Key Insights

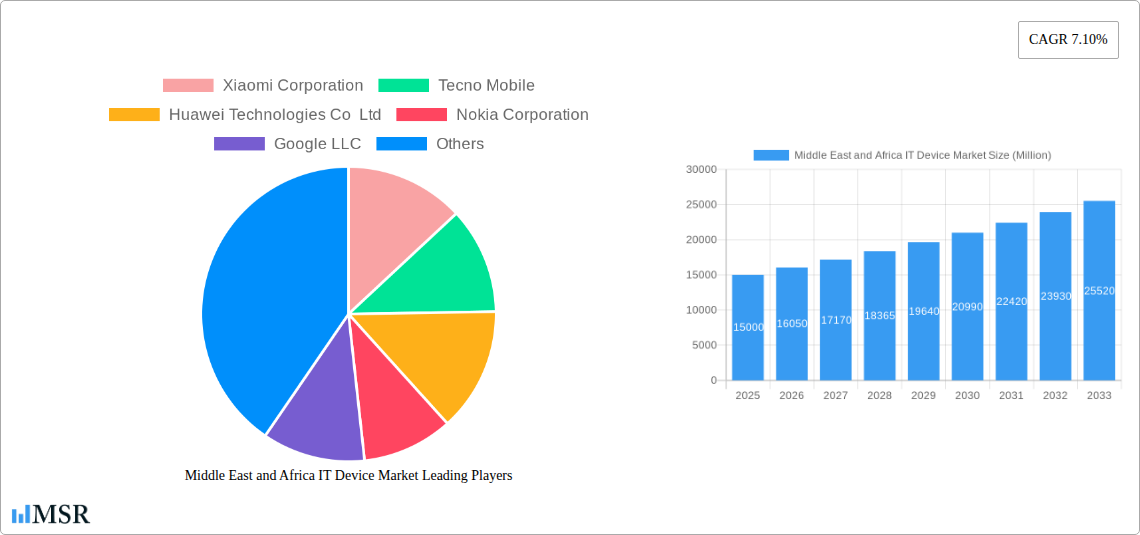

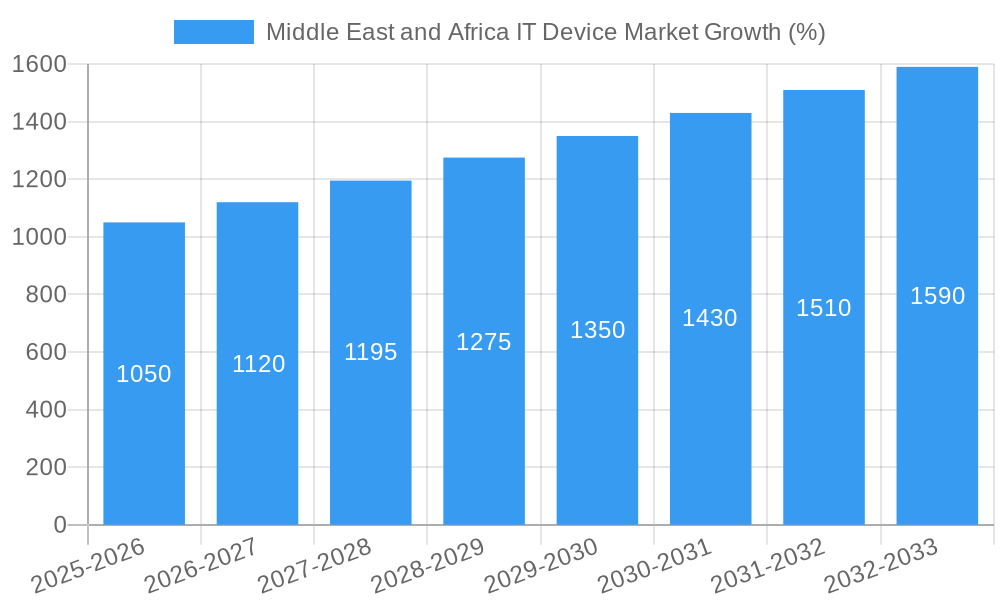

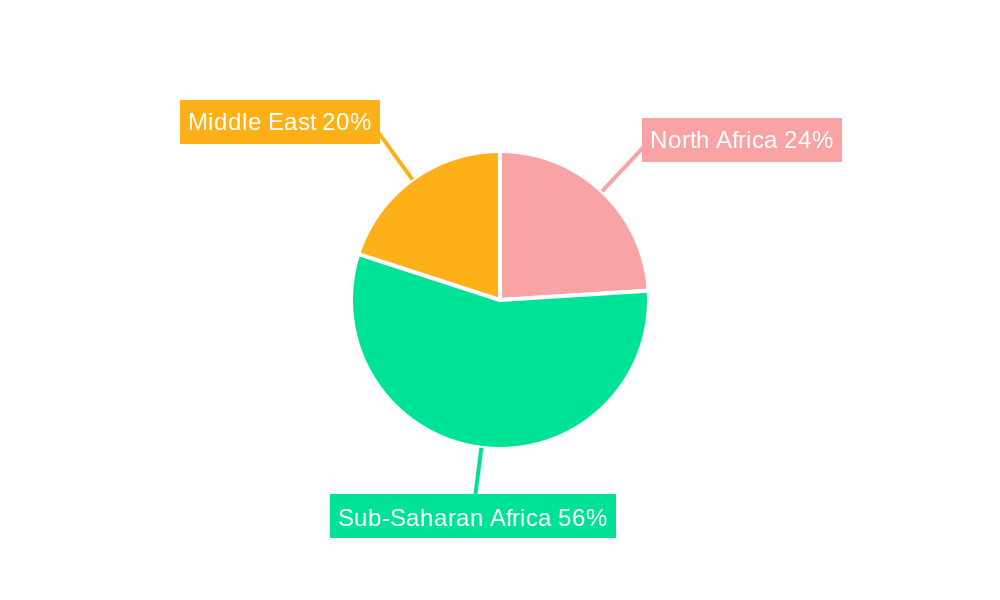

The Middle East and Africa (MEA) IT device market, encompassing PCs, tablets, and phones, exhibits robust growth, projected at a 7.10% CAGR from 2025 to 2033. This expansion is fueled by several key factors. Increasing smartphone penetration, particularly in underserved African markets, is a primary driver. The rising adoption of mobile internet and data services, coupled with government initiatives promoting digital inclusion, significantly boosts demand. Furthermore, the growing adoption of cloud computing and remote work models further accelerates the need for personal computing devices. The market's segmentation reveals a strong preference for mobile devices (smartphones and tablets) over PCs, driven by affordability and accessibility. Competitive dynamics are intense, with established players like Samsung, Apple, and Xiaomi competing fiercely against local brands like Tecno Mobile and others catering to price-sensitive segments. Challenges remain, including infrastructure limitations in certain regions, uneven digital literacy levels, and economic disparities impacting purchasing power. However, ongoing investments in infrastructure development and a burgeoning tech-savvy youth population suggest a bright outlook for sustained growth. The regional disparity within MEA is significant, with countries like South Africa, Kenya, and Nigeria showing higher adoption rates compared to others. Future growth will be significantly impacted by the success of initiatives promoting digital literacy and affordable connectivity.

The market's segmentation by device type reveals a significant share held by smartphones, followed by tablets and PCs. The dominance of smartphones reflects the affordability and convenience they offer, especially in developing markets. The PC segment, while experiencing growth, faces competition from increasingly capable tablets and smartphones, potentially leading to slower growth compared to the mobile segments. Regional variations are significant, with countries in North Africa generally showing higher adoption rates of PCs due to better infrastructure and economic development compared to sub-Saharan Africa. Successful market penetration strategies for device manufacturers will rely on understanding these regional nuances, addressing affordability concerns, and tailoring product offerings to the specific needs and preferences of target markets within the diverse MEA landscape.

Middle East & Africa IT Device Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa IT device market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of past performance, current market dynamics, and future growth projections. The market is segmented by device type (PCs, Tablets, Phones) and encompasses key players like Xiaomi, Tecno Mobile, Huawei, Samsung, and Apple, among others. The total market size is projected to reach xx Million by 2033.

Middle East and Africa IT Device Market Concentration & Dynamics

The Middle East and Africa IT device market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. However, the presence of numerous regional and international brands fosters competition. Innovation ecosystems are developing, particularly in key markets like the UAE and South Africa, driven by government initiatives and investments in digital infrastructure. Regulatory frameworks vary across the region, impacting market access and product compliance. Substitute products, such as feature phones and older generation devices, still hold a niche market, primarily in price-sensitive segments. End-user trends show a growing preference for smartphones and tablets, fueled by increasing internet penetration and mobile payments adoption. M&A activity has been moderate in recent years, with xx deals recorded between 2019 and 2024, primarily focused on expanding distribution networks and acquiring local expertise.

- Market Share: Samsung and Huawei hold the largest market shares in smartphones, while Lenovo and HP dominate the PC segment. Precise figures are detailed within the full report.

- M&A Activity: xx deals recorded between 2019 and 2024 indicate consolidation and expansion strategies within the market.

- Innovation: Growing investment in R&D is driving innovation in areas like 5G technology and mobile payment solutions.

- Regulatory Landscape: Varying regulatory environments across different countries in the region present opportunities and challenges.

Middle East and Africa IT Device Market Industry Insights & Trends

The Middle East and Africa IT device market is experiencing robust growth, driven by factors such as increasing smartphone penetration, rising disposable incomes, and government investments in digital infrastructure. The market size reached xx Million in 2024 and is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million by 2033. Technological disruptions, particularly the adoption of 5G technology, are transforming the landscape, enabling faster data speeds and innovative applications. Evolving consumer behaviors, such as a preference for online shopping and mobile banking, further fuel demand for sophisticated devices. Challenges like affordability and digital literacy remain significant factors impacting market growth.

Key Markets & Segments Leading Middle East and Africa IT Device Market

The smartphone segment dominates the market, accounting for the largest share of revenue and volume. Within the region, countries like South Africa, Egypt, Nigeria, and the UAE are key markets due to their high population densities, growing economies, and relatively advanced digital infrastructure.

Key Drivers:

- Economic Growth: Rising disposable incomes in several key markets are driving demand.

- Infrastructure Development: Investments in 5G networks and internet connectivity are boosting market growth.

- Government Initiatives: Digital transformation programs are creating favorable regulatory environments.

- Mobile Money Adoption: The expansion of mobile money services fuels smartphone demand.

Dominance Analysis: The UAE and South Africa show higher per capita consumption and adoption of advanced technologies compared to other countries. This is detailed with specific data points in the full report.

Middle East and Africa IT Device Market Product Developments

Recent years have witnessed significant product innovation in the Middle East and Africa IT device market. Manufacturers are focusing on features like improved camera capabilities, enhanced processing power, longer battery life, and advanced security features to cater to evolving consumer preferences. The integration of 5G connectivity, artificial intelligence (AI), and other cutting-edge technologies is becoming increasingly common. These advancements provide competitive edges and enhance user experiences, driving market growth and stimulating competition.

Challenges in the Middle East and Africa IT Device Market Market

The Middle East and Africa IT device market faces several challenges, including inconsistent regulatory frameworks across different countries, which complicate market entry and product certification. Supply chain disruptions, particularly experienced post-2020, also create volatility in pricing and availability. Intense competition from both established international brands and emerging local players puts downward pressure on profit margins. These issues, quantified by specific data within the full report, contribute to uncertainty within the market.

Forces Driving Middle East and Africa IT Device Market Growth

Several factors are driving the growth of the Middle East and Africa IT device market: expanding internet and mobile network penetration, increasing affordability of devices, government initiatives promoting digital inclusion, and the growing adoption of mobile payments and e-commerce. The rise of mobile gaming and streaming services is also pushing demand. Technological advancements, particularly in 5G and AI, are creating new applications and opportunities.

Long-Term Growth Catalysts in Middle East and Africa IT Device Market

Long-term growth in the Middle East and Africa IT device market will be fueled by continued investments in digital infrastructure, the expansion of e-commerce, and the growing adoption of advanced technologies such as AI and IoT. Strategic partnerships between technology companies and local distributors will also play a vital role. Government policies promoting digital inclusion will be a significant driver.

Emerging Opportunities in Middle East and Africa IT Device Market

Emerging opportunities lie in expanding into underserved rural markets, the increasing demand for affordable yet durable devices, and the potential for growth in the enterprise sector. The development of localized applications and services tailored to specific regional needs will also create significant opportunities. The adoption of innovative financing schemes to make devices more accessible represents a promising avenue for growth.

Leading Players in the Middle East and Africa IT Device Market Sector

- Xiaomi Corporation

- Tecno Mobile

- Huawei Technologies Co Ltd

- Nokia Corporation

- Google LLC

- Lenovo Group Limited

- ASUSTek Computer Inc

- Acer Group

- Guangdong Oppo Mobile Telecommunications Corp Ltd

- Samsung Electronics Co Ltd

- Apple Inc

- Motorola Inc

- Sony Corporation

- Microsoft Corporation

- Dell Technologies

- HP Inc

Key Milestones in Middle East and Africa IT Device Market Industry

- October 2022: Xiaomi launched its 12T Series in the Saudi market, expanding its reach and offering high-quality technology to consumers.

- September 2022: Lenovo introduced new ThinkPad computers in the UAE, demonstrating commitment to the premium business laptop market.

Strategic Outlook for Middle East and Africa IT Device Market Market

The Middle East and Africa IT device market holds significant future potential, driven by strong demographic trends, economic growth, and expanding digital infrastructure. Strategic opportunities exist for companies focusing on affordable devices, developing localized applications, and leveraging the growth of e-commerce and mobile financial services. Companies that adapt to the unique challenges and opportunities of the region are poised for substantial growth in the coming years.

Middle East and Africa IT Device Market Segmentation

-

1. Type

-

1.1. PC's

- 1.1.1. Laptops

- 1.1.2. Desktop PCs

- 1.1.3. Tablets

-

1.2. Phones

- 1.2.1. Landline Phones

- 1.2.2. Smartphones

- 1.2.3. Feature Phones

-

1.1. PC's

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Qatar

- 2.4. Kuwait

- 2.5. South Africa

- 2.6. Egypt

- 2.7. Nigeria

- 2.8. Rest of Middle-East and Africa

Middle East and Africa IT Device Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. Kuwait

- 5. South Africa

- 6. Egypt

- 7. Nigeria

- 8. Rest of Middle East and Africa

Middle East and Africa IT Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Smartphone Usage Across the Region; Robust Demand for Online Gaming

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Inflation Impacting the Market

- 3.4. Market Trends

- 3.4.1. Growing Demand for Smartphones

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. PC's

- 5.1.1.1. Laptops

- 5.1.1.2. Desktop PCs

- 5.1.1.3. Tablets

- 5.1.2. Phones

- 5.1.2.1. Landline Phones

- 5.1.2.2. Smartphones

- 5.1.2.3. Feature Phones

- 5.1.1. PC's

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. United Arab Emirates

- 5.2.3. Qatar

- 5.2.4. Kuwait

- 5.2.5. South Africa

- 5.2.6. Egypt

- 5.2.7. Nigeria

- 5.2.8. Rest of Middle-East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. Kuwait

- 5.3.5. South Africa

- 5.3.6. Egypt

- 5.3.7. Nigeria

- 5.3.8. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. PC's

- 6.1.1.1. Laptops

- 6.1.1.2. Desktop PCs

- 6.1.1.3. Tablets

- 6.1.2. Phones

- 6.1.2.1. Landline Phones

- 6.1.2.2. Smartphones

- 6.1.2.3. Feature Phones

- 6.1.1. PC's

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. United Arab Emirates

- 6.2.3. Qatar

- 6.2.4. Kuwait

- 6.2.5. South Africa

- 6.2.6. Egypt

- 6.2.7. Nigeria

- 6.2.8. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. PC's

- 7.1.1.1. Laptops

- 7.1.1.2. Desktop PCs

- 7.1.1.3. Tablets

- 7.1.2. Phones

- 7.1.2.1. Landline Phones

- 7.1.2.2. Smartphones

- 7.1.2.3. Feature Phones

- 7.1.1. PC's

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. United Arab Emirates

- 7.2.3. Qatar

- 7.2.4. Kuwait

- 7.2.5. South Africa

- 7.2.6. Egypt

- 7.2.7. Nigeria

- 7.2.8. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Qatar Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. PC's

- 8.1.1.1. Laptops

- 8.1.1.2. Desktop PCs

- 8.1.1.3. Tablets

- 8.1.2. Phones

- 8.1.2.1. Landline Phones

- 8.1.2.2. Smartphones

- 8.1.2.3. Feature Phones

- 8.1.1. PC's

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. United Arab Emirates

- 8.2.3. Qatar

- 8.2.4. Kuwait

- 8.2.5. South Africa

- 8.2.6. Egypt

- 8.2.7. Nigeria

- 8.2.8. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Kuwait Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. PC's

- 9.1.1.1. Laptops

- 9.1.1.2. Desktop PCs

- 9.1.1.3. Tablets

- 9.1.2. Phones

- 9.1.2.1. Landline Phones

- 9.1.2.2. Smartphones

- 9.1.2.3. Feature Phones

- 9.1.1. PC's

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. United Arab Emirates

- 9.2.3. Qatar

- 9.2.4. Kuwait

- 9.2.5. South Africa

- 9.2.6. Egypt

- 9.2.7. Nigeria

- 9.2.8. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Africa Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. PC's

- 10.1.1.1. Laptops

- 10.1.1.2. Desktop PCs

- 10.1.1.3. Tablets

- 10.1.2. Phones

- 10.1.2.1. Landline Phones

- 10.1.2.2. Smartphones

- 10.1.2.3. Feature Phones

- 10.1.1. PC's

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. United Arab Emirates

- 10.2.3. Qatar

- 10.2.4. Kuwait

- 10.2.5. South Africa

- 10.2.6. Egypt

- 10.2.7. Nigeria

- 10.2.8. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Egypt Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. PC's

- 11.1.1.1. Laptops

- 11.1.1.2. Desktop PCs

- 11.1.1.3. Tablets

- 11.1.2. Phones

- 11.1.2.1. Landline Phones

- 11.1.2.2. Smartphones

- 11.1.2.3. Feature Phones

- 11.1.1. PC's

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Saudi Arabia

- 11.2.2. United Arab Emirates

- 11.2.3. Qatar

- 11.2.4. Kuwait

- 11.2.5. South Africa

- 11.2.6. Egypt

- 11.2.7. Nigeria

- 11.2.8. Rest of Middle-East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Nigeria Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. PC's

- 12.1.1.1. Laptops

- 12.1.1.2. Desktop PCs

- 12.1.1.3. Tablets

- 12.1.2. Phones

- 12.1.2.1. Landline Phones

- 12.1.2.2. Smartphones

- 12.1.2.3. Feature Phones

- 12.1.1. PC's

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. Saudi Arabia

- 12.2.2. United Arab Emirates

- 12.2.3. Qatar

- 12.2.4. Kuwait

- 12.2.5. South Africa

- 12.2.6. Egypt

- 12.2.7. Nigeria

- 12.2.8. Rest of Middle-East and Africa

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Rest of Middle East and Africa Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. PC's

- 13.1.1.1. Laptops

- 13.1.1.2. Desktop PCs

- 13.1.1.3. Tablets

- 13.1.2. Phones

- 13.1.2.1. Landline Phones

- 13.1.2.2. Smartphones

- 13.1.2.3. Feature Phones

- 13.1.1. PC's

- 13.2. Market Analysis, Insights and Forecast - by Geography

- 13.2.1. Saudi Arabia

- 13.2.2. United Arab Emirates

- 13.2.3. Qatar

- 13.2.4. Kuwait

- 13.2.5. South Africa

- 13.2.6. Egypt

- 13.2.7. Nigeria

- 13.2.8. Rest of Middle-East and Africa

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. South Africa Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 15. Sudan Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 16. Uganda Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 17. Tanzania Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 18. Kenya Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Africa Middle East and Africa IT Device Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Xiaomi Corporation

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Tecno Mobile

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Huawei Technologies Co Ltd

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Nokia Corporation

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Google LLC

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Lenovo Group Limited

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 ASUSTek Computer Inc

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Acer Group

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Guangdong Oppo Mobile Telecommunications Corp Ltd

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Samsung Electronics Co Ltd

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.11 Apple Inc

- 20.2.11.1. Overview

- 20.2.11.2. Products

- 20.2.11.3. SWOT Analysis

- 20.2.11.4. Recent Developments

- 20.2.11.5. Financials (Based on Availability)

- 20.2.12 Motorola Inc *List Not Exhaustive

- 20.2.12.1. Overview

- 20.2.12.2. Products

- 20.2.12.3. SWOT Analysis

- 20.2.12.4. Recent Developments

- 20.2.12.5. Financials (Based on Availability)

- 20.2.13 Sony Corporation

- 20.2.13.1. Overview

- 20.2.13.2. Products

- 20.2.13.3. SWOT Analysis

- 20.2.13.4. Recent Developments

- 20.2.13.5. Financials (Based on Availability)

- 20.2.14 Microsoft Corporation

- 20.2.14.1. Overview

- 20.2.14.2. Products

- 20.2.14.3. SWOT Analysis

- 20.2.14.4. Recent Developments

- 20.2.14.5. Financials (Based on Availability)

- 20.2.15 Dell Technologies

- 20.2.15.1. Overview

- 20.2.15.2. Products

- 20.2.15.3. SWOT Analysis

- 20.2.15.4. Recent Developments

- 20.2.15.5. Financials (Based on Availability)

- 20.2.16 HP Inc

- 20.2.16.1. Overview

- 20.2.16.2. Products

- 20.2.16.3. SWOT Analysis

- 20.2.16.4. Recent Developments

- 20.2.16.5. Financials (Based on Availability)

- 20.2.1 Xiaomi Corporation

List of Figures

- Figure 1: Middle East and Africa IT Device Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa IT Device Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Middle East and Africa IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Middle East and Africa IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East and Africa IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Middle East and Africa IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Middle East and Africa IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Middle East and Africa IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Middle East and Africa IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Middle East and Africa IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Middle East and Africa IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Middle East and Africa IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Middle East and Africa IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Middle East and Africa IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Middle East and Africa IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Middle East and Africa IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Middle East and Africa IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Middle East and Africa IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Middle East and Africa IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Middle East and Africa IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Middle East and Africa IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Middle East and Africa IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Middle East and Africa IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Middle East and Africa IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Middle East and Africa IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Middle East and Africa IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Middle East and Africa IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Middle East and Africa IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Middle East and Africa IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Middle East and Africa IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Middle East and Africa IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Middle East and Africa IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Middle East and Africa IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Middle East and Africa IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 35: Middle East and Africa IT Device Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa IT Device Market?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Middle East and Africa IT Device Market?

Key companies in the market include Xiaomi Corporation, Tecno Mobile, Huawei Technologies Co Ltd, Nokia Corporation, Google LLC, Lenovo Group Limited, ASUSTek Computer Inc, Acer Group, Guangdong Oppo Mobile Telecommunications Corp Ltd, Samsung Electronics Co Ltd, Apple Inc, Motorola Inc *List Not Exhaustive, Sony Corporation, Microsoft Corporation, Dell Technologies, HP Inc.

3. What are the main segments of the Middle East and Africa IT Device Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Smartphone Usage Across the Region; Robust Demand for Online Gaming.

6. What are the notable trends driving market growth?

Growing Demand for Smartphones.

7. Are there any restraints impacting market growth?

Adverse Effects of Inflation Impacting the Market.

8. Can you provide examples of recent developments in the market?

October 2022: Xiaomi, the top smartphone manufacturer, launched the 12T Series in the Saudi Market. The event was arranged to give customers in the Kingdom access to the Xiaomi 12T smartphone series and a variety of luxury tech solutions as part of its mission to make high-quality technology available to individuals and communities worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa IT Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa IT Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa IT Device Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa IT Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence