Key Insights

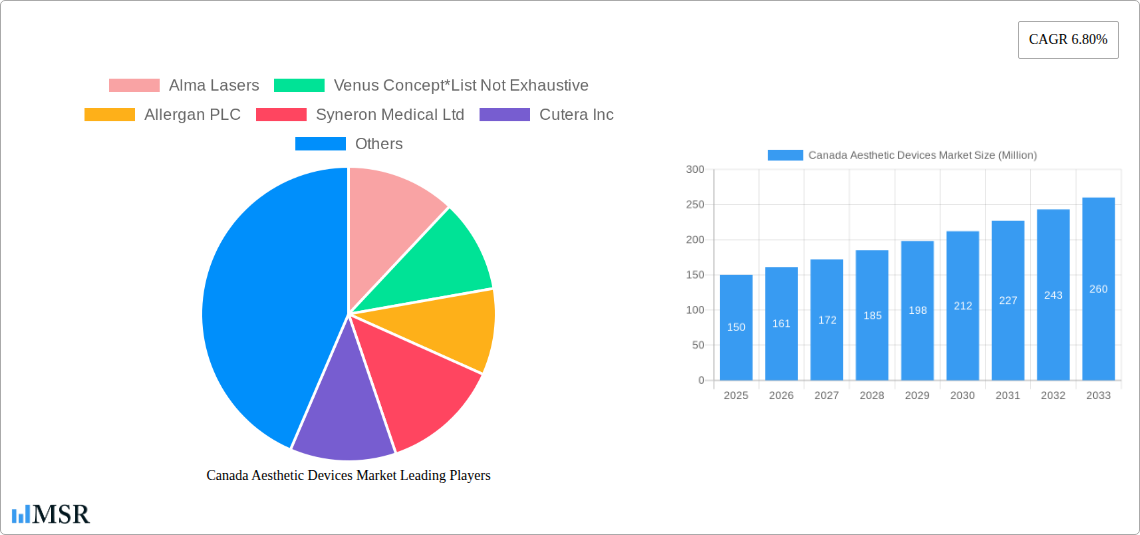

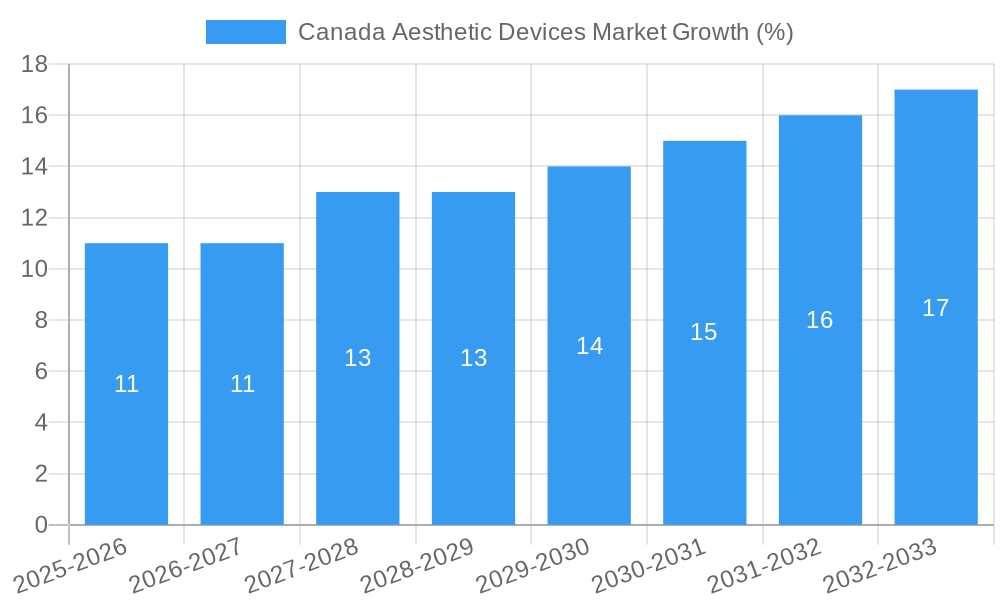

The Canadian aesthetic devices market is experiencing robust growth, driven by increasing disposable incomes, a rising awareness of non-invasive cosmetic procedures, and an aging population seeking to maintain youthful appearances. The market, valued at approximately $XX million in 2025 (assuming a logical estimation based on available CAGR and market trends for similar regions), is projected to expand at a Compound Annual Growth Rate (CAGR) of 6.80% from 2025 to 2033. This growth is fueled by advancements in technology leading to more effective and less invasive procedures. Energy-based devices, such as lasers and ultrasound, dominate the market due to their versatility in addressing various aesthetic concerns like skin resurfacing, body contouring, and hair removal. However, non-energy-based devices are also gaining traction, particularly in home settings, driven by affordability and convenience. The increasing prevalence of skin conditions and the desire for personalized beauty solutions further contribute to market expansion. Clinics and hospitals remain the primary end-users, although the home-use segment is demonstrating significant growth potential. Key players like Alma Lasers, Venus Concept, Allergan PLC, and others are driving innovation through product development and strategic partnerships, further shaping the competitive landscape.

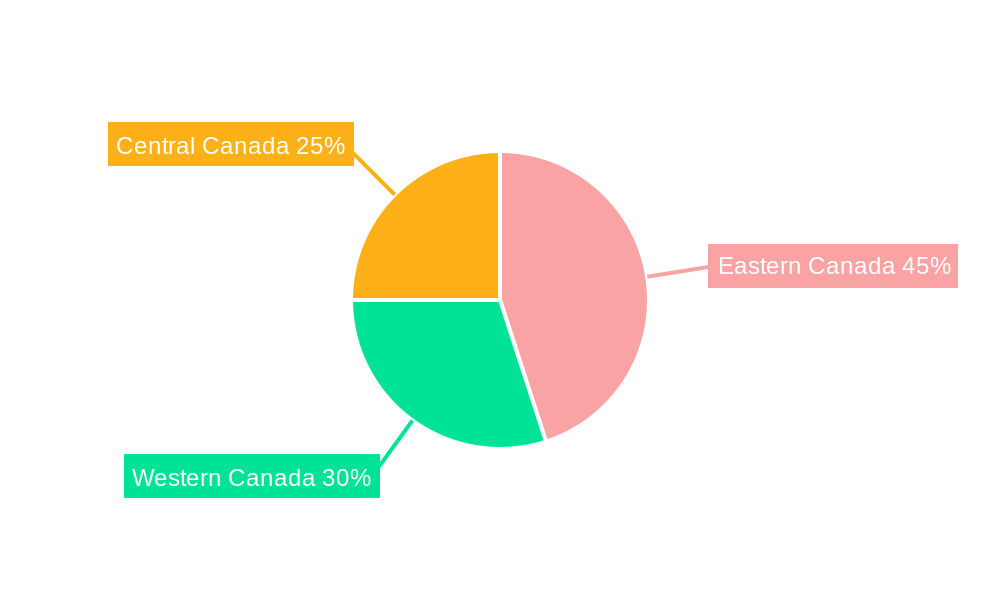

Regional variations within Canada exist, with potentially higher growth in urban centers and provinces with higher per capita incomes. Eastern Canada, with its larger population and concentration of medical facilities, may exhibit a larger market share compared to Western or Central Canada. However, increasing accessibility and adoption of aesthetic procedures across all regions will contribute to market expansion throughout the forecast period. The market faces certain restraints, including regulatory hurdles for new device approvals and the potential for adverse effects associated with certain procedures. Despite these challenges, the long-term outlook for the Canadian aesthetic devices market remains positive, driven by consistent demand and technological innovation. Further segmentation analysis within applications (e.g., specific types of skin resurfacing treatments) and device types (e.g., specific laser technologies) would provide a more granular understanding of market dynamics.

Canada Aesthetic Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Canada aesthetic devices market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research to deliver actionable intelligence on market size, growth drivers, key segments, leading players, and future trends. The report is meticulously crafted, incorporating high-ranking keywords for optimal search engine visibility and easy navigation.

Canada Aesthetic Devices Market Concentration & Dynamics

The Canadian aesthetic devices market exhibits a moderately consolidated landscape, with key players such as Alma Lasers, Venus Concept, Allergan PLC, Syneron Medical Ltd, Cutera Inc, Lumenis Inc, Galderma SA (Nestle), Hologic Inc, LUTRONIC, and Bausch & Lomb Incorporated holding significant market share. Market concentration is influenced by factors such as brand recognition, technological innovation, and regulatory approvals. The innovation ecosystem is robust, driven by ongoing R&D efforts focused on minimally invasive procedures and advanced technologies. Regulatory frameworks, including Health Canada's stringent approvals process, significantly impact market entry and product lifecycle. Substitute products, such as non-invasive cosmetic treatments, exert competitive pressure, while end-user trends, such as increasing demand for non-surgical aesthetic procedures, shape market growth. M&A activity within the sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on expanding product portfolios and geographical reach.

- Market Share: Top 5 players account for approximately xx% of the total market.

- M&A Deal Counts (2019-2024): xx deals, indicating a moderate level of consolidation.

- Regulatory Framework: Health Canada's regulations significantly impact market entry and product approvals.

- Substitute Products: Non-invasive treatments present competitive challenges.

- End-User Trends: Growing preference for minimally invasive procedures drives market expansion.

Canada Aesthetic Devices Market Industry Insights & Trends

The Canadian aesthetic devices market is projected to experience significant growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The market size is estimated to reach xx Million by 2025. This growth is primarily fueled by rising disposable incomes, increased awareness of aesthetic procedures, and a growing preference for non-surgical options. Technological disruptions, such as advancements in energy-based devices and minimally invasive techniques, are further driving market expansion. Evolving consumer behaviors, marked by a heightened focus on personalized treatments and quick recovery times, are shaping product development and marketing strategies. The market is also influenced by factors such as the rising prevalence of skin aging, the increasing demand for body contouring and hair removal treatments, and the adoption of advanced technologies. The growing trend towards at-home aesthetic devices also presents both opportunities and challenges.

Key Markets & Segments Leading Canada Aesthetic Devices Market

The Canadian aesthetic devices market is segmented by type of device (energy-based, ultrasound, non-energy-based), application (skin resurfacing, body contouring, hair removal, tattoo removal, breast augmentation, others), and end-user (hospitals, clinics, home settings). Based on application, Skin Resurfacing and Tightening currently represents the largest segment, followed closely by body contouring and cellulite reduction. The clinic segment dominates end-user sales, owing to the higher adoption of sophisticated devices.

Drivers for Growth by Segment:

- Energy-based Devices: Technological advancements leading to improved efficacy and safety.

- Skin Resurfacing and Tightening: Growing demand for non-surgical skin rejuvenation treatments.

- Clinics: High concentration of skilled professionals and advanced equipment.

Dominance Analysis: The clinic segment leads in terms of market share due to higher adoption of advanced technology and skilled professionals. Energy-based devices constitute the largest segment by device type due to effectiveness and variety of applications. Skin Resurfacing and Tightening holds the largest market share among applications due to its popularity and broad appeal.

Canada Aesthetic Devices Market Product Developments

Recent years have witnessed significant advancements in aesthetic device technology, including the development of more precise, efficient, and minimally invasive devices. Innovations in energy-based devices, such as improved laser and radiofrequency technologies, have enhanced treatment efficacy and reduced recovery times. The introduction of new applications for existing technologies, such as the use of ultrasound for body contouring, expands market opportunities. Competitive pressures drive companies to introduce innovative features and improved safety profiles, leading to a dynamic and evolving market landscape.

Challenges in the Canada Aesthetic Devices Market Market

The Canadian aesthetic devices market faces several challenges. Regulatory hurdles, including stringent approval processes and compliance requirements, can increase the time and cost associated with product launches. Supply chain disruptions, exacerbated by global events, can impact device availability and pricing. Intense competition from established players and new entrants necessitates continuous innovation and strategic differentiation.

Forces Driving Canada Aesthetic Devices Market Growth

Key growth drivers include technological advancements, such as miniaturization of devices and improved safety profiles; rising disposable incomes leading to increased consumer spending on aesthetic procedures; a growing demand for minimally invasive and non-surgical options; and increased awareness of cosmetic treatments through social media and celebrity endorsements. Favorable regulatory environments supporting innovation contribute to market growth.

Challenges in the Canada Aesthetic Devices Market Market

Long-term growth hinges on ongoing technological innovation, strategic partnerships to expand market reach, and international market expansion. Companies that invest in R&D and develop cutting-edge technologies will be well-positioned to capture future market opportunities. A focus on patient safety and efficacy will be critical for maintaining consumer trust and market share.

Emerging Opportunities in Canada Aesthetic Devices Market

Emerging opportunities include the development of personalized treatments tailored to individual patient needs, the expansion of at-home devices for less-invasive treatments, the increasing adoption of artificial intelligence (AI) for treatment planning and outcome prediction, and the development of combination therapies that leverage multiple technologies for enhanced results. Addressing unmet clinical needs for specific aesthetic concerns will drive innovation and market growth.

Leading Players in the Canada Aesthetic Devices Market Sector

- Alma Lasers

- Venus Concept

- Allergan PLC

- Syneron Medical Ltd

- Cutera Inc

- Lumenis Inc

- Galderma SA (Nestle)

- Hologic Inc

- LUTRONIC

- Bausch & Lomb Incorporated

Key Milestones in Canada Aesthetic Devices Market Industry

- June 2022: Croma Aesthetics Canada Ltd. received Health Canada approval for Letybo for glabellar line treatment.

- May 2022: Suneva Medical Inc. received approval for Dermapose fat sizing syringe.

Strategic Outlook for Canada Aesthetic Devices Market Market

The future of the Canadian aesthetic devices market appears promising, with sustained growth driven by technological innovations, rising consumer demand, and expanding applications. Companies focusing on personalized treatments, advanced technologies, and strategic partnerships will be well-positioned to capture significant market share. The focus on minimally invasive procedures and non-surgical options, along with increased consumer spending, positions the market for continued expansion.

Canada Aesthetic Devices Market Segmentation

-

1. Type of Device

-

1.1. Energy-based Aesthetic Device

- 1.1.1. Laser-based Aesthetic Device

- 1.1.2. Radiofrequency (RF)-based Aesthetic Device

- 1.1.3. Light-based Aesthetic Device

- 1.1.4. Ultrasound Aesthetic Device

-

1.2. Non-energy-based Aesthetic Device

- 1.2.1. Botulinum Toxin

- 1.2.2. Dermal Fillers and Aesthetic Threads

- 1.2.3. Chemical Peels

- 1.2.4. Microdermabrasion

- 1.2.5. Implants

- 1.2.6. Other Non-energy-based Aesthetic Devices

-

1.1. Energy-based Aesthetic Device

-

2. Application

- 2.1. Skin Resurfacing and Tightening

- 2.2. Body Contouring and Cellulite Reduction

- 2.3. Hair Removal

- 2.4. Tattoo Removal

- 2.5. Breast Augmentation

- 2.6. Other Applications

-

3. End-user

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Home Settings

Canada Aesthetic Devices Market Segmentation By Geography

- 1. Canada

Canada Aesthetic Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancement in Devices; Increasing Obese Population; Increasing Awareness Regarding Aesthetic Procedures and Rising Adoption of Minimally Invasive Devices

- 3.3. Market Restrains

- 3.3.1. Poor Reimbursement Scenario

- 3.4. Market Trends

- 3.4.1. Body Contouring and Cellulite Reduction Segment is Expected to Register High Growth in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Aesthetic Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Energy-based Aesthetic Device

- 5.1.1.1. Laser-based Aesthetic Device

- 5.1.1.2. Radiofrequency (RF)-based Aesthetic Device

- 5.1.1.3. Light-based Aesthetic Device

- 5.1.1.4. Ultrasound Aesthetic Device

- 5.1.2. Non-energy-based Aesthetic Device

- 5.1.2.1. Botulinum Toxin

- 5.1.2.2. Dermal Fillers and Aesthetic Threads

- 5.1.2.3. Chemical Peels

- 5.1.2.4. Microdermabrasion

- 5.1.2.5. Implants

- 5.1.2.6. Other Non-energy-based Aesthetic Devices

- 5.1.1. Energy-based Aesthetic Device

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Skin Resurfacing and Tightening

- 5.2.2. Body Contouring and Cellulite Reduction

- 5.2.3. Hair Removal

- 5.2.4. Tattoo Removal

- 5.2.5. Breast Augmentation

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Home Settings

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Eastern Canada Canada Aesthetic Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Aesthetic Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Aesthetic Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Alma Lasers

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Venus Concept*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Allergan PLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Syneron Medical Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Cutera Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Lumenis Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Galderma SA (Nestle)

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Hologic Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 LUTRONIC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Bausch & Lomb Incorporated

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Alma Lasers

List of Figures

- Figure 1: Canada Aesthetic Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Aesthetic Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Aesthetic Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Aesthetic Devices Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 3: Canada Aesthetic Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Canada Aesthetic Devices Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 5: Canada Aesthetic Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Aesthetic Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Eastern Canada Canada Aesthetic Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Canada Canada Aesthetic Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Central Canada Canada Aesthetic Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Aesthetic Devices Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 11: Canada Aesthetic Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Canada Aesthetic Devices Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 13: Canada Aesthetic Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Aesthetic Devices Market?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Canada Aesthetic Devices Market?

Key companies in the market include Alma Lasers, Venus Concept*List Not Exhaustive, Allergan PLC, Syneron Medical Ltd, Cutera Inc, Lumenis Inc, Galderma SA (Nestle), Hologic Inc, LUTRONIC, Bausch & Lomb Incorporated.

3. What are the main segments of the Canada Aesthetic Devices Market?

The market segments include Type of Device, Application, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancement in Devices; Increasing Obese Population; Increasing Awareness Regarding Aesthetic Procedures and Rising Adoption of Minimally Invasive Devices.

6. What are the notable trends driving market growth?

Body Contouring and Cellulite Reduction Segment is Expected to Register High Growth in the Forecast Period.

7. Are there any restraints impacting market growth?

Poor Reimbursement Scenario.

8. Can you provide examples of recent developments in the market?

In June 2022, Croma Aesthetics Canada Ltd. announced it received a Notice of Compliance from Health Canada for Letybo for temporary improvement in the appearance of moderate to severe glabellar lines associated with corrugator and/or procerus muscle activity in adult patients under 65 years of age.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Aesthetic Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Aesthetic Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Aesthetic Devices Market?

To stay informed about further developments, trends, and reports in the Canada Aesthetic Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence