Key Insights

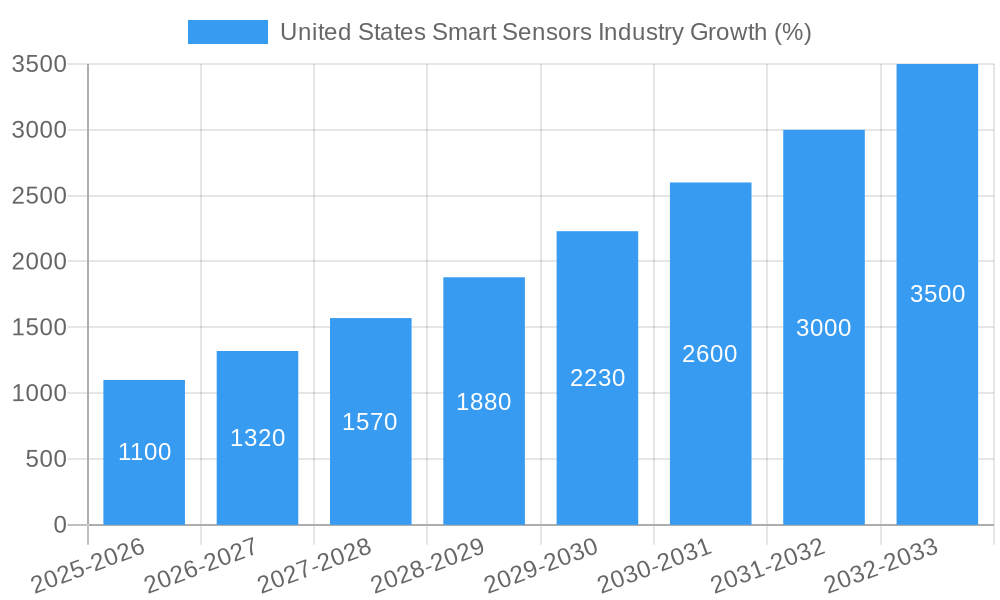

The United States smart sensors market is experiencing robust growth, driven by increasing automation across various sectors and the proliferation of IoT devices. With a Compound Annual Growth Rate (CAGR) of 18.40% between 2019 and 2033, the market, currently valued in the billions (a precise figure requires more specific initial market size data, but based on industry benchmarks and the provided CAGR, a reasonable estimate would place the 2025 market size in the range of $5-7 billion USD), is poised for significant expansion. Key drivers include the rising demand for advanced sensor technologies in automotive and transportation (autonomous vehicles, advanced driver-assistance systems), healthcare (wearable health monitoring, medical imaging), and industrial automation (predictive maintenance, process optimization). Technological advancements such as the miniaturization of MEMS sensors, the improved performance of CMOS image sensors, and the development of sophisticated optical spectroscopy techniques are further fueling market growth. While the increasing complexity and cost associated with integrating smart sensors in certain applications present some challenges, the overall market trajectory remains positive. The market segmentation shows strong growth across multiple types (flow, image, pressure, temperature sensors) and applications, indicating broad-based adoption of smart sensor technologies. Major players like Infineon, Honeywell, and Analog Devices are investing heavily in R&D and strategic partnerships to capitalize on this expanding market.

The growth in the US smart sensor market is particularly pronounced in sectors like automotive, where the increasing adoption of autonomous driving features demands sophisticated and highly accurate sensor systems. Healthcare also presents a significant opportunity, given the growing emphasis on remote patient monitoring and personalized medicine. The industrial automation sector's integration of smart sensors for predictive maintenance and process optimization is also driving significant demand. While factors such as the high initial investment costs for sensor integration and potential cybersecurity concerns can act as restraints, the long-term benefits in terms of enhanced efficiency, improved safety, and data-driven decision-making far outweigh these challenges. The diverse applications and technologies within the smart sensor market guarantee continued growth and innovation, solidifying its position as a crucial element of the burgeoning IoT and Industry 4.0 ecosystems. Specific market segment projections would require more granular data on segment-specific growth rates, but existing data strongly suggests balanced growth across the technology, component, application, and type segments.

United States Smart Sensors Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the United States smart sensors industry, offering valuable insights for stakeholders, investors, and industry professionals. The report covers the period from 2019 to 2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The study encompasses key segments including MEMS, CMOS, and optical spectroscopy technologies, various components such as Analog-to-Digital Converters and Amplifiers, and applications across diverse sectors like aerospace & defense, automotive, healthcare, and industrial automation. Leading players like Infineon Technologies AG, Honeywell International Inc, and ABB Ltd are thoroughly analyzed. The report’s meticulous data analysis and projections reveal a robust market poised for significant growth.

United States Smart Sensors Industry Market Concentration & Dynamics

The U.S. smart sensors market exhibits a moderately concentrated landscape, with a few major players holding significant market share. While precise figures vary by segment, the top 10 companies likely account for xx% of the overall market revenue in 2025. The industry is characterized by a dynamic interplay of innovation ecosystems, stringent regulatory frameworks (particularly within sectors like aerospace and healthcare), and the presence of substitute products (e.g., traditional sensing technologies). End-user trends, especially the increasing adoption of IoT and Industry 4.0, are key drivers.

- Market Share: Top 3 players hold an estimated xx% market share in 2025.

- M&A Activity: The historical period (2019-2024) saw an average of xx M&A deals annually, reflecting consolidation efforts and strategic expansion within the industry. This activity is expected to continue, driven by the need to access new technologies and expand market reach.

- Regulatory Landscape: Stringent regulations, particularly in sectors like medical devices and automotive, influence product development and adoption.

- Innovation Ecosystems: Significant investments in R&D from both established players and startups fuel innovation, especially in areas like MEMS and advanced sensor integration.

United States Smart Sensors Industry Industry Insights & Trends

The U.S. smart sensors market is experiencing robust growth, driven by several converging factors. The market size reached an estimated $xx Million in 2024 and is projected to reach $xx Million by 2033, registering a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is fueled by escalating demand across diverse application segments. Technological disruptions, such as the miniaturization of sensors, advancements in AI-driven analytics, and the proliferation of 5G connectivity, are significantly enhancing the capabilities and applications of smart sensors. The increasing focus on data-driven decision-making across industries is another significant driver, along with the growing preference for automation and smart solutions in various sectors. Furthermore, evolving consumer behaviors, particularly the rising adoption of smart devices and the demand for personalized experiences, are impacting the market's trajectory.

Key Markets & Segments Leading United States Smart Sensors Industry

The U.S. smart sensors market demonstrates strong growth across multiple segments, but some areas are particularly dominant.

Dominant Segments: The automotive and transportation sector is expected to be a major driver, followed by industrial automation and healthcare. Within technology types, MEMS sensors hold a significant market share due to their cost-effectiveness and versatility. In terms of components, Analog-to-Digital Converters (ADCs) and amplifiers are in high demand.

Growth Drivers:

- Economic Growth: Overall economic growth fuels increased investment in automation and smart technologies across industries.

- Infrastructure Development: Smart city initiatives and upgrades to industrial infrastructure create substantial demand for sensors.

- Technological Advancements: Continuous improvements in sensor technology lead to higher accuracy, lower power consumption, and broader applicability.

- Government Regulations: Regulations promoting energy efficiency and safety in various sectors drive adoption of smart sensors.

United States Smart Sensors Industry Product Developments

Recent product developments have focused on enhancing sensor accuracy, miniaturization, and power efficiency. The integration of advanced signal processing and AI capabilities is also prevalent. These advancements are enhancing the performance and usability of sensors across diverse applications. Furthermore, manufacturers are focusing on developing sensors with robust capabilities and increased lifespan to improve their reliability and market appeal. Competition is fierce, with companies innovating to create more cost-effective and sophisticated sensors.

Challenges in the United States Smart Sensors Industry Market

The U.S. smart sensors industry faces several challenges, including supply chain disruptions impacting component availability and pricing. Regulatory hurdles, particularly in specialized sectors, can hinder product adoption. Furthermore, intense competition from both domestic and international players necessitates continuous innovation and cost optimization to maintain market share. The fluctuating prices of raw materials can also significantly affect production costs.

Forces Driving United States Smart Sensors Industry Growth

The U.S. smart sensors industry is propelled by significant growth drivers, including rapid technological advancements, such as the development of miniature, low-power sensors and advanced sensor fusion techniques. Expanding applications across diverse sectors (automotive, healthcare, industrial automation) are also key contributors. Government initiatives supporting IoT and Industry 4.0 adoption stimulate market growth. The increasing demand for data-driven insights and improved operational efficiency across various industries further boosts market expansion.

Challenges in the United States Smart Sensors Industry Market

Long-term growth catalysts for the U.S. smart sensor market include ongoing technological innovation, strategic partnerships between sensor manufacturers and system integrators, and the continuous expansion of smart sensor applications into new markets. This is further supported by government investment in research and development, along with increasing awareness of the benefits of data-driven decision-making and enhanced efficiency.

Emerging Opportunities in United States Smart Sensors Industry

Emerging opportunities lie in the development of specialized sensors for niche applications, such as environmental monitoring and precision agriculture. The integration of advanced analytics and AI for real-time data processing is also creating new avenues for growth. The increasing demand for high-performance sensors in autonomous vehicles and robotics represents a significant market opportunity. Furthermore, the expansion into new markets, such as wearable technology and smart homes, offers further potential.

Leading Players in the United States Smart Sensors Industry Sector

- Infineon Technologies AG

- Honeywell International Inc

- ABB Ltd

- General Electric

- Legrand Inc

- NXP Semiconductors NV

- Siemens AG

- TE Connectivity Ltd

- STMicroelectronics

- Analog Devices Inc

- Vishay Technology Inc

- Eaton Corporation

Key Milestones in United States Smart Sensors Industry Industry

- December 2021: Eaton contracts with the U.S. Department of Defense to manufacture inductive proximity sensors for naval applications, showcasing the increasing adoption of smart sensors in defense.

- March 2021: Siemens and Senseware partnership expands IoT solutions for indoor air quality, highlighting the synergy between sensor technology and IoT platforms.

Strategic Outlook for United States Smart Sensors Industry Market

The U.S. smart sensors market is poised for sustained growth, driven by technological advancements, increasing digitization across various sectors, and government support for smart technologies. Strategic opportunities lie in focusing on niche applications, developing innovative sensor fusion technologies, and establishing strong partnerships to expand market reach and create comprehensive solutions. The focus on energy efficiency, sustainability, and data security will also shape future market dynamics.

United States Smart Sensors Industry Segmentation

-

1. Type

- 1.1. Flow Sensors

- 1.2. Image Sensors

- 1.3. Position Sensors

- 1.4. Pressure Sensors

- 1.5. Temperature Sensors

- 1.6. Other Types

-

2. Technology

- 2.1. MEMS

- 2.2. CMOS

- 2.3. Optical Spectroscopy

- 2.4. Other Technologies

-

3. Component

- 3.1. Analog-to-Digital Converters

- 3.2. Digital-to-Analog Converters

- 3.3. Amplifiers

- 3.4. Other Components

-

4. Application

- 4.1. Aerospace and Defense

- 4.2. Automotive and Transportation

- 4.3. Healthcare

- 4.4. Industrial Automation

- 4.5. Building Automation

- 4.6. Consumer Electronics

- 4.7. Other Applications

United States Smart Sensors Industry Segmentation By Geography

- 1. United States

United States Smart Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Energy Efficiency and Saving; Technology Advancements in Miniaturization and Wireless Capabilities

- 3.3. Market Restrains

- 3.3.1. Complex Design Compared to Traditional Sensors; Relatively High Deployment Costs

- 3.4. Market Trends

- 3.4.1. Temperature Sensors are Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Smart Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flow Sensors

- 5.1.2. Image Sensors

- 5.1.3. Position Sensors

- 5.1.4. Pressure Sensors

- 5.1.5. Temperature Sensors

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. MEMS

- 5.2.2. CMOS

- 5.2.3. Optical Spectroscopy

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Component

- 5.3.1. Analog-to-Digital Converters

- 5.3.2. Digital-to-Analog Converters

- 5.3.3. Amplifiers

- 5.3.4. Other Components

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Aerospace and Defense

- 5.4.2. Automotive and Transportation

- 5.4.3. Healthcare

- 5.4.4. Industrial Automation

- 5.4.5. Building Automation

- 5.4.6. Consumer Electronics

- 5.4.7. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Infineon Technologies AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Electric

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Legrand Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NXP Semiconductors NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siemens AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TE Connectivity Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ST Microelectronics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Analog Devices Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vishay Technology Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Eaton Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Infineon Technologies AG

List of Figures

- Figure 1: United States Smart Sensors Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Smart Sensors Industry Share (%) by Company 2024

List of Tables

- Table 1: United States Smart Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Smart Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States Smart Sensors Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: United States Smart Sensors Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 5: United States Smart Sensors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: United States Smart Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: United States Smart Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Smart Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 9: United States Smart Sensors Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 10: United States Smart Sensors Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 11: United States Smart Sensors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 12: United States Smart Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Smart Sensors Industry?

The projected CAGR is approximately 18.40%.

2. Which companies are prominent players in the United States Smart Sensors Industry?

Key companies in the market include Infineon Technologies AG, Honeywell International Inc, ABB Ltd, General Electric, Legrand Inc, NXP Semiconductors NV, Siemens AG, TE Connectivity Ltd, ST Microelectronics, Analog Devices Inc, Vishay Technology Inc, Eaton Corporation.

3. What are the main segments of the United States Smart Sensors Industry?

The market segments include Type, Technology, Component, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Energy Efficiency and Saving; Technology Advancements in Miniaturization and Wireless Capabilities.

6. What are the notable trends driving market growth?

Temperature Sensors are Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Complex Design Compared to Traditional Sensors; Relatively High Deployment Costs.

8. Can you provide examples of recent developments in the market?

December 2021 - Power management company Eaton contracted with the US Department of Defense to manufacture inductive proximity sensors for the Navy to use in aircraft shipboard applications and for evaluation in additional platforms. The sensors incorporate patented technology developed by BH Sensors of Pomona, New York, through the DoD Small Business Innovation Research program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Smart Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Smart Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Smart Sensors Industry?

To stay informed about further developments, trends, and reports in the United States Smart Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence