Key Insights

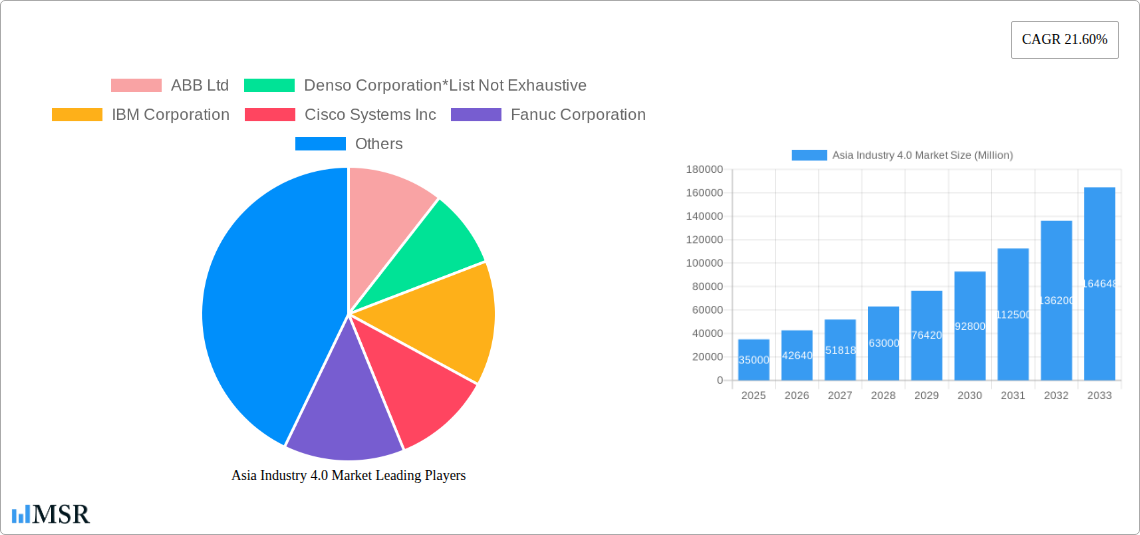

The Asia Industry 4.0 market is experiencing robust growth, driven by increasing automation needs across diverse sectors and significant government initiatives promoting digital transformation. The region's large manufacturing base, particularly in countries like China, Japan, South Korea, and India, is fueling the adoption of technologies like Industrial Robotics, IIoT, AI & ML, and digital twins. A compound annual growth rate (CAGR) of 21.60% from 2019 to 2024 suggests a rapidly expanding market. While a precise market size for 2025 isn't provided, extrapolating from the historical data and considering the sustained CAGR, a reasonable estimate would place the market value in the billions of dollars. This growth is further accelerated by the rising adoption of Industry 4.0 solutions in automotive, electronics, and energy sectors, as companies seek to enhance efficiency, productivity, and product quality. However, challenges remain, including the high initial investment costs associated with implementing these technologies, a potential skills gap in managing and maintaining these systems, and concerns about data security and cybersecurity. Nevertheless, the long-term growth trajectory remains exceptionally positive, with continued investment in research and development, further government support, and the increasing pressure on manufacturers to remain competitive globally.

The competitive landscape is characterized by both global giants like ABB, IBM, and Fanuc, and strong regional players. These companies are actively engaged in developing and deploying cutting-edge Industry 4.0 solutions tailored to the unique requirements of the Asian market. Future growth will be significantly influenced by the successful integration of various technologies, the development of robust cybersecurity measures, and the emergence of new innovative solutions. Specific market segments such as AI and ML, and Extended Reality are anticipated to demonstrate particularly rapid growth due to their potential to optimize processes, enhance decision-making, and improve worker safety. Government policies promoting digitalization and smart manufacturing in key economies across Asia will continue to be a pivotal driver of this substantial growth potential.

Asia Industry 4.0 Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Industry 4.0 market, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this rapidly evolving landscape. With a focus on key segments, technological advancements, and market dynamics, this report presents a detailed forecast for the Asia Industry 4.0 market, projecting a market size of xx Million by 2033. The report's detailed segmentation, including by technology type (Industrial Robotics, IIoT, AI and ML, Blockchain, Extended Reality, Digital Twin, 3D Printing, and Other Technology Types), end-user industry (Manufacturing, Automotive, Oil and Gas, Energy and Utilities, Electronics and Foundry, Food and Beverage, Aerospace and Defense, and Other End-user Industries), and country (China, South Korea, Japan, India, Indonesia, and Rest of Asia), allows for a granular understanding of market opportunities and challenges. Leading players such as ABB Ltd, Denso Corporation, IBM Corporation, Cisco Systems Inc, Fanuc Corporation, Omron Corporation, Robert Bosch GmbH, Yokogawa Electric Corporation, Mitsubishi Electric, General Electric Company, Intel Corporation, and Yaskawa Electric Corporation are profiled, offering crucial insights into their strategies and market positions.

Asia Industry 4.0 Market Concentration & Dynamics

The Asia Industry 4.0 market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is characterized by intense competition, driven by continuous innovation and the entry of new players. The market concentration is further influenced by factors like M&A activities and the emergence of strong regional players.

Market Share: The top 5 players hold an estimated xx% market share in 2025, while smaller players account for the remaining xx%. This is expected to shift slightly by 2033, with the top 5 players increasing their share to xx%.

M&A Activity: The number of M&A deals in the Asia Industry 4.0 market has shown a steady increase from xx in 2019 to xx in 2024. This signifies strategic consolidation and the pursuit of technological advancements.

Innovation Ecosystems: Several vibrant innovation ecosystems are emerging in key Asian countries, driven by government initiatives, research institutions, and collaborative ventures between companies and startups. These ecosystems are fostering the development and adoption of cutting-edge Industry 4.0 technologies.

Regulatory Frameworks: Government regulations in different Asian countries play a significant role in shaping the market, with policies focused on promoting digitalization and fostering innovation. These frameworks vary from country to country affecting implementation of standards and technologies in specific regions.

Substitute Products: The lack of perfect substitutes for many Industry 4.0 technologies limits direct substitution impact, although alternative solutions can occasionally impact certain market segments.

End-User Trends: The growing adoption of Industry 4.0 technologies among end-user industries reflects changing operational needs, including enhanced efficiency and optimized supply chains.

Asia Industry 4.0 Market Industry Insights & Trends

The Asia Industry 4.0 market is experiencing robust growth, driven by several key factors. The market size is estimated at xx Million in 2025, with a CAGR of xx% projected during 2025-2033. This growth is fueled by increasing government initiatives promoting digital transformation across various industries, alongside the rising adoption of smart manufacturing technologies and the growing need for enhanced operational efficiency and productivity. Furthermore, technological advancements like AI and machine learning are revolutionizing manufacturing processes and optimizing resource utilization. The increasing focus on data-driven decision-making, enabled by technologies such as the Internet of Things (IIoT), is another significant driver. Evolving consumer behavior towards sustainable and technologically advanced products further fuels the adoption of Industry 4.0 technologies, especially in consumer goods manufacturing. The push for improved supply chain resilience and automation in response to recent global disruptions also adds to the significant growth trajectory.

Key Markets & Segments Leading Asia Industry 4.0 Market

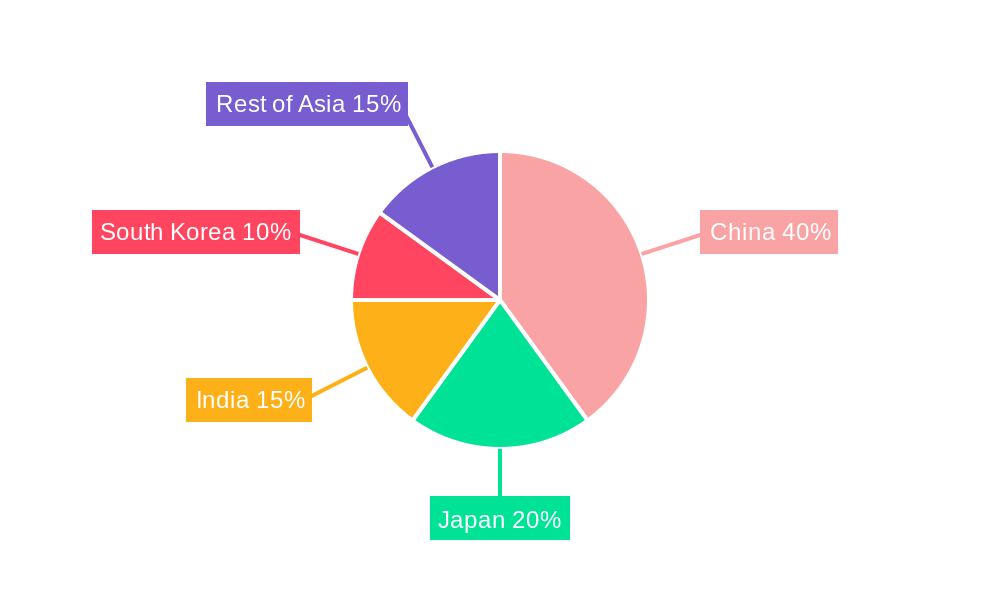

Dominant Regions/Countries:

China: China holds the largest market share within the Asia region due to its vast manufacturing base, substantial government investments in digital infrastructure, and supportive policies driving the development and adoption of Industry 4.0 technologies.

South Korea: South Korea's advanced technological infrastructure and high level of digital adoption contribute to its significant market presence.

Japan: Japan is a leader in the development and deployment of advanced manufacturing technologies, including industrial robotics and automation, which positions it strongly in this market.

Dominant Segments:

By Technology Type: Industrial Robotics and IIoT are currently the dominant segments, due to their widespread applications across various industries. However, the AI and ML segment shows significant potential for future growth as their capabilities expand.

By End-user Industry: Manufacturing currently holds the largest market share, followed closely by the Automotive sector due to the intense focus on automation and optimization within these industries.

Drivers for Growth:

Economic Growth: The sustained economic growth in many Asian countries fuels increased investments in Industry 4.0 technologies.

Government Initiatives: Government policies promoting digital transformation and technological advancement actively support market expansion.

Infrastructure Development: Significant investments in digital infrastructure, including 5G networks, are facilitating the seamless integration and operation of Industry 4.0 technologies.

Rising Labor Costs: Increasing labor costs in certain Asian countries make automation an attractive option for manufacturers.

Asia Industry 4.0 Market Product Developments

Recent product innovations focus on enhancing the capabilities of existing Industry 4.0 technologies. This includes advancements in industrial robotics with increased precision and dexterity, development of more sophisticated IIoT platforms offering advanced analytics and data visualization, and the integration of AI and ML capabilities into existing systems to optimize operations and improve decision-making. These advancements are providing companies with a competitive edge by enabling greater efficiency, productivity, and optimized resource allocation.

Challenges in the Asia Industry 4.0 Market Market

The Asia Industry 4.0 market faces several challenges including the high initial investment costs associated with implementing Industry 4.0 technologies, which can be a barrier for smaller businesses. Further challenges include the lack of skilled workforce to operate and maintain sophisticated technologies and concerns over data security and cybersecurity within interconnected systems. Supply chain disruptions, particularly those impacting crucial components, can also impact market growth. Finally, navigating varying regulatory environments and differing industrial standards across the diverse Asia region presents an ongoing complexity.

Forces Driving Asia Industry 4.0 Market Growth

Key growth drivers include increasing government support for digital transformation, substantial investments in infrastructure development, particularly in 5G technology and cloud computing, and continuous technological innovation in areas such as AI, ML, and IIoT. The expanding adoption of Industry 4.0 technologies by diverse end-user industries, driven by the need for enhanced efficiency and productivity, is another key force driving market growth.

Long-Term Growth Catalysts in Asia Industry 4.0 Market

Long-term growth will be fueled by continued technological advancements, strategic partnerships between technology providers and end-user industries, and expansion into new markets. The development and integration of more advanced and user-friendly Industry 4.0 technologies, coupled with increasing government support for digital transformation across the region, promise sustained growth in the years to come.

Emerging Opportunities in Asia Industry 4.0 Market

Significant opportunities exist in expanding Industry 4.0 adoption in previously underserved sectors, such as agriculture and healthcare. Development and deployment of specialized Industry 4.0 solutions catering to specific regional needs will unlock considerable market potential. Further opportunities lie in leveraging AI and ML for predictive maintenance and optimizing energy consumption across various industries. This includes developing robust cybersecurity measures to mitigate potential risks associated with increased data connectivity and automation within industry.

Leading Players in the Asia Industry 4.0 Market Sector

- ABB Ltd

- Denso Corporation

- IBM Corporation

- Cisco Systems Inc

- Fanuc Corporation

- Omron Corporation

- Robert Bosch GmbH

- Yokogawa Electric Corporation

- Mitsubishi Electric

- General Electric Company

- Intel Corporation

- Yaskawa Electric Corporation

Key Milestones in Asia Industry 4.0 Market Industry

June 2022: Yokogawa Electric Corporation launched OpreX asset health insights, a cloud-based plant asset monitoring service leveraging AI and ML analytics for enhanced asset management. This showcases a shift towards cloud-based solutions for optimized asset performance.

February 2022: Mitsubishi Electric Corporation received the SAP Japan Customer Award 2021 for its leadership in digital transformation. This highlights the importance of IT/OT integration in driving Industry 4.0 adoption.

Strategic Outlook for Asia Industry 4.0 Market Market

The Asia Industry 4.0 market presents significant long-term growth potential, driven by continuous technological innovation, expanding digital infrastructure, and supportive government policies. Strategic focus on developing customized solutions tailored to the diverse needs of various industries and regions will be crucial for success in this market. Companies focusing on enhancing cybersecurity and addressing skills gaps will gain a significant competitive advantage. Early adoption of emerging technologies such as blockchain and extended reality will also shape the future market leaders.

Asia Industry 4.0 Market Segmentation

-

1. Technology Type

- 1.1. Industrial Robotics

- 1.2. IIoT

- 1.3. AI and ML

- 1.4. Blockchain

- 1.5. Extended Reality

- 1.6. Digital Twin

- 1.7. 3D Printing

- 1.8. Other Technology Types

-

2. End-user Industry

- 2.1. Manufacturing

- 2.2. Automotive

- 2.3. Oil and Gas

- 2.4. Energy and Utilities

- 2.5. Electronics and Foundry

- 2.6. Food and Beverage

- 2.7. Aerospace and Defense

- 2.8. Other End-user Industries

Asia Industry 4.0 Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asia Industry 4.0 Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Governmental Initiatives and Collaborations Between Stakeholders in the Region; Growth in Demand for Industrial Robotics; Digital Transformation Initiatives Undertaken by SMEs

- 3.3. Market Restrains

- 3.3.1. Sluggish Adoption of New Technologies

- 3.4. Market Trends

- 3.4.1. Manufacturing Industry to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 5.1.1. Industrial Robotics

- 5.1.2. IIoT

- 5.1.3. AI and ML

- 5.1.4. Blockchain

- 5.1.5. Extended Reality

- 5.1.6. Digital Twin

- 5.1.7. 3D Printing

- 5.1.8. Other Technology Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Manufacturing

- 5.2.2. Automotive

- 5.2.3. Oil and Gas

- 5.2.4. Energy and Utilities

- 5.2.5. Electronics and Foundry

- 5.2.6. Food and Beverage

- 5.2.7. Aerospace and Defense

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 6. China Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ABB Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Denso Corporation*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 IBM Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Cisco Systems Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fanuc Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Omron Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Robert Bosch GmbH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yokogawa Electric Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Mitsubishi Electric

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 General Electric Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Intel Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Yaskawa Electric Corporation

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 ABB Ltd

List of Figures

- Figure 1: Asia Industry 4.0 Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Industry 4.0 Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Industry 4.0 Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Industry 4.0 Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 3: Asia Industry 4.0 Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Asia Industry 4.0 Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Industry 4.0 Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Industry 4.0 Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 14: Asia Industry 4.0 Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Asia Industry 4.0 Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Bangladesh Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Pakistan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Industry 4.0 Market?

The projected CAGR is approximately 21.60%.

2. Which companies are prominent players in the Asia Industry 4.0 Market?

Key companies in the market include ABB Ltd, Denso Corporation*List Not Exhaustive, IBM Corporation, Cisco Systems Inc, Fanuc Corporation, Omron Corporation, Robert Bosch GmbH, Yokogawa Electric Corporation, Mitsubishi Electric, General Electric Company, Intel Corporation, Yaskawa Electric Corporation.

3. What are the main segments of the Asia Industry 4.0 Market?

The market segments include Technology Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Governmental Initiatives and Collaborations Between Stakeholders in the Region; Growth in Demand for Industrial Robotics; Digital Transformation Initiatives Undertaken by SMEs.

6. What are the notable trends driving market growth?

Manufacturing Industry to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Sluggish Adoption of New Technologies.

8. Can you provide examples of recent developments in the market?

June 2022: Yokogawa Electric Corporation released OpreX asset health insights. OpreX is a cloud-based plant asset monitoring service that refines, collects, and aggregates operational technology data from distributed assets. Asset Health Insights Oprex powered by Yokogawa Cloud is equipped with ML and AI analytics capability. As the adoption of Industry 4.0 technologies continues to pace in the region, companies are changing the way they do asset management by introducing cloud-based technologies that can monitor assets from anywhere in the world and optimize their performance in real-time. Driven by customers' focus on integrated, remote, and increasingly autonomous operations, Yokogawa Electric developed Asset Health Insights to make data more visible, integrated, and actionable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Industry 4.0 Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Industry 4.0 Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Industry 4.0 Market?

To stay informed about further developments, trends, and reports in the Asia Industry 4.0 Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence