Key Insights

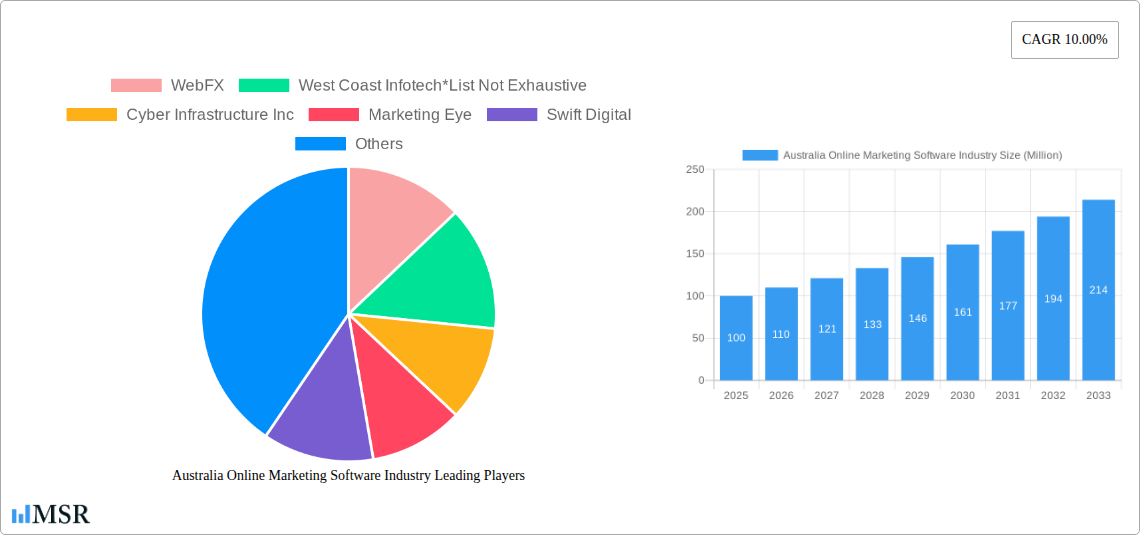

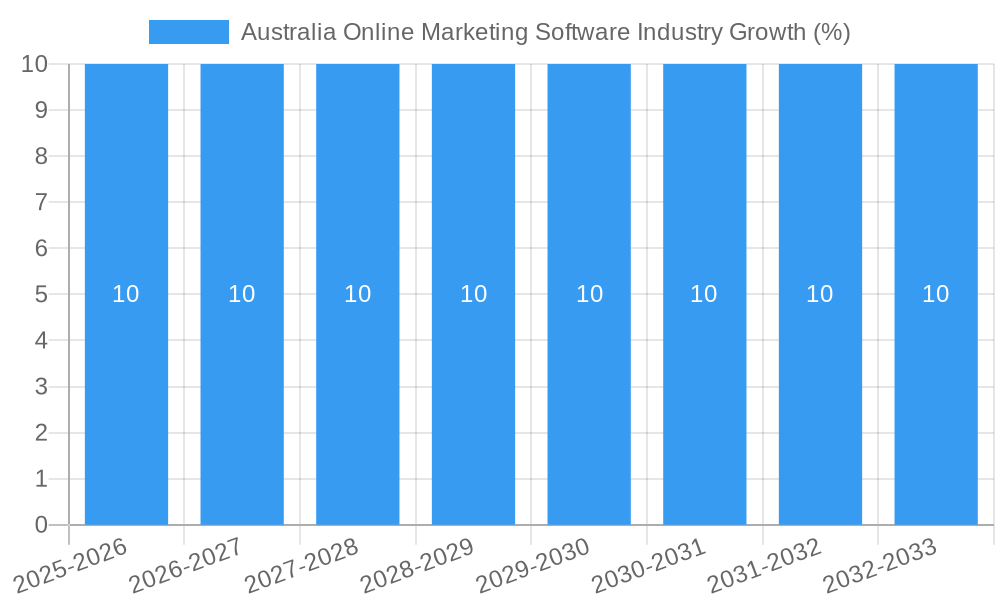

The Australian online marketing software market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a 10% Compound Annual Growth Rate (CAGR) through 2033. This expansion is driven by several key factors. Increasing digital adoption across diverse sectors like retail, BFSI (Banking, Financial Services, and Insurance), and media & entertainment fuels demand for sophisticated marketing tools. Businesses are prioritizing data-driven strategies, leading to higher investments in marketing automation, CRM, and web analytics software. The shift towards cloud-based deployments further contributes to market growth, offering scalability and cost-effectiveness. While the market faces some constraints, such as the need for skilled professionals to implement and manage these complex systems and potential data security concerns, the overall positive outlook remains strong. The market's segmentation reveals a preference for cloud-based solutions, suggesting a broader trend towards agile and flexible marketing strategies. Major players like WebFX, West Coast Infotech, and Cyber Infrastructure Inc. are contributing to the market's dynamism through innovation and competition.

The diverse end-user industries in Australia are adopting online marketing software at varying paces. The IT and Telecom sectors are early adopters, driving significant market revenue. However, sectors like healthcare and automotive show promising growth potential as they increasingly embrace digital marketing strategies to reach and engage their target audiences. The market's competitive landscape demonstrates the presence of both established players and emerging companies catering to specific niche needs. The dominance of cloud-based solutions reflects broader industry trends prioritizing accessibility, cost-efficiency, and scalability. The forecast period anticipates sustained growth, fuelled by continuous technological advancements, rising digital literacy, and the ongoing need for businesses to optimize their marketing ROI in an increasingly competitive landscape.

Australia Online Marketing Software Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australian online marketing software industry, covering market size, growth drivers, key segments, leading players, and future outlook. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for businesses, investors, and stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The Australian online marketing software market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Australia Online Marketing Software Industry Market Concentration & Dynamics

The Australian online marketing software market exhibits a moderately concentrated landscape, with several major players and a growing number of smaller, niche players. Market share is predominantly held by established companies like WebFX, West Coast Infotech, Cyber Infrastructure Inc, Marketing Eye, Swift Digital, Lounge Lizard, and Andmine, although this list is not exhaustive. Innovation is driven by continuous advancements in AI, machine learning, and data analytics, integrated into CRM, marketing automation, and web analytics solutions. The regulatory framework, primarily governed by the Australian Competition and Consumer Commission (ACCC), focuses on data privacy and consumer protection, impacting product development and data handling practices. Substitute products, such as in-house developed solutions or simpler, less feature-rich software, present a competitive challenge. End-user trends towards personalized marketing experiences and omnichannel strategies significantly influence software demand. M&A activity has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024, indicating potential for future consolidation. The average deal size is estimated at xx Million.

Australia Online Marketing Software Industry Industry Insights & Trends

The Australian online marketing software market has witnessed significant growth over the past five years, driven by factors such as increasing digital adoption across industries, the rising need for data-driven marketing strategies, and the growing prevalence of e-commerce. The market size reached xx Million in 2024 and is expected to grow to xx Million by 2025, showcasing a robust expansion trajectory. Technological disruptions, particularly the rise of AI-powered marketing automation tools and the increasing sophistication of analytics platforms, are reshaping the competitive landscape. Evolving consumer behaviors, emphasizing personalized experiences and seamless omnichannel engagement, are pushing businesses to adopt more advanced marketing software solutions. The increasing adoption of cloud-based solutions, offering scalability and cost-effectiveness, further fuels market growth. The market’s compound annual growth rate (CAGR) for the period 2025-2033 is projected at xx%, indicating sustained expansion driven by these converging factors.

Key Markets & Segments Leading Australia Online Marketing Software Industry

The Australian online marketing software market is segmented by software type (Email Marketing, CRM, Social CRM, Web Analytics, Marketing Automation, E-commerce, Content Management), end-user industry (Information Technology, Telecom, BFSI, Media & Entertainment, Retail, Manufacturing, Healthcare, Automotive), and deployment model (On-Premise, Cloud). The cloud deployment segment dominates the market due to its flexibility, scalability, and cost-effectiveness. Among end-user industries, the BFSI and Retail sectors are significant drivers, owing to their heavy reliance on digital marketing and customer relationship management. The Marketing Automation segment is experiencing the fastest growth, driven by the need for efficient campaign management and data-driven decision making.

Key Growth Drivers:

- Rapid digital transformation across industries

- Increasing demand for data-driven marketing strategies

- Growing adoption of cloud-based solutions

- Rise of AI and machine learning in marketing

- Focus on personalized customer experiences

- Strong economic growth in Australia

Dominance Analysis: The cloud-based segment’s dominance stems from its inherent scalability and cost-effectiveness, particularly appealing to SMEs. The BFSI and Retail sectors exhibit the highest demand due to their reliance on targeted customer engagement and data analysis. The growth of marketing automation reflects the need for optimized campaign management and data-driven decisions.

Australia Online Marketing Software Industry Product Developments

Recent product innovations focus on AI-powered features such as predictive analytics, personalized content recommendations, and automated campaign optimization. Integration with other marketing tools and platforms is also a key development trend, enhancing data flow and streamlining workflows. These advancements provide businesses with improved efficiency, data-driven insights, and enhanced customer experiences, giving companies a significant competitive edge.

Challenges in the Australia Online Marketing Software Industry Market

The market faces challenges such as intense competition, the need for continuous innovation to keep pace with technological advancements, data security concerns, and the complexity of integrating diverse marketing tools. Regulatory hurdles relating to data privacy and consumer protection also impact software development and marketing practices. Supply chain disruptions can affect the availability of certain software components, impacting delivery times and potentially increasing costs. These factors can collectively limit market growth by xx% if not addressed effectively.

Forces Driving Australia Online Marketing Software Industry Growth

Several factors drive market growth, including strong economic growth in Australia, increasing digital adoption across various industries, the growing importance of data-driven marketing, and the increasing demand for cloud-based solutions. Government initiatives promoting digital transformation further stimulate market expansion. Technological advancements, especially in AI and machine learning, enhance marketing effectiveness and fuel software adoption. Favorable regulatory policies supporting data privacy and digital innovation also contribute to this growth.

Long-Term Growth Catalysts in Australia Online Marketing Software Industry

Long-term growth is fueled by continued innovation in areas such as AI, machine learning, and predictive analytics. Strategic partnerships between software vendors and marketing agencies expand market reach and service offerings. Expansion into new markets, such as small and medium-sized enterprises (SMEs), and penetration into under-served industries offers significant growth potential. These combined factors are expected to drive sustained market expansion over the next decade.

Emerging Opportunities in Australia Online Marketing Software Industry

Emerging opportunities lie in the integration of marketing software with emerging technologies like the metaverse, blockchain, and Web3. The increasing use of conversational AI for customer engagement presents new avenues for software development. The focus on personalized and data-driven experiences creates ongoing demand for advanced analytics and automation tools. These innovations open pathways for market expansion and growth within the sector.

Leading Players in the Australia Online Marketing Software Industry Sector

- WebFX

- West Coast Infotech

- Cyber Infrastructure Inc

- Marketing Eye

- Swift Digital

- Lounge Lizard

- Andmine

Key Milestones in Australia Online Marketing Software Industry Industry

- 2020: Increased adoption of cloud-based marketing solutions.

- 2021: Launch of AI-powered marketing automation platforms.

- 2022: Growing emphasis on data privacy and compliance.

- 2023: Increased M&A activity within the sector.

- 2024: Focus on omnichannel marketing strategies.

Strategic Outlook for Australia Online Marketing Software Industry Market

The Australian online marketing software market holds significant long-term growth potential, driven by continuous technological advancements, increasing digital adoption, and the growing need for data-driven marketing strategies. Strategic opportunities exist for companies focusing on AI-powered solutions, omnichannel integration, and personalized customer experiences. By proactively adapting to evolving market demands and leveraging emerging technologies, companies can establish a strong competitive position and capitalize on the sustained growth of this dynamic sector.

Australia Online Marketing Software Industry Segmentation

-

1. Deployment

- 1.1. On-Premise

- 1.2. Cloud

-

2. Type

- 2.1. Email

- 2.2. CRM

- 2.3. Social CRM

- 2.4. Web Analytics

- 2.5. Marketing Automation

- 2.6. E-commerce

- 2.7. Content Management

-

3. End-user Industry

- 3.1. Information Technology

- 3.2. Telecom

- 3.3. BFSI

- 3.4. Media & Entertainment

- 3.5. Retail

- 3.6. Manufacturing

- 3.7. Healthcare

- 3.8. Automotive

Australia Online Marketing Software Industry Segmentation By Geography

- 1. Australia

Australia Online Marketing Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Surge of Web and Expanded Digitization; Adoption of Cloud Technologies

- 3.3. Market Restrains

- 3.3.1. ; Lack of Skilled Professional in Marketing Solutions

- 3.4. Market Trends

- 3.4.1. Facebook Driving Social Media Marketing Platform

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Online Marketing Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-Premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Email

- 5.2.2. CRM

- 5.2.3. Social CRM

- 5.2.4. Web Analytics

- 5.2.5. Marketing Automation

- 5.2.6. E-commerce

- 5.2.7. Content Management

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Information Technology

- 5.3.2. Telecom

- 5.3.3. BFSI

- 5.3.4. Media & Entertainment

- 5.3.5. Retail

- 5.3.6. Manufacturing

- 5.3.7. Healthcare

- 5.3.8. Automotive

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 WebFX

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 West Coast Infotech*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cyber Infrastructure Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marketing Eye

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Swift Digital

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lounge Lizard

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Andmine

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 WebFX

List of Figures

- Figure 1: Australia Online Marketing Software Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Online Marketing Software Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia Online Marketing Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Online Marketing Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Australia Online Marketing Software Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Australia Online Marketing Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Australia Online Marketing Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Australia Online Marketing Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Australia Online Marketing Software Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 8: Australia Online Marketing Software Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 9: Australia Online Marketing Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: Australia Online Marketing Software Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Online Marketing Software Industry?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the Australia Online Marketing Software Industry?

Key companies in the market include WebFX, West Coast Infotech*List Not Exhaustive, Cyber Infrastructure Inc, Marketing Eye, Swift Digital, Lounge Lizard, Andmine.

3. What are the main segments of the Australia Online Marketing Software Industry?

The market segments include Deployment, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Surge of Web and Expanded Digitization; Adoption of Cloud Technologies.

6. What are the notable trends driving market growth?

Facebook Driving Social Media Marketing Platform.

7. Are there any restraints impacting market growth?

; Lack of Skilled Professional in Marketing Solutions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Online Marketing Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Online Marketing Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Online Marketing Software Industry?

To stay informed about further developments, trends, and reports in the Australia Online Marketing Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence