Key Insights

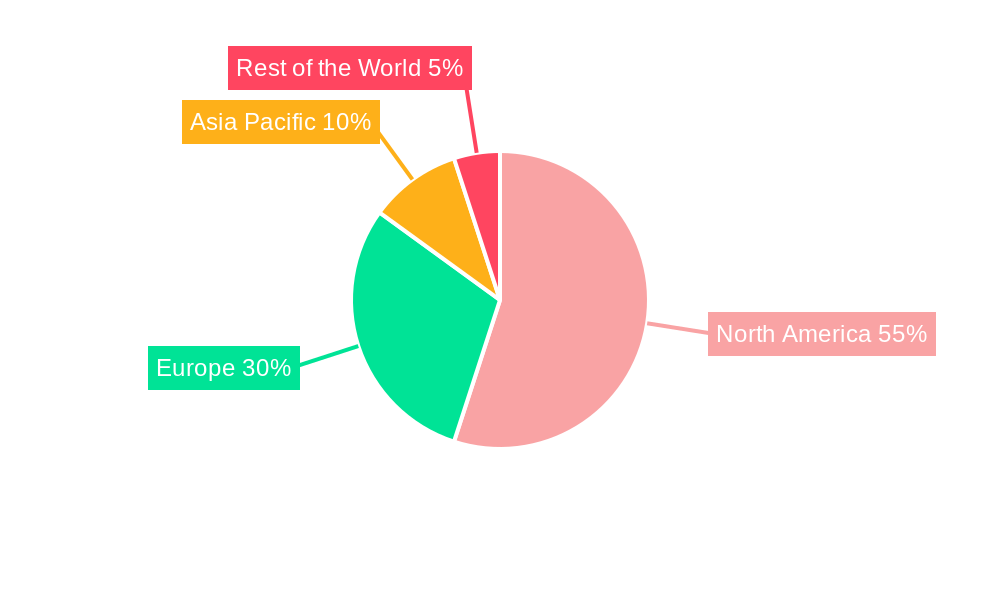

The Recreational Vehicle (RV) rental market, currently valued at $810 million (2025), is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.11% from 2025 to 2033. This expansion is driven by several key factors. The rising popularity of experiential travel and the increasing preference for outdoor recreational activities are significant contributors. Furthermore, the convenience and flexibility offered by RV rentals, allowing for customized itineraries and exploration of diverse landscapes, are attracting a growing segment of travelers. Technological advancements, such as improved online booking platforms and mobile applications, have streamlined the rental process and broadened market access. The market is segmented by rental supplier type (private/individual owners versus fleet operators), booking type (online versus offline), and product type (motorized RVs, campervans, and towable RVs). The dominance of online booking platforms reflects the increasing digitalization of the travel sector. North America, particularly the United States, currently holds the largest market share due to established infrastructure and a high propensity for RV travel. However, Europe and the Asia-Pacific region are emerging as significant growth markets, fueled by increasing disposable incomes and a rising middle class with a growing interest in outdoor adventure tourism.

The competitive landscape includes both large established fleet operators like Cruise America and El Monte RV, and smaller, specialized rental companies like Just Go Motorhome Hire and Indie Campers catering to niche segments. The rise of peer-to-peer RV rental platforms like RV Share and Outdoorsy Inc. is disrupting the traditional market by offering diverse RV options and fostering a more dynamic and competitive environment. While the market faces challenges such as seasonality and the fluctuating cost of fuel, the overall positive outlook is supported by sustained demand and the ongoing development of innovative business models within the industry. The forecast period (2025-2033) suggests a significant expansion of the RV rental market, creating attractive opportunities for both established players and new entrants.

Recreational Vehicle Rental Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Recreational Vehicle (RV) rental market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The study period spans from 2019 to 2033, with a focus on the base year 2025 and a forecast period extending to 2033. The report leverages rigorous research methodologies and data analysis to present a clear picture of market trends, growth drivers, and potential challenges. With a projected market size of xx Million by 2025 and a CAGR of xx%, the RV rental market presents significant opportunities.

Recreational Vehicle Rental Market Concentration & Dynamics

The RV rental market exhibits a moderately concentrated landscape, with a few major players and numerous smaller, independent operators. Market share is influenced by factors such as fleet size, brand reputation, geographic reach, and online booking capabilities. While precise market share figures for each player remain proprietary, we estimate that the top five players command approximately xx% of the global market.

Innovation Ecosystems: The industry is witnessing significant innovation, particularly in areas like electric RV technology, online booking platforms, and service enhancements for renters and owners.

Regulatory Frameworks: Regulations related to vehicle safety, emissions, and licensing vary across jurisdictions and can significantly impact market dynamics. Changes in regulations can create both opportunities and challenges.

Substitute Products: Alternative travel options like hotels, vacation rentals, and camping present some level of competition. However, the unique experience and flexibility offered by RV rentals continue to attract a substantial customer base.

End-User Trends: The growing popularity of experiential travel, coupled with a preference for flexibility and independence, is driving demand. Millennials and Gen Z are increasingly embracing RV rentals as an affordable and adventurous travel option.

M&A Activities: The number of mergers and acquisitions (M&A) in the RV rental sector has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024. Strategic acquisitions often focus on expanding geographic reach, technology integration, and fleet size.

Recreational Vehicle Rental Market Industry Insights & Trends

The global RV rental market is experiencing robust growth fueled by several key factors. Increasing disposable incomes, a rise in adventure tourism, and the appeal of flexible and personalized travel experiences are contributing significantly to this expansion. Technological advancements such as mobile apps for booking and navigation, coupled with the increasing integration of smart technology in RVs themselves, enhance the overall rental experience. This, alongside the changing preferences of consumers who prioritize unique and memorable travel encounters, fuels the continued rise in market demand. The market size is projected to reach xx Million by 2025, representing substantial growth compared to previous years and a compounded annual growth rate (CAGR) of xx%. The rise of online booking platforms has also had a profound impact on the ease of renting RVs, streamlining the process and broadening accessibility. The integration of sustainable practices within the industry, such as the adoption of electric vehicles, is another noteworthy development shaping market trends.

Key Markets & Segments Leading Recreational Vehicle Rental Market

Dominant Regions/Countries: North America (particularly the United States and Canada) and Europe currently dominate the RV rental market due to established infrastructure, high tourist traffic, and a significant base of RV enthusiasts. However, developing economies in Asia and South America are showcasing promising growth potential.

Dominant Segments:

- Rental Supplier Type: Fleet operators currently hold a larger market share compared to private/individual owners due to their economies of scale, professional management, and wider vehicle selection. However, the peer-to-peer rental model (private owners) is expanding rapidly due to the ease of access and localized availability.

- Booking Type: Online booking is experiencing exponential growth, accounting for a significant and increasing portion of bookings due to convenience and broader access to inventory. Offline booking continues to play a role, especially among older demographics or those preferring direct interaction.

- Product Type: Motorized RVs currently constitute a larger segment than campervans and towable RVs due to the higher level of comfort and self-sufficiency they offer. However, campervans are growing in popularity among younger demographics seeking more compact and fuel-efficient options.

Drivers:

- Economic growth: Disposable income levels significantly influence RV rental demand.

- Tourism infrastructure: Well-developed camping facilities and scenic routes enhance the appeal of RV travel.

- Government policies: Tourism promotion initiatives and infrastructure investment directly impact market growth.

Recreational Vehicle Rental Market Product Developments

Recent years have witnessed significant product innovations within the RV rental market. This includes the integration of smart technology within RVs, offering features like remote monitoring, climate control, and entertainment systems. The rise of electric RVs and the introduction of more sustainable materials showcase a movement toward eco-conscious travel options. Companies are constantly striving to offer a wider variety of RV types to cater to diverse customer preferences. These developments cater to evolving consumer expectations, leading to a more comfortable, convenient, and technologically advanced rental experience.

Challenges in the Recreational Vehicle Rental Market Market

The RV rental market faces several challenges. Regulatory hurdles, including licensing, safety standards, and environmental regulations, can impose costs and complexities. Supply chain disruptions can impact vehicle availability and rental prices. Intense competition from established players and new entrants creates pricing pressures. Fluctuations in fuel prices directly affect operational costs. Finally, seasonal demand variations can pose challenges in maintaining optimal resource utilization.

Forces Driving Recreational Vehicle Rental Market Growth

The RV rental market's growth is propelled by factors such as rising disposable incomes globally, allowing more people to afford leisure travel; growing popularity of experiential tourism, where travelers seek unique and immersive experiences; and the advent of technological advancements in RV technology, enhancing comfort and convenience, influencing consumer preference. Government policies promoting tourism also contribute to market growth.

Long-Term Growth Catalysts in the Recreational Vehicle Rental Market

Long-term growth hinges on continuous innovation in RV technology, including electric and hybrid models, and the development of sustainable practices. Strategic partnerships between RV rental companies and other travel-related businesses can expand market reach and create bundled offerings. Expansion into new markets, especially in developing economies with growing tourism sectors, promises significant growth potential.

Emerging Opportunities in Recreational Vehicle Rental Market

Emerging opportunities reside in expanding into niche markets such as luxury RV rentals, targeting affluent travelers. Integrating technology to provide a seamless rental experience and leveraging data analytics to personalize service offerings represents another avenue for growth. Focus on sustainable and eco-friendly RV rentals will appeal to environmentally conscious travelers.

Leading Players in the Recreational Vehicle Rental Market Sector

- Just Go Motorhome Hire

- Indie Campers

- RoadSurfer GmbH

- Cruise America

- McRent

- RV Share

- Outdoorsy Inc

- El Monte RV

- MotorVana (Ideamerge LLC, Apollo Tourism & Leisure Ltd (ATL))

Key Milestones in Recreational Vehicle Rental Market Industry

- June 2023: Roadsurfer secured a EUR 21 million (USD 22.2 million) investment, bolstering its expansion in the US and Europe.

- August 2023: BromontCampervan integrated electric vans into its fleet, demonstrating a commitment to sustainability.

- August 2023: RecNation partnered with RVshare to simplify RV rentals for owners and renters.

- September 2023: RVshare launched an electric RV rental program in Detroit, showcasing the adoption of eco-friendly vehicles.

Strategic Outlook for Recreational Vehicle Rental Market Market

The future of the RV rental market appears bright. Continued innovation in technology and sustainability will attract new customers. Strategic partnerships and expansion into new markets will drive further growth. Focusing on providing a seamless and personalized customer experience will be critical for success. The market is poised for significant expansion in the coming years, driven by evolving consumer preferences and technological advancements.

Recreational Vehicle Rental Market Segmentation

-

1. Rental Supplier Type

- 1.1. Private/Individual Owners

- 1.2. Fleet Operators

-

2. Booking Type

- 2.1. Offline Booking

- 2.2. Online Booking

-

3. Product Type

-

3.1. Motorized RVs

- 3.1.1. Class A Motorhomes

- 3.1.2. Class B Motorhomes

- 3.1.3. Class C Motorhomes

- 3.1.4. Campervans

-

3.2. Towable RVs

- 3.2.1. Fifth-Wheel Trailers

- 3.2.2. Travel Trailers

- 3.2.3. Truck Campers

- 3.2.4. Sports Utility Trailers

-

3.1. Motorized RVs

Recreational Vehicle Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Recreational Vehicle Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. High Maintenance cost of RV Rental Fleets

- 3.4. Market Trends

- 3.4.1. Motorized RVs are the Largest Segment by Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Recreational Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Rental Supplier Type

- 5.1.1. Private/Individual Owners

- 5.1.2. Fleet Operators

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Offline Booking

- 5.2.2. Online Booking

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Motorized RVs

- 5.3.1.1. Class A Motorhomes

- 5.3.1.2. Class B Motorhomes

- 5.3.1.3. Class C Motorhomes

- 5.3.1.4. Campervans

- 5.3.2. Towable RVs

- 5.3.2.1. Fifth-Wheel Trailers

- 5.3.2.2. Travel Trailers

- 5.3.2.3. Truck Campers

- 5.3.2.4. Sports Utility Trailers

- 5.3.1. Motorized RVs

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Rental Supplier Type

- 6. North America Recreational Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Rental Supplier Type

- 6.1.1. Private/Individual Owners

- 6.1.2. Fleet Operators

- 6.2. Market Analysis, Insights and Forecast - by Booking Type

- 6.2.1. Offline Booking

- 6.2.2. Online Booking

- 6.3. Market Analysis, Insights and Forecast - by Product Type

- 6.3.1. Motorized RVs

- 6.3.1.1. Class A Motorhomes

- 6.3.1.2. Class B Motorhomes

- 6.3.1.3. Class C Motorhomes

- 6.3.1.4. Campervans

- 6.3.2. Towable RVs

- 6.3.2.1. Fifth-Wheel Trailers

- 6.3.2.2. Travel Trailers

- 6.3.2.3. Truck Campers

- 6.3.2.4. Sports Utility Trailers

- 6.3.1. Motorized RVs

- 6.1. Market Analysis, Insights and Forecast - by Rental Supplier Type

- 7. Europe Recreational Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Rental Supplier Type

- 7.1.1. Private/Individual Owners

- 7.1.2. Fleet Operators

- 7.2. Market Analysis, Insights and Forecast - by Booking Type

- 7.2.1. Offline Booking

- 7.2.2. Online Booking

- 7.3. Market Analysis, Insights and Forecast - by Product Type

- 7.3.1. Motorized RVs

- 7.3.1.1. Class A Motorhomes

- 7.3.1.2. Class B Motorhomes

- 7.3.1.3. Class C Motorhomes

- 7.3.1.4. Campervans

- 7.3.2. Towable RVs

- 7.3.2.1. Fifth-Wheel Trailers

- 7.3.2.2. Travel Trailers

- 7.3.2.3. Truck Campers

- 7.3.2.4. Sports Utility Trailers

- 7.3.1. Motorized RVs

- 7.1. Market Analysis, Insights and Forecast - by Rental Supplier Type

- 8. Asia Pacific Recreational Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Rental Supplier Type

- 8.1.1. Private/Individual Owners

- 8.1.2. Fleet Operators

- 8.2. Market Analysis, Insights and Forecast - by Booking Type

- 8.2.1. Offline Booking

- 8.2.2. Online Booking

- 8.3. Market Analysis, Insights and Forecast - by Product Type

- 8.3.1. Motorized RVs

- 8.3.1.1. Class A Motorhomes

- 8.3.1.2. Class B Motorhomes

- 8.3.1.3. Class C Motorhomes

- 8.3.1.4. Campervans

- 8.3.2. Towable RVs

- 8.3.2.1. Fifth-Wheel Trailers

- 8.3.2.2. Travel Trailers

- 8.3.2.3. Truck Campers

- 8.3.2.4. Sports Utility Trailers

- 8.3.1. Motorized RVs

- 8.1. Market Analysis, Insights and Forecast - by Rental Supplier Type

- 9. Rest of the World Recreational Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Rental Supplier Type

- 9.1.1. Private/Individual Owners

- 9.1.2. Fleet Operators

- 9.2. Market Analysis, Insights and Forecast - by Booking Type

- 9.2.1. Offline Booking

- 9.2.2. Online Booking

- 9.3. Market Analysis, Insights and Forecast - by Product Type

- 9.3.1. Motorized RVs

- 9.3.1.1. Class A Motorhomes

- 9.3.1.2. Class B Motorhomes

- 9.3.1.3. Class C Motorhomes

- 9.3.1.4. Campervans

- 9.3.2. Towable RVs

- 9.3.2.1. Fifth-Wheel Trailers

- 9.3.2.2. Travel Trailers

- 9.3.2.3. Truck Campers

- 9.3.2.4. Sports Utility Trailers

- 9.3.1. Motorized RVs

- 9.1. Market Analysis, Insights and Forecast - by Rental Supplier Type

- 10. North America Recreational Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Recreational Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Spain

- 11.1.5 Rest of Europe

- 12. Asia Pacific Recreational Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 India

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Recreational Vehicle Rental Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Just Go Motorhome Hire

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Indie Campers

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 RoadSurfer GmbH

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Cruise America

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 McRent

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 RV Share

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Outdoorsy Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 El Monte RV

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 MotorVana (Ideamerge LLC

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Apollo Tourism & Leisure Ltd (ATL)

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Just Go Motorhome Hire

List of Figures

- Figure 1: Global Recreational Vehicle Rental Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Recreational Vehicle Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Recreational Vehicle Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Recreational Vehicle Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Recreational Vehicle Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Recreational Vehicle Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Recreational Vehicle Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Recreational Vehicle Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Recreational Vehicle Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Recreational Vehicle Rental Market Revenue (Million), by Rental Supplier Type 2024 & 2032

- Figure 11: North America Recreational Vehicle Rental Market Revenue Share (%), by Rental Supplier Type 2024 & 2032

- Figure 12: North America Recreational Vehicle Rental Market Revenue (Million), by Booking Type 2024 & 2032

- Figure 13: North America Recreational Vehicle Rental Market Revenue Share (%), by Booking Type 2024 & 2032

- Figure 14: North America Recreational Vehicle Rental Market Revenue (Million), by Product Type 2024 & 2032

- Figure 15: North America Recreational Vehicle Rental Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 16: North America Recreational Vehicle Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Recreational Vehicle Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Recreational Vehicle Rental Market Revenue (Million), by Rental Supplier Type 2024 & 2032

- Figure 19: Europe Recreational Vehicle Rental Market Revenue Share (%), by Rental Supplier Type 2024 & 2032

- Figure 20: Europe Recreational Vehicle Rental Market Revenue (Million), by Booking Type 2024 & 2032

- Figure 21: Europe Recreational Vehicle Rental Market Revenue Share (%), by Booking Type 2024 & 2032

- Figure 22: Europe Recreational Vehicle Rental Market Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Europe Recreational Vehicle Rental Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Europe Recreational Vehicle Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Recreational Vehicle Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Recreational Vehicle Rental Market Revenue (Million), by Rental Supplier Type 2024 & 2032

- Figure 27: Asia Pacific Recreational Vehicle Rental Market Revenue Share (%), by Rental Supplier Type 2024 & 2032

- Figure 28: Asia Pacific Recreational Vehicle Rental Market Revenue (Million), by Booking Type 2024 & 2032

- Figure 29: Asia Pacific Recreational Vehicle Rental Market Revenue Share (%), by Booking Type 2024 & 2032

- Figure 30: Asia Pacific Recreational Vehicle Rental Market Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Asia Pacific Recreational Vehicle Rental Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Asia Pacific Recreational Vehicle Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Recreational Vehicle Rental Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Recreational Vehicle Rental Market Revenue (Million), by Rental Supplier Type 2024 & 2032

- Figure 35: Rest of the World Recreational Vehicle Rental Market Revenue Share (%), by Rental Supplier Type 2024 & 2032

- Figure 36: Rest of the World Recreational Vehicle Rental Market Revenue (Million), by Booking Type 2024 & 2032

- Figure 37: Rest of the World Recreational Vehicle Rental Market Revenue Share (%), by Booking Type 2024 & 2032

- Figure 38: Rest of the World Recreational Vehicle Rental Market Revenue (Million), by Product Type 2024 & 2032

- Figure 39: Rest of the World Recreational Vehicle Rental Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 40: Rest of the World Recreational Vehicle Rental Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Recreational Vehicle Rental Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Rental Supplier Type 2019 & 2032

- Table 3: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 4: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 5: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: South America Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Middle East and Africa Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Rental Supplier Type 2019 & 2032

- Table 26: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 27: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of North America Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Rental Supplier Type 2019 & 2032

- Table 33: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 34: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 35: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Germany Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Spain Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Rental Supplier Type 2019 & 2032

- Table 42: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 43: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 44: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Rental Supplier Type 2019 & 2032

- Table 51: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 52: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 53: Global Recreational Vehicle Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: South America Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Middle East and Africa Recreational Vehicle Rental Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Recreational Vehicle Rental Market?

The projected CAGR is approximately 8.11%.

2. Which companies are prominent players in the Recreational Vehicle Rental Market?

Key companies in the market include Just Go Motorhome Hire, Indie Campers, RoadSurfer GmbH, Cruise America, McRent, RV Share, Outdoorsy Inc, El Monte RV, MotorVana (Ideamerge LLC, Apollo Tourism & Leisure Ltd (ATL).

3. What are the main segments of the Recreational Vehicle Rental Market?

The market segments include Rental Supplier Type, Booking Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

Motorized RVs are the Largest Segment by Product Type.

7. Are there any restraints impacting market growth?

High Maintenance cost of RV Rental Fleets.

8. Can you provide examples of recent developments in the market?

September 2023: RVshare announced a new agreement with Grounded, an electric RV company, to deliver a pioneering Electric Recreational Vehicle rental program to the Detroit market. These rentals are only accessible on RVshare, making Grounded RVs the platform's first electric vehicle fleet. This program, which the Michigan Office also sponsors for Future Mobility and Electrification (OFME), is expected to provide sustainable transport choices for travelers in a historically underserved community through a fleet of E-RVs that are expected to be available for daily hire.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Recreational Vehicle Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Recreational Vehicle Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Recreational Vehicle Rental Market?

To stay informed about further developments, trends, and reports in the Recreational Vehicle Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence