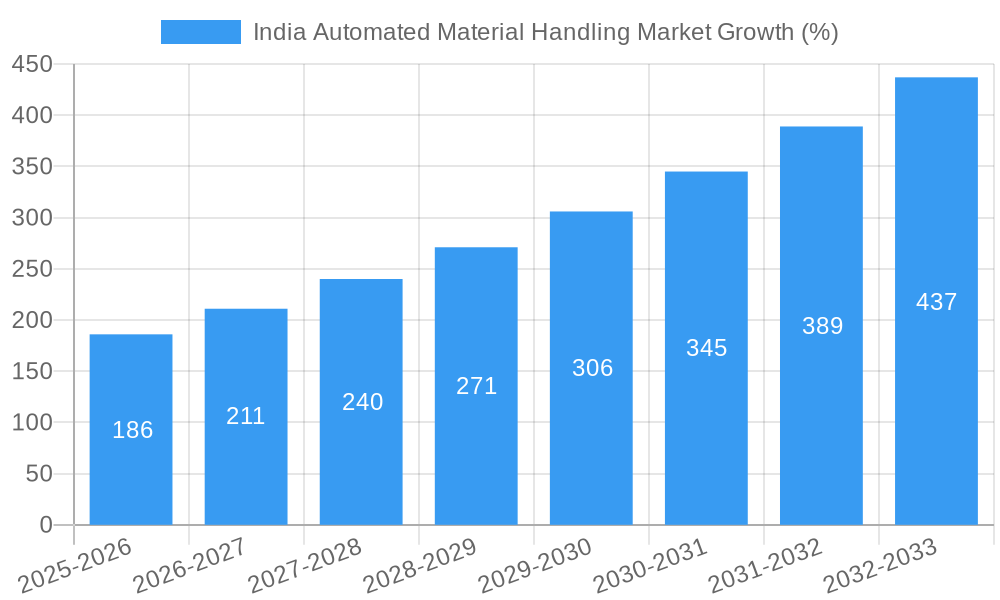

The India automated material handling market is experiencing robust growth, projected to reach \$1.47 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.70% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector necessitates efficient warehouse management and order fulfillment, driving demand for automated systems. Simultaneously, the manufacturing industry's push for increased productivity and reduced operational costs is fostering the adoption of automated material handling solutions. Furthermore, government initiatives promoting industrial automation and "Make in India" are creating a favorable environment for market growth. The increasing labor costs and the need for enhanced accuracy and speed in logistics operations are further accelerating market adoption. Key segments within the market, such as Automated Storage and Retrieval Systems (AS/RS) and Automated Guided Vehicles (AGVs), are witnessing particularly strong growth, driven by their ability to optimize warehouse space and improve throughput. The retail and logistics sectors are major end-users, reflecting the high volume of goods movement and the need for efficient handling across the supply chain. While challenges like high initial investment costs and the need for skilled technicians might act as restraints, the long-term benefits of improved efficiency and reduced operational expenses are outweighing these concerns, contributing to the overall positive market outlook.

The regional distribution of the market across North, South, East, and West India reflects varying levels of industrial development and e-commerce penetration. While specific regional breakdowns are not provided, it's reasonable to expect higher growth in regions with concentrated industrial activity and rapidly developing logistics infrastructure. Companies like GreyOrange, Addverb Technologies, and Daifuku India are key players, leveraging their technological expertise and market presence to capture a significant share of this expanding market. The market's future trajectory suggests sustained growth, propelled by continuous technological advancements, increasing adoption across diverse industries, and ongoing government support. This makes the India automated material handling market an attractive investment opportunity for both domestic and international players.

India Automated Material Handling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Automated Material Handling Market, offering crucial insights for industry stakeholders, investors, and businesses seeking to capitalize on this rapidly expanding sector. The report covers the period from 2019 to 2033, with a focus on the estimated year 2025 and a forecast period from 2025 to 2033. Key segments analyzed include Automated Conveyor, Automated Storage & Retrieval System (AS/RS), Automated Guided Vehicles (AGV), Palletizer/Sortation Systems, and WMS/WCS Solutions, across key end-users like Airports, Manufacturing, Retail/Warehouse/Logistics Centers, and Others. Leading players like GreyOrange Pte Ltd, Addverb Technologies Inc, and Daifuku India Private Limited are profiled, providing a detailed understanding of market dynamics and future opportunities. The report's data-driven analysis helps you understand market trends, competitive landscapes, and growth drivers to make informed business decisions. The market is poised for significant growth driven by e-commerce expansion, technological advancements, and government initiatives.

India Automated Material Handling Market Concentration & Dynamics

The Indian automated material handling market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, a growing number of smaller, specialized companies are also emerging, fostering a dynamic competitive environment. The market is characterized by a robust innovation ecosystem, driven by technological advancements in robotics, AI, and IoT. Regulatory frameworks, while generally supportive of industrial automation, present some complexities related to safety standards and data privacy. Substitute products, such as manual handling systems, are gradually being replaced by automated solutions due to efficiency gains and cost savings. End-user trends indicate a strong preference for flexible, scalable, and technologically advanced systems. The market has witnessed a moderate level of M&A activity in recent years, with larger companies acquiring smaller firms to expand their product portfolios and geographical reach.

- Market Share: Top 5 players hold approximately xx% of the market share (2024).

- M&A Deal Count: An estimated xx M&A deals were recorded between 2019 and 2024.

- Innovation Ecosystem: Strong focus on R&D, partnerships with technology providers, and government support programs.

- Regulatory Framework: Focus on safety, standardization, and data security.

India Automated Material Handling Market Industry Insights & Trends

The Indian automated material handling market is experiencing robust growth, driven by factors such as the burgeoning e-commerce sector, increasing industrial automation adoption, and the government's focus on infrastructure development. The market size in 2024 was estimated at xx Million, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is expected to continue during the forecast period (2025-2033), driven by technological advancements such as the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into automated systems. Evolving consumer behavior, particularly the increased preference for faster delivery and enhanced supply chain efficiency, further fuels market demand. The increasing focus on warehouse optimization and efficiency improvements across industries is another key driver. The adoption of Industry 4.0 principles is accelerating the integration of automated material handling systems into smart factories and warehouses.

Key Markets & Segments Leading India Automated Material Handling Market

The Retail/Warehouse/Logistics Center segment dominates the end-user landscape, fueled by the rapid growth of e-commerce and the need for efficient order fulfillment. The Manufacturing sector is also a significant contributor, with increasing automation in production lines. The Automated Storage & Retrieval System (AS/RS) segment holds a leading position in the solution type category, owing to its ability to optimize warehouse space and improve throughput.

Key Growth Drivers:

- Booming E-commerce: Driving demand for faster order fulfillment and efficient warehouse management.

- Government Initiatives: Focus on infrastructure development and "Make in India" promoting domestic manufacturing.

- Rising Labor Costs: Increasing the attractiveness of automation as a cost-effective solution.

- Technological Advancements: AI and IoT integration enhance efficiency and productivity.

Dominance Analysis:

The dominance of Retail/Warehouse/Logistics Centers is primarily due to the explosive growth of the e-commerce sector in India. The segment's demand for efficient order fulfillment and inventory management systems directly translates into higher demand for automated material handling solutions. The strong growth in this sector is further amplified by the rising adoption of 3PL providers, who rely heavily on automated systems to manage their vast networks.

India Automated Material Handling Market Product Developments

Recent product innovations emphasize increased efficiency, flexibility, and integration with existing warehouse management systems (WMS). The integration of AI and machine learning enables predictive maintenance, optimized routing, and improved overall system performance. New solutions are focusing on smaller footprints, catering to the needs of companies with limited space. These advancements provide competitive advantages through improved productivity, reduced operational costs, and enhanced safety.

Challenges in the India Automated Material Handling Market

The market faces challenges including high initial investment costs, the need for skilled labor for installation and maintenance, and integration complexities with existing systems. Supply chain disruptions and the availability of skilled technicians are also notable constraints. Furthermore, regulatory hurdles and safety standards can create implementation barriers, potentially delaying project timelines.

Forces Driving India Automated Material Handling Market Growth

Technological advancements like AI and IoT integration are key growth drivers. The booming e-commerce sector, coupled with the government's "Make in India" initiative and focus on infrastructure, significantly boost market growth. Furthermore, rising labor costs make automation a cost-effective alternative.

Challenges in the India Automated Material Handling Market

Long-term growth relies on addressing skilled labor shortages through comprehensive training programs and fostering collaborations between technology providers and end-users. Sustained market expansion necessitates continued technological innovations and strategic partnerships for seamless system integration.

Emerging Opportunities in India Automated Material Handling Market

Emerging opportunities lie in the adoption of autonomous mobile robots (AMRs), collaborative robots (cobots), and the integration of blockchain technology for enhanced supply chain transparency. Expansion into smaller cities and rural areas with growing industrialization offers significant untapped potential. The growing demand for sustainable and energy-efficient solutions presents a further opportunity.

Leading Players in the India Automated Material Handling Market Sector

- GreyOrange Pte Ltd

- Addverb Technologies Inc

- Space Magnum Equipment Pvt Ltd

- Hinditron Group

- Armstrong Ltd

- Kardex India Storage Solutions Private Limited

- Daifuku India Private Limited (Incl Vega Conveyors & Automation)

- Falcon Autotech Private Limited

- Godrej Consoveyo Logistics Automation Ltd (GCLA)

- The Hi-Tech Robotic Systemz Limited

- Bastian Solution Private Limited

Key Milestones in India Automated Material Handling Market Industry

November 2022: Daifuku India Private Limited announced a ₹450 Crore investment in a new 2 lakh sq ft intra-logistics equipment facility in Hyderabad, significantly expanding its manufacturing capacity for AS/RS, conveyors, and sorters. This indicates a strong commitment to meeting the growing demand for automated material handling solutions.

September 2022: Godrej Consoveyo Logistics Automation Ltd strengthened its product portfolio in Telangana, aiming for a 30% revenue share in the region. This reflects the growing demand for automated material handling solutions driven by the e-commerce and retail sectors in the state.

Strategic Outlook for India Automated Material Handling Market

The Indian automated material handling market presents significant growth potential driven by continued e-commerce expansion, increased industrial automation, and technological advancements. Strategic opportunities lie in developing innovative solutions tailored to specific industry needs, fostering partnerships for seamless system integration, and expanding into new geographical markets. Companies that adapt quickly to evolving market dynamics and invest in R&D will be well-positioned to capture a significant share of this rapidly growing market.

India Automated Material Handling Market Segmentation

-

1. Solution Type

- 1.1. Automated Conveyor

- 1.2. Automated Storage & Retrieval System (AS/RS)

- 1.3. Automated Guided Vehicles (AGV)

- 1.4. Palletizer/Sortation Systems

- 1.5. WMS/WCS Solutions

-

2. End-User

- 2.1. Airport

- 2.2. Manufacturing

- 2.3. Retail/Warehouse/Logistics Center

- 2.4. Other End-User

India Automated Material Handling Market Segmentation By Geography

- 1. India

India Automated Material Handling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Industry 4.0 investments driving the demand for automation and material handling

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Implementation

- 3.4. Market Trends

- 3.4.1. Industry 4.0 Investments Driving the Demand for Automation and Material Handling is Expected to Drive Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automated Material Handling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Automated Conveyor

- 5.1.2. Automated Storage & Retrieval System (AS/RS)

- 5.1.3. Automated Guided Vehicles (AGV)

- 5.1.4. Palletizer/Sortation Systems

- 5.1.5. WMS/WCS Solutions

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Airport

- 5.2.2. Manufacturing

- 5.2.3. Retail/Warehouse/Logistics Center

- 5.2.4. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. North India India Automated Material Handling Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Automated Material Handling Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Automated Material Handling Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Automated Material Handling Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 GreyOrange Pte Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Addverb Technologies Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Space Magnum Equipment Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hinditron Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Armstrong Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kardex India Storage Solutions Private Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Daifuku India Private Limited (Incl Vega Conveyors & Automation)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Falcon Autotech Private Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Godrej Consoveyo Logistics Automation Ltd (GCLA)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 The Hi-Tech Robotic Systemz Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bastian Solution Private Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 GreyOrange Pte Ltd

List of Figures

- Figure 1: India Automated Material Handling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Automated Material Handling Market Share (%) by Company 2024

List of Tables

- Table 1: India Automated Material Handling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Automated Material Handling Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 3: India Automated Material Handling Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: India Automated Material Handling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Automated Material Handling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Automated Material Handling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Automated Material Handling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Automated Material Handling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Automated Material Handling Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Automated Material Handling Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 11: India Automated Material Handling Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 12: India Automated Material Handling Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automated Material Handling Market?

The projected CAGR is approximately 12.70%.

2. Which companies are prominent players in the India Automated Material Handling Market?

Key companies in the market include GreyOrange Pte Ltd, Addverb Technologies Inc, Space Magnum Equipment Pvt Ltd, Hinditron Group, Armstrong Ltd, Kardex India Storage Solutions Private Limited, Daifuku India Private Limited (Incl Vega Conveyors & Automation), Falcon Autotech Private Limited, Godrej Consoveyo Logistics Automation Ltd (GCLA), The Hi-Tech Robotic Systemz Limited, Bastian Solution Private Limited.

3. What are the main segments of the India Automated Material Handling Market?

The market segments include Solution Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Industry 4.0 investments driving the demand for automation and material handling.

6. What are the notable trends driving market growth?

Industry 4.0 Investments Driving the Demand for Automation and Material Handling is Expected to Drive Market.

7. Are there any restraints impacting market growth?

; High Cost of Implementation.

8. Can you provide examples of recent developments in the market?

November 2022: Daifuku India Private Limited, an automated material handling tech solutions provider, announced its investing 450 crores in setting up a new 2 lakh sq ft intra-logistics equipment facility at Hyderabad; the new facility will add to the company's current manufacturing footprint of 60,000 sq ft will produce automated storage and retrieval systems, sortings transfer vehicles conveyors and sorters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automated Material Handling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automated Material Handling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automated Material Handling Market?

To stay informed about further developments, trends, and reports in the India Automated Material Handling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence