Key Insights

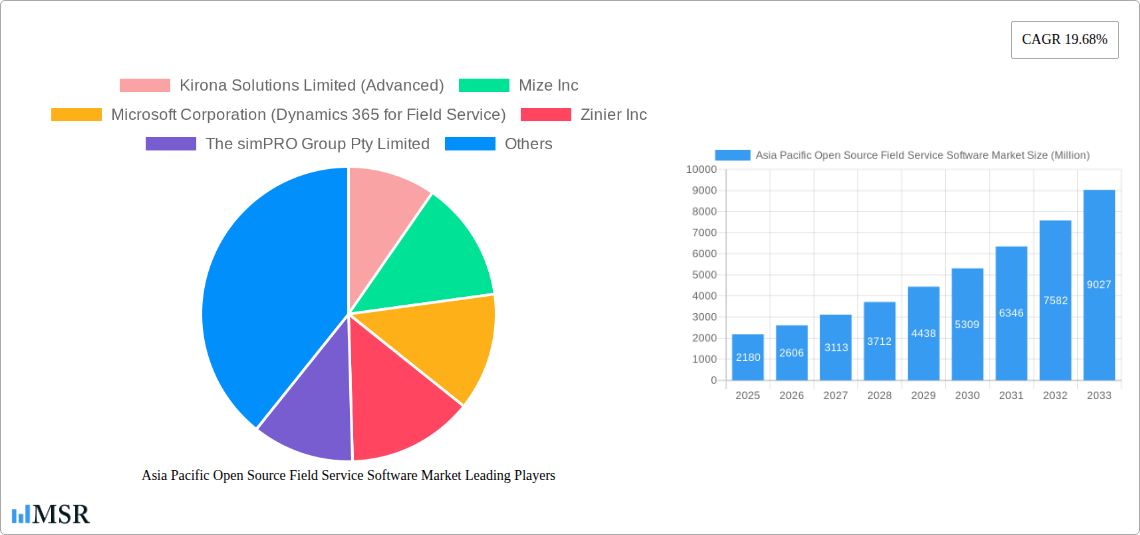

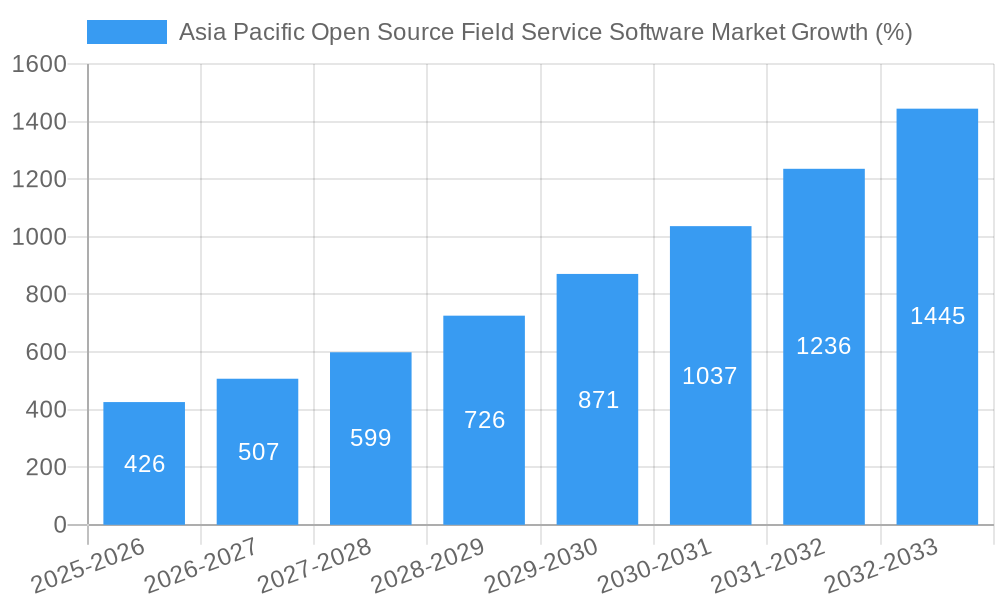

The Asia Pacific open-source field service software market is experiencing robust growth, projected to reach \$2.18 billion by 2025 and maintain a Compound Annual Growth Rate (CAGR) of 19.68% from 2025 to 2033. This expansion is driven by several factors. The increasing adoption of cloud-based solutions offers scalability and cost-effectiveness for businesses of all sizes, particularly small and medium enterprises (SMEs) seeking to optimize operational efficiency. Furthermore, the rising demand for improved customer service and real-time data visibility is fueling the need for advanced field service management tools. Growth within key end-user segments like Allied FM (including building maintenance, HVAC, landscaping, and cleaning), IT and Telecom, and Healthcare and Lifesciences is significant, driven by the need for efficient resource allocation and optimized service delivery. The expansion is geographically diverse, with strong growth projected across countries like India, China, Japan, and Australia, reflecting the region's rapidly developing economies and expanding digital infrastructure. The preference for open-source solutions stems from their flexibility, cost-effectiveness, and potential for customization, attracting a range of businesses seeking tailored solutions. However, the market's growth might face constraints from the complexity of integrating open-source systems with existing enterprise infrastructure and the need for skilled professionals to manage and maintain them.

The competitive landscape is dynamic, with both established players like Microsoft (Dynamics 365 for Field Service) and Salesforce (Field Service Cloud) alongside specialized open-source providers like Kirona Solutions and Mize Inc. These companies are constantly innovating, offering a range of features such as mobile workforce management, scheduling optimization, inventory management, and customer relationship management (CRM) integration. The future growth of the market depends on continuous technological advancements, the development of more user-friendly interfaces, and the ability of open-source solutions to address the specific needs of diverse industries in the Asia Pacific region. The increasing adoption of Internet of Things (IoT) technologies and the integration of AI-powered functionalities within field service software will further propel market growth in the coming years. The market's success will hinge on addressing challenges related to data security and compliance with industry-specific regulations.

Asia Pacific Open Source Field Service Software Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific Open Source Field Service Software market, covering market dynamics, industry trends, key segments, leading players, and future growth opportunities. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report is crucial for businesses, investors, and stakeholders seeking to understand and capitalize on the growth potential within this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Asia Pacific Open Source Field Service Software Market Market Concentration & Dynamics

The Asia Pacific open source field service software market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the market is also characterized by a dynamic competitive environment with ongoing innovation, mergers and acquisitions (M&A) activity, and the emergence of new entrants. Market share data for 2024 reveals that the top five players collectively hold approximately xx% of the market, while the remaining share is distributed among numerous smaller players and niche providers.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market is estimated to be xx, indicating a moderately concentrated market.

- Innovation Ecosystems: Significant investment in R&D and a robust ecosystem of developers contribute to continuous product improvements and innovation within the open-source community.

- Regulatory Frameworks: Varying data privacy regulations across the Asia Pacific region influence market dynamics, particularly impacting the adoption of cloud-based solutions.

- Substitute Products: Proprietary field service management (FSM) software presents a key competitive alternative, although the cost-effectiveness and flexibility of open-source options remain a compelling factor.

- End-User Trends: Increasing demand for mobile-first solutions and real-time data analytics is driving market growth. The trend toward digitization across various industries is further propelling the adoption of open-source FSM software.

- M&A Activities: The past five years have witnessed xx M&A deals in the Asia Pacific open-source field service software market, indicating a consolidating market with players seeking to expand their capabilities and market reach. These deals predominantly involve acquisitions of smaller companies with specialized technologies or significant customer bases.

Asia Pacific Open Source Field Service Software Market Industry Insights & Trends

The Asia Pacific open-source field service software market is experiencing robust growth, driven by a multitude of factors. The market size in 2024 is estimated at xx Million, reflecting a significant expansion from the xx Million recorded in 2019. This growth is primarily attributable to the increasing adoption of digital technologies across diverse industries, the rising demand for enhanced operational efficiency and customer satisfaction, and the cost-effectiveness of open-source solutions. Technological advancements, such as the integration of artificial intelligence (AI) and Internet of Things (IoT) technologies, are further accelerating market expansion. The evolving preferences of consumers for personalized and seamless service experiences are also playing a key role. The market's expansion is particularly pronounced in rapidly developing economies across the region, where the demand for efficient and cost-effective field service solutions is high. The increasing adoption of cloud-based deployment models contributes to market growth due to their scalability and accessibility. Furthermore, the growing need for real-time data analytics for optimizing field operations is another prominent driver.

Key Markets & Segments Leading Asia Pacific Open Source Field Service Software Market

The Asia Pacific open source field service software market is segmented by deployment type (on-premise and cloud), organization size (small and medium enterprises (SMEs) and large enterprises), end-user (Allied FM (Hard - Building and HVAC and Soft - Landscaping and Cleaning), IT and Telecom, Healthcare and Lifesciences, Energy and Utilities, Oil and Gas, Manufacturing, and Other End-Users), and country (India, China, Japan, Australia, and Rest of Asia Pacific).

Dominant Segments:

- Deployment Type: Cloud deployment models are experiencing the highest growth rate, driven by their scalability, flexibility, and reduced infrastructure costs.

- Organization Size: Large enterprises currently represent the largest segment, owing to their greater technological adoption capabilities and higher budgets for software solutions. However, SMEs are demonstrating a strong growth trajectory, driven by the increasing affordability and accessibility of cloud-based solutions.

- End-User: The IT and Telecom, Energy and Utilities, and Allied FM sectors are currently the leading end-users of open-source field service software, driven by their significant operational complexities and high need for efficient service management.

- Country: India and China are the fastest-growing markets, fueled by rapid economic expansion, increasing digitalization, and the growing need for efficient field service solutions. Japan and Australia represent mature markets with a substantial existing user base.

Growth Drivers:

- Economic Growth: Rapid economic expansion in several Asia Pacific countries fuels investments in technological upgrades and operational efficiency.

- Infrastructure Development: Significant infrastructure development projects are driving demand for efficient field service management solutions.

- Technological Advancements: Continuous innovations in areas such as AI, IoT, and mobile technologies enhance the capabilities and appeal of open-source FSM software.

- Government Initiatives: Government policies promoting digital transformation are creating favorable conditions for market growth.

Asia Pacific Open Source Field Service Software Market Product Developments

Recent product developments have focused on enhancing the functionality and user experience of open-source field service software. Key innovations include improved mobile accessibility, advanced analytics capabilities, and enhanced integration with other enterprise systems. These advancements are geared towards improving operational efficiency, customer satisfaction, and overall business outcomes. The integration of AI-powered features, such as predictive maintenance and intelligent routing, is increasingly prominent. Competition is driving innovation, with companies focusing on providing specialized solutions tailored to specific industry requirements.

Challenges in the Asia Pacific Open Source Field Service Software Market Market

Several challenges hinder the growth of the Asia Pacific open-source field service software market. These include the complexities associated with integrating open-source solutions into existing IT infrastructures, concerns regarding data security and privacy, and the need for skilled personnel to manage and maintain these systems. Competition from established proprietary software providers also presents a significant challenge. The fragmented nature of the market, with numerous smaller players, poses challenges to standardization and interoperability. The varying levels of digital literacy across the region also impede the adoption of such technologies. These factors collectively contribute to a slower-than-expected market growth in certain regions.

Forces Driving Asia Pacific Open Source Field Service Software Market Growth

Key growth drivers for the Asia Pacific open-source field service software market include the increasing adoption of cloud-based solutions, the rising demand for mobile-first functionalities, and the growing need for real-time data analytics. The cost-effectiveness of open-source solutions compared to proprietary alternatives is another significant factor. Government initiatives supporting digital transformation in several countries within the region also contribute to market expansion.

Challenges in the Asia Pacific Open Source Field Service Software Market Market

Long-term growth catalysts include the ongoing development of innovative features such as AI-powered predictive maintenance and advanced analytics. Strategic partnerships between open-source providers and industry giants are further accelerating market growth. Expansion into new markets and increased integration capabilities also contribute to sustained growth. Furthermore, the growing trend toward modular and customizable solutions facilitates wider adoption across different industry verticals.

Emerging Opportunities in Asia Pacific Open Source Field Service Software Market

Emerging opportunities include expanding into underserved markets, developing specialized solutions for niche industries, and leveraging the increasing popularity of Internet of Things (IoT) technologies. The adoption of blockchain technology for enhancing data security and transparency also presents a significant growth avenue. The rise of mobile-first and AI-powered functionalities is opening up new market opportunities.

Leading Players in the Asia Pacific Open Source Field Service Software Market Sector

- Kirona Solutions Limited (Advanced)

- Mize Inc

- Microsoft Corporation (Dynamics 365 for Field Service)

- Zinier Inc

- The simPRO Group Pty Limited

- IFS AB

- ServiceMax Inc

- Field Aware US Inc

- Salesforce com Inc (Field Service Cloud)

- Trimble Inc

- Oracle Corporation (OFSC)

- Accruent LLC (Fortive Corp)

- Coresystems (SAP SE)

- ServicePower Inc

Key Milestones in Asia Pacific Open Source Field Service Software Market Industry

- October 2021: Salesforce introduced four new capabilities for Field Service, enhancing mobile workforce capabilities and customer self-service options. This significantly impacted customer experience and broadened Salesforce's market reach.

- August 2022: ServiceMax expanded ServiceMax Core, adding features that improved customer field service management performance, revenue, and margins. This reinforced ServiceMax's position as a market leader and spurred further adoption of its platform.

Strategic Outlook for Asia Pacific Open Source Field Service Software Market Market

The Asia Pacific open-source field service software market exhibits considerable growth potential, driven by increasing technological advancements, expanding digitalization across industries, and rising demand for efficient service management solutions. Strategic opportunities exist in developing innovative solutions tailored to specific industry needs, leveraging emerging technologies such as AI and IoT, and fostering strategic partnerships to expand market reach. Focus on enhancing data security and privacy will be crucial for sustaining long-term growth.

Asia Pacific Open Source Field Service Software Market Segmentation

-

1. Deployment Type

- 1.1. On-premise

- 1.2. Cloud

-

2. Organization Size

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. End-User

- 3.1. Allied F

- 3.2. IT and Telecom

- 3.3. Healthcare and Lifesciences

- 3.4. Energy and Utilities

- 3.5. Oil and Gas

- 3.6. Manufacturing

- 3.7. Other

Asia Pacific Open Source Field Service Software Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Open Source Field Service Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Customer Demand for Quicker Response Time enabling FMS Companies to Invest in New Technologies; Growing Emphasis on Maximizing Work Efficiency

- 3.3. Market Restrains

- 3.3.1. Increasing Risk of Counterfeits

- 3.4. Market Trends

- 3.4.1. Adoption of Field Service Management Solutions in India is Increasing at a High Pace

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Open Source Field Service Software Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Allied F

- 5.3.2. IT and Telecom

- 5.3.3. Healthcare and Lifesciences

- 5.3.4. Energy and Utilities

- 5.3.5. Oil and Gas

- 5.3.6. Manufacturing

- 5.3.7. Other

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. China Asia Pacific Open Source Field Service Software Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Open Source Field Service Software Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Open Source Field Service Software Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Open Source Field Service Software Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Open Source Field Service Software Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Open Source Field Service Software Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Open Source Field Service Software Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Kirona Solutions Limited (Advanced)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Mize Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Microsoft Corporation (Dynamics 365 for Field Service)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Zinier Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 The simPRO Group Pty Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 IFS AB

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 ServiceMax Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Field Aware US Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Salesforce com Inc (Field Service Cloud)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Trimble Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Oracle Corporation (OFSC)

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Accruent LLC (Fortive Corp)

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Coresystems (SAP SE)

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 ServicePower Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Kirona Solutions Limited (Advanced)

List of Figures

- Figure 1: Asia Pacific Open Source Field Service Software Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Open Source Field Service Software Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 3: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 4: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 15: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 16: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: New Zealand Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Malaysia Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Singapore Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Thailand Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Vietnam Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Philippines Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Open Source Field Service Software Market?

The projected CAGR is approximately 19.68%.

2. Which companies are prominent players in the Asia Pacific Open Source Field Service Software Market?

Key companies in the market include Kirona Solutions Limited (Advanced), Mize Inc, Microsoft Corporation (Dynamics 365 for Field Service), Zinier Inc, The simPRO Group Pty Limited, IFS AB, ServiceMax Inc, Field Aware US Inc, Salesforce com Inc (Field Service Cloud), Trimble Inc, Oracle Corporation (OFSC), Accruent LLC (Fortive Corp), Coresystems (SAP SE), ServicePower Inc.

3. What are the main segments of the Asia Pacific Open Source Field Service Software Market?

The market segments include Deployment Type, Organization Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Customer Demand for Quicker Response Time enabling FMS Companies to Invest in New Technologies; Growing Emphasis on Maximizing Work Efficiency.

6. What are the notable trends driving market growth?

Adoption of Field Service Management Solutions in India is Increasing at a High Pace.

7. Are there any restraints impacting market growth?

Increasing Risk of Counterfeits.

8. Can you provide examples of recent developments in the market?

August 2022 - ServiceMax, a leader in asset-centric field service management, declared the continued expansion of ServiceMax Core by adding new extra features that can fuel better customer field service management performance, revenue, and margin growth. These advancements benefit not only administrators, field technicians, planners, and dispatchers but also an increasing scope of roles associated with expanding operating margins, driving customer value, and improving revenues.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Open Source Field Service Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Open Source Field Service Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Open Source Field Service Software Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Open Source Field Service Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence