Key Insights

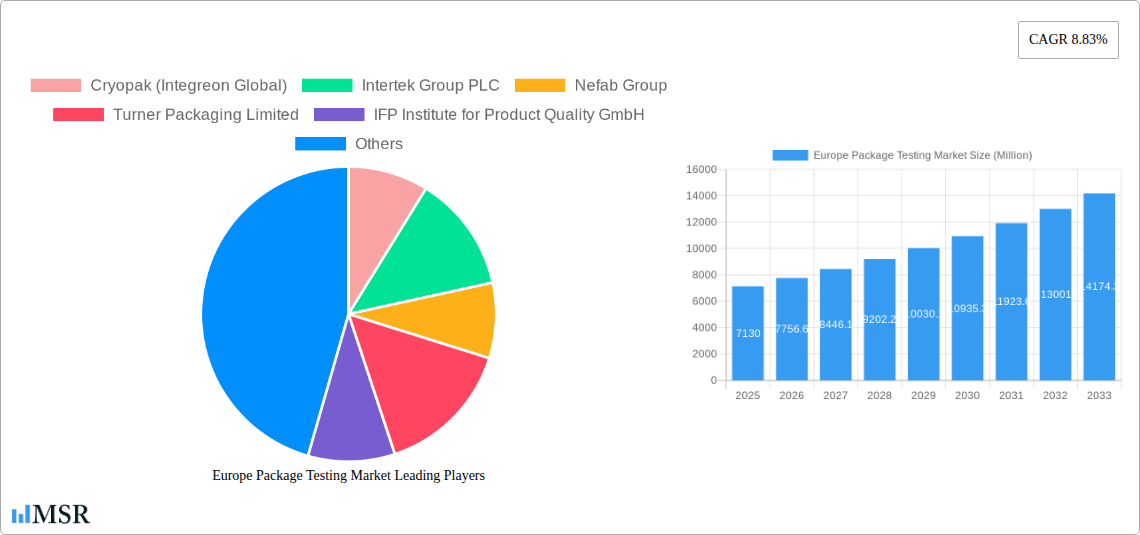

The European package testing market, valued at €7.13 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 8.83% from 2025 to 2033. This expansion is driven by several key factors. Stringent regulatory compliance requirements across the food and beverage, healthcare, and industrial sectors necessitate rigorous package testing to ensure product safety and quality. Growing consumer awareness of sustainable packaging and its environmental impact is fueling demand for eco-friendly packaging solutions and associated testing services. Furthermore, the increasing e-commerce penetration and the subsequent rise in the need for durable and protective packaging are significant contributors to market growth. The market is segmented by primary material (glass, paper, plastic, metal), testing type (physical performance, chemical, environmental), and end-user vertical. While the exact market share of each segment isn't explicitly provided, the significant presence of companies like Intertek, SGS, and Bureau Veritas suggests a competitive landscape with established players catering to diverse needs. The European region, particularly Germany, France, and the UK, are expected to drive a substantial portion of the market growth due to their robust manufacturing sectors and stringent quality control regulations.

Europe Package Testing Market Market Size (In Billion)

The forecast period (2025-2033) promises continued expansion, driven by technological advancements in testing methodologies and the increasing adoption of automation. However, factors like fluctuating raw material prices and potential economic downturns could pose challenges to the market's consistent growth. Nevertheless, the overall trajectory suggests a positive outlook for the European package testing market, with consistent expansion expected throughout the forecast period, fueled by ongoing demand for ensuring product safety and quality while complying with stringent regulations. The diverse range of testing services offered, catering to various packaging materials and end-use industries, will continue to fuel this growth.

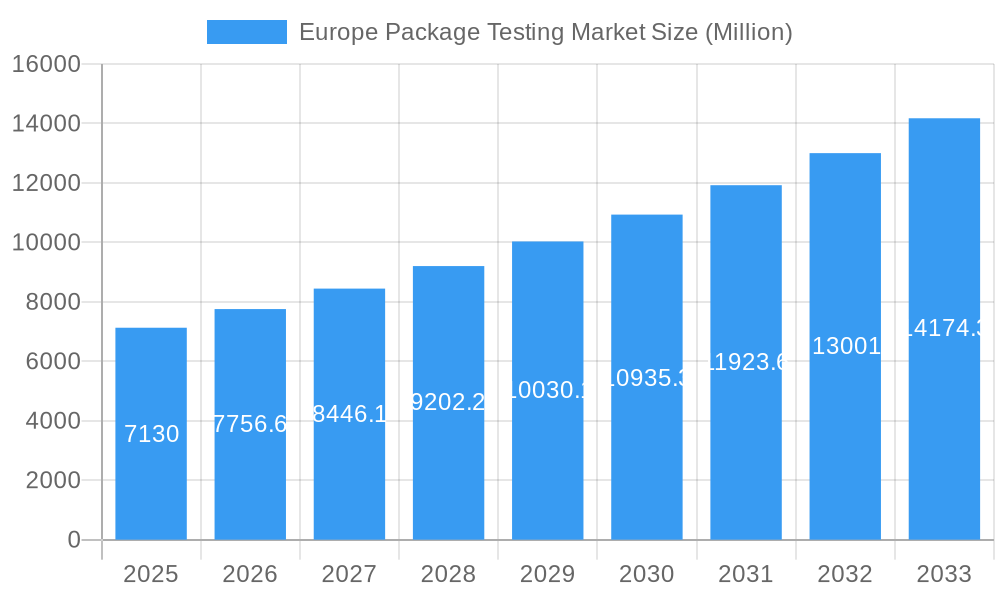

Europe Package Testing Market Company Market Share

Europe Package Testing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Package Testing market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, key segments, leading players, and future growth potential. The report leverages extensive data analysis and expert insights to deliver actionable intelligence, empowering businesses to navigate the evolving landscape of the European package testing industry. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe Package Testing Market Concentration & Dynamics

The Europe Package Testing market exhibits a moderately consolidated structure, with several major players holding significant market share. The market share of the top five players is estimated at xx%, indicating both established presence and opportunities for growth amongst smaller players. Innovation within the sector is driven by advancements in testing methodologies, automation, and data analytics, fostering improved efficiency and accuracy. Stringent regulatory frameworks, particularly concerning food safety and environmental compliance, heavily influence testing requirements and industry practices. Substitute products, such as alternative packaging materials, present ongoing competitive pressure, driving the need for continuous innovation in testing technologies. End-user trends, such as the growing preference for sustainable packaging and e-commerce expansion, are shaping demand for specialized package testing services. Mergers and acquisitions (M&A) activities have played a role in market consolidation.

- Market Concentration: Top 5 players hold approximately xx% market share (Estimated).

- M&A Activity: A significant number of M&A deals, approximately xx deals in the past five years, indicating consolidation and strategic expansion efforts within the sector.

- Innovation Ecosystem: Focus on automation, data analytics, and advanced testing techniques.

- Regulatory Framework: Stringent regulations drive demand for compliant testing solutions.

- Substitute Products: Alternative packaging materials pose competitive pressure.

- End-User Trends: Growing demand for sustainable packaging and e-commerce fuels specialized testing needs.

Europe Package Testing Market Industry Insights & Trends

The Europe Package Testing market is experiencing robust growth, driven by a confluence of factors. The increasing focus on product safety and quality assurance, coupled with stringent regulatory compliance mandates, is a primary driver. Technological advancements, including the adoption of automated testing systems and advanced analytical techniques, are enhancing testing efficiency and accuracy. Evolving consumer behaviors, characterized by heightened awareness of sustainability and ethical sourcing, are influencing packaging choices and demanding comprehensive testing to ensure compliance with ethical standards and consumer expectations. The market size in 2024 is estimated at xx Million and is projected to reach xx Million by 2025, demonstrating significant year-on-year growth.

This growth is further fueled by the expansion of the e-commerce sector, demanding robust and reliable packaging solutions. The rise of sophisticated consumer products necessitates stringent quality controls, hence the growing need for comprehensive package testing. The market is expected to continue its upward trajectory, driven by ongoing technological innovations, changing consumer preferences, and strengthening regulatory norms.

Key Markets & Segments Leading Europe Package Testing Market

The Europe Package Testing market is diverse, encompassing various primary materials, testing types, and end-user verticals. While specific market share data requires further research and might differ based on the source, preliminary analysis suggests the following:

Dominant Region: Western Europe (e.g., Germany, UK, France) due to higher industrial activity and stringent regulations.

Dominant Primary Material: Plastic, given its widespread use across various industries.

Dominant Type of Testing: Physical Performance Testing, due to essential requirement for quality control.

Key Drivers by Segment:

- Food and Beverage: Stringent food safety regulations and growing consumer awareness.

- Healthcare: Strict quality and sterility requirements for pharmaceutical and medical device packaging.

- Industrial: Demand for robust and durable packaging for industrial goods.

- Glass as Primary Material: Driven by its use in food and beverage, and pharmaceutical industries.

- Paper as Primary Material: Driven by its use in a variety of applications, and growing focus on sustainability.

- Metal as Primary Material: Driven by its use in industrial, and some food applications.

Europe Package Testing Market Product Developments

Recent product innovations in the Europe Package Testing market include the integration of advanced analytical techniques like spectroscopy and chromatography into testing protocols. These advancements enhance accuracy and speed, offering significant competitive advantages. Automated testing systems are becoming increasingly prevalent, streamlining workflows and reducing human error. The development of specialized testing procedures for emerging packaging materials (e.g., biodegradable plastics) is another significant trend, catering to the evolving needs of environmentally conscious companies.

Challenges in the Europe Package Testing Market Market

Significant challenges facing the Europe Package Testing market include navigating the complex regulatory landscape, ensuring consistency across various testing standards and dealing with supply chain disruptions that impact the timely provision of testing services. Competition among established players and new entrants is also intense. These factors impose operational challenges, impacting profitability and market penetration. The quantifiable impact of these challenges includes higher operational costs, potential delays in project completion, and potential loss of market share.

Forces Driving Europe Package Testing Market Growth

Several key factors are driving growth in the Europe Package Testing market. Technological advancements in testing methodologies and automation lead to enhanced efficiency and improved accuracy. The increasing demand for sustainable and eco-friendly packaging solutions drives the need for specialized testing procedures, focusing on biodegradability and recyclability. Stringent regulatory compliance requirements necessitate thorough testing to ensure product safety and quality, stimulating market expansion.

Long-Term Growth Catalysts in Europe Package Testing Market

Long-term growth will be fuelled by collaborations between testing companies and packaging material manufacturers, allowing for the development of tailored testing solutions. Investments in research and development focused on advanced testing technologies will enhance the efficiency and accuracy of testing services, opening new opportunities in specialized niche markets. Expansion into developing European markets with increasing industrialization and rising consumer expectations for quality products will broaden the market's reach.

Emerging Opportunities in Europe Package Testing Market

Significant opportunities lie in specialized testing for emerging packaging materials such as bioplastics and compostable packaging. The increasing demand for sustainable packaging presents lucrative prospects for companies offering eco-friendly testing services. The expansion of the e-commerce sector creates opportunities for package testing services that cater to the specific needs of online retailers, including specialized testing for protective packaging and efficient distribution.

Leading Players in the Europe Package Testing Market Sector

- Cryopak (Integreon Global)

- Intertek Group PLC

- Nefab Group

- Turner Packaging Limited

- IFP Institute for Product Quality GmbH

- Campden BRI

- Glass Technology Services

- TUV SUD AG

- SGS SA

- Bureau Veritas SA

- Eurofins Scientific SE

Key Milestones in Europe Package Testing Market Industry

- December 2020: Berlin Packaging acquired Newpack, marking its tenth European acquisition since 2016, signaling commitment to European market expansion across various packaging materials and sectors.

- August 2020: ePac Holdings Europe established two new digital-only production plants in Lyon (France) and Wrocław (Poland), expanding its European footprint.

Strategic Outlook for Europe Package Testing Market Market

The future of the Europe Package Testing market is promising, with substantial growth potential driven by technological advancements, regulatory changes, and evolving consumer preferences. Strategic partnerships, investments in R&D, and a focus on specialized testing services will be crucial for success. The market's expansion into emerging sectors and adaptation to new packaging materials will shape the industry's trajectory in the coming years. Companies prioritizing innovation and sustainability will be well-positioned to capture significant market share in this dynamic and expanding sector.

Europe Package Testing Market Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Plastic

- 1.4. Metal

-

2. Type of Testing

- 2.1. Physical Performance Testing

- 2.2. Chemical Testing

- 2.3. Environmental Testing

-

3. End-user Vertical

- 3.1. Food and Beverage

- 3.2. Healthcare

- 3.3. Industrial

- 3.4. Personal and Household Products

- 3.5. Other End-user Verticals

Europe Package Testing Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Package Testing Market Regional Market Share

Geographic Coverage of Europe Package Testing Market

Europe Package Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Package Testing

- 3.4. Market Trends

- 3.4.1. Glass Usage in Packaging Expected to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Package Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Plastic

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Type of Testing

- 5.2.1. Physical Performance Testing

- 5.2.2. Chemical Testing

- 5.2.3. Environmental Testing

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare

- 5.3.3. Industrial

- 5.3.4. Personal and Household Products

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cryopak (Integreon Global)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Intertek Group PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nefab Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Turner Packaging Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IFP Institute for Product Quality GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Campden BRI

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Glass Technology Services*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TUV SUD AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SGS SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bureau Veritas SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eurofins Scientific SE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Cryopak (Integreon Global)

List of Figures

- Figure 1: Europe Package Testing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Package Testing Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Package Testing Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 2: Europe Package Testing Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 3: Europe Package Testing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Europe Package Testing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Package Testing Market Revenue Million Forecast, by Primary Material 2020 & 2033

- Table 6: Europe Package Testing Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 7: Europe Package Testing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Europe Package Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Package Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Package Testing Market?

The projected CAGR is approximately 8.83%.

2. Which companies are prominent players in the Europe Package Testing Market?

Key companies in the market include Cryopak (Integreon Global), Intertek Group PLC, Nefab Group, Turner Packaging Limited, IFP Institute for Product Quality GmbH, Campden BRI, Glass Technology Services*List Not Exhaustive, TUV SUD AG, SGS SA, Bureau Veritas SA, Eurofins Scientific SE.

3. What are the main segments of the Europe Package Testing Market?

The market segments include Primary Material, Type of Testing, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions.

6. What are the notable trends driving market growth?

Glass Usage in Packaging Expected to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

High Costs Associated with Package Testing.

8. Can you provide examples of recent developments in the market?

December 2020 - Berlin Packaging acquired Newpack and is it's tenth European acquisition since 2016. This step confirmsBerlin Packaging's commitment to supplying packaging across all geographies, substrates, and market verticals in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Package Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Package Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Package Testing Market?

To stay informed about further developments, trends, and reports in the Europe Package Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence