Key Insights

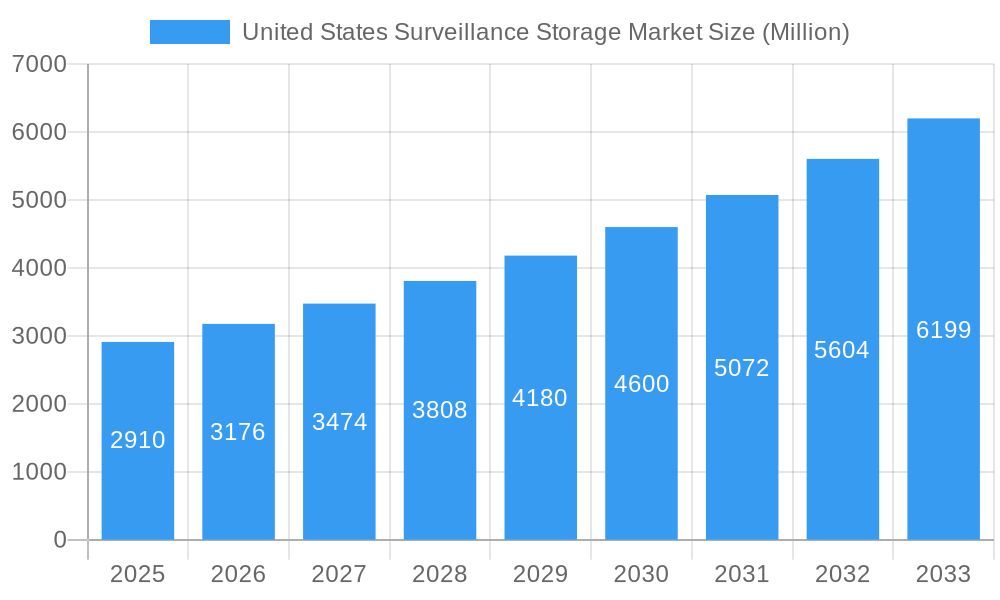

The United States surveillance storage market, valued at $2.91 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 9.04% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of advanced surveillance technologies, such as AI-powered video analytics and higher-resolution cameras, necessitates significantly larger storage capacities. Furthermore, the growing concerns regarding public safety and security, coupled with the rising incidence of crime and terrorism, are fueling demand for sophisticated surveillance systems, directly impacting storage requirements. Stringent government regulations mandating data retention for extended periods also contribute to this market growth. The proliferation of connected devices, the Internet of Things (IoT), and the increasing need for real-time monitoring across various sectors, including retail, healthcare, and transportation, further amplify the demand for robust and scalable surveillance storage solutions. Competition among established players like Seagate, Western Digital, and NetApp, alongside the emergence of specialized surveillance storage providers, is fostering innovation and driving down costs, making these solutions accessible to a wider range of users.

United States Surveillance Storage Market Market Size (In Billion)

The market segmentation is likely diverse, encompassing various storage technologies (e.g., HDDs, SSDs, cloud storage), deployment models (on-premise, cloud), and end-user verticals (e.g., government, commercial). While the provided data lacks specific segment breakdowns, we can infer that the cloud-based segment is experiencing particularly rapid growth due to its scalability, cost-effectiveness, and accessibility. However, on-premise solutions remain relevant, particularly for organizations with high security and latency requirements. Future market growth will hinge on the continued advancements in storage technologies, the development of more efficient data management techniques, and the decreasing cost of storage capacity. The increasing adoption of edge computing, allowing for processing and storing data closer to its source, will also significantly shape the future trajectory of this market.

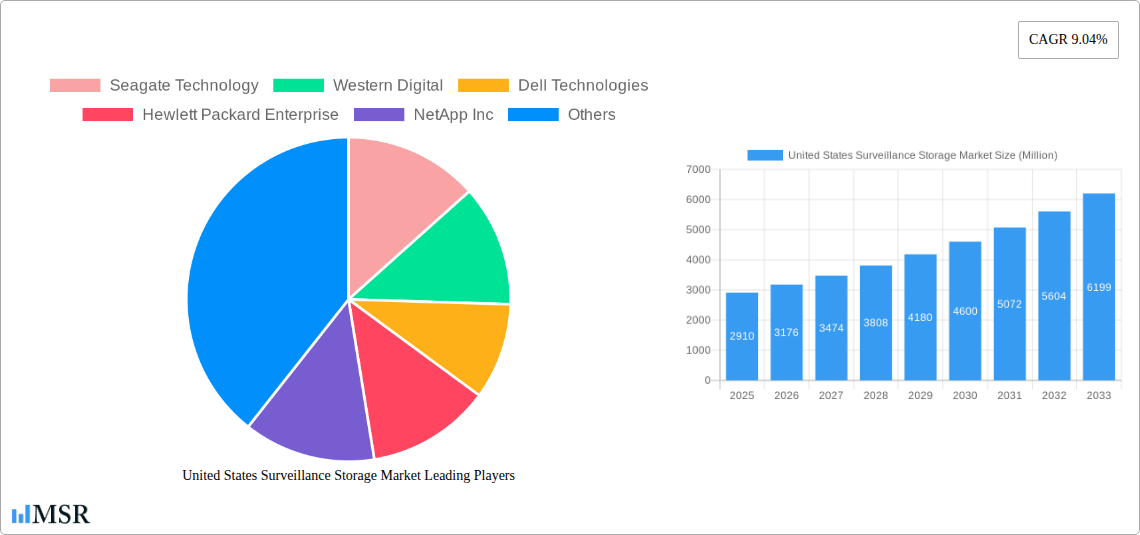

United States Surveillance Storage Market Company Market Share

United States Surveillance Storage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Surveillance Storage Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and future growth potential. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Key players analyzed include Seagate Technology, Western Digital, Dell Technologies, Hewlett Packard Enterprise, NetApp Inc, IBM, Quantum Corporation, Cisco Systems, Genetec, Axis Communication, Tiger Technology, Wasabi Technologies, Cloudian, Milestone Systems, Verkada Inc, Broadberry Data Systems LLC, and Synology Inc.

United States Surveillance Storage Market Market Concentration & Dynamics

The United States surveillance storage market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is also characterized by a dynamic ecosystem of innovative startups and established players constantly vying for dominance. Seagate Technology and Western Digital currently hold the largest market share, followed by Dell Technologies and Hewlett Packard Enterprise. The market share of these key players is estimated to be approximately xx% in 2025. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Ecosystems: Strong presence of both established players and innovative startups.

- Regulatory Frameworks: Subject to evolving data privacy regulations impacting storage and security.

- Substitute Products: Cloud storage and other data management solutions pose some competitive threat.

- End-User Trends: Increasing adoption of cloud-based surveillance solutions and AI-powered analytics.

- M&A Activities: Moderate activity observed in recent years, driven by consolidation and expansion strategies.

United States Surveillance Storage Market Industry Insights & Trends

The United States surveillance storage market is experiencing robust growth fueled by several key factors. The increasing adoption of video surveillance systems across various sectors, including security, retail, and transportation, is a primary driver. The rising demand for high-capacity storage solutions to handle the ever-increasing volume of video data is another significant contributor. Technological advancements such as cloud-based storage solutions, edge computing, and AI-powered analytics are further accelerating market growth. The shift towards cloud-based solutions offers scalability, cost-effectiveness, and enhanced accessibility. Evolving consumer behaviors, prioritizing security and data protection, are also creating a favorable market environment. Government initiatives promoting smart city projects and public safety are further contributing to market expansion.

Key Markets & Segments Leading United States Surveillance Storage Market

The largest segment within the US surveillance storage market is currently the physical security sector, driven by the escalating demand for enhanced security across various industries. The government and public safety segment is also experiencing substantial growth owing to government initiatives aimed at improving public safety and infrastructure. The fastest-growing segment is cloud-based storage, propelled by its advantages in scalability, cost-effectiveness, and accessibility.

- Drivers for Physical Security Segment: Growing concerns about crime and terrorism; increasing need for evidence-based security solutions; advancements in video analytics.

- Drivers for Government and Public Safety Segment: Smart city initiatives; increased funding for public safety programs; need for improved law enforcement efficiency.

- Drivers for Cloud-Based Storage Segment: Scalability and flexibility; cost savings; remote accessibility and data management capabilities.

The key regions driving market growth include major metropolitan areas and states with robust infrastructure and high technological adoption rates. California, New York, and Texas currently hold a significant portion of the market share due to their large population density and robust commercial sectors.

United States Surveillance Storage Market Product Developments

Recent product innovations focus on increasing storage capacity, improving data management capabilities, and enhancing security features. Cloud-based storage solutions are rapidly gaining traction, offering seamless integration with existing surveillance systems. Advancements in AI and machine learning are allowing for more sophisticated video analytics, leading to improved threat detection and crime prevention. The introduction of edge computing technologies enables faster processing and reduced latency, enhancing real-time monitoring capabilities.

Challenges in the United States Surveillance Storage Market Market

The market faces challenges related to data security concerns, stringent data privacy regulations like GDPR and CCPA, and the increasing costs associated with handling large volumes of video data. Supply chain disruptions can also impact the availability and pricing of storage solutions. Furthermore, intense competition among established players and emerging startups puts downward pressure on pricing and profit margins. These challenges collectively impact market growth by xx% annually.

Forces Driving United States Surveillance Storage Market Growth

Technological advancements in areas like AI-driven analytics, cloud storage, and edge computing are key drivers. Growing concerns about security and safety are also pushing adoption. Government initiatives such as the Smart Cities initiative are further boosting the market. The increasing affordability of surveillance storage solutions is making them accessible to a broader range of users.

Challenges in the United States Surveillance Storage Market Market

Long-term growth will be driven by continued innovation in areas such as AI-powered video analytics and the development of more secure and efficient storage solutions. Strategic partnerships between hardware and software providers will play a key role in driving market expansion. Government investments in smart city infrastructure will sustain market growth.

Emerging Opportunities in United States Surveillance Storage Market

Emerging opportunities lie in the integration of IoT devices, AI-driven video analytics, and edge computing technologies. The expansion of 5G networks will enable faster data transfer and enhanced real-time monitoring capabilities. The development of more secure and reliable cloud-based storage solutions will attract new customers.

Leading Players in the United States Surveillance Storage Market Sector

- Seagate Technology

- Western Digital

- Dell Technologies

- Hewlett Packard Enterprise

- NetApp Inc

- IBM

- Quantum Corporation

- Cisco Systems

- Genetec

- Axis Communication

- Tiger Technology

- Wasabi Technologies

- Cloudian

- Milestone Systems

- Verkada Inc

- Broadberry Data Systems LLC

- Synology Inc

Key Milestones in United States Surveillance Storage Market Industry

- March 2024: Wasabi Technologies launches its White Label OEM program, enabling SaaS providers, CSPs, and technology vendors to integrate its cloud storage into their offerings, expanding its reach into the surveillance storage market.

- January 2024: Tiger Technology integrates file-tiering-to-the-cloud technology into surveillance video systems, improving disaster recovery and enhancing playback capabilities from public cloud platforms.

Strategic Outlook for United States Surveillance Storage Market Market

The future of the US surveillance storage market looks bright, driven by continued technological advancements and increasing demand. Strategic partnerships and collaborations among players will shape the market landscape. Investing in AI-powered analytics and robust cybersecurity measures will be crucial for sustained growth. The market's future hinges on companies' ability to innovate, adapt, and meet evolving customer needs.

United States Surveillance Storage Market Segmentation

-

1. Product Type

- 1.1. NAS

- 1.2. SAN

- 1.3. DAS

- 1.4. Other Product Types

-

2. Deployment

- 2.1. Cloud

- 2.2. On Premise

-

3. End User Industry

- 3.1. Banking and Financial Institutions

- 3.2. Transportation and Infrastructure

- 3.3. Government and Defense

- 3.4. Healthcare

- 3.5. Industrial

- 3.6. Retail

- 3.7. Enterprises

- 3.8. Residential

- 3.9. Others

United States Surveillance Storage Market Segmentation By Geography

- 1. United States

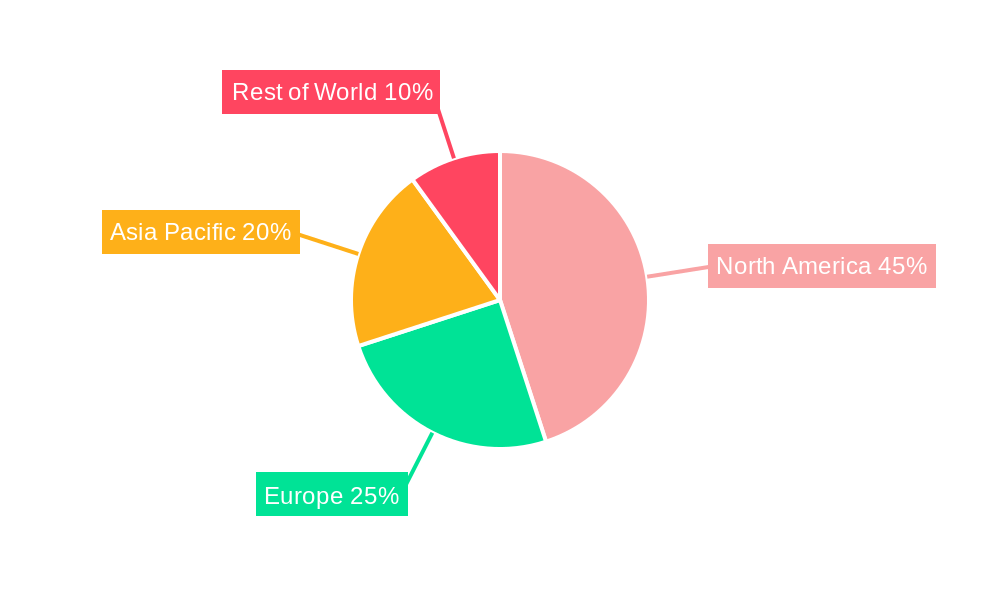

United States Surveillance Storage Market Regional Market Share

Geographic Coverage of United States Surveillance Storage Market

United States Surveillance Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Advanced Surveillance Systems; Expanding Cloud Infrastructure in the Country

- 3.3. Market Restrains

- 3.3.1. Growing Adoption of Advanced Surveillance Systems; Expanding Cloud Infrastructure in the Country

- 3.4. Market Trends

- 3.4.1. Cloud Storage Segment to Witness Substantial Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Surveillance Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. NAS

- 5.1.2. SAN

- 5.1.3. DAS

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On Premise

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. Banking and Financial Institutions

- 5.3.2. Transportation and Infrastructure

- 5.3.3. Government and Defense

- 5.3.4. Healthcare

- 5.3.5. Industrial

- 5.3.6. Retail

- 5.3.7. Enterprises

- 5.3.8. Residential

- 5.3.9. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Seagate Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Western Digital

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dell Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hewlett Packard Enterprise

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NetApp Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IBM

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Quantum Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cisco Systems

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Genetec

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Axis Communication

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tiger Technology

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Wasabi Technologies

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Cloudian

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Milestone Systems

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Verkada Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Broadberry Data Systems LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Synology In

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Seagate Technology

List of Figures

- Figure 1: United States Surveillance Storage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Surveillance Storage Market Share (%) by Company 2025

List of Tables

- Table 1: United States Surveillance Storage Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Surveillance Storage Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: United States Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 4: United States Surveillance Storage Market Volume Billion Forecast, by Deployment 2020 & 2033

- Table 5: United States Surveillance Storage Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 6: United States Surveillance Storage Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 7: United States Surveillance Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Surveillance Storage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: United States Surveillance Storage Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: United States Surveillance Storage Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 11: United States Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 12: United States Surveillance Storage Market Volume Billion Forecast, by Deployment 2020 & 2033

- Table 13: United States Surveillance Storage Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 14: United States Surveillance Storage Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 15: United States Surveillance Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Surveillance Storage Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Surveillance Storage Market?

The projected CAGR is approximately 9.04%.

2. Which companies are prominent players in the United States Surveillance Storage Market?

Key companies in the market include Seagate Technology, Western Digital, Dell Technologies, Hewlett Packard Enterprise, NetApp Inc, IBM, Quantum Corporation, Cisco Systems, Genetec, Axis Communication, Tiger Technology, Wasabi Technologies, Cloudian, Milestone Systems, Verkada Inc, Broadberry Data Systems LLC, Synology In.

3. What are the main segments of the United States Surveillance Storage Market?

The market segments include Product Type, Deployment, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Advanced Surveillance Systems; Expanding Cloud Infrastructure in the Country.

6. What are the notable trends driving market growth?

Cloud Storage Segment to Witness Substantial Growth.

7. Are there any restraints impacting market growth?

Growing Adoption of Advanced Surveillance Systems; Expanding Cloud Infrastructure in the Country.

8. Can you provide examples of recent developments in the market?

March 2024: Wasabi Technologies, known for its innovative cloud storage solutions, has extended its acclaimed services to SaaS, Cloud Service Providers, and technology vendors. These entities can now leverage Wasabi's White Label OEM program to incorporate its cloud storage into their offerings. This integration empowers them to provide their end-users with various services, including backup, disaster recovery, physical security video surveillance storage, and media archiving. Wasabi's program ensures that partners can deliver cloud storage that is predictably priced, scalable, and renowned for its reliability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Surveillance Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Surveillance Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Surveillance Storage Market?

To stay informed about further developments, trends, and reports in the United States Surveillance Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence