Key Insights

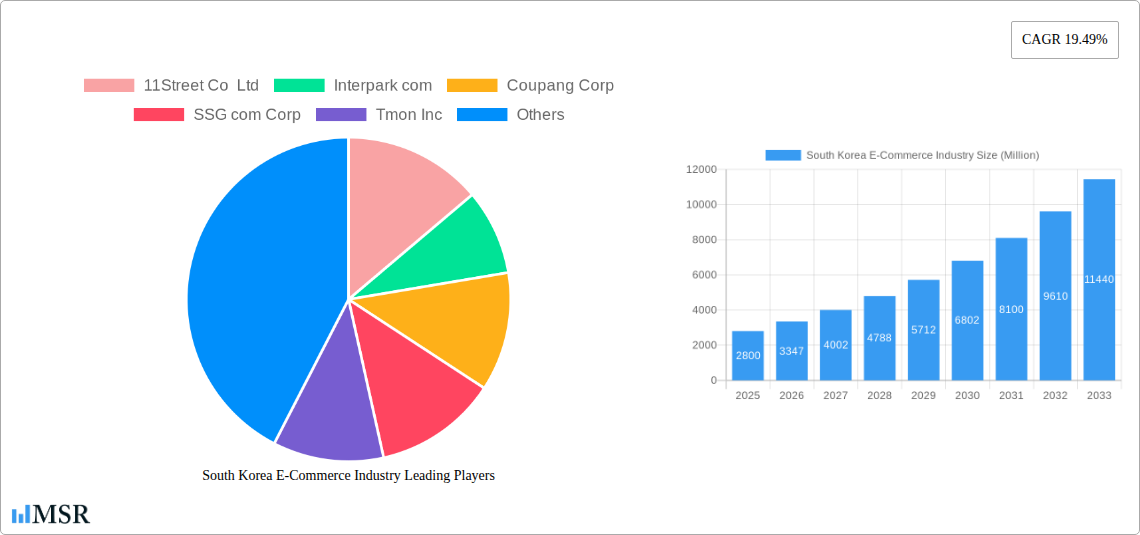

The South Korean e-commerce market, valued at $2.8 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 19.49% from 2025 to 2033. This dynamic market is driven by several key factors. High internet and smartphone penetration rates among South Korea's tech-savvy population fuel the adoption of online shopping. Furthermore, the increasing popularity of mobile commerce, facilitated by advanced mobile infrastructure and convenient payment options like KakaoPay and Naver Pay, significantly contributes to the market's expansion. The rise of social commerce, leveraging platforms like Instagram and KakaoTalk for product discovery and purchasing, also plays a significant role. Finally, the strong logistics infrastructure and efficient delivery services ensure a seamless online shopping experience, further boosting market growth. Competition is fierce, with established players like Coupang, Naver Shopping, and SSG.com battling newer entrants and global giants like Amazon. The market is segmented by product categories (Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home, and Others) and business models (B2C and B2B). While growth is substantial, potential restraints include concerns about data privacy and security, along with the challenges of maintaining high customer satisfaction and managing logistics costs in a competitive landscape. The continued focus on innovation and customer experience will be crucial for success in this rapidly evolving market.

South Korea E-Commerce Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates significant expansion fueled by the aforementioned drivers. The increasing adoption of omnichannel strategies by retailers, integrating online and offline channels, will likely contribute significantly to growth. Moreover, the integration of advanced technologies like artificial intelligence (AI) and big data analytics for personalized marketing and improved customer service will further shape the industry's evolution. However, maintaining sustainable growth requires navigating regulatory changes, addressing consumer concerns related to counterfeits and returns, and ensuring the scalability of logistics operations to meet increasing demand. The B2C sector is expected to dominate, with the continued growth in mobile commerce and social commerce driving substantial market share gains. The B2B segment, although smaller, will likely experience significant expansion due to growing adoption of e-procurement and digital transformation initiatives within South Korean businesses.

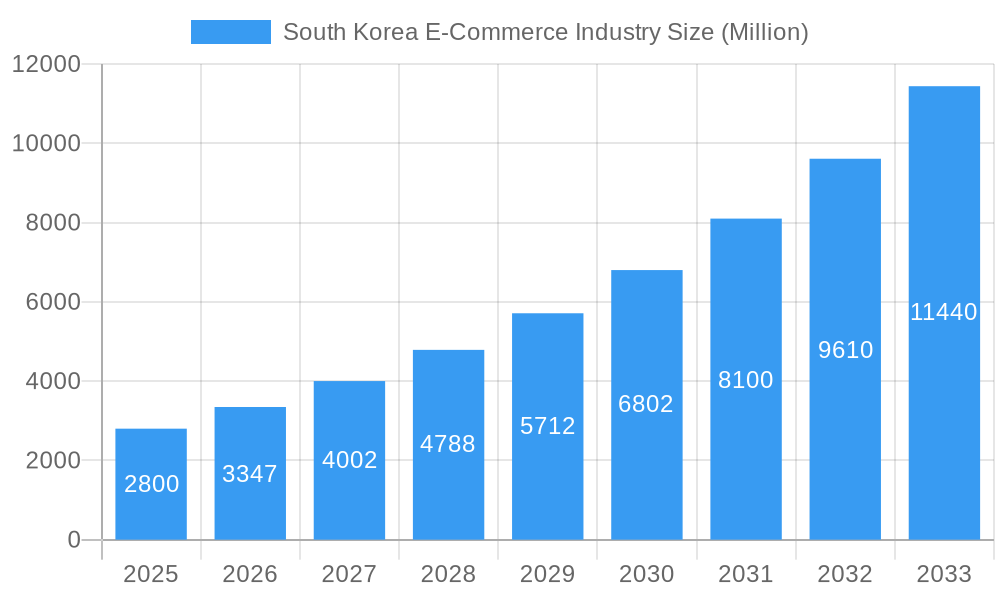

South Korea E-Commerce Industry Company Market Share

South Korea E-Commerce Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a deep dive into the dynamic South Korean e-commerce market, analyzing its current state, future trends, and key players. Covering the period 2019-2033, with a base year of 2025, this report is essential for businesses, investors, and stakeholders seeking to understand and navigate this rapidly evolving landscape. The report projects a market size of xx Million USD in 2025, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Key segments analyzed include B2C e-commerce, B2B e-commerce, and various application segments like Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverage, and Furniture & Home. Leading players such as Coupang Corp, Naver Shopping, and SSG.com Corp are profiled, offering insights into their market strategies and competitive positions.

South Korea E-Commerce Industry Market Concentration & Dynamics

The South Korean e-commerce market exhibits a high degree of concentration, with a few dominant players controlling a significant market share. Coupang Corp, Naver Shopping, and SSG.com Corp hold the largest shares, followed by other key players like 11Street Co Ltd, Interpark.com, Tmon Inc, and EMart. The market is characterized by intense competition, driven by innovation in technology, aggressive marketing strategies, and a focus on customer experience. The regulatory framework in South Korea is generally supportive of e-commerce, although certain regulations related to data privacy and consumer protection need to be considered. The market also witnesses frequent mergers and acquisitions (M&A) activity, with xx M&A deals recorded between 2019 and 2024. This consolidation trend is expected to continue, further shaping the market landscape. End-user trends show a strong preference for mobile commerce, convenient delivery options, and personalized shopping experiences. Substitute products, such as traditional brick-and-mortar retail, still exist, but their market share is steadily declining.

- Market Share: Coupang Corp (xx%), Naver Shopping (xx%), SSG.com Corp (xx%), Others (xx%)

- M&A Deal Count (2019-2024): xx

- Key Innovation Ecosystems: Strong focus on mobile technology, AI-powered recommendations, and advanced logistics.

South Korea E-Commerce Industry Industry Insights & Trends

The South Korean e-commerce market has experienced significant growth in recent years, driven by factors such as increasing internet and smartphone penetration, rising disposable incomes, and a shift towards online shopping among consumers. The market size in 2024 was approximately xx Million USD, exhibiting a substantial CAGR of xx% during the historical period (2019-2024). This growth is further fueled by technological advancements such as the proliferation of mobile payment systems, the rise of social commerce, and the increasing adoption of e-commerce platforms by businesses of all sizes. Evolving consumer behaviors, including a preference for personalized experiences, faster delivery, and seamless omnichannel integration, continue to shape market dynamics. Technological disruptions, such as the rise of live commerce and the integration of AR/VR technologies, are expected to further revolutionize the market in the coming years.

Key Markets & Segments Leading South Korea E-Commerce Industry

The South Korean e-commerce market is dominated by the B2C segment, with a significant contribution from the applications of Beauty and Personal Care, Consumer Electronics, and Fashion and Apparel. The rapid urbanization and rising disposable incomes in major metropolitan areas like Seoul, Busan, and Incheon have driven significant growth in these segments. The B2B e-commerce segment is also witnessing gradual growth, driven by increased adoption of digital platforms by businesses for procurement and supply chain management.

- Dominant Segment: B2C E-commerce

- Fastest-Growing Application: Beauty and Personal Care (driven by K-beauty trends)

- Key Market Drivers:

- Rapid urbanization and increasing disposable incomes.

- Strong digital infrastructure and high internet penetration.

- Growing preference for convenience and personalized shopping experiences.

The dominance of B2C e-commerce is primarily attributed to the high internet and smartphone penetration rates in South Korea, coupled with the rising adoption of online shopping among consumers of all age groups. The convenience and wider selection offered by online platforms have contributed significantly to the shift from traditional retail to e-commerce.

South Korea E-Commerce Industry Product Developments

Recent product innovations in the South Korean e-commerce industry have focused on enhancing customer experience through personalized recommendations, improved search functionalities, and seamless checkout processes. Advancements in logistics and delivery technologies, such as drone delivery and automated warehouses, are also gaining traction. The integration of augmented reality (AR) and virtual reality (VR) technologies is transforming the online shopping experience, allowing consumers to virtually try on clothes or view products in 3D. These developments provide competitive edges for e-commerce businesses by improving customer satisfaction and driving sales.

Challenges in the South Korea E-Commerce Industry Market

The South Korean e-commerce market faces challenges such as intense competition, stringent regulations related to data privacy and consumer protection, and supply chain complexities. These factors can significantly impact the profitability and growth of businesses operating in this space. The high cost of logistics and last-mile delivery is another major concern. Further, counterfeiting and intellectual property rights infringements pose a threat to the industry. Estimates suggest that these issues lead to a xx Million USD loss annually.

Forces Driving South Korea E-Commerce Industry Growth

Several factors drive the growth of the South Korean e-commerce industry. Technological advancements such as the widespread adoption of 5G technology and the rise of artificial intelligence (AI) are enhancing the online shopping experience. Economic growth and increased disposable incomes are contributing to higher consumer spending on online goods and services. Moreover, government support for digital transformation initiatives is creating a favorable environment for e-commerce businesses to thrive.

Long-Term Growth Catalysts in the South Korea E-Commerce Industry

Long-term growth in the South Korean e-commerce market will be driven by innovations in areas such as personalized shopping experiences, mobile commerce, and omnichannel strategies. Strategic partnerships between e-commerce players and logistics providers will enhance delivery efficiency and reduce costs. Expansion into new market segments and geographic regions will also contribute to future growth. The continuous development of technological solutions to address existing challenges will further enable market expansion.

Emerging Opportunities in South Korea E-Commerce Industry

Emerging opportunities in the South Korean e-commerce sector include the growth of social commerce, the adoption of livestreaming shopping, and the expansion of cross-border e-commerce. The increasing popularity of mobile payments and the integration of blockchain technology present additional growth avenues. Moreover, the increasing demand for sustainable and ethically sourced products is creating opportunities for businesses to cater to environmentally conscious consumers.

Leading Players in the South Korea E-Commerce Industry Sector

- Coupang Corp

- Naver Shopping

- SSG.com Corp

- 11Street Co Ltd

- Interpark.com

- Tmon Inc

- EMart

- Amazon.com Inc

- eBay Inc

- Apple Inc

Key Milestones in South Korea E-Commerce Industry Industry

- April 2023: SSG.com announced a new personnel system focusing on competency-based promotion and flexible compensation to enhance competitiveness. This signals a strategic move to attract and retain talent within the increasingly competitive e-commerce sector.

- April 2023: TMON launched a 'Sports & Leisure Special Hall' with discounted sporting goods and an additional 8% discount for Kakao Pay users. This targeted marketing campaign aims to boost sales during the spring season, highlighting the importance of promotional strategies in the market.

Strategic Outlook for South Korea E-Commerce Industry Market

The South Korean e-commerce market holds significant future potential, driven by ongoing technological advancements, evolving consumer preferences, and supportive government policies. Companies that can successfully adapt to these changes and leverage emerging technologies will be well-positioned to capitalize on the growth opportunities in the years to come. Strategic investments in logistics, technology, and customer experience will be critical for success in this dynamic and competitive environment.

South Korea E-Commerce Industry Segmentation

-

1. Application

- 1.1. Beauty and Personal Care

- 1.2. Consumer Electronics

- 1.3. Fashion and Apparel

- 1.4. Food and Beverage

- 1.5. Furniture and Home

- 1.6. Other Applications

South Korea E-Commerce Industry Segmentation By Geography

- 1. South Korea

South Korea E-Commerce Industry Regional Market Share

Geographic Coverage of South Korea E-Commerce Industry

South Korea E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Smartphone and Internet Penetration Across the Country; High Demand for Food Delivery Services

- 3.3. Market Restrains

- 3.3.1. ; High installation and Maintenance Cost is Hindering the Market Growth

- 3.4. Market Trends

- 3.4.1. Food and Beverages sector to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Beauty and Personal Care

- 5.1.2. Consumer Electronics

- 5.1.3. Fashion and Apparel

- 5.1.4. Food and Beverage

- 5.1.5. Furniture and Home

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 11Street Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Interpark com

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coupang Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SSG com Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tmon Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EMart

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amazon com Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Naver Shopping

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 eBay Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apple Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 11Street Co Ltd

List of Figures

- Figure 1: South Korea E-Commerce Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea E-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: South Korea E-Commerce Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: South Korea E-Commerce Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: South Korea E-Commerce Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: South Korea E-Commerce Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea E-Commerce Industry?

The projected CAGR is approximately 19.49%.

2. Which companies are prominent players in the South Korea E-Commerce Industry?

Key companies in the market include 11Street Co Ltd, Interpark com, Coupang Corp, SSG com Corp, Tmon Inc, EMart, Amazon com Inc, Naver Shopping, eBay Inc, Apple Inc.

3. What are the main segments of the South Korea E-Commerce Industry?

The market segments include Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 2.80 Million as of 2022.

5. What are some drivers contributing to market growth?

High Smartphone and Internet Penetration Across the Country; High Demand for Food Delivery Services.

6. What are the notable trends driving market growth?

Food and Beverages sector to Register Significant Growth.

7. Are there any restraints impacting market growth?

; High installation and Maintenance Cost is Hindering the Market Growth.

8. Can you provide examples of recent developments in the market?

April 2023: SSG.com announced that it would introduce a personnel system that reflects the grade system competency/performance-based promotion flexible compensation system to secure competitiveness in the e-commerce business and future growth strategy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea E-Commerce Industry?

To stay informed about further developments, trends, and reports in the South Korea E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence