Key Insights

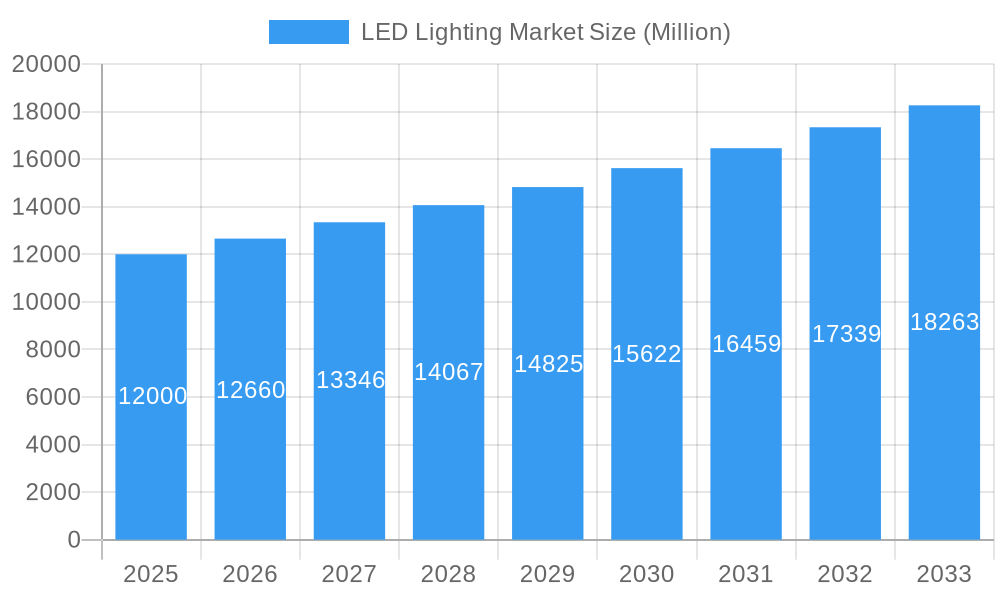

The global LED lighting market is driven by escalating energy efficiency demands, supportive government regulations, and the rapid integration of smart lighting solutions. The market is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 3.49%. This growth trajectory, beginning from a base year of 2025, is underpinned by several key drivers. Firstly, the decreasing cost of LED technology enhances its accessibility across residential, commercial, and automotive sectors, positioning it as a superior alternative to conventional lighting. Secondly, the extended lifespan and minimal maintenance requirements of LEDs offer substantial long-term cost benefits for both businesses and consumers. Furthermore, technological advancements, particularly in smart lighting systems featuring integrated controls and connectivity, are stimulating demand and creating new market opportunities. The automotive industry is a notable adopter, with LEDs increasingly prevalent in daytime running lights, headlights, and taillights for improved visibility and aesthetics. The market's dynamism is further amplified by its diverse segmentation, including residential, commercial, industrial, outdoor, and automotive applications. Leading companies such as OSRAM, HELLA, Koito, and Signify are actively innovating, fostering product diversification and competitive pricing.

LED Lighting Market Market Size (In Billion)

While opportunities abound, challenges such as the initial capital investment for LED infrastructure, particularly in developing economies, and emerging environmental concerns related to light pollution and LED waste disposal, require strategic attention. Nevertheless, the long-term outlook remains strongly positive, with ongoing technological advancements and government initiatives expected to drive widespread adoption. The market size in 2025 is estimated at 9.3 billion, and is expected to grow consistently.

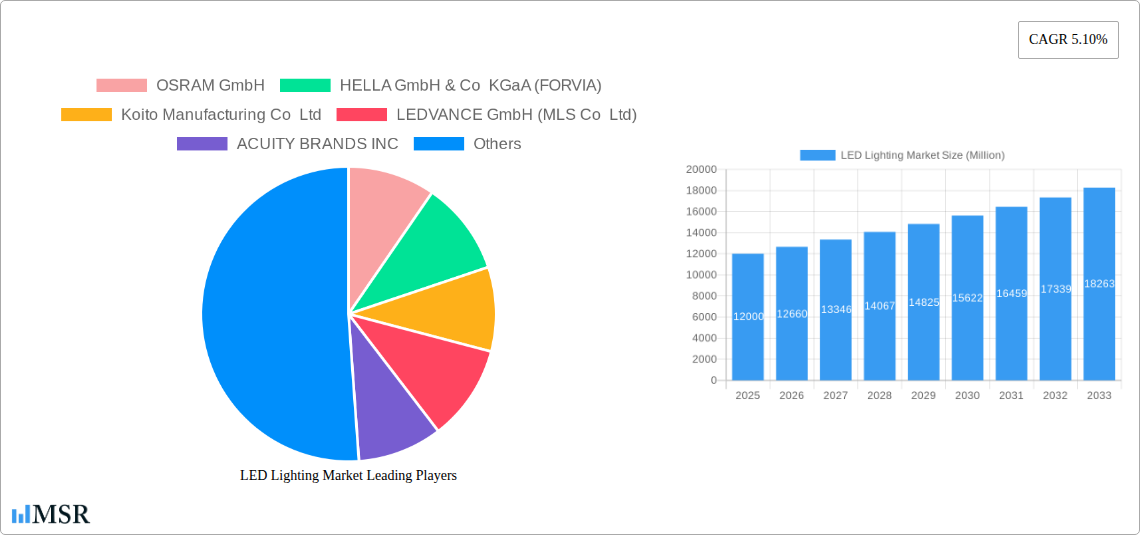

LED Lighting Market Company Market Share

LED Lighting Market Analysis: Trends, Growth, and Forecast (2025-2033)

This comprehensive report delivers an in-depth analysis of the global LED lighting market, examining market dynamics, industry trends, key segments, leading players, and future growth prospects. Covering the period from 2025 to 2033, with 2025 as the base year, this report provides essential insights for industry stakeholders, investors, and businesses navigating this evolving market. The analysis extends across critical segments including automotive, residential, industrial, and outdoor lighting. The market is projected to reach significant value by 2033, exhibiting a robust CAGR.

LED Lighting Market Market Concentration & Dynamics

The LED lighting market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. However, the market is characterized by intense competition, particularly among manufacturers of high-end products and those focused on specific niche applications. Market share is dynamic, influenced by factors such as technological advancements, strategic acquisitions, and evolving consumer preferences.

Market Concentration Metrics:

- Top 5 players hold approximately xx% of the global market share (2024).

- The market witnessed xx M&A deals in the past five years (2019-2024).

Innovation Ecosystems:

Continuous innovation is a defining feature of the LED lighting market, driven by R&D investments by major players and the emergence of innovative startups. This ecosystem fosters the development of energy-efficient lighting solutions, smart lighting technologies, and specialized lighting applications for diverse sectors.

Regulatory Frameworks:

Government regulations concerning energy efficiency and sustainability significantly influence market growth. Stringent energy efficiency standards in various regions drive the adoption of LED lighting, creating favorable market conditions.

Substitute Products:

While LED lighting is rapidly replacing traditional lighting technologies, alternative technologies such as OLED and laser lighting pose some competitive challenges, particularly in niche applications demanding specific performance characteristics.

End-User Trends:

Growing awareness of energy efficiency and environmental sustainability is a major factor driving end-user demand for LED lighting. Moreover, the increasing adoption of smart home technologies and IoT devices is boosting the demand for smart LED lighting solutions.

M&A Activities:

Strategic mergers and acquisitions are shaping the market landscape, consolidating industry players and driving innovation. Large corporations are acquiring smaller companies with specialized technologies or strong market presence in specific regions.

LED Lighting Market Industry Insights & Trends

The global LED lighting market is experiencing robust growth, propelled by several key factors. The increasing adoption of energy-efficient lighting solutions, coupled with government initiatives promoting sustainable technologies, is significantly driving market expansion. Technological advancements, such as the development of smart lighting systems and advancements in LED technology itself, are further fueling market growth. The rising demand for LED lighting across various applications, including residential, commercial, and industrial sectors, is also contributing to the market’s overall expansion. Evolving consumer preferences, emphasizing energy savings, aesthetics, and smart features, are significantly shaping market trends. The market size was valued at xx Million in 2024, and is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

Key Markets & Segments Leading LED Lighting Market

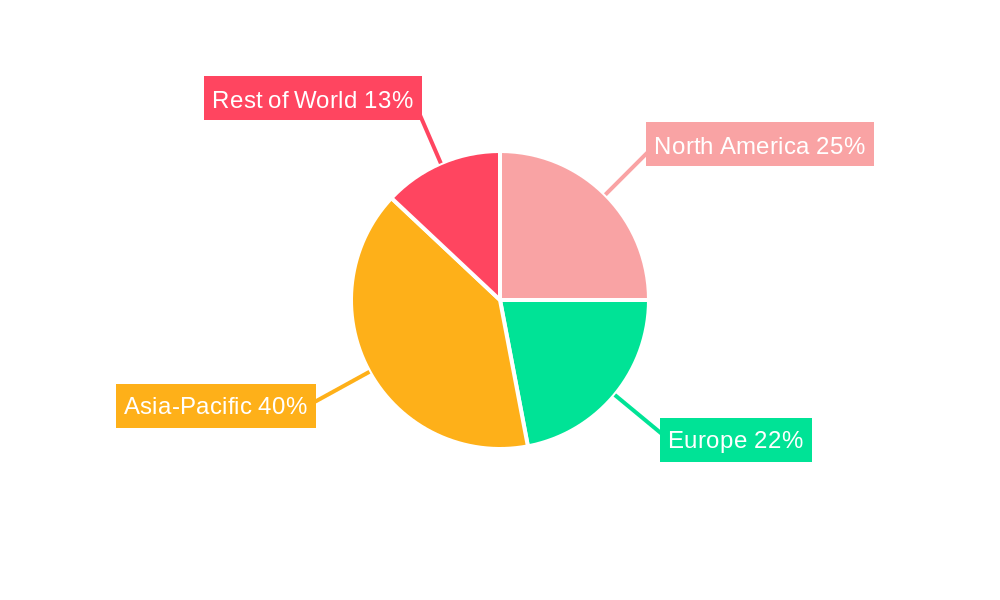

The LED lighting market demonstrates significant regional variations in growth and adoption. While the Asia-Pacific region currently holds a dominant position, driven by rapid economic growth and increasing infrastructure development, other regions are also experiencing substantial growth. The Automotive sector displays impressive growth potential due to increasing demand for advanced lighting systems. The residential sector is a crucial market segment, characterized by increasing demand for energy-efficient and smart lighting solutions.

Key Growth Drivers:

- Economic Growth: Expanding economies drive construction activity and infrastructure development, boosting LED lighting demand.

- Infrastructure Development: Investments in smart cities and infrastructure projects increase the need for efficient public lighting.

- Government Regulations: Stringent energy efficiency standards promote the adoption of LED lighting.

- Technological Advancements: Continuous innovation in LED technology enhances performance, reduces costs, and expands applications.

- Consumer Preferences: Growing preference for energy-efficient and aesthetically pleasing lighting solutions.

Dominance Analysis:

The Asia-Pacific region currently leads the market, fueled by rapid economic growth and substantial infrastructure development. However, North America and Europe are also exhibiting substantial growth, driven by strong consumer demand and supportive government policies. Within segments, the automotive sector shows remarkable growth potential due to the increasing demand for advanced and energy-efficient vehicle lighting systems. The residential segment remains a crucial driver, with ongoing demand for smart and energy-efficient home lighting solutions.

LED Lighting Market Product Developments

Recent product developments in the LED lighting market highlight advancements in efficiency, smart features, and specialized applications. Signify's launch of Philips Wiz Connected smart bulbs underscores the growing integration of smart technology in lighting solutions. Osram's OSLON Optimum LEDs for horticulture lighting demonstrate the application of LED technology in specialized sectors. Cyclone Lighting's Elencia luminaire exemplifies improvements in design and aesthetics for outdoor lighting applications. These innovations enhance the competitiveness of LED lighting solutions by offering improved performance, increased energy efficiency, and enhanced user experiences.

Challenges in the LED Lighting Market Market

Several challenges hamper the growth of the LED lighting market. Supply chain disruptions due to global events can lead to increased costs and production delays. Intense competition from established and new players can create pricing pressures. Varying regulatory landscapes across different regions can add complexity to market entry and operation. These factors, when combined, significantly affect the overall profitability and expansion plans of companies operating in this industry.

Forces Driving LED Lighting Market Growth

Technological advancements, including the development of more energy-efficient and cost-effective LEDs, are significant growth drivers. Government initiatives promoting energy efficiency and sustainability create a supportive regulatory environment. Economic growth in developing countries fuels infrastructure development and increased demand for lighting solutions. The increasing adoption of smart home technology further drives market expansion by increasing demand for connected lighting systems.

Challenges in the LED Lighting Market Market

Long-term growth catalysts include continuous innovation in LED technology, leading to improvements in efficiency, lifespan, and functionality. Strategic partnerships and collaborations between manufacturers and technology providers accelerate innovation and market penetration. Expanding into new markets, particularly in developing economies with rapidly growing infrastructure, presents substantial growth opportunities.

Emerging Opportunities in LED Lighting Market

The integration of LED lighting with IoT technologies opens opportunities for creating smart lighting solutions that enhance energy efficiency and user experience. The rising adoption of LED lighting in specialized applications, such as horticulture, healthcare, and industrial settings, creates new market segments for specialized LED products. The increasing demand for sustainable and eco-friendly lighting solutions presents opportunities for manufacturers focusing on environmentally responsible production practices.

Leading Players in the LED Lighting Market Sector

Key Milestones in LED Lighting Market Industry

- September 2023: Signify launches Philips Wiz Connected smart LED bulbs, expanding its smart lighting portfolio.

- May 2023: Osram releases OSLON Optimum LEDs for horticulture lighting, enhancing efficiency and performance in specialized applications.

- May 2023: Cyclone Lighting (Acuity Brands) introduces the Elencia luminaire, enhancing the aesthetics of outdoor post-top lighting.

Strategic Outlook for LED Lighting Market Market

The LED lighting market is poised for continued growth, driven by technological advancements, supportive government policies, and expanding applications across diverse sectors. Strategic opportunities exist in developing innovative smart lighting solutions, penetrating new markets, and leveraging sustainable manufacturing practices. The market's future potential rests on the ability of industry players to capitalize on these opportunities and overcome existing challenges.

LED Lighting Market Segmentation

-

1. Indoor Lighting

- 1.1. Agricultural Lighting

-

1.2. Commercial

- 1.2.1. Office

- 1.2.2. Retail

- 1.2.3. Others

- 1.3. Industrial and Warehouse

- 1.4. Residential

-

2. Outdoor Lighting

- 2.1. Public Places

- 2.2. Streets and Roadways

- 2.3. Others

-

3. Automotive Utility Lighting

- 3.1. Daytime Running Lights (DRL)

- 3.2. Directional Signal Lights

- 3.3. Headlights

- 3.4. Reverse Light

- 3.5. Stop Light

- 3.6. Tail Light

- 3.7. Others

-

4. Automotive Vehicle Lighting

- 4.1. 2 Wheelers

- 4.2. Commercial Vehicles

- 4.3. Passenger Cars

LED Lighting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

LED Lighting Market Regional Market Share

Geographic Coverage of LED Lighting Market

LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts

- 3.3. Market Restrains

- 3.3.1. Regulation Compliance Associated with Laser Usage

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 5.1.1. Agricultural Lighting

- 5.1.2. Commercial

- 5.1.2.1. Office

- 5.1.2.2. Retail

- 5.1.2.3. Others

- 5.1.3. Industrial and Warehouse

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.2.1. Public Places

- 5.2.2. Streets and Roadways

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.3.1. Daytime Running Lights (DRL)

- 5.3.2. Directional Signal Lights

- 5.3.3. Headlights

- 5.3.4. Reverse Light

- 5.3.5. Stop Light

- 5.3.6. Tail Light

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.4.1. 2 Wheelers

- 5.4.2. Commercial Vehicles

- 5.4.3. Passenger Cars

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6. North America LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6.1.1. Agricultural Lighting

- 6.1.2. Commercial

- 6.1.2.1. Office

- 6.1.2.2. Retail

- 6.1.2.3. Others

- 6.1.3. Industrial and Warehouse

- 6.1.4. Residential

- 6.2. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 6.2.1. Public Places

- 6.2.2. Streets and Roadways

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 6.3.1. Daytime Running Lights (DRL)

- 6.3.2. Directional Signal Lights

- 6.3.3. Headlights

- 6.3.4. Reverse Light

- 6.3.5. Stop Light

- 6.3.6. Tail Light

- 6.3.7. Others

- 6.4. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 6.4.1. 2 Wheelers

- 6.4.2. Commercial Vehicles

- 6.4.3. Passenger Cars

- 6.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 7. South America LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 7.1.1. Agricultural Lighting

- 7.1.2. Commercial

- 7.1.2.1. Office

- 7.1.2.2. Retail

- 7.1.2.3. Others

- 7.1.3. Industrial and Warehouse

- 7.1.4. Residential

- 7.2. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 7.2.1. Public Places

- 7.2.2. Streets and Roadways

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 7.3.1. Daytime Running Lights (DRL)

- 7.3.2. Directional Signal Lights

- 7.3.3. Headlights

- 7.3.4. Reverse Light

- 7.3.5. Stop Light

- 7.3.6. Tail Light

- 7.3.7. Others

- 7.4. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 7.4.1. 2 Wheelers

- 7.4.2. Commercial Vehicles

- 7.4.3. Passenger Cars

- 7.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 8. Europe LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 8.1.1. Agricultural Lighting

- 8.1.2. Commercial

- 8.1.2.1. Office

- 8.1.2.2. Retail

- 8.1.2.3. Others

- 8.1.3. Industrial and Warehouse

- 8.1.4. Residential

- 8.2. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 8.2.1. Public Places

- 8.2.2. Streets and Roadways

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 8.3.1. Daytime Running Lights (DRL)

- 8.3.2. Directional Signal Lights

- 8.3.3. Headlights

- 8.3.4. Reverse Light

- 8.3.5. Stop Light

- 8.3.6. Tail Light

- 8.3.7. Others

- 8.4. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 8.4.1. 2 Wheelers

- 8.4.2. Commercial Vehicles

- 8.4.3. Passenger Cars

- 8.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 9. Middle East & Africa LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 9.1.1. Agricultural Lighting

- 9.1.2. Commercial

- 9.1.2.1. Office

- 9.1.2.2. Retail

- 9.1.2.3. Others

- 9.1.3. Industrial and Warehouse

- 9.1.4. Residential

- 9.2. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 9.2.1. Public Places

- 9.2.2. Streets and Roadways

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 9.3.1. Daytime Running Lights (DRL)

- 9.3.2. Directional Signal Lights

- 9.3.3. Headlights

- 9.3.4. Reverse Light

- 9.3.5. Stop Light

- 9.3.6. Tail Light

- 9.3.7. Others

- 9.4. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 9.4.1. 2 Wheelers

- 9.4.2. Commercial Vehicles

- 9.4.3. Passenger Cars

- 9.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 10. Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 10.1.1. Agricultural Lighting

- 10.1.2. Commercial

- 10.1.2.1. Office

- 10.1.2.2. Retail

- 10.1.2.3. Others

- 10.1.3. Industrial and Warehouse

- 10.1.4. Residential

- 10.2. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 10.2.1. Public Places

- 10.2.2. Streets and Roadways

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 10.3.1. Daytime Running Lights (DRL)

- 10.3.2. Directional Signal Lights

- 10.3.3. Headlights

- 10.3.4. Reverse Light

- 10.3.5. Stop Light

- 10.3.6. Tail Light

- 10.3.7. Others

- 10.4. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 10.4.1. 2 Wheelers

- 10.4.2. Commercial Vehicles

- 10.4.3. Passenger Cars

- 10.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 OSRAM GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HELLA GmbH & Co KGaA (FORVIA)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Koito Manufacturing Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LEDVANCE GmbH (MLS Co Ltd)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ACUITY BRANDS INC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OPPLE Lighting Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Marelli Holdings Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Stanley Electric Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Signify (Philips)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Panasonic Holdings Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 OSRAM GmbH

List of Figures

- Figure 1: Global LED Lighting Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America LED Lighting Market Revenue (billion), by Indoor Lighting 2025 & 2033

- Figure 3: North America LED Lighting Market Revenue Share (%), by Indoor Lighting 2025 & 2033

- Figure 4: North America LED Lighting Market Revenue (billion), by Outdoor Lighting 2025 & 2033

- Figure 5: North America LED Lighting Market Revenue Share (%), by Outdoor Lighting 2025 & 2033

- Figure 6: North America LED Lighting Market Revenue (billion), by Automotive Utility Lighting 2025 & 2033

- Figure 7: North America LED Lighting Market Revenue Share (%), by Automotive Utility Lighting 2025 & 2033

- Figure 8: North America LED Lighting Market Revenue (billion), by Automotive Vehicle Lighting 2025 & 2033

- Figure 9: North America LED Lighting Market Revenue Share (%), by Automotive Vehicle Lighting 2025 & 2033

- Figure 10: North America LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America LED Lighting Market Revenue (billion), by Indoor Lighting 2025 & 2033

- Figure 13: South America LED Lighting Market Revenue Share (%), by Indoor Lighting 2025 & 2033

- Figure 14: South America LED Lighting Market Revenue (billion), by Outdoor Lighting 2025 & 2033

- Figure 15: South America LED Lighting Market Revenue Share (%), by Outdoor Lighting 2025 & 2033

- Figure 16: South America LED Lighting Market Revenue (billion), by Automotive Utility Lighting 2025 & 2033

- Figure 17: South America LED Lighting Market Revenue Share (%), by Automotive Utility Lighting 2025 & 2033

- Figure 18: South America LED Lighting Market Revenue (billion), by Automotive Vehicle Lighting 2025 & 2033

- Figure 19: South America LED Lighting Market Revenue Share (%), by Automotive Vehicle Lighting 2025 & 2033

- Figure 20: South America LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe LED Lighting Market Revenue (billion), by Indoor Lighting 2025 & 2033

- Figure 23: Europe LED Lighting Market Revenue Share (%), by Indoor Lighting 2025 & 2033

- Figure 24: Europe LED Lighting Market Revenue (billion), by Outdoor Lighting 2025 & 2033

- Figure 25: Europe LED Lighting Market Revenue Share (%), by Outdoor Lighting 2025 & 2033

- Figure 26: Europe LED Lighting Market Revenue (billion), by Automotive Utility Lighting 2025 & 2033

- Figure 27: Europe LED Lighting Market Revenue Share (%), by Automotive Utility Lighting 2025 & 2033

- Figure 28: Europe LED Lighting Market Revenue (billion), by Automotive Vehicle Lighting 2025 & 2033

- Figure 29: Europe LED Lighting Market Revenue Share (%), by Automotive Vehicle Lighting 2025 & 2033

- Figure 30: Europe LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa LED Lighting Market Revenue (billion), by Indoor Lighting 2025 & 2033

- Figure 33: Middle East & Africa LED Lighting Market Revenue Share (%), by Indoor Lighting 2025 & 2033

- Figure 34: Middle East & Africa LED Lighting Market Revenue (billion), by Outdoor Lighting 2025 & 2033

- Figure 35: Middle East & Africa LED Lighting Market Revenue Share (%), by Outdoor Lighting 2025 & 2033

- Figure 36: Middle East & Africa LED Lighting Market Revenue (billion), by Automotive Utility Lighting 2025 & 2033

- Figure 37: Middle East & Africa LED Lighting Market Revenue Share (%), by Automotive Utility Lighting 2025 & 2033

- Figure 38: Middle East & Africa LED Lighting Market Revenue (billion), by Automotive Vehicle Lighting 2025 & 2033

- Figure 39: Middle East & Africa LED Lighting Market Revenue Share (%), by Automotive Vehicle Lighting 2025 & 2033

- Figure 40: Middle East & Africa LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific LED Lighting Market Revenue (billion), by Indoor Lighting 2025 & 2033

- Figure 43: Asia Pacific LED Lighting Market Revenue Share (%), by Indoor Lighting 2025 & 2033

- Figure 44: Asia Pacific LED Lighting Market Revenue (billion), by Outdoor Lighting 2025 & 2033

- Figure 45: Asia Pacific LED Lighting Market Revenue Share (%), by Outdoor Lighting 2025 & 2033

- Figure 46: Asia Pacific LED Lighting Market Revenue (billion), by Automotive Utility Lighting 2025 & 2033

- Figure 47: Asia Pacific LED Lighting Market Revenue Share (%), by Automotive Utility Lighting 2025 & 2033

- Figure 48: Asia Pacific LED Lighting Market Revenue (billion), by Automotive Vehicle Lighting 2025 & 2033

- Figure 49: Asia Pacific LED Lighting Market Revenue Share (%), by Automotive Vehicle Lighting 2025 & 2033

- Figure 50: Asia Pacific LED Lighting Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific LED Lighting Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LED Lighting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Global LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 3: Global LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 4: Global LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 5: Global LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 6: Global LED Lighting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Global LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 8: Global LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 9: Global LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 10: Global LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 11: Global LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Canada LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Mexico LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 16: Global LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 17: Global LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 18: Global LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 19: Global LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Brazil LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Argentina LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of South America LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 24: Global LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 25: Global LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 26: Global LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 27: Global LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: United Kingdom LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Germany LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: France LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Italy LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Spain LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Russia LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Benelux LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Nordics LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 38: Global LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 39: Global LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 40: Global LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 41: Global LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Turkey LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Israel LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: GCC LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: North Africa LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: South Africa LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Middle East & Africa LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Global LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 49: Global LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 50: Global LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 51: Global LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 52: Global LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 53: China LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: India LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: Japan LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: South Korea LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: ASEAN LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Oceania LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 59: Rest of Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LED Lighting Market?

The projected CAGR is approximately 3.49%.

2. Which companies are prominent players in the LED Lighting Market?

Key companies in the market include OSRAM GmbH, HELLA GmbH & Co KGaA (FORVIA), Koito Manufacturing Co Ltd, LEDVANCE GmbH (MLS Co Ltd), ACUITY BRANDS INC, OPPLE Lighting Co Ltd, Marelli Holdings Co Ltd, Stanley Electric Co Ltd, Signify (Philips), Panasonic Holdings Corporation.

3. What are the main segments of the LED Lighting Market?

The market segments include Indoor Lighting, Outdoor Lighting, Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Regulation Compliance Associated with Laser Usage.

8. Can you provide examples of recent developments in the market?

September 2023: Signify, the owner of the Philips Hue brand announced the global launch of its Philips Smart LED bulbs. The new portfolio is the result of Signify's 2019 acquisition of Wiz, and it is distinguished from Hue products by the "Wiz Connected" badge on its blue box.May 2023: Osram announced the release of the OSLON Optimum family of LEDs in May 2022. These LEDs are based on the most recent ams Osram 1mm2 chip and are designed for horticulture lighting. They offer an exceptional combination of high efficiency, dependable performance, and great value.May 2023: Cyclone Lighting, a well-known manufacturer of outdoor luminaires of Acuity brand announced the debut of its Elencia luminaire. Outdoor post-top lighting has an upscale look thanks to high-performance optics and revised, modern lantern style.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LED Lighting Market?

To stay informed about further developments, trends, and reports in the LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence