Key Insights

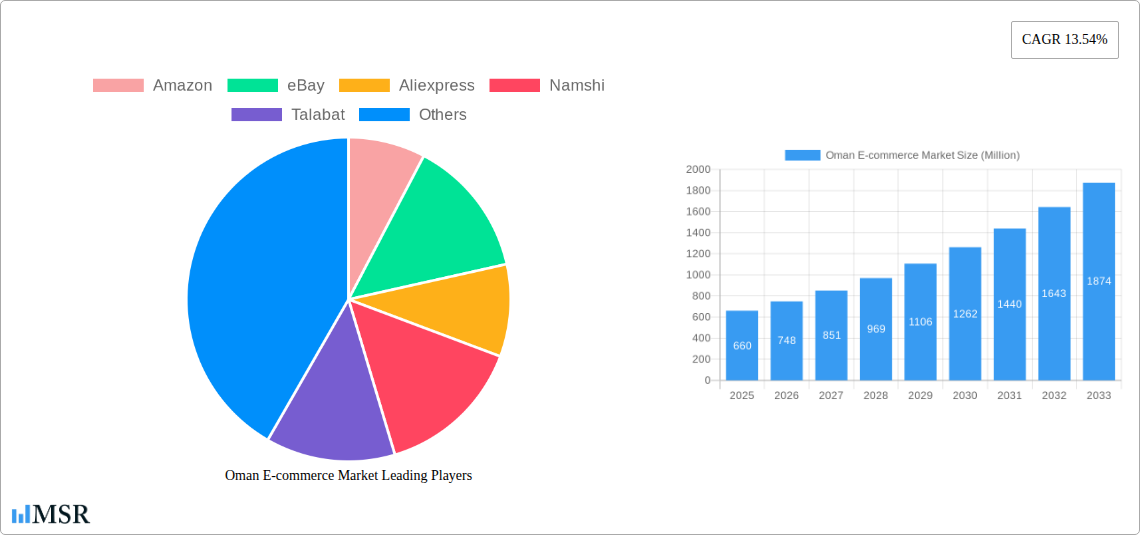

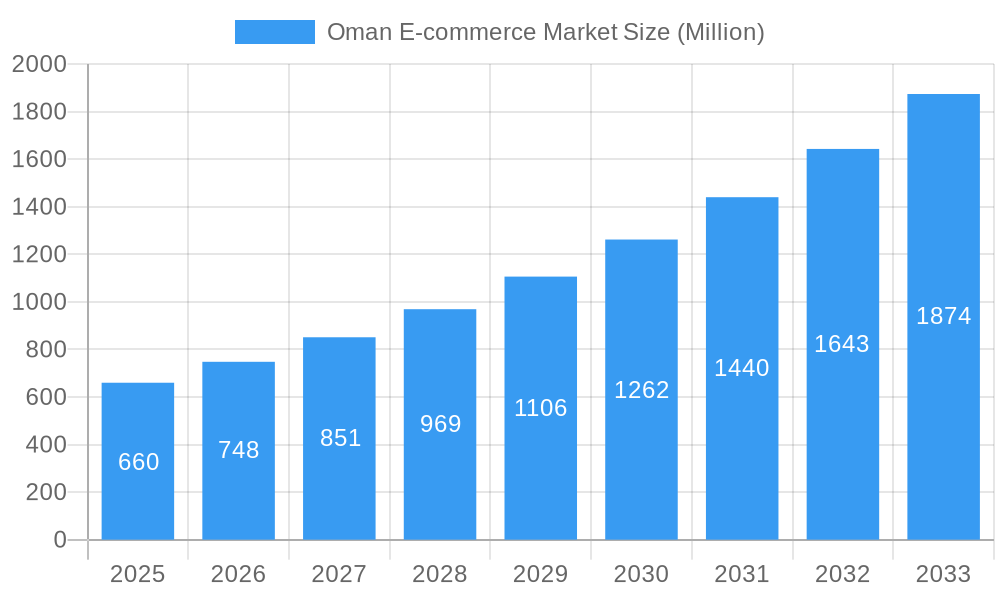

The Oman e-commerce market, valued at $660 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 13.54% from 2025 to 2033. This expansion is fueled by increasing internet and smartphone penetration, a young and tech-savvy population, and a rising preference for online shopping convenience. Government initiatives promoting digital infrastructure and e-commerce adoption further contribute to this positive trajectory. Key players like Amazon, eBay, AliExpress, and regional giants such as Namshi, Talabat, and Shein are actively competing for market share, driving innovation and expanding product offerings. The market is segmented by product categories (likely including electronics, fashion, groceries, and others), with each segment exhibiting varying growth rates based on consumer preferences and market saturation. Challenges include the need for improved logistics infrastructure to ensure efficient delivery across the country and the need to address potential consumer concerns regarding online payment security and product authenticity.

Oman E-commerce Market Market Size (In Million)

Looking ahead, the Oman e-commerce market is poised for significant expansion, driven by sustained economic growth and increasing digital literacy. The focus on enhancing payment gateways and addressing logistical bottlenecks will be crucial for accelerating market penetration. The emergence of new business models, such as social commerce and the growth of mobile e-commerce, will shape the future landscape. Competitive pressures will continue to drive innovation and offer consumers more choice and value. Furthermore, personalized marketing and customer experience enhancements will play a key role in attracting and retaining customers, fostering loyalty and long-term market growth. While data on specific regional breakdowns is unavailable, projections can be made based on population density and infrastructure development within Oman, indicating stronger growth in urban areas compared to rural regions.

Oman E-commerce Market Company Market Share

Oman E-commerce Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Oman e-commerce market, encompassing market dynamics, industry trends, key players, and future growth prospects. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report is an essential resource for businesses, investors, and stakeholders seeking to understand and capitalize on the burgeoning opportunities within the Omani e-commerce landscape. The report projects a market size of xx Million by 2025, with a CAGR of xx% from 2025 to 2033.

Oman E-commerce Market Concentration & Dynamics

The Oman e-commerce market exhibits a moderately concentrated landscape, with several key players vying for market share. While giants like Amazon, eBay, and Aliexpress hold significant global presence, regional players such as Namshi, Talabat, Shein.com, Jazp.com, Haraj, Mumzworld, and Vogacloset.com are also significant contributors. Market share data for 2024 suggests that the top 5 players collectively hold approximately xx% of the market. The innovation ecosystem is relatively nascent but shows promise, with increasing investments in fintech and logistics infrastructure. The regulatory framework, while evolving, is generally supportive of e-commerce growth. Substitute products, primarily traditional retail channels, continue to compete, although the shift towards online shopping is undeniable. End-user trends indicate a preference for convenient, user-friendly platforms with robust delivery services. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated

- M&A Deal Count (2019-2024): xx

- Top 5 Players Market Share (2024): xx%

Oman E-commerce Market Industry Insights & Trends

The Omani e-commerce market has witnessed significant growth driven by increasing internet and smartphone penetration, rising disposable incomes, and a young, tech-savvy population. Technological disruptions, particularly the rise of mobile commerce and social commerce, are reshaping the landscape. Consumers increasingly value seamless online experiences, secure payment gateways, and fast delivery options. The market size in 2024 was estimated at xx Million, reflecting a substantial increase from xx Million in 2019. This growth is projected to continue at a healthy CAGR, driven by factors such as government initiatives to promote digitalization and increased investments in logistics infrastructure. Evolving consumer behaviours show a marked preference for personalized shopping experiences, omnichannel strategies, and the use of social media for product discovery. The increasing adoption of e-wallets and digital payment systems is further fueling the growth of the sector.

Key Markets & Segments Leading Oman E-commerce Market

The most dominant segment within the Oman e-commerce market is currently the fashion and apparel sector, followed by electronics and consumer durables. This is fueled by a growing young population with a high propensity to spend on fashion and technology.

- Drivers for Fashion & Apparel Dominance:

- High disposable incomes among young consumers

- Growing preference for online fashion shopping

- Increasing availability of diverse products from international and local brands.

- Drivers for Electronics & Consumer Durables Growth:

- Rising demand for technology gadgets

- Increased affordability of electronics

- Growing preference for online purchases for electronics.

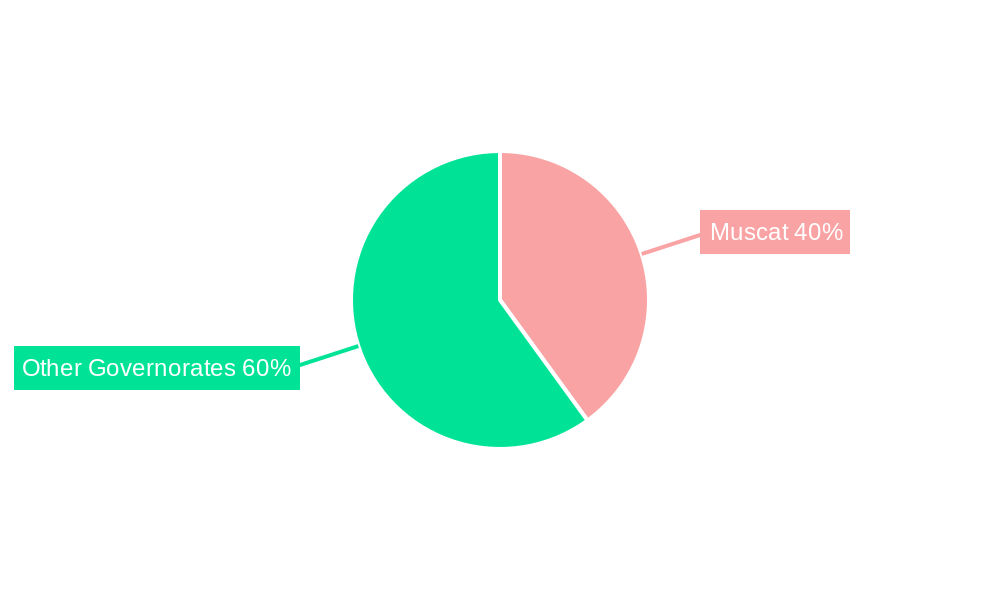

Further analysis indicates that the Muscat region accounts for the largest share of e-commerce transactions due to higher internet penetration and higher concentration of population. This dominance is expected to continue in the forecast period driven by planned infrastructural developments and government incentives.

Oman E-commerce Market Product Developments

Product innovations in the Omani e-commerce sector are largely focused on enhancing customer experience. This includes features like personalized recommendations, improved search functionalities, advanced payment options, and seamless integration with social media platforms. Technological advancements in areas such as artificial intelligence and machine learning are being utilized to personalize the shopping experience and optimize logistics. These developments are crucial for businesses seeking to gain a competitive edge in the market.

Challenges in the Oman E-commerce Market

The Oman e-commerce market faces challenges such as limited logistics infrastructure in certain regions, resulting in high delivery costs and longer delivery times. Regulatory hurdles related to data privacy and consumer protection can also impede growth. Furthermore, intense competition from established players and the emergence of new entrants create pressure on margins and profitability. These factors have a quantifiable impact on market growth, estimated to be xx% reduction in overall growth projections during the period.

Forces Driving Oman E-commerce Market Growth

Several factors propel the growth of the Oman e-commerce market. These include the government's active promotion of digitalization, including investments in improving digital infrastructure. Furthermore, increasing internet and smartphone penetration, coupled with rising disposable incomes, are contributing significantly to the surge in online shopping. Regulatory reforms aimed at simplifying business processes and fostering a more conducive environment for e-commerce are also crucial drivers.

Long-Term Growth Catalysts in the Oman E-commerce Market

Long-term growth catalysts include strategic partnerships between e-commerce platforms and logistics providers to streamline delivery processes. Innovations in areas such as augmented reality and virtual reality are poised to further revolutionize the online shopping experience. Expansion into new market segments, such as grocery and healthcare, will also contribute to sustained growth.

Emerging Opportunities in Oman E-commerce Market

Emerging opportunities include the increasing adoption of mobile payments and the growth of social commerce. The potential for cross-border e-commerce with neighboring countries presents a significant avenue for growth. Targeting niche markets with specialized products and services can also create significant opportunities for businesses.

Leading Players in the Oman E-commerce Market Sector

- Amazon

- eBay

- Aliexpress

- Namshi

- Talabat

- Shein.com

- Jazp.com

- Haraj

- Mumzworld

- Vogacloset.com

- List Not Exhaustive

Key Milestones in Oman E-commerce Market Industry

- October 2023: Asyad Express partnered with Evri to launch a transformational e-commerce gateway hub in Oman and the Middle East, aiming to attract major international players.

- February 2023: Ourshopee.com revamped its operations in Oman, expanding its product offerings.

Strategic Outlook for Oman E-commerce Market

The Oman e-commerce market presents significant long-term growth potential. Strategic opportunities lie in leveraging technological advancements to enhance customer experience, expanding into new market segments, and forging strong partnerships within the logistics ecosystem. Focus on addressing existing challenges related to infrastructure and regulation will be vital for unlocking the full potential of this dynamic market.

Oman E-commerce Market Segmentation

-

1. Product Type

- 1.1. Apparel and Footwear

- 1.2. Consumer Appliances and Electronics

- 1.3. Consumer Healthcare

- 1.4. Food and Beverages

- 1.5. Home Care and Home Furnishing

- 1.6. Pet Care

- 1.7. Toys, Games, and Baby Products

- 1.8. Sports and Outdoor and Other Products

- 1.9. Accessories and Eyewear

Oman E-commerce Market Segmentation By Geography

- 1. Oman

Oman E-commerce Market Regional Market Share

Geographic Coverage of Oman E-commerce Market

Oman E-commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Government Initiatives to Drive the Market

- 3.4. Market Trends

- 3.4.1. Raising Internet Penetration in Oman has a Positive Impact on the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Apparel and Footwear

- 5.1.2. Consumer Appliances and Electronics

- 5.1.3. Consumer Healthcare

- 5.1.4. Food and Beverages

- 5.1.5. Home Care and Home Furnishing

- 5.1.6. Pet Care

- 5.1.7. Toys, Games, and Baby Products

- 5.1.8. Sports and Outdoor and Other Products

- 5.1.9. Accessories and Eyewear

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 eBay

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aliexpress

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Namshi

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Talabat

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shein com

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jazp com

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Haraj

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mumzworld

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vogacloset com**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: Oman E-commerce Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Oman E-commerce Market Share (%) by Company 2025

List of Tables

- Table 1: Oman E-commerce Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Oman E-commerce Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Oman E-commerce Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Oman E-commerce Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Oman E-commerce Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Oman E-commerce Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 7: Oman E-commerce Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Oman E-commerce Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman E-commerce Market?

The projected CAGR is approximately 13.54%.

2. Which companies are prominent players in the Oman E-commerce Market?

Key companies in the market include Amazon, eBay, Aliexpress, Namshi, Talabat, Shein com, Jazp com, Haraj, Mumzworld, Vogacloset com**List Not Exhaustive.

3. What are the main segments of the Oman E-commerce Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Drive the Market.

6. What are the notable trends driving market growth?

Raising Internet Penetration in Oman has a Positive Impact on the Market.

7. Are there any restraints impacting market growth?

Government Initiatives to Drive the Market.

8. Can you provide examples of recent developments in the market?

October 2023: Asyad Express partnered with Evri to launch a transformational e-commerce gateway hub in Oman and the Middle East. The partnership was made to attract major UK, European, US, and Chinese players to Oman by facilitating access to Asyad Group's logistics ecosystem.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman E-commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman E-commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman E-commerce Market?

To stay informed about further developments, trends, and reports in the Oman E-commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence